Drohende Liquiditätsabnahme und Wal-Börsen-Zuflüsse setzen Kryptoassets kurzfristig unter Druck

DDA Krypto-Marktimpuls, 5. Juni 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- In der vergangenen Woche wurden die meisten wichtigen Kryptoassets nach unten gehandelt, da die Anleger über den bevorstehenden Liquiditätsabzug aufgrund des TGA-Umbaus nachdenken

- Unser hauseigener Crypto Sentiment Index ist in der vergangenen Woche erneut gestiegen

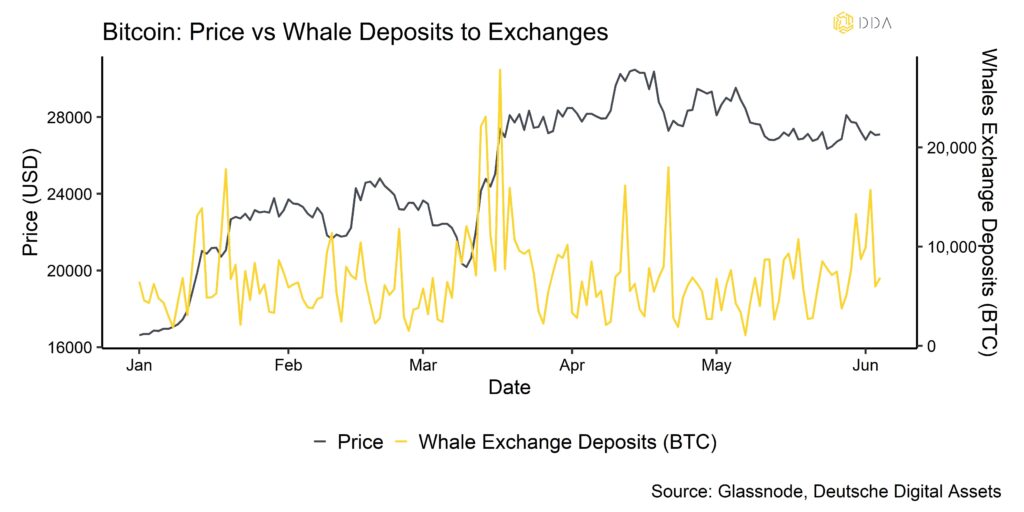

- Die Einzahlungen von Walen an Börsen haben in letzter Zeit zugenommen, ebenso wie die Überweisungen von BTC-Minern an Börsen, was kurzfristig einen gewissen Abwärtsdruck auf die Preise ausüben könnte

Chart der Woche

Kryptoasset Leistung

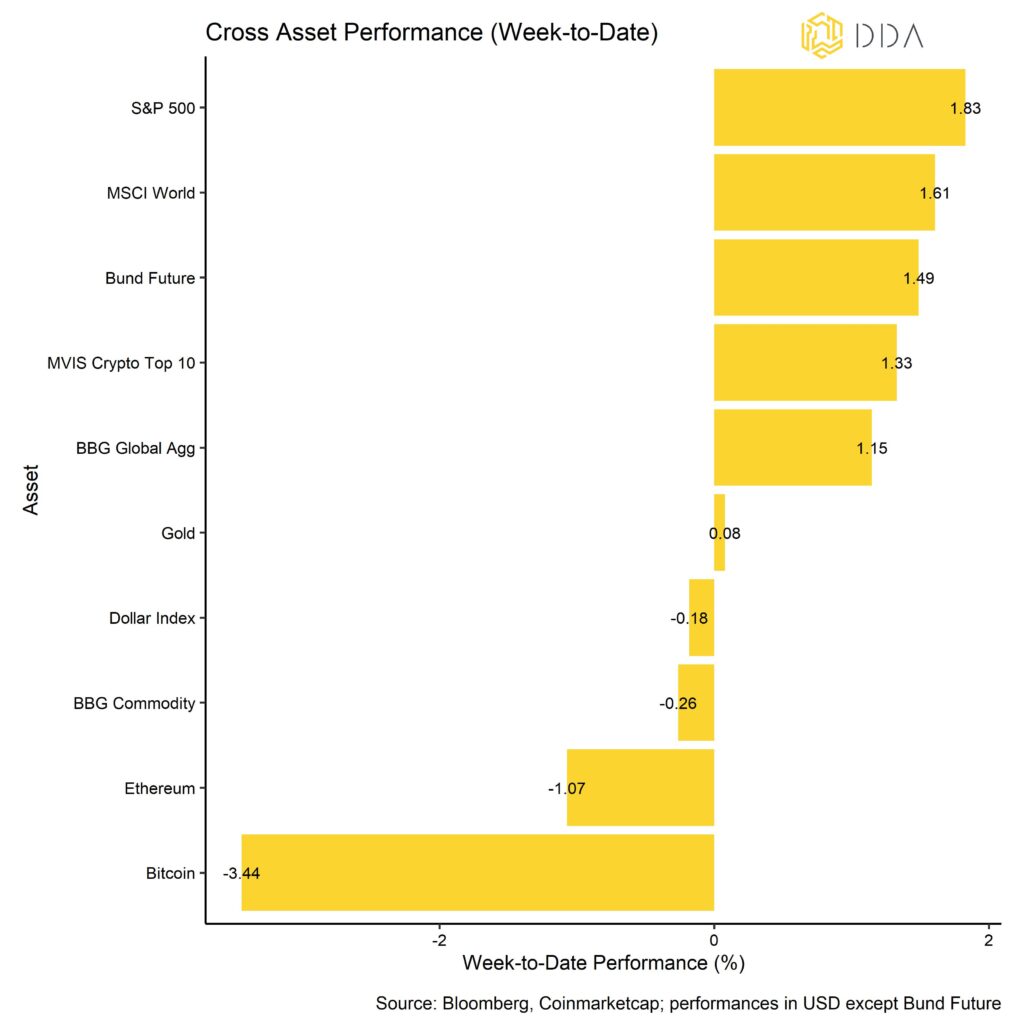

In der vergangenen Woche wurden die meisten wichtigen Kryptoassets nach unten gehandelt. Die Anleger haben darüber nachgedacht, dass der bevorstehende Abbau von Bankreserven in den USA aufgrund des Umbaus des Treasury General Account (TGA) sich als Gegenwind für Kryptoassets erweisen könnte. Es wird erwartet, dass das US-Finanzministerium wahrscheinlich bis zu 1 Billion USD in Form von Schatzwechseln ausgeben wird, was erhebliche Mengen an Liquidität von Kryptoassets und anderen Vermögenswerten abziehen könnte.

Gleichzeitig ist in letzter Zeit ein Anstieg der Whale-Bitcoin-Börseneinlagen zu verzeichnen (Chart-der-Woche), was kurzfristig einen gewissen Abwärtsdruck auf die Preise ausüben könnte. Wale sind definiert als Netzwerkeinheiten (Cluster von Adressen), die mindestens 1000 BTC halten.

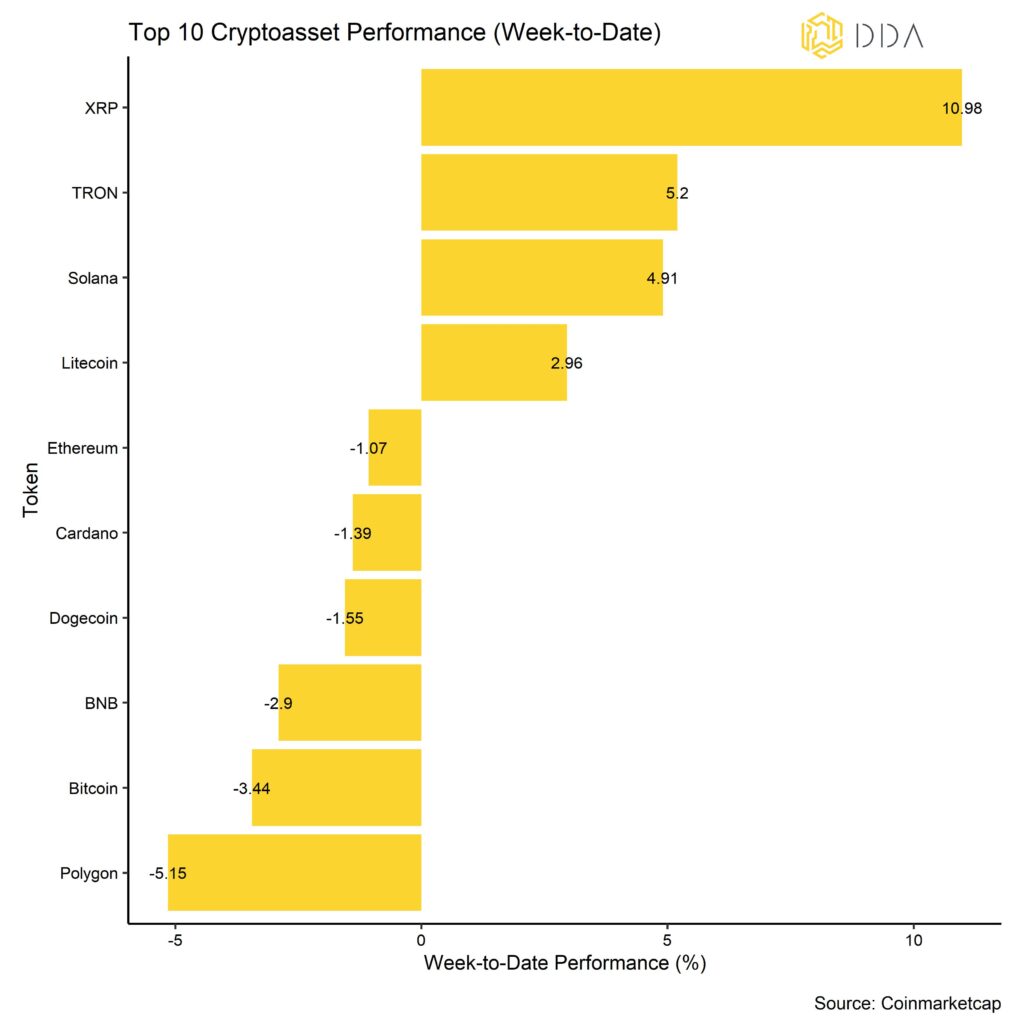

Insgesamt haben sich die 10 wichtigsten Kryptoassets in der vergangenen Woche leicht positiv entwickelt. Im Allgemeinen schnitten globale Aktien besser ab als Anleihen, während Rohstoffe in der vergangenen Woche zurückfielen.

Unter den wichtigsten Kryptoassets waren XRP, TRON und Solana die relativen Outperformer. Insgesamt hat sich die Outperformance von Altcoins in der letzten Woche erhöht, wobei 60% der erfassten Altcoins auf wöchentlicher Basis eine Outperformance gegenüber BTC aufwiesen.

Krypto-Marktstimmung

Unser hauseigener Krypto-Sentiment-Index ist weiter gestiegen. 8 von 15 Indikatoren liegen über ihrem kurzfristigen Trend.

Im Vergleich zur letzten Woche gab es beim Altseason-Index und beim Verhältnis zwischen Put- und Call-Volumen bei BTC einen deutlichen Umschwung nach oben.

Der Crypto Fear & Greed Index ist im Vergleich zur letzten Woche weitgehend unverändert geblieben und befindet sich heute Morgen immer noch im "neutralen" Bereich.

Die Leistungsstreuung zwischen den Kryptoassets hat in letzter Zeit weiter zugenommen, da die Korrelationen zwischen den Kryptoassets abgenommen haben, was bedeutet, dass die Kryptoassets stärker von münzspezifischen Faktoren abhängig sind. Gleichzeitig hat die Outperformance von Altcoins in der letzten Woche zugenommen und liegt nun bei 60% Altcoins, die Bitcoin auf wöchentlicher Basis outperformen.

Im Allgemeinen geht die Outperformance von Altcoins mit einer zunehmenden Streuung der Kryptowährungen einher, d. h. Bitcoin und Altcoins werden während der "Altsaison" in der Regel höher gehandelt als Bitcoin, wobei sich Altcoins besser entwickeln als Bitcoin. Eine breitere Outperformance von Altcoins ist in der Regel ein Zeichen für eine zunehmende Risikobereitschaft.

Krypto Asset Flows

In der vergangenen Woche kam es erneut zu Netto-Fondsabflüssen aus Krypto-Assets.

Insgesamt verzeichneten wir Netto-Fondsabflüsse in Höhe von -53,8 Mio. USD (Woche bis Freitag). Die Abflüsse der letzten Woche konzentrierten sich jedoch hauptsächlich auf Altcoin-basierte ETPs, die insgesamt Nettoabflüsse von -50,6 Mio. USD verzeichneten. Allein ein TRON-basiertes ETP verzeichnete letzte Woche Mittwoch Abflüsse in Höhe von -51,2 Mio. USD.

Bitcoin-Fonds verzeichneten geringfügige Nettoabflüsse von -2,8 Mio. USD und Ethereum-Fonds verzeichneten ebenfalls geringfügige Nettoabflüsse von -3,7 Mio. USD. Im Gegensatz dazu verzeichneten Basket- und thematische Kryptoasset-Fonds Nettozuflüsse (+3,2 Mio. USD).

Außerdem hat sich der Abschlag auf den Nettoinventarwert des größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - wieder leicht vergrößert, was ebenfalls auf geringfügige Nettoabflüsse aus diesem Fondsvehikel hindeutet.

In der Zwischenzeit ist das Beta der globalen Hedge-Fonds gegenüber Bitcoin in den letzten 20 Handelstagen erneut gestiegen, wenn auch von einem niedrigen Niveau aus, was bedeutet, dass die globalen Hedge-Fonds ihr Engagement in Krypto-Assets ein wenig erhöht haben. Allerdings ist das Beta noch zu gering, um es als statistisch signifikant zu betrachten. Globale Hedge-Fonds scheinen derzeit im Allgemeinen neutral gegenüber Kryptoanlagen positioniert zu sein.

On-Chain Tätigkeit

In der vergangenen Woche haben sich die wichtigsten On-Chain-Kennzahlen für Bitcoin, wie neue oder aktive Adressen, weiter von den niedrigen Niveaus erholt, die wir aufgrund der Überlastung des Bitcoin-Netzwerks gesehen hatten, die die Netzwerkbeteiligung zum Stillstand gebracht hatte. Die Anzahl der Transaktionen, die im Bitcoin-Mempool darauf warten, von den Minern abgeholt zu werden, ist ebenfalls weiter gesunken, bleibt aber immer noch erhöht im Vergleich zur Zeit vor den Vorwahlen (d.h. vor Ende April 2023).

Die Zahl der Transaktionen ist ebenfalls zurückgegangen, wenn auch von einem sehr hohen Niveau, das durch den Hype um die Ordinals erreicht wurde. Im gleichen Zusammenhang sind auch die durchschnittlichen Transaktionsgebühren für Bitcoin wieder gesunken und liegen derzeit bei 1,10 USD.

Das Gesamtwachstum des Netzes ist nach wie vor recht positiv mit einem Zuwachs von etwa 4% an Nicht-Null-Adressen in den letzten 30 Tagen.

Gleichzeitig ist in letzter Zeit ein Anstieg der Whale-Bitcoin-Börseneinlagen zu verzeichnen (Chart-der-Woche), was kurzfristig einen gewissen Abwärtsdruck auf die Preise ausüben könnte. Whales sind definiert als Netzwerkeinheiten (Cluster von Adressen), die mindestens 1000 BTC halten. Börseneinlagen werden in der Regel als zunehmender Verkaufsdruck interpretiert.

Zum Zeitpunkt der Erstellung dieses Artikels befinden sich 66% der Bitcoin-Adressen im (nicht realisierten) Gewinn. Der Nettobetrag von % an nicht realisierten Gewinnen minus Verlusten beträgt derzeit etwa 27%. Die Mehrheit der Münzen im Gewinn wird von Langzeit-Inhabern gehalten, d.h. von Personen, die Münzen mindestens 155 Tage gehalten haben. Diese Unternehmen sind auch diejenigen, die in den letzten zwei Wochen Gewinne erzielt haben.

Darüber hinaus haben die Überweisungen von BTC-Minern an Börsen über das Wochenende deutlich zugenommen. Sie haben nun den höchsten Stand seit November 2019 erreicht. Die Bitcoin-Miner spüren zunehmend den Druck durch den parabolischen Anstieg der Hash-Rate.

Die zunehmenden Devisenzuflüsse von Walen und Minenbetreibern werden wahrscheinlich kurzfristig einen gewissen Abwärtsdruck auf die Preise ausüben.

Krypto-Asset-Derivate

Die wohl wichtigste Entwicklung auf der Derivatseite war die Tatsache, dass die implizite 1-Monats-Volatilität von Bitcoin über das Wochenende ein Allzeittief erreichte. Genauer gesagt fiel die implizite 1-Monats-Volatilität unter 35% - und damit unter den bisherigen Tiefststand, der im Januar 2023 markiert wurde. Dies verdeutlicht, dass der Markt derzeit eine gewisse Selbstzufriedenheit an den Tag legt, und die Wahrscheinlichkeit eines Volatilitätsanstiegs hat zugenommen, da sich die Volatilität in der Regel im Mittelwert umkehrt. Das Verhältnis zwischen Put- und Call-Volumen ist tendenziell gesunken (zugunsten von Calls). Das Put-Call-Open-Interest-Verhältnis liegt derzeit bei 0,46 für Bitcoin-Optionen. Die Händler sind also im Allgemeinen mehr in Call-Optionen als in Put-Optionen engagiert.

Eine Call-Option (Put-Option) gibt dem Inhaber das Recht, den Basiswert zu einem vorher festgelegten Preis, dem so genannten "Strike", in der Zukunft zu kaufen (zu verkaufen).

Auf der Futures-Seite haben sich die offenen Zinsen sowohl für Futures als auch für unbefristete Kontrakte auf BTC überwiegend seitwärts bewegt. Der 3-Monats-Basissatz hat sich ebenfalls seitwärts bewegt und liegt derzeit bei etwa 2,3% p.a. Die ewigen Finanzierungssätze sind ebenfalls positiv.

Unterm Strich

In der vergangenen Woche wurden die meisten wichtigen Kryptoassets nach unten gehandelt, da die Anleger über den bevorstehenden Liquiditätsabzug aufgrund des TGA-Umbaus nachdenken.

Unser hauseigener Krypto-Sentiment-Index ist in der vergangenen Woche erneut gestiegen.

Die Einzahlungen von Walen an Börsen haben in letzter Zeit zugenommen, ebenso wie die Überweisungen von BTC-Minern an Börsen, was kurzfristig einen gewissen Abwärtsdruck auf die Preise ausüben könnte.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.