Krypto-Assets: Es gibt keine zweitbeste Lösung? Die Vor- und Nachteile der Portfoliodiversifizierung

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Aus rein statistischer Sicht sind die meisten Altcoins Derivate von Bitcoin (BTC) mit hohem Beta und negativem Theta. Es gibt nur wenige Altcoins unter den Top 10, die eine systematische Outperformance (Alpha) aufweisen, die nicht durch ein relativ höheres Marktrisiko (Beta) erklärt werden kann

- Ausnahmen sind Binance Coin (BNB), Solana (SOL), Polygon (MATIC) und TRON (TRX), die ein positives Theta im Vergleich zu Bitcoin (BTC) aufweisen

- Altcoins haben einen Platz in einem diversifizierten Portfolio von Kryptoassets, aber Bitcoin (BTC) sollte ein Kernbestand des passiven Portfolios selbst sein - dies spiegelt sich unter anderem auch in der Konstruktion unseres DDA Crypto Select 10 ETP (SLCT)

Es gibt keine zweitbeste Lösung?

Bitcoin-Maximalisten, d. h. diejenigen, die dafür plädieren, nur in Bitcoin zu investieren, verweisen auf die Tatsache, dass Bitcoin (BTC) seit seiner Einführung im Jahr 2009 stets der nach Marktkapitalisierung dominierende Vermögenswert war. Dies bedeutet, dass Bitcoin in den letzten 14 Jahren durchweg besser abgeschnitten hat als andere Krypto-Assets.

Tatsächlich gibt es nur sehr wenige Kryptoassets, die es geschafft haben, Bitcoin im Laufe verschiedener Marktzyklen zu übertreffen: Bislang haben es nur Ripple (XRP), Dogecoin (DOGE) und Ethereum (ETH) geschafft, Bitcoin (BTC) über zwei Marktzyklen hinweg zu übertreffen, d. h. zwei neue relative Höchststände (in Bitcoin) zu erreichen.

Eine wichtige Frage für Kryptoasset-Investoren bleibt jedoch, ob eine Diversifikation in "Altcoins", also alles, was nicht Bitcoin ist, aus rein statistischer Sicht und unter Performance-Gesichtspunkten noch sinnvoll ist?

In den folgenden Abschnitten werden wir die jeweiligen Vor- und Nachteile der Diversifizierung darlegen und aufzeigen, wie die optimale passive Portfolioallokation für Anleger aussehen könnte.

Das Alpha, Beta und Theta der Altcoins

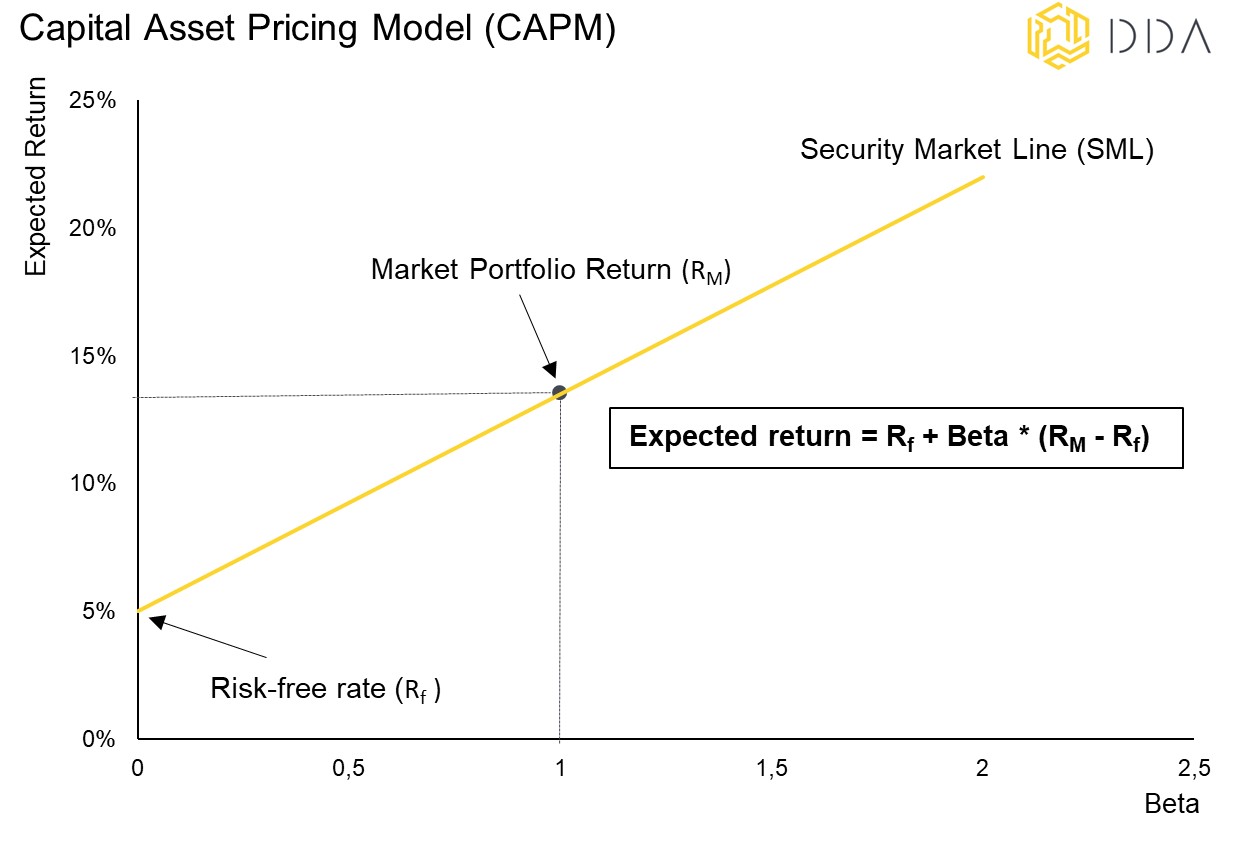

Das traditionelle Capital Asset Pricing Model (CAPM), das erstmals von Nobelpreisträger William Sharpe und anderen in den 1960er Jahren vorgeschlagen wurde, geht davon aus, dass es kein kostenloses Mittagessen gibt und dass eine enge Beziehung zwischen (nicht-diversifizierbarem) Risiko und Ertrag besteht:

Höhere Renditen sind in der Regel mit höheren Marktrisiken verbunden (Beta > 1) und umgekehrt.

William Sharpe und andere entwickelten die Idee, dass Überrenditen darauf zurückzuführen sein könnten, dass der Anleger im Vergleich zu einer Marktbenchmark, die ein nicht diversifizierbares Risiko darstellt, ein Übermaß an Risiko eingeht.

Dies ist allgemein als "Beta" bekannt, das die relative Empfindlichkeit eines Vermögenswerts im Vergleich zu einem für die Anlageklasse repräsentativen Referenzwert beschreibt.

Es gibt jedoch Ausnahmen. Einige einzelne Vermögenswerte können eine Überrendite gegenüber der Benchmark aufweisen, die nicht mit einem relativ höheren Marktrisiko (Beta) verbunden ist, was allgemein als "Alpha" bezeichnet wird.

Professionelle Anleger sind seither auf der Suche nach systematischem Alpha, d. h. einer beständigen Outperformance gegenüber dem Referenzwert, die nicht mit relativ höheren Risiken verbunden ist.

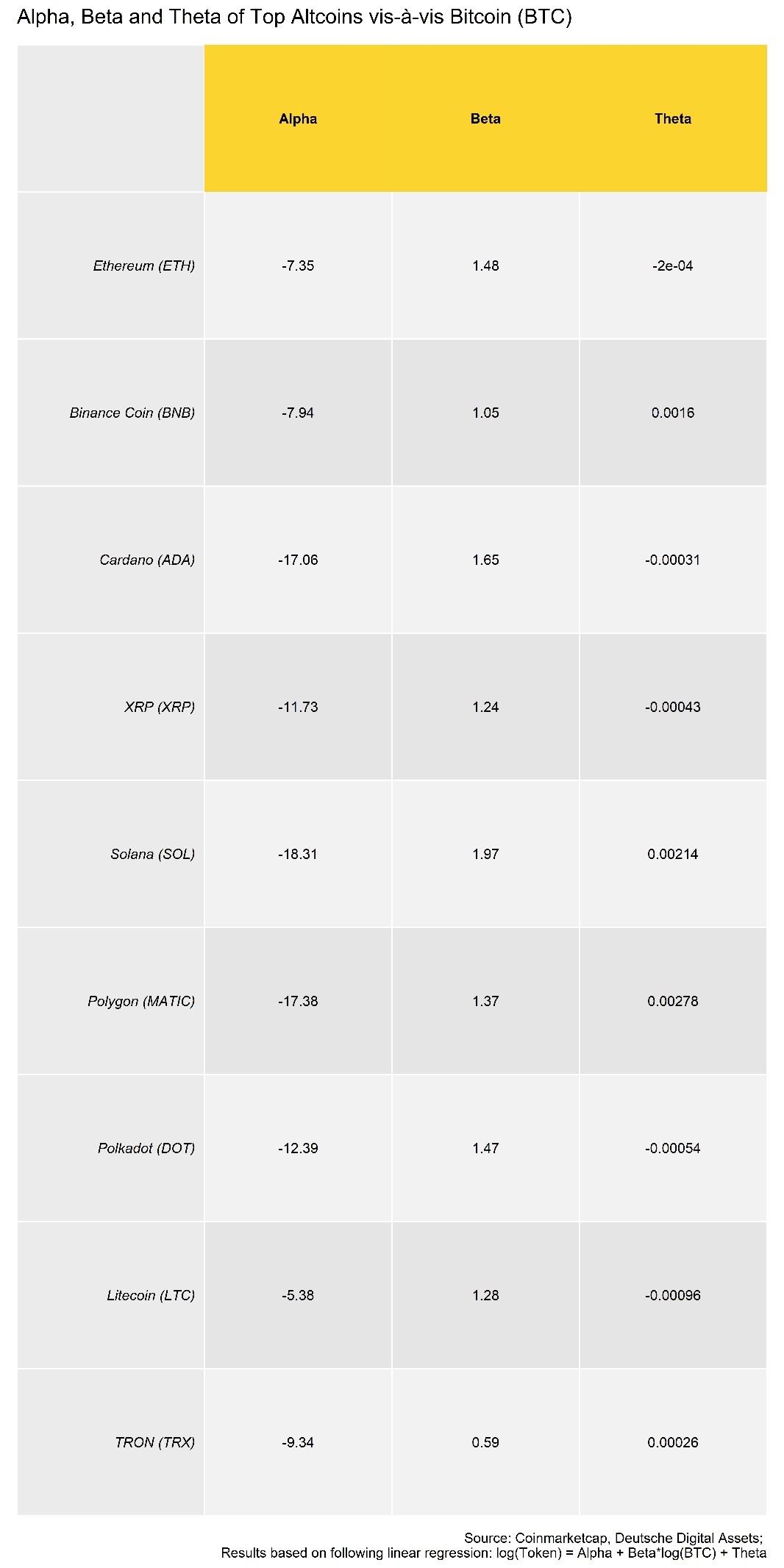

Um mehr Licht in diese Angelegenheit zu bringen, haben wir uns die wichtigsten Large-Cap-Kryptoassets unter den Top 10 nach Marktkapitalisierung angesehen und ihr jeweiliges Alpha, Beta und Theta in Bezug auf Bitcoin betrachtet.

Wir haben die folgende lineare Regression geschätzt:

Log(Token) = Alpha + Beta * log(BTC) + Theta

Mit Alpha ist die Regressionskonstante, Beta die Empfindlichkeit des Tokens im Verhältnis zu BTC und Theta ein zeitlicher Trend, gemessen in Tagen seit Beginn des Stichprobenzeitraums, ist.

Die Regressionen basieren auf Ordinary-Least-Squares (OLS) und wurden auf der Grundlage täglicher Preise durchgeführt, die die längste verfügbare Zeitreihe von Coinmarketcap verwenden. Alle geschätzten Koeffizienten sind hoch signifikant.

Die folgende Tabelle zeigt das Ergebnis dieser Regressionen:

Wie aus der oben genannten Tabelle hervorgeht, weist keiner der Altcoins eine Outperformance (positives Alpha) gegenüber Bitcoin (BTC) auf, die über ihre relativ höhere Volatilität (Beta > 1,0) gegenüber Bitcoin hinausgeht. Die Mehrheit der Altcoins weist auch ein historisches Beta auf, das größer als 1 ist, mit Ausnahme von TRON (TRX). Ein Beta-Koeffizient von mehr als 1 bedeutet, dass der Token im Vergleich zu Bitcoin um den Beta-Faktor ansteigt/abfällt. Weist der Token beispielsweise ein Beta von 1,5 auf, war ein Anstieg von Bitcoin um 1% in der Vergangenheit mit einem Anstieg des Tokens um 1,5% verbunden.

Außerdem ist der Betrag der Outperformance (Alpha), der von der relativen Volatilität (Beta) und dem Zeittrend (Theta) abhängt, immer negativ.

Die einzigen Ausnahmen sind Binance Coin (BNB), Solana (SOL), Polygon (MATIC) und TRON (TRX), die ein positives Theta im Vergleich zu Bitcoin (BTC) aufweisen.

Das bedeutet, dass es abgesehen von ihrem höheren Risiko aus rein statistischer Sicht eine positive Option ist, diese Token längerfristig zu halten.

Bei den anderen Token bedeuten ein negatives Theta und ein Beta von über 1,0, dass diese Token in einem Bullenmarkt eine bessere Wertentwicklung als Bitcoin (BTC) aufweisen, dass aber die Preise gegenüber Bitcoin längerfristig strukturell fallen.

Aus rein statistischer Sicht gibt es also eine negative Optionalität, die mit dem Besitz dieser Token auf lange Sicht verbunden ist.

Bitte beachten Sie jedoch, dass sich diese historischen Ergebnisse in Zukunft ändern können.

Altcoins: Eine kalte Dusche?

Wenn es um die strategische/passive Portfoliokonstruktion geht, sind professionelle Anleger vor allem an zwei Aspekten interessiert:

Der Grad der Outperformance durch Nicht-Kernbeteiligungen (in unserem Fall Altcoins gegenüber Bitcoin) und die Grad der Diversifizierung durch diese Nicht-Kernbeteiligungen (relative Korrelation gegenüber Bitcoin).

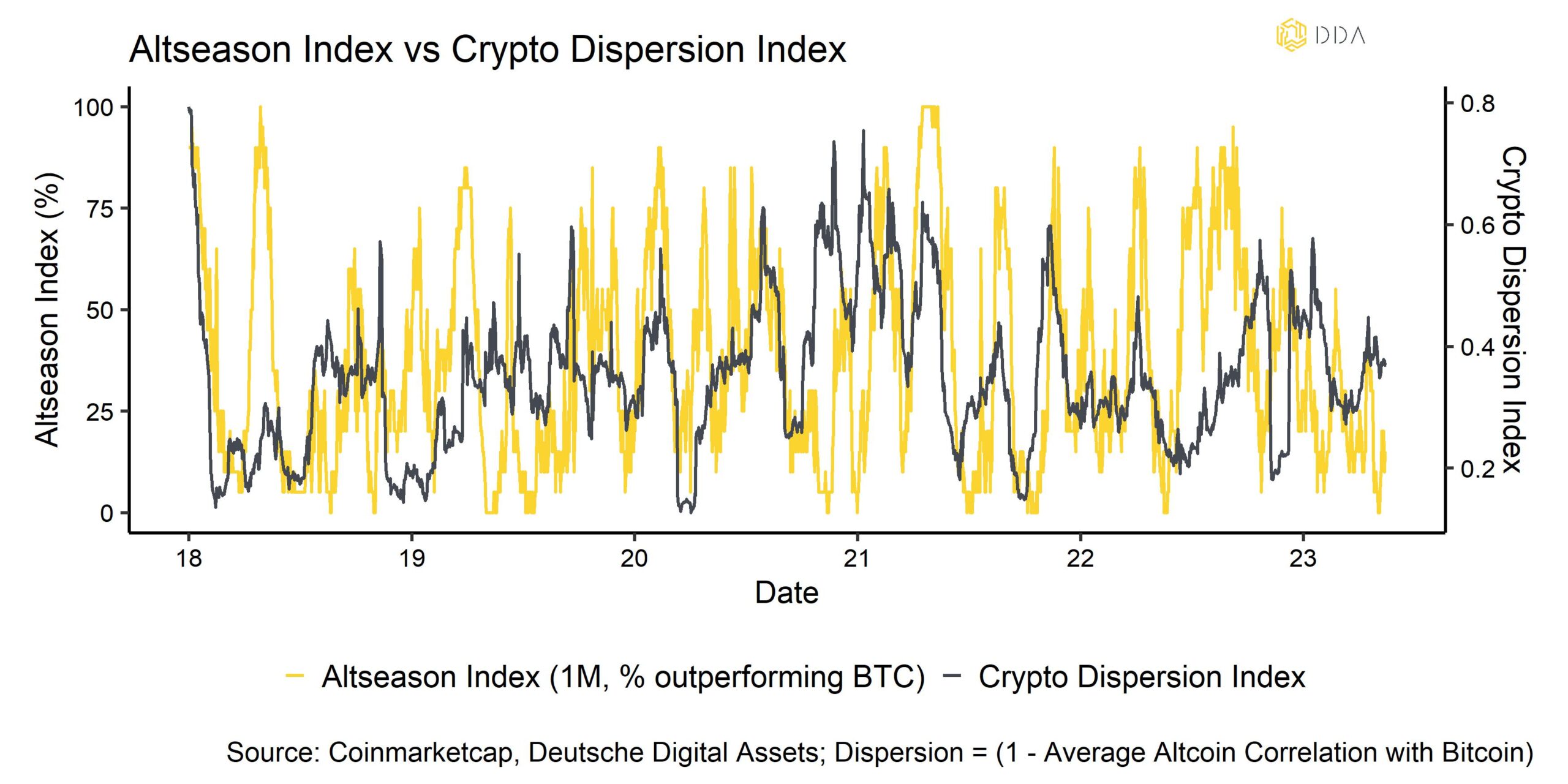

Im Allgemeinen neigen Altcoins dazu, Bitcoin (BTC) in Hausse-Märkten zu übertreffen, wenn die Leistungsstreuung zwischen ihnen zunimmt bzw. die Korrelationen abnehmen und sie eher auf Token-spezifischen Faktoren als auf systematischen Faktoren handeln.

Im Gegensatz dazu nimmt die Streuung unter den Altcoins in Bärenmärkten in der Regel ab, was mit einer Underperformance gegenüber Bitcoin (BTC) einhergeht, wenn die Altcoins meist in dieselbe Richtung wie Bitcoin handeln.

Dies wird auch in der folgenden Grafik deutlich, die eine positive Beziehung zwischen dem Prozentsatz der Altcoins, die Bitcoin auf 1-Monats-Basis übertreffen („Altseason-Index“), und der durchschnittlichen Streuung unter den Altcoins („Crypto Dispersion Index“) zeigt:

- Normalerweise gibt es eine hohe Altcoin-Outperformance und eine hohe Krypto-Streuung während Bullenmärkten (d.h. steigender BTC-Preis) und vice versa.

Mit anderen Worten: In Baissezeiten, wenn die Streuung zwischen den Krypto-Assets tendenziell abnimmt (die Korrelation nimmt zu) und die Outperformance von Altcoins gegenüber Bitcoin in der Regel gering ist, sind die Vorteile einer Diversifizierung in Altcoins ebenfalls geringer.

In Hausse-Märkten können andere Altcoins jedoch aufgrund ihres höheren Beta eine bessere Performance als Bitcoin (BTC) erzielen. Daher sollten professionelle Anleger die meisten Altcoins wie eine kalte Dusche behandeln: In Bullenmärkten einsteigen, in Bärenmärkten aussteigen.

Alles in allem deuten die Ergebnisse darauf hin, dass einige Altcoins durchaus einen Platz in einem diversifizierten Portfolio von Kryptoassets haben, dass aber Bitcoin (BTC) ein Kernbestandteil des passiven Portfolios selbst sein sollte.

Diese Überlegung spiegelt sich unter anderem auch in unserer DDA Crypto Select 10 ETP (ISIN: DE000A3G3ZD0, WKN: A3G3ZD, Ticker: SLCT) die wir kürzlich eingeführt haben. Mehr Informationen finden Sie unter hier.

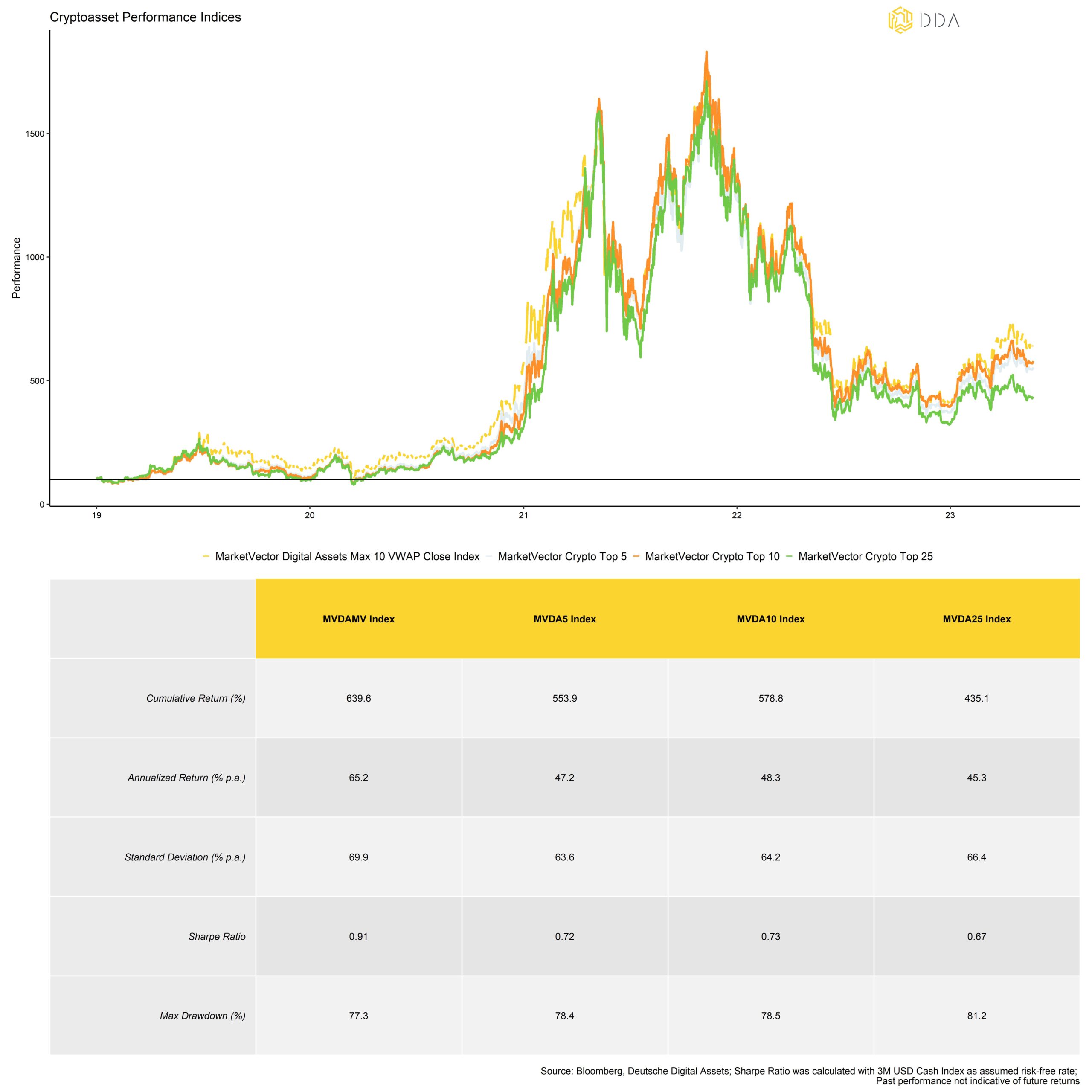

Während andere Basket-ETP-Konzepte ein gekapptes Gewichtungsschema verwenden, das zu einer relativ geringen Gewichtung von Bitcoin (BTC) führt, verwendet SLCT - das dem MarketVector Digital Assets Max 10 VWAP Close Index folgt - ein ungekapptes Gewichtungsschema. Diese Entscheidung wurde bewusst getroffen, um den Anlegern die meisten statistischen Vorteile zu bieten Ein Performancevergleich der dem ETP zugrunde liegenden Indexbenchmark (MarketVector Digital Assets Max 10 VWAP Close Index, MVDAMV) zeigt, dass er die höchste (historische) kumulative Rendite, die höchste risikobereinigte Rendite (Sharpe Ratio) und den geringsten maximalen Drawdown im Vergleich zu anderen Capped-Benchmarks aufweist, die die wichtigsten Large-Cap-Krypto-Assets abbilden:

Unterm Strich:

Rein statistisch gesehen sind die meisten Altcoins Derivate mit hohem Beta und negativem Theta von Bitcoin (BTC). Es gibt nur wenige Altcoins unter den Top 10, die eine systematische Outperformance aufweisen, die nicht durch ein relativ höheres Marktrisiko (Beta) zu erklären ist.

Ausnahmen sind Binance Coin (BNB), Solana (SOL), Polygon (MATIC) und TRON (TRX), die ein positives Theta im Vergleich zu Bitcoin (BTC) aufweisen.

Altcoins haben durchaus einen Platz in einem diversifizierten Portfolio von Kryptoassets, aber Bitcoin (BTC) sollte ein Kernbestand des passiven Portfolios selbst sein - dies spiegelt sich unter anderem auch in der Konstruktion unseres DDA Crypto Select 10 ETP (SLCT) wider.

Registrieren Sie sich für den DDA-Newsletter hier und erhalten Sie unsere neuesten Forschungsberichte, wöchentliche Marktanalysen und die neuesten Erkenntnisse über Makro-, Industrie- und Kryptomarkttrends von unseren Top-Experten direkt in Ihren Posteingang.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.