Wichtigste Erkenntnisse

- Massive Verwerfungen an den Krypto-Derivatemärkten in Folge des FTX-Debakels deuten auf eine kurzfristige Bodenbildung hin

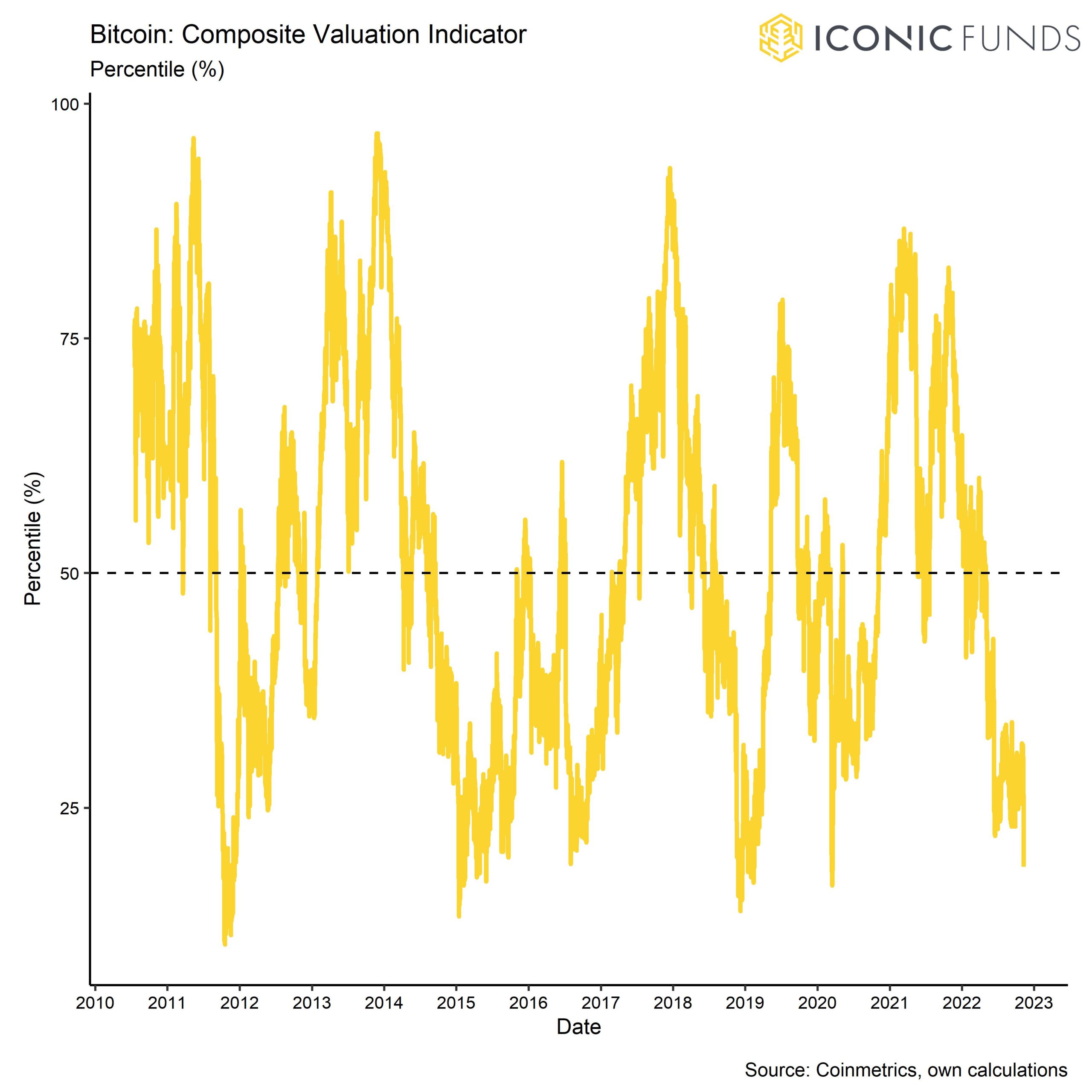

- Fire-Sale-Bewertungen und die Tatsache, dass wir nach den jüngsten US-Inflationsdaten den Höhepunkt der maximalen Falschheit der Fed überschritten haben könnten, erhöhen die Wahrscheinlichkeit einer zyklischen Bodenbildung an den Kryptomärkten

Massive Verwerfungen auf den Derivatemärkten

(Wir haben kürzlich ausführlicher über die Ereignisse berichtet, die zum FTX-Debakel führten hier.)

Infolge des jüngsten Debakels um die große Kryptobörse FTX und ihre Muttergesellschaft Alameda Research haben die Kryptomärkte deutlich nachgegeben. Während Bitcoin seit Beginn der Woche weitere -17% verloren hat, hat der FTX Token (FTT) bisher -85% verloren.

Der Ausverkauf wurde von starken Verwerfungen an den Krypto-Derivatemärkten begleitet. Genauer gesagt, stieg das Verhältnis zwischen Put- und Call-Volumen für Bitcoin-Optionen an der wichtigsten Krypto-Derivate-Börse Deribit sprunghaft an, was darauf hindeutet, dass Händler Abwärtsrisiken in erheblichem Maße durch Puts absicherten. Zu einem Zeitpunkt am Dienstag dieser Woche wurden 1,6 Mal mehr Puts als Calls auf Bitcoin gehandelt.

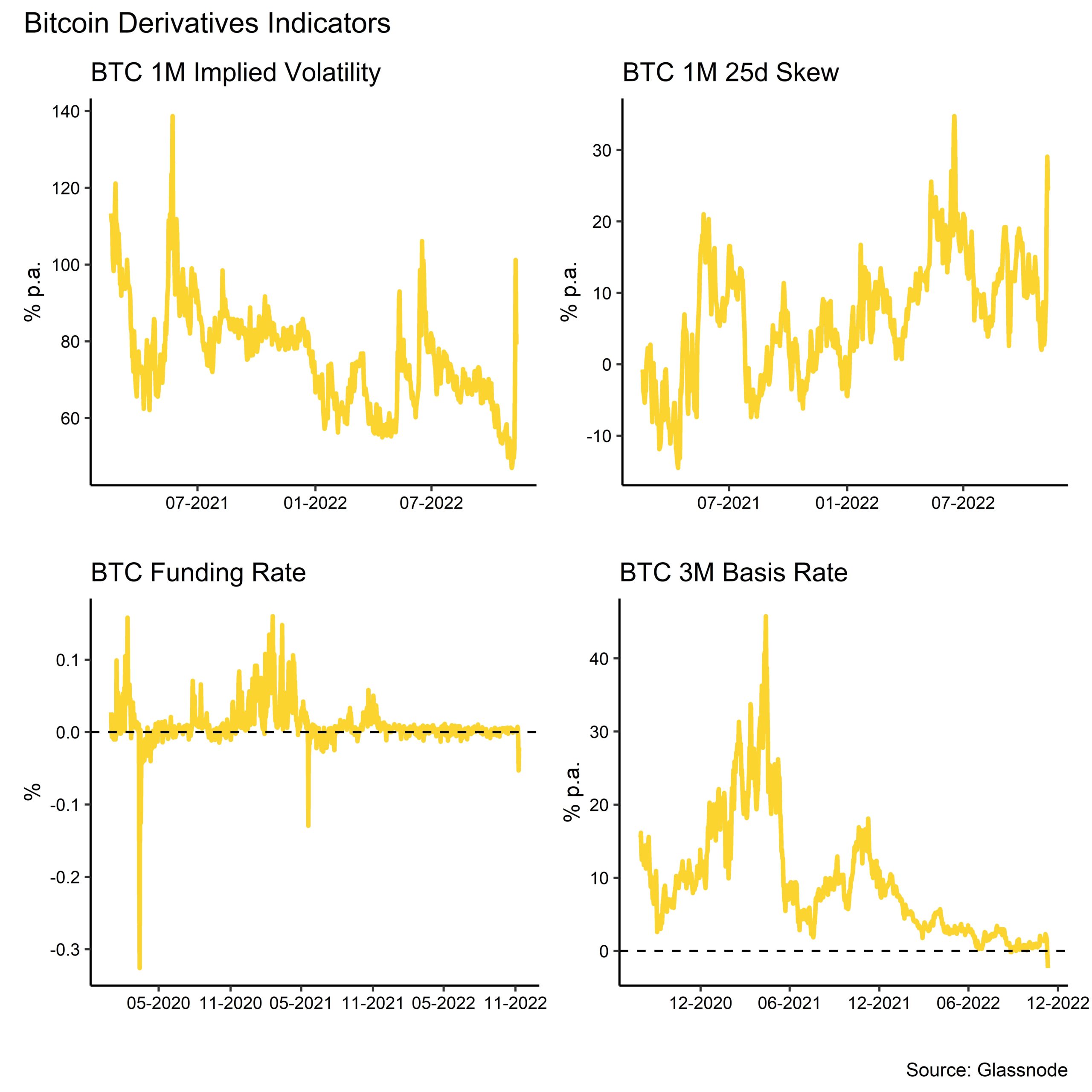

Dies wird auch durch die Tatsache gestützt, dass der Options-Skew deutlich zugunsten von Puts zunahm und die implizite Volatilität von Bitcoin-Optionen in die Höhe schnellte.

Darüber hinaus fielen die Refinanzierungssätze für unbefristete Bitcoin-Futures-Kontrakte stark ins Minus, ebenso wie der 3-Monats-Basissatz. Beide Phänomene deuten darauf hin, dass die Händler weitgehend Short- gegenüber Long-Kontrakten bevorzugten.

Die 3-Monats-Basis wurde sogar negativ, was darauf hindeutet, dass die Markterwartungen für die nächsten drei Monate relativ pessimistisch sind. Die 3-Monats-Basis ist die Differenz zwischen einem 3-Monats-Futures-Kontrakt und dem aktuellen Spotpreis von Bitcoin. Eine Long-Position am Kassamarkt und eine Short-Position im delta-äquivalenten 3-Monats-Futures-Kontrakt wird oft als "Carry Trade" bezeichnet, da der Futures-Kontrakt früher mit hohen Aufschlägen gegenüber dem Kassakurs gehandelt wurde.

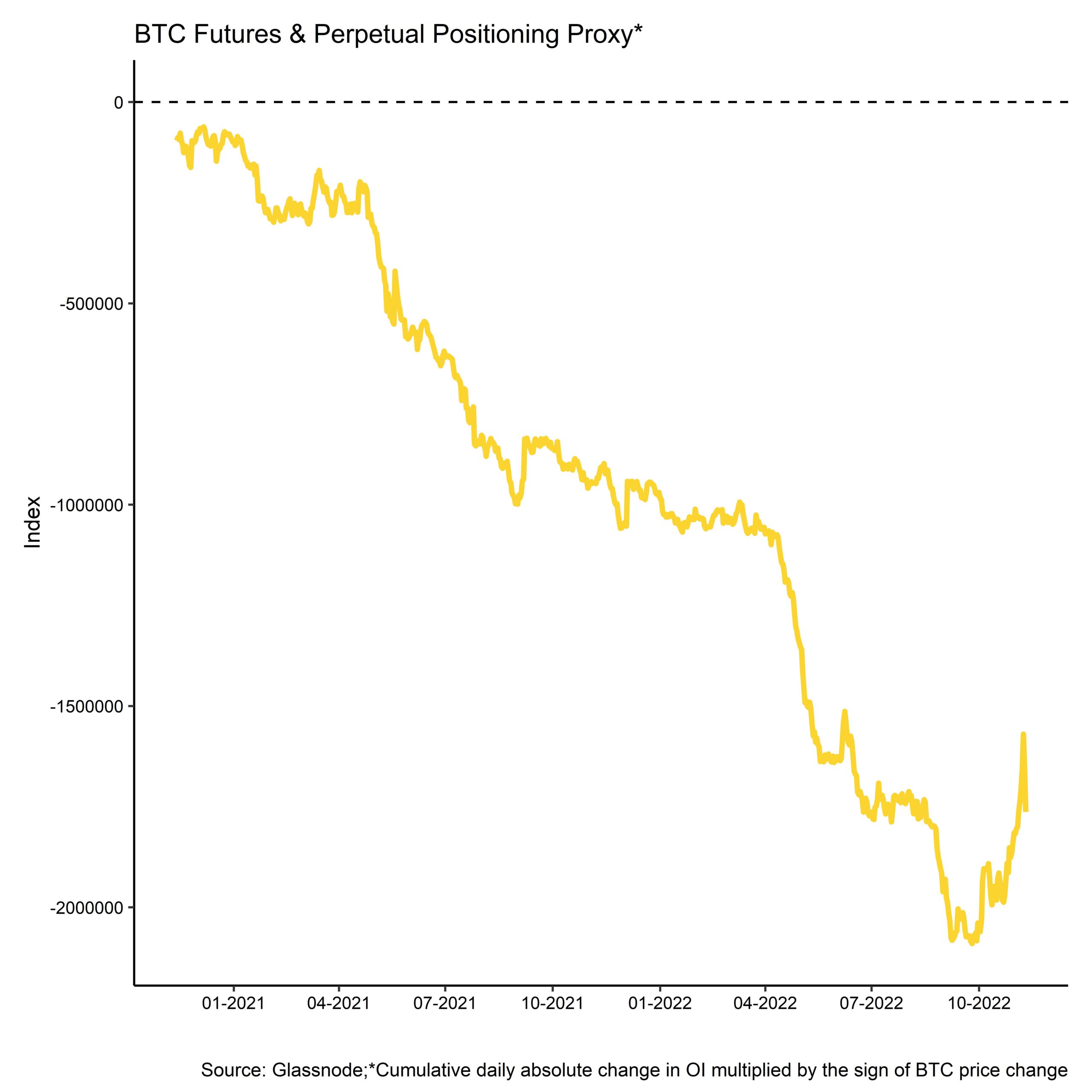

Dies hat sich in jüngster Zeit infolge der jüngsten Marktverwerfungen dahingehend geändert, dass die Händler diese Carry Trades massiv auflösten. Dies zeigt sich auch in unserem "Bitcoin Futures & Perpetual Positioning Proxy", der einen deutlichen Rückgang der Bitcoin-Netto-Short-Positionierung auf Tagesbasis zeigt. Nicht-kommerzielle Händler sind in der Regel aufgrund des Carry Trades netto short bei Bitcoin-Futures und Perpetuals.

Abgesehen von den oben erwähnten Verwerfungen war die Streuung zwischen den Altcoins im Vergleich zu Bitcoin sehr gering, was darauf hindeutet, dass der Markt eher von systematischen Faktoren als von münzspezifischen Faktoren beeinflusst wurde - etwas, das man normalerweise in der Nähe lokaler Tiefstände beobachtet.

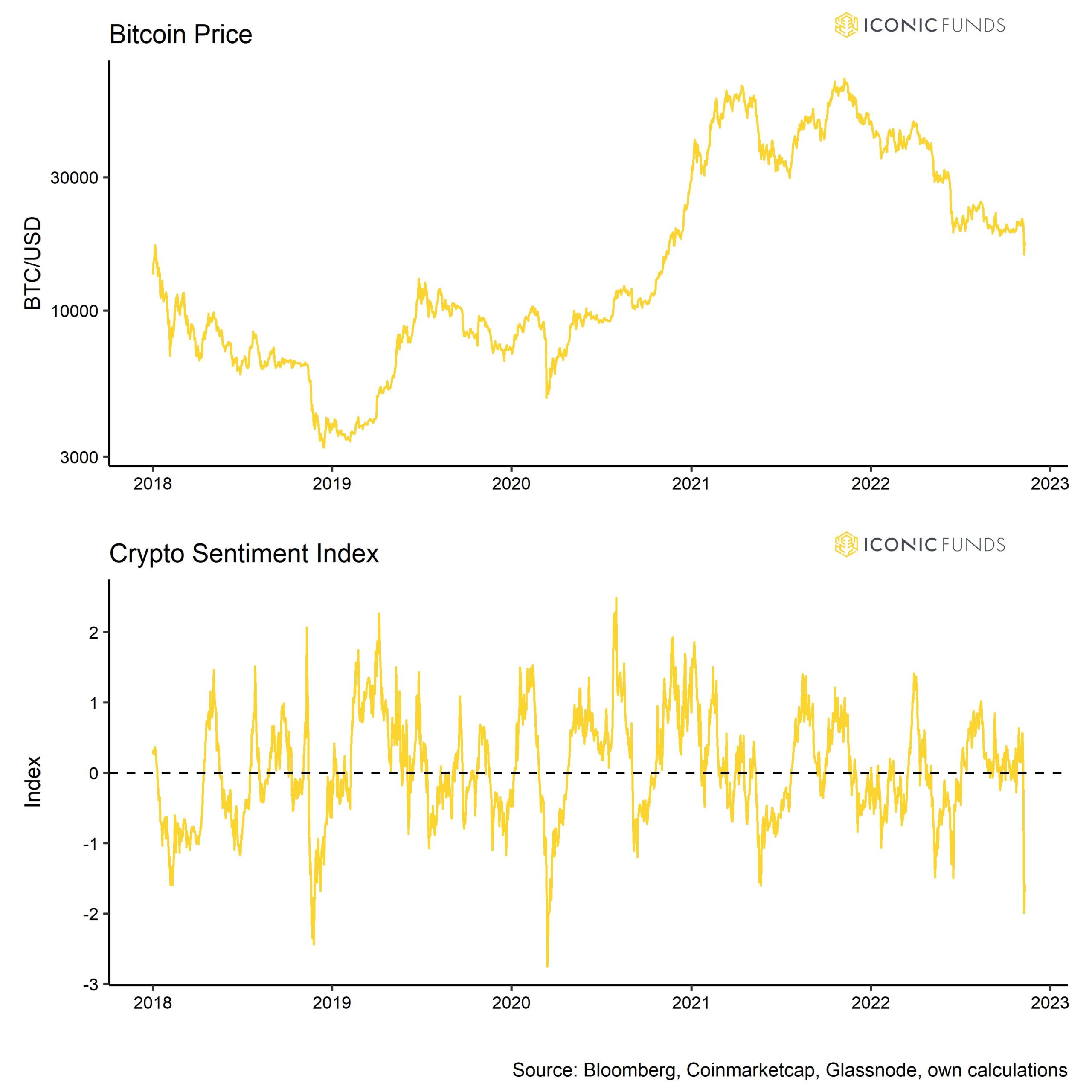

Wir haben vor kurzem 15 Metriken zu einem Aggregat zusammengefasst "Krypto-Stimmungsindex" die sogar ein höheres Maß an Baisse signalisiert als während des LUNA-Absturzes im Juni 2022. Alles in allem deuten diese Indikatoren derzeit auf einen kurzfristigen Tiefpunkt hin.

Der "Crypto Sentiment Index" wird auch Teil unseres neuen Wochenberichts sein, den wir bis Ende November regelmäßig veröffentlichen wollen.

In Kombination mit den "Ausverkaufs"-Bewertungen glauben wir, dass die Wahrscheinlichkeit einer zyklischen Bodenbildung bei Bitcoin und Kryptoassets im Allgemeinen zunimmt.

Die jüngsten US-Inflationsdaten, die unter dem Konsens liegen, unterstützen diese These aus makroökonomischer Sicht noch mehr, da sie darauf hindeuten, dass wir den Höhepunkt der "maximalen Falschheit" der Fed überschritten haben könnten. Wir haben diese Anlagehypothese auch in unserem letzten "Crypto Market Intelligence" ausführlicher behandelt (siehe hier).

Unterm Strich: Generell sind wir der Meinung, dass sich das Risiko-Ertrags-Verhältnis nach den jüngsten Ereignissen deutlich verbessert hat und dass dies ein attraktives Umfeld für Anleger sein könnte, um ihr strategisches Engagement in Krypto-Assets zu erhöhen.

Bleiben Sie bescheiden und stapeln Sie Sats,

Über DDA Ikonische Fonds

Iconic Funds ist die Brücke zu Krypto-Investitionen durch vertrauenswürdige Anlageinstrumente. Wir bieten Anlegern sowohl passive als auch Alpha-Strategien für Kryptowährungen sowie Risikokapitalmöglichkeiten.

Wir liefern hervorragende Leistungen durch vertraute, regulierte Vehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter erwarten, während wir unsere Mission verfolgen, die Verbreitung von Kryptoanlagen voranzutreiben.

Aktuelle Nachrichten und Artikel

- Institutionelle Krypto-Annahme: Warum und wie Institutionen auf Krypto umsteigen

- Krypto-Portfolio-Zusammensetzung: Wie sich verschiedene Portfolios während der jüngsten Bullen- und Bärenmärkte entwickelt haben

- Maßgeschneiderte Krypto-Fonds: Wie das Iconic Quant Solutions Team Anlegern ermöglicht, Zielrenditen zu erzielen

- Wie man in Ethereum (ETH) investiert: Ein Leitfaden für professionelle Anleger

- Das Argument für aktiv verwaltete Anlagestrategien auf den Kryptomärkten

- Wie man in NFTs investiert: Ein Leitfaden für professionelle Anleger

- Warum die Volatilität von Bitcoin Sie nicht erschrecken sollte

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

Iconic in der Presse

- ETF-Stream: Zahl der White-Label-Emittenten in Europa innerhalb einer Woche verdreifacht

- ETF-Strategie: Iconic Funds lanciert das weltweit erste Krypto-ETP auf ApeCoin

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds erweitert seine Produktpalette mit einem physischen Ethereum-ETP

Aktuelle Forschungsberichte

Kryptoassets und die Makroökonomie: Können Makrofaktoren den Preis von Bitcoin erklären?

Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Iconic Holding GmbH, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Iconic Holding GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.