Bitcoin ist für seinen enormen Energieverbrauch bekannt. Nach Angaben der Universität Cambridge Bitcoin-Stromverbrauchsindexverbraucht das Bitcoin-Netzwerk derzeit mehr Energie als Österreich. Während die Genauigkeit dieser Schätzung fraglich ist, bleibt der Kohlenstoff-Fußabdruck einer der Hauptkritikpunkte der Bitcoin-Gegner.

Die Baisse hat die Umweltauswirkungen des Bitcoin-Minings nicht verbessert; in diesem Jahr hat sich die Gesamt-Hashrate des Bitcoin-Netzwerks mehr als verdoppelt (von 42,10 EH/s auf 92,66 EH/s), was in der Tat auch einen Anstieg des Energieverbrauchs nahelegt. Gleichzeitig haben Bitmain und Whatsminer in diesem Jahr jedoch neue Hardware auf den Markt gebracht, nämlich die S17 Pro und die M20, die weitaus effizienter sind als die S9-Maschinen, das am häufigsten verwendete Bitcoin-Minermodell (40 W/THs gegenüber 90 W/THs). Effizientere Bitcoin-Miner bieten zwar die Möglichkeit, den Energieverbrauch zu senken und gleichzeitig das gleiche Maß an Netzwerksicherheit aufrechtzuerhalten (stellvertretend für die Gesamt-Hashrate), aber solche Veröffentlichungen haben bisher nur zu einem Anstieg der Gesamt-Hashrate geführt, anstatt den CO2-Fußabdruck von Bitcoin zu verringern.

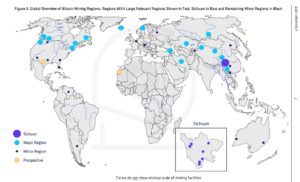

Einem Forschungsbericht zufolge, der von Münzaktien in diesem Monat stammen 73% des von Bitcoin-Minern verbrauchten Stroms aus einer erneuerbaren Quelle, die hauptsächlich aus Wasserkraft besteht. Die Studie ordnet 54% der gesamten Hashrate der Region Sichuan in China zu, die hauptsächlich durch Wasserkraft betrieben wird. Obwohl diese Zahl höchstwahrscheinlich zu hoch angesetzt ist, wird ein großer Teil, wenn nicht sogar die Mehrheit, des Bitcoin-Minings mit Wasserkraft betrieben.

* Bildnachweis: Coinshares

* Bildnachweis: Coinshares

Darüber hinaus wird die Gesamtenergiemenge aus Wasserkraft auf der Welt auf das 60-fache des gesamten Energieverbrauchs von Bitcoin geschätzt, was darauf hindeutet, dass Bitcoin theoretisch völlig umweltfreundlich sein und einen vergleichbaren oder sogar geringeren CO2-Fußabdruck als andere Zahlungsmittel haben könnte. Wie der PWC-Forscher Alex de Vries jedoch genau feststellt hervorgehoben: "Sobald eine Bitcoin-Maschine aktiviert ist, wird sie erst abgeschaltet, wenn sie nicht mehr profitabel arbeitet. Doch während dieser hohe Strombedarf konstant bleibt, schwankt die Wasserkraft, mit der er gedeckt wird. Die chinesische Provinz Sichuan, in der Bitcoin-Befürwortern zufolge hauptsächlich Miner angesiedelt sind, erzeugt in den feuchten Sommermonaten dreimal so viel Wasserkraft wie in den trockenen Wintermonaten. Es wird erwartet, dass der Klimawandel diese Schwankungen noch verschlimmern wird, und in der Regel wird Energie auf Kohlebasis verwendet, um diese Schwankungen auszugleichen."

Bitcoin-Schürfer verlangen nämlich Stabilität bei der Energieerzeugung und beim Strompreis, die derzeit nicht durch erneuerbare Energiequellen wie Wasserkraft gewährleistet werden kann, wodurch eine Nachfrage nach nicht erneuerbaren Energiequellen entsteht, um die Lücken auszugleichen. Daher ist Bitcoin weder grün noch schwarz, sondern benötigt beide Energiequellen, um die Rentabilität des Mining zu gewährleisten. Während andere Wertaufbewahrungsmittel, wie Gold, mehr Energie verbrauchen als Bitcoin Die Umweltauswirkungen des Proof-of-Work-Minings sind nach wie vor einer der größten Nachteile von Bitcoin und stellen eine Chance für andere Kryptowährungen dar, sich durch die Verwendung weniger energieintensiver Konsensmechanismen als Zahlungsmittel durchzusetzen.