Download the Full Report in PDF

by André Dragosch, Head of Research

Wichtigste Erkenntnisse

- Market is still dominated by ongoing contagion fears after the FTX insolvency

- Our proprietary Crypto Sentiment Index has improved marginally last week coming from very bearish levels the week prior

- Underlying crypto ETP flows and on-chain indicators suggest ongoing accumulation among institutional investors at these lower prices

Chart of the Week

Leistung

Leistung

Last week was still dominated by an ongoing fear of financial contagion within crypto markets due to a possible collapse of Genesis – a major cryptoasset lending desk which is highly-interconnected within the institutional crypto borrowing & lending business.

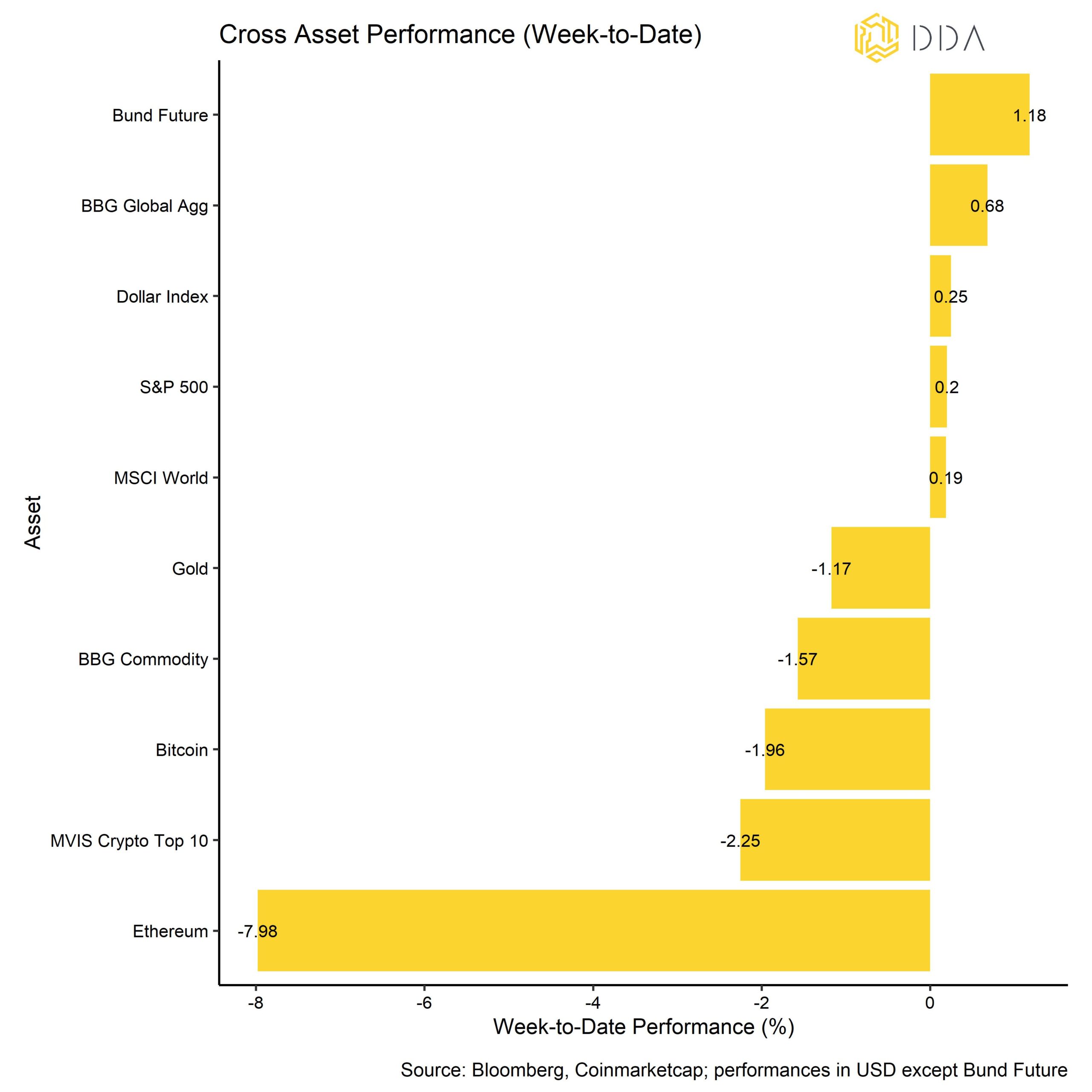

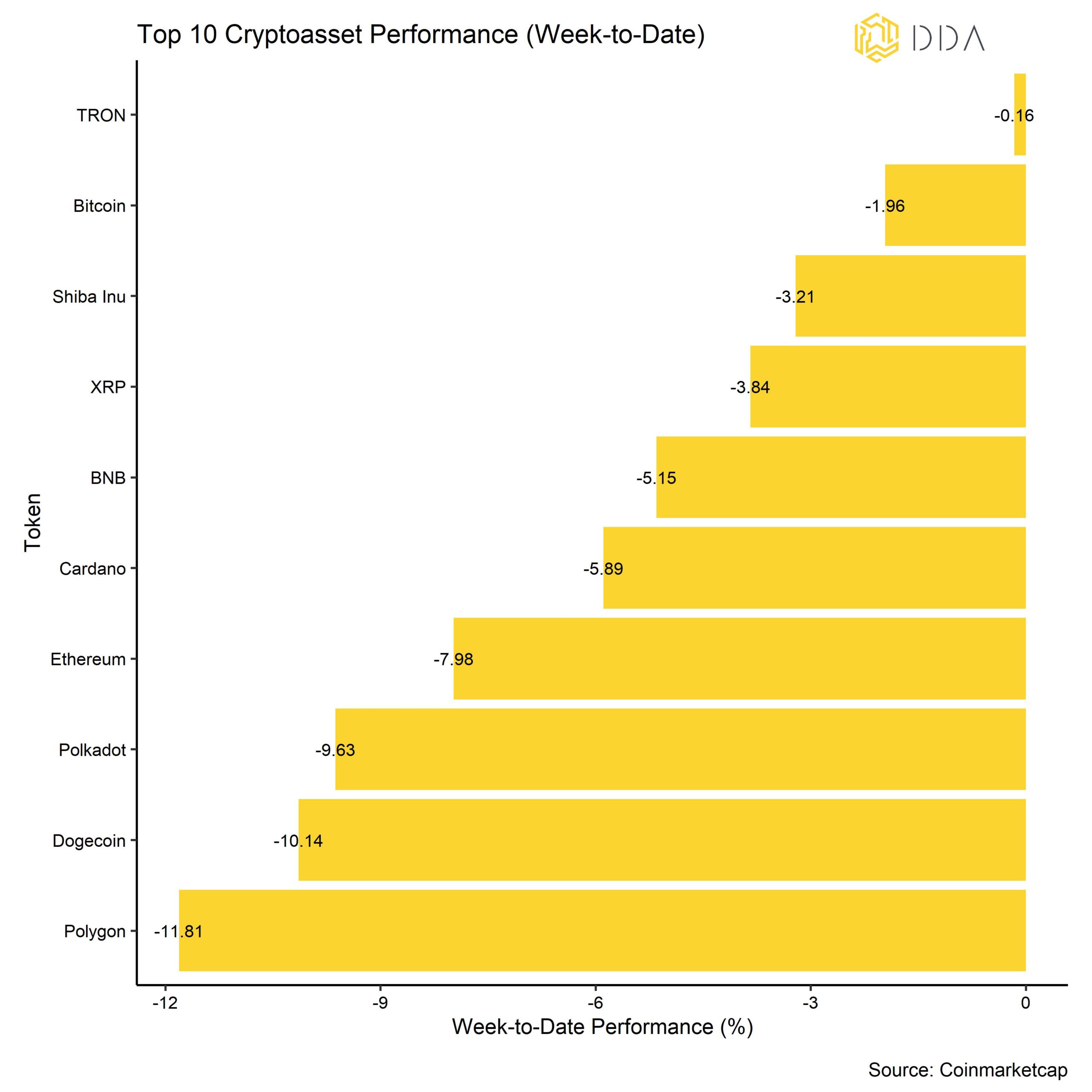

Accordingly, cryptoasset prices were still largely under pressure last week from the reverberation of the FTX fallout. Among the major cryptoassets, TRON, Bitcoin, Shiba Inu and XRP were the relative outperformers. Cryptoassets also underperformed global equities and bonds last week.

Sentiment

Our proprietary Crypto Sentiment Index has improved marginally last week coming from very bearish levels the week prior. Obviously, cross asset sentiment held up quite well and was rather unaffected by the recent developments in crypto markets. On a positive note, Altcoin outperformance has picked up recently – a sign of returning risk appetite within crypto markets. However, judging by the Crypto Fear & Greed Index, the market remains overall in an “extreme fear” mode.

Flows

Interestingly enough, crypto ETP fund flows continued to be positive (+4.7 mn USD net), although fund flows were smaller than during the week when FTX collapsed. Based on the crypto ETPs that we track on a daily basis, the bulk of money flew into BTC-based products (+14.3 mn USD) and Basket & Thematic Crypto products (+8.2 mn USD) while ETH-based products and other Altcoin-based products experienced net outflows last week (-7.8 mn USD and -10.0 mn USD, respectively).

On a similar note, global macro hedge funds might have increased their exposure to cryptoassets lately judging by the increase in their 1-month rolling Beta to Bitcoin.

The reversal in the deep NAV discount of the biggest Bitcoin fund in the world, Grayscale Bitcoin Trust, is emblematic for a return in buying interest in the last week, although there has been slight decrease in the discount in the last days.

On-Chain

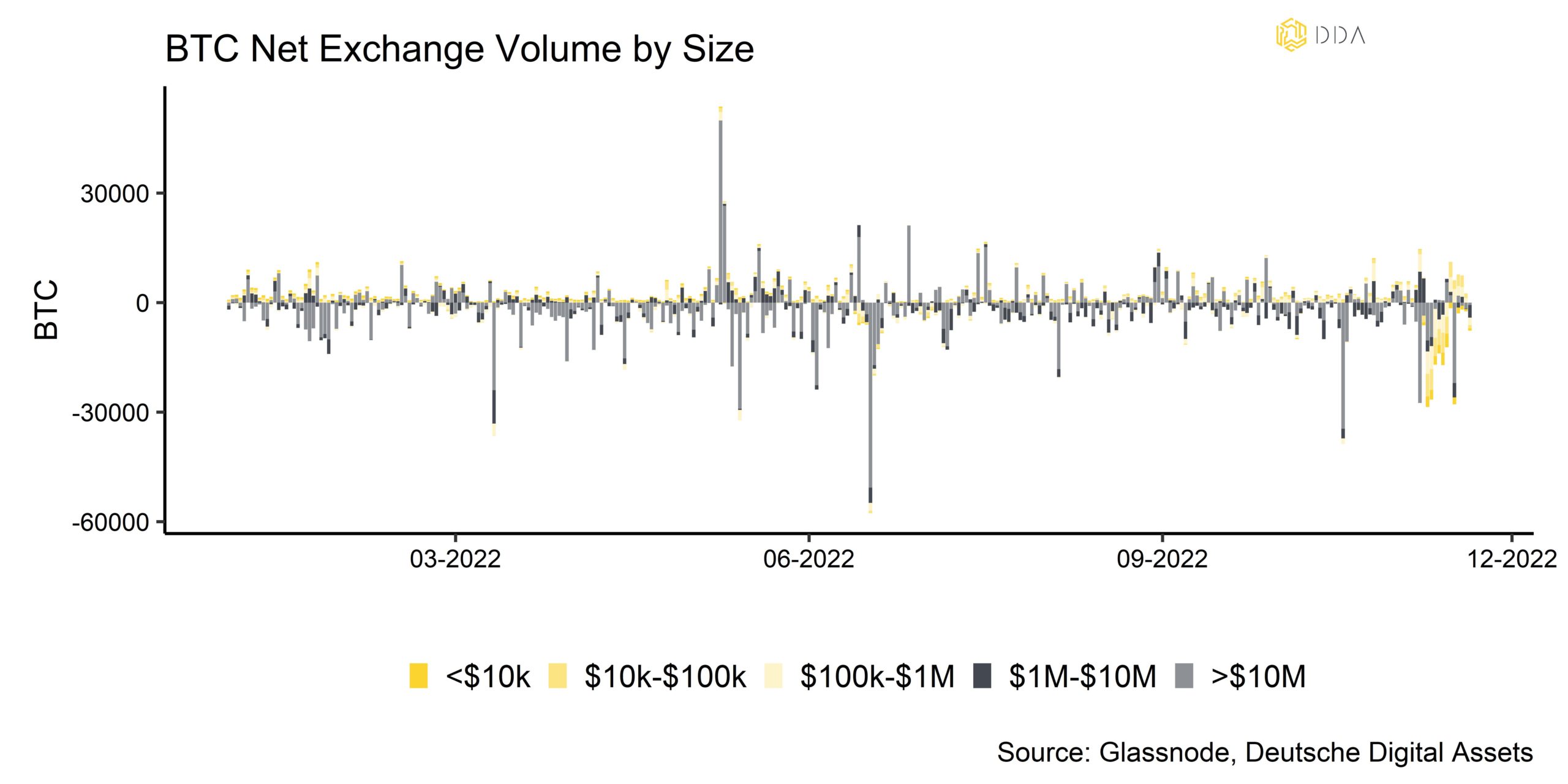

A major highlight among on-chain indicators was the fact that Bitcoins continued to flow out of exchanges on a net basis – usually a positive signal as it implies increased investments and subsequent transfers into cold-storage. What is more, is the fact that these net outflows occurred majorly into wallets of larger investors with wallet sizes of 10 mn USD or more. This is consistent with the abovementioned fact that crypto ETP fund flows also held up quite well during the last week. The smallest and biggest investor cohorts (below $10k USD and above $10mn USD) were among the biggest buyers based on these net exchange outflows. We have generally noticed a significant pick-up in small investor cohort buying interest after the FTX collapse which appears to have continued last week.

In this context, we have seen the lowest Bitcoin exchange balances since mid-2018 – a sign of continuing accumulation. The same can be said for Ethereum, were exchange balances also reached a fresh 4-year low.

Derivatives

The stabilization in cryptoasset prices has led to an overall decline in uncertainty within the derivatives space: Bitcoin implied volatilities have declined, and the option skew is less biased towards puts than during the week prior. Nonetheless, the level of uncertainty remains relatively high based on the absolute levels of implied volatility. However, perpetual funding rates and the futures basis rate have returned to positive levels – a sign that derivatives traders are slightly more optimistic about the price outlook. Nonetheless, the level of anxiety among derivatives traders remains high which can also be seen in the increased relative trading volume of Bitcoin put options vs call options which has recently picked up significantly. Investors are apparently still hedging against potential downside risks.

Bottom Line: Overall cryptoasset market sentiment has improved marginally last week coming from very bearish levels the week prior. Nonetheless, the level of uncertainty remains relatively high based on the signals from Bitcoin derivatives markets. On a positive note, money continued to flow into crypto ETP funds and out of exchanges into small and larger investor wallets on a net basis.

Download the full report with appendix here.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Recent News and Articles

- Institutional Crypto Adoption: Why & How Institutions Are Going Crypto

- Crypto Portfolio Composition: How Different Portfolios Have Performed During the Recent Bull and Bear Markets

- How to Invest in Ethereum (ETH): A Guide for Professional Investors

- The Case for Actively Managed Investment Strategies in the Crypto Markets

- Wie man in NFTs investiert: Ein Leitfaden für professionelle Anleger

- Warum die Volatilität von Bitcoin Sie nicht erschrecken sollte

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

Deutsche Digital Assets in Press

- ETF-Stream: Zahl der White-Label-Emittenten in Europa innerhalb einer Woche verdreifacht

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin,Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld,Krypto-Manager steigt bei Family Office ein

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.