Erfahren Sie mehr über grünes Bitcoin-Mining und warum mit erneuerbarer Energie betriebenes Krypto-Mining höchstwahrscheinlich zur Norm werden wird.

Das Bitcoin-Mining ist in den letzten Monaten wegen des hohen Energieverbrauchs, der erforderlich ist, um das Bitcoin-Netzwerk am Laufen zu halten, in die Kritik geraten. Was die Bitcoin-Kritiker jedoch nicht wissen, ist, dass das Bitcoin-Mining immer umweltfreundlicher wird. Mehr noch, das Bitcoin-Mining fördert die Entwicklung effizienterer Lösungen für erneuerbare Energien.

Bitcoin-Mining ist bereits grüner als Sie denken

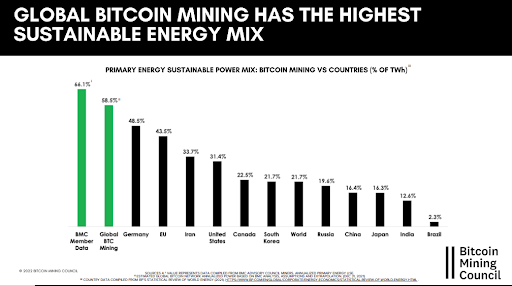

Laut einem Q4/2021-Bericht des Bitcoin Mining Council (BMC) verbraucht das Bitcoin-Mining "einen höheren Mix an nachhaltiger Energie als jedes andere große Land oder jede andere Industrie der Welt".

BMC sammelte die Daten aus über 46% des globalen Bitcoin-Netzwerks. BMC-Mitglieder und Umfrageteilnehmer nutzten zu diesem Zeitpunkt "Strom mit einem 66,1% nachhaltigen Strommix".

Wie aus dem obigen Diagramm hervorgeht, belief sich der globale nachhaltige Strommix für den BTC-Bergbau in Q4/2021 auf 58,5%, was einem Wachstum von 1% gegenüber Q3/2021 entspricht. Daher, Grünes Bitcoin-Mining ist auf dem Vormarsch, und das könnte bis 2022 anhalten.

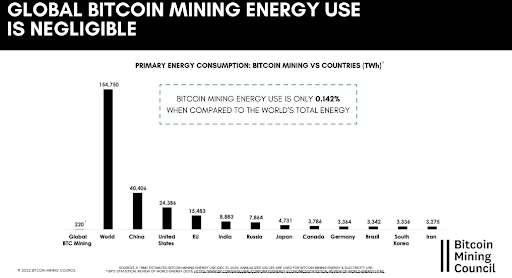

Der BMC Bericht stellt außerdem fest, dass der Energieverbrauch des Bitcoin-Minings im Vergleich zur weltweiten Gesamtenergie nur 0,142% beträgt und damit fast vernachlässigbar ist.

Auch der Energieverbrauch von Bitcoin macht positive Fortschritte, indem er die Energie verbraucht, die die Welt verschwendet. Wie BMC berichtet, Das weltweite Bitcoin-Mining verbraucht 0,44% der weltweit verschwendeten Energie.

In Texas zum Beispiel kaufen Bitcoin-Schürfer überschüssige Energie, wenn sie nicht nachgefragt wird, und schalten ihre Anlagen ab, wenn die Nachfrage steigt.

Die wichtigsten Quellen für grünen Strom für das Bitcoin-Mining sind Solar, Wasser und Wind.

Darüber hinaus wird durch das Bitcoin-Mining auch der Abfall aus nicht erneuerbaren Quellen wie Kohle reduziert.

Zum Beispiel, laut eine Geschichte In der Zeitschrift Forbes wird berichtet, dass ein Einwohner von West-Pennsylvania gefährliches Material durch Bitcoin-Mining für einen guten Zweck verwendet. Bill Spence verwandelt Bitumenmüll in Bitcoin und rettet so das Grundwasser vor einer möglichen Verschmutzung und unterstützt gleichzeitig das Bitcoin-Netzwerk.

Bitcoin-Initiativen für grüne Energie im Bergbau

Die Akteure in der Bitcoin-Branche sind bestrebt, das Bitcoin-Mining so umweltfreundlich wie möglich zu gestalten.

Um dieses Ziel zu unterstützen, spielt das BMC eine entscheidende Rolle bei der Aufklärung der Welt über die Vorteile des Bitcoin-Minings und den aktuellen Stand des grünen Bitcoin-Minings durch vierteljährliche Berichte.

Darüber hinaus unterstützt die Bitcoin Clean Energy Initiative (BCEI) von Square Bitcoin-Mining-Unternehmen bei der Einführung von umweltfreundlichen Lösungen. So sind Square und das Bitcoin-Infrastrukturunternehmen Blockstream eine Partnerschaft eingegangen, um ein solarbetriebenes Mining-Rig für BTC zu bauen. Im Rahmen dieser Partnerschaft wird Square $5 Millionen investieren, während Blockstream die Infrastruktur bereitstellt.

Außerdem veröffentlichte die BCEI eine Memo die zeigt, dass Bitcoin-Mining die weltweite Energiewende hin zu erneuerbaren Energien beschleunigen könnte. In dem Papier wird argumentiert, dass integriertes Bitcoin-Mining intermittierende Energiequellen wie Solarenergie in grundlastfähige Energieerzeugung umwandeln könnte.

Eine weitere Initiative, die Krypto-Klimavereinbarung, setzt sich für die Schaffung einer 100% kohlenstoffneutralen Kryptoindustrie bis 2030 ein. Die Partner des Crypto Climate Accord sind Energy Web, Rocky Mountain Institute und Alliance for Innovative Regulation.

Energy Web hat sich auch mit Ripple zusammengetan, um EW Zero zu entwickeln, "ein Open-Source-Tool, das wird jede Blockchain in die Lage versetzen, durch den Kauf von erneuerbarer Energie in lokalen Märkten weltweit zu dekarbonisieren."

Darüber hinaus hat sich Binance mit dem International Rec Standard zusammengeschlossen, um den Grünes Bitcoin-Projekt. Das Projekt bietet "eine vollständig transparenter Erwerb von Zertifikaten für erneuerbare Energien (REC) zur Verwaltung und Verfolgung des Energieverbrauchs aus erneuerbaren Energiequellen, da REC ein rechtlicher Nachweis dafür sind, dass die Energie aus erneuerbaren Stromquellen wie Sonnen- oder Windenergie erzeugt wurde".

Das bedeutet, dass Sie Ihre BTC grüner machen können, indem Sie RECs kaufen. Jeder REC steht für 1 MWh an grüner Energieerzeugung. RECs können dann verwendet werden, um den Strom von der Erzeugung bis zum Verbrauch zu verfolgen.

Immer mehr Bergleute werden grün

Bitfarms, eines der größten börsennotierten Bitcoin-Mining-Unternehmen, nutzt bereits erneuerbare Energien. Das kanadische Unternehmen kündigte außerdem Pläne an, 10 MW an grüner Wasserkraft durch eine Stromabnahmevereinbarung mit Paraguay zu sichern.

Andere Bitcoin-Mining-Unternehmen, die "grün" geworden sind, sind Argo Blockchain und Marathon. Argo sicherte sich ein Darlehen in Höhe von $25 Millionen, um eine Bitcoin-Mining-Anlage in Texas zu finanzieren, die ausschließlich erneuerbare Energie verwendet. Marathon Pläne im Jahr 2022 70% klimaneutral zu werden, mit dem Ziel, schließlich 100% klimaneutral zu werden.

Auch Unternehmen, die bereits in der Energiebranche tätig sind, leisten einen Beitrag zum grünen Bitcoin-Mining. Zum Beispiel, ein Ein altes Wasserkraftwerk im Bundesstaat New York wurde zu neuem Leben erweckt, als seine Besitzer begannen, seine Energie zum Bitcoin-Mining zu nutzen..

Im Oktober 2021 schließlich begann El Salvador mit dem vulkanischen Bitcoin-Mining, wenige Wochen nachdem es Bitcoin als gesetzliches Zahlungsmittel erklärt hatte. Das mittelamerikanische Land ist dank regelmäßiger vulkanischer Aktivität und Erdbeben als Land der Vulkane bekannt. Sobald dieses Projekt vollständig umgesetzt ist, wird es zu den globalen Bemühungen beitragen, das Bitcoin-Mining 100% grün zu machen.

Grünes Bitcoin-Mining wird wahrscheinlich die Norm werden

Die wachsende Zahl von Initiativen zum Bitcoin-Mining mit grüner Energie macht deutlich, dass die Akteure in der Bitcoin-Branche sehr daran interessiert sind, das Bitcoin-Mining umweltfreundlich zu gestalten.

In Zukunft wird grünes Bitcoin-Mining wahrscheinlich zur Norm werden, da Mining-Unternehmen sich beeilen, die Vorteile erschwinglicher erneuerbarer Energiequellen zu nutzen.

Dies wiederum könnte zur Entwicklung effizienterer Lösungen für erneuerbare Energien führen. Der freie Markt wird den Minern einen Anreiz bieten, die billigsten Energiequellen zu finden, um die Bitcoin-Mining-Gewinne zu maximieren.

Wir werden sehen, wie mehr grüne Bitcoin-Mining-Projekte auftauchen und schließlich zu 100% grünem Bitcoin-Mining führen. Früher oder später werden selbst die schärfsten Bitcoin-Kritiker ihre Meinung über die Umweltauswirkungen von Bitcoin ändern müssen.

Erfahren Sie mehr über Bitcoin und wie er zur ultimativen ESG-Investition werden könnte, hier klicken.

Iconic's Initiative zum Kohlenstoffausgleich

Anleger haben auch die Möglichkeit, klimafreundlich in Bitcoin zu investieren: Wir haben den CO2-Fußabdruck unseres Flaggschiff-Bitcoin-ETPs, des Iconic Funds Physisches Bitcoin-ETPmit projektbezogenen Emissionsgutschriften.

Mit Hilfe der transaktionsbasierten Methodik, die von der Kommission entwickelt wurde Frankfurt School Blockchain Centererzeugte unser Physical Bitcoin ETP einen CO2-Fußabdruck von etwa 37 Tonnen Kohlendioxid-Äquivalent (tCO2eq) über den analysierten Zeitraum vom 15. April bis 30. Juni 2021 (Q2 2021).

Um diese Emissionen langfristig auszugleichen, haben wir CO2-Zertifikate erworben und eingelöst (d.h. dauerhaft aus dem Verkehr gezogen), um wirkungsorientierte Projekte zu unterstützen, die von renommierten Klima- und Naturschutzverbänden geprüft und zertifiziert wurden.

Kohlenstoffemissionen von Bitcoin aus der Sicht von Investoren

Das Blockchain Center der Frankfurt School und intas.tech eine Studie veröffentlicht, die einen neuen Ansatz zum Ausgleich der durch das Bitcoin-Netzwerk verursachten CO2-Emissionen skizziert.

Sie befassen sich mit einem der stärksten Kritikpunkte an Bitcoin - dem Stromverbrauch. Diese Studie analysiert den aktuellen globalen CO2-Fußabdruck, der durch das Bitcoin-Netzwerk verursacht wird, und skizziert einen neuen Ansatz zum Ausgleich der CO2-Emissionen.

Laden Sie den Bericht herunter

Iconic's Forschungsberichte

- Kryptowährungen und die Sharpe-Ratio traditioneller Anlagemodelle ➡ Hier herunterladen

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

- Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Wichtige Hinweise

Dieser Artikel stellt lediglich eine unverbindliche Vorabinformation dar, die ausschließlich Werbezwecken dient. Es handelt sich nicht um einen Prospekt im Sinne der Verordnung (EU) 2017/1129 - Prospektverordnung) und des Wertpapierprospektgesetzes (WpPG).

Diese Mitteilung stellt weder ein Angebot zum Verkauf von Wertpapieren noch eine Aufforderung oder ein Angebot zum Kauf von Wertpapieren in einem Land dar, in dem ein solches Angebot oder eine solche Aufforderung ungesetzlich ist.

Sie stellt kein Angebot von Wertpapieren zum Verkauf in den Vereinigten Staaten dar. Die Wertpapiere, auf die in dieser Mitteilung Bezug genommen wird, dürfen in den Vereinigten Staaten nicht angeboten oder verkauft werden, es sei denn, sie sind registriert oder von der Registrierungspflicht befreit.

Zukunftsgerichtete Informationen beruhen auf einer Reihe von Annahmen und unterliegen einer Reihe von Risiken und Unsicherheiten. Viele dieser Risiken und Unwägbarkeiten liegen außerhalb der Kontrolle von Iconic und könnten dazu führen, dass die tatsächlichen Ergebnisse erheblich von denen abweichen, die in solchen zukunftsgerichteten Informationen angegeben oder impliziert sind. Zu diesen Risiken und Ungewissheiten gehören unter anderem die Bedingungen auf den Kapitalmärkten und die Fähigkeit, die Schuldverschreibungen erfolgreich zu vermarkten, sowie die globalen und lokalen wirtschaftlichen und geschäftlichen Bedingungen.

Alle zukunftsgerichteten Informationen in dieser Mitteilung beziehen sich auf das Datum dieser Mitteilung.

Iconic Funds verpflichtet sich nicht, solche zukunftsgerichteten Informationen zu aktualisieren, sei es aufgrund neuer Informationen, zukünftiger Ereignisse oder aus anderen Gründen, es sei denn, dies ist gesetzlich vorgeschrieben. Zusätzliche Informationen über diese Annahmen sowie Risiken und Ungewissheiten sind in den von Iconic Fund bei den Wertpapieraufsichtsbehörden eingereichten Unterlagen enthalten, einschließlich des letzten jährlichen Informationsformulars und der MD&A. Diese Unterlagen sind auch auf der Website von Iconic Fund abrufbar unter https://deutschedastg.

Die Kursentwicklung von Kryptowährungen ist sehr volatil und unvorhersehbar und die vergangene Kursentwicklung ist keine Garantie für die zukünftige Kursentwicklung.

Die Billigung des Prospekts ist nicht als Billigung der angebotenen oder zum Handel an einem geregelten Markt zugelassenen Wertpapiere zu verstehen. Potenzielle Anleger sollten den Prospekt lesen, bevor sie eine Anlageentscheidung treffen, um sich ein umfassendes Bild von den möglichen Risiken und Vorteilen einer Anlage in die Wertpapiere zu machen.

Die Prospekte der einzelnen ETP-Produkte sind unter https://deutschedigitalassets.com/xbti-iconic-funds-physical-bitcoin-etp/