Bleiben Sie auf dem Laufenden mit unserer monatlichen Kryptoübersicht:

- Der September war ein historischer Monat für Bitcoin, da El Salvador als erstes Land die Kryptowährung als gesetzliches Zahlungsmittel eingeführt hat.

- Unter den Top Ten der Kryptowährungen war Solana im vergangenen Monat ein großer Gewinner, der trotz der allgemeinen Korrektur an den Kryptomärkten um 38,57% gestiegen ist.

- Obwohl die US-Finanzaufsichtsbehörden ihre Bemühungen zur Regulierung von Kryptowährungen zu verstärken scheinen, ist das Interesse der Institutionen an Bitcoin und anderen Kryptowährungen so groß wie nie zuvor.

Krypto-Markt Überblick

Download des vollständigen Kommentars

Der September war ein historischer Monat für Bitcoin, da El Salvador als erstes Land die Kryptowährung als gesetzliches Zahlungsmittel eingeführt hat.

Seit dem 7. September können die Salvadorianerinnen und Salvadorianer wählen, ob sie Waren und Dienstleistungen mit Bitcoin oder dem US-Dollar bezahlen wollen. Bis Mitte September haben über 1,6 Millionen Bürgerinnen und Bürger Chivo Wallet, die offizielle Bitcoin-Wallet der Regierung, heruntergeladen.

El Salvador ist auch der erste Nationalstaat, der Bitcoin kauft und hält. Präsident Nayib Bukele auf Twitter angekündigt dass das mittelamerikanische Land im September insgesamt 700 BTC gekauft hat.

In den Tagen vor dem "Bitcoin-Tag" in El Salvador stieg der Bitcoin-Preis (BTC) in der ersten Septemberwoche auf über $52.000. Aufgrund der weltweiten Marktunsicherheit angesichts der Evergrande-Saga in China stürzte der Bitcoin-Kurs jedoch ab.

Evergrande, ein börsennotierter chinesischer Immobilienentwickler, expandierte aggressiv durch die Aufnahme von Krediten in Höhe von mehr als $300 Mrd. (255 Mrd. €), hat aber nun Schwierigkeiten, die Zinszahlungen zu decken, da die Volksrepublik kürzlich Kreditobergrenzen für Immobilienentwickler eingeführt hat.

Angesichts der schieren Größe von Evergrande und des systemischen Risikos, das der Zusammenbruch des Unternehmens für den chinesischen Immobilienmarkt und den Bankensektor bedeuten würde, reagierten die globalen Aktienmärkte mit einem starken Rückgang. Die Kryptowährungen folgten mit einer Kurskorrektur von über 20% bei Bitcoin und anderen führenden Kryptowährungen, obwohl sie sich in den folgenden Tagen relativ gut erholt haben.

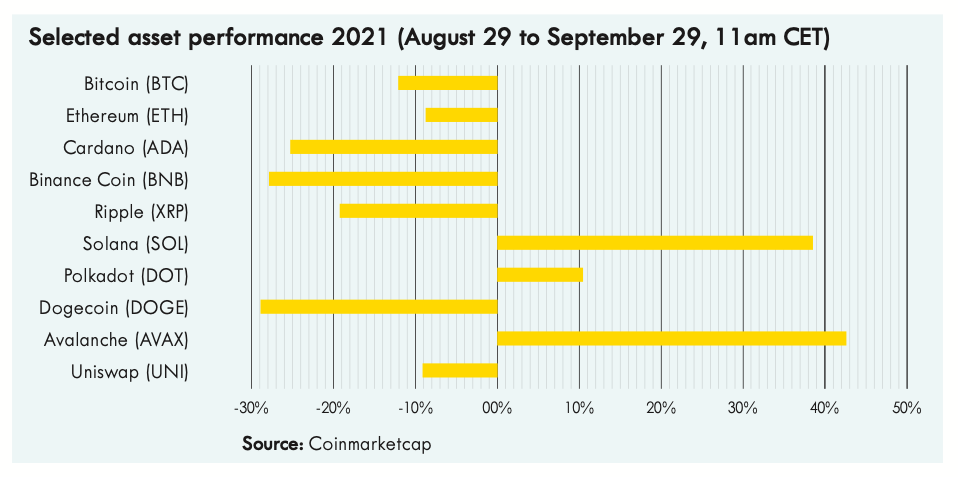

Krypto Asset Performance Übersicht

Unter den Top Ten der Kryptowährungen war Solana (SOL) im vergangenen Monat ein großer Gewinner, der trotz der allgemeinen Korrektur an den Kryptomärkten um 38,57% gestiegen ist. Die relativ neue Kette, die sich als Favorit unter VCs und Crypto Twitter herauskristallisiert hat, war in der Lage, Entwickler anzuziehen, um DeFi-Protokolle zu erstellen und NFT-Ventures auf der Blockchain der nächsten Generation zu starten, was unterstreicht, dass sie eine echte Bedrohung für die Dominanz von Ethereum im dApp-Bereich ist.

Ähnlich wie Solana konnte auch Avalanche (AVAX) deutliche Zuwächse verbuchen (42,67%), während der Kurs von Polkadot um 10,46% gestiegen ist, da Entwickler und Nutzer von Ethereum (aufgrund seiner hohen Gasgebühren) zu skalierbareren und erschwinglicheren Chains wechseln.

Bitcoin fiel im Vergleich zum Vormonat um 12,05%, was darauf hindeutet, dass die weltweit führende Kryptowährung, obwohl sie in Zeiten wirtschaftlicher Turbulenzen als sicherer Hafen gilt, sich zuweilen immer noch wie ein riskanter Vermögenswert verhält. Wie bei den meisten führenden digitalen Vermögenswerten folgte der starke Kursrückgang von Bitcoin auf den Fall von Evergrande.

Ether (ETH) fiel um 8,75%, während Cardano (ADA), Ripple (XRP), Binance Coin (BNB) und Dogecoin (DOGE) zwischen 18% und 28% an Wert verloren. Uniswap (UNI) schloss den Monat 9,08% niedriger

Die Preiskorrektur bei Uniswap war teilweise auf eine berichtet SEC-Untersuchung des Uniswap-Entwicklers Uniswap Labs als Teil des Vorstoßes der Finanzaufsichtsbehörde zum besseren Verständnis und zur potenziellen Regulierung dezentraler Finanzen (DeFi).

Ein Blick auf die Entwicklung der traditionellen Anlageklassen zeigt, dass Evergrande die Aktienmärkte weltweit erschütterte, als die Probleme des Unternehmens bekannt wurden. Trotz einer relativ schnellen Erholung schloss der S&P 500 den Monat 3,89% niedriger, während der MSCI World Equity Index um 3,59% fiel.

Der Goldpreis (XAU) erholte sich nach der Nachricht von Evergrande, da die Anleger Mittel in den sicheren Hafen umschichteten. Im Monatsvergleich hat das Edelmetall jedoch 4,07% seines Wertes verloren und damit seine schlechte Performance in diesem Jahr fortgesetzt.

US-Treasuries waren auch im September gefragt. Die Renditen zogen an, da die Anleger Zuflucht vor der Volatilität an den Aktienmärkten suchten. Der S&P U.S. Government Bond Index ist im Monatsvergleich um 1,03% gefallen.

Institutionelles Interesse an Kryptowährungen

Obwohl die US-Finanzaufsichtsbehörden ihre Bemühungen zur Regulierung von Kryptowährungen zu verstärken scheinen, ist das Interesse der Institutionen an Bitcoin und anderen Kryptowährungen so groß wie nie zuvor.

Die Citigroup ist Berichten zufolge wartet auf die behördliche Genehmigung, um den Handel mit Bitcoin-Futures an der Chicago Mercantile Exchange (CME) aufzunehmen. Der US-Backgigant sucht außerdem aktiv nach Mitarbeitern für ein in London ansässiges Krypto-Handelsteam.

Die Schweizer Börse SIX, an der zahlreiche börsengehandelte Krypto-Produkte gehandelt werden, hat erhielt eine behördliche Genehmigung um seine Börse für digitale Vermögenswerte, SIX Digital Asset Exchange (SDX), zu lancieren. Die Genehmigung der Eidgenössischen Finanzmarktaufsicht FINMA erlaubt es SDX, den regulierten Handel, die Abwicklung und die Verwahrung von Kryptowährungen und digitalen Wertpapieren aufzunehmen.

Am 13. September hat die zur Deutschen Börse gehörende Terminbörse Eurex, gestartet Der Handel mit Bitcoin-ETN-Futures ist der erste Schritt der Börse in den Bereich der Krypto-Derivate.

Der Vorstoß für einen Bitcoin-ETF in den USA hat sich auch in diesem Monat fortgesetzt, mit Invesco und Galaxy Digital gemeinsame Einreichung für einen physisch besicherten Bitcoin-ETF und folgt damit den Unternehmen Van Eck und Fidelity. Obwohl die SEC noch keine Krypto-ETFs genehmigt hat, deutet die fortschreitende Institutionalisierung von Bitcoin als Anlageklasse darauf hin, dass es nur eine Frage der Zeit sein könnte, bis ein Bitcoin-ETF an einer großen US-Börse notiert wird.

Bitcoin in den Bilanzen

MicroStrategy, angeführt von Michael Saylor, einem ausgesprochenen Bitcoin-Befürworter, weitere 5.050 BTC gekauft Im September kaufte das börsennotierte Unternehmen 114.042 BTC im Wert von $3,16 Mrd. am Tag der Bekanntgabe. Das Unternehmen kaufte seine Münzen zu einem Durchschnittspreis von $27.713 pro Bitcoin.

Über DDA Ikonische Fonds

Iconic Funds ist die Brücke zum passiven und aktiv verwalteten Engagement in Kryptowährungen. Iconic Funds bietet über seine Tochtergesellschaften Krypto-Asset-ETPs, diversifizierte Indexfonds und Alpha-Strategien für Anleger an.

Iconic Funds hat es sich zur Aufgabe gemacht, die Akzeptanz von Krypto-Assets zu fördern. Als Brücke für Anleger, die in Krypto-Assets investieren wollen, bieten die lizenzierten und regulierten Vehikel von Iconic den Anlegern eine Auswahl an Anlagemöglichkeiten, die von passiven Indexanlagen bis hin zu aktiv verwalteten Strategien reichen. Iconic Funds beseitigt die technischen Risiken von Krypto-Investitionen, indem es Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten bietet.

Durch die Verbindung von modernster Technologie, innovativen Anlageprodukten und kompromissloser Professionalität steht Iconic an der Spitze der Krypto-Vermögensverwaltung.

Neueste Nachrichten

- Iconic Funds erhält die behördliche Genehmigung für einen neuen Fonds, der in Partnerschaft mit Coin Metrics aufgelegt wird, hier lesen

- Iconic Funds' Physical Bitcoin ETP Listing in Paris und Amsterdam an der Euronext, hier lesen

Iconic in der Presse

- ETF-Magazin, Die wichtigsten Werttreiber von Bitcoin und Ethereumvon Michael Geister, Leiter der Krypto-ETPs

- Ikonischer Blog, Ein Update zur Hash-Rate von BitcoinDominik Poiger, Leiter des Produktmanagements

- Börsen-Zeitung, Bitcoin hat nun Spielraum nach obenInterview mit Maximilian Lautenschläger, Mitbegründer und Abgeordneter von Iconic und Michael Geister, Leiter Krypto ETPs

- Fundview, Bitcoin, Ethereum & Co: Welche Faktoren beeinflussen den Wert von Kryptowährungen?

- Der Fonds, Krypto-RundtischMaximilian Lautenschläger, Mitbegründer und Abgeordneter der Iconic Holding

Kommende Webinare und Veranstaltungen

- HEDGEWEEK BETTER BUSINESS SUMMIT, 07. Oktober 2021, Simonne Hurse, Leiterin Investor Relations

- IM | Power -FUNDFORUM INTERNATIONAL, 20-22 Oktober, 2021, Maximilian Lautenschläger, Mitbegründer und MP von Iconic

Aktuelle Forschungsberichte

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

- Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

In keinem Fall können Sie die ICONIC HOLDING GMBH, ihre Tochtergesellschaften oder eine mit ihr verbundene Partei für direkte oder indirekte Anlageverluste haftbar machen, die durch Informationen in diesem Artikel verursacht wurden. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die ICONIC HOLDING GMBH ist in keiner Rechtsordnung als Anlageberater registriert. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Investitionsentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Investitionsmöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Prognosen und Meinungen, die sich als wesentlich ungenau erweisen können und von Natur aus erheblichen Risiken und Unsicherheiten unterliegen, die außerhalb der Kontrolle der ICONIC HOLDING GMBH liegen. Unsere Artikel und Berichte drücken unsere Meinungen aus, die wir auf der Grundlage allgemein verfügbarer Informationen, Feldforschung, Schlussfolgerungen und Ableitungen durch unsere Due Diligence und unseren analytischen Prozess gewonnen haben.

Die ICONIC HOLDING GMBH geht davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen, die wir für korrekt und zuverlässig halten. Diese Informationen werden jedoch "wie besehen", ohne jegliche Garantie, präsentiert.