Laden Sie den vollständigen Bericht im PDF-Format herunter

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

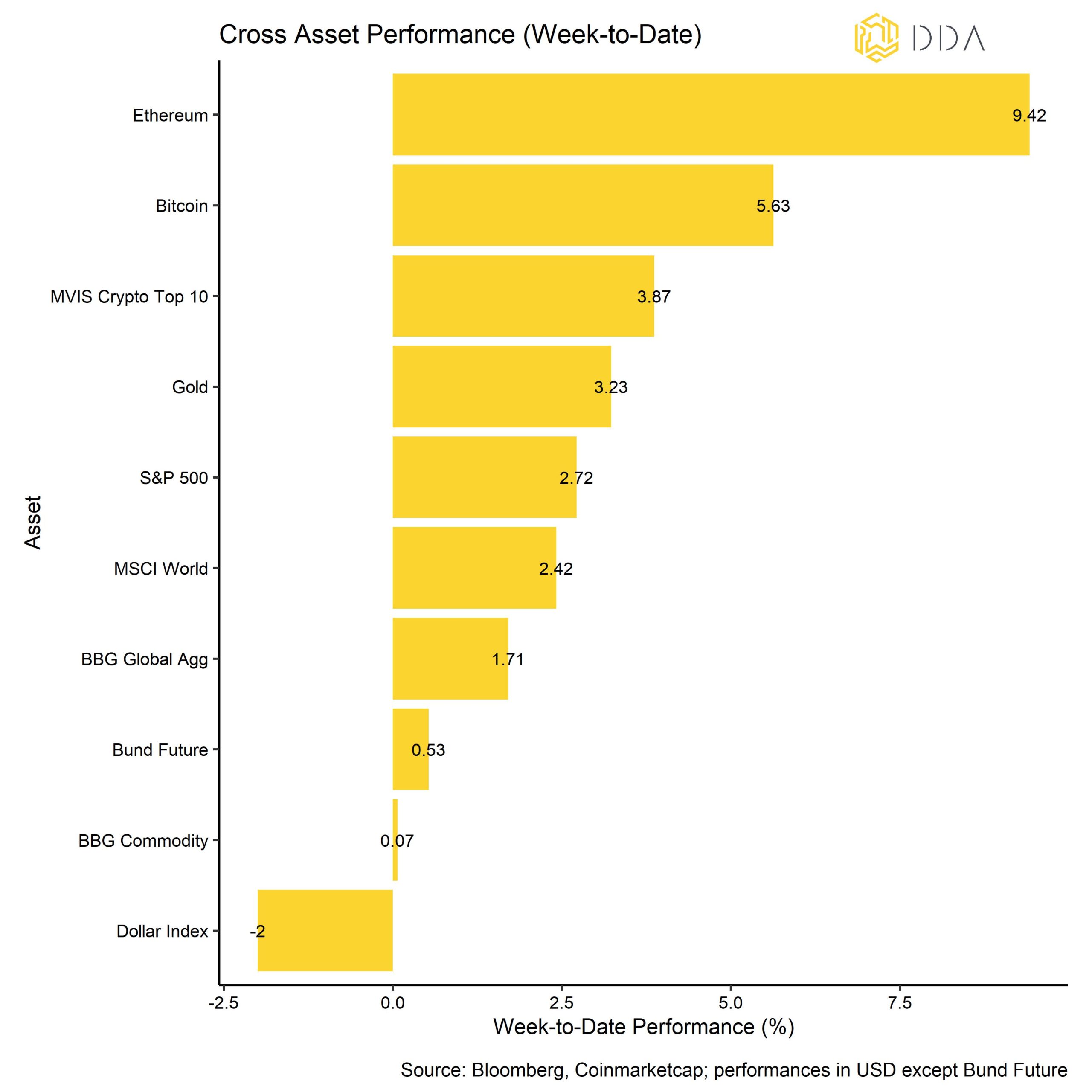

- Kryptoassets waren letzte Woche erneut die beste Anlageklasse und übertrafen globale Aktien, Anleihen und Rohstoffe

- Unser hauseigener Crypto Sentiment Index hat sich weiter verbessert, da die zugrundeliegende Stimmung vor allem durch die positiven Aussagen des Fed-Vorsitzenden Powell gestützt wurde

- Im Allgemeinen haben sich die Zuflüsse an den Börsen ebenfalls abgeflacht, was auf einen insgesamt geringeren Verkaufsdruck hindeutet, was auch für die Überweisungen der Bitcoin-Miner an die Börsen gilt

Chart der Woche

Leistung

In der vergangenen Woche konnten die Preise für Kryptowährungen erneut zulegen, was durch die Nachricht unterstützt wurde, dass "Es ist sinnvoll, das Tempo unserer Zinserhöhungen zu mäßigen" für die Federal Reserve schon im Dezember. Diese Aussage wurde letzte Woche vom Fed-Vorsitzenden Powell gemacht.

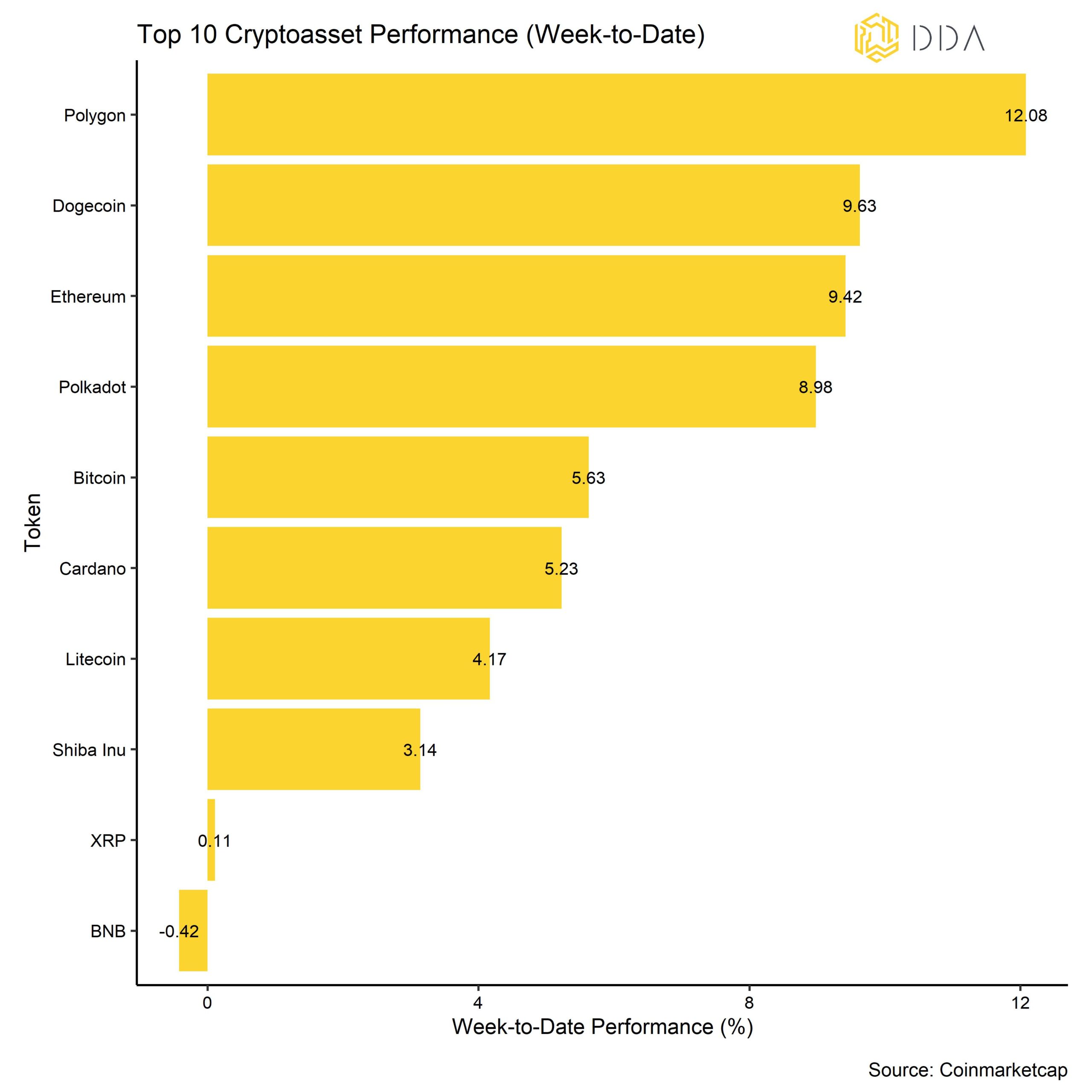

Dementsprechend haben sich die Preise von Kryptoassets und anderen risikobehafteten Vermögenswerten überwiegend positiv entwickelt. Unter den wichtigsten Kryptoassets waren Polygon, Dogecoin und Ethereum die relativen Outperformer. Kryptoassets waren in der vergangenen Woche erneut die beste Anlageklasse und schnitten besser ab als globale Aktien, Rohstoffe und Anleihen. Der Dollar schwächte sich letzte Woche erneut ab.

Stimmung

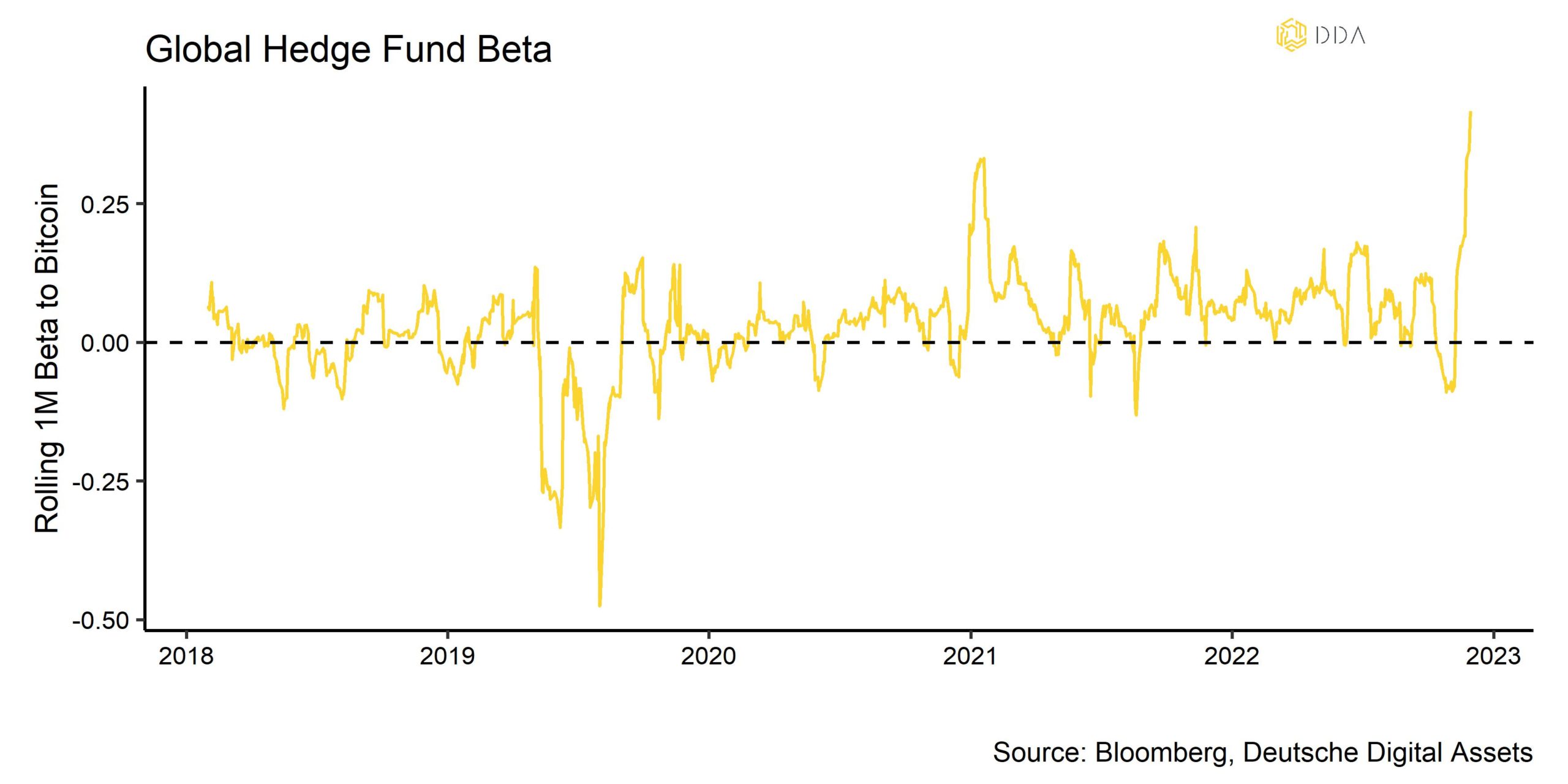

Unser hauseigener Krypto-Sentiment-Index hat sich im Vergleich zur letzten Woche weiter verbessert und ist kurzzeitig in den positiven Bereich eingetreten. Das bedeutet, dass die meisten unserer Indikatoren über ihrem kurzfristigen Trend lagen. Die wichtigsten Faktoren waren der Anstieg des Hedgefonds-Beta für BTC sowie die Umkehrung der impliziten Volatilität von BTC-Optionen und der Refinanzierungssätze, die in der Regel auf eine Zunahme der Risikobereitschaft bei Kryptowährungen hinweisen.

Die Streuung zwischen den Kryptoassets auf rollierender Basis war nach wie vor sehr gering, was bedeutet, dass der Kryptomarkt eher von systematischen Faktoren als von münzspezifischen Faktoren beeinflusst wurde. Gleichzeitig konnten sich Altcoins meist besser entwickeln als Bitcoin, was in der Regel ein Zeichen für eine zunehmende Risikobereitschaft ist.

Der Crypto Fear & Greed Index hat sich ebenfalls verbessert, befindet sich aber immer noch im Bereich "Angst".

Strömungen

Die Fondsflüsse waren in der letzten Woche weiterhin schwach und wir sahen Nettoabflüsse aus globalen Krypto-ETPs in Höhe von -4,0 Mio. USD. Bitcoin-basierte Produkte schnitten jedoch recht gut ab und verzeichneten im Laufe der Woche Nettozuflüsse von 13,7 Mio. USD, während alle anderen Krypto-ETPs Nettoabflüsse verzeichneten.

Positiv zu vermerken ist, dass das Beta der globalen Hedgefonds gegenüber Bitcoin in den letzten 20 Handelstagen weiter angestiegen ist, was darauf hindeutet, dass Hedgefonds ihr Engagement in Kryptoassets im Laufe des Monats weiter erhöht haben könnten. Das Beta der globalen Hedgefonds zu Bitcoin stieg auf den höchsten Wert seit 2018, was auf eine deutliche Zunahme des Engagements der Hedgefonds in Kryptoassets in den letzten 20 Handelstagen hindeutet.

Ein weiteres Highlight ist, dass die Coinbase-Binance-Prämie die ganze Woche über positiv war, was auf ein relatives Kaufinteresse von institutionellen Anlegern im Vergleich zu Kleinanlegern hindeutet.

On-Chain

Auch die Devisenzuflüsse haben sich im Allgemeinen abgeschwächt, was bedeutet, dass der Verkaufsdruck insgesamt nachgelassen hat.

In der vergangenen Woche gab es keine nennenswerten Devisenströme, weder von noch zu den Börsen.

Es scheint, dass wir langsam in die eher ruhige Weihnachtszeit eintreten, da das Bitcoin-Transaktionsvolumen auf ein 2-Jahres-Tief gesunken ist.

Auch die Überweisungen von BTC-Minern an Börsen sind im Vergleich zur letzten Woche zurückgegangen, als wir die höchsten Überweisungen seit Jahresbeginn verzeichneten, was bedeutet, dass der Verkaufsdruck etwas nachgelassen hat.

Wir haben das erhöhte Risiko der "Kapitulation der Bergleute" in unserer letzten Ausgabe des "Krypto-Marktintelligenz" Bericht. Der Rückgang der Devisenzuflüsse in den Bergbau ist in dieser Hinsicht eine positive Entwicklung.

Ein weiteres Highlight ist, dass kurzfristige Anleger mit einer Haltedauer von weniger als 155 Tagen nach wochenlangen herben Verlusten wieder Gewinne realisieren konnten, was in der Regel auch die allgemeine Marktstimmung verbessert.

Allerdings sind die außerbörslichen Bitcoin-Bestände immer noch sehr gering und lassen noch nicht auf ein großes Kaufinteresse institutioneller Anleger schließen.

Derivate

Im Allgemeinen konnten wir eine deutliche Mäßigung der Risikoaversion auf den Bitcoin-Derivatemärkten feststellen. Dies zeigt sich in der anhaltenden Abnahme der impliziten Bitcoin-Volatilität und einer Normalisierung der Schiefe. Die drastische Umkehr bei den ewigen Finanzierungssätzen ist ebenfalls ein Hinweis auf eine allmähliche Auflösung von Abwärtsabsicherungen und eine Verringerung der Risikoaversion unter den Derivatehändlern.

Unterm Strich

Kryptoassets waren letzte Woche erneut die beste Anlageklasse und übertrafen globale Aktien, Anleihen und Rohstoffe.

Unser hauseigener Crypto Sentiment Index hat sich weiter verbessert, da die zugrundeliegende Stimmung vor allem durch die Aussage des Fed-Vorsitzenden Powell unterstützt wurde, das Tempo der Zinserhöhungen bereits im Dezember zu moderieren. Die Mittelzuflüsse aus Krypto-ETPs waren mit Ausnahme von Bitcoin-ETPs leicht negativ, während das Beta der globalen Hedgefonds in Bitcoin weiter zunahm. On-Chain-Indikatoren deuten darauf hin, dass der allgemeine Verkaufsdruck nachgelassen hat, da die Zuflüsse an den Börsen im Vergleich zur letzten Woche zurückgegangen sind. Die Überweisungen der Miner an die Börsen sind ebenfalls zurückgegangen, was angesichts einer möglichen "Kapitulation der Miner" eine positive Entwicklung darstellt.

Außerdem haben wir einen weiteren deutlichen Rückgang der Risikoaversion an den Bitcoin-Derivatemärkten festgestellt.

Laden Sie den vollständigen Bericht mit Anhang hier herunter.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Aktuelle Nachrichten und Artikel

- Institutionelle Krypto-Annahme: Warum und wie Institutionen auf Krypto umsteigen

- Krypto-Portfolio-Zusammensetzung: Wie sich verschiedene Portfolios während der jüngsten Bullen- und Bärenmärkte entwickelt haben

- Wie man in Ethereum (ETH) investiert: Ein Leitfaden für professionelle Anleger

- Das Argument für aktiv verwaltete Anlagestrategien auf den Kryptomärkten

- Wie man in NFTs investiert: Ein Leitfaden für professionelle Anleger

- Warum die Volatilität von Bitcoin Sie nicht erschrecken sollte

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

Deutsche Digital Assets in der Presse

- ETF-Stream: Zahl der White-Label-Emittenten in Europa innerhalb einer Woche verdreifacht

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.