Wale auf dem Vormarsch: Untersuchung von Bitcoins beträchtlichen Börsenzuflüssen und des US Bitcoin Spot ETF Effekts

DDA Krypto-Marktimpuls, 04. September 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- In der vergangenen Woche verzeichneten Kryptoassets eine schwache Performance aufgrund des zunehmenden Verkaufsdrucks nach der positiven Nachricht über die mögliche Zulassung eines US Bitcoin Spot ETF

- Unser hauseigener Crypto Sentiment Index ist immer noch im rückläufigen Bereich

- Bitcoin verzeichnete erhebliche Zuflüsse von Walen, die den jüngsten SEC-bedingten Preisanstieg als Ausstiegsliquidität genutzt haben könnten

Chart der Woche

Kryptoasset Leistung

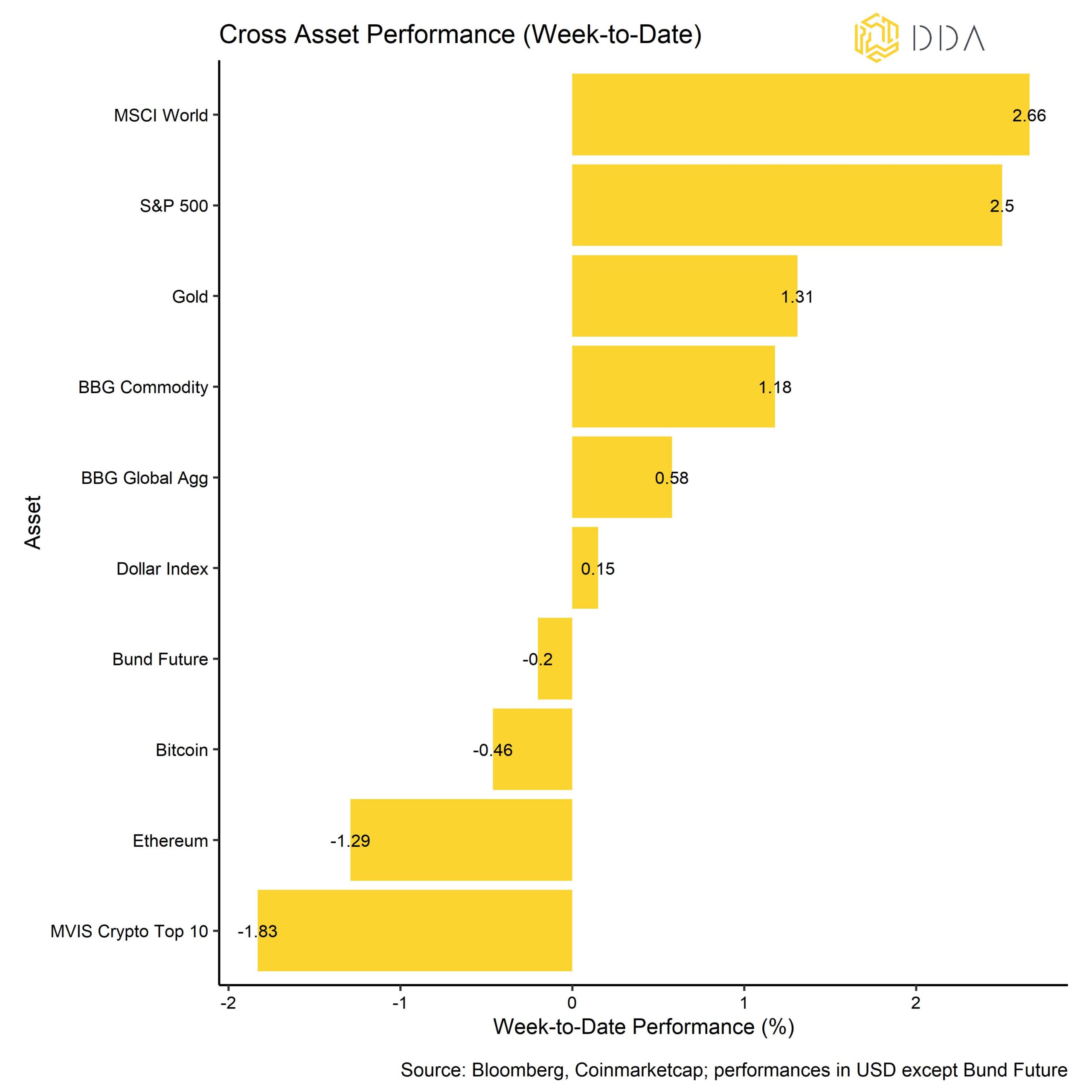

In der vergangenen Woche verzeichneten Kryptoassets eine schwache Performance, was auf den zunehmenden Verkaufsdruck nach der positiven Nachricht über die mögliche Zulassung eines US-amerikanischen Bitcoin-Spot-ETF zurückzuführen war. Genauer gesagt, wies das Gericht des DC Circuit die Ansicht der SEC, dass der ETF-Vorschlag von Grayscale nicht zulässig sei, entschieden zurück. "um betrügerische und manipulative Handlungen und Praktiken zu verhindern". Das Gericht hat die SEC nicht angewiesen, den ETF-Antrag von Grayscale zu genehmigen. Es sagte lediglich, dass die Analyse der SEC zum Thema "Betrug und Manipulation" falsch war, was bedeutet, dass die SEC den ETF-Antrag von Grayscale erneut prüfen muss.

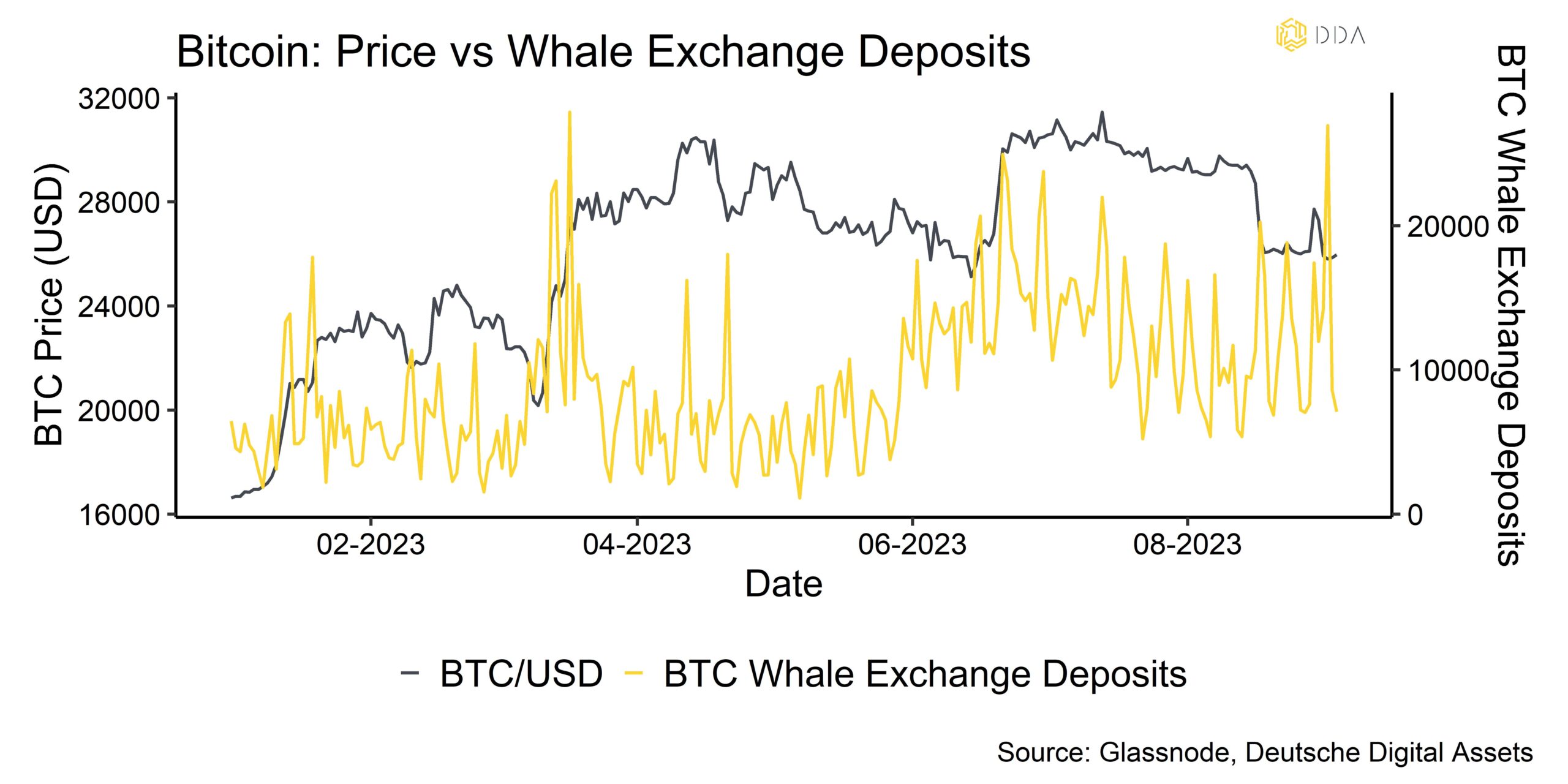

Bloomberg-Analysten weisen jedoch bereits auf eine sehr hohe Wahrscheinlichkeit für die Zulassung eines Bitcoin-Spot-ETF in den USA hin. Diese Art von Nachrichten scheint mehr als eingepreist zu sein. In diesem Zusammenhang verzeichnete Bitcoin erhebliche Börsenzuflüsse von Walen, die den jüngsten Preisanstieg im Zusammenhang mit dem Bitcoin-ETF als Ausstiegsliquidität genutzt haben könnten. (Chart-der-Woche).

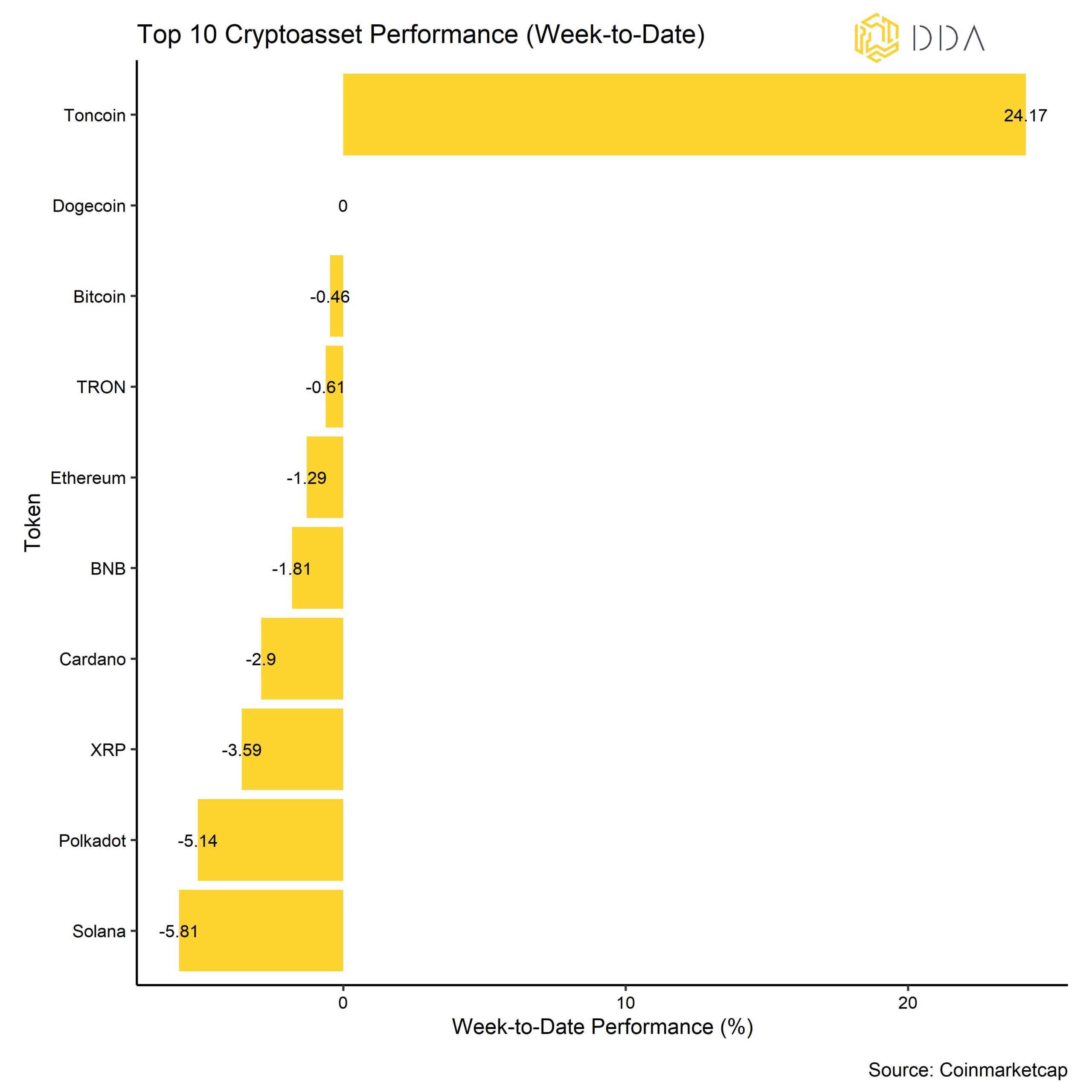

Unter den Top 10 der Kryptoassets waren Toncoin, Dogecoin und Bitcoin die relativen Outperformer. Toncoin (TON) trotzte der allgemein rückläufigen Marktstimmung, da der Token, der mit der Messenger-Plattform Telegram verbunden ist, Gerüchten zufolge auf Binance debütieren soll.

Im Allgemeinen war die Outperformance von Altcoins gegenüber Bitcoin in der vergangenen Woche weiterhin gering. Auf Basis der von uns beobachteten Altcoins konnten nur 30% der Altcoins Bitcoin auf Wochenbasis übertreffen.

Krypto-Marktstimmung

Unser hauseigener Krypto-Sentiment-Index ist im Vergleich zur letzten Woche erneut gesunken und befindet sich weiterhin im rückläufigen Bereich. Nur 2 von 15 Indikatoren liegen über ihrem kurzfristigen Trend.

Im Vergleich zur letzten Woche kam es beim BTC Futures & Perpetual Positioning Proxy und beim Crypto Dispersion Index zu größeren Umschwüngen nach unten.

Der Crypto Fear & Greed Index bleibt heute Morgen im Bereich "Fear".

Die Streuung der Wertentwicklung von Kryptoassets hat sich seit dem Liquidationsereignis Ende August weiter deutlich verringert.

Im Allgemeinen bedeutet eine geringe Leistungsstreuung zwischen Kryptoassets, dass die Korrelationen zwischen Kryptoassets hoch sind, was bedeutet, dass Kryptoassets stärker von systematischen Faktoren abhängig sind.

Gleichzeitig war die Outperformance der Altcoins, wie oben erwähnt, in der letzten Woche weiterhin gering und liegt nun bei 30% Altcoins, die Bitcoin auf wöchentlicher Basis übertreffen.

Im Allgemeinen geht die Outperformance von Altcoins mit einer zunehmenden Streuung der Kryptowährungen einher, d. h. Bitcoin und Altcoins werden während der "Altsaison" in der Regel höher gehandelt, wobei Altcoins besser abschneiden als Bitcoin. Eine breitere Outperformance von Altcoins ist in der Regel ein Zeichen für zunehmende Risikobereitschaft und eine breitere Underperformance von Altcoins ein Zeichen für zunehmende Risikoaversion.

Krypto Asset Flows

In der vergangenen Woche gab es Nettoabflüsse aus globalen Krypto-ETPs mit Ausnahme von Bitcoin.

Insgesamt verzeichneten wir Nettomittelabflüsse in Höhe von -21,8 Mio. USD (Woche bis Freitag).

Dementsprechend verzeichneten Ethereum-Fonds und andere Altcoin-basierte Fonds erhebliche Nettoabflüsse (-16,9 Mio. USD bzw. -8,8 Mio. USD auf Nettobasis).

Thematische und Korb-Kryptofonds verzeichneten letzte Woche ebenfalls Nettoabflüsse in Höhe von 2,5 Mio. USD.

Im Gegensatz dazu verzeichneten Bitcoin-basierte Fonds Nettozuflüsse (+6,5 Mio. USD).

Außerdem hat sich der Abschlag auf den Nettoinventarwert des größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - in der vergangenen Woche weiter verringert, was auf Nettozuflüsse in dieses Fondsvehikel schließen lässt. Die Verringerung des Abschlags auf den Nettoinventarwert scheint mit der Erwartung zusammenzuhängen, dass dieser Trust mit größerer Wahrscheinlichkeit in einen Bitcoin-Spot-ETF umgewandelt werden wird.

Darüber hinaus war das Beta der globalen Krypto-Hedgefonds gegenüber Bitcoin in den letzten 20 Handelstagen weiterhin niedrig, was bedeutet, dass die globalen Krypto-Hedgefonds immer noch ein geringeres Marktengagement in Kryptoanlagen haben.

On-Chain Tätigkeit

Die Gesamtaktivität auf der Bitcoin-Blockchain ist weniger ermutigend als vor einer Woche, obwohl es immer noch einige positive Lichtblicke gibt. Zum Beispiel haben sich die aktiven Adressen auf der Bitcoin-Blockchain noch nicht von dem Einbruch Ende August erholt. Die neuen Adressen haben jedoch eine gewisse Widerstandsfähigkeit gezeigt und bleiben auf dem bisherigen Jahreshöchststand. Außerdem bewegt sich die Bitcoin-Hash-Rate in der Nähe von Allzeithochs, da auch die Mining-Schwierigkeit ein neues Allzeithoch erreicht hat. Die Anzahl der Adressen mit einem Guthaben ungleich Null ist ebenfalls weiter angestiegen.

Die Überweisungsvolumina befinden sich nach wie vor auf einem mehrjährigen Tiefstand, was die Marktbewegungen und die Volatilität derzeit erschwert.

In der Zwischenzeit sinken die Börsensalden weiter, was auf eine anhaltende Akkumulation auf Nettobasis schließen lässt. Dies gilt sowohl für Bitcoin (BTC) als auch für Ethereum (ETH).

Die jüngsten BTC-Börsenzuflüsse wurden von kurzfristigen Inhabern dominiert, und die meisten dieser Zuflüsse waren verlustbehaftet, d. h. die Mehrheit der Börsenzuflüsse erfolgte aufgrund von realisierten Verlusten.

Es ist jedoch wichtig zu beachten, dass sowohl lang- als auch kurzfristige Bitcoin-Inhaber in zunehmendem Maße Gewinne realisieren. Es scheint, als ob die Investoren ihre Positionen neutralisieren, da sie nicht erwarten, dass der Aufwärtstrend vorerst anhält.

Interessant ist auch die Beobachtung, dass Anleger mittlerer Größe ($100k - $1M) weiterhin in erheblichem Umfang Münzen von den Börsen abziehen, während größere Geldbörsen (> $1M) Nettoeinzahlungen von Münzen an Börsen vornehmen. Tatsächlich sind die Einzahlungen von Walen an Börsen auf den höchsten Stand seit dem Zusammenbruch der SVB im März 2023 angestiegen. Wale könnten den jüngsten Preisanstieg als "Ausstiegsliquidität" betrachtet und nach den positiven SEC-Nachrichten in die Stärke verkauft haben (Chart-der-Woche). Wale sind Unternehmen, die mindestens 1000 BTC kontrollieren.

Krypto-Asset-Derivate

In der vergangenen Woche zeigten die Derivatemetriken eine anhaltende Marktbereinigung.

Die Liquidationen von BTC-Long-Positionen haben infolge des jüngsten Ausverkaufs zugenommen, waren aber nicht so ausgeprägt wie während des Liquidationsereignisses Mitte August.

Das offene Interesse sowohl für BTC-Futures als auch für Perpetuals hatte im Vorfeld des jüngsten Preisrückgangs zugenommen und ging mit dem erneuten Preisrückgang wieder zurück. Dies bedeutet, dass die meisten der vor dem Urteil des DC Circuit aufgebauten Long-Positionen in Futures und Perpetuals bereits wieder aufgezehrt wurden.

Trotz der jüngsten Marktturbulenzen ist die implizite 1-Monats-Volatilität von BTC weiter gesunken, da Optionshändler für die Zukunft ein ruhigeres Marktumfeld für Bitcoin zu erwarten scheinen.

Im Zuge des jüngsten Kursrückgangs war ein deutlicher Anstieg des Handelsvolumens von BTC-Puts im Vergleich zu Calls zu beobachten, d. h. BTC-Optionshändler boten verstärkt auf einen Abwärtsschutz. Auch das relative offene Interesse an Puts gegenüber Calls ist weiterhin hoch. Das 1-Monats-25-Delta der BTC-Optionen hat sich ebenfalls deutlich zugunsten der Puts verschoben. Generell signalisiert der Markt für BTC-Optionen derzeit ebenfalls eine rückläufige Stimmung.

In der Zwischenzeit ist der 3-Monats-Basissatz für BTC weiter gesunken und liegt nun bei etwa 3,9% p.a.

Unterm Strich

In der vergangenen Woche verzeichneten Kryptoassets eine schwache Performance, was auf den zunehmenden Verkaufsdruck nach den positiven Nachrichten im Zusammenhang mit der möglichen Genehmigung eines US-Bitcoin-Spot-ETF zurückzuführen ist.

Unser hauseigener Krypto-Sentiment-Index befindet sich immer noch im rückläufigen Bereich.

Bitcoin verzeichnete beträchtliche Börsenzuflüsse von Walen, die den jüngsten SEC-bedingten Preisanstieg als Ausstiegsliquidität genutzt haben könnten.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.