von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Februar: Kryptoasset-Preise hin- und hergerissen zwischen positiven On-Chain-Fundamentaldaten und einer länger als erwarteten Straffung der US-Geldpolitik

- Während die Straffung der Geldpolitik in den USA und der EU die Liquidität belasten dürfte, scheinen die jüngste chinesische Wiedereröffnung und die quantitative Lockerung einen Anstieg der weltweiten Liquidität gefördert zu haben

- Viele Indikatoren auf der Kette deuten darauf hin, dass wir an der Schwelle zu einem neuen Bullenmarkt stehen könnten, einschließlich höherer Marktrentabilität, höherer Netzwerkaktivität und eines Zustroms neuer Investoren

Grafik des Monats

Kryptoasset Leistung

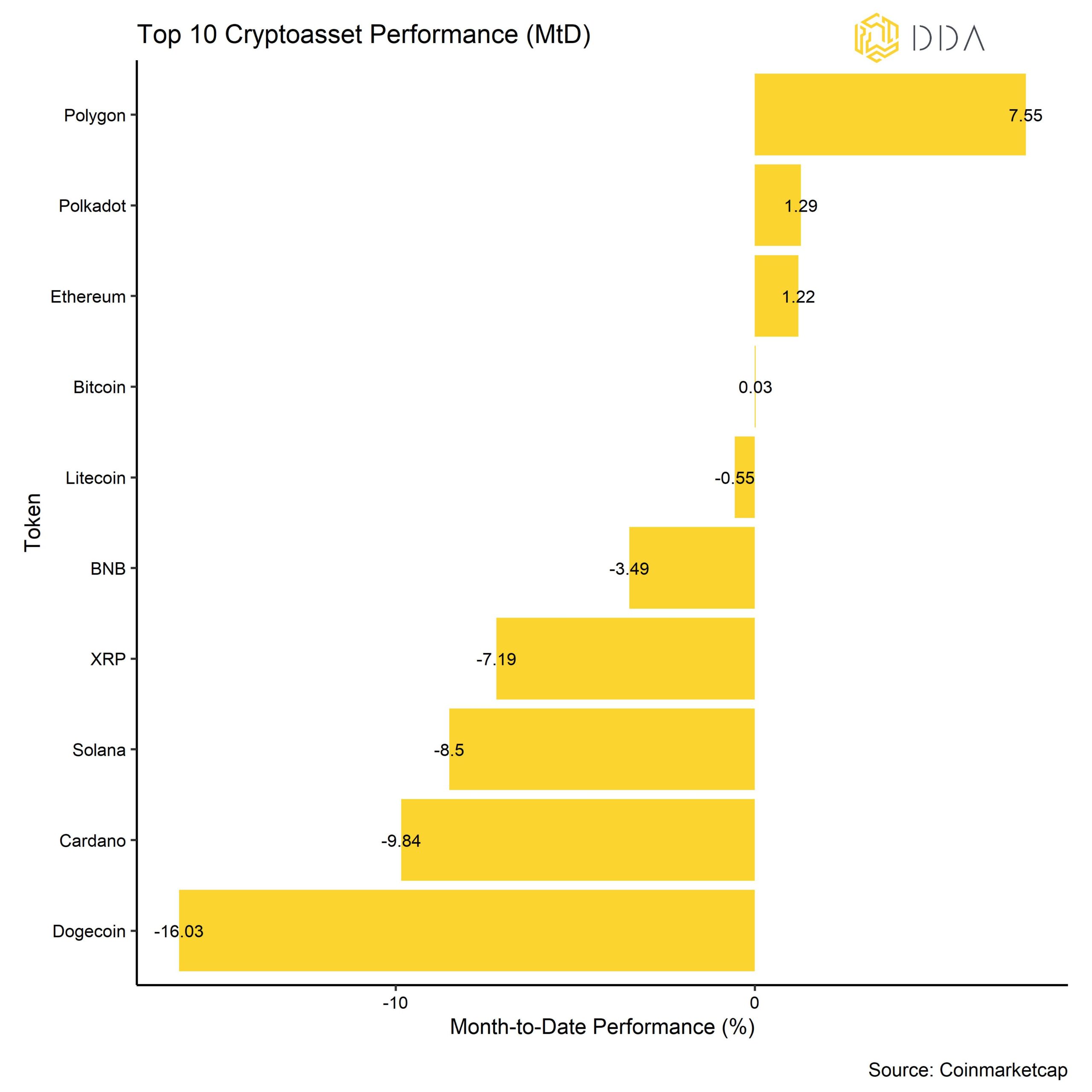

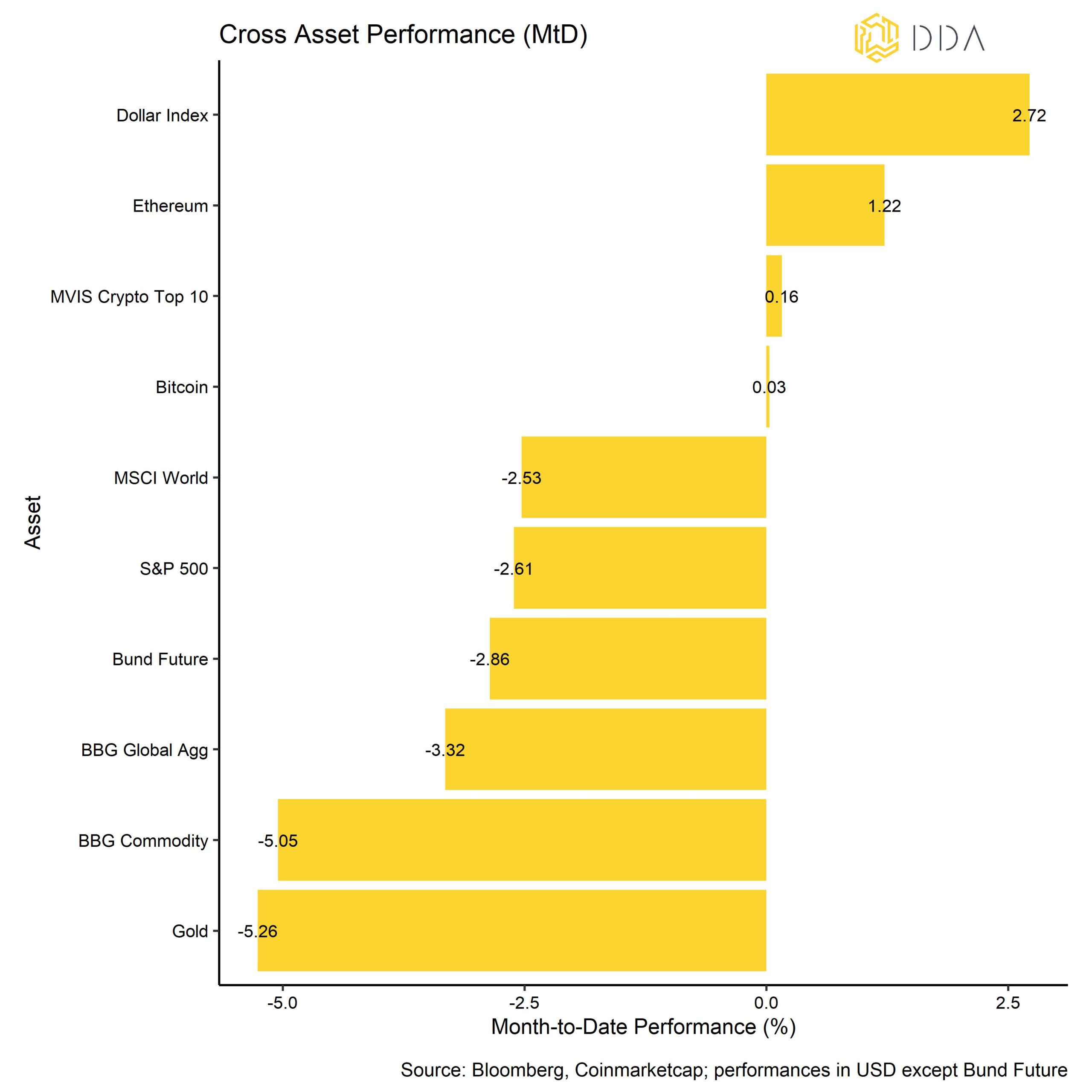

Die Preise für Kryptowährungen blieben im Februar weitgehend unverändert, da der Markt zwischen positiven Fundamentaldaten auf der Kette und den Aussichten auf eine länger als erwartete Straffung der Federal Reserve hin- und hergerissen war. Der Dollar war die am besten abschneidende Anlageklasse, was auf einen Anstieg der US-Zinsen zurückzuführen ist, der die traditionellen Finanzanlagen wie Aktien und Anleihen erheblich belastete. Auch Gold geriet aufgrund der Neubewertung der Zinserhöhungserwartungen der Fed deutlich unter Druck.

Unter den Top 10 der wichtigsten Kryptoassets waren Polygon, Polkadot und Ethereum die größten Outperformer. Die Outperformance von Altcoins hat sich in letzter Zeit verstärkt und lag für die von uns beobachteten Altcoins auf 1-Monats-Basis kurzzeitig über 50%. Gleichzeitig ist die Streuung bei Kryptowährungen stetig gesunken, was darauf hindeutet, dass die Wertentwicklung von Kryptowährungen hauptsächlich durch systematische Faktoren und nicht durch münzspezifische Faktoren bestimmt wurde. Unterm Strich:Die Preise für Kryptoassets blieben im Februar weitgehend unverändert, da der Markt zwischen den positiven Fundamentaldaten auf der Kette und den Aussichten auf eine länger als erwartete Straffung der Federal Reserve hin- und hergerissen war.

Kommentar zu Makro & Märkte

Nachdem die Fed wie erwartet den Leitzins um 25 Basispunkte angehoben hatte, hat sie es im Wesentlichen versäumt, gegen die von den Finanzmärkten in letzter Zeit eingeschätzte Lockerung der finanziellen Bedingungen vorzugehen, und schien sich mit der allgemeinen Verschärfung der finanziellen Bedingungen seit dem letzten Jahr zufrieden zu geben. Dies hat zu Beginn des Monats zu einer allgemeinen Aufwertung der Preise in allen Anlageklassen geführt.

Im Februar wurden jedoch eine Reihe von harten und weichen Daten aus den USA veröffentlicht, die meist über den Konsenserwartungen lagen. So überraschten beispielsweise der ISM-Dienstleistungsindex, die Verbraucherstimmung der Universität Michigan, der Empire Manufacturing Index und die US-Einzelhandelsumsätze allesamt positiv, was die Ansicht einer potenziellen "sanften Landung" der US-Wirtschaft stützte. In diesem Zusammenhang bedeutet eine sanfte Landung eine leichte Rezession der US-Wirtschaft mit nur geringen Auswirkungen auf das Wachstum der Unternehmensgewinne. Infolgedessen stiegen die wirtschaftlichen Überraschungsindizes wie der von Citi auf den höchsten Stand seit April 2022.

Trotzdem bleiben wir aus den folgenden Gründen vorerst im Lager der US-Rezession:

- Wir haben eine der bedeutendsten Umkehrungen der Renditekurve von US-Schatzpapieren erlebt - Umkehrungen der Renditekurve sind historisch gesehen einer der zuverlässigsten Indikatoren für eine Rezession in den USA

- Auch andere zukunftsgerichtete Indikatoren wie der ISM-Index für Auftragseingänge im verarbeitenden Gewerbe oder der vom Conference Board veröffentlichte vorlaufende Wirtschaftsindikator deuten auf eine Rezession in den USA hin.

- Verschiedene Umfragen zeigen, dass die Kreditkonditionen in den USA sehr ungünstig sind und sich wahrscheinlich immer noch auf die Wirtschaft auswirken werden.

- Der durch den Anstieg der Hypothekenzinsen ausgelöste Abschwung auf dem Wohnungsmarkt muss sich noch in den Beschäftigungszahlen im Baugewerbe niederschlagen, die in der Regel ein Vorläufer für die Gesamtbeschäftigung sind; die Erschwinglichkeit von Wohnraum ist nach Schätzungen von Goldman Sachs so schlecht wie nie zuvor.

- Arbeitsmarktdaten wie die Beschäftigungszahlen außerhalb der Landwirtschaft sind nachlaufende Wirtschaftsindikatoren und unterliegen Revisionen. Zukunftsorientiertere Beschäftigungsindikatoren wie die Ankündigung von Entlassungen deuten nach wie vor auf einen deutlichen Anstieg der Arbeitslosigkeit in den kommenden Monaten hin; dies wird auch durch die jüngste Zunahme der Google-Suchanfragen nach "Arbeitslosigkeit beantragen" bestätigt.

Ein wichtiger Punkt in diesem Zusammenhang ist die Beobachtung, dass die Erwartungen für den Zinserhöhungspfad der Fed aufgrund dieser verbesserten Wirtschaftsdaten kürzlich gestiegen sind. Dies bedeutet, dass der Markt davon ausgeht, dass die Straffung der Fed länger andauern wird als bisher angenommen. Genauer gesagt wurde die so genannte "Terminal Rate", d. h. die Fed Funds Rate, bei der der Markt den Höhepunkt des Zinserhöhungszyklus der Fed erwartet, aufgrund der jüngsten Überraschungen bei den Wirtschaftsdaten um mehr als 50 Basispunkte auf etwa 5,40% im September 2023 angehoben.

Dies bedeutet jedoch auch, dass die negativen Auswirkungen auf die Wirtschaft überwiegen werden. Die jüngste Marktreaktion hat also einen gewissen Reflexcharakter - keine Rezession jetzt kann nur eine tiefere Rezession später bedeuten, wenn die Geldpolitik weiter gestrafft wird und die Renditen weiter steigen.

Ein weiteres wichtiges Gesprächsthema ist die chinesische Wiedereröffnung. In der Tat lagen die jüngsten Datenveröffentlichungen aus China größtenteils über dem Konsens und stützen auch die Ansicht einer anhaltenden Wachstumsbeschleunigung in China. Dies wurde heute Morgen erneut bestätigt, als der Caixin PMI für das verarbeitende Gewerbe auf den höchsten Stand seit April 2012 stieg. Darüber hinaus deuten die kürzlich veröffentlichten Kreditdaten für Januar auf eine sehr deutliche Belebung der Kreditvergabe in China hin. Normalerweise eilt der chinesische Kreditzyklus der weltweiten Industriekonjunktur und den Rohstoffpreisen um etwa 6 Monate voraus. Der jüngste Aufschwung bei den chinesischen Kreditdaten wird also wahrscheinlich für den größten Teil dieses Jahres das Narrativ der Wiedereröffnung unterstützen, was für Risikoanlagen und Kryptoassets im Allgemeinen positiv sein dürfte. Allerdings sind die Datenveröffentlichungen im Januar und Februar aufgrund des chinesischen Neujahrsfestes in der Regel recht volatil, weshalb man auf die Bestätigung durch die kommenden Veröffentlichungen warten sollte. Hochfrequente Daten wie die Reisetätigkeit innerhalb Chinas deuten ebenfalls auf eine deutliche Umkehr der Kovid-Beschränkungen hin. Darüber hinaus haben die Liquiditätsspritzen der People's Bank of China (PBoC) deutlich zugenommen, was die laufende chinesische Erholung ebenfalls unterstützen dürfte.

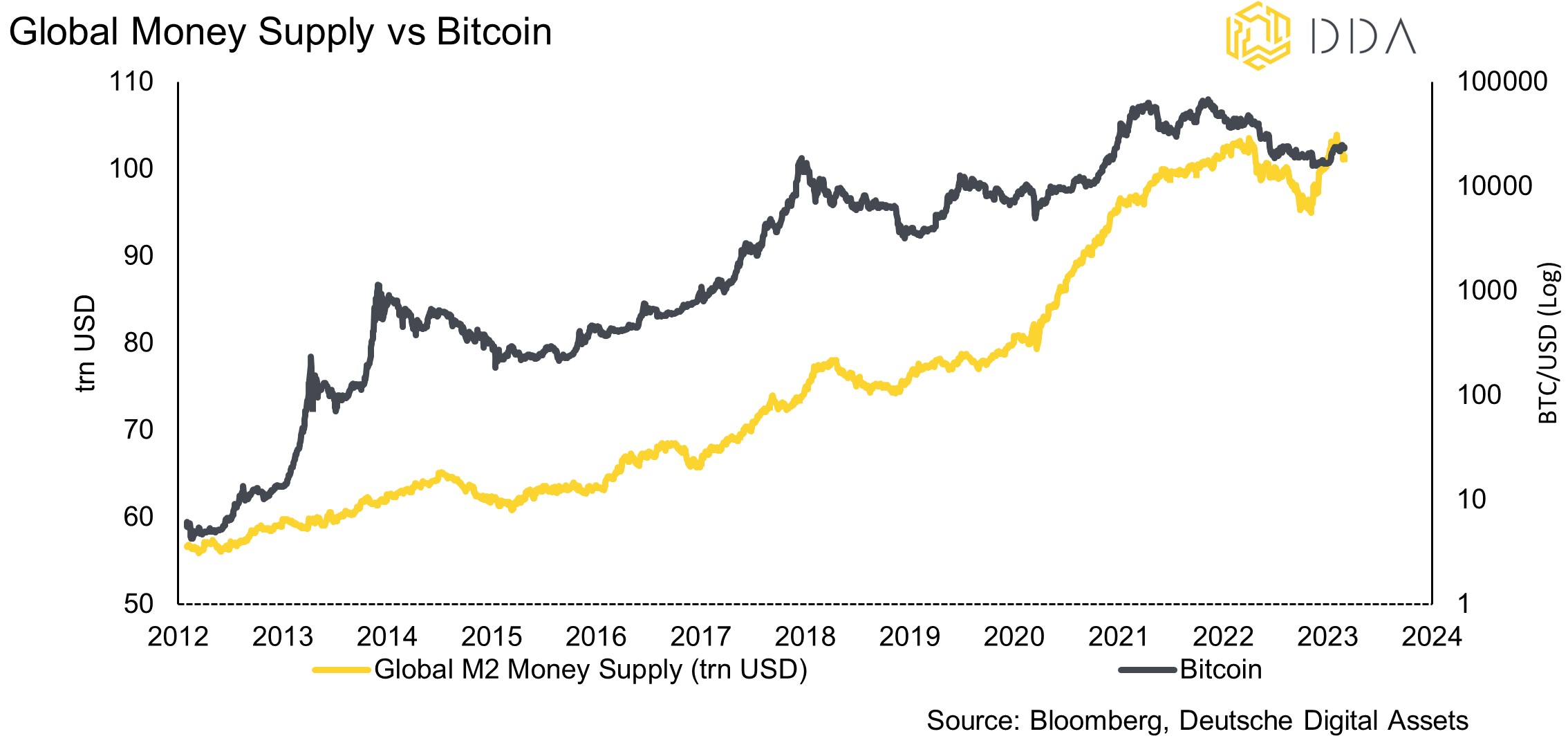

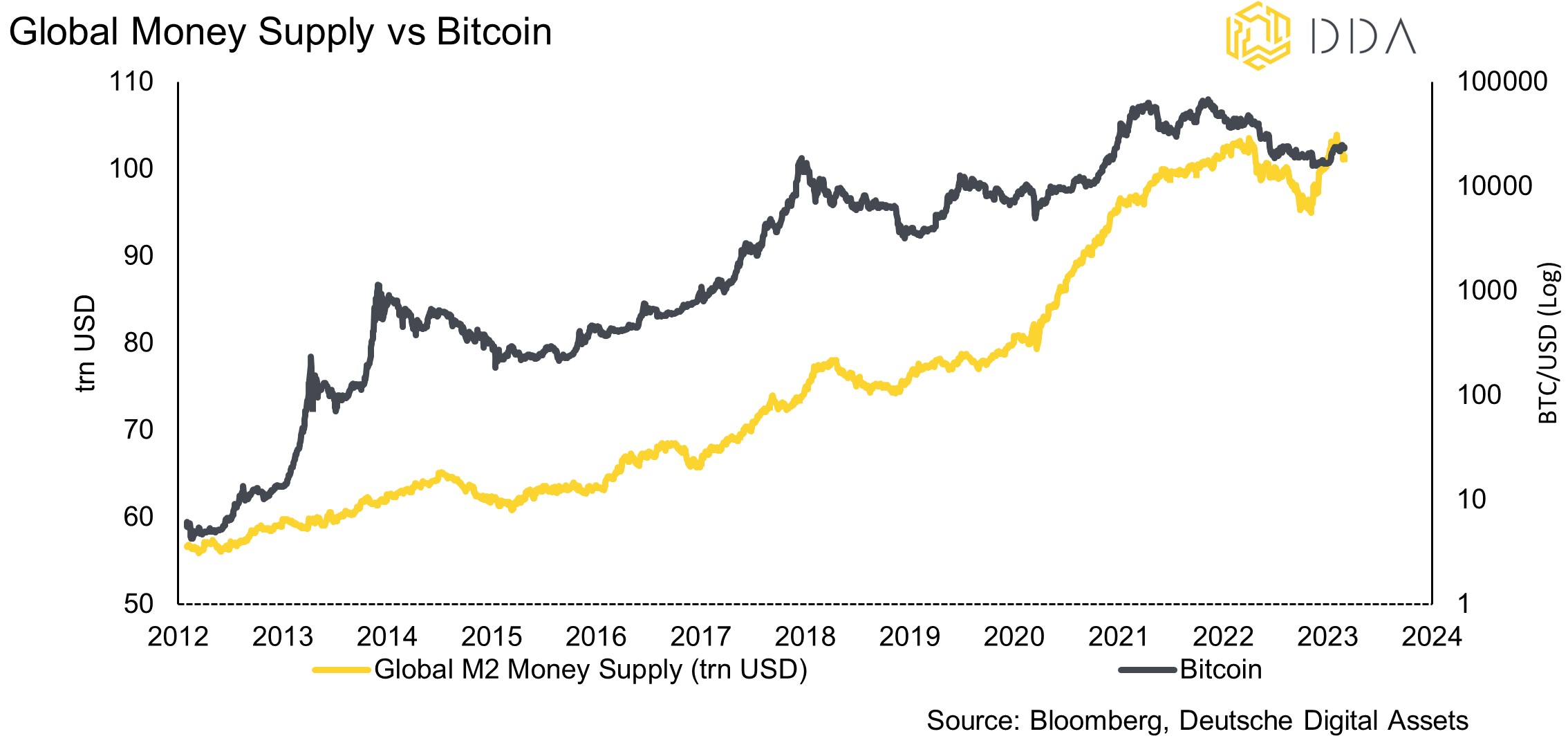

In diesem Zusammenhang ist es interessant festzustellen, dass die weltweiten Liquiditätsmaßnahmen bereits seit Ende letzten Jahres zugenommen haben. Dies geschah trotz der laufenden geldpolitischen Straffungsmaßnahmen der Fed und der EZB. Auch die derzeitige quantitative Lockerung in China dürfte diese Entwicklung weiter unterstützen.

Bislang hat die chinesische Wiedereröffnung zu einem Anstieg der zyklischen Rohstoffe wie Kupfer und der globalen Inflationserwartungen geführt, was die Gesamtbewertung der Auswirkungen auf die Kryptoasset-Märkte erschweren könnte. Dennoch gehen wir davon aus, dass eine Rezession in den USA erst später als bisher erwartet eintritt, was mit einer deutlichen Lockerung der Geldpolitik durch die Fed in der Zukunft vereinbar wäre. In Kombination mit einer Wiederbeschleunigung des chinesischen Wachstums könnte dies zu einer ausgeprägten Schwäche des US-Dollars führen, was letztlich ein Segen für Kryptoassets sein dürfte.

Unterm Strich: Nachsicht ist kein Freispruch: Trotz der jüngsten positiven Datenüberraschungen in den USA bleiben wir vorerst bei der Einschätzung einer Rezession in den USA, und zwar aus einer Reihe von Gründen, darunter die Umkehrung der Renditekurve und andere Signale von zukunftsorientierten Frühindikatoren. Dies stünde im Einklang mit einer deutlichen Lockerung der Fed in der Zukunft. In Kombination mit einer anhaltenden Wiederbeschleunigung der chinesischen Wachstumsdynamik könnte dies letztlich zu einer ausgeprägten Dollarschwäche führen, was ein Segen für Kryptoassets sein dürfte.

On-Chain-Analytik

Die positive Entwicklung der Kryptoassets im letzten Monat setzte sich auch im Februar fort, aber die Gründe für die Outperformance scheinen in diesem Monat nuancierter zu sein. Während es im Januar viele Anzeichen für institutionelles Kaufinteresse an Kryptoassets gab, wie wir zuvor dargelegt haben, kam es im Februar eher zu einer allgemeinen Zunahme der Netzwerkaktivität, die hauptsächlich durch das erneute Interesse von Privatanlegern angetrieben wurde.

Im Fall von Bitcoin war dies vor allem auf die Zunahme der sogenannten "Inskriptionen" zurückzuführen, bei denen es sich um nicht fungible Token (NFTs) auf der Bitcoin-Blockchain handelt. Die Dateien, die in die Bitcoin-Blockchain eingeschrieben wurden, reichen von einfachen Bildern über Audiodateien bis hin zu Videospielen.

Diese Inschriften, die sich von NFTs auf anderen Chains unterscheiden, lassen sich am besten als digitale Artefakte beschreiben. NFTs werden typischerweise auf Ethereum oder Solana gefunden und sind einzigartige Token, die einen Referenzzeiger auf die Zieldatei tragen, die typischerweise eine Datei ist, die anderswo gehostet wird, wie eine Bilddatei. Cloud-Server, IPFS und Dateispeicherblöcke sind nur einige Beispiele für die verfügbaren Hosting-Dienste; jeder hat seine eigenen Gegenparteirisiko-Abwägungen und ist exklusiv für jeden NFT-Coin. Auf der anderen Seite sind Inskriptionen relativ einzigartig, da sie wirklich die rohen Dateidaten enthalten, die direkt im Bitcoin-Netzwerk aufgezeichnet werden.

Die Bitcoin-Gemeinschaft ist immer noch in Aufruhr und es gibt immer noch grundlegende Diskussionen über diesen nicht-monetären Anwendungsfall der Bitcoin-Blockchain.

Auf der einen Seite behaupten die Befürworter dieser neuen Art von Anwendungsfällen, dass Bitcoin als erlaubnisfreies, zensurresistentes Protokoll für jeden gewünschten Anwendungsfall verwendet werden sollte, solange die Miner mit einer Gebühr belohnt werden.

Auf der anderen Seite behaupten die Gegner von Inskriptionen, dass dies die Gebühren und Abwicklungszeiten für wichtige Geldtransaktionen erhöhen könnte, insbesondere für Personen in Entwicklungsländern. Außerdem könnte dies möglicherweise die Tür für einen potenziellen Angriffsvektor durch einen feindlichen Akteur öffnen, der das Netz mit unwichtigen Einschreibungen verstopfen könnte.

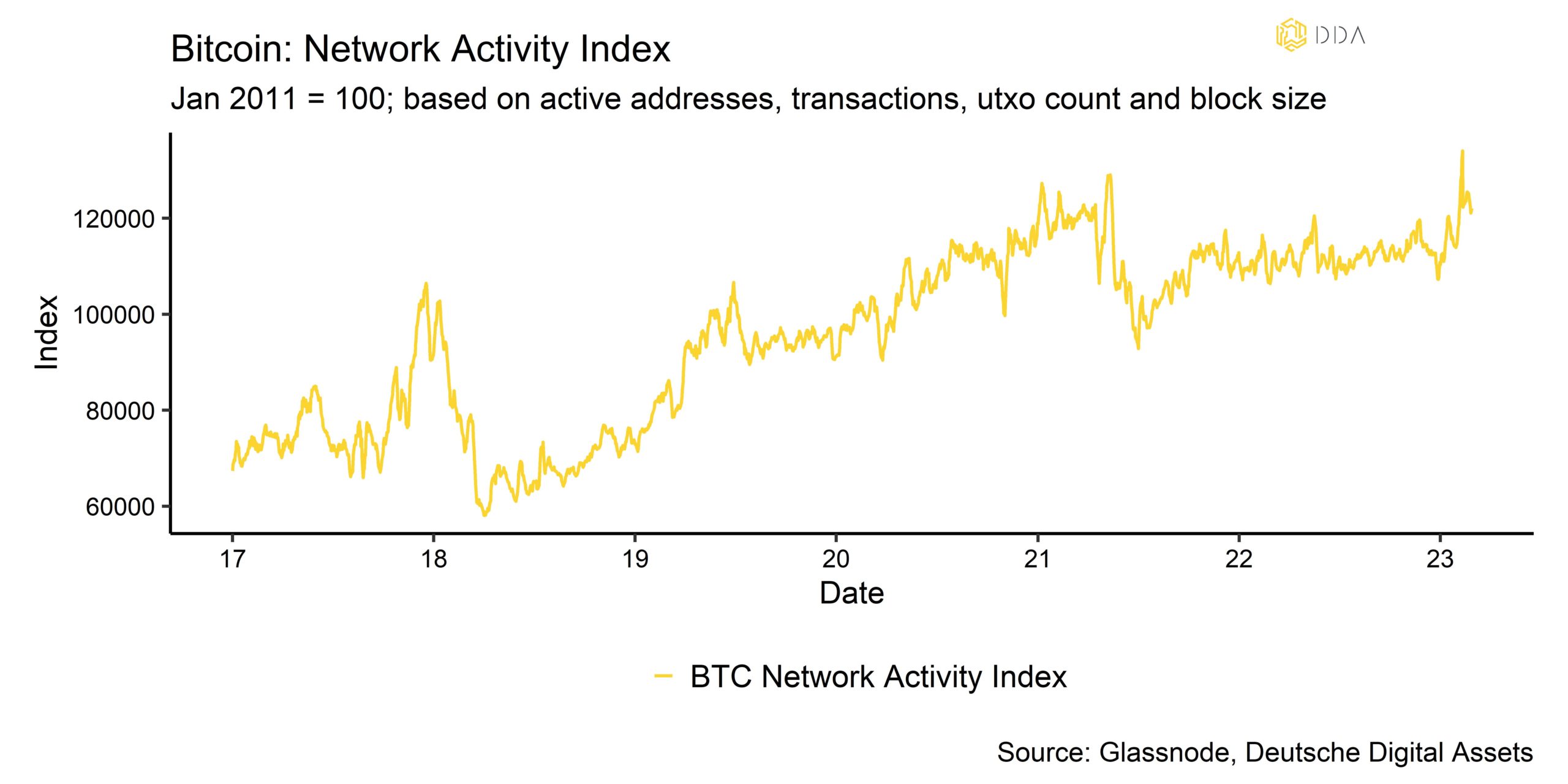

Die gute Nachricht für die Anleger ist, dass die Netzaktivität insgesamt aufgrund dieses neuen Trends erheblich zugenommen hat:

Ein Anstieg der Netzwerkaktivität ist in der Regel auch mit einem Anstieg des Preises verbunden, da der Gesamtwert des Netzwerks mit zunehmender Netzwerkbeteiligung und -nutzen steigt. Im Fall von Bitcoin ist der jüngste Anstieg der Netzwerkaktivität vor allem auf einen Anstieg der Transaktionszahl und der Blockgröße zurückzuführen, da Inskriptionen in der Regel mehr Platz in einem Bitcoin-Block einnehmen.

Inskriptionen werden wahrscheinlich weiterhin die Beteiligung des Einzelhandels an Bitcoin erhöhen und könnten ein signifikanter Werttreiber sein, ähnlich wie bei anderen Blockchains wie Ethereum oder Solana, wo NFT-Transaktionen zu einem bedeutenden Teil des getätigten Wertes beitragen.

Im Fall von Ethereum beispielsweise machen NFT-Transaktionen derzeit etwa 25% der gezahlten Gasnutzung/Transaktionsgebühren und etwa 15% der Transaktionsanzahl im Vergleich zu anderen Transaktionsarten aus. Einige On-Chain-Analysten behaupten, dass das Aufkommen von NFT-Transaktionen auf der Ethereum-Blockchain ab Mitte 2021 den Preis während des Bärenmarktes erheblich gestützt hat, da die Gesamtnetzwerknutzung ohne NFTs deutlich geringer gewesen wäre.

Was die Art der Einschreibungen betrifft, so sind Bilder derzeit der wichtigste Datentyp, der in die Bitcoin-Blockchain eingeschrieben wird, gefolgt von einfachen Textnachrichten. Bislang ist der Bitcoin Mempool aufgrund der Inskriptionen deutlich weniger überlastet und mit vielen Transaktionen gefüllt, für die extrem niedrige Gebühren anfallen - typischerweise 1-2 sat/vByte.

Die These, dass die Zunahme der Einschreibungen/NFTs der Hauptgrund für den jüngsten Ausbruch war, wird auch durch die Tatsache gestützt, dass die Taproot-Akzeptanzraten in letzter Zeit deutlich gestiegen sind. Das Taproot-Soft-Fork-Upgrade hat Inskriptionen überhaupt erst ermöglicht, so dass die Nutzung ein Indikator für vermehrte Inskriptionen ist.

Abgesehen vom Trend bei den Einschreibungen haben wir eine Reihe positiver Entwicklungen auf der Kette gesehen, die die Wahrscheinlichkeit eines neuen Haussezyklus deutlich erhöht haben.

Beachten Sie die folgenden Entwicklungen:

- Die Preise liegen sowohl für kurzfristige als auch für langfristige Besitzer von Bitcoin über dem Realisierten Preis

- Neue Adressen Die Dynamik hat in letzter Zeit zugenommen, da die Gesamtaktivität des Netzes zugenommen hat und neue Nutzer dem Netz beitreten

- Die Ausgaben in der Kette sind jetzt im Durchschnitt für den Markt rentabel. Dies korrespondiert in der Regel mit einem stärkeren Zufluss an Nachfrage (um Gewinnmitnahmen aufzufangen) sowie einer positiveren Bewertung des Vermögenswerts.

- Das realisierte P/L-Verhältnis hat sich zu Beginn des Jahres ebenfalls ins Positive gedreht. Wenn das realisierte Kurs-Gewinn-Verhältnis den Wert von 1,0 durchbricht und sich darüber hält, bedeutet dies, dass der Markt jetzt einen größeren Anteil der Gewinne und Verluste in USD realisiert als Verluste. Dies deutet in der Regel darauf hin, dass den Verkäufern mit nicht realisierten Verlusten die Optionen ausgegangen sind und dass ein stärkerer Nachfragestrom besteht, um Gewinnmitnahmen entgegenzuwirken.

- Einige Indikatoren wie der RHODL-Multiplikator signalisieren eine stärkere Beteiligung kurzfristiger gegenüber langfristigen Anlegern; die Beteiligung kurzfristiger Anleger (die meist aus dem Einzelhandel stammen) ist in der Regel eine der notwendigen Voraussetzungen für einen neuen Haussezyklus

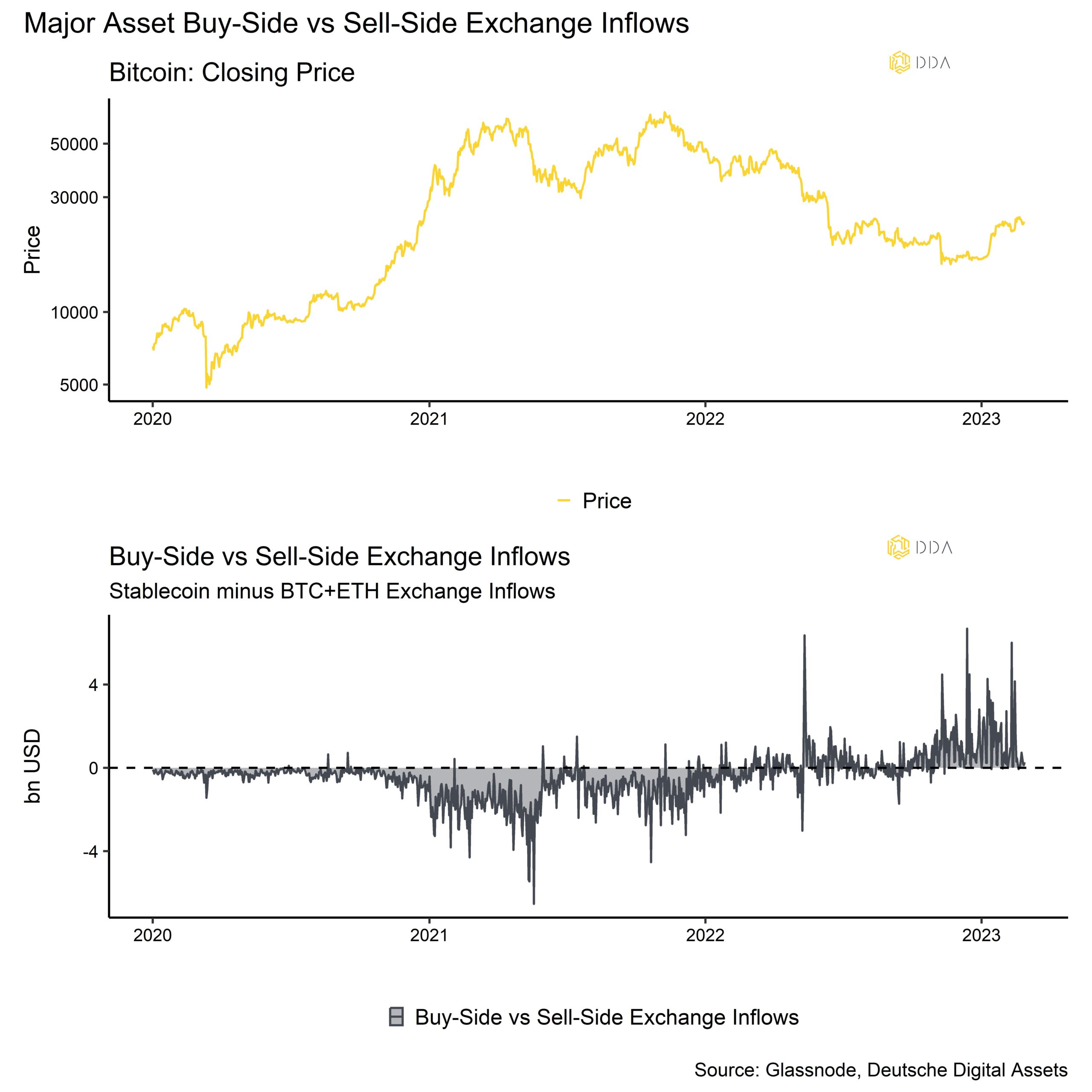

Der Anstieg der globalen Liquidität zeigt sich auch in den On-Chain-Analysen in der Form, dass die Zuflüsse an den Stablecoin-Börsen nun die Zuflüsse an den Bitcoin-Börsen überwiegen, was einen Anstieg der potenziellen Kaufkraft bzw. des "trockenen Pulvers" für Krypto-Assets in der Zukunft impliziert.

Alles in allem haben die Spotpreise begonnen, oberhalb wichtiger Schwellenwerte zu handeln (sowohl technisch als auch auf der Kette), die Nutzung des Netzwerks beschleunigt sich (höhere Aktivität auf der Kette, erhöhte Netzwerküberlastung, mehr Gebühreneinnahmen), die Rentabilität des Marktes ist zurückgekehrt, und die Vermögensbilanz ist größtenteils auf der Seite der langfristigen Inhaber, die nun damit beginnen können, ihre Bestände an neue kurzfristige (Privat-)Marktteilnehmer zu verteilen. Gleichzeitig ist eine zunehmende Börsenliquidität zu beobachten, die die Kryptoasset-Preise auch in Zukunft stützen dürfte.

Unterm Strich: Die Bitcoin-Preise wurden in letzter Zeit durch eine erhöhte Netzwerkaktivität aufgrund der zunehmenden Nutzung von Einschreibungen gestützt. Viele On-Chain-Indikatoren deuten darauf hin, dass wir an der Schwelle zu einem neuen Bullenmarkt stehen könnten, einschließlich höherer Marktrentabilität, höherer Netzwerkaktivität und eines Zustroms neuer Investoren. Gleichzeitig haben die Zuflüsse auf der Kaufseite der Börse im Verhältnis zu den Zuflüssen auf der Verkaufsseite zugenommen, was die Kryptoasset-Preise auch in Zukunft stützen sollte.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.