In traditional finance, passive investing is becoming more and more relevant, since active funds often don’t generate enough alpha to make up for the higher fees attached to them. Most of the passively managed capital is invested through Exchange Traded Funds (ETFs), which nowadays are not only tracking big indices like S&P or Nasdaq, but also more exotic investment areas like cannabis or hydrogen.

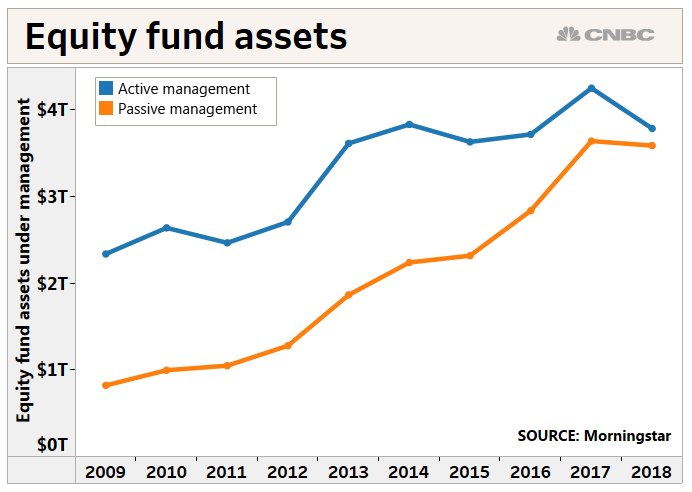

In 2009, actively managed funds had a market share of almost 75 percent, according to Morningstar. Since then, it has dropped significantly and today, passive investing controls nearly half the US stock market. But why? Is it only because of the very low management fee? I don’t think so. People today hold certain beliefs and values and through passive investment products, they’re able to diversify within their area of interest. Here is a personal example: I’m completely convinced of hydrogen when it comes to sustainable mobility. But since I’m not an expert in this field, I simply don’t know what part of the value chain might benefit the most from this development. As a result, I wasn’t able to decide what company stock to buy. Instead, I bought a passive product covering the ten most important stocks in this field. I think at this point you can see where I am going. Today, you can invest in your beliefs without knowing which company will be the winner and without having to trust a third-party asset manager who, in most cases, doesn’t generate alpha anyways.

In 2009, actively managed funds had a market share of almost 75 percent, according to Morningstar. Since then, it has dropped significantly and today, passive investing controls nearly half the US stock market. But why? Is it only because of the very low management fee? I don’t think so. People today hold certain beliefs and values and through passive investment products, they’re able to diversify within their area of interest. Here is a personal example: I’m completely convinced of hydrogen when it comes to sustainable mobility. But since I’m not an expert in this field, I simply don’t know what part of the value chain might benefit the most from this development. As a result, I wasn’t able to decide what company stock to buy. Instead, I bought a passive product covering the ten most important stocks in this field. I think at this point you can see where I am going. Today, you can invest in your beliefs without knowing which company will be the winner and without having to trust a third-party asset manager who, in most cases, doesn’t generate alpha anyways.

Blockchain and Crypto

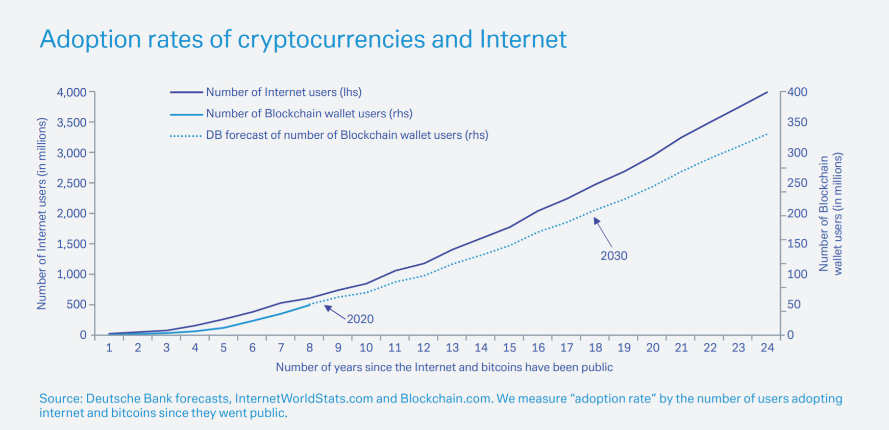

Of course, I’m not only convinced of hydrogen. Working in this field, I might sound biased saying this, but my biggest belief when it comes to the future of finance and society is blockchain technology and cryptographic assets in particular. And please  keep in mind, that these are still very early days for blockchain. If you think in internet years, we are now maybe in the year 1996 – Amazon is only two years old, Google doesn’t even exist yet and no one has even ever heard of social networks like Facebook, Snapchat or Instagram. A question I’m very frequently asked by interested investors is how to gain exposure to this field. Most often, those people are concerned about the technical knowledge which they think is required, and additionally, they just don’t know what crypto asset to buy. Personally, I do not care whether you buy your Bitcoin either directly on a crypto exchange or you prefer to order a certificate through your favorite broker. There are pros and cons in both cases, I might elaborate on that in another article, but you have to feel comfortable with the option you choose and most importantly, if you are invested in crypto, that’s great! The second question is way more difficult to answer and I’m sure you’ll know much more if you are patient enough to keep on reading for a few more minutes.

keep in mind, that these are still very early days for blockchain. If you think in internet years, we are now maybe in the year 1996 – Amazon is only two years old, Google doesn’t even exist yet and no one has even ever heard of social networks like Facebook, Snapchat or Instagram. A question I’m very frequently asked by interested investors is how to gain exposure to this field. Most often, those people are concerned about the technical knowledge which they think is required, and additionally, they just don’t know what crypto asset to buy. Personally, I do not care whether you buy your Bitcoin either directly on a crypto exchange or you prefer to order a certificate through your favorite broker. There are pros and cons in both cases, I might elaborate on that in another article, but you have to feel comfortable with the option you choose and most importantly, if you are invested in crypto, that’s great! The second question is way more difficult to answer and I’m sure you’ll know much more if you are patient enough to keep on reading for a few more minutes.

Bitcoin

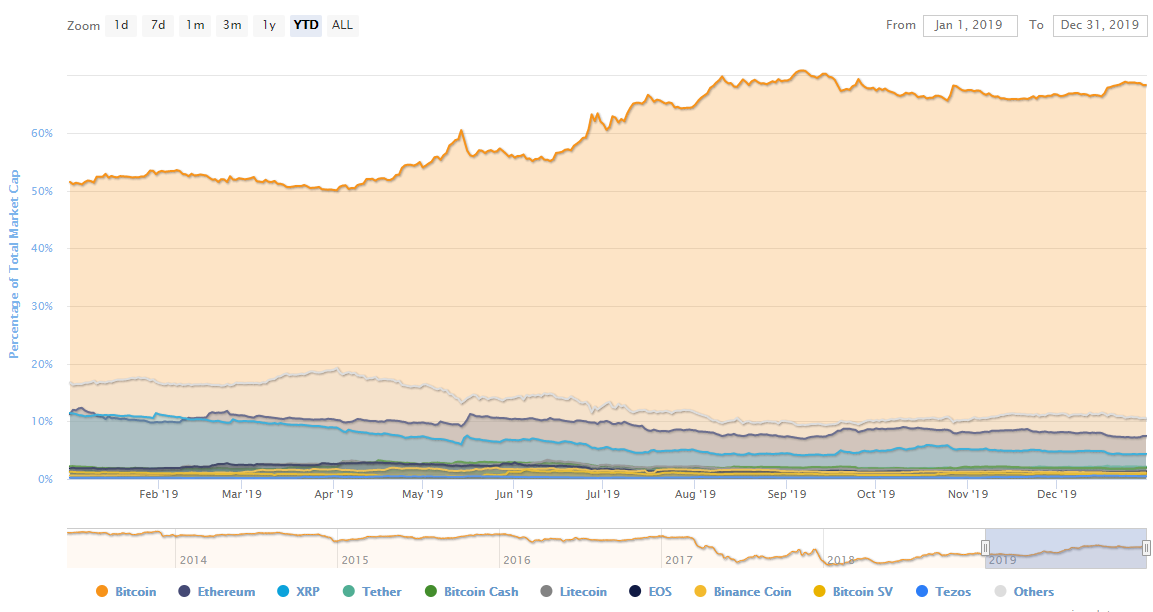

Whenever I’m asked what field I’m working in, my first answer is blockchain and crypto assets. In most cases, people only give me a blank stare and I realize that they have absolutely no clue what I’m talking about. When I then mention Bitcoin,it seems like they have at least read something about it. I can’t blame them. If you look at the relative market capitalization of Bitcoin (BTC Dominance) during the last year, it has always been above 50 percent, which means that its price movements have a greater impact on crypto than all other crypto assets together. It also accounts for 30 percent of the overall trading volume on crypto exchanges and on traditional exchanges. Bitcoin certificates have by far the highest market capitalization and liquidity. Most of the investors interested in crypto assets are only invested in Bitcoin and if you look at the historical performance and

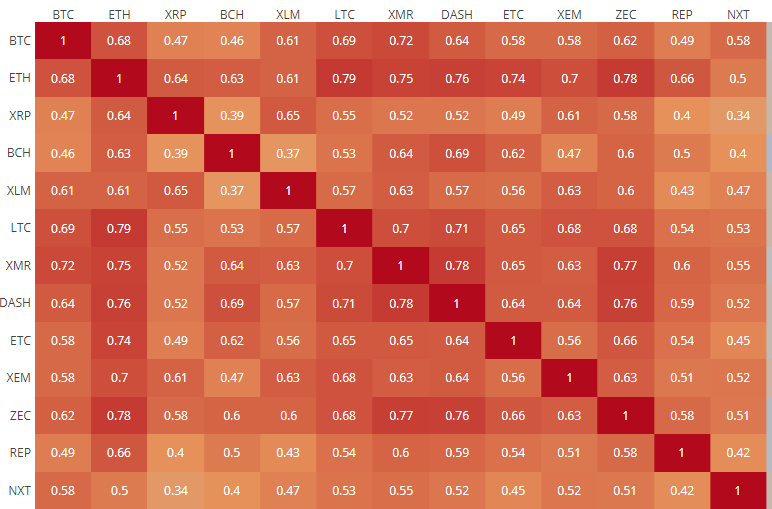

I can’t blame them. If you look at the relative market capitalization of Bitcoin (BTC Dominance) during the last year, it has always been above 50 percent, which means that its price movements have a greater impact on crypto than all other crypto assets together. It also accounts for 30 percent of the overall trading volume on crypto exchanges and on traditional exchanges. Bitcoin certificates have by far the highest market capitalization and liquidity. Most of the investors interested in crypto assets are only invested in Bitcoin and if you look at the historical performance and  correlation between BTC and the Altcoins (other major crypto assets), it wasn’t a bad decision. Over the years, Altcoins and Bitcoins often correlated with 80 to 90 percent and in 2019, this relationship remained strong, ranging from 45 to 72 percent over the last 365 days. But does this really reflect the value drivers behind the respective coins? What developments have the biggest impact on each individual crypto asset? Should you diversify your crypto portfolio and if so, are you able to select the right ones or would a passive strategy benefit you the most? Let’s take a look at what really drives value, and naturally, I’ll begin with Bitcoin.

correlation between BTC and the Altcoins (other major crypto assets), it wasn’t a bad decision. Over the years, Altcoins and Bitcoins often correlated with 80 to 90 percent and in 2019, this relationship remained strong, ranging from 45 to 72 percent over the last 365 days. But does this really reflect the value drivers behind the respective coins? What developments have the biggest impact on each individual crypto asset? Should you diversify your crypto portfolio and if so, are you able to select the right ones or would a passive strategy benefit you the most? Let’s take a look at what really drives value, and naturally, I’ll begin with Bitcoin.

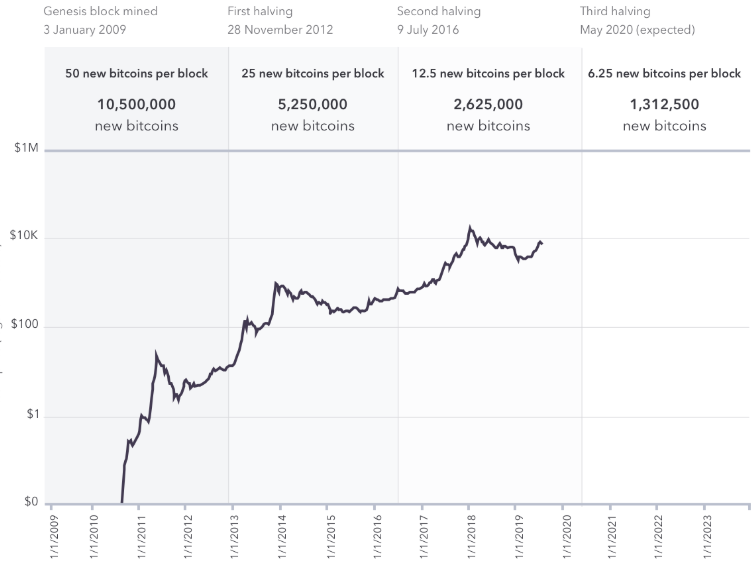

Digital gold, safe haven, store of value – a lot of phrases have been used to describe Bitcoin, and to a certain extent, I agree with all of them. For me, Bitcoin is a commodity like gold, other rare metals or rare earths. By design, there is a limited overall supply of 21 Million coins. Today, roughly 18 million of those have been mined and at the moment, every ten minutes additional 12.5 BTC of supply is generated in the network. Roughly every four years (210,000 blocks), the amount of new Bitcoins created is reduced by 50 percent, which is known as the “halving event”. Until now, this has happened twice and has had a huge impact on the price. When the first halving happened, the price was at around 12 USD and increased to an all-time high of the respective reward area of almost 1,000 USD. The second halving brought the price up from 650 USD to a peak of nearly 20,000 USD. Logically, the prices declined again afterwards. Of course, two historical events are not a precise indicator for the future, but so far, the halving effect has been very positive for the price development. And here is the good news: In May 2020, the next halving event is going to happen. A study conducted by the “Bayerische Landesbank” applied the stock-to-flow ratio

Digital gold, safe haven, store of value – a lot of phrases have been used to describe Bitcoin, and to a certain extent, I agree with all of them. For me, Bitcoin is a commodity like gold, other rare metals or rare earths. By design, there is a limited overall supply of 21 Million coins. Today, roughly 18 million of those have been mined and at the moment, every ten minutes additional 12.5 BTC of supply is generated in the network. Roughly every four years (210,000 blocks), the amount of new Bitcoins created is reduced by 50 percent, which is known as the “halving event”. Until now, this has happened twice and has had a huge impact on the price. When the first halving happened, the price was at around 12 USD and increased to an all-time high of the respective reward area of almost 1,000 USD. The second halving brought the price up from 650 USD to a peak of nearly 20,000 USD. Logically, the prices declined again afterwards. Of course, two historical events are not a precise indicator for the future, but so far, the halving effect has been very positive for the price development. And here is the good news: In May 2020, the next halving event is going to happen. A study conducted by the “Bayerische Landesbank” applied the stock-to-flow ratio  of Gold to Bitcoin and came to the result that Bitcoin could increase to 90,000 USD by the end of 2020. Of course, this is only a model and you have to be cautious with any sort of prediction. So for me, this is the real value behind Bitcoin – the scarcity and reduced additional supply combined with a high level of trust and decentralization. There are also other valid value drivers. If you look at empirical data of the percentage of people holding cryptos, countries with inflationary national currencies tend to have the highest number. As a Venezuelan you have a bigger incentive to go into Bitcoin than someone in the eurozone or in the US. As a third value driver, the lightning network could be mentioned, since it makes payments in Bitcoin scalable even for micro transactions.

of Gold to Bitcoin and came to the result that Bitcoin could increase to 90,000 USD by the end of 2020. Of course, this is only a model and you have to be cautious with any sort of prediction. So for me, this is the real value behind Bitcoin – the scarcity and reduced additional supply combined with a high level of trust and decentralization. There are also other valid value drivers. If you look at empirical data of the percentage of people holding cryptos, countries with inflationary national currencies tend to have the highest number. As a Venezuelan you have a bigger incentive to go into Bitcoin than someone in the eurozone or in the US. As a third value driver, the lightning network could be mentioned, since it makes payments in Bitcoin scalable even for micro transactions.

Blockchain Applications

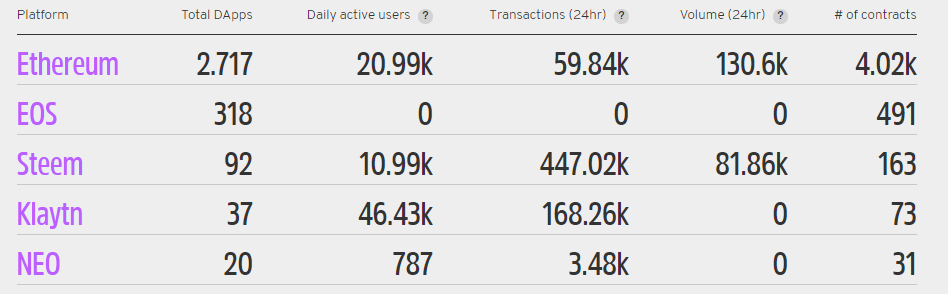

What will be the blockchain infrastructure decentralized applications (dApps) will be built on? Is it Ethereum, because it has the biggest developer community? Is it EOS, because it is incredibly fast and supports its ecosystem with different VC funds? Is it Neo, because China wants to play a central role in blockchain development and this is their “home infrastructure”?

What will be the blockchain infrastructure decentralized applications (dApps) will be built on? Is it Ethereum, because it has the biggest developer community? Is it EOS, because it is incredibly fast and supports its ecosystem with different VC funds? Is it Neo, because China wants to play a central role in blockchain development and this is their “home infrastructure”?

This question is of the highest importance. Let’s draw an analogy to mobile operating systems (OS) back in the days. The main reason Microsoft never succeeded with its own smartphone is that they wanted to put their own OS on every phone with its own native app store. They ran into a classic chicken and egg problem. Android and iOS were the incumbents in that sector with the most users by far and that’s why every developer decided to code on their infrastructure. Because of that, Microsoft couldn’t reach the critical mass of users.

I believe it’s a similar story here: Blockchain developers will go where the users are and vice versa. Users will use the infrastructure that offers them the applications they need. And yes, at the moment this is clearly Ethereum. There are more dApps and smart contracts deployed than on all other application-focused blockchain protocols put together. Often, you hear people discussing about transactions per second and scalability of the protocols, but in my view, this is not the main point. EOS and Stellar are much faster and more scalable than Ethereum, and in fact, they have the superior underlying technology. But what is scalability worth if you don’t have users and developers? That’s why I’m looking forward to Ethereum 2.0 which is supposed to launch in 2020 (migration will take up to three years though) and will hopefully solve the remaining issues. Of course, there are opposite examples like Google killing Yahoo even though they entered the game much later. It’s also worth mentioning, that there are also private blockchains like IBM’s Hyperledger that are competing with those protocols and don’t have a cryptocurrency or built-in native token.

All of these have their distinct advantages, but at the end of the day, only a few will succeed, many will disappear and some will end up in niche use cases. At this point, I’m not able to pick the winner. Are you?

International Payments

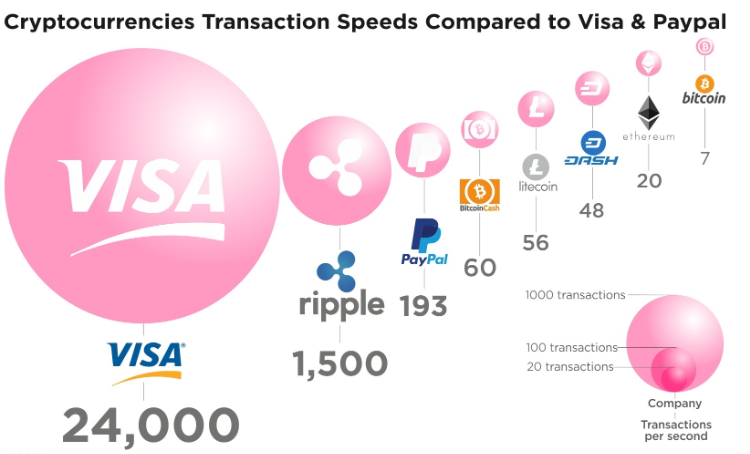

Most people still think that Bitcoin’s main use case is payment and they’re not entirely wrong. Even though I elaborated on the real value drivers earlier, it was originally designed as a peer-to-peer payment system without the need for a bank or other financial institutions acting as intermediaries. But today, those payment-focused cryptocurrencies are rather called Litecoin, Bitcoin Cash, Dash and Monero among many others. Even though we don’t feel the pain in our daily Western lifestyle, this is a great use case for a huge part of the world, in particular for the unbanked population. Let’s talk about remittances here.  Let’s imagine you live in the countryside in Columbia and during the summer you work in the US. In order to get your family to survive, you have to send them money back home, but they have no access to any financial institution. The only options you really have are Western Union or Moneygram, which take 10 percent of your money just for sending it over. This is why a lot of remittance payments are already made through crypto, since it is cheaper and faster and even works for the unbanked people. The fluctuating value makes those assets less attractive in terms of wealth protection, but on the other side more attractive as an investment case. To solve the first issue, so-called stable coins have been created during the last years, which I’m going to talk about that in the next chapter.

Let’s imagine you live in the countryside in Columbia and during the summer you work in the US. In order to get your family to survive, you have to send them money back home, but they have no access to any financial institution. The only options you really have are Western Union or Moneygram, which take 10 percent of your money just for sending it over. This is why a lot of remittance payments are already made through crypto, since it is cheaper and faster and even works for the unbanked people. The fluctuating value makes those assets less attractive in terms of wealth protection, but on the other side more attractive as an investment case. To solve the first issue, so-called stable coins have been created during the last years, which I’m going to talk about that in the next chapter.

Also for shop owners, it would make a lot of sense to accept crypto payments, since average credit card processing fees range from 1.5 to 3.5 percent compared to only a few cents for crypto payments in Dash, EOS or Ethereum.

The main question here is which cryptocurrency is really used for international payments? Are infrastructure providers like Wirecard supporting the respective technology, and how many resellers are accepting it as payment? How many transactions per second can be done and how low are the transaction fees? Personally, I think Dash is doing a great job moving away from private transactions and they are growing rapidly in the developing world. But again, I’m not able to pick the winner. Are you?

Stable Coins

Cryptographic tokens backed by real-world values are gaining a lot of traction. Even though it’s not an investment case from my point of view, it still plays a crucial role. Due to the volatility of most crypto assets, investors want to get out of their investment for a specific time, but don’t want to return to fiat currencies. Most likely, they’ll convert their holdings into US-Dollar backed coins like Tether (USDT) or USD Coin (USDC). Recently, Libra (by Facebook) has been discussed a lot in the media, which is mainly backed by major fiat currencies like USD, EUR, and GBP, as well as low yield securities like German government bonds. From an investor’s point of view, those stable crypto assets are only tools for staying within the tokenized economy and avoiding the fiat world. Even though they’re less interesting for investors, they play a crucial role in the unbanked world, since other payment options like Dash, Monero and Litecoin are still too volatile. In the future, we will see more and more real asset-backed tokens. Real Estate, commodities, and arts have already been tokenized and will be of the highest importance for decentralized finance.

Börsen

More and more crypto exchanges are issuing their own token to create loyalty through a reward system similar to Payback. The three most well-known ones are BNB (Binance), LEO (Bitfinex), and the Huobi Token. Even though they slightly differ in their tokenomics, they all have one thing in common: the more users they have and the more volume is traded on their platforms, the better it is for the value of the token. There are two things to consider from an investor’s perspective. First of all, the exchanges themselves have to be compared to each other in terms of users, real volume, regulation, and security. A lot of them don’t exist anymore and that’s mainly due to regulatory complications or massive hacks. At the moment, it seems like Binance is doing a good job, but also here I’m not able to predict which will be the main fiat-crypto-gate in the future and whether something like this will still be needed in a fully tokenized world. This brings me to my second thought. Do you really think those crypto exchanges can compete with NYSE, Nasdaq, Xetra or the Hong Kong Stock Exchange? Those giants are already getting prepared to trade all sorts of tokenized assets in the future, and in my opinion, they’ll agree on a unified blockchain framework, on which they’ll do transactions with banks and other financial institutions.

Other Use Cases

There are so many more coins and tokens I could mention, but let’s just focus on a few more here. Even though it isn’t a real blockchain, I’ve always been a proponent of IOTA and its tangle network. I think machine micro payments in the internet of things (IoT) is a great use case and needs an extremely scalable platform, which IOTA clearly provides. Also, its public APIs make it the first choice for building prototypes in the automotive sector. But isn’t this something Ethereum or EOS could also achieve? Besides partnerships and prototypes not much appeared yet, So I’m very curious about what might happen here in 2020.

Ripple is the first choice for people working in finance, because the use case is more tangible for them. Just think about the billions of dollars of overnight repos (repurchase agreements) happening constantly. And also, the settlement from one currency to another can be done efficiently through the ripple network. The great news is that their partnerships have been impressive from the very first day and the technology can facilitate a lot of transactions. A problem I’m seeing here is that the usage of the ripple network is not 100 percent connected to the XRP token itself, and furthermore, the token is very inflationary and still quite centralized.

On what blockchain will securities like stocks and bonds be issued? And what platform is ideal for issuing tokenized real estate and arts? For some people, the answer here is Tezos as it is designed to support security offerings and is quite scalable. When we talk about decentralized finance (DeFi), this also plays a crucial role and Tezos is one of the blockchains which could benefit from this development. But you could also look at other protocols like Stellar, Ethereum, or EOS here.

Unterm Strich

What’s the bottom line? What’s the point I’m trying to make?

- If you’re convinced of blockchain technology and believe it is one of the most impactful developments for our society in the next decade, you should definitely start to gain exposure to it. As I said in the beginning, invest in your beliefs and in what you’re passionate about. These are still very early days.

- The correlation between different crypto assets has already been declining and this trend will continue as the very distinct value drivers will come into play.

- Bitcoin, Ethereum and other cryptos have exciting events ahead, which makes me very bullish about 2020.

- It’s extremely hard to predict which protocol is going to play a huge role in the respective field, which one will die, and which one will find its place in a niche.

- Passive investments are on the rise because they are less painful and time-consuming than stock picking, cheaper than actively managed investments, and enable you to diversify within an area you’re personally convinced of.

We will inevitably live in a world of decentralized finance, in which all financial and real-world assets are traded on-chain. Machines will pay each other through crypto tokens and international payments and investments will be affordable for everyone.

Let’s get ready for the future, let’s get into crypto!