Our monthly crypto overview for February:

- The crypto markets had a volatile month, driven by global economic woes and the war in Ukraine.

- Bitcoin and Ether are up 8.70% and 8.16%, respectively.

- The top outperformer last month was Terra’s LUNA token.

Crypto Market Overview February

Following the sharp correction in January, the crypto markets experienced a volatile month in February. Worrying inflation figures in numerous leading economies followed by Russia’s invasion of Ukraine rocked global markets, which spilled over to the crypto markets.

The two market-leading cryptocurrencies, Bitcoin (BTC) and Ether (ETH), managed to recover some of their January losses, closing the month 8.70% and 8.16%, respectively.

Bitcoin managed to once again act as a safe haven asset during times of economic and geopolitical turmoil when the digital currency rallied substantially since war broke out in Ukraine, outperforming gold.

With the Eastern European country’s banking system coming to a de facto halt as a result of Russia’s invasion, Bitcoin’s ability to act as a censorship-resistant store of value that allows individuals to digitally store wealth and move their funds across borders has proven to be incredibly valuable.

Numerous stories have emerged on social media of Ukrainians not being able to access their money held in bank accounts, resorting to fleeing the country with cryptocurrency held in digital wallets instead.

In such a tragic and challenging time, cryptocurrencies like Bitcoin are showing that they can have a real impact on the lives of everyday individuals.

Crypto Performance Overview February

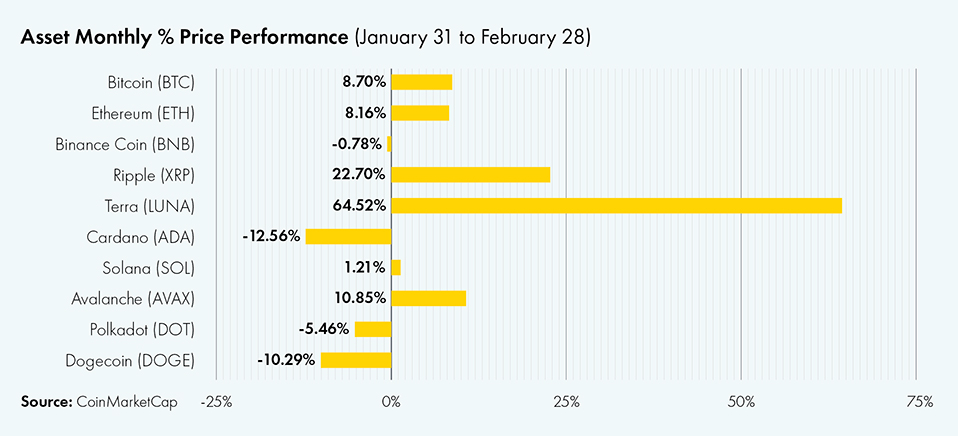

February’s month-end price closes show a fairly even mix of green and red in the crypto asset markets.

Some Layer-1 chains, such as Terra (LUNA), Avalanche (AVAX), and Solana (SOL), are in the green, while others, like Cardano (ADA), Near Protocol (NEAR), and Algorand (ALGO), are in the red.

Several exchange tokens, such as FTX Token (FTT), Bitfinex’s UNUS SED LEO (LEO), and Huobi Token (HT), made healthy gains while Binance Coin (BNB) and Crypto.com’s Cronos (CRO) closed the month lower.

The two big outperformers in February were Terra’s LUNA and Bitfinex’s LEO token, rallying 64.52% and 67.76%, respectively.

LUNA managed to recover almost all of its January losses, rallying 64.52% month-on-month after the Luna Foundation Guard (LFG) announced that it will back Terra’s stablecoin, UST, with $1 billion in Bitcoin reserves.

Bitfinex’s exchange token LEO rallied 67.76% month-on-month after the alleged Bitfinex hackers were arrested and billions of the exchange’s funds were retrieved from the two arrested individuals. Investors are betting that the confiscated funds will be returned to the exchange, which could lead to a further price increase of the exchange’s native token.

Stocks dropped significantly in February with looking rate hikes expected in the future and following Russia’s attack on Ukraine, with the S&P 500 Index losing -3.96% in February. U.S. Treasuries, measured by the S&P U.S. Government Bond Index, closed the month -1.30% lower.

Like Bitcoin, the precious metal Gold (XAU) managed to fulfill its role as a store of value, gaining 5.95% in value in February, as investors moved money out of risky assets and into safe haven assets.

Institutional Interest in Crypto

State Street Bank, one of the world’s largest custodian banks, is planning to roll out crypto asset custody services. According to an interview with Bloomberg, Nadine Chakar, executive vice president and head of State Street Digital, stated that as soon as U.S. regulators give the nod, the Boston-based bank will roll out custody solutions for Bitcoin and other digital assets.

Institutional investors are reportedly becoming the biggest investors in the crypto markets. According to a report by the Wall Street Journal, institutional investors traded $1.14 trillion on Coinbase in 2021, up from only $120 billion in 2020. Conversely, retail traders on traded around $535 million on the popular exchange.

Bitcoin on Balance Sheets

KPMG Canada announced that it added Bitcoin and Ether to its corporate treasury balance sheet. “Cryptoassets are a maturing asset class. […] This investment reflects our belief that institutional adoption of cryptoassets and blockchain technology will continue to grow and become a regular part of the asset mix,” explained Benjie Thomas, Canadian Managing Partner, Advisory Services, KPMG in Canada.

Flexport, a global supply-chain logistics company, reportedly also holds Bitcoin on its balance sheet. According to a tweet from company CEO Ryan Petersen, the San Francisco-based company holds a non-zero amount of the digital currency on its $1.6 billion balance sheet.

Über DDA Iconic Funds

Iconic Funds is the bridge to passive and actively-managed exposure to crypto. Iconic Funds, via its subsidiaries, offers crypto asset ETP’s, diversified index funds, and alpha-seeking strategies for investors.

Our mission is driving the adoption of crypto assets. As the bridge for investors to gain exposure to Crypto Assets, Iconic’s licensed and regulated vehicles offer investors a menu of investment choices ranging from passive index exposure to actively-managed strategies. Iconic Funds removes the technical risks of crypto investing by offering investors trusted and familiar means to invest in crypto at industry-leading low costs.

The marriage of state-of-the-art technology, innovative investment products, and uncompromising professionalism places Iconic at the vanguard of crypto asset management.

Recent News

- Iconic Acquires Licensed Company to Become Regulated Crypto Portfolio Manager and Advisor

- Wie Layer-2-Lösungen Ethereum bei der Skalierung helfen

- Bitcoin Education Will Pave the Way for Hyperbitcoinization

- Iconic Funds lists Ethereum ETP on Xetra

Iconic in Press

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds Expands Product Range With a Physical Ethereum ETP

Recent Research Reports

- Wie haben sich die Portfolios während der Pandemie entwickelt? ➡ Hier herunterladen

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

- Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen nur zu Informationszwecken.

Iconic Holding GmbH, its affiliates, and subsidiaries are not soliciting any action based upon such material. This article is neither investment advice nor a recommendation or solicitation to buy any securities.

Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung.

Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen.

Our articles and reports include forward-looking statements, estimates, projections, and opinions. These may prove to be substantially inaccurate and are inherently subject to significant risks and uncertainties beyond Iconic Holding GmbH’s control.

Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" ohne jegliche Garantie präsentiert.