DDA Krypto-Marktimpuls, 13. März 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Die Wertentwicklung von Kryptoassets wurde durch zwei bedeutende Konkurse von US-Banken (Silvergate und Silicon Valley Bank) belastet, allerdings aus unterschiedlichen Gründen.

- Unser hauseigener Crypto Sentiment Index hat sich im Vergleich zur letzten Woche deutlich verschlechtert und befindet sich nun fest im rückläufigen Bereich

- Während die Risikoaversion kurzfristig zugenommen hat, könnte die höhere Unsicherheit im traditionellen Bankensystem uns einer Pause im Zinserhöhungszyklus der Fed näher bringen, was für Kryptoassets sehr positiv wäre

Chart der Woche

Kryptoasset Leistung

In der vergangenen Woche wurde die Wertentwicklung von Kryptoassets durch zwei bedeutende Konkurse von US-Banken (Silvergate und Silicon Valley Bank) belastet, allerdings aus unterschiedlichen Gründen.

Die Insolvenz der stark vernetzten Krypto-Händlerbank Silvergate (SI US Equity) hatte die Unsicherheit auf den Kryptomärkten erhöht, da das "Silvergate Exchange Network" (SEN), eine von der Bank betriebene Echtzeit-Zahlungsplattform, es Kryptowährungsbörsen, Organisationen und Nutzern ermöglichte, Fiat-Währungen einschließlich US-Dollar und Euro zu handeln. Der Ausfall stand höchstwahrscheinlich im Zusammenhang mit dem Zusammenbruch der Kryptowährungsbörse FTX Ende letzten Jahres.

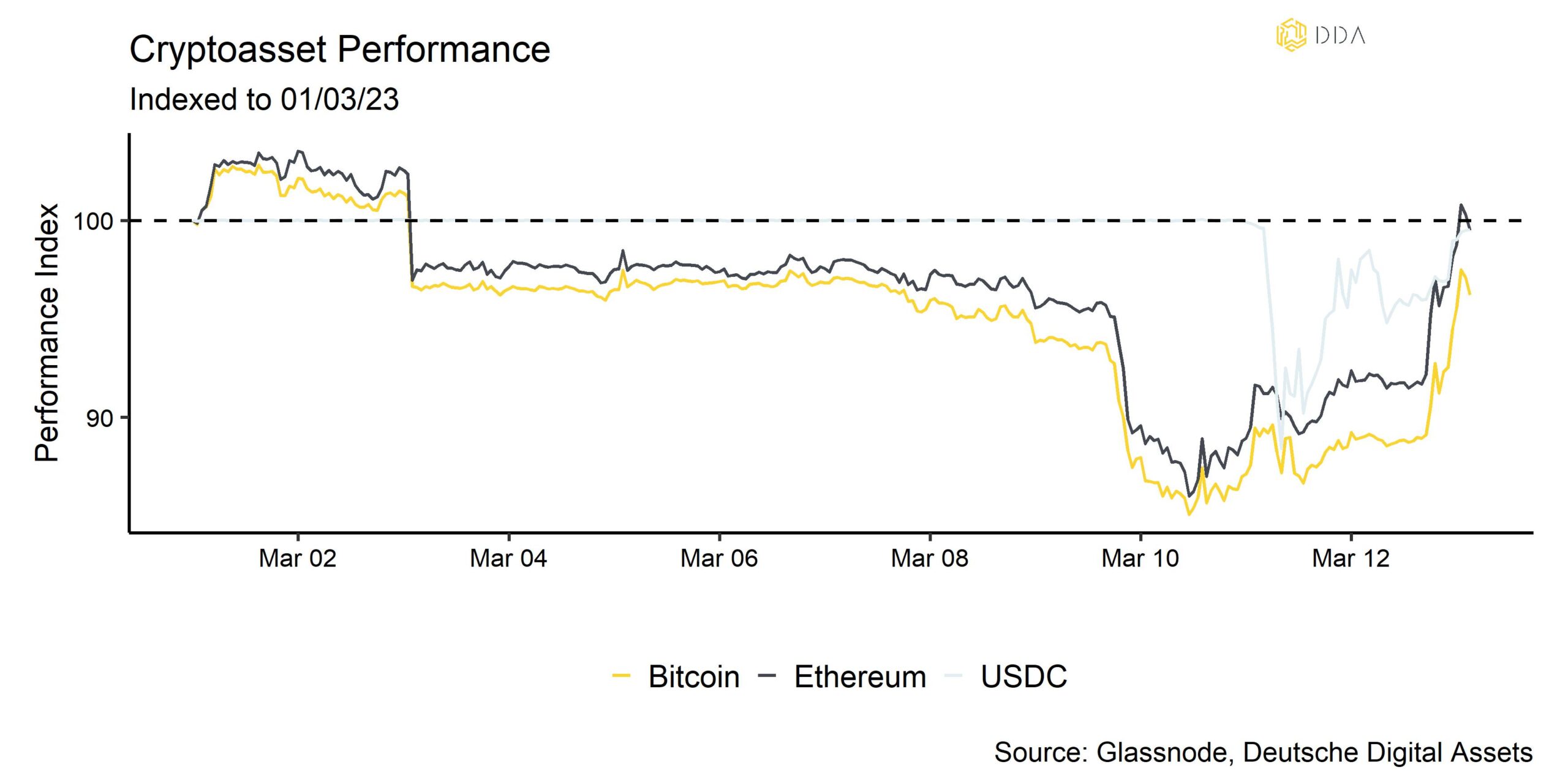

Im Gegensatz dazu war der Zusammenbruch der Silicon Valley Bank (SIVB US Equity) das Ergebnis einer Reihe von Ursachen, darunter ein schlechtes Risikomanagement und ein von Investoren aus dem Technologiesektor organisierter Bank-Run. Der Grund für die finanzielle Ansteckung von Kryptoassets war, dass das Unternehmen Circle - der Emittent des USDC-Stablecoins - Berichten zufolge etwa 3,3 Mrd. USD seiner Barreserven bei der Silicon Valley Bank hielt. Dies führte zu einem kurzen De-Peg des durch den US-Dollar gedeckten Stablecoins auf unter 90 Cents pro Dollar, wie in unserem Chart-der-Wochewas den gesamten Kryptoasset-Sektor belastete.

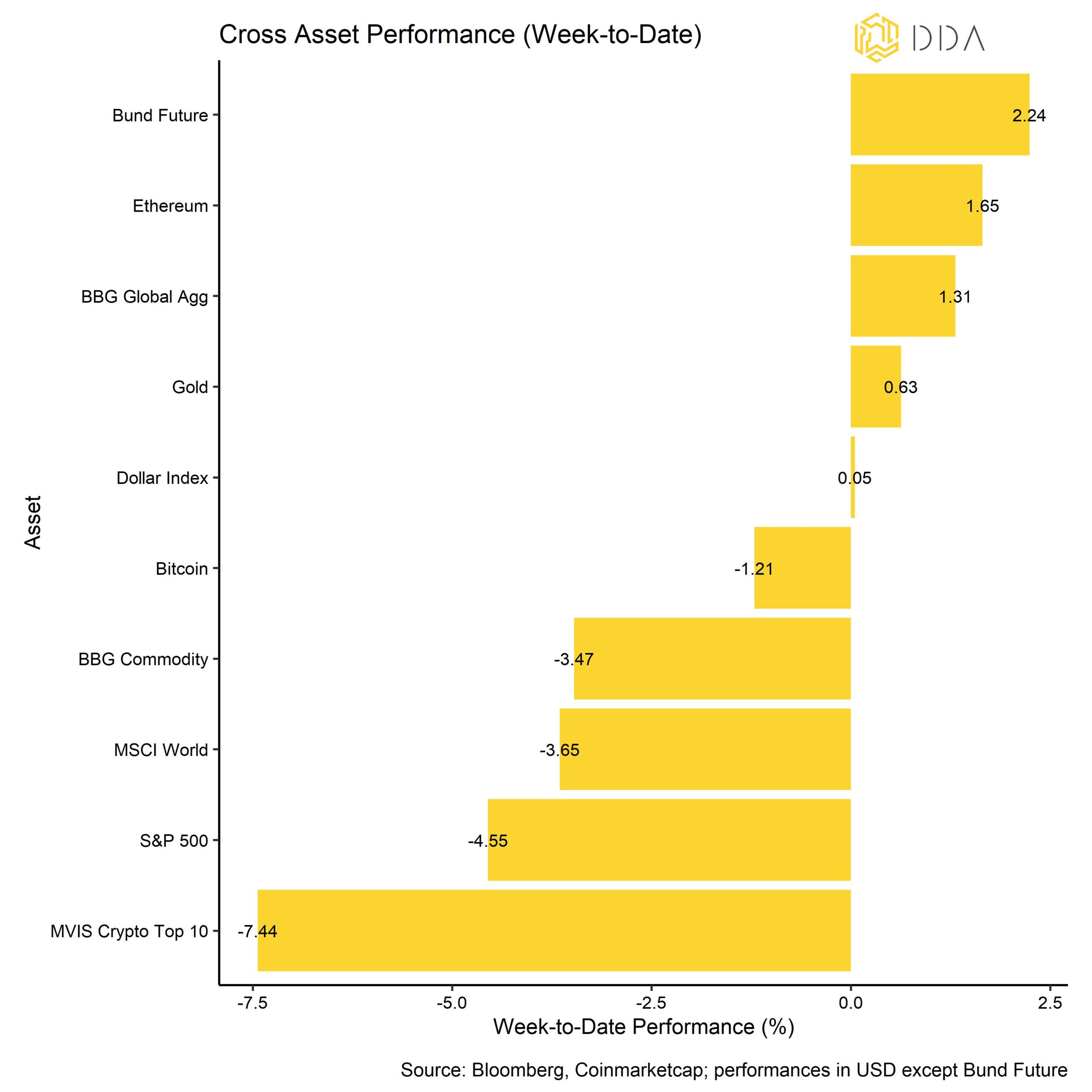

Andere traditionelle Finanzanlagen wurden ebenfalls negativ beeinflusst, insbesondere US-amerikanische und globale Aktien. Anleihen und Gold legten zu.

Da die US-Regierung und die Fed jedoch kürzlich interveniert haben, um eine weitere finanzielle Ansteckung zu verhindern, hat sich die unterdurchschnittliche Wertentwicklung von Kryptoassets heute im Wesentlichen umgekehrt.

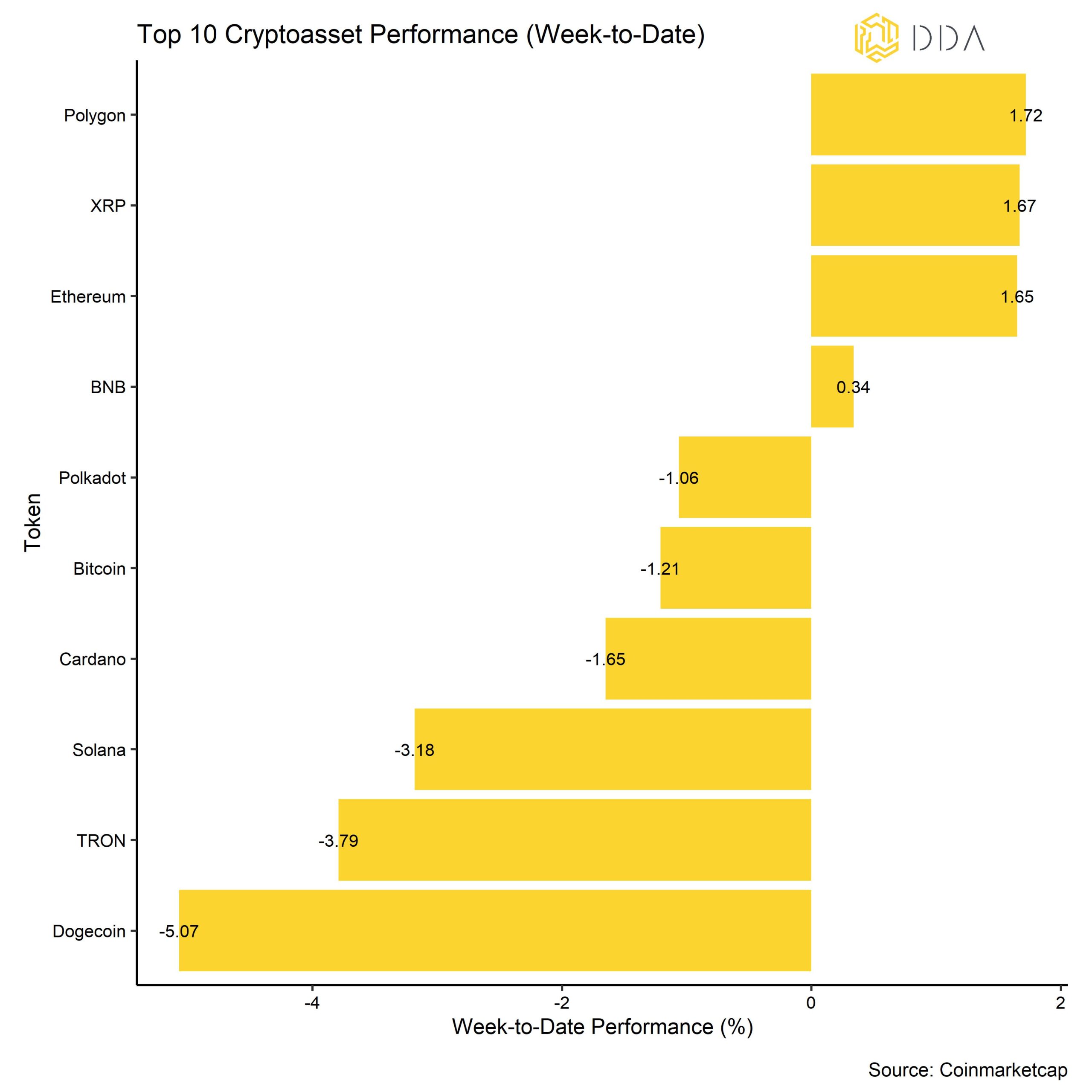

Unter den wichtigsten Kryptoassets waren Polygon, XRP und Ethereum die relativen Outperformer. Insbesondere Ethereum übertraf Bitcoin trotz des risikoarmen Umfelds, das hauptsächlich mit der anhaltenden Angebotsdeflation von Ethereum im Vergleich zu Bitcoin verbunden war.

Stimmung

Unser hauseigener Krypto-Sentiment-Index ist im Vergleich zur letzten Woche weiter zurückgegangen und befindet sich nun fest im rückläufigen Bereich. Nur 5 von 15 Indikatoren bleiben über ihrem kurzfristigen Trend.

Im Vergleich zur letzten Woche haben wir einen starken Rückgang der BTC-Finanzierungsrate und der Krypto-Fondsflüsse festgestellt.

Der Crypto Fear & Greed Index fiel unter die 50%-Linie in den "Fear"-Bereich, ist aber derzeit wieder "Neutral". Die auf Bitcoin Twitter gemessene Stimmung blieb während der gesamten letzten Woche bärisch.

Die Streuung zwischen den Kryptoassets nahm weiter ab, da die meisten Kryptoassets zunehmend nach systematischen Faktoren gehandelt wurden. Gleichzeitig entwickelten sich Altcoins auch auf 1-Monats- und 3-Monats-Basis schlechter als Bitcoin. Auf 1-Monats-Basis gelang es nur 20% der beobachteten Altcoins, Bitcoin zu übertreffen. Eine Outperformance von Altcoins ist in der Regel ein Zeichen für eine erhöhte Risikobereitschaft, und eine geringe Outperformance von Altcoins ist immer noch ein Hinweis auf eine eher vorsichtige Marktstimmung.

Strömungen

In der vergangenen Woche verzeichneten Kryptoassets sehr hohe Fondsabflüsse, wobei die meisten Abflüsse am Mittwoch letzter Woche erfolgten und sich hauptsächlich auf ein einziges Bitcoin-Fondsvehikel in Kanada konzentrierten.

Insgesamt verzeichneten wir Netto-Fondsabflüsse in Höhe von -278,4 Mio. USD. Alle Produkttypen verzeichneten Nettoabflüsse mit Ausnahme von Basket- und Themenfonds (+7,4 Mio. USD). Die Mittelabflüsse konzentrierten sich stark auf Bitcoin-Fonds (-260,4 Mio. USD). Ethereum-Fonds und andere Altcoin-Fonds verzeichneten ebenfalls Nettoabflüsse (-23,8 Mio. USD bzw. -1,7 Mio. USD).

Im Gegensatz dazu war der Abschlag auf den Nettoinventarwert des größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - seit Anfang März rückläufig, bevor er in den letzten Tagen nur leicht anstieg.

Im Vergleich zur letzten Woche ist das Beta der globalen Hedge-Fonds gegenüber Bitcoin in den letzten 20 Handelstagen weiter gesunken und liegt nun bei etwa 0, was bedeutet, dass die globalen Hedge-Fonds ihr Marktengagement gegenüber Kryptoassets neutralisiert haben.

Die auf Coinbase gehandelten Bitcoin-Preise waren im Vergleich zu den auf Binance gehandelten (Coinbase-Binance-Prämie) die ganze Woche über positiv, was auf ein erhöhtes Kaufinteresse von institutionellen Anlegern im Vergleich zu Kleinanlegern angesichts der Marktverwerfungen hindeutet.

On-Chain

Die On-Chain-Aktivitäten standen im Einklang mit einem Anstieg der allgemeinen Risikoaversion auf den Kryptomärkten, obwohl die Börsenzuflüsse trotz der gestiegenen Unsicherheit im Allgemeinen ziemlich gedämpft blieben. Nichtsdestotrotz gab es letzte Woche einige bedeutende Bitcoin-Miner-zu-Börsen-Transfers, die die höchsten seit Oktober 2021 waren. Dies unterstreicht, dass die Miner immer noch in einem sehr schwierigen Umfeld arbeiten, da die Hash-Rate kürzlich auf ein neues Allzeithoch gestiegen ist und die Preise relativ niedrig bleiben.

Insgesamt haben kurzfristige Anleger Verluste auf der Kette realisiert, bleiben aber im Allgemeinen über der Kostenbasis in ihren Geldbörsen, was sich stabilisierend auf den Markt auswirken dürfte, da diese Händler nicht geneigt sind, ihre Positionen mit nicht realisierten Gewinnen zu verlassen.

Eine weitere wichtige Entwicklung ist die Tatsache, dass die OTC-Bestände in letzter Zeit deutlich zurückgegangen sind, was ein Zeichen für eine nachlassende institutionelle Nachfrage nach Bitcoin sein könnte.

Aufgrund der erhöhten Risikoaversion im Zusammenhang mit der Silicon Valley Bank und USDC war am Samstag eine erhebliche Aktivität auf der USDC-Kette mit der höchsten Anzahl aktiver Adressen zu beobachten, die jemals auf der Kette verzeichnet wurde. Auch das gesamte Transfervolumen erreichte am Samstag mit rund 53,3 Mrd. USD-Äquivalenten auf der Kette ein Allzeithoch. Während USDC über das Wochenende deutlich unter dem Nennwert gehandelt wurde, lag Tether USD (USDT) deutlich über dem Nennwert, was bedeutet, dass die meisten Anleger ihre USDC-Bestände wahrscheinlich in USDT umgetauscht haben.

Derivate

Im Allgemeinen hat der allgemeine Stimmungsrückgang bei den Kryptowährungen auch zu einem deutlichen Anstieg der Risikoaversion an den Derivatemärkten geführt. Während die implizite Volatilität von Bitcoin-Optionen nur geringfügig anstieg, veränderte sich die 25-Delta-1-Monats-Optionen-Schiefe deutlich zugunsten von Put-Optionen im Vergleich zu Call-Optionen. Put-Optionen (Call-Optionen) geben den Inhabern das Recht, eine bestimmte Menge Bitcoin in der Zukunft zu einem vorher festgelegten Ausübungspreis zu verkaufen (zu kaufen). Die Umkehrung des Options-Skew fiel auch mit einem Anstieg des relativen offenen Interesses an Put-/Call-Optionen zusammen.

Darüber hinaus gab es einen sehr deutlichen Umschwung sowohl beim Futures-Basissatz als auch bei den ewigen Finanzierungssätzen, die einen steilen Anstieg der Nachfrage nach Short-Positionen in Bitcoin signalisieren. Der Finanzierungssatz ist auf ein Niveau gefallen, das zuletzt während des FTX-Einbruchs im November 2022 zu beobachten war. Der Basissatz ist derzeit wieder leicht negativ, was auf einen eher rückläufigen Preisausblick der Futures-Händler hindeutet. Derart negative Funding Rates sollten jedoch bereits als antizyklische Kaufgelegenheit betrachtet werden, da zu niedrige Funding Rates eine kurzfristige Erschöpfung der Verkäufer und eine einseitige Positionierung der Futures-Händler signalisieren.

Unterm Strich

Die Wertentwicklung von Kryptoassets wurde durch zwei bedeutende Konkurse von US-Banken (Silvergate und Silicon Valley Bank) belastet, allerdings aus unterschiedlichen Gründen.

Unser hauseigener Crypto Sentiment Index hat sich im Vergleich zur letzten Woche deutlich verschlechtert und befindet sich nun fest im bärischen Bereich.

Während die Risikoaversion kurzfristig zugenommen hat, könnte die größere Unsicherheit im traditionellen Bankensystem uns einer Pause im Zinserhöhungszyklus der Fed näher bringen, was für Kryptoassets sehr positiv wäre.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.