DDA Krypto-Marktimpuls, 11. April 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Bitcoin ist gerade aus seiner Seitwärtsspanne der letzten Wochen ausgebrochen

- Unser hauseigener Krypto-Sentiment-Index blieb die ganze Woche über neutral

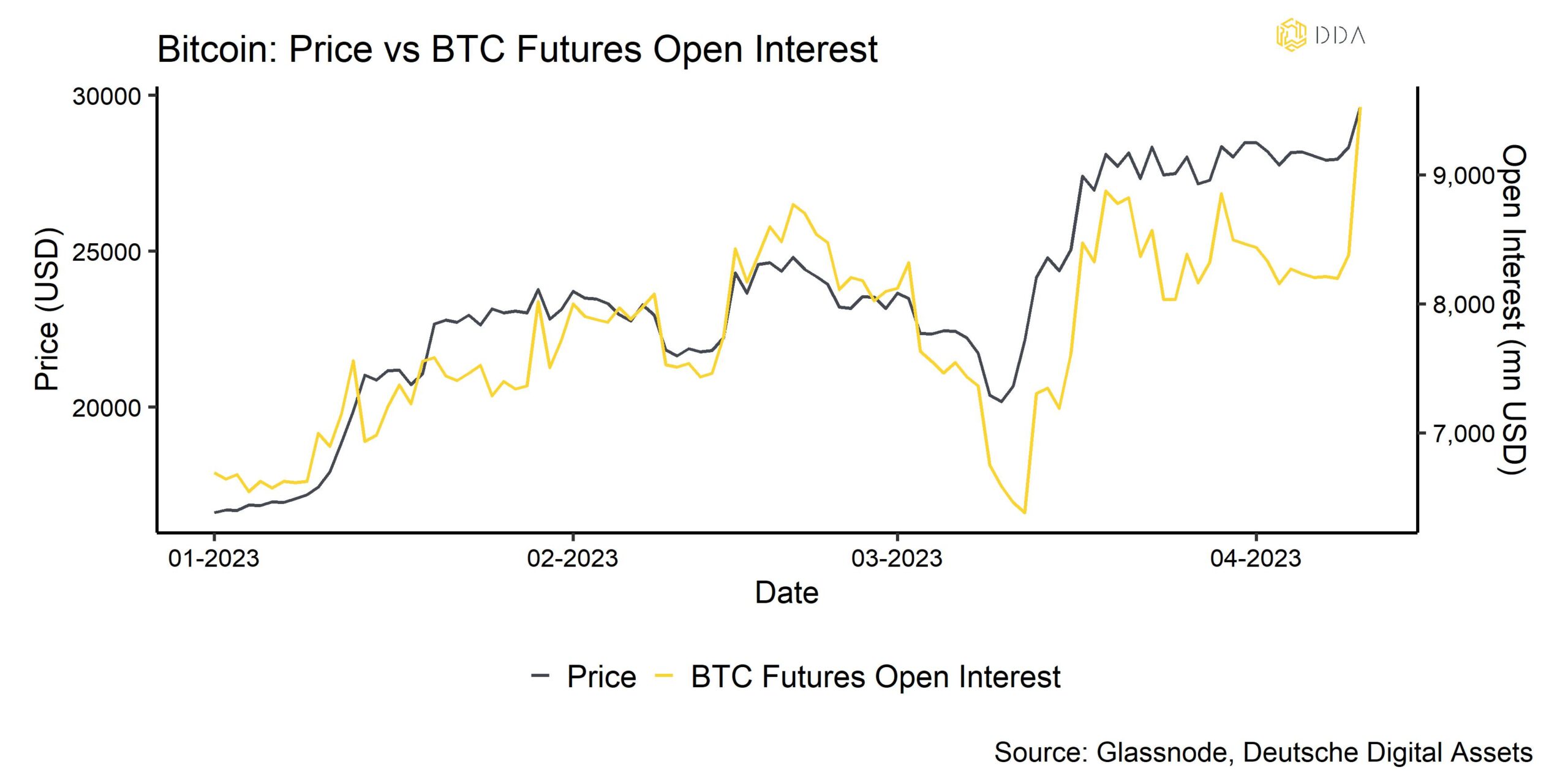

- Das Engagement in Kryptowährungen über Bitcoin-Futures hat in letzter Zeit stark zugenommen

Chart der Woche

Kryptoasset Leistung

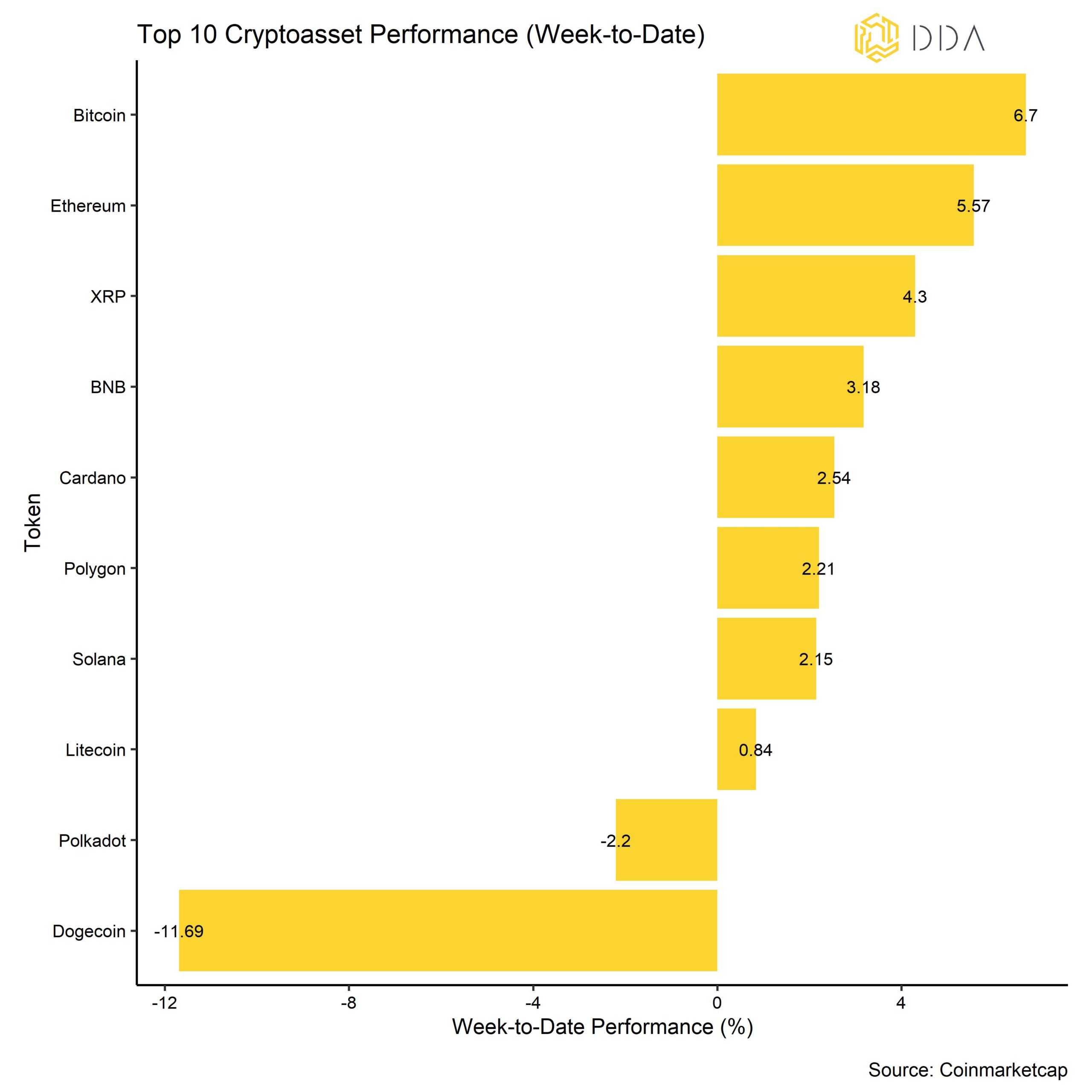

Die Performance der Kryptoassets in der letzten Woche war eher verhalten, und erst vor kurzem scheinen die Kryptoassets aus ihrer Frühjahrsflaute der letzten Wochen herausgekommen zu sein.

Dies scheint mit einem Anstieg des offenen Interesses an Bitcoin-Futures (und perpetual) auf den höchsten Stand seit Jahresbeginn verbunden zu sein (siehe Chart-der-Woche).

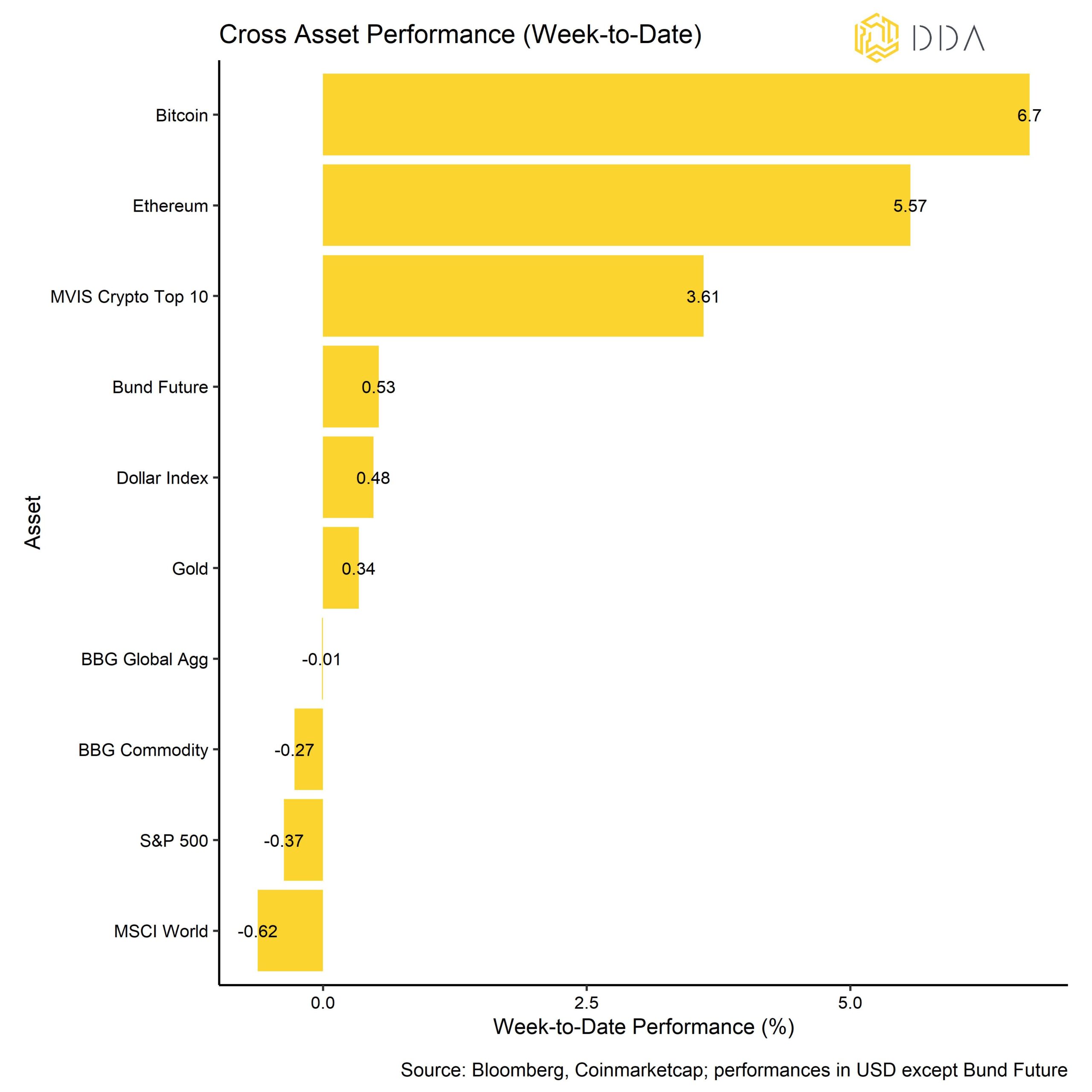

Im Vergleich zu traditionellen Finanzanlagen haben Krypto-Assets eine sehr gute Performance erzielt. Globale Anleihen und Gold haben sich in der vergangenen Woche besser entwickelt als globale Aktien.

Unter den großen Kryptoassets waren Bitcoin, Ethereum und XRP die relativen Outperformer. Dogecoin zeigte in der letzten Woche eine deutliche Underperformance, da das Logo des Meme-Coins wieder von Twitter entfernt wurde. Twitter hatte vor kurzem ein Logo des berüchtigten Shiba Inu von Dogecoin auf seine Website gestellt, was zu weiteren Preissteigerungen des Tokens führte.

Krypto-Marktstimmung

Unser hauseigener Krypto-Sentiment-Index blieb die ganze Woche über neutral, ohne größere Bewegungen in die eine oder andere Richtung. 8 von 15 Indikatoren liegen über ihrem kurzfristigen Trend.

Im Vergleich zur letzten Woche gab es große Umschwünge im BTC Put-Call-Volumenverhältnis und bei den Kryptofondsflüssen.

Der Crypto Fear & Greed Index ist die ganze Woche über im Bereich "Greed" geblieben.

Die Streuung zwischen den Kryptoassets hat sich in letzter Zeit erhöht, wenn auch von einem niedrigen Niveau aus, was bedeutet, dass Kryptoassets immer noch hauptsächlich nach systematischen Faktoren gehandelt werden. Gleichzeitig entwickelten sich Altcoins auf 1-Monats- und 3-Monats-Basis ebenfalls schlechter als Bitcoin. Eine Outperformance von Altcoins ist in der Regel ein Zeichen für eine erhöhte Risikobereitschaft, und eine geringe Outperformance von Altcoins ist immer noch ein Hinweis auf eine eher vorsichtige Marktstimmung.

Krypto Asset Flows

In der vergangenen Woche kam es erneut zu einer deutlichen Umkehrung der Kryptoasset-Fondsströme.

Insgesamt verzeichneten wir Nettomittelzuflüsse in Höhe von +65,0 Mio. USD (bis Freitag), wobei der Löwenanteil der Zuflüsse erneut in Bitcoin-Fonds floss (+66,1 Mio. USD). Altcoin-Fonds ohne Ethereum konnten ebenfalls kleinere Zuflüsse verzeichnen (+1,2 Mio. USD), während sowohl Ethereum-Fonds als auch Basket & Thematic Cryptoasset-Fonds kleinere Nettoabflüsse verzeichneten (-0,7 Mio. USD bzw. -1,6 Mio. USD).

Im Gegensatz dazu ist es dem größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - gelungen, den Abschlag auf den Nettoinventarwert noch weiter zu verringern, was auf Nettozuflüsse in dieses Fondsvehikel schließen lässt.

Im Vergleich zur letzten Woche war das Beta der globalen Hedge-Fonds zu Bitcoin in den letzten 20 Handelstagen weiterhin negativ, was bedeutet, dass die globalen Hedge-Fonds immer noch eine Netto-Short-Position in Krypto-Assets haben.

Die auf Coinbase gehandelten Bitcoin-Preise gegenüber den auf Binance gehandelten (Coinbase-Binance-Prämie) sind zuletzt gestiegen, was auf ein erhöhtes Kaufinteresse von institutionellen Anlegern gegenüber Kleinanlegern angesichts der Marktverwerfungen hindeutet. Allerdings scheint sich der Aufschlag in letzter Zeit abgeschwächt zu haben.

On-Chain Tätigkeit

Die On-Chain-Daten haben eine weitere Woche mit starken Netzwerk-Fundamentaldaten verzeichnet.

So hat die Zahl der neuen Adressen auf der Bitcoin-Blockchain den höchsten Stand seit Mai 2021 erreicht und die Zahl der Transaktionen hat sogar den höchsten Stand seit Januar 2021 erreicht.

Das derzeitige Preisniveau scheint also immer noch gut durch die zugrunde liegende Netzaktivität gestützt zu sein.

Unter der Oberfläche deuten die Transaktionen mit realisiertem Cap auf der Bitcoin-Blockchain darauf hin, dass sich das Angebot an Coins verjüngt hat, was ein typisches Zeichen für einen Bullenmarkt ist, da neue Investoren in den Markt einsteigen. Zum Beispiel ist der realisierte Cap von Coins mit einer Haltedauer von 1-2 Jahren von 46,3% im November 2022 auf 33,1% im April 2023 gesunken. Gleichzeitig sind die Münzen mit einer Haltedauer von weniger als 6 Monaten von 22% im November 2022 auf 26,8% gestiegen. Mit anderen Worten: 1/4 des aktuellen Bitcoin-Angebots wurde in den letzten 6 Monaten erworben bzw. wechselte den Besitzer. In Bullenmärkten nimmt dieser Prozentsatz tendenziell zu.

Abgesehen davon waren die Börsenvolumina ziemlich verhalten und es gab keine größeren Börsenzuflüsse, die einen Verkaufsdruck auf diesen höheren Preisniveaus signalisieren könnten. Sowohl die Ethereum- als auch die Bitcoin-Börsensalden haben sich in den letzten zwei Wochen im Wesentlichen seitwärts bewegt.

Im Allgemeinen bleiben die kurzfristigen Bitcoin-Inhaber in der Gewinnzone, sowohl was die realisierten als auch die nicht realisierten Gewinne auf der Kette angeht. Dies sollte sich positiv auf den Markt auswirken, da kein signifikanter Verkaufsdruck von "schwachen Händen" zu erwarten ist, die normalerweise in Verluste verkaufen.

Krypto-Asset-Derivate

Auch die Metriken für Krypto-Derivate bleiben derzeit recht bullisch. Die implizite Volatilität von Bitcoin-Optionen hat sich aufgrund des Seitwärtsmarktes überwiegend nach unten entwickelt und ist erst kürzlich aufgrund des jüngsten Ausbruchs nach oben wieder angestiegen. Bitcoin-Optionshändler bleiben optimistisch, wie die positive 25-Delta-Schieflage von Calls gegenüber Puts zeigt.

Auch der 3-Monats-Basissatz der Bitcoin-Futures bleibt positiv. Somit sind sich die Bitcoin-Futures-Händler einig, dass die Preisaussichten für die nächsten 3 Monate positiv sind, da die Futures-Kurve weiterhin im Contango, d.h. aufwärts geneigt, verläuft. In diesem Zusammenhang gab es sowohl bei den Futures als auch bei den perpetual open interest einen signifikanten Anstieg auf den höchsten Stand seit Jahresbeginn in nominalen USD-Werten, wie aus unserer Chart-of-the-Week, was der Hauptgrund für den jüngsten Ausbruch von Bitcoin in Richtung 30k USD zu sein scheint.

In diesem Zusammenhang fällt auf, dass unsere hauseigene Messung der Positionierung von Futures und Perpetuals immer noch darauf hindeutet, dass Bitcoin-Futures- und Perpetual-Händler nach wie vor unterinvestiert sind, was auf weiteres Potenzial zur Erhöhung des Engagements schließen lässt.

Unterm Strich

Bitcoin ist gerade aus seiner Seitwärtsspanne der letzten Wochen ausgebrochen.

Unser hauseigener Krypto-Sentiment-Index ist die ganze Woche über neutral geblieben.

Das Engagement in Kryptowährungen über Bitcoin-Futures hat in letzter Zeit stark zugenommen.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.