Laden Sie den vollständigen Bericht im PDF-Format herunter

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

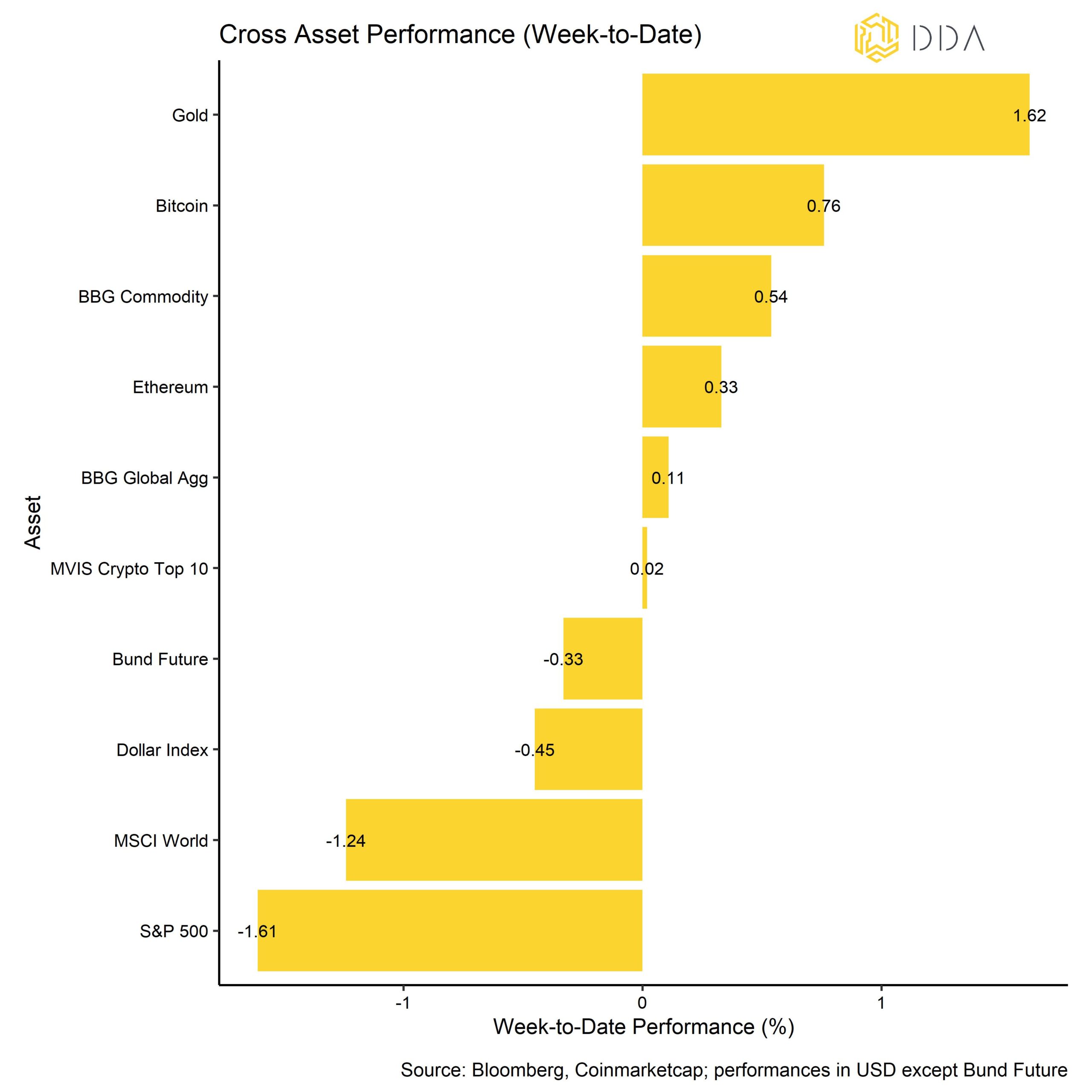

- Kryptoassets waren in der vergangenen Woche trotz des negativen Nachrichtenflusses die zweitbeste Anlageklasse und übertrafen globale Aktien und Anleihen, aber untertrafen Rohstoffe

- Unser hauseigener Crypto Sentiment Index hat sich im Vergleich zur letzten Woche nur leicht verbessert und ist derzeit neutral

- Im Allgemeinen ist die Handelsaktivität auf den Ketten- und Derivatemärkten nach wie vor recht gedämpft.

Chart der Woche

Leistung

In der vergangenen Woche gelang es den Kursen von Kryptowährungen, die meisten risikobehafteten Vermögenswerte erneut zu übertreffen, obwohl die Nachrichtenlage eher schlecht war. Unter anderem forderte die SEC in den USA notierte Unternehmen auf, ihr Engagement und ihren Schaden durch das jüngste Chaos auf den Kryptomärkten offenzulegen. Außerdem gab es am Wochenende Gerüchte über eine mögliche Insolvenz des Börsenriesen Binance. Ein aktueller Finanzbericht von Mazar hat jedoch ergeben, dass die Bitcoin-Reserven von Binance überbesichert sind.

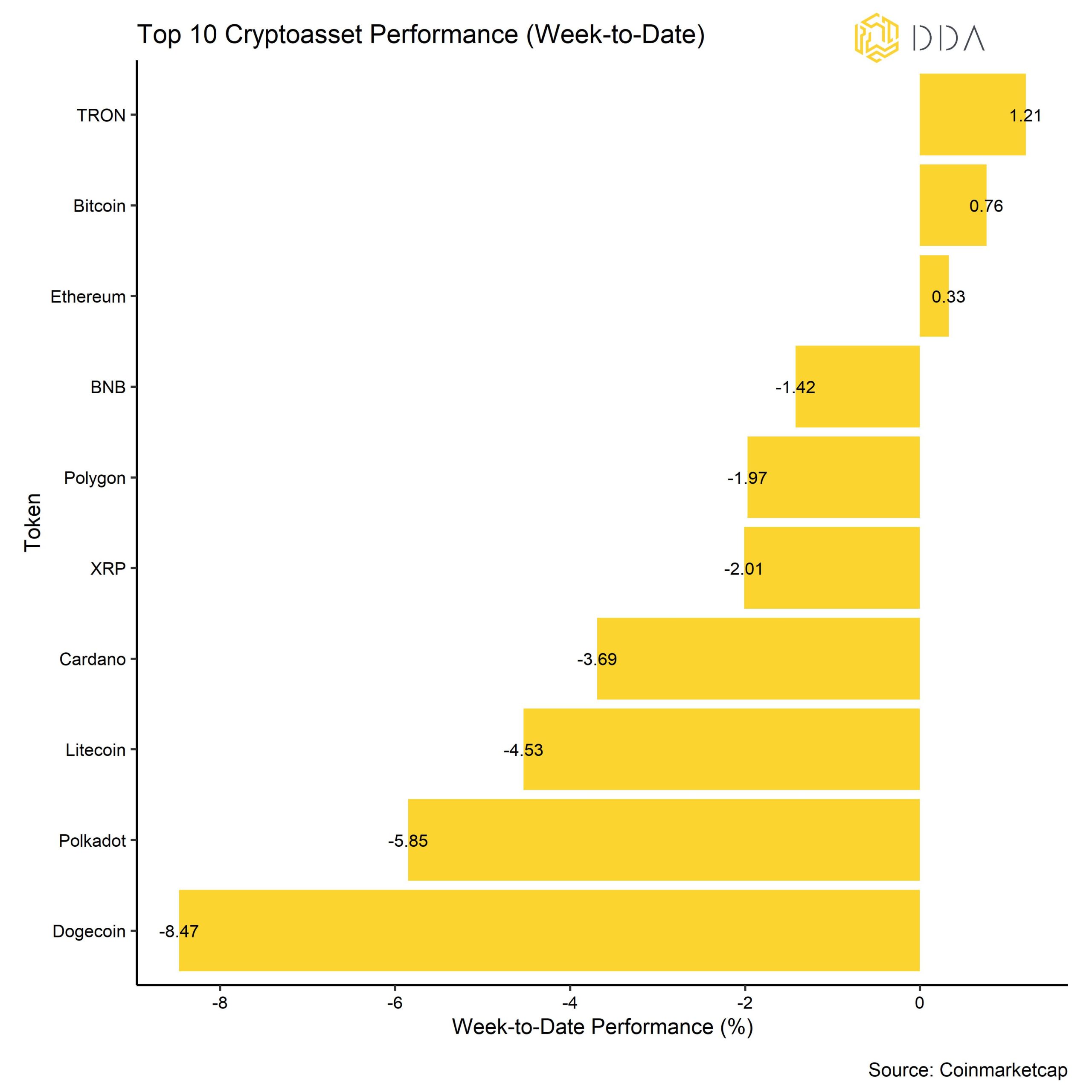

Nichtsdestotrotz waren die Kryptoasset-Preise die meiste Zeit der Woche stabil. Unter den wichtigsten Kryptoassets waren TRON, Bitcoin und Ethereum die relativen Outperformer. Kryptoassets waren letzte Woche die zweitbeste Anlageklasse und übertrafen globale Aktien und Anleihen. Rohstoffe und Gold erzielten eine überdurchschnittliche Performance. Der Dollar schwächte sich letzte Woche erneut ab.

In dieser Woche wird sich der Markt wahrscheinlich auf die VPI-Inflationszahlen für die USA und die Eurozone konzentrieren, die am Dienstag bzw. Mittwoch erwartet werden. Außerdem steht am Mittwoch eine weitere Zinsentscheidung des FOMC an. Die Fed Funds Futures gehen derzeit von einer Zinserhöhung um 50 Basispunkte durch die Fed aus.

Stimmung

Unser hauseigener Krypto-Sentiment-Index hat sich im Vergleich zur letzten Woche nur leicht verbessert und ist derzeit neutral. Das bedeutet, dass es keinen klaren kurzfristigen Trend innerhalb unserer Indikatoren in eine der beiden Richtungen gibt.

Positiv zu vermerken ist, dass die Streuung zwischen den Kryptoassets auf rollierender Basis deutlich zugenommen hat, was darauf hindeutet, dass der Kryptomarkt eher auf münzspezifischen Faktoren gehandelt wurde, was darauf hindeutet, dass der Markt begonnen hat, den systematischen Handel rund um den FTX-Zusammenbruch hinter sich zu lassen und sich wieder auf Fundamentaldaten zu konzentrieren. Gleichzeitig schnitten Altcoins meist schlechter ab als Bitcoin, was auf einen Rückgang der allgemeinen Risikobereitschaft in der letzten Woche schließen lässt.

Der Crypto Fear & Greed Index hat sich im Vergleich zur letzten Woche nicht verändert und befindet sich immer noch im Bereich "Fear".

Strömungen

Die Fondsflüsse waren in der letzten Woche weiterhin schwach und wir sahen Nettoabflüsse aus globalen Krypto-ETPs in Höhe von -6,7 Mio. USD. Bitcoin-basierte Produkte schnitten jedoch wieder recht gut ab und verzeichneten im Laufe der Woche Nettozuflüsse von +14,8 Mio. USD, während alle anderen Krypto-ETPs Nettoabflüsse verzeichneten. Die meisten Abflüsse erfolgten zu Beginn der letzten Woche, während wir insbesondere am vergangenen Freitag positive Nettozuflüsse verzeichneten.

Das Beta der globalen Hedge-Fonds in Bezug auf Bitcoin ist in den letzten 20 Handelstagen im Vergleich zu den sehr hohen Werten der letzten Woche gesunken, was bedeutet, dass die globalen Hedge-Fonds ihr Engagement wieder etwas reduziert haben.

Ein weiteres Highlight ist, dass die Coinbase-Binance-Prämie die ganze Woche über positiv war, was auf ein relatives Kaufinteresse von institutionellen Anlegern im Vergleich zu Kleinanlegern hindeutet.

In der Zwischenzeit erreichte der Abschlag auf den Nettoinventarwert des größten Bitcoin-Fonds der Welt (Grayscale Bitcoin Trust - GBTC) ein neues Allzeittief, da der Hedgefonds Fir Tree Grayscale verklagt hat, die Rücknahme seiner Fondsanteile wieder aufzunehmen und die Gebühren zu senken. Die Bitcoin-Trust-Anteile von Grayscale werden derzeit mit einem Abschlag von rund -48,6% auf den NAV gehandelt.

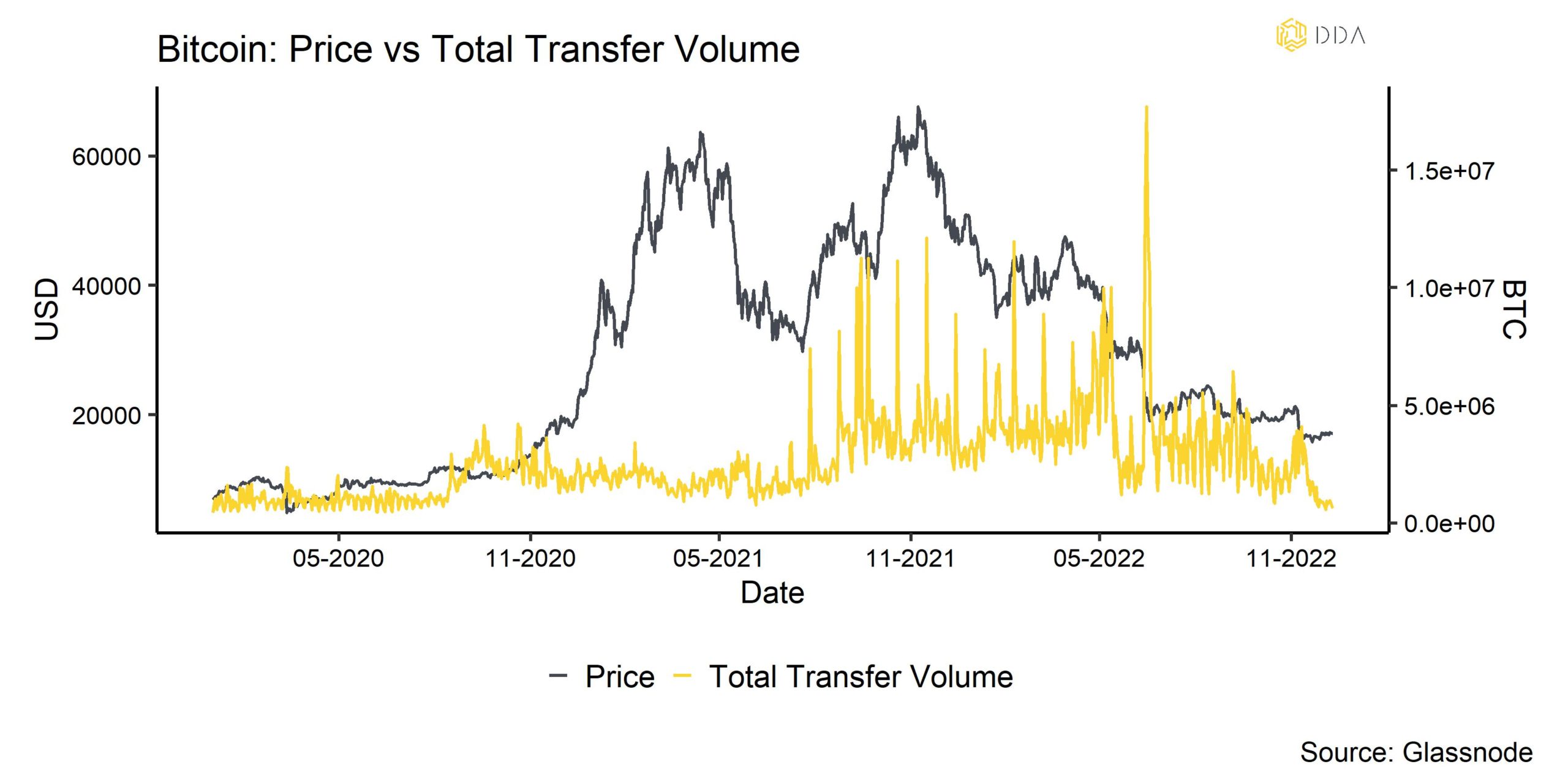

On-Chain

Im Allgemeinen sind die Bitcoin (BTC)-Börsenzuflüsse noch weiter zurückgegangen. Das Volumen der Börsenzuflüsse (gleitender 7-Tage-Durchschnitt) hat gerade ein 2-Jahres-Tief erreicht, was auf einen insgesamt nachlassenden Verkaufsdruck und ruhige Märkte hindeutet.

In ähnlicher Weise hat das BTC-Angebot, das in den letzten 24 Stunden aktiv war, gerade einen 15-Monats-Tiefstand erreicht. Es findet also generell wenig Transaktionsvolumen auf der Kette statt.

Nichtsdestotrotz haben die Bilanzen der BTC-Bergleute gerade ein 14-Monats-Tief erreicht, was deutlich macht, dass die Bergleute immer noch unter Druck stehen.

Wir haben das erhöhte Risiko der "Kapitulation der Bergleute" in unserer letzten Ausgabe des "Krypto-Marktintelligenz" Bericht ebenfalls.

Eine weitere interessante Entwicklung ist die Tatsache, dass die Anzahl der sendenden Adressen (7d MA) bei Tether (USDT) gerade ein 23-Monats-Hoch erreicht hat. Dies geschieht in der Regel in Zeiten von Stress, da die Anleger zunehmend in Stablecoins investieren, um sich gegen Volatilität abzusichern. Dies könnte ein Symptom für die jüngsten Gerüchte sein, dass Binance untergehen könnte. Allerdings scheinen die BTC-, ETH-, USDT- und BUSD-Börsensalden auf Binance bisher relativ stabil zu sein, mit nur Abflüssen bei BTC bis heute Morgen.

Im Bereich der Altcoins wurde Ether inflationär, da sich die Netzwerkaktivität verlangsamte. Das bedeutet, dass die Menge an Ether, die geprägt wird, die Menge, die "verbrannt" (aus dem Umlauf genommen) wird, übersteigt, was sich negativ auf den Token-Preis von ETH auswirken könnte.

Derivate

Ähnlich wie bei der Kette hat das Volumen der BTC-Futures-Kontrakte gerade ein Zwei-Jahres-Tief erreicht, was auch die Tatsache unterstreicht, dass die Marktaktivität im Moment ziemlich gedämpft ist.

Allerdings gab es auch einige negative Entwicklungen, wie den erneuten Rückgang der ewigen Finanzierungssätze, was darauf hindeutet, dass Händler ihre BTC-Short-Positionen wieder leicht erhöht haben. Bei den BTC-Optionen war außerdem ein Anstieg des offenen Interesses an Put-Call-Optionen zu beobachten, was ebenfalls auf eine Zunahme der Absicherungen nach unten hindeutet.

Dennoch bleibt die Risikoaversion insgesamt recht gering, wenn man die niedrigen Werte der impliziten Volatilität betrachtet.

Unterm Strich

Kryptoassets waren in der vergangenen Woche trotz der negativen Nachrichtenlage die zweitbeste Anlageklasse. Sie schnitten besser ab als globale Aktien und Anleihen, aber schlechter als Rohstoffe. Unser hauseigener Krypto-Sentiment-Index hat sich im Vergleich zur Vorwoche nur leicht verbessert und ist derzeit neutral. Im Allgemeinen ist die Handelsaktivität an den Ketten- und Derivatemärkten nach wie vor recht verhalten.

Laden Sie den vollständigen Bericht mit Anhang hier herunter.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.