Erkundung der Verschiebung: Die Outperformance von Altcoins, der Anstieg des Dispersionsindex und die Bitcoin-Übernahme durch Tether

DDA Krypto-Markt-Puls, 22. Mai 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Die Outperformance von Altcoins hat zugenommen, während die Streuung der Performance zwischen den Kryptoassets ebenfalls zugenommen hat

- Trotz der schwachen BTC-Performance ist unser hauseigener Crypto Sentiment Index in der letzten Woche gestiegen und liegt nun wieder leicht im positiven Bereich

- Tether sagt, dass es Bitcoin für Stablecoin-Reserven mit realisierten Gewinnen kaufen wird

Chart der Woche

Kryptoasset Leistung

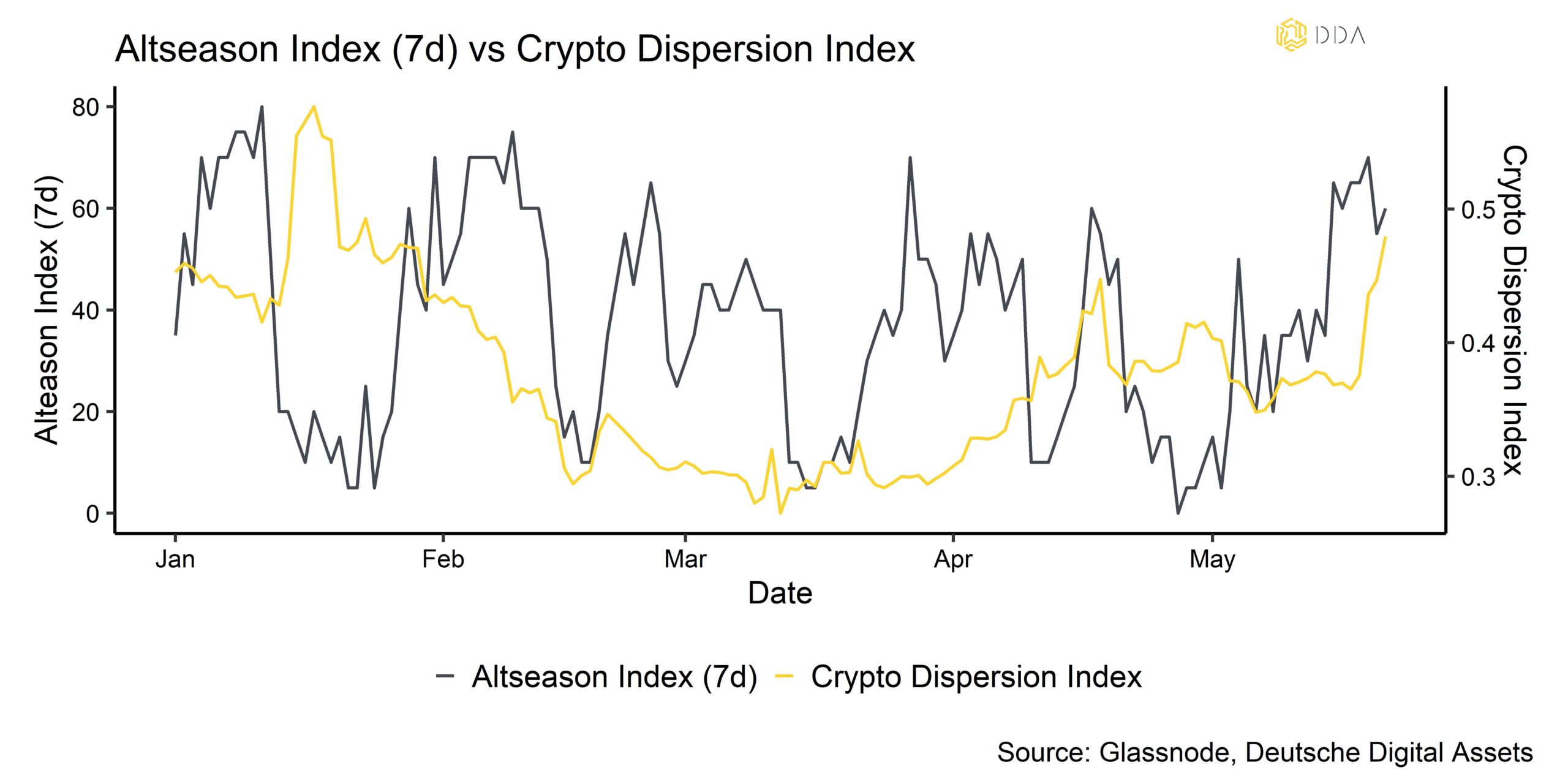

In der vergangenen Woche wurde die Performance von Kryptowährungen überwiegend nach unten korrigiert, obwohl der Grad der Netzwerküberlastung im Bitcoin-Netzwerk weiter abnahm. Gleichzeitig hat die Outperformance von Altcoins gegenüber Bitcoin auf wöchentlicher Basis zugenommen, während die Performance-Streuung unter den Kryptoassets ebenfalls zugenommen hat (Chart der Woche). Auch die Korrelation zwischen Ethereum und Bitcoin erreichte ein Zweijahrestief.

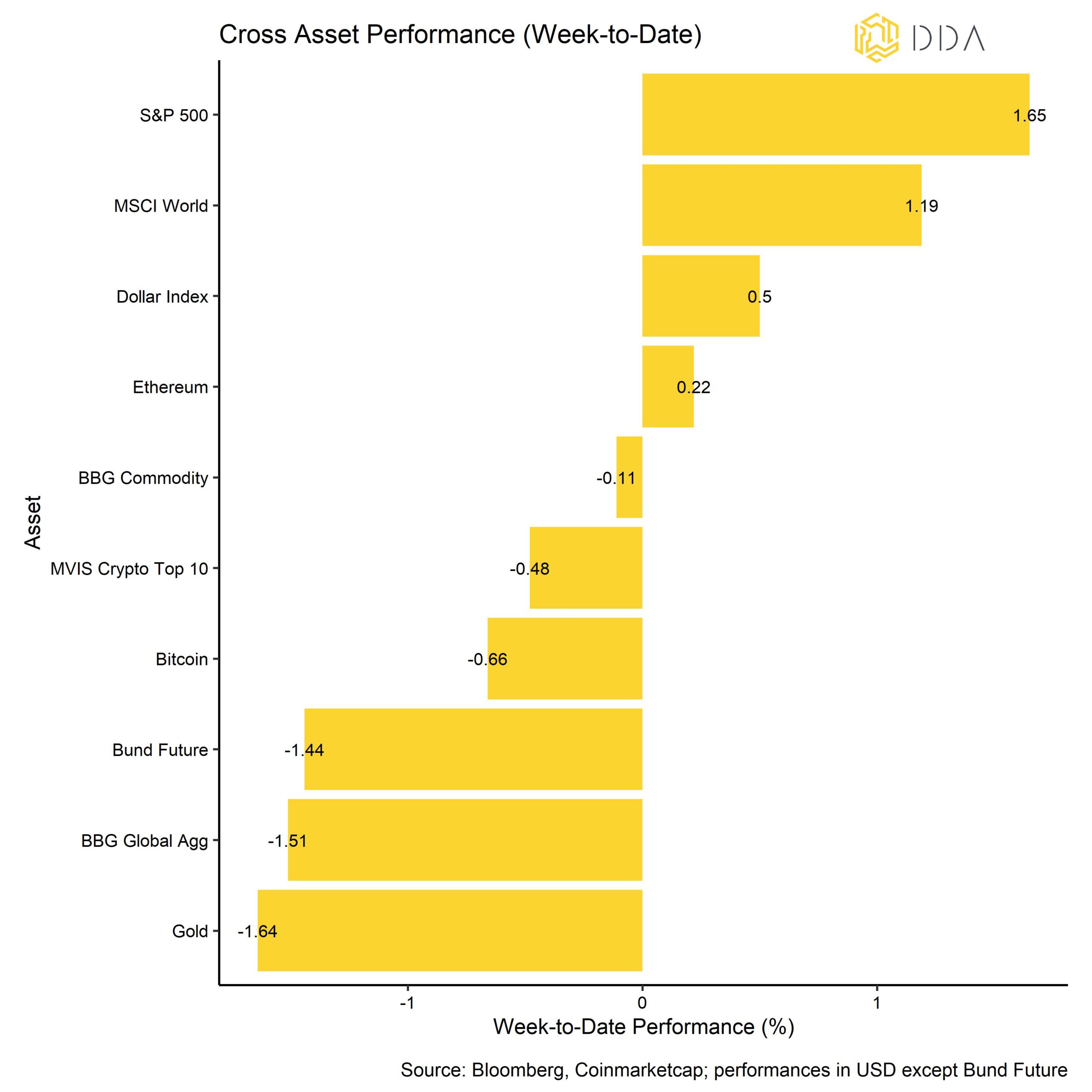

Im Vergleich dazu erzielten traditionelle Finanzanlagen wie Aktien eine Outperformance, die jedoch hauptsächlich auf die Outperformance von Mega-Caps und eine schwache Marktbreite zurückzuführen war. Zinssensitive Anlagen wie Anleihen und Gold standen unter Druck, da die Fed angesichts schwacher Arbeitsmarkt- und Inflationsdaten die Zinssenkungserwartungen zurückstellte.

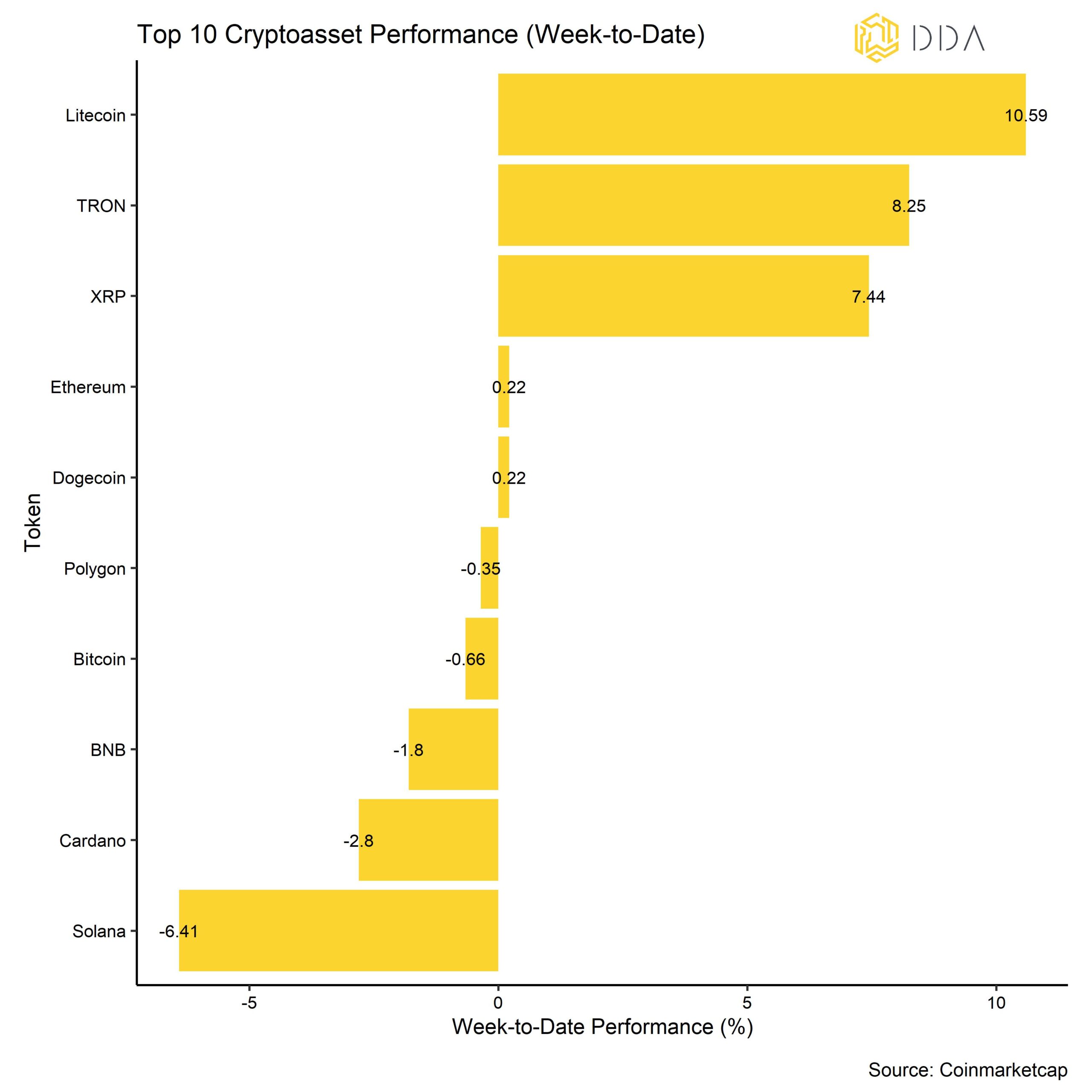

Unter den wichtigsten Kryptoassets waren Litecoin, TRON und XRP die relativen Outperformer. Wie bereits erwähnt, hat die Outperformance von Altcoins gegenüber Bitcoin in der letzten Woche zugenommen, wobei mehr als 50% der erfassten Altcoins Bitcoin auf Wochenbasis übertrafen.

Krypto-Marktstimmung

Trotz der Tatsache, dass Bitcoin in der letzten Woche überwiegend nach unten gehandelt wurde, ist unser hauseigener Krypto-Sentiment-Index gestiegen. Allerdings liegen nur 6 von 15 Indikatoren über ihrem kurzfristigen Trend.

Im Vergleich zur letzten Woche gab es große Umschwünge im Crypto Dispersion Index und bei den Indikatoren im BTC-Derivatebereich, einschließlich des Put-Call-Volumenverhältnisses und der impliziten Volatilitäten.

Der Crypto Fear & Greed Index ist nur geringfügig gesunken und befindet sich heute Morgen immer noch im "neutralen" Bereich.

Wie bereits erwähnt, hat die Leistungsstreuung zwischen den Kryptoassets in letzter Zeit zugenommen, da die Korrelationen zwischen den Kryptoassets zurückgegangen sind, was bedeutet, dass Kryptoassets zunehmend nach münzspezifischen Faktoren gehandelt werden. Die 30-Tage-Korrelation zwischen Ethereum und Bitcoin ist unter 80% auf ein Zweijahrestief gesunken. Gleichzeitig hat die Outperformance von Altcoins in der letzten Woche weiter zugenommen und liegt nun bei über 50% Altcoins, die Bitcoin auf wöchentlicher Basis übertreffen.

Im Allgemeinen geht die Outperformance von Altcoins mit einer zunehmenden Streuung der Kryptowährungen einher, d. h. Bitcoin und Altcoins werden während der "Altsaison" in der Regel höher gehandelt als Bitcoin, wobei sich Altcoins besser entwickeln als Bitcoin. Eine breitere Outperformance von Altcoins ist in der Regel ein Zeichen für eine zunehmende Risikobereitschaft.

Krypto Asset Flows

In der vergangenen Woche gab es erneut erhebliche Nettoabflüsse aus Kryptoanlagen.

Insgesamt verzeichneten wir Netto-Fondsabflüsse in Höhe von -55,1 Mio. USD (Woche bis Freitag) - die höchsten Nettoabflüsse seit mehr als einem Monat - wobei der Großteil der Abflüsse aus Bitcoin-Fonds floss (-49,4 Mio. USD). Ethereum-Fonds verzeichneten nur geringe Nettoabflüsse von -4,7 Mio. USD. Dagegen verzeichneten Altcoin-Fonds ohne Ethereum wieder einige Nettozuflüsse (+1,1 Mio. USD), während Basket- und thematische Kryptoasset-Fonds in dieser Woche einige Nettoabflüsse verzeichneten (-2,2 Mio. USD).

Außerdem hat sich der Abschlag auf den Nettoinventarwert des größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - erneut vergrößert, was auf geringfügige Nettoabflüsse aus diesem Fondsvehikel hindeutet.

In der Zwischenzeit ist das Beta der globalen Hedge-Fonds gegenüber Bitcoin in den letzten 20 Handelstagen weiter gesunken, was bedeutet, dass die globalen Hedge-Fonds ihr Engagement in Krypto-Assets weiter reduzieren.

On-Chain Tätigkeit

Nach der jüngsten Überlastung des Bitcoin-Netzwerks haben sich die wichtigsten On-Chain-Kennzahlen wie aktive und neue Adressen wieder erholt, wenn auch von einem niedrigen Niveau aus. Das Adresswachstum wurde vor kurzem erheblich gebremst, weil hohe Gebühren die Nutzer davon abhielten, Transaktionen über die Bitcoin-Blockchain durchzuführen. Schwache On-Chain-Kennzahlen für Bitcoin sind weiterhin der Schwachpunkt für den gesamten Markt und sollten in den kommenden Wochen genau beobachtet werden.

Allerdings sind die Bitcoin-Börsensalden zu Beginn der letzten Woche deutlich zurückgegangen, da einige größere Käufer die jüngste Preiskorrektur zur Akkumulation genutzt zu haben scheinen. Tatsächlich sahen wir den höchsten Netto-Tauschabfluss von großen Wallet-Kohorten seit November 2022. Unsere Analyse der verschiedenen BTC-Wallet-Kohorten zeigt, dass die Akkumulationsaktivität wieder zunimmt. Gleichzeitig gab es einen Anstieg der OTC-Börsensalden für BTC, was auf ein erhöhtes Kaufinteresse von Institutionen schließen lässt.

In der Zwischenzeit haben die von Glassnode bereitgestellten On-Chain-Messungen des illiquiden Angebots ein neues Allzeithoch für Bitcoin erreicht. Laut Glassnode sind 15,1 Mio. Bitcoins "illiquide", was 77,9% des zirkulierenden Angebots entspricht. Ein Anstieg des illiquiden Angebots ist in der Regel mit höheren Preisen verbunden, da dies eine Zunahme der Angebotsknappheit an den Börsen bedeutet.

In ähnlicher Weise sind die Börsenbestände für Ethereum weiter auf neue Mehrjahrestiefs gesunken, was ebenfalls ein positives Zeichen ist. Gleichzeitig ist der Zuwachs an neuen Validatoren auf der Ethereum-Blockchain weiterhin sehr hoch, da täglich etwa 3900 neue Validatoren in den Validator-Pool aufgenommen werden. Die Anzahl der aktiven ETH-Validatoren steigt weiter an und hat nun mit rund 580.000 aktiven Validatoren ein Allzeithoch erreicht.

Eine weitere positive Entwicklung war die Ankündigung von Tether, dem Emittenten des USDT-Stablecoins, Bitcoin für Stablecoin-Reserven mit realisierten Gewinnen zu kaufen. Tether hat USDT im Gegenwert von 82 Mrd. USD emittiert, meldete im ersten Quartal 2023 einen Nettogewinn von 1,48 Mrd. USD und wies in seinen jüngsten Berichten Bitcoin-Bestände in Höhe von 1,5 Mrd. USD aus.

Krypto-Asset-Derivate

In der letzten Woche sind die impliziten Volatilitäten trotz der negativen Preisentwicklung weiter gesunken. Die impliziten 1-Monats-Volatilitäten von Bitcoin sind erneut auf den niedrigsten Stand seit Januar 2023 gesunken. Der 1-Monats-25-Delta-Options-Skew wurde weiterhin zugunsten von Put-Optionen gehandelt, was auf eine negative Tendenz unter Bitcoin-Optionshändlern schließen lässt. Allerdings ist das offene Interesse an BTC-Put-Optionen gegenüber Call-Optionen in der letzten Woche deutlich zurückgegangen. Allerdings ist das offene Interesse an BTC-Optionen seit Mitte März 2023 generell rückläufig. Andererseits sind die offenen Positionen bei Futures und Perpetuals im Zuge der jüngsten Preiskorrektur gestiegen, was darauf hindeutet, dass Händler ihre Short-Positionen prozyklisch zur Schwäche hin erhöht haben. Dies könnte zu einem potenziellen Short-Squeeze führen, wenn der Markt wieder ins Plus dreht. Der annualisierte 3-Monats-Basissatz für BTC-Futures bewegt sich weiterhin seitwärts und liegt nun leicht unter 2% p.a.

Unterm Strich

Die Outperformance von Altcoins hat zugenommen, während die Streuung der Performance unter den Kryptoassets ebenfalls zugenommen hat.

Trotz der schwachen BTC-Performance ist unser hauseigener Krypto-Sentiment-Index in der vergangenen Woche gestiegen und liegt nun wieder leicht im positiven Bereich.

Tether sagt, dass es Bitcoin für Stablecoin-Reserven mit realisierten Gewinnen kaufen wird.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.