Kryptoassets underperformen, während globale Aktien trotz Zinserhöhungen anziehen; Bitcoin-Wale in Aktion

DDA Krypto-Marktimpuls, 31. Juli 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

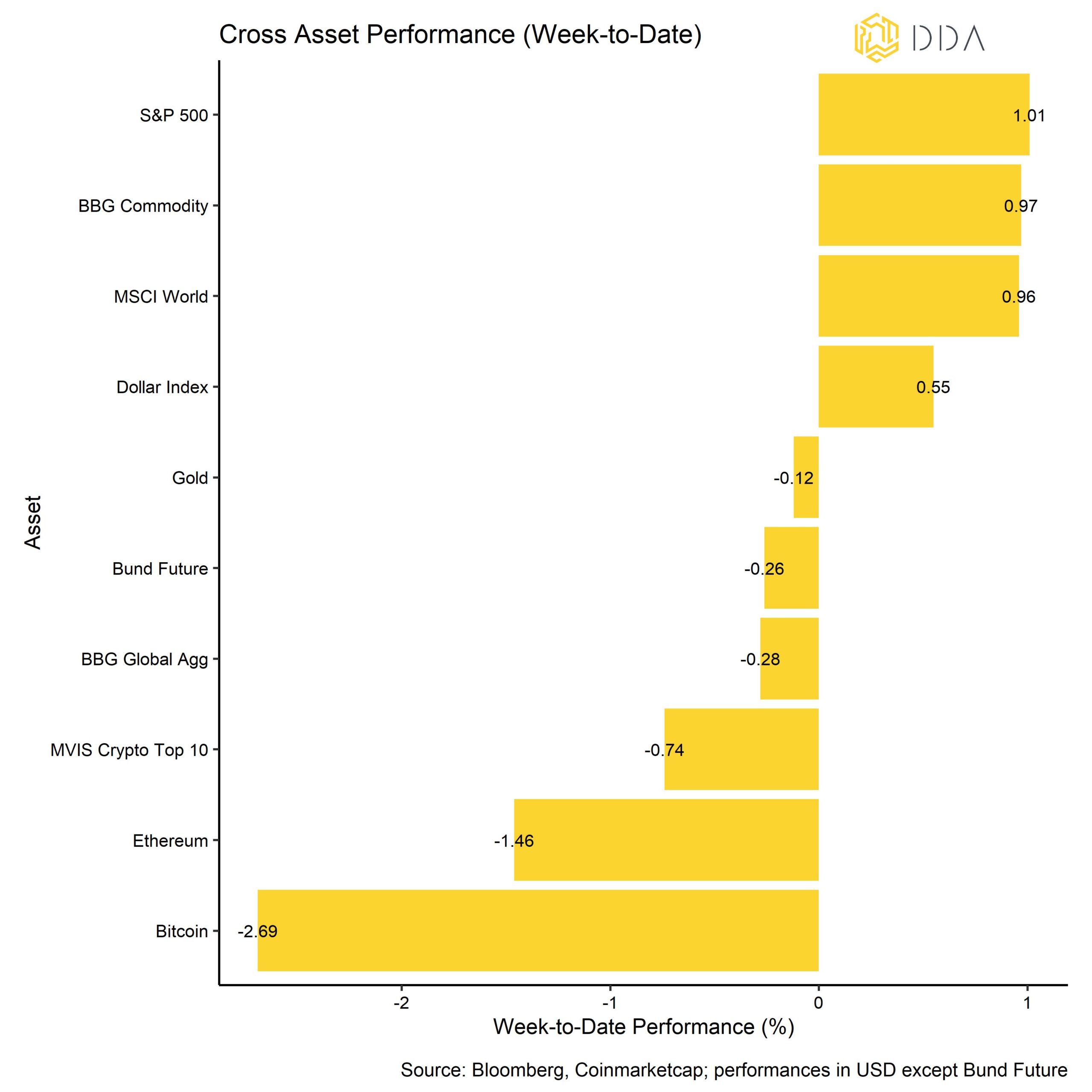

- Kryptoassets schnitten aufgrund einiger münzspezifischer Faktoren schlechter ab als traditionelle Vermögenswerte, während globale Aktien trotz weiterer Zinserhöhungen der Fed und der EZB weiter zulegen konnten

- Unser hauseigener Crypto Sentiment Index hat einen Teil der Euphorie der vergangenen Wochen wieder aufgefangen

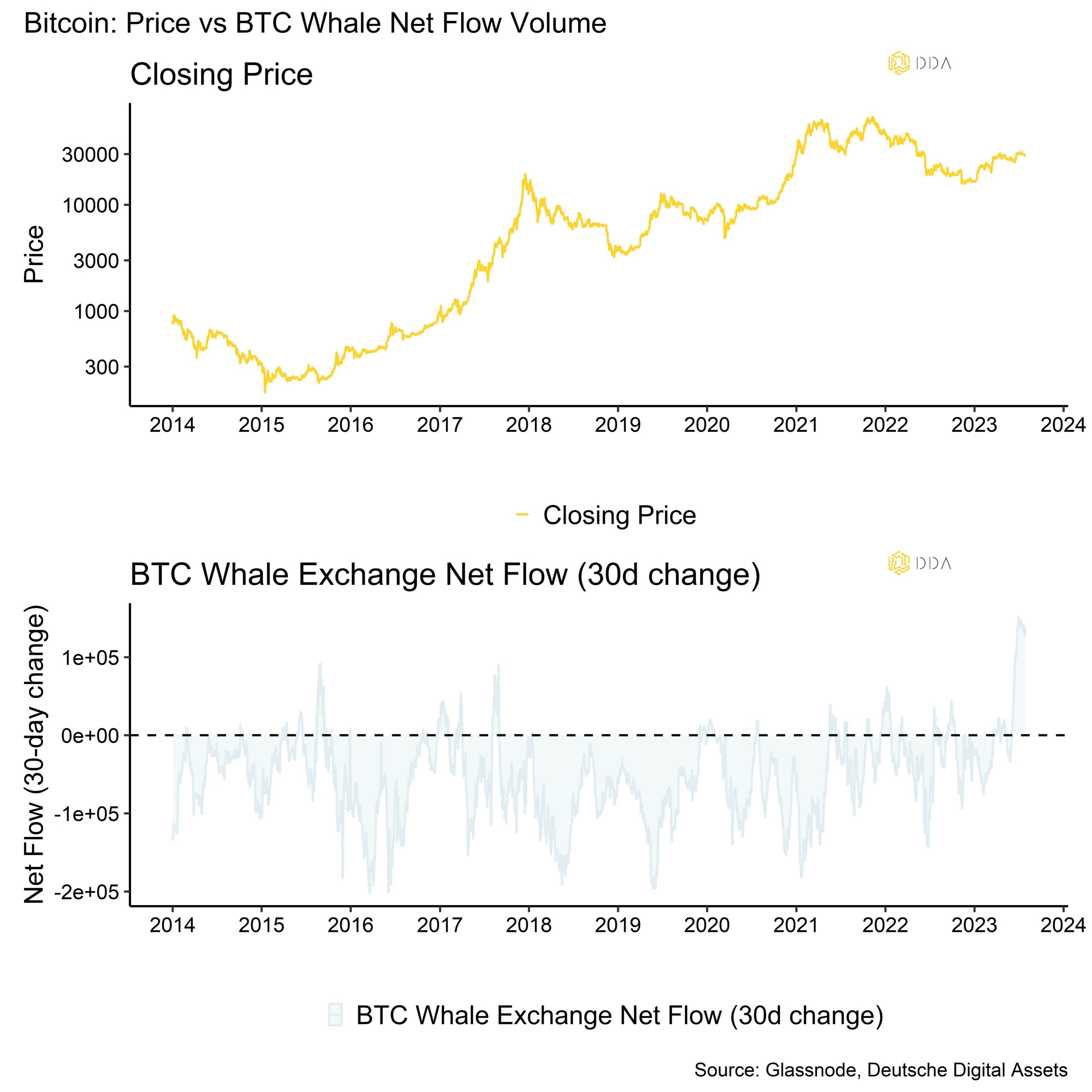

- Gleichzeitig scheint es derzeit erhebliche Handelsaktivitäten von Bitcoin-Walen (Wallets > 1k BTC) zu geben, die einen starken Anstieg der Nettozuflüsse zu den Börsen verzeichnen

Chart der Woche

Kryptoasset Leistung

In der vergangenen Woche entwickelten sich Kryptoassets aufgrund einiger münzspezifischer Faktoren, darunter die jüngste Ausnutzung der DeFi-Austauschkurve, die zu einem Anstieg der Marktunsicherheit führte, unterdurchschnittlich. In der Zwischenzeit setzten die globalen Aktien ihre Rallye fort, obwohl sowohl die Fed als auch die EZB in der vergangenen Woche die Zinsen um weitere 25 Basispunkte anhoben.

Gleichzeitig scheint es derzeit erhebliche Handelsaktivitäten von Bitcoin-Walen (Wallets > 1k BTC) zu geben, die in den letzten 30 Tagen einen starken Anstieg der Nettozuflüsse zu den Börsen verzeichneten (Chart-der-Woche).

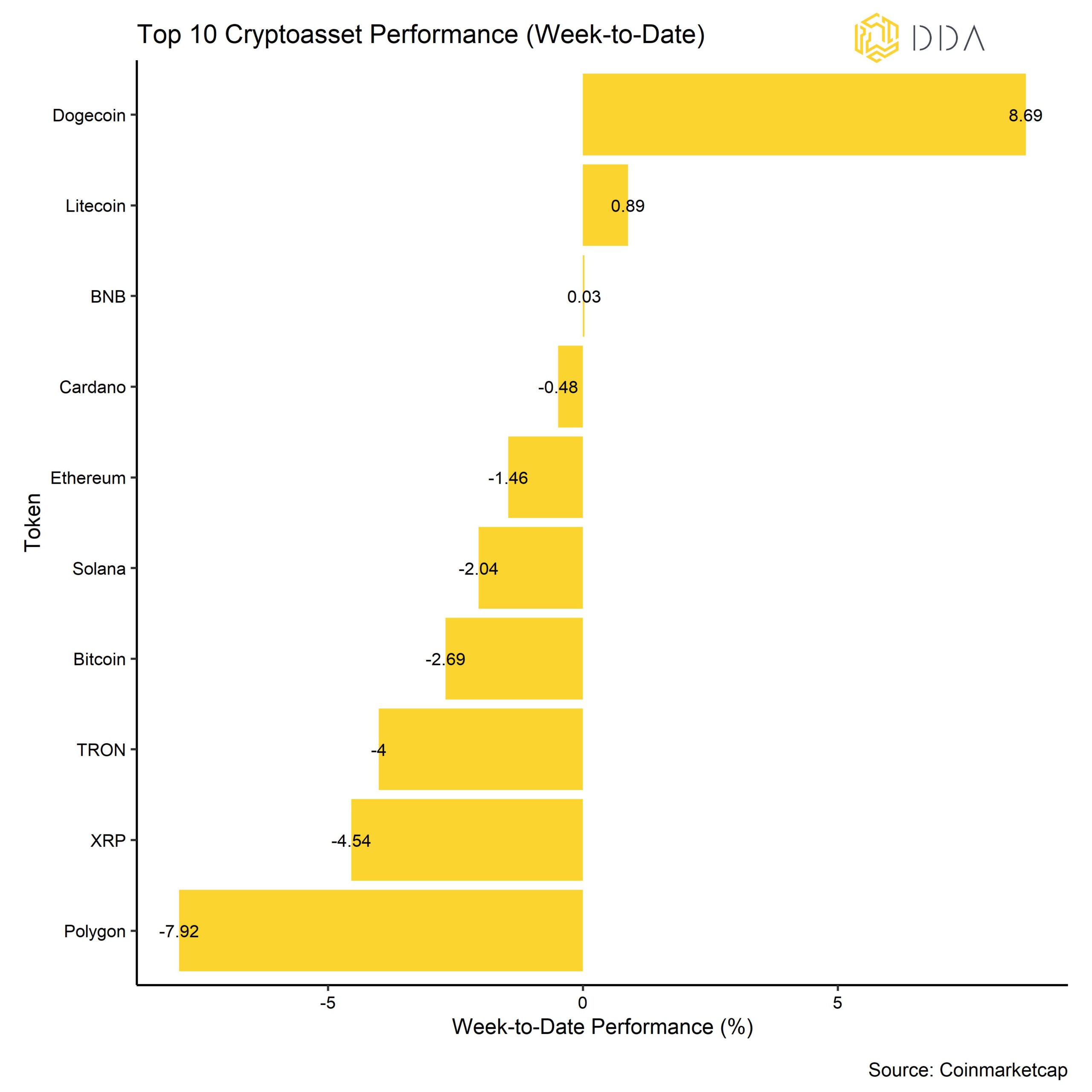

Unter den Top 10 Kryptoassets waren Dogecoin, Litecoin und BNB die relativen Outperformer.

Im Allgemeinen hat die Outperformance von Altcoins gegenüber Bitcoin in der letzten Woche leicht abgenommen. Auf Basis der von uns beobachteten Altcoins waren 45% Altcoins in der Lage, Bitcoin auf Wochenbasis zu übertreffen.

Krypto-Marktstimmung

Unser hauseigener Krypto-Sentiment-Index hat einen Teil der Euphorie der vergangenen Wochen wieder eingebüßt. 10 von 15 Indikatoren liegen immer noch über ihrem kurzfristigen Trend.

Im Vergleich zur letzten Woche gab es beim Krypto-Dispersionsindex und bei den BTC-Perpetual-Funding-Raten große Umschwünge nach unten.

Der Crypto Fear & Greed Index bleibt heute Morgen im "neutralen" Bereich.

Die Leistungsstreuung zwischen den Kryptoassets hat sich etwas umgekehrt, wenn auch von einem hohen Niveau aus.

Im Allgemeinen bedeutet eine hohe Leistungsstreuung zwischen Kryptoassets, dass die Korrelationen zwischen den Kryptoassets gering sind, was bedeutet, dass Kryptoassets stärker von münzspezifischen Faktoren abhängig sind.

Gleichzeitig ist, wie oben erwähnt, die Outperformance der Altcoins in der letzten Woche leicht zurückgegangen und liegt nun bei 45% Altcoins, die Bitcoin auf wöchentlicher Basis outperformen.

Im Allgemeinen geht die Outperformance von Altcoins mit einer zunehmenden Streuung der Kryptowährungen einher, d. h. Bitcoin und Altcoins werden während der "Altsaison" in der Regel höher gehandelt, wobei Altcoins besser abschneiden als Bitcoin. Eine breitere Outperformance von Altcoins ist in der Regel ein Zeichen für zunehmende Risikobereitschaft und eine breitere Underperformance von Altcoins ein Zeichen für zunehmende Risikoaversion.

Krypto Asset Flows

In der vergangenen Woche gab es erneut geringe Nettoabflüsse aus globalen Krypto-ETPs.

Insgesamt verzeichneten wir Nettomittelabflüsse in Höhe von -8,3 Mio. USD (Woche bis Freitag).

Auch Bitcoin-Fonds und Ethereum-Fonds verzeichneten Nettomittelabflüsse (-6,8 Mio. USD bzw. -9,7 Mio. USD auf Nettobasis).

Im Gegensatz dazu verzeichneten andere Kryptoasset-Fonds Nettozuflüsse.

Altcoin-basierte Fonds erhielten +1,9 Mio. USD an Nettozuflüssen, während thematische und Korb-Kryptofonds in der letzten Woche +6,4 Mio. USD an Nettoabflüssen verzeichneten.

Außerdem hat sich der Abschlag auf den Nettoinventarwert des größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - in der vergangenen Woche erneut vergrößert, was auf einen gewissen Verkauf dieses Fondsvehikels schließen lässt.

Darüber hinaus war das Beta der globalen Hedge-Fonds gegenüber Bitcoin in den letzten 20 Handelstagen leicht positiv, was bedeutet, dass globale Hedge-Fonds ein positives Nettoengagement gegenüber Kryptowährungen haben. Allerdings ist das Beta noch zu gering, um es als statistisch signifikant zu betrachten. Globale Hedgefonds scheinen in Bezug auf Kryptoassets derzeit noch neutral positioniert und daher eher unterdurchschnittlich engagiert zu sein.

On-Chain Tätigkeit

In letzter Zeit sind insbesondere die Nettotransfers von Bitcoin-Walen sehr auffällig gewesen. In den letzten Monaten wurde ein Allzeithoch bei der 1-Monats-Änderung der Netto-Börseneinlagen von Walen verzeichnet. Die Menge der Münzen, die an die Börsen geflossen sind, deutet immer noch auf einen möglichen Verkaufsdruck und damit auf ein potenzielles Risiko hin, auch wenn einige On-Chain-Analysten dies auf kurzfristige "Wallet-Umschichtungen" zurückführen.

Positiv zu vermerken ist, dass langfristige Bitcoin-Investoren anscheinend nicht mehr von ihren Beständen verkaufen. Genauer gesagt werden nur 0,0002% der Bestände von Langzeitinvestoren an die Börsen überwiesen. Die überwiegende Mehrheit der Münzen, die ursprünglich verschickt wurden, war profitabel.

Der durchschnittliche Akkumulationswert über alle Geldbörsenkohorten hinweg ist ebenfalls drastisch gesunken und befindet sich nach einer Analyse der Überweisungsvolumina nach verschiedenen Geldbörsenkohorten immer noch auf dem bisher niedrigsten Stand des Jahres.

In der Zwischenzeit steigen die wichtigsten On-Chain-Kennzahlen wie neue Adressen weiter an, was ein positives Zeichen für das allgemeine Wachstum des Bitcoin-Netzwerks ist. Sowohl die UTXOs als auch die Gesamtzahl der Transaktionen haben in letzter Zeit an Schwung gewonnen.

Krypto-Asset-Derivate

In der vergangenen Woche deuteten die Derivatemetriken weiterhin auf eine eher gedämpfte Preisentwicklung hin.

So erreichte die implizite 1-Monats-Volatilität von BTC ein Allzeittief von 31% p.a., da die Optionshändler offenbar ein eher ruhiges Marktumfeld für Bitcoin erwarten.

Auch das BTC-Put-Call-Verhältnis ist weiter gesunken. Die Schieflage der 1-Monats-25-Delta-Optionen für BTC hat sich leicht erhöht, ist aber immer noch eher auf Calls ausgerichtet, was bedeutet, dass BTC-Optionshändler positive Erwartungen hinsichtlich der künftigen Marktentwicklung haben.

Der 3-Monats-Basissatz für BTC tendierte weiter unter 5% p.a., was bedeutet, dass die Kurve der BTC-Futures leicht abflachte.

Das offene Interesse an BTC-Derivaten war die ganze Woche über bei Futures (Kalender- und ewige Terminkontrakte) relativ stabil, während es bei Optionen zurückging, da wir uns dem monatlichen Verfall der Kontrakte für Juli am 31. nähern.

Unterm Strich

Kryptoassets schnitten aufgrund einiger münzspezifischer Faktoren schlechter ab als traditionelle Vermögenswerte, während globale Aktien trotz weiterer Zinserhöhungen durch die Fed und die EZB weiter anzogen.

Unser hauseigener Krypto-Sentiment-Index hat einen Teil der Euphorie der vergangenen Wochen wieder zurückgenommen.

Gleichzeitig scheinen die Bitcoin-Wale (Wallets mit mehr als 1.000 BTC) derzeit sehr aktiv zu sein und die Nettozuflüsse zu den Börsen sind stark angestiegen.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.