Portfolios können von der Anlage in Kryptowährungen profitieren, da sie ein Engagement in Vermögenswerten mit hohem Aktienanteil und eine Diversifizierung des Portfolios ermöglichen.

Lesen Sie weiter, um mehr über Kryptoanlagen im Kontext der Portfoliotheorie zu erfahren.

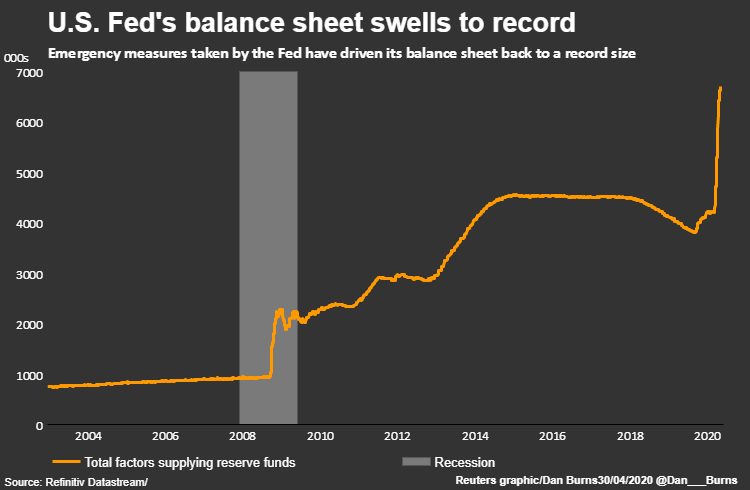

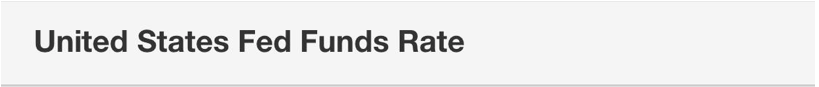

Geldpolitik und ein sehr erfolgreiches Investitionsjahrzehnt

Das vergangene Jahrzehnt war eines der erfolgreichsten Anlagejahrzehnte der Geschichte: US-Aktien stiegen um durchschnittlich 248%, der US-Immobilienmarkt um 200% und Gold als "sicherer Hafen" um 40%. Die lockere Geldpolitik als Folge der Finanzkrise hat sicherlich einen großen Teil zu diesem Trend beigetragen. Denn Alternativen wie Sparkonten oder Lebensversicherungen sind in Zeiten von Niedrigzinsen und Geldmengenausweitung einfach keine Option mehr. Die beiden folgenden Grafiken verdeutlichen dieses Phänomen sehr gut.

Auch heute, in Zeiten der Corona-Krise, scheint die Rallye kein Ende zu nehmen.

Aber wohin soll das Geld sonst fließen?

Krypto-Assets als Allokation - warum?

Erfahrene Anleger wissen inzwischen, dass Bitcoin die beste Investition des letzten Jahrzehnts war und dass Kryptoanlagen heute die am schnellsten wachsende Anlageklasse sind.

Dennoch stellt sich die Frage, ob es das Risiko wert ist, das ein Anleger aufgrund der Volatilität und anderer Faktoren eingehen muss.

Ich habe bereits geschrieben über der beste Weg für Investitionen in Krypto-Vermögenswerte und ihre unterschiedlichen Werttreiber Unser heutiges Thema ist: Ist es aus portfoliotheoretischer Sicht sinnvoll, Krypto einzubeziehen? Warum sprechen Starinvestoren und Milliardäre wie Mike Novogratz, die Winklevoss-Zwillinge oder Paul Tudor Jones so enthusiastisch über diese Anlageklasse?

Die Antwort liegt im Verhältnis Sharp.

Die Sharpe Ratio berücksichtigt nicht nur die Performance, sondern auch die Schwankungsbreite (Volatilität) eines Portfolios und relativiert die beiden Variablen. Sie gibt also an, wie viel Rendite ein Portfolio pro Risikoeinheit bietet.

Je höher die Sharpe Ratio, desto mehr entschädigt das Portfolio für das eingegangene Risiko.

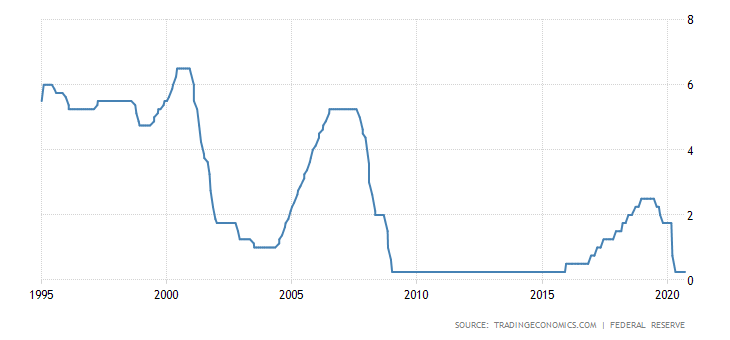

Als Chartered Alternative Investment Analyst (CAIA) wollte ich herausfinden, welche Auswirkungen eine Allokation von Kryptowährungen auf verschiedene Portfoliotypen wie das Norwegen-Modell, das Family-Office-Modell oder das Stiftungsmodell hat. Dabei war es wichtig, nicht nur das steigende Alpha zu betrachten (natürlich, wenn man bedenkt, dass es sich hierbei um den Vermögenswert mit der besten Wertentwicklung in den letzten Jahren handelt), sondern sich insbesondere auf die Sharpe Ratio und damit auf das Beta (systemisches Risiko) zu konzentrieren.

Welche Arten von Portfolios profitieren am meisten von Kryptowährungen?

Kurz gesagt, jedes Portfolio profitiert von einer Allokation, nicht nur in Bezug auf die Performance (Alpha), sondern auch in Bezug auf das Risiko-Rendite-Verhältnis, gemessen durch die Sharpe Ratio.

Dies ist besonders erstaunlich, wenn man bedenkt, dass es sich um eine sehr volatile Anlageklasse handelt. Die Volatilität wird in der Portfoliotheorie bestraft, und es braucht schon einiges, um die Sharpe Ratio zu erhöhen. Erst durch diesen Anstieg legitimiert sich ein Vermögenswert als Ergänzung zu einem ausgewogenen Portfolio.

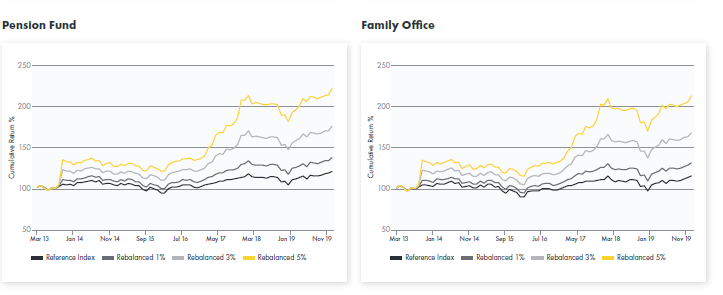

Family Offices und Pensionsfonds profitieren am meisten von einer 5%-Allokation von Kryptoanlagen in ihrem Portfolio. Die Sharpe Ratio für einen Pensionsfonds verdoppelt sich und die eines Family Offices steigt sogar um 180%, also fast um das Dreifache. Die steigende Performance, das zusätzlich generierte Alpha, wird durch die folgende Grafik gut veranschaulicht:

Die annualisierte Performance der jeweiligen Portfolios hätte sich in diesem Zeitraum sogar vervierfacht oder verfünffacht. Und das nur bei einer 5%-Beimischung eines Krypto-Indexes.

Wichtigste Erkenntnisse

Wie lauten also unsere Schlussfolgerungen?

- Die Anlage eines Teils Ihres Vermögens in Kryptowährungen ist aus Sicht der Portfoliotheorie sinnvoll. Und zwar nicht nur in Bezug auf die Performance, sondern auch im Hinblick auf das Risiko-Rendite-Verhältnis.

- Übermäßiges Gelddrucken scheint die Märkte weiter anzuheizen, da es an Alternativen mangelt. Aktien und Immobilien sowie Kryptowährungen profitieren davon.

- Krypto-Assets sind eine eigenständige Anlageklasse und sollten als solche, auch aufgrund ihrer geringen Korrelation, zumindest ein kleiner Bestandteil eines jeden Portfolios sein

- "Das größte Risiko bei Kryptowährungen ist, keine zu besitzen"

Der vollständige Bericht mit den genauen Ergebnissen und Einzelheiten zur Methodik kann heruntergeladen werden hier. Oder buchen Sie Ihren kostenlosen Workshop, der alle Themen rund um Blockchain und Krypto abdeckt, hier.

Verwandte Artikel

- Ein Anfängerleitfaden für Krypto-Investitionen

- Korrelationen in der Portfoliotheorie

- Der Einfluss von Kryptowährungen auf die Sharpe Ratio traditioneller Anlagemodelle

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes

Haftungsausschluss

In keinem Fall können Sie die ICONIC HOLDING GMBH, ihre Tochtergesellschaften oder eine mit ihr verbundene Partei für direkte oder indirekte Anlageverluste haftbar machen, die durch Informationen in diesem Artikel verursacht wurden. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die ICONIC HOLDING GMBH ist in keiner Rechtsordnung als Anlageberater registriert. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Investitionsentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Investitionsmöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Prognosen und Meinungen, die sich als wesentlich ungenau erweisen können und von Natur aus erheblichen Risiken und Unsicherheiten unterliegen, die außerhalb der Kontrolle der ICONIC HOLDING GMBH liegen. Unsere Artikel und Berichte drücken unsere Meinungen aus, die wir auf der Grundlage allgemein verfügbarer Informationen, Feldforschung, Schlussfolgerungen und Ableitungen durch unsere Due Diligence und unseren analytischen Prozess gewonnen haben.

Die ICONIC HOLDING GMBH geht davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen, die wir für korrekt und zuverlässig halten. Diese Informationen werden jedoch "wie besehen", ohne jegliche Garantie, präsentiert.