Laden Sie den vollständigen Bericht im PDF-Format herunter

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

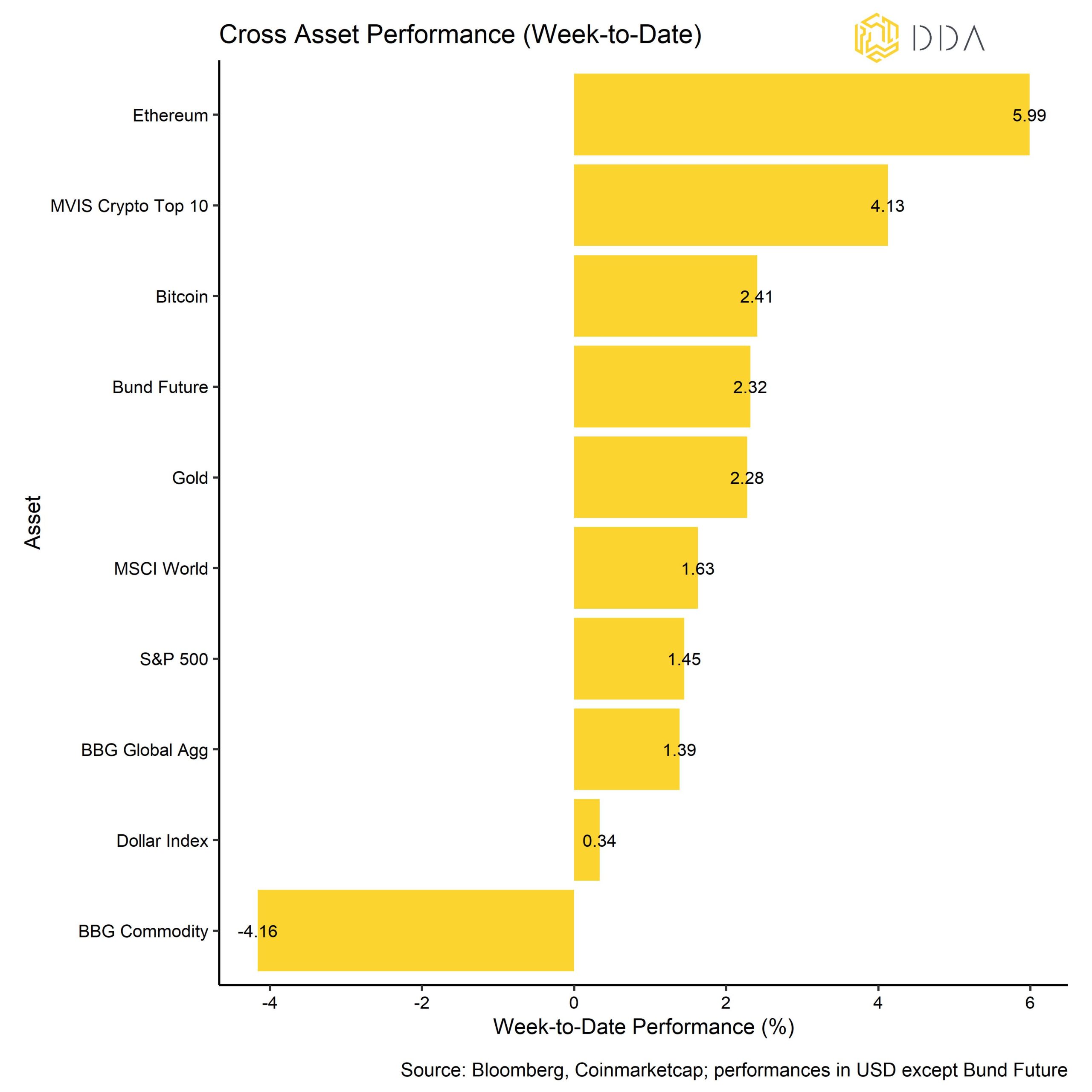

- Kryptoassets waren letzte Woche die beste Anlageklasse und übertrafen globale Aktien, Anleihen und Rohstoffe

- Unser hauseigener Crypto Sentiment Index ist deutlich gestiegen und befindet sich nun klar im positiven Bereich

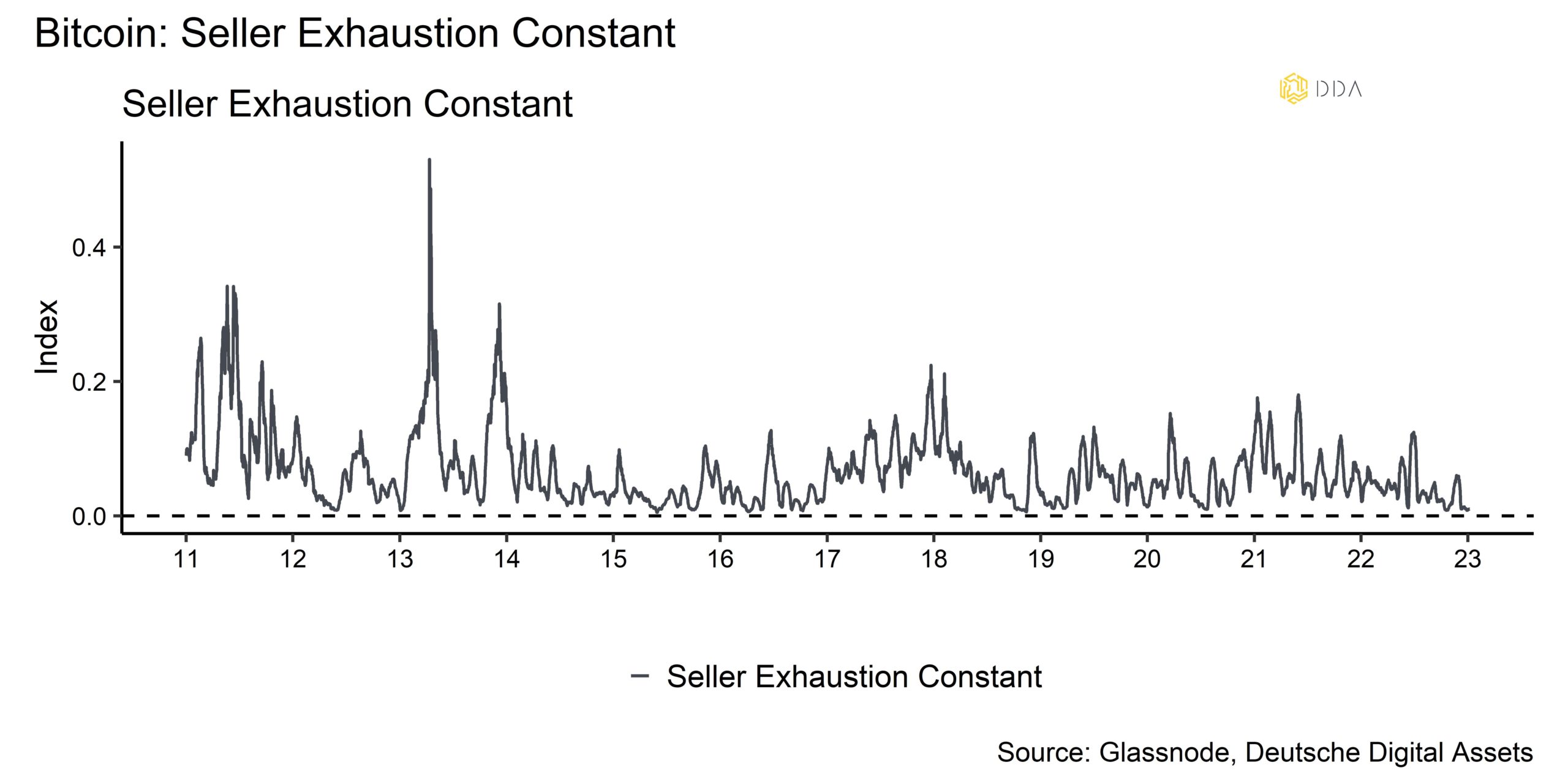

- Im Allgemeinen scheint es eine zunehmende Erschöpfung der Verkäufer zu geben, da das jüngste Kaufverhalten der Bitcoin-Investoren den Preis nicht wesentlich beeinflusst hat

Chart der Woche

Leistung

In der vergangenen Woche konnten die Preise für Kryptowährungen erneut zulegen, da die Risikoaversion im Laufe der Woche allmählich zurückging. Ein positiver Katalysator war der US-Arbeitsmarktbericht, der erste Hinweise auf eine Verlangsamung des Lohnwachstums enthielt, was die US-Notenbank zu einem moderateren geldpolitischen Kurs veranlassen könnte.

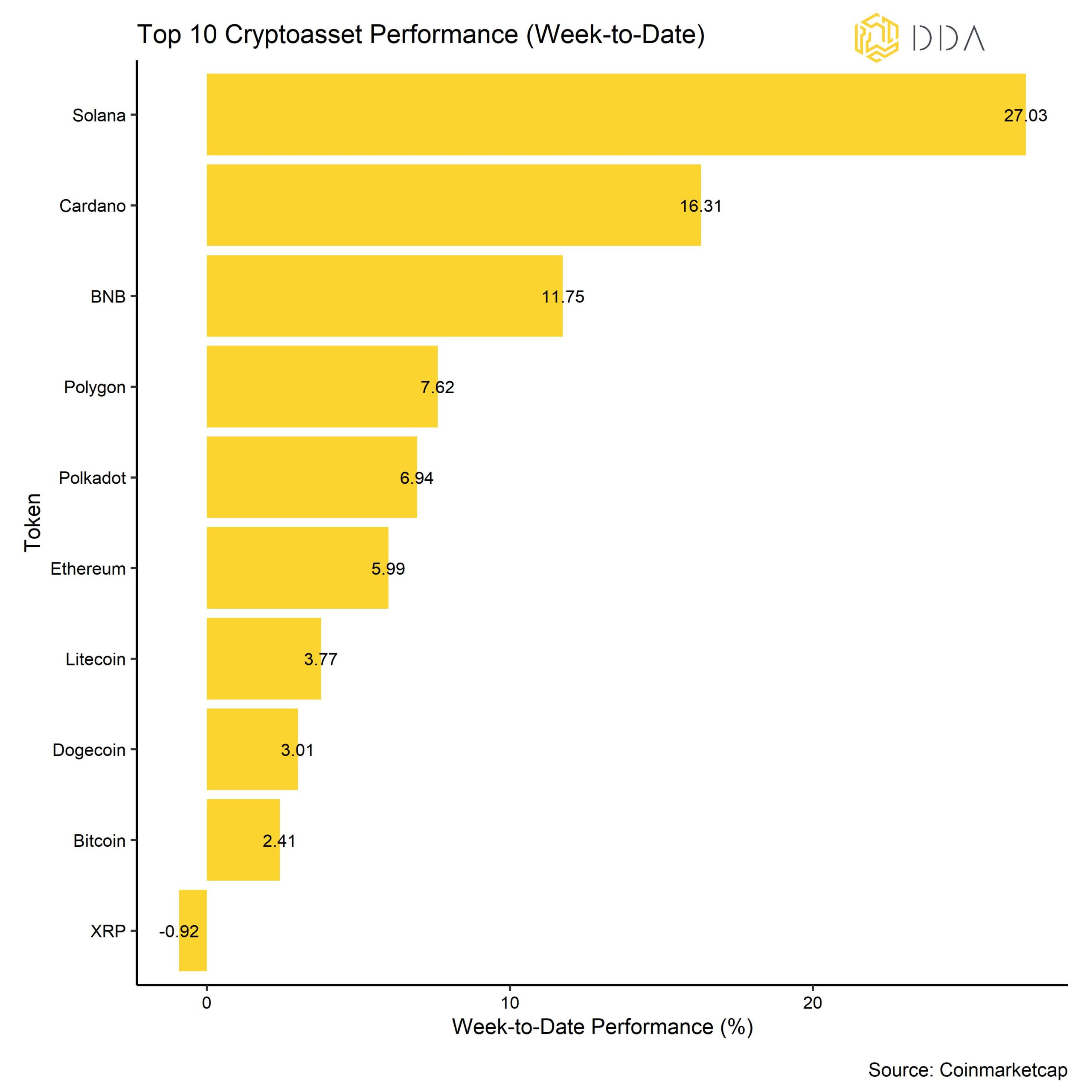

Unter den wichtigsten Kryptoassets waren Solana, Cardano und BNB die relativen Outperformer. Solana vollzog eine scharfe technische Umkehr, nachdem er im letzten Jahr zu den schlechtesten Kryptoassets gehörte. Kryptoassets waren in der ersten Woche des Jahres die beste Anlageklasse und übertrafen globale Aktien, Anleihen und Rohstoffe. Rohstoffe waren in der vergangenen Woche die schlechteste Anlageklasse, während der Dollar an Wert zulegte.

Stimmung

Unser hauseigener Krypto-Sentiment-Index ist deutlich gestiegen und befindet sich nun klar im positiven Bereich. Das bedeutet, dass die meisten unserer Indikatoren über ihrem kurzfristigen Trend liegen.

Dazu trugen vor allem der Rückgang der impliziten 1-Monats-Optionsvolatilität für BTC sowie der Anstieg der kurzfristigen nicht realisierten Gewinne/Verluste (NUPL) bei, die auf eine geringere Risikoaversion der Anleger hindeuten.

Die Streuung zwischen den Kryptoassets war weiterhin hoch, was bedeutet, dass der Kryptomarkt eher von münzspezifischen Faktoren als von systematischen Faktoren beeinflusst wurde. Die Streuung war während des größten Teils des Dezembers 2022 und der letzten Woche ziemlich unverändert. Gleichzeitig entwickelten sich Altcoins auf 1-Monats-Basis meist schlechter als Bitcoin und haben erst vor kurzem wieder eine Outperformance erzielt. Die Outperformance von Altcoins ist in der Regel ein Zeichen für eine erhöhte Risikobereitschaft.

Der Crypto Fear & Greed Index bewegte sich größtenteils seitwärts und befindet sich immer noch im Bereich "Fear". Bitte beachten Sie, dass wir kürzlich einen neuen Indikator hinzugefügt haben, der das Niveau der Bitcoin-Stimmung auf Twitter anzeigt (siehe Anhang). Dieser BTC Twitter Sentiment Index ist in der letzten Woche ebenfalls gesunken, nachdem er in der Vorwoche stark angestiegen war. Auch dieser Index deutet auf eine insgesamt bearishe Krypto-Stimmung hin.

Strömungen

Die Fondsflüsse waren in der letzten Woche weiterhin schwach und wir sahen Nettoabflüsse aus globalen Krypto-ETPs in Höhe von -38,5 Mio. USD während der Woche. Alle Arten von Krypto-ETP-Produkten verzeichneten Nettoabflüsse, mit Ausnahme von Altcoin ex ETH-basierten Produkten, die einen leichten Nettozufluss von +3,2 Mio. USD verzeichneten. BTC-basierte Produkte verzeichneten Nettoabflüsse in Höhe von -10,8 Mio. USD und ETH-basierte Produkte verzeichneten Nettoabflüsse in Höhe von -6,6 Mio. USD.

In diesem Zusammenhang wurden große Krypto-Asset-Fonds wie der kanadische 3iQ-Fonds und der XBT-Provider mit einem Abschlag auf ihren NAV gehandelt. Interessanterweise begann der Abschlag auf den Nettoinventarwert des größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - Ende Dezember die Tiefststände zu überwinden, was angesichts des potenziellen 20%-Tenderangebots für GBTC-Anteile ein positives Zeichen ist.

Das Beta der globalen Hedge-Fonds gegenüber Bitcoin ist in den letzten 20 Handelstagen weiter leicht gesunken, was bedeutet, dass Hedge-Fonds ihr Engagement in Krypto-Assets in den letzten 20 Tagen weiter reduziert haben könnten.

Die Coinbase-Binance-Prämie war die ganze Woche über neutral, was auf ein nur mäßiges Kaufinteresse von institutionellen Anlegern gegenüber Kleinanlegern hindeutet.

On-Chain

Die Entwicklungen auf der Bitcoin-Kette verliefen in der letzten Woche eher ruhig, ohne größere Zu- oder Abflüsse zu oder von den Börsen. Sowohl die Bitcoin- als auch die Ethereum-Börsensalden bewegen sich seit Ende Dezember im Wesentlichen seitwärts. Im Allgemeinen gibt es eine anhaltende Akkumulations- und Halteaktivität, da das Bitcoin-Angebot, das seit mehr als einem Jahr aktiv ist, weiter zunimmt. Die Tatsache, dass sich das SOPR-Verhältnis (Spend-Output-Profit-Ratio) der kurzfristigen Inhaber langsam erholt hat und derzeit nur leicht unter 1,0 liegt, deutet darauf hin, dass die meisten kurzfristig gehandelten Münzen nicht mit Verlust gehandelt werden, was die Marktstimmung weiter stabilisieren könnte.

Darüber hinaus scheint es eine zunehmende Erschöpfung der Verkäufer zu geben, da das jüngste Kaufverhalten der Bitcoin-Investoren den Preis nicht wesentlich beeinflusst hat. In der Tat, die sogenannte "Verkäufer Erschöpfung konstant" für Bitcoin ist auf einem Mehrjahrestief, was auch ein hohes Maß an Verkäufermüdigkeit signalisiert (siehe unsere Chart-der-Woche). Wir haben vor kurzem einen ausführlichen Beitrag zu dieser Kennzahl veröffentlicht, den Sie sich unbedingt ansehen sollten (Link).

Derivate

Im Allgemeinen konnten wir eine deutliche Mäßigung der Risikoaversion auf den Bitcoin-Derivatemärkten feststellen. Dies zeigt sich in dem anhaltenden Rückgang der impliziten Bitcoin-Volatilität und einer Normalisierung der Schiefe.

Die implizite 1-Monats-Volatilität für Bitcoin-Optionen ist unter 40% gesunken - der niedrigste jemals verzeichnete Wert. Kurzfristig sollten Anleger Vorsicht walten lassen, da Volatilitäten in der Regel mean reverting sind, d.h. niedrige Volatilitätsniveaus führen zu hohen Niveaus in der Zukunft und vice versa.

Darüber hinaus hat sich die 3-Monats-Basisrate für Bitcoin-Futures erhöht und ist nun wieder positiv, was bedeutet, dass Futures-Investoren in 3 Monaten mit höheren Preisen rechnen.

Unterm Strich

Kryptoassets waren letzte Woche die beste Anlageklasse und übertrafen globale Aktien, Anleihen und Rohstoffe.

Unser hauseigener Krypto-Sentiment-Index ist deutlich gestiegen und befindet sich nun klar im positiven Bereich.

Im Allgemeinen scheint es eine zunehmende Erschöpfung der Verkäufer zu geben, da das jüngste Kaufverhalten der Bitcoin-Investoren den Preis nicht wesentlich beeinflusst hat.

Laden Sie den vollständigen Bericht mit Anhang hier herunter.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.