Download the Full Report in PDF

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

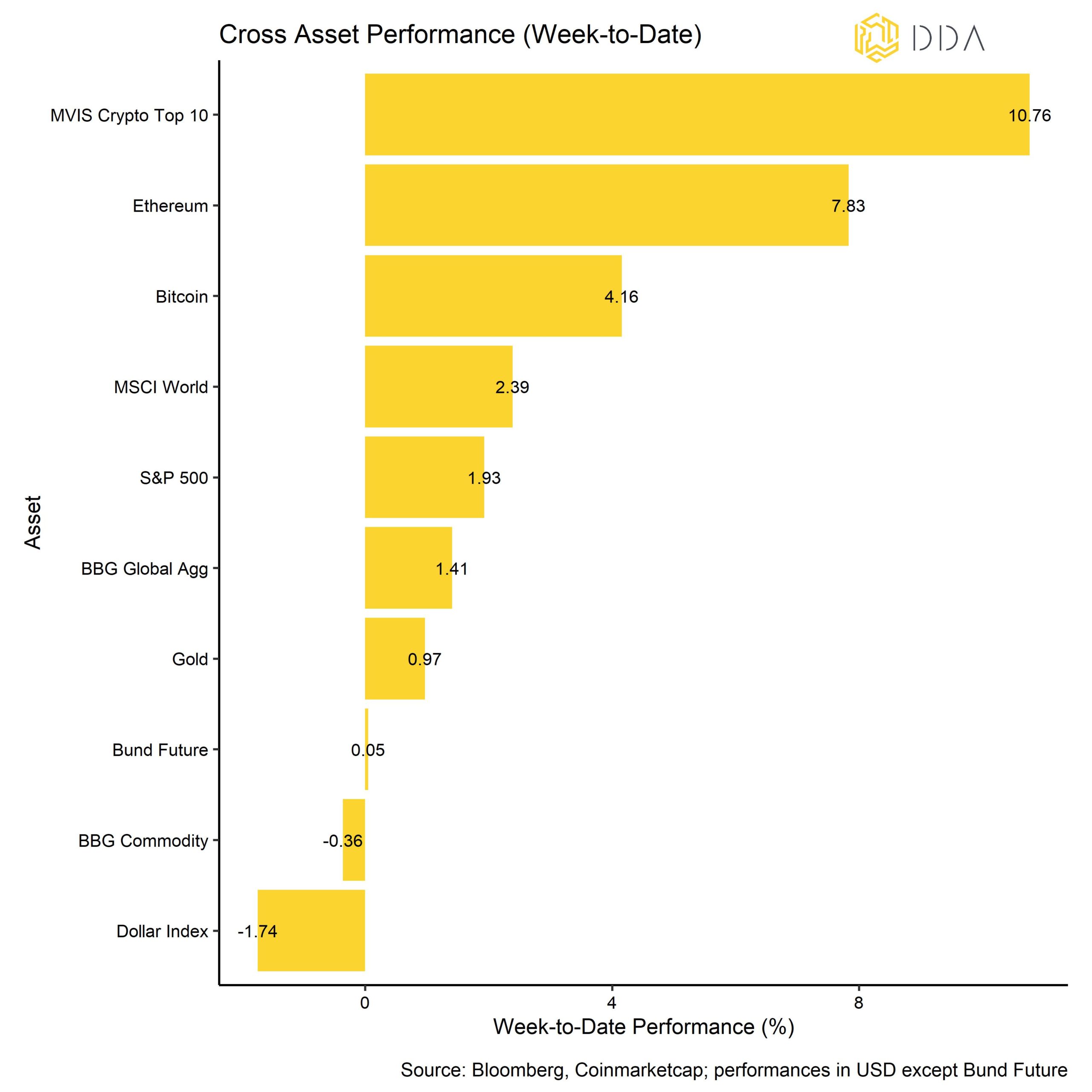

- Cryptoassets were the best asset class last week, outperforming global equities, bonds and commodities

- Our proprietary Crypto Sentiment Index has improved further as underlying sentiment was mainly supported by the planned distressed assets fund by Binance

- The market will probably focus on US employment data this week for hints of weakness in the US jobs markets that could lead the market to further price out a hawkish monetary policy by the Fed

Chart of the Week

Leistung

Leistung

Last week, cryptoasset prices managed to creep back up mostly being supported by the news that exchange behemoth Binance is aiming for a roughly 1bn USD fund for the potential purchase of distressed assets in the digital-asset sector and will make another bid for bankrupt lender Voyager Digital.

Although some other crypto lending platforms such as Nexo have recently come under scrutiny, the market appears to have adapted to this kind of news.

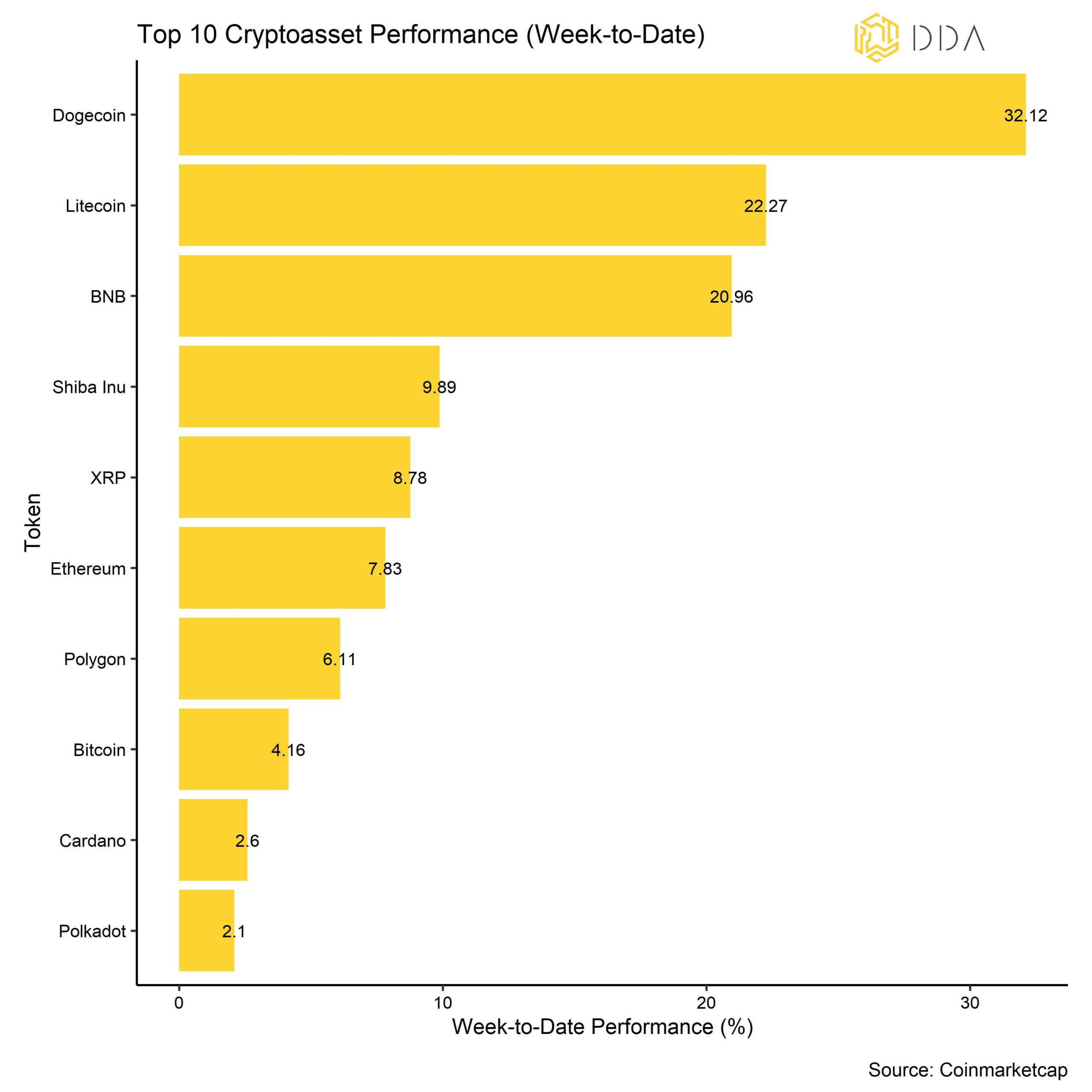

Accordingly, cryptoasset prices have mostly performed positively. Among the major cryptoassets, Dogecoin, Litecoin, BNB and Shiba Inu were the relative outperformers. Cryptoassets were also the best asset class last week, outperforming global equities, commodities and bonds. The dollar weakened last week.

This week, we have an array of important US jobs numbers coming up, with particular attention on Thursday, where the market will probably focus on the Job Cuts Announcements and Initial Claims data for hints of weakness in US employment. November already saw the biggest year-to-date increase in layoff announcements at big tech companies such as Amazon or Google both of which announced to cut around 10000 jobs each. Hints of weakness in US employment could lead the market to further pricing out a hawkish monetary policy by the Fed which most likely would be positive for both traditional financial markets and crypto markets.

Sentiment

Our proprietary Crypto Sentiment Index has improved further compared to last week. The major contributors were the increase in hedge fund beta to BTC as well as the outperformance in Altcoins which is usually indicative of an increase in risk appetite within cryptoassets. We also saw a significant moderation in risk aversion within the Bitcoin derivatives market and the Crypto Fear & Geed Index also increased from “Extreme Fear” to “Fear” territory.

Flows

Fund flows have moderated during the last week and we saw net outflows from global crypto ETPs in the amount of -23.6 mn USD after two weeks of inflows. All our categories of crypto ETPs experienced net outflows with Bitcoin ETPs being the most-affected (-11.7 mn USD) while basket & thematic crypto ETPs only experienced mild net outflows (-1.1 mn USD).

On a positive note, the Beta of global Hedge Funds to Bitcoin over the last 20 trading days continued to rise, implying that hedge funds might have further increased their exposure to cryptoassets during the month. In fact, their beta has increased to one of the highest readings ever recorded.

On-Chain

There was a suspicious on-chain transaction in the amount of ~10k BTC on the 24th of November which was one of the largest transactions of dormant coins ever. These Bitcoins have been dormant for more than 7 years. Transactions of previously dormant coins are usually bearish as they imply selling intentions of these coins after a long period of inactivity. On-chain analysts have attributed these coins to the Mt Gox exchange hack in 2014 that are currently being liquidated via smaller transactions. This could exert some downward pressure on the price in the short term. Apart from this, coins continued to flow out of exchanges on a net basis which implies ongoing accumulation, especially by the largest wallet cohorts.

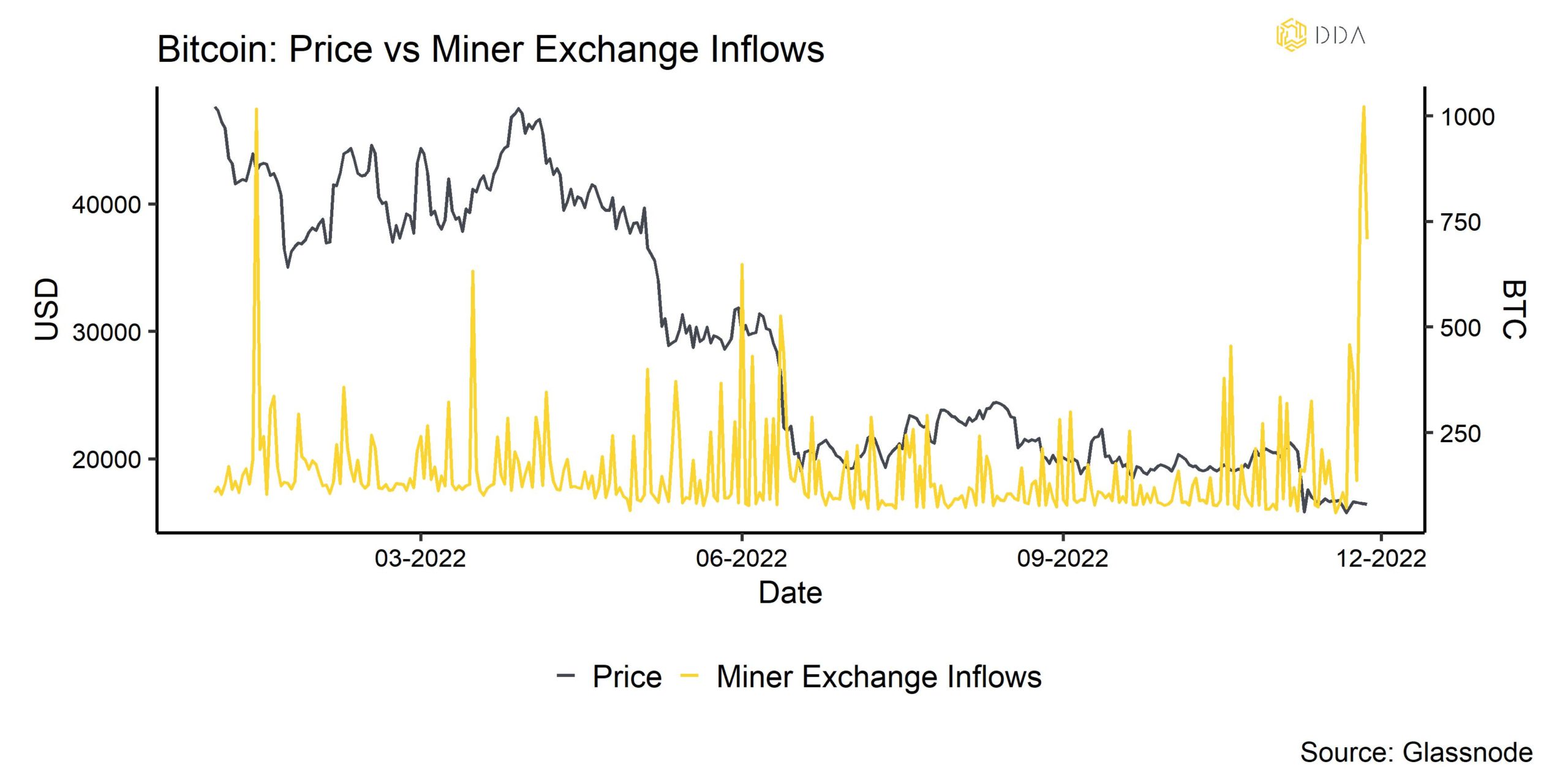

There were also some significant transfers of Bitcoin miners to exchanges (see Chart of the Week) which underline the risk that BTC miners are increasingly coming under pressure at these low prices and need to liquidate larger portions of their holdings to raise liquidity. Aggregate Bitcoin mining revenues have recently declined to the lowest levels in 2 years and the hash rate has started to decline again.

Derivatives

In general, we saw some significant moderation in risk aversion within the Bitcoin derivatives markets. This Is evident in the decrease in Bitcoin Implied volatilities and a normalization in the skew. The reduction in put-call volume ratios and open interest is also indicative of a gradual unwind of downside hedges and a reduction in risk aversion among derivatives traders.

However, the 3-month futures basis rate continues to be negative, implying that derivatives traders are still pessimistic about the near future.

Unterm Strich

Cryptoassets were the best asset class last week, outperforming global equities, bonds and commodities.

Our proprietary Crypto Sentiment Index has improved further as underlying sentiment was mainly supported by the planned distressed assets fund by Binance. Crypto ETP fund flows were negative while global hedge funds’ beta to Bitcoin increased significantly. Bitcoin saw some suspicious on-chain activity of dormant coins that could put some downward pressure on the price in the short term and miners have transferred a significant amount of coins to exchanges.

Besides, we saw some significant moderation in risk aversion within the Bitcoin derivatives markets.

The market will probably focus on US employment data this week for hints of weakness in the US jobs markets that could lead the market to further price out a hawkish monetary policy by the Fed.

Download the full report with appendix here.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Recent News and Articles

- Institutional Crypto Adoption: Why & How Institutions Are Going Crypto

- Crypto Portfolio Composition: How Different Portfolios Have Performed During the Recent Bull and Bear Markets

- How to Invest in Ethereum (ETH): A Guide for Professional Investors

- The Case for Actively Managed Investment Strategies in the Crypto Markets

- Wie man in NFTs investiert: Ein Leitfaden für professionelle Anleger

- Warum die Volatilität von Bitcoin Sie nicht erschrecken sollte

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

Deutsche Digital Assets in Press

- ETF-Stream: Zahl der White-Label-Emittenten in Europa innerhalb einer Woche verdreifacht

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.