Atempause für Kryptoasset-Preise: On-Chain-Metriken zeigen einige Gewinnmitnahmen von Langfristbesitzern

DDA Krypto-Marktimpuls, 25. April 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Die Kryptoasset-Preise haben eine Verschnaufpause eingelegt, da einige Investoren nach der starken Rallye in diesem Jahr Gewinne mitgenommen zu haben scheinen

- Unser hauseigener Krypto-Sentiment-Index bleibt bisher noch neutral

- On-Chain-Metriken deuten darauf hin, dass es einige Gewinnmitnahmen von Langzeitbesitzern gab, da einige ältere Münzen in Bewegung waren

Chart der Woche

Kryptoasset Leistung

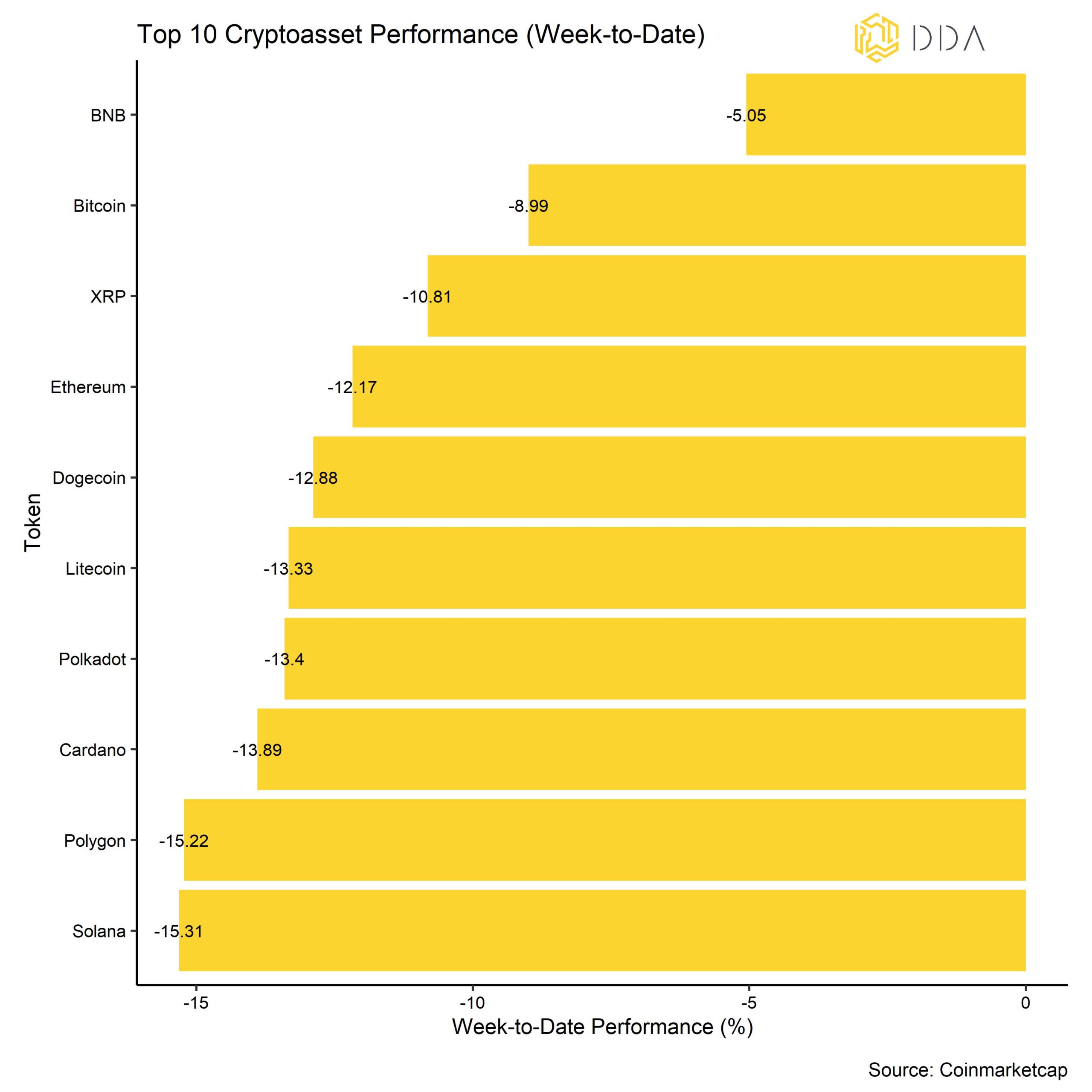

Die Performance der Kryptowährungen in der vergangenen Woche wurde vor allem durch Gewinnmitnahmen von Langzeitbesitzern belastet, nachdem wichtige Kryptowährungen wie Bitcoin in diesem Jahr bereits um mehr als 80% gestiegen waren. Falsche Aussagen der US-Notenbank, die auf eine weitere Zinserhöhung im Mai hindeuteten, drückten ebenfalls auf die allgemeine Risikostimmung des Marktes.

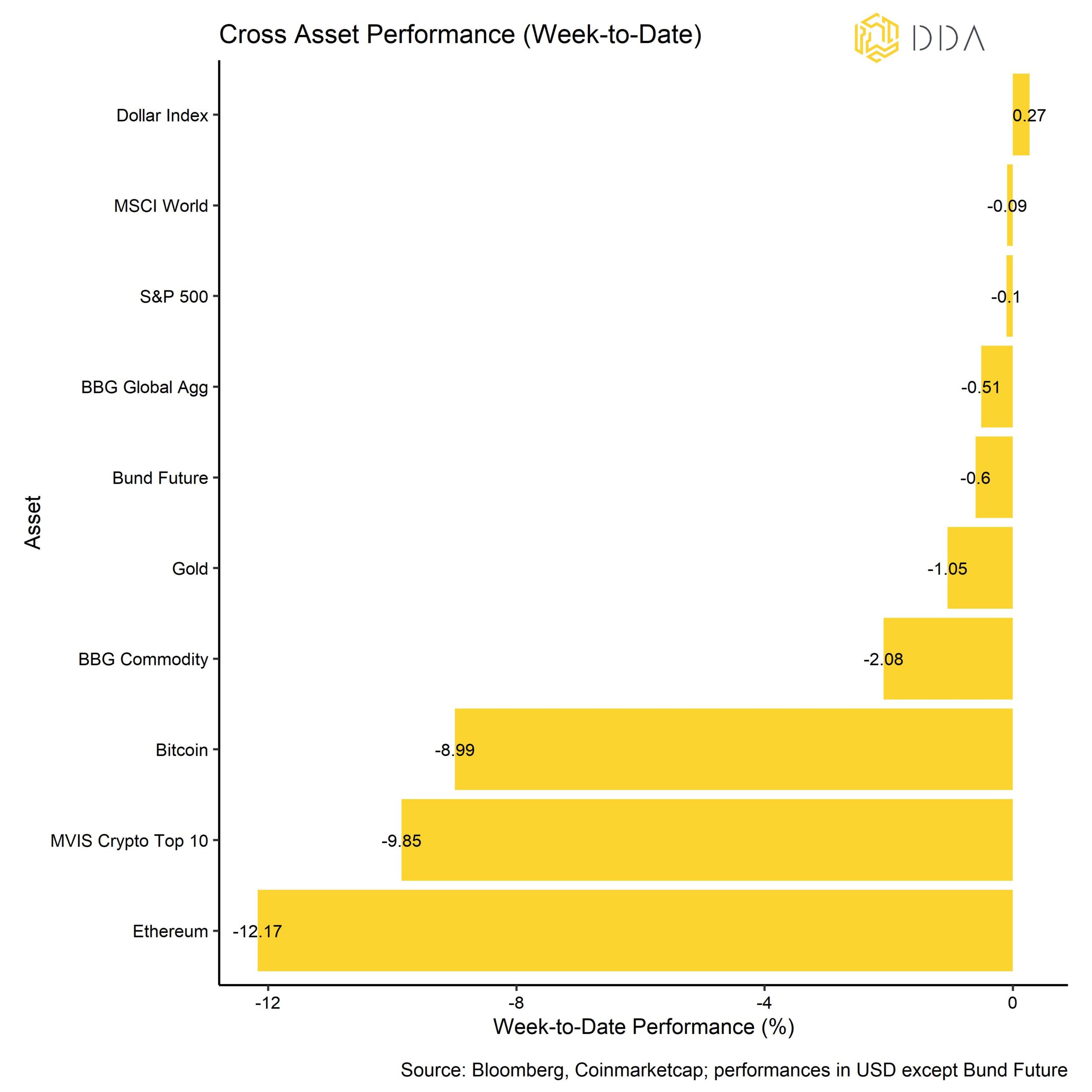

Im Vergleich zu traditionellen Finanzanlagen waren Kryptoanlagen die Hauptverlierer. Globale Aktien und Anleihen entwickelten sich ebenfalls negativ, während der US-Dollar aufwertete.

Unter den wichtigsten Kryptoassets waren BNB, Bitcoin und XRP die relativen Outperformer. Die Outperformance der Altcoins, die kurz nach dem Ethereum Shapella-Upgrade zu beobachten war, scheint in der vergangenen Woche wieder abgeklungen zu sein.

Krypto-Marktstimmung

Im Einklang mit dieser negativen Entwicklung hat sich unser hauseigener Krypto-Sentiment-Index erneut gedreht, ist aber derzeit noch neutral. 7 von 15 Indikatoren liegen über ihrem kurzfristigen Trend.

Im Vergleich zur letzten Woche gab es große Umschwünge im Crypto Fear & Greed Index und in der BTC 1-Monats 25-Delta Option Skew.

Der Crypto Fear & Greed Index ist in der letzten Woche auf "Neutral" gesunken.

Die Streuung zwischen den Kryptoassets hat in letzter Zeit etwas abgenommen, was bedeutet, dass Kryptoassets zunehmend nach systematischen Faktoren gehandelt werden. Gleichzeitig hatte die Outperformance von Altcoins nach der Aufwertung von Ethereum Shapella zugenommen, kehrte sich aber wieder um und ist auf 1-Wochen- und 1-Monats-Basis immer noch relativ niedrig. Im Allgemeinen geht die Outperformance von Altcoins mit einer zunehmenden Streuung der Kryptowährungen einher, d. h. Bitcoin und Altcoins werden während der "Altsaison" in der Regel höher gehandelt als Bitcoin, wobei sich Altcoins besser entwickeln als Bitcoin.

Eine breitere Altcoin-Outperformance ist in der Regel ein Zeichen für eine erhöhte Risikobereitschaft, während eine geringe Altcoin-Outperformance auf eine eher vorsichtige Marktstimmung hindeutet. Eine sehr geringe Outperformance von Altcoins sollte jedoch eher als antizyklische Kaufgelegenheit betrachtet werden.

Krypto Asset Flows

In der vergangenen Woche kam es zu erheblichen Nettokapitalabflüssen aus Kryptoassets.

Insgesamt verzeichneten wir Netto-Fondsabflüsse in Höhe von -33,9 Mio. USD (Woche bis Freitag), wobei der Großteil der Abflüsse aus Bitcoin-Fonds floss (-55,4 Mio. USD). Im Gegensatz dazu konnten Ethereum-Fonds nach dem erfolgreichen Shapella-Upgrade erhebliche Zuflüsse verzeichnen (+14,7 Mio. USD), während sowohl Altcoin-Fonds ohne Ethereum als auch Basket & Thematic Cryptoasset-Fonds ebenfalls Nettozuflüsse verzeichneten (+1,7 Mio. USD bzw. +5,0 Mio. USD).

Die Nettomittelzuflüsse der letzten Woche sprechen für eine mögliche "Altsaison", d.h. ein Umfeld, in dem Altcoins dazu neigen, Bitcoin nachhaltiger zu übertreffen.

Außerdem hat sich der Abschlag auf den Nettoinventarwert des größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - etwas vergrößert, was auf geringfügige Nettoabflüsse aus diesem Fondsvehikel hindeutet.

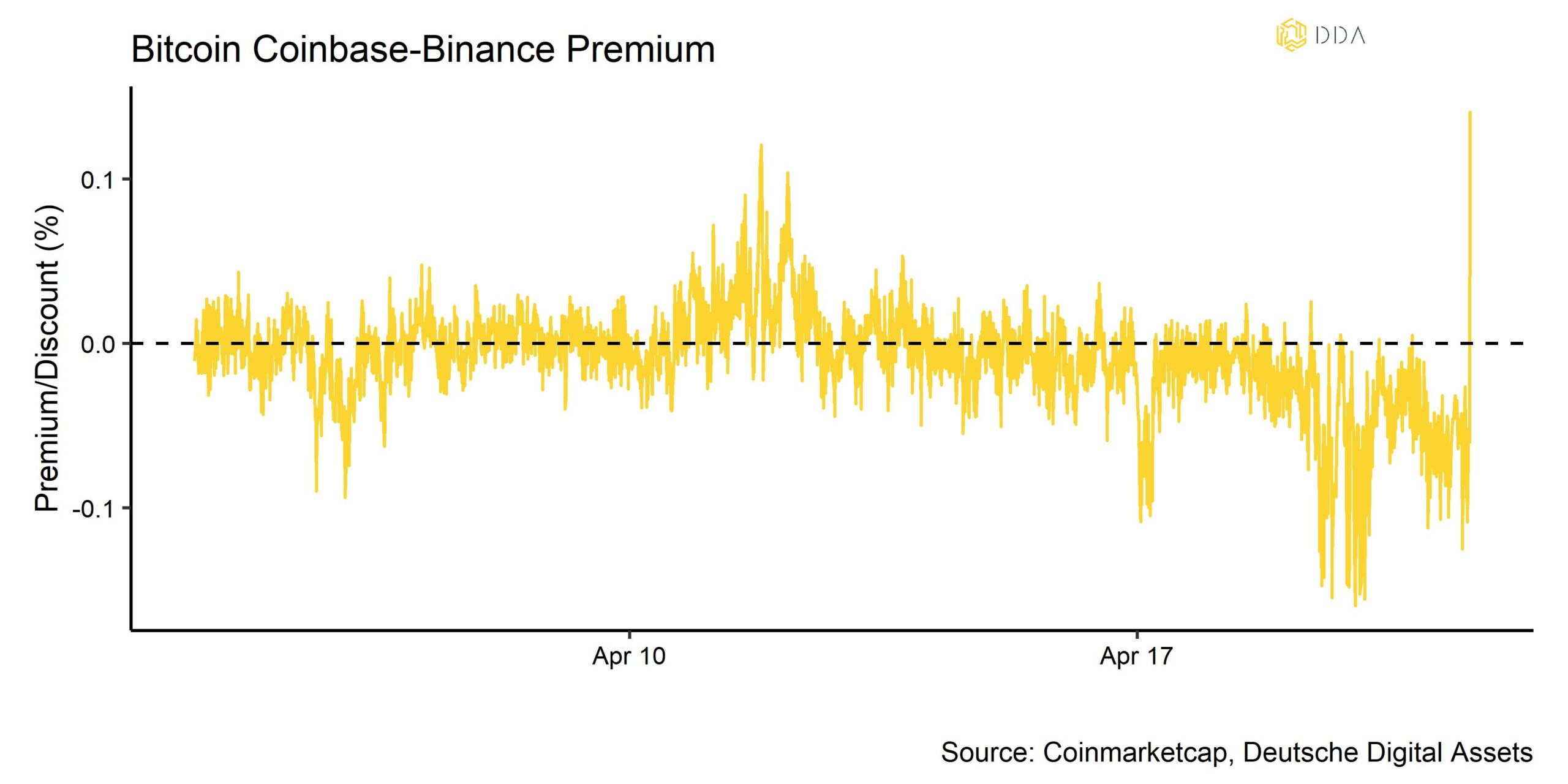

Eine der wichtigsten Veränderungen im Vergleich zur letzten Woche war wahrscheinlich die Tatsache, dass das Beta der globalen Hedge-Fonds zu Bitcoin in den letzten 20 Handelstagen weiter in den positiven Bereich gestiegen ist, was bedeutet, dass die globalen Hedge-Fonds ihr Nettoengagement in Kryptoassets weiter erhöht haben.Die auf Coinbase gehandelten Bitcoin-Preise standen gegenüber den auf Binance gehandelten (Coinbase-Binance-Prämie) die ganze Woche über deutlich unter Druck, was auf einen erhöhten Verkaufsdruck von institutionellen Anlegern gegenüber Kleinanlegern hindeutet (siehe Chart-der-Woche). In jüngster Zeit haben sie jedoch wieder deutlich zugenommen, was auf eine erneute Umkehr des institutionellen Kaufinteresses hindeutet.

On-Chain Tätigkeit

Der Eindruck, dass größere institutionelle Anleger in der vergangenen Woche Nettoverkäufer waren, wird auch durch einige On-Chain-Kennzahlen bestätigt. Die On-Aktivität für Bitcoin war in der letzten Woche eher vorsichtig, da die Langzeitbesitzer anscheinend einige Gewinne mitnahmen. Dies zeigt sich zum Beispiel in der Zunahme der ruhenden Langzeitbesitzer, die kurz vor dem jüngsten Ausverkauf am 19.4. in die Höhe schoss.

Dormancy ist die durchschnittliche Anzahl der vernichteten Tage pro umgesetzter Münze und ist definiert als das Verhältnis von vernichteten Münztagen und Gesamttransfervolumen.

Zerstörte Münztage ist ein technisches Konzept in der On-Chain-Metrik, das das jeweilige Alter der ausgegebenen Münzen berücksichtigt. Ältere Münzen haben eine höhere Anzahl von Tagen, die "zerstört" werden, wenn diese Münzen ausgegeben werden. Das Ausgeben älterer Münzen wird in der Regel als bärisches Signal interpretiert, da es auf einen gewissen Verlust an Überzeugung bei langfristigen Investoren/"starken Händen" hindeutet.

Im Allgemeinen gab es in der letzten Woche auch einen allmählichen Anstieg der Bitcoin-Börsensalden, was darauf hindeutet, dass es mehr Zuflüsse als Abflüsse gab, was ebenfalls zu der rückläufigen Preisentwicklung beitrug.

Die Ethereum-Börsensalden sanken jedoch weiter und erreichten letzte Woche ein neues Mehrjahrestief.

Zentrale On-Chain-Kennzahlen wie die Anzahl der aktiven Adressen, die Gesamtzahl der Wallet-Adressen, die nicht Null sind, das Transfervolumen in USD oder die durchschnittliche Blockgröße für Bitcoin sind ebenfalls zurückgegangen, was ebenfalls zu der schwachen Performance beitrug. Das Gesamttransfervolumen, gemessen an der Gesamtzahl der Transaktionen auf der Bitcoin-Blockchain, erreichte jedoch den höchsten Wert seit April 2019. Das Transfervolumen scheint immer noch gut durch die zugrunde liegende Menge an Inskriptionen gestützt zu werden, da die Anzahl der neuen täglichen Inskriptionen gestern den höchsten Stand aller Zeiten erreichte. Da es sich bei den meisten dieser Inskriptionen jedoch nur um Text handelt, wurde die durchschnittliche Blockgröße nicht wesentlich beeinflusst.

Krypto-Asset-Derivate

Der jüngste Preisrückgang wurde durch einen Anstieg der Bitcoin-Futures-Long-Liquidationen, die auf den höchsten Stand seit Mitte März 2023 anstiegen, noch etwas verschärft. Auch bei Ethereum-Futures stiegen die Long-Liquidationen auf den höchsten Stand seit dem 03.09.2023.

Zu Liquidationen kommt es, wenn Händler durch ungünstige Kursbewegungen in die Irre geführt werden und nicht mehr in der Lage sind, die von der Börse geforderten Einschusszahlungen zu leisten. Dies hat in der Regel einen verstärkenden Effekt auf die Marktbewegungen, da die Börse die gegenteilige Position des Handels einnehmen muss (in diesem Fall verkaufen), um die Position zu schließen.

Eine erhebliche Anzahl von Futures-Liquidationen ist jedoch auch ein Kontraindikator, da sie signalisiert, dass eine Marktbereinigung stattgefunden hat und der Verkaufsdruck nachlässt. Daher ist es recht wahrscheinlich, dass sich der Markt auf diesen Preisniveaus wieder zu stabilisieren beginnt.

In der Zwischenzeit sind die impliziten Volatilitäten von Bitcoin und Ethereum trotz der jüngsten Preiskorrektur tendenziell gesunken und liegen nun bei 50% bzw. 53% für 1-Monats-Optionen. Die 25-Delta-Optionen haben sich jedoch weitgehend zugunsten von Put-Kontrakten vergrößert und sind nun wieder positiv, was darauf hindeutet, dass die Anleger zunehmend zu Put-Optionen übergegangen sind, um sich gegen weitere Abwärtsrisiken abzusichern. Put-Optionen geben dem Inhaber das Recht, eine bestimmte Menge an Münzen zu einem vorher festgelegten Preis (Strike) in der Zukunft zu verkaufen.

Unterm Strich

Die Kryptoasset-Preise haben eine Verschnaufpause eingelegt, da einige Anleger nach der starken Rallye in diesem Jahr offenbar Gewinne mitgenommen haben.

Unser hauseigener Krypto-Sentiment-Index bleibt bislang neutral.

On-Chain-Metriken deuten darauf hin, dass es einige Gewinnmitnahmen von Langzeitbesitzern gab, da einige ältere Münzen in Bewegung waren.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.