DDA Krypto-Marktimpuls, 20. März 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Kryptoassets profitieren von einer wahrscheinlichen Pause im Zinserhöhungszyklus der Fed und dem letzten Lockerungszyklus der Fed aufgrund des aktuellen Stresses im Bankensektor

- Unser hauseigener Crypto Sentiment Index hat sich im Vergleich zur letzten Woche deutlich erholt und ist nun wieder neutral

- Auch Ethereum hat sich gegenüber Bitcoin deutlich unterdurchschnittlich entwickelt, was vor allem auf On-Chain-Faktoren zurückzuführen sein dürfte

Chart der Woche

Kryptoasset Leistung

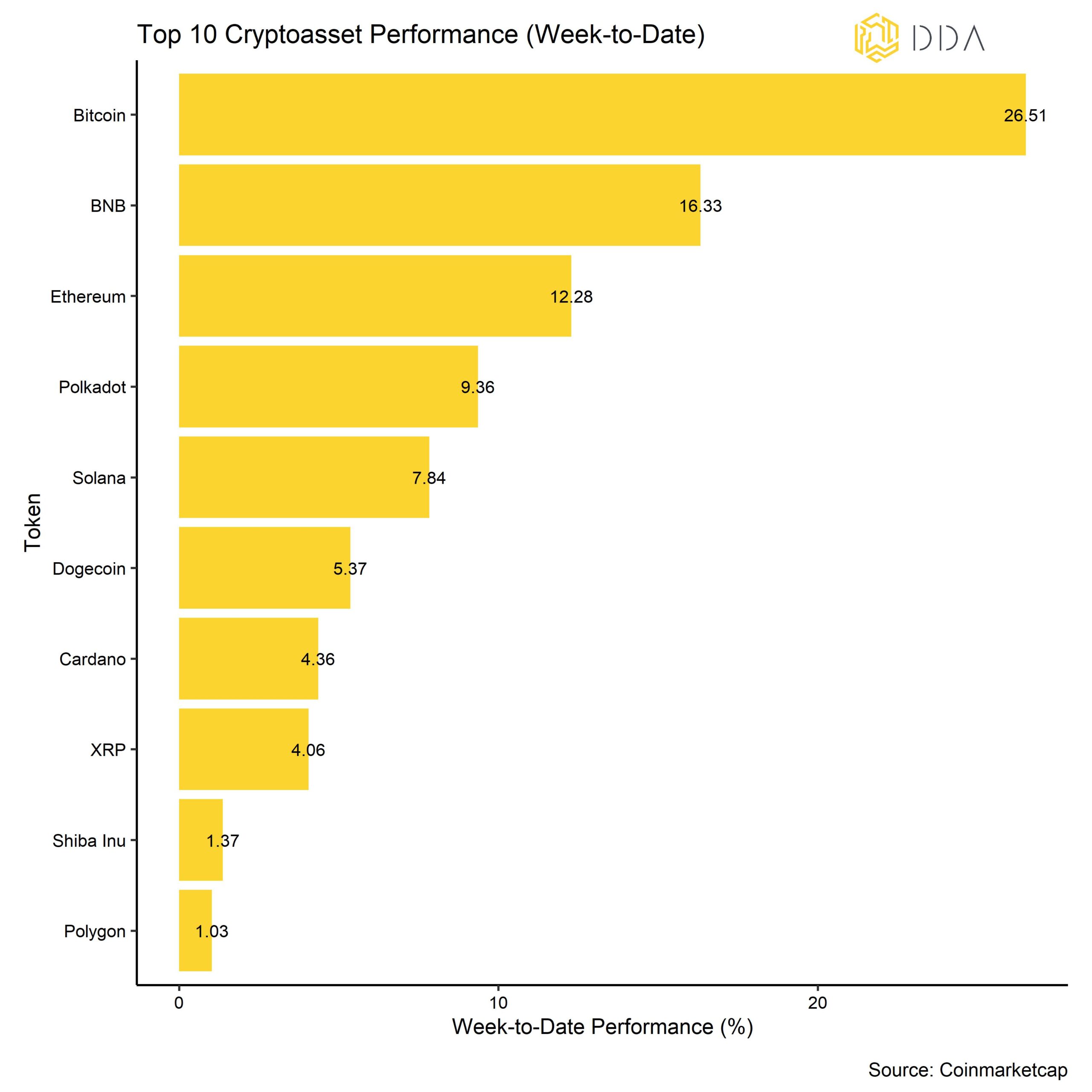

Die Performance der Kryptowährungen in der vergangenen Woche war eine der stärksten seit Anfang 2021, also während des letzten Bullenmarktes. Dies war vor allem auf die erwartete Pause im Zinserhöhungszyklus der Fed und den letzten Lockerungszyklus der Fed aufgrund des aktuellen Stresses im Bankensektor zurückzuführen.

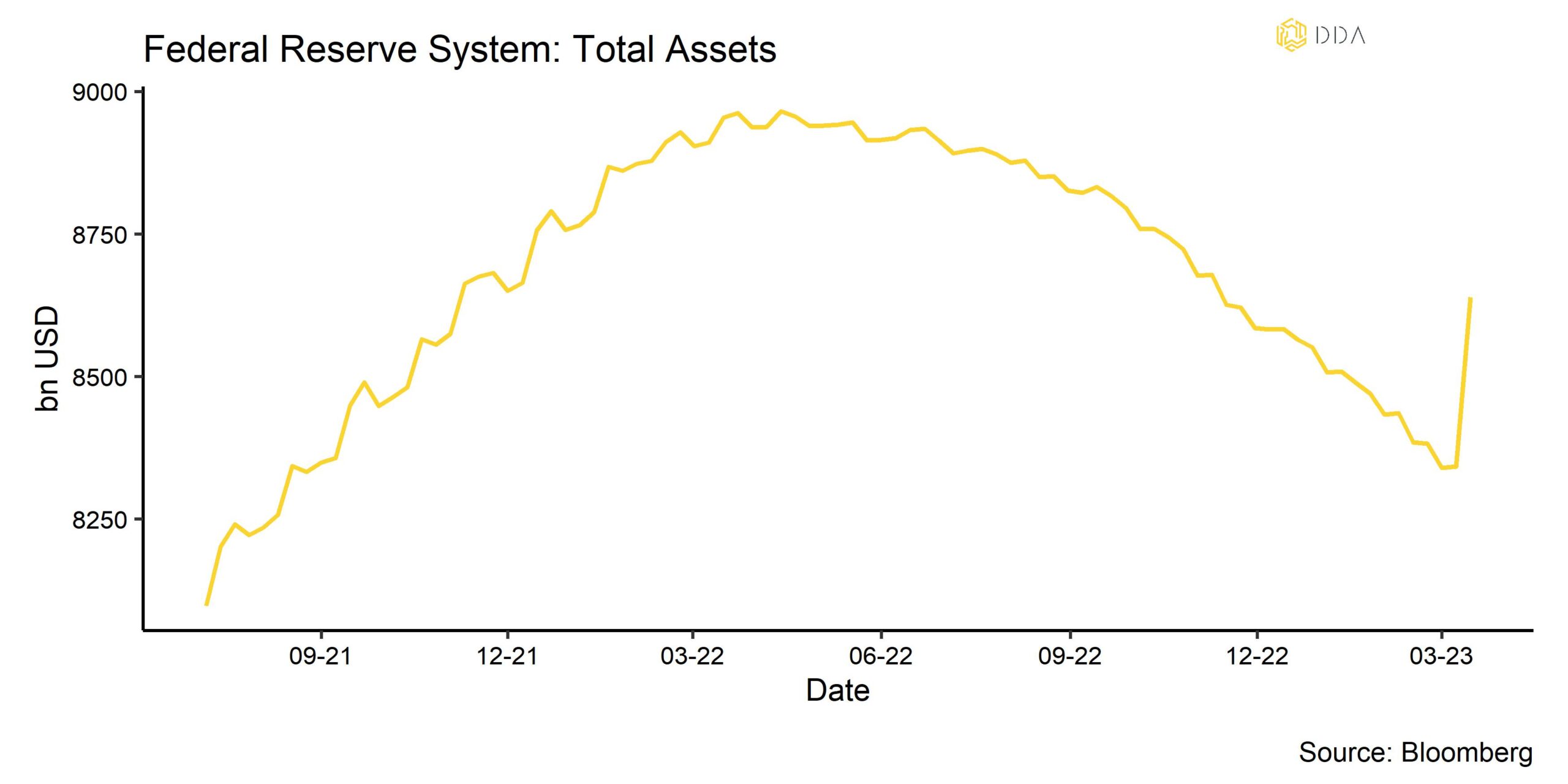

Die Märkte freuten sich vor allem über die Tatsache, dass die Gesamtaktiva der Federal Reserve in einer einzigen Woche um rund 300 Mrd. USD gestiegen sind (siehe Chart-der-Woche). Obwohl viele Marktbeobachter vorsichtig waren, dies als eine weitere Runde der "quantitativen Lockerung" (QE) durch die Fed zu bezeichnen, gab es auch einen erheblichen Anstieg der Reserven der Geschäftsbanken bei der Fed (~250 Mrd. USD), was einen Netto-Liquiditätszuwachs auf dem US-Interbankenmarkt darstellt und somit de facto die Lockerung der Liquiditätsbedingungen durch die Fed. Außerdem wurde das Diskontfenster der Fed so stark in Anspruch genommen (~156 Mrd. USD) wie seit der Covid-Krise nicht mehr, was ebenfalls die erhebliche Liquiditätsbereitstellung durch die Fed angesichts des Stresses im Bankensektor unterstreicht.

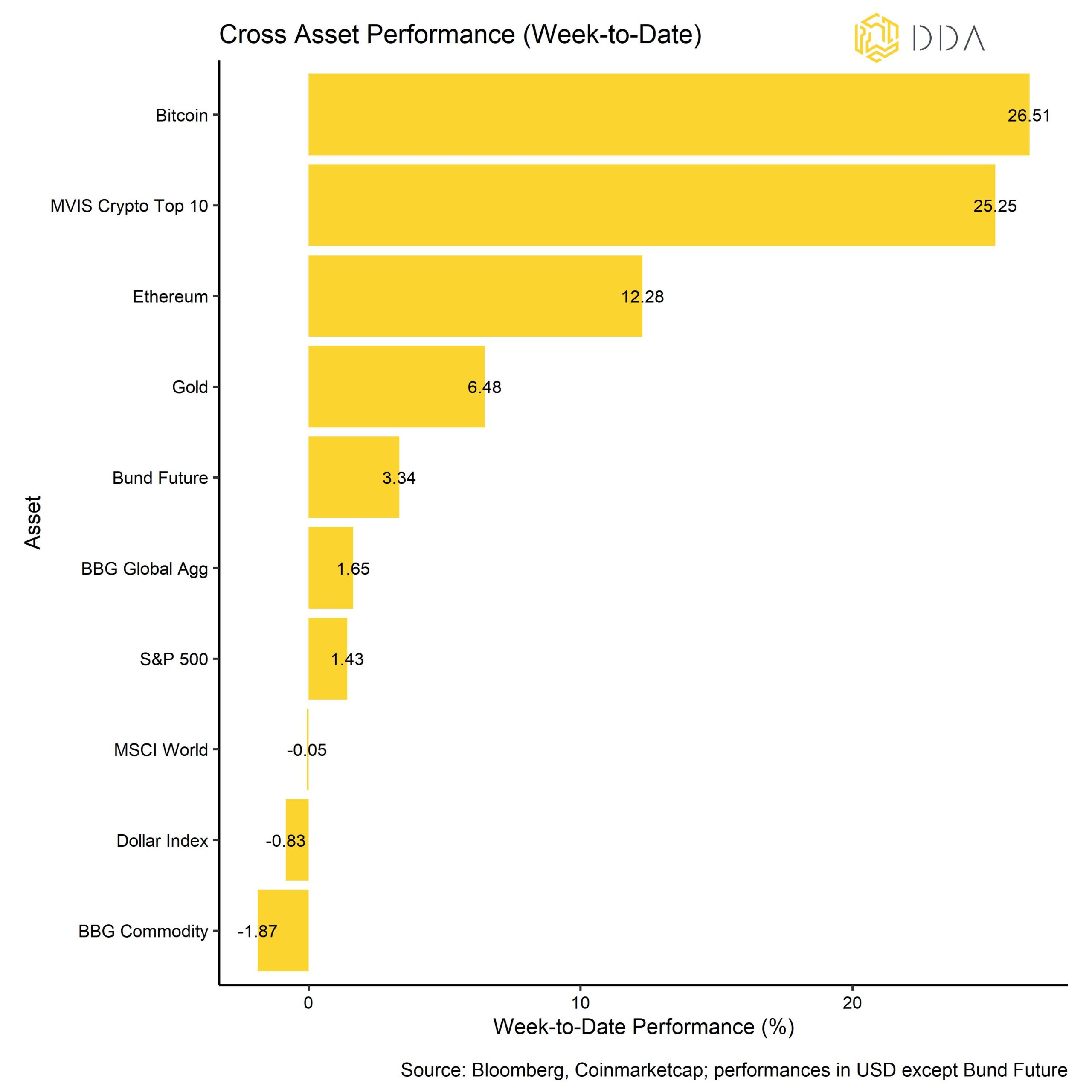

Obwohl Kryptoassets eine sehr gute Performance erzielten, schnitten andere traditionelle Finanzanlagen wie Aktien, Anleihen und Gold relativ gut ab, was auch an den Aussichten auf eine weitere geldpolitische Lockerung der Fed lag. Lediglich der Dollar und die Rohstoffe wurden durch die Aussicht auf einen Anstieg der Liquidität und die höhere Wahrscheinlichkeit einer Rezession belastet.

Unter den wichtigsten Kryptoassets waren Bitcoin, BNB und Ethereum die relativen Outperformer. Allerdings gab es eine deutliche Underperformance von Ethereum im Vergleich zu Bitcoin (ETH/BTC), was auf einen Anstieg der "freiwilligen Ausstiegszahlen" im Vorfeld des Shanghai-Upgrades zurückzuführen ist. (Mehr dazu im Abschnitt über die On-Chain weiter unten).

Krypto-Marktstimmung

Unser hauseigener Krypto-Sentiment-Index hat sich im Vergleich zur letzten Woche deutlich gedreht und befindet sich nun wieder im neutralen Bereich. 8 von 15 Indikatoren liegen über ihrem kurzfristigen Trend.

Im Vergleich zur letzten Woche kam es bei BTC zu größeren Umkehrungen im kurzfristigen Halter Spent-Output-Profit-Ratio (STH-SOPR) und im 1-Monats-25-Delta-Optionsskew.

Der Crypto Fear & Greed Index stieg deutlich über die 50%-Linie in den Bereich "Greed".

Die Streuung zwischen den Kryptoassets war weiterhin gering, da die meisten Kryptoassets zunehmend nach systematischen Faktoren gehandelt wurden. Gleichzeitig entwickelten sich Altcoins auch auf 1-Monats- und 3-Monats-Basis schlechter als Bitcoin. Auf 1-Monats-Basis gelang es nur 20% der erfassten Altcoins, eine bessere Performance als Bitcoin zu erzielen. Eine Outperformance von Altcoins ist in der Regel ein Zeichen für eine erhöhte Risikobereitschaft, und eine geringe Outperformance von Altcoins ist immer noch ein Hinweis auf eine eher vorsichtige Marktstimmung.

Krypto Asset Flows

Die vergangene Woche war eine weitere Woche mit sehr deutlichen Mittelabflüssen aus Kryptoassets, trotz der sehr starken Performance der Anlageklasse. Die Anleger scheinen aufgrund des aktuellen Stresses im Bankensektor generell Liquidität zu benötigen, was diese Art von Fondsabflüssen erklären könnte.

Insgesamt verzeichneten wir Netto-Fondsabflüsse in Höhe von -172,5 Mio. USD. Alle Produkttypen verzeichneten Nettoabflüsse, mit Ausnahme von Altcoin-Fonds (+1,0 Mio. USD). Die Fondsabflüsse konzentrierten sich stark auf Bitcoin-Fonds (-102,8 Mio. USD) und Ethereum-Fonds (-42,5 Mio. USD), während Basket- und thematische Krypto-Fonds ebenfalls erhebliche Nettoabflüsse verzeichneten (-28,3 Mio. USD).

Im Gegensatz dazu ist es dem größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - gelungen, den Abschlag auf den Nettoinventarwert etwas zu verringern, was auf Nettozuflüsse in dieses Fondsvehikel schließen lässt.

Im Vergleich zur letzten Woche ist das Beta der globalen Hedgefonds zu Bitcoin in den letzten 20 Handelstagen weiter gesunken und liegt nun unter 0, was bedeutet, dass die globalen Hedgefonds nun eine Netto-Short-Position in Kryptoassets haben.

Die auf Coinbase gehandelten Bitcoin-Preise waren im Vergleich zu den auf Binance gehandelten (Coinbase-Binance-Prämie) die ganze Woche über positiv, was auf ein erhöhtes Kaufinteresse von institutionellen Anlegern im Vergleich zu Kleinanlegern angesichts der Marktverwerfungen hindeutet.

On-Chain Tätigkeit

Die On-Chain-Aktivitäten standen im Einklang mit einem Anstieg der allgemeinen Risikoaversion auf den Kryptomärkten, da die Börsenzuflüsse angesichts der gestiegenen Unsicherheit allgemein zugenommen haben.

Genauer gesagt, haben wir den höchsten Betrag an Bitcoin-Börsenzuflüssen seit dem FTX-Ausfall im November 2022 gesehen. Im Gegensatz zur aktuellen Preisentwicklung haben wir einen kontinuierlichen Anstieg der BTC-Börsenguthaben gesehen. Währenddessen sind die ETH-Börsensalden weiter gesunken.

Darüber hinaus haben wir kontinuierlich hohe Überweisungen von den Wallets der BTC-Miner an die Börsen beobachtet, was darauf hindeutet, dass die Kombination aus relativ niedrigen Preisen und hoher Hash-Rate die Finanzen der Bitcoin-Miner immer noch belastet. Der Großteil dieser Überweisungen scheint vom Poolin BTC Mining Pool zu stammen. In diesem Zusammenhang hat sich die BTC-Hash-Rate weiterhin in der Nähe des Allzeithochs gehalten.

Was die jüngste Underperformance von Ethereum gegenüber Bitcoin (ETH/BTC) betrifft, so scheint die Unsicherheit bezüglich des bevorstehenden Shanghai-Capella-Upgrades, auch bekannt als Shapella, zuzunehmen.

Das Ethereum Improvement Proposal (EIP) 4895, das Validator Staking-Abhebungen im Hauptnetzwerk ermöglicht, ist das herausragende Merkmal des Upgrades. Diese wichtige Funktion wurde ausgelassen, als Ethereum nach dem Merge-Upgrade im September 2022 zum Proof-of-Stake-Konsens (PoS) überging.

Wir haben kürzlich einen Anstieg der "freiwilligen Ausstiegszahlen" auf der Ethereum-Blockchain auf den höchsten Stand seit September 2022 und den zweithöchsten jemals verzeichnet.

Die Zahl der freiwillig ausgeschiedenen Prüfer gibt die Gesamtzahl der Prüfer an, die den Prüferpool freiwillig verlassen haben.

Ein Validator kommt in die Exit-Warteschlange, wenn er beschließt, nicht mehr am Konsens teilzunehmen. Obwohl diese Validierer keine Blöcke mehr vorschlagen oder bezeugen, ist der ETH-Anteil noch vorhanden und kann noch nicht entfernt werden. Dies hat die Unsicherheit im Vorfeld des Shapella-Upgrades erhöht.

Darüber hinaus sind die Gebühren auf Ethereum zusammen mit dem Anstieg des USD-Preises erheblich gestiegen, was derzeit den wahrgenommenen Nutzen der L1-Chain beeinträchtigt. Zu einem bestimmten Zeitpunkt waren die durchschnittlichen Gebühren im Ethereum-Hauptnetz auf den höchsten Stand seit Mai 2022 gestiegen.

Die meisten Marktbeobachter führen die jüngste Underperformance von ETH/BTC auf diese On-Chain-Entwicklungen zurück.

Krypto-Asset-Derivate

Im Allgemeinen haben wir einen allgemeinen Anstieg der impliziten Volatilitäten aufgrund der starken Umkehr und des Preisanstiegs in der letzten Woche gesehen. Dies ist in erster Linie auf einen Anstieg der Preisvolatilität nach oben zurückzuführen, was sich auch im Anstieg der 1-Monats-25-Delta-Optionen für Bitcoin widerspiegelt, die ebenfalls wieder in den positiven Bereich zurückgekehrt sind. Das bedeutet, dass Optionshändler für delta-äquivalente Call-Optionen mehr bezahlen als für Put-Optionen.

Darüber hinaus gab es sowohl bei den Futures-Basissätzen als auch bei den Refinanzierungssätzen für unbefristete Kontrakte eine sehr deutliche Umkehrung, was auf einen Abbau von Short-Positionen in Bitcoin aufgrund des starken Preisanstiegs schließen lässt. Es gab jedoch keinen signifikanten Anstieg bei der Auflösung von Short-Positionen in Futures, was darauf schließen lässt, dass der größte Teil dieser Neupositionierung in Futures und unbefristeten Verträgen freiwillig erfolgte.

Unterm Strich

Kryptoassets profitieren von einer wahrscheinlichen Pause im Zinserhöhungszyklus der Fed und dem letzten Lockerungszyklus der Fed aufgrund des derzeitigen Stresses im Bankensektor.

Unser hauseigener Crypto Sentiment Index hat sich im Vergleich zur letzten Woche deutlich erholt und ist nun wieder neutral.

Ethereum hat sich auch gegenüber Bitcoin deutlich unterdurchschnittlich entwickelt, was vor allem auf On-Chain-Faktoren zurückzuführen sein dürfte.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.