Bleiben Sie auf dem Laufenden mit unserer monatlichen Kryptoübersicht:

- Die Kryptomärkte hatten im Juni weiter zu kämpfen, angeheizt durch Probleme bei großen, zentralisierten Kryptoanbietern.

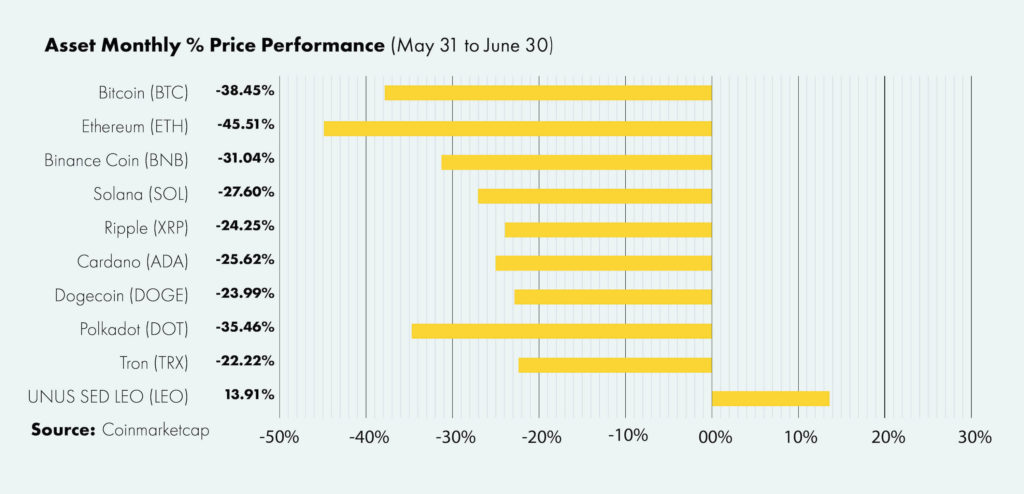

- Bitcoin und Ether sind um -38,45% bzw. -45,51% gefallen.

- Der Top-Performer unter den führenden Krypto-Assets im Juni war der Exchange-Token LEO von Bitfinex.

Krypto-Markt Überblick Juni 2022

Der Markt für Krypto-Assets setzte seinen Abwärtstrend im Juni fort, angetrieben durch Insolvenzsorgen bei einigen der führenden Kreditgeber für digitale Assets.

Am 13. Juni hat Celsius Network, eines der größten zentralisierten Krypto-Lending-Unternehmen, angekündigt dass es die Abhebungen gestoppt hat, so dass seine Kunden nicht mehr auf die Gelder zugreifen können, die sie bei dem Kreditgeber eingezahlt haben. Sofort machten Gerüchte die Runde, dass das Unternehmen kurz vor der Insolvenz stehe, was die Kryptomärkte nach unten drückte.

Darüber hinaus kamen Befürchtungen auf, dass andere Krypto-Kreditgeber mit ähnlichen Schwierigkeiten konfrontiert sein könnten, die bestätigt wurden, als die in Hongkong ansässige Babel Finance hat Abhebungen gestoppt vier Tage später mit der Begründung "ungewöhnlicher Liquiditätsdruck".

Die Liquiditätsprobleme auf dem Krypto-Kreditmarkt haben Krypto-Investoren dazu veranlasst, den Verkaufsknopf zu drücken, was zu einem Rückgang der Vermögenswerte auf dem gesamten Markt um 30% bis 40% geführt hat, wobei Bitcoin zum ersten Mal seit Ende 2020 unter die Marke von $20.000 gefallen ist.

Der Rückgang von Bitcoin wurde noch verstärkt durch eine weitere Ablehnung eines börsengehandelten Bitcoin-Spotfonds durch die US-Börsenaufsichtsbehörde Securities and Exchange Commission. Der abgelehnte Bitcoin-ETF wurde von Grayscale Investments eingereicht, die auf die Ablehnung mit der Einreichung einer Klage gegen die SEC reagierten.

Krypto Asset Performance Übersicht

Der Juni war ein weiterer schwieriger Monat für Krypto-Investoren, da die Märkte durch die sich entwickelnden Liquiditätsprobleme auf den Krypto-Kreditmärkten erschüttert wurden. Infolgedessen setzte sich der Abwärtsdruck auf Kryptoanlagen fort, was dazu führte, dass führende Anlagen wie Bitcoin (BTC), Ethereum (ETH) und Binance Coin (BNB) um 38,45%, 45,51% bzw. 31,04% fielen.

Der Outperformer in diesem Monat war der Exchange-Token LEO von Bitfinex, der den Monat mit einem Plus von 13,91% abschloss. Der UNUS SED LEO gefeiert Jahrestag des Token-Brennens und startete einen Wettbewerb für LEO-Inhaber, der das Interesse an dem beliebten Tausch-Token weckte.

Während die Kryptomärkte einen weiteren schlechten Monat erlebten, erging es den Aktien nicht viel besser. US-Aktien, gemessen am S&P 500, verloren im Monatsvergleich 7,7% an Wert und beendeten den schlechteste erste Jahreshälfte seit 1970.

US-Treasuries fielen um -0,79%, während der Wert von Gold (XAU) um -3,64% auf ein Fünfmonatstief von $1.794 je Feinunze sank.

Institutionelles Interesse an Kryptowährungen

Trotz des Bärenmarktes hat das institutionelle Interesse an Kryptowährungen nicht nachgelassen, da Die Institutionalisierung von Bitcoin geht an der Wall Street weiter.

Die französische Bank Societe Generale hat angekündigt, dass sie verpartnert mit dem Schweizer Kryptoanbieter Metaco, um die Krypto-Tochtergesellschaft SG FORGE der Bank zu entwickeln. Diese Partnerschaft wird sich im Vorgriff auf die bevorstehende EU-Pilotregelung für regulierte Wertpapier-Token hauptsächlich auf Sicherheits-Token konzentrieren.

In einem aktuellen Forschungspapier mit dem Titel "PropTech: Towards a Frictionless Housing Market?" des Wall Street-Riesen Citigroup kommentiert über die steigende Popularität von Krypto-Hypotheken und stellt fest, dass "ein neues Krypto-Hypothekenprodukt an Bedeutung gewonnen hat", das es "Krypto-Investoren ermöglicht, ihre Investitionsgewinne zur Absicherung eines Kredits zu nutzen, ohne dass das Steuerereignis eintritt." Der Bericht legt auch nahe, dass es bald ähnliche Hypothekenprodukte für Käufer von virtuellem Land im Metaverse geben könnte. Die Citigroup bietet solche Produkte zwar (noch) nicht an, aber das Interesse der Bank an ihnen zeigt ihre Bereitschaft, innovative, kryptobasierte Finanzprodukte zu erforschen.

Die New Yorker Gemeinschaftsbank angekündigt dass sie als Verwahrstelle für die Vermögenswerte fungieren wird, die den durch den Dollar gedeckten Stablecoin USD Coin (USDC) unterstützen. Circle, der Emittent hinter USDC, und die New York Community Bank planen außerdem, gemeinsam an "kostengünstigen Finanzlösungen für unterversorgte und bankenferne Gemeinschaften" zu arbeiten.

Bitcoin in den Bilanzen

Das an der Nasdaq notierte Unternehmen MicroStrategy hat nach eigenen Angaben weitere 480 BTC gekauft. eine Ankündigung von Firmenchef und Bitcoin-Befürworter Michael Saylor. Die Münzen wurden zu einem Durchschnittspreis von $20.817 erworben, womit sich der Gesamtbestand des Technologieunternehmens an Bitcoin auf 129.699 BTC erhöht.

Die "Bitcoin-Nation" El Salvador hat seine Bitcoin-Position ebenfalls aufgestockt und 80 BTC zu $19.000 gekauft, wie die ein Tweet von Präsident Nayib Bukele. Berichten zufolge verfügt das zentralamerikanische Land nun über 2.301 BTC in seiner Staatskasse.

Über DDA Ikonische Fonds

Iconic Funds ist die Brücke zum passiven und aktiv verwalteten Engagement in Kryptowährungen. Iconic Funds bietet über seine Tochtergesellschaften Krypto-Asset-ETPs, diversifizierte Indexfonds und Alpha-Strategien für Anleger an.

Unsere Aufgabe ist es, die Akzeptanz von Krypto-Assets zu fördern. Als Brücke für Anleger, die in Krypto-Assets investieren wollen, bieten die lizenzierten und regulierten Vehikel von Iconic den Anlegern eine Auswahl an Investitionsmöglichkeiten, die von passiven Indexinvestitionen bis hin zu aktiv verwalteten Strategien reichen. Iconic Funds beseitigt die technischen Risiken von Krypto-Investitionen, indem es Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten bietet.

Durch die Verbindung von modernster Technologie, innovativen Anlageprodukten und kompromissloser Professionalität steht Iconic an der Spitze der Krypto-Vermögensverwaltung.

Neueste Nachrichten

- Bitcoin vs. Gold: Warum Sie wahrscheinlich besser dran sind, wenn Sie "digitales Gold" kaufen

- Warum die Volatilität von Bitcoin Sie nicht erschrecken sollte

- Wie Green Mining zur Norm für das Bitcoin-Netzwerk wird

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

- Wie Layer-2-Lösungen Ethereum bei der Skalierung helfen

Iconic in der Presse

- ETF-Stream: Zahl der White-Label-Emittenten in Europa innerhalb einer Woche verdreifacht

- ETF-Strategie: Iconic Funds lanciert das weltweit erste Krypto-ETP auf ApeCoin

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds erweitert seine Produktpalette mit einem physischen Ethereum-ETP

Aktuelle Forschungsberichte

- Wie haben sich die Portfolios während der Pandemie entwickelt? ➡ Hier herunterladen

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

- Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen nur zu Informationszwecken.

Die Iconic Holding GmbH, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung.

Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen naturgemäß erheblichen Risiken und Unsicherheiten, die außerhalb der Kontrolle der Iconic Holding GmbH liegen.

Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" ohne jegliche Garantie präsentiert.