Blackrock’s Bitcoin ETF Filing Sparks Optimism in Crypto Assets, Crypto ETP Fund Flows Surge to Year-to-Date High

DDA Crypto Market Pulse, June 26, 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Blackrock’s Bitcoin ETF filing in the US has sparked a new wave of optimism in crypto assets

- Our in-house Crypto Sentiment Index has surged significantly throughout last week

- As a result, global crypto ETP fund flows increased to the highest level year-to-date

Chart der Woche

Kryptoasset Leistung

Last week, cryptoasset performances were still propped up by some secondary effects related to Blackrock’s ETF filing in the US the week prior.

The Bitcoin Trust filing by Blackrock has sparked a new wave of optimism among institutional asset managers and banks who have hurried to move into the crypto asset space.

Consider the following events:

• Deutsche Bank has officially applied for crypto custody license in Germany

• Fidelity, Charles Schwab, and Citadel back new crypto asset exchange EDX Markets (EDX): Products traded on EDX include Bitcoin, Bitcoin Cash, Ethereum and Litecoin

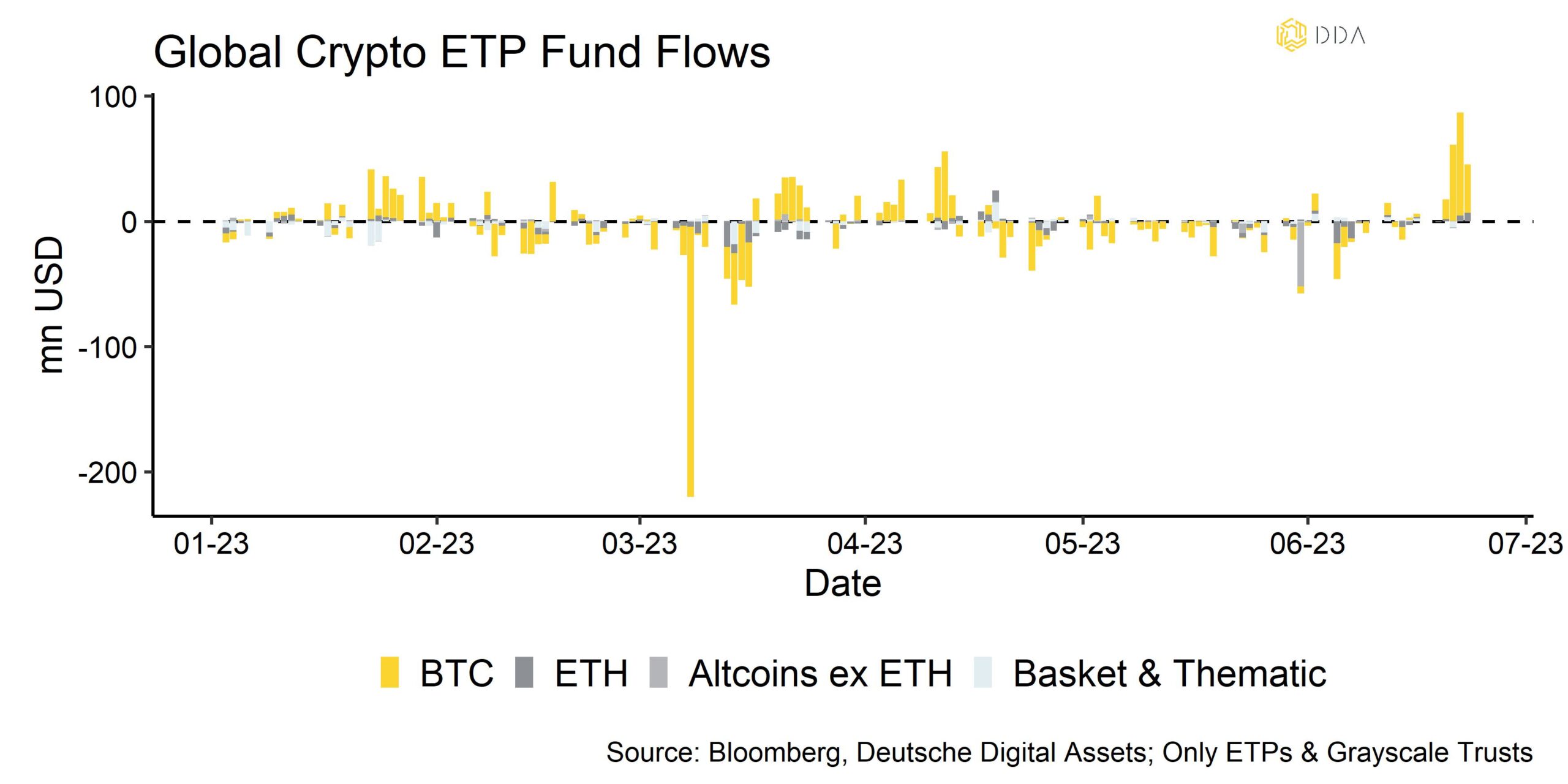

• Other large asset managers have (re-)filed for a spot Bitcoin ETF with the SEC, including Invesco and Wisdomtree within 24 hours of Blackrock’s filing.As a result of this new wave of optimism, global crypto ETP fund flows have increased to the highest level year-to-date with almost 200 mn USD flowing into Bitcoin funds alone (Chart-der-Woche).

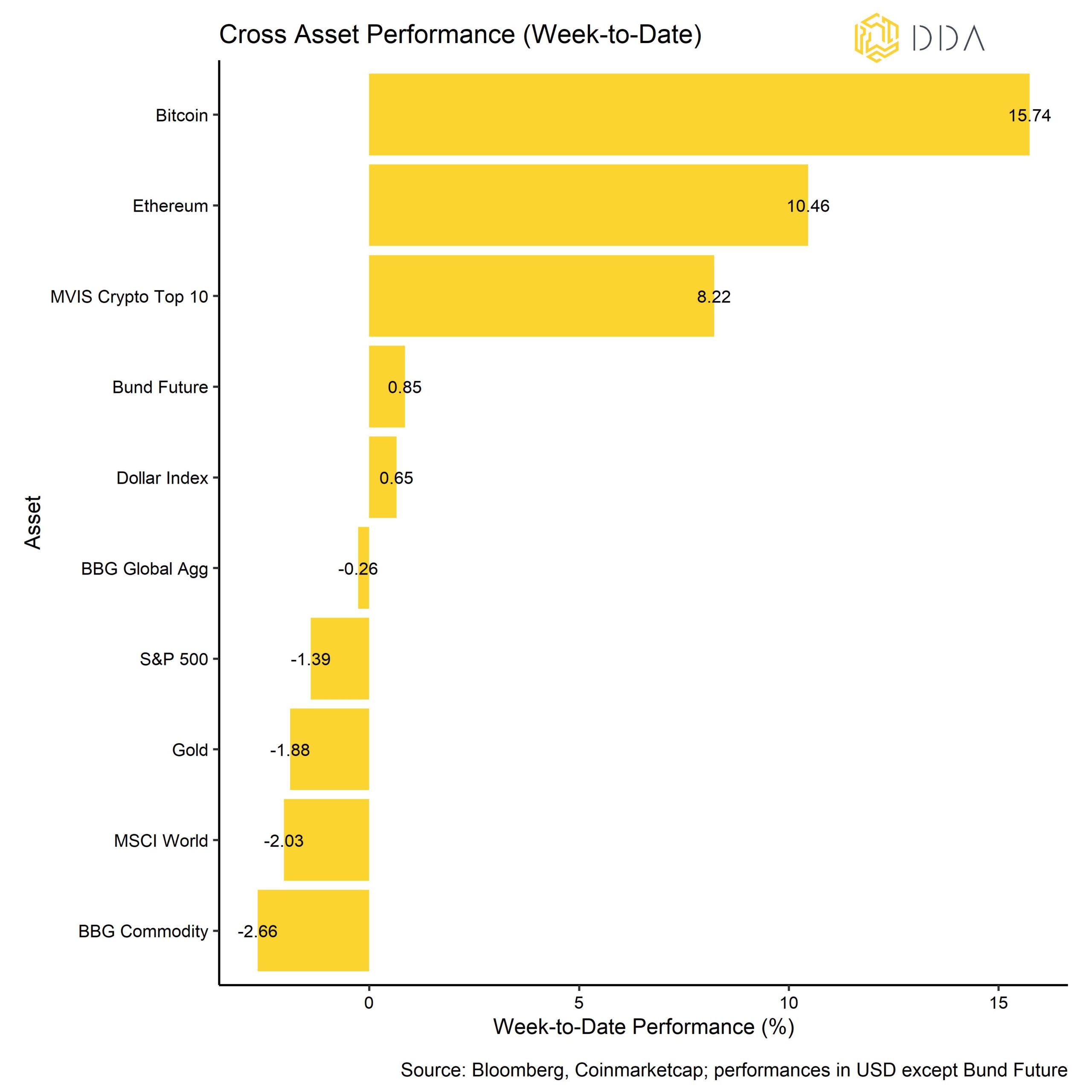

Not surprisingly, cryptoassets were the best performing asset class last week, outperforming other assets by a very wide margin. Meanwhile, global equities, global bonds, and commodities retreated signalling that correlations are breaking down between equities, bonds, commodities and cryptoassets. The Dollar appreciated slightly last week.

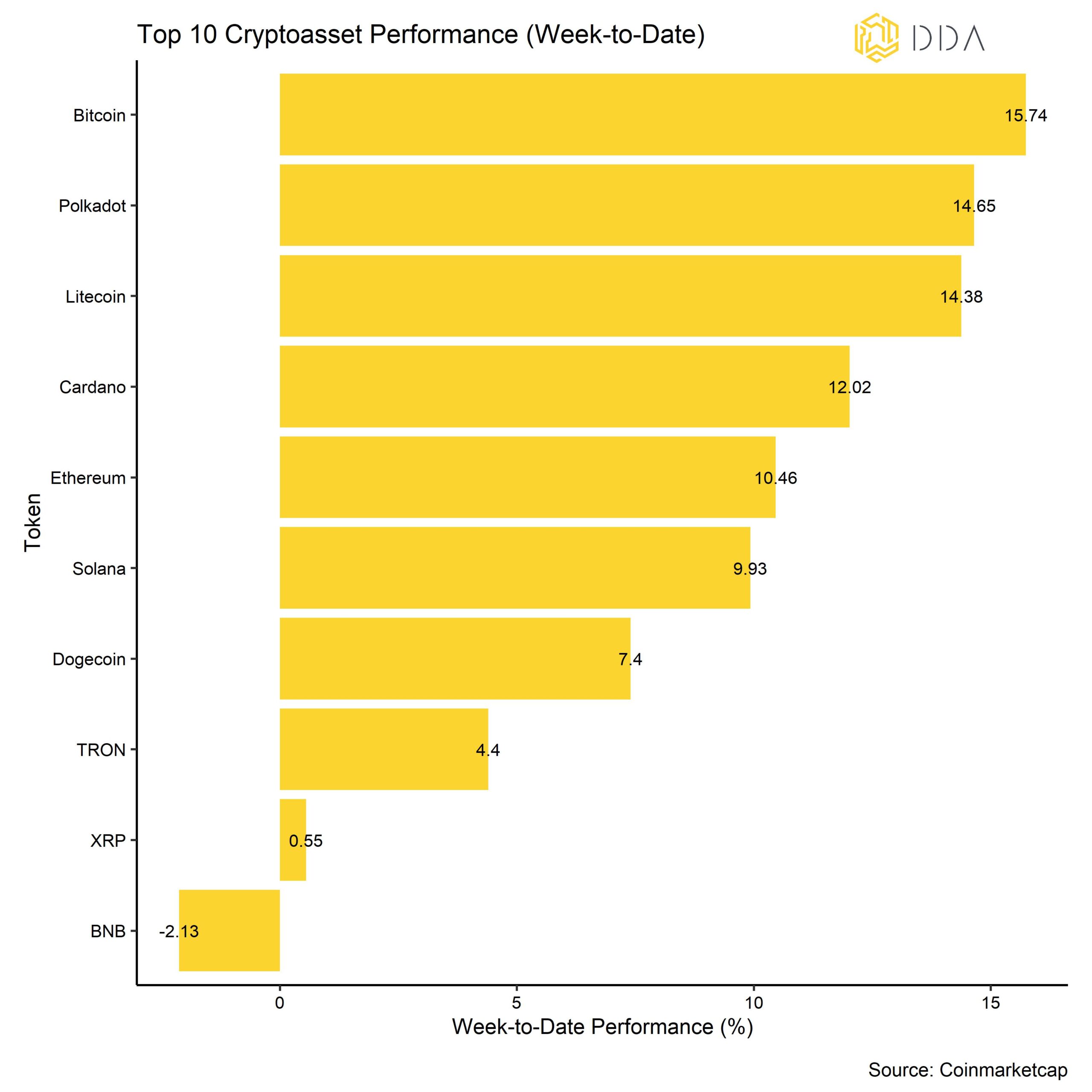

Among the top 10 cryptoassets, Bitcoin, Polkadot, and Litecoin were the relative outperformers. Overall, Bitcoin was very dominant during last week’s advance.

In this context, altcoins were able to outperform Bitcoin again albeit from very low levels. Based on our set of tracked altcoins, only 35% of altcoins were able to outperform Bitcoin on a weekly basis.

Krypto-Marktstimmung

Our in-house Crypto Sentiment Index has surged significantly compared to last week and is firmly in positive territory again. 12 out of 15 indicators are above their short-term trend. So far, we have seen the highest levels of our Crypto Sentiment Index this year which increases the risk of short-term set-backs on account of overbought conditions.

Compared to last week, we saw major reversals to the upside in the Bitcoin 3-months futures basis and perpetual funding rate. There was a generally a sharp increase across futures and perpetual positioning indicators last week.

The Crypto Fear & Greed Index remains in “Greed” territory as of this morning.

Performance dispersion among cryptoassets has recently picked up again, albeit from lower levels.

Im Allgemeinen bedeutet eine hohe Leistungsstreuung zwischen den Kryptoassets, dass die Korrelationen zwischen den Kryptoassets abgenommen haben, was bedeutet, dass Kryptoassets stärker von münzspezifischen Faktoren abhängig sind.

At the same time, altcoin outperformance has increased slightly last week and is now at only 35% of altcoins outperforming Bitcoin on a weekly basis.

In general, altcoin outperformance goes hand in hand with an increase in crypto dispersion, i.e. Bitcoin and altcoins are generally trading up during “altseason” with altcoins outperforming Bitcoin. Broader altcoin outperformance is usually a sign of increasing risk appetite and broader altcoin underperformance a sign of increasing risk aversion.

Krypto Asset Flows

Last week saw the strongest net inflows in global crypto ETPs year-to-date.

In aggregate, we saw slight net fund inflows in the amount of +203.7 mn USD (week ending Friday).

Bitcoin funds attracted the lion’s chare of these inflows with +197.4 mn USD of net inflows last week.

Ethereum funds also experienced net inflows (+11.4 mn USD) while other altcoin-based funds were essentially flat (+0.3 mn USD).

In contrast, thematic & basket crypto funds struggled last week with -5.4 mn USD in net outflows.

Besides, the NAV discount of the biggest Bitcoin fund in the world – Grayscale Bitcoin Trust (GBTC) – has narrowed significantly to the highest level year-to-date which also implies some net inflows into this fund vehicle.

In contrast, the beta of global Hedge Funds to Bitcoin over the last 20 trading days was slightly negative, implying that global hedge funds have a negative net exposure to cryptoassets. However, the beta is still too small to consider it statistically significant. Global hedge funds still appear to be neutrally positioned with respect to cryptoassets at the moment and therefore rather underexposed. Further upside in cryptoassets should induce these types of investors to increase their exposure, too.

On-Chain Tätigkeit

Before the latest spike in prices, bitcoin short-term holders briefly went below cost-basis (~26.4k USD) and we saw some level of capitulation of this investor cohort in a spike in realized losses on-chain.

So, there was some element of short-term “seller exhaustion” that supported a renewed increase in prices.

From a pure investor perspective, short-term holders are usually considered to be “weak hands” with a higher probability of distribution when prices decline.

Apart from that, bitcoins continued to flow out of exchanges on a net basis as prices moved upwards which implies ongoing buying interest and accumulation in the background.

This happened at a back of still very strong exchange inflows from miners. The majority of these exchange transfers have been coming from “Poolin” BTC mining pool which appears to be liquidating a significant part of its BTC balances. However, overall BTC miner wallet balances have continued to trend up.

Notwithstanding, overall Bitcoin supply continues to become scarcer with almost 69% of supply remaining inactive for more than one year.

Another interesting development in recent weeks is the continued increase in OTC desk balances of bitcoins that signals and increased demand for bitcoins from institutional investors.

During the latest spike in prices, the Bitcoin mempool saw a sharp increase as well to levels last seen during the BRC-20 inscription hype in May. However, transaction fees remained relatively low. Other core on-chain such as active addresses or active entities continued to recover as well.

Krypto-Asset-Derivate

Last week, we saw one of the most significant reversals in derivatives metrics.

The recent spike in prices was also fuelled by a significant spike in BTC futures short liquidations that increased to the highest level since March 2023. Consistent with this development, perpetual funding rates and the 3-months futures basis rate increased as well. At the time of writing, the average 3-months annualized futures basis is at 4.36% p.a.

That being said, our in-house Bitcoin futures and perpetual positioning indicator already signals that long positioning is stretched which increases the probability of a short-term set-back in prices.

In the BTC options space, implied volatilities increased significantly consistent with the sharp reversal in prices. BTC 1-month implied volatilities increased above 50% again for the first time since April 2023. Option open interest also increased significantly (by ~100k BTC notional) in the run-up to the latest spike in prices.

Unterm Strich

Blackrock’s Bitcoin ETF filing in the US has sparked a new wave of optimsim in crypto assets.

Our in-house Crypto Sentiment Index has surged significantly throughout last week.

As a result, global crypto ETP fund flows increased to the highest level year-to-date.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.