Zuvor hatten wir die ersten Auswirkungen des "China Mining Ban" auf chinesische Bergleute in unserem Artikel vom 21. Juni 2021. Nach fast zwei Monaten ist es nun Zeit für ein Update der Bitcoin-Hash-Rate.

Es ist ziemlich klar geworden, dass China - nach Jahren der Fake News zu diesem Thema - das Bitcoin-Mining nun endlich offiziell verboten zu haben scheint. Wie in unserem letzten Artikel erwähnt, können langfristige Investoren jegliche FUD ("Angst, Unsicherheit, Zweifel") aus China getrost ignorieren. Das Bitcoin-Netzwerk ist widerstandsfähig, robust und antifragil. Während die Hash-Rate in der Tat gesunken ist, da die Miner entweder ihre ASICs einpacken und umziehen oder ihr Geschäft ganz aufgeben, hat sich der Schwierigkeitsindex nach unten angepasst, was es den bestehenden Minern erleichtert, neue Blöcke zu finden und die Blockzeit bei etwa 10 Minuten zu halten.

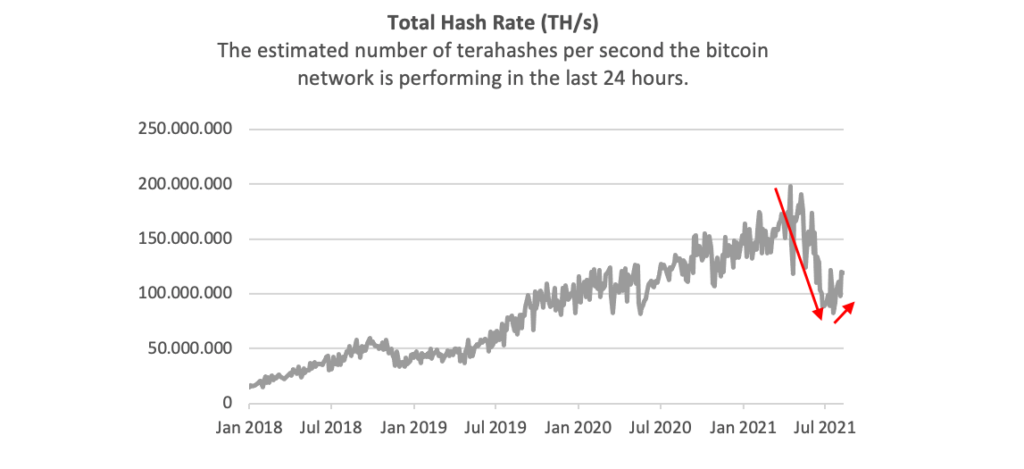

Quelle: Iconic Funds GmbH, blockchain.info

Nach den Rohdaten von blockchain.info ist die gesamte Hash-Rate um ca. 55% gesunken, hat sich aber bereits um ca. 40% vom lokalen Tiefpunkt erholt. Die Bitcoin-Mining-Rat schätzt, dass die Gesamt-Hash-Rate im zweiten Quartal 2021 um etwa 45,5% gesunken ist.

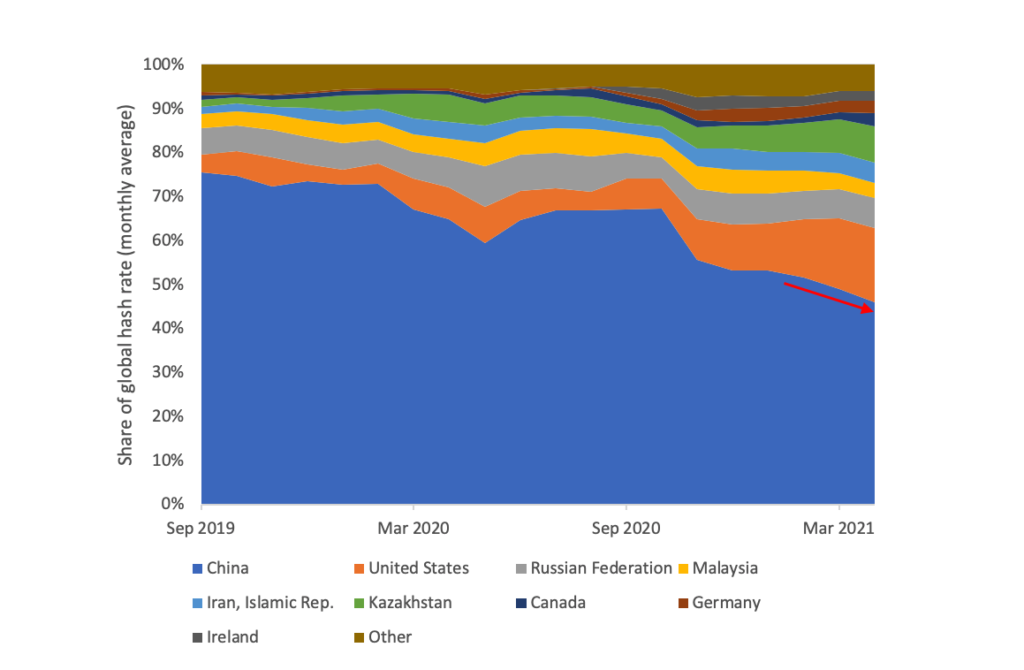

In der Zwischenzeit ist der Anteil Chinas am Bitcoin-Mining-Netzwerk erheblich zurückgegangen. Das Cambridge Centre for Alternative Finance schätzt, dass der Anteil Chinas inzwischen deutlich unter 50% liegt und weiter sinkt.

Quelle: Iconic Funds GmbHCambridge Centre for Alternative Finance

Anderen Quellen zufolge haben 20% der chinesischen Miner (etwa 10% der gesamten Hash-Rate) das Land verlassen. Der Hauptempfänger dieser Abwanderung der Hash-Rate scheint zunächst Nordamerika zu sein, wo Stellflächen, gebrauchte Mining-Ausrüstung und überschüssige Energie jetzt sehr gefragt sind. Ein nordamerikanischer Miner beobachtet neue Stromverträge, die weit über den Marktpreisen liegen. "Was früher vier, fünf oder sechs Cent kostete, kostet jetzt plötzlich 9, 10 oder 11 Cent." Diese Umstellung hat bereits Auswirkungen auf den Kohlenstoff-Fußabdruck von Bitcoin, da der Energiemix in den USA und Kanada viel stärker auf erneuerbare Energien ausgerichtet ist (Quelle).

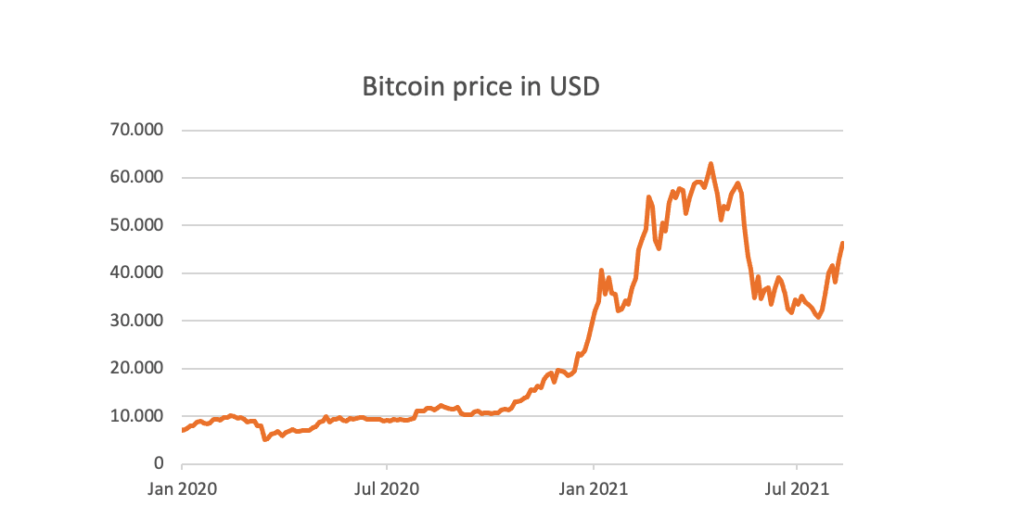

Schließlich hat sich der Bitcoin-Preis bereits um mehr als 50% von seinem Tiefstand im Juli 2021 erholt.

Quelle: Iconic Funds GmbH

Es ist zwar allgemein anerkannt, dass weder der Bitcoin-Preis die Hash-Rate noch die Hash-Rate den Bitcoin-Preis beeinflusst, aber es könnte sein, dass die Tail-Ends (große Preisschwankungen innerhalb eines kurzen Zeitraums) tatsächlich einen Anreiz für Miner darstellen, ihre Mining-Ausrüstung aufzustocken (oder stillzulegen), wenn das Mining deutlich profitabler (oder weniger profitabel) wird.

Wie wir in unserem ursprünglichen Artikel festgestellt haben, waren die Anleger gut beraten, den China-FUD zu ignorieren, wie sie auch gut beraten sind, jeden FUD zu ignorieren. Bitcoins gut geölte Protokollanpassungen (d.h. Schwierigkeitsanpassungen) führen zu einer Verlagerung der globalen Hash-Rate, die das Potenzial hat, die Diskussion um den CO2-Fußabdruck von Bitcoin weiter zu entschärfen. Die Miner verlagern ihren Standort in der Tat in Länder, die einen stärker auf erneuerbare Energien ausgerichteten Energiemix haben.

- Verbessert sich der Kohlenstoff-Fußabdruck von Bitcoin?

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen

- Der Einfluss von Kryptowährungen auf die Sharpe Ratio traditioneller Anlagemodelle

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes

_ _ _

Haftungsausschluss

In keinem Fall können Sie die ICONIC HOLDING GMBH, ihre Tochtergesellschaften oder eine mit ihr verbundene Partei für direkte oder indirekte Anlageverluste haftbar machen, die durch Informationen in diesem Artikel verursacht wurden. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die ICONIC HOLDING GMBH ist in keiner Rechtsordnung als Anlageberater registriert. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Investitionsentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Investitionsmöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Prognosen und Meinungen, die sich als wesentlich ungenau erweisen können und von Natur aus erheblichen Risiken und Unsicherheiten unterliegen, die außerhalb der Kontrolle der ICONIC HOLDING GMBH liegen. Unsere Artikel und Berichte drücken unsere Meinungen aus, die wir auf der Grundlage allgemein verfügbarer Informationen, Feldforschung, Schlussfolgerungen und Ableitungen durch unsere Due Diligence und unseren analytischen Prozess gewonnen haben.

Die ICONIC HOLDING GMBH geht davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen, die wir für korrekt und zuverlässig halten. Diese Informationen werden jedoch "wie besehen", ohne jegliche Garantie, präsentiert.