Bleiben Sie auf dem Laufenden mit unserer monatlichen Kryptoübersicht:

- Die Kryptomärkte fielen im Mai weiter, angeheizt durch den Zusammenbruch des algorithmischen Stablecoins UST von Terra und seines Schwester-Tokens LUNA.

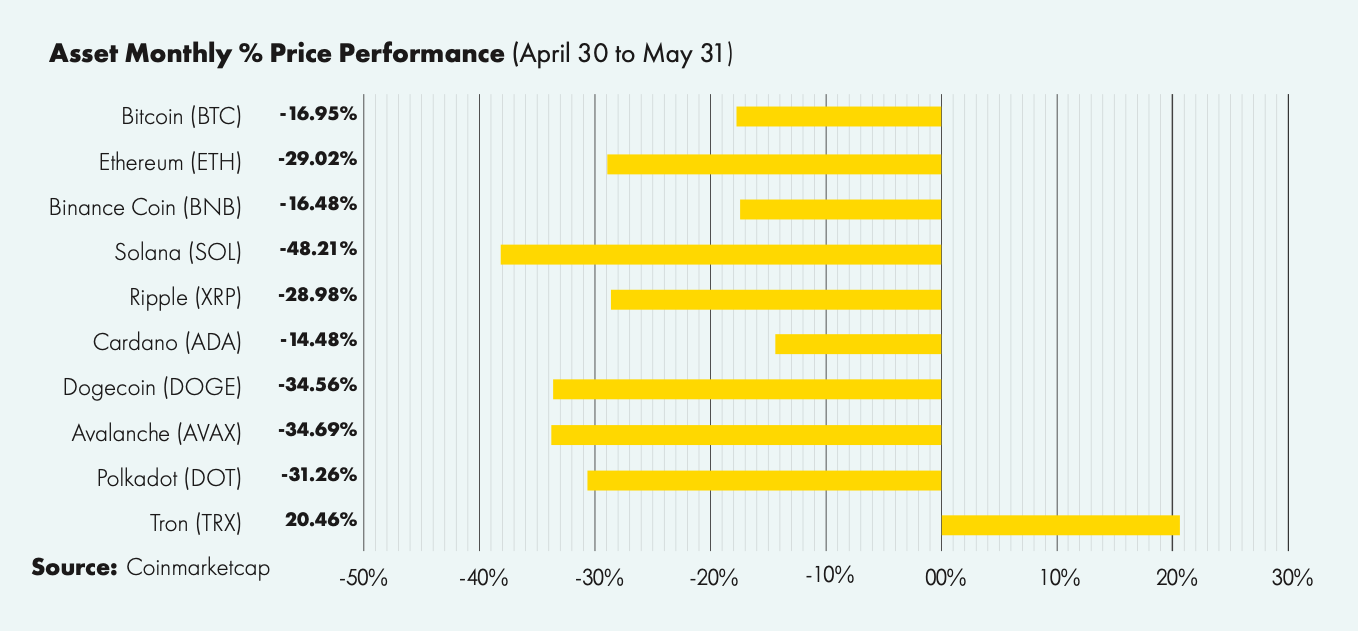

- Bitcoin und Ether sind um -16,95% bzw. -29,02% gefallen.

- Der beste Outperformer unter den führenden Kryptoanlagen war Tron (TRX).

Krypto-Markt Überblick Mai

Nach einem rückläufigen April bewegten sich die Kryptomärkte nach dem Depegging und der anschließenden Zusammenbruch der algorithmischen stabilen Münze, TerraUSD (UST).

Der Untergang von UST führte auch zu einem Verlust von 99%+ für die Inhaber des Stablecoin-Schwester-Tokens Luna (LUNA), der im Preisstabilisierungsmechanismus des algorithmischen Stablecoins verwendet wurde. $60 Milliarden an Marktwert wurden vernichtet, was zu einem erheblichen Ausverkauf auf den Kryptomärkten führte.

Bitcoin (BTC) fiel um 16,95%, während Ether (ETH) 29,02% an Wert gegenüber dem letzten Monatsschluss verlor. Die übrigen Top-Kryptowährungen nach Marktkapitalisierung folgten ihrem Beispiel und verloren zwischen 15% und 35%, wobei Solana (SOL) fast die Hälfte seines Wertes (-48,21%) gegenüber dem Vormonat verlor.

Der Zusammenbruch von TerraUSD veranlasste auch die Gesetzgeber, sich näher mit Stablecoins zu befassen und zu überlegen, welche Rolle sie künftig im globalen Finanzsystem spielen könnten. US-Finanzministerin Janet Yellen forderte Kongress, um einen regulatorischen Rahmen für Stablecoins zu schaffen, während das britische Finanzministerium vorgeschlagen Stablecoin-Regelungen, die der Bank of England mehr Aufsicht über gescheiterte Stablecoin-Emittenten geben würden.

Krypto-Performance-Übersicht Mai

Angestachelt durch die Terra-Saga verloren Bitcoin 16,95% und Ether 29,02% an Wert, während der Markt seinen Abwärtstrend auf breiter Front fortsetzte.

Führende Layer-1-Blockchain-Token verbuchten Verluste zwischen 15% und 55%, wobei Avalance (AVAX) in den letzten 30 Tagen mehr als die Hälfte seines Wertes (54%) verlor.

Der Outperformer in diesem Monat und die einzige führende Kryptowährung, die an Wert gewann, war Tron (TRX). TRX stieg im Mai um 20,46%, nachdem er nach der Ankündigung eines neuen, von Tron betriebenen algorithmischen Stablecoins namens USDD, der TRX in seinen Preisstabilisierungsmechanismus einbeziehen wird, einen Schub erhielt.

USDD sieht zwar dem inzwischen de facto nicht mehr existierenden UST-Stablecoin sehr ähnlich, aber das Team hinter USDD plant, die Lehren aus dem Zusammenbruch von TerraUSD zu ziehen, um sicherzustellen, dass seinem Stablecoin nicht dasselbe passiert.

Am Aktienmarkt sieht es derzeit nicht viel besser aus als an den Kryptomärkten, da zahlreiche Tech-Unternehmen 70% an Wert im Vergleich zu ihren IPO-Notierungspreisen verlieren. Nachdem die US-Lagerbestände in den ersten drei Maiwochen um mehrere Prozentpunkte gefallen waren, erholten sie sich jedoch gegen Ende des Monats und schlossen im Wesentlichen unverändert gegenüber April.

US-Staatsanleihen, gemessen am S&P U.S. Government Bond Index, legten um 0,76%w zu, während der Goldpreis in den letzten 30 Tagen um 2,47% fiel.

Institutionelles Interesse an Kryptowährungen

Die Schweizer Vermögensverwaltungsgesellschaft Julius Bär hat angekündigt, dass sie beginnen, Krypto- und DeFi-Engagement anzubieten an seine vermögenden Privatkunden. CEO Philipp Rickenbacher erklärte im jüngsten Strategie- und Finanzupdate des Unternehmens, dass: "[Krypto-Assets] werden den Finanzsektor in den nächsten zehn Jahren verändern, und es ist wichtig für uns, in diesem Bereich ein starkes Standbein zu haben. Deshalb ist es genau der richtige Zeitpunkt, um in das langfristige Potenzial der Digital-Asset-Technologie zu investieren."

Fidelity Digital Assets plant eine Verdoppelung der Mitarbeiterzahl, was ein klares Zeichen für das Engagement des Vermögensverwaltungsunternehmens im Bereich der Kryptowährungen ist. Das Unternehmen Berichten zufolge plant die Einstellung von 110 technischen Blockchain-Experten und 100 Kundendienstspezialisten. Seit dem Start konnte die Digital-Asset-Abteilung von Fidelity über 400 Kunden, darunter Hedgefonds und Vermögensverwalter, an Bord holen.

Bitcoin in den Bilanzen

Die "Bitcoin-Nation" El Salvador hat durch den Kauf von 500 BTC weitere $15,5 Millionen Bitcoin in ihre Staatskasse gespült. Laut ein Tweet von Präsident Nayib Bukele erwarb das mittelamerikanische Land die Münzen zu einem Durchschnittspreis von $30.744.

Das in New York ansässige Unternehmen für digitale Medien, Townsquare Media, erklärte in eine SEC-Anmeldung Es hat Bitcoin im Wert von $5 Millionen für seine Bilanz in Q1/2022 gekauft. Das börsennotierte Unternehmen sagte, dass es "an das langfristige Potenzial von digitalen Vermögenswerten als Investition glaubt".

Laut einer jüngste SEC-AnmeldungDie aufstrebende Streaming-Plattform Angel Studios hat Bitcoin im Wert von $10,6 Millionen gekauft. Das Unternehmen hat Bitcoin gekauft, "um die Renditen der liquiden Mittel, die nicht zur Aufrechterhaltung einer angemessenen operativen Liquidität erforderlich sind, weiter zu diversifizieren".

Über DDA Ikonische Fonds

Iconic Funds ist die Brücke zum passiven und aktiv verwalteten Engagement in Kryptowährungen. Iconic Funds bietet über seine Tochtergesellschaften Krypto-Asset-ETPs, diversifizierte Indexfonds und Alpha-Strategien für Anleger an.

Unsere Aufgabe ist es, die Akzeptanz von Krypto-Assets zu fördern. Als Brücke für Anleger, die in Krypto-Assets investieren wollen, bieten die lizenzierten und regulierten Vehikel von Iconic den Anlegern eine Auswahl an Investitionsmöglichkeiten, die von passiven Indexinvestitionen bis hin zu aktiv verwalteten Strategien reichen. Iconic Funds beseitigt die technischen Risiken von Krypto-Investitionen, indem es Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten bietet.

Durch die Verbindung von modernster Technologie, innovativen Anlageprodukten und kompromissloser Professionalität steht Iconic an der Spitze der Krypto-Vermögensverwaltung.

Neueste Nachrichten

- Warum die Volatilität von Bitcoin Sie nicht erschrecken sollte

- Wie Green Mining zur Norm für das Bitcoin-Netzwerk wird

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

- Wie Layer-2-Lösungen Ethereum bei der Skalierung helfen

- Bitcoin-Bildung ebnet den Weg für die Hyperbitcoinisierung

Iconic in der Presse

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds erweitert seine Produktpalette mit einem physischen Ethereum-ETP

Aktuelle Forschungsberichte

- Wie haben sich die Portfolios während der Pandemie entwickelt? ➡ Hier herunterladen

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

- Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen nur zu Informationszwecken.

Die Iconic Holding GmbH, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung.

Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen naturgemäß erheblichen Risiken und Unsicherheiten, die außerhalb der Kontrolle der Iconic Holding GmbH liegen.

Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" ohne jegliche Garantie präsentiert.