NFTs are trading for millions of dollars, raking in substantial profits for creators, NFT marketplaces, and investors. No wonder then that more and more people – from high-net-worth individuals and venture capital firms to famous artists and celebrities – are rushing to cash in on this opportunity. If you find yourself being pulled into the vortex of NFT investing keep reading to learn how to invest in NFTs.

What Are NFTs?

Non-fungible tokens (NFTs) are digital assets that represent unique real-world or virtual items on the blockchain.

Examples of items that NFTs can represent include car ownership documents, land titles, art, music, in-game items, tickets to a physical event, and collectibles.

Non-fungible means that an item isn’t interchangeable with another because of its unique properties. For example, if you lend someone your car, you will not accept back a different car even if it’s the same model. The reason might be that your car holds sentimental value to you, which makes it distinctively different from any other car of the same model. On the contrary, fungible objects are perfectly interchangeable. A prime example is money. Because of their fungibility, one dollar bill can be swapped for another dollar bill at virtually no cost.

Die origin of NFTs can be traced back to 2012 when Yoni Assia, the CEO of eToro, presented the concept of colored coins. These described the concept of unique tokens existing on the Bitcoin blockchain. It was the idea that colored coins would represent assets like company shares, coupons, and digital collectibles. However, they never really took off, not least because Bitcoin’s blockchain is technically inept to allow for the straightforward creation of colored coins.

Consequently, attention shifted to other blockchains. Technically alike but under a different name, the concept of colored coins started to emerge under the new name of NFTs as Ethereum gained popularity in 2017. Some of the projects that date back to that time are Peperium, Cryptopunks, and CryptoKitties.

Today, arguably the most prolific NFT collection is the Board Ape Yacht Club (BAYC), a collection of 10,000 unique Bored Ape NFTs typically used as profile pictures, on merchandise, or showcased as physical artwork.

Launched by Yuga Labs in April 2021, the BAYC has grown into a web3 ecosystem, composed of NFT collections, a native token called ApeCoin, a community-powered DAO, and an upcoming metaverse.

How Do NFTs Work?

A digital asset can be considered an NFT if it’s unique and is minted on the blockchain. Besides Ethereum, you can mint NFTs on Avalanche, Binance Smart Chain, Flow, Polygon, Solana, Stacks, and numerous other chains.

Smart contracts power NFTs as is the case with Ethereum. If you mint an NFT on Ethereum, the smart contract assigns you exclusive ownership over it. No one else can own that NFT at the same time as you. The NFT will have a unique ID and metadata that no person can replicate. If you decide to transfer the NFT to someone else, the smart contract will execute the move. Once the NFT has reached their wallet, you can no longer control it.

When you mint an NFT, you execute a code in the smart contract that corresponds to the blockchain’s token standard. The most popular NFT standard on Ethereum is ERC-721. A more recent Ethereum token standard that has gained popularity is ERC-1155, which allows for a single smart contract to include non-fungible, fungible, and semi-fungible tokens. Being a copycat of Ethereum, Binance Smart Chain has the same standards called BEP-721 and BEP-1155, while Solana has Metaplex.

Because of a blockchain’s transparency, an NFTs history is accessible to anyone, which means that you can track the ownership history on the blockchain. The history of your NFT contains the public key of the person that created the NFT. The creator’s public key is stored on the blockchain as a permanent record and acts as a certificate of authenticity. If you sell an NFT, the original creator may earn a resale royalty if programmed into the NFT’s smart contract.

NFT Use Cases

Creators, brands, and web3 startups are minting NFTs for various applications, generating value for themselves and consumers. The most popular use cases are listed below:

- Art NFTs: Artists are minting their art on the blockchain and selling it for millions of dollars. The blockchain ensures that anyone can verify the ownership and authenticity of digital art online. Also, art NFTs have improved accessibility for smaller investors, who can’t afford the generally expensive physical pieces.

- Gaming NFTs: Blockchain gaming provides an avenue to invest in NFTs. As a player, you acquire full ownership of in-game items upon purchase. You can buy virtual land, skins, or weapons, and sell them on NFT marketplaces to make money.

- DeFi NFTs: Decentralized finance (DeFi) and NFTs have merged to provide investors with a variety of benefits. For instance, you can use an NFT as collateral to access a loan on a DeFi lending platform. Conversely, you can earn NFTs for staking tokens on a DeFi platform like BakerySwap and then sell them for profit on secondary markets.

- Collectibles: You can buy NFTs in the form of digital collectibles. Collectibles can also be art, gaming, and sports memorabilia NFTs.

- Wearable NFTs: Fashion has made its way into the metaverse in the form of wearable NFTs. The metaverse is a virtual world, inspired by real-world features but cooler. Avatars in the metaverse need clothes, and you can dress them in a variety of fashionable pieces. You can also sell wearable NFTs on secondary markets for a profit.

- Music NFTs: Music artists are raking in millions of dollars from selling music NFTs. Buyers can hold these music NFTs and sell them later for a profit. Grimes, Steve Aoki, Eminem, Kings of Leon, The Weekend, and most notably Snoop Dogg have all made money through music NFTs.

Top-Selling NFTs

Both creators and investors are earning a lot of money with NFTs.

According to a NonFungible report, NFT sales hit $17.7 billion in 2021, which is more than 200 times the sales in 2020 ($82.5 million).

In comparison, the traditional art market generated an estimated $65.1 billion in sales, according to the Art Basel and UBS Global Art Market Report 2022.

And NFTs continue to sell for a lot of money in 2022. It will be interesting to see how the total annual sales compared to 2021. Will the market be able to achieve another record this year?

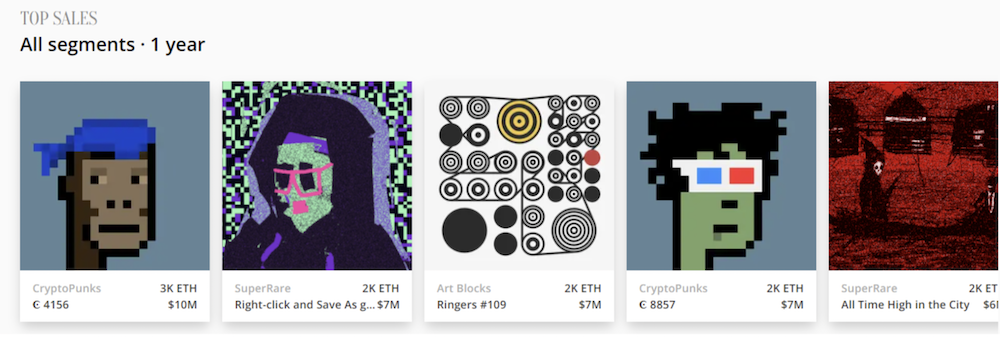

Examples of last year’s top-selling NFTs include:

- Cryptopunks #4156 – $10 million

- Right-click and Save As Guy – $7 million

- Ringers #109 – $7 million

- Cryptopunks #8857 – $7 million

- All Time High in the City – $6 million

The artist behind Right-click and Save As Guy and All Time High in the City uses the pseudonym XCOPY. He’s a London-based artist and well-known for his dark dystopian art.

It’s worth mentioning that The Merge by Pak is the most expensive NFT ever sold. 28,983 collectors contributed funds to purchase this NFT for $91.8 million. The piece sold on December 2, 2021.

Another expensive NFT is Beeple’s Everyday: the First 5000 Days. The sale of this digital art made headlines across the globe, grabbing the attention of the mainstream media. It sold for $69.3 million, rewarding Beeple for his efforts towards creating one artwork every day since 2007. The collage contains 5,000 pieces created throughout that period.

How to Invest in NFTs

As with any other investment, the process of investing begins with research. This way you will better understand the market and you can adjust your expectations accordingly.

For instance, Cryptopunks NFTs are popular but expensive. So, unless you have several millions of dollars lying around, this might not be the NFT for you.

Research can also provide information on upcoming and promising NFT projects that allow investors to get in as early adopters. That way, you can buy the project NFTs when they’re still affordable and sell them later for a profit. Keep in mind, though, that profitable sales don’t happen overnight. For example, the Cryptopunks project has been around since 2017, and only in 2021 did it really take off. Therefore, it takes time before an NFT investment pays off, if at all. Also, bear in mind the uncertainty around taxation, and regulation but also the high risk of a total loss of investment.

Once you find something of interest, load your wallet with the necessary cryptocurrency to pay for the NFT and potential gas fees associated with it. With most NFTs, you’ll need a digital asset like ETH to invest in NFTs. For NFTs on other blockchains, the chain’s respective asset is needed. The cryptocurrencies you will need you can buy from reputable exchanges like Kraken, Coinbase, and Gemini. While some exchanges have NFT marketplaces, a popular way to buy an NFT is to use secondary marketplaces like OpenSea and SuperRare or a project’s own NFT marketplace.

With the funds in your wallet, you can now bid or pay a fixed price for the NFT you want to own. A successful purchase will result in the transfer of the NFT to your wallet, where you can hold it until you decide to sell.

Exposure to the ApeCoin ecosystem

ApeCoin is the native token of the APE Ecosystem, launched by Yuga Labs, the creators of BAYC. ApeCoin gives the participants the ability to control the ApeCoin DAO (“decentralized autonomous organization”) and vote on how the ecosystem funds should be used, e.g. for the development of games or services.

The Iconic Physical ApeCoin ETP (ISIN: DE000A3GYNY2) is an exchange-traded product that tracks the spot price of ApeCoin via the CMBI ApeCoin Index. The ETP is 100% collateralized by APE tokens held in an institutional-grade custody solution with Coinbase Germany GmbH.

- Physically backed by APE stored in cold storage with additional third-party insurance.

- Competitive total expense ratio of 1.49% p.a.

- Listed and traded on Börse Stuttgart.

- No lending/staking of assets.

Click here to learn more about the Iconic Physical ApeCoin ETP.

Über DDA Iconic Funds

Iconic Funds is the bridge to crypto asset investing through trusted investment vehicles. We provide investors both passive and alpha-seeking strategies to crypto, as well as venture capital opportunities.

We deliver excellence through familiar, regulated vehicles offering investors the quality assurances they deserve from a world-class asset manager as we champion our mission of driving crypto asset adoption.

Recent News

- Bitcoin vs. Gold: Warum Sie wahrscheinlich besser dran sind, wenn Sie "digitales Gold" kaufen

- Warum die Volatilität von Bitcoin Sie nicht erschrecken sollte

- Wie Green Mining zur Norm für das Bitcoin-Netzwerk wird

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

- Wie Layer-2-Lösungen Ethereum bei der Skalierung helfen

Iconic in Press

- ETF-Stream: Zahl der White-Label-Emittenten in Europa innerhalb einer Woche verdreifacht

- ETF-Strategie: Iconic Funds debuts world’s first ApeCoin crypto ETP

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

Recent Research Reports

Wie haben sich die Portfolios während der Pandemie entwickelt? ➡ Hier herunterladen

Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

“This article represents solely a non-binding preliminary information which serves exclusively advertising purposes. It is not a prospectus in the sense of the Regulation (EU) 2017/1129(Prospectus Regulation) and the German Securities Prospectus Act (Wertpapierprospektgesetz – WpPG). It does not constitute an offer of securities for sale in the United States and the securities referred to in this notice may not be offered or sold in the United States absent registration or an exemption from registration.

Risikoerwägungen:

The price of an investment in an Iconic ETP may go up or down and the investor may not get back the amount invested. The price performance of cryptocurrencies is highly volatile and unpredictable. Past performance is hence no guarantee of future performance. You agree to do your own research and due diligence before making any investment decision with respect to securities or investment opportunities discussed herein. The approval of the prospectus should not be construed as an endorsement of the securities offered or admitted to trading on a Regulated Market. These are not extensive risk considerations. Prospective investors should read the prospectus before making any investment decision in order to fully understand the potential risks and rewards of deciding to invest in the securities. The prospectus is available at https://deutschedigitalassets.com/iape-iconic-physical-apecoin-etp/.