Our monthly crypto overview for January:

- The crypto markets corrected significantly to kick-start the year.

- Bitcoin and Ether dropped by 20.64% and 31.58%, respectively.

- The top outperformer last month was Cosmos.

- Regulatory uncertainty is weighing on the markets.

Crypto Market Overview January

The first month of the year didn’t bring a turnaround in crypto investor sentiment. Following the correction in December, the crypto markets moved another leg lower in January, with several leading cryptocurrencies dropping by over 30% since the start of the year.

Regulatory uncertainty coming out of the U.S. combined with a proposed ban on crypto mining in the E.U. have pushed cryptocurrency prices lower in January.

Moreover, 2021 was a record year, with almost every major cryptocurrency hitting a new all-time high. Following such an incredible bull market, past crypto market cycles suggest that we may be entering a period of consolidation and strategic accumulation at lower price levels.

Crypto Performance Overview January

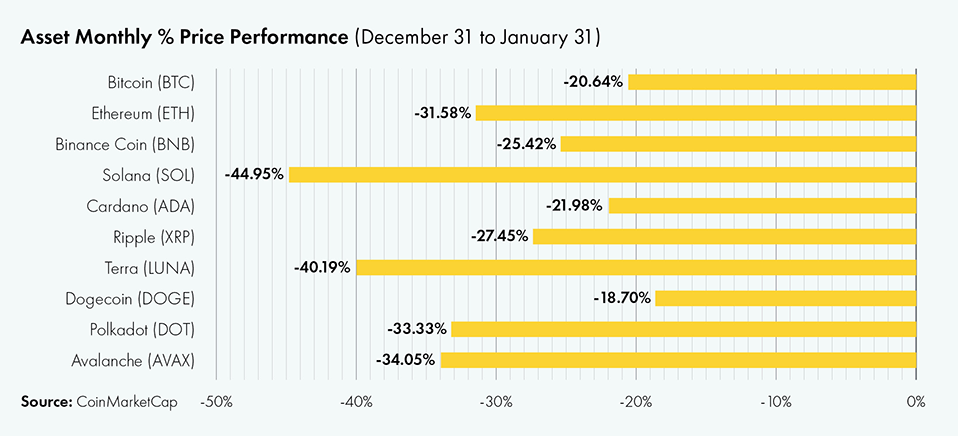

In January, the crypto asset markets were red across the board.

The two leading cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), dropped by -20.64% and -31.58%, respectively. In a similar vein, leading Layer-1 blockchains Cardano, Terra, and Avalanche dropped by 21.98%, 40.19%, and 34.05%, respectively.

The only notable outperformer among the top crypto assets was FTX Token (FTT). The exchange token closed the month 8.88% higher following the announcement of a new web3-focused venture capital fund launched by the leading crypto derivatives exchange.

Stocks performed similar to crypto assets, with the S&P 500 Index losing -6.39% in January. U.S. Treasuries, measured by the S&P U.S. Government Bond Index, are lower by -1.48%.

The precious metal Gold (XAU) managed to retain its value in January, closing the month de facto unchanged (+0.12%).

Institutional Interest in Crypto

New York-based asset manager WisdomTree Investments announced plans to launch a crypto trading app targeting retail investors. The investment firm wants the new crypto app, called WisdomTree Prime, to “provide a core suite of savings, payments and investment” services while avoiding a focus on “trading and speculation.”

U.S. hedge fund Brevan Howard has reportedly made numerous key hires for its new crypto asset unit. The hedge fund is planning to invest directly in crypto and is building a digital asset division called BH Digital.

Bitcoin on Balance Sheets

Once again, El Salvador added more Bitcoin to its treasury. On January 21, President Nayib Bukele announced the purchase of an additional 410 BTC by the Central American nation’s treasury. El Salvador now holds at least 1,801 bitcoins, which amounts to around $68 million.

The Brazilian city Rio de Janeiro announced that it plans to allocate 1% of its treasury to Bitcoin and is also exploring discounts to tax payments made with Bitcoin.

Über DDA Iconic Funds

Iconic Funds is the bridge to passive and actively-managed exposure to crypto. Iconic Funds, via its subsidiaries, offers crypto asset ETP’s, diversified index funds, and alpha-seeking strategies for investors.

Our mission is driving the adoption of crypto assets. As the bridge for investors to gain exposure to Crypto Assets, Iconic’s licensed and regulated vehicles offer investors a menu of investment choices ranging from passive index exposure to actively-managed strategies. Iconic Funds removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

The marriage of state-of-the-art technology, innovative investment products, and uncompromising professionalism places Iconic at the vanguard of crypto asset management.

Recent News

- Iconic Acquires Licensed Company to Become Regulated Crypto Portfolio Manager and Advisor

- Wie Layer-2-Lösungen Ethereum bei der Skalierung helfen

- Bitcoin Education Will Pave the Way for Hyperbitcoinization

- Iconic Funds lists Ethereum ETP on Xetra

Iconic in Press

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

Recent Research Reports

- Wie haben sich die Portfolios während der Pandemie entwickelt? ➡ Hier herunterladen

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

- Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

In no event will you hold ICONIC HOLDING GMBH, its subsidiaries or any affiliated party liable for any direct or indirect investment losses caused by any information in this article. This article is not investment advice or a recommendation or solicitation to buy any securities.

ICONIC HOLDING GMBH is not registered as an investment advisor in any jurisdiction. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein.

Our articles and reports include forward-looking statements, estimates, projections, and opinions which may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond ICONIC HOLDING GMBH’s control. Our articles and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process.

ICONIC HOLDING GMBH believes all information contained herein is accurate and reliable and has been obtained from public sources we believe to be accurate and reliable. However, such information is presented “as is,” without warranty of any kind.