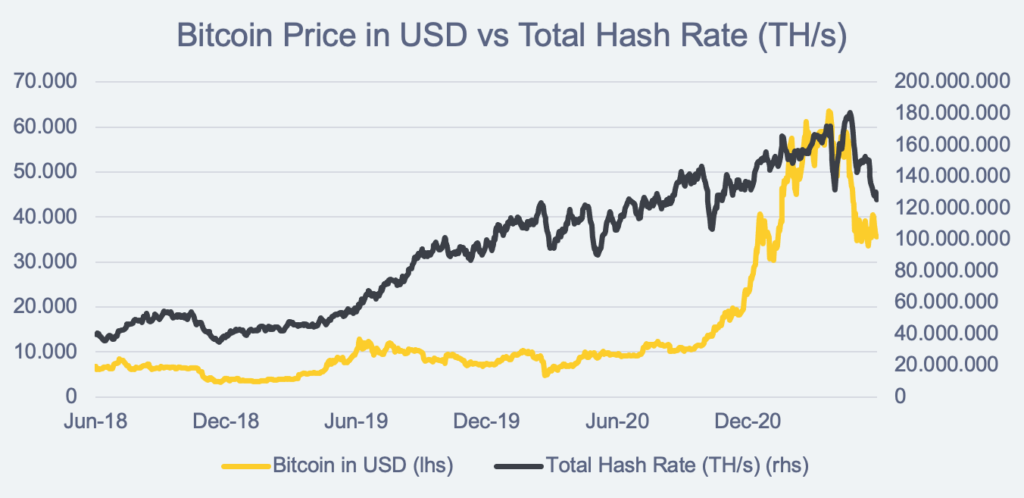

Die Bitcoin-Hashrate ist von ihrem Allzeithoch deutlich gesunken und liegt nun bei einer Rate, die seit November 2020 nicht mehr erreicht wurde.

Nach Daten von blockchain.info liegt die aktuelle Bitcoin-Hashrate derzeit (Stand 21. Juni 2021) bei etwa 110 Mio. TH/s, 30% unter dem Allzeithoch von etwa 190 Mio. TH/s von vor einigen Wochen.

Das Bitcoin-Mining hat sich weitgehend in China konzentriert, da die Miner aggressiv nach billigen Stromquellen auf der ganzen Welt suchten. Laut blockchain.info waren 65% der weltweiten Bitcoin-Mining-Kapazität in China angesiedelt.

Überkapazitäten bei (teilweise) erneuerbaren Energiequellen, insbesondere bei der Wasserkraft in der chinesischen Provinz Sichuan, lockten Bergleute nach China. Das geht jetzt nach hinten los. Verschiedenen Quellen zufolge musste der Mining-Betrieb in China eingestellt werden. Infolgedessen sinkt die Hashrate von Bitcoin.

So wurden beispielsweise Bergbaubetriebe in Sichuan und Yunnan für Inspektionen geschlossen. Andere chinesische Provinzen, wie z. B. Xinjiang, haben ähnliche Maßnahmen ergriffen, um Bergleute stillzulegen. Allerdings möglicherweise nur vorübergehend.

Warum ist die Hashrate so wichtig?

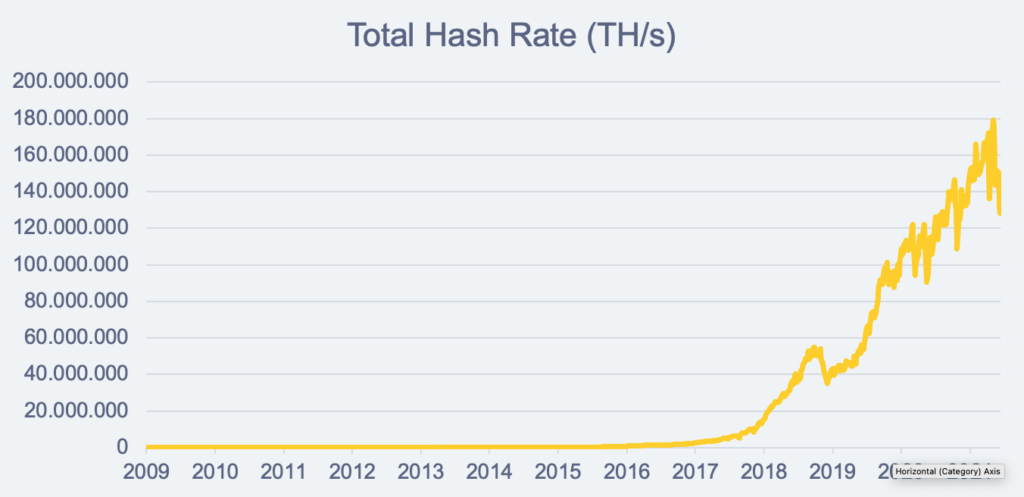

"Hashrate" bezieht sich auf die gesamte kombinierte Rechenleistung, die zum Mining und zur Verarbeitung von Transaktionen auf einer Proof-of-Work-Blockchain wie Bitcoin verwendet wird.

Eine hohe Hashrate ist ein allgemeines Anzeichen für ein stabiles Bitcoin-Mining-Umfeld, da dem Bitcoin-Netzwerk mehr Ressourcen für die Verarbeitung von Transaktionen zur Verfügung gestellt werden. Es bedeutet auch, dass die Miner ihre Operationen aufgrund ihres wachsenden Vertrauens in das Netzwerk ausweiten. Außerdem ist das Netzwerk umso widerstandsfähiger gegen Angriffe wie den "51%-Angriff", je höher die Hash-Rate ist.

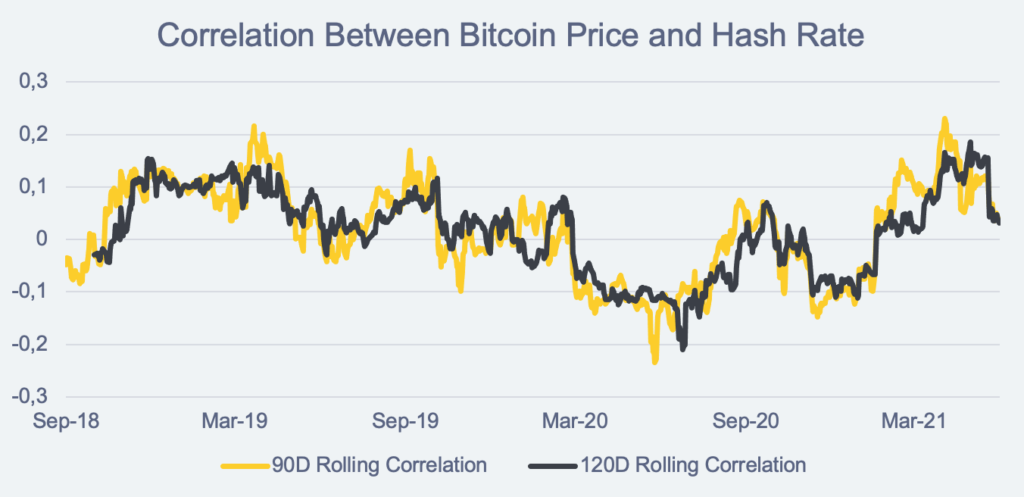

Aber die Hash-Rate von Bitcoin war für die Vorhersage des Preises nicht relevant, und die Korrelation zwischen den Veränderungen des Bitcoin-Preises und der Hash-Rate schwankte trotz einiger Argumente, dass der Preis der Hash-Rate oder die Hash-Rate dem Preis folgt, um Null.[1]

Quelle: Iconic Funds GmbH, blockchain.info

Quelle: Iconic Funds GmbH, blockchain.info

Quelle: Iconic Funds GmbH, blockchain.info

Mechanik von Bitcoin zum Ausgleich der Neuemission

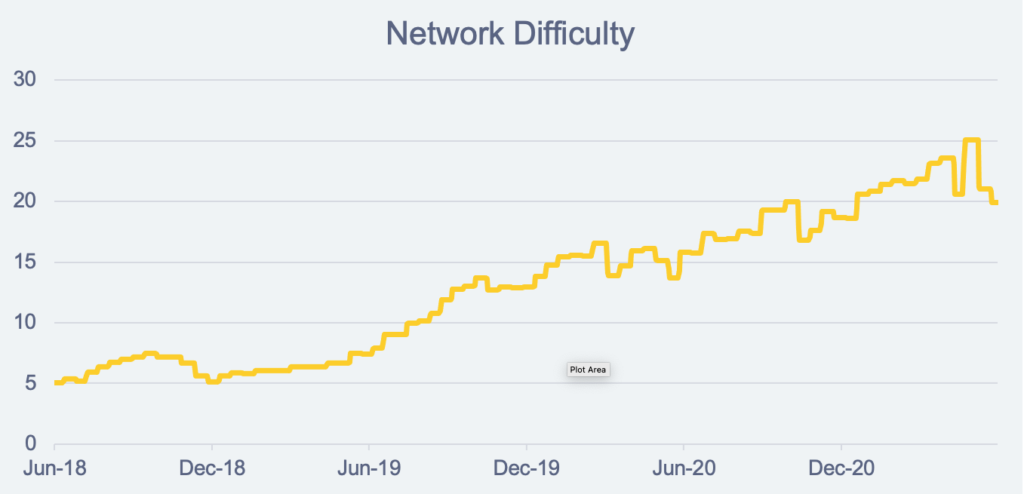

Bitcoin ist eine perfekt geölte Maschine, die den Fluktuationen der Mining-Ausrüstung, die zum Netzwerk hinzugefügt oder von ihm abgezogen wird, standhält.

Durch die "Schwierigkeitsanpassung" stellt das Bitcoin-Protokoll sicher, dass die Miner im Durchschnitt alle 10 Minuten einen neuen Block schürfen.

Quelle: Iconic Funds GmbH, blockchain.info

Das Fazit für Bitcoin-Investoren

Trotz des starken Rückgangs der Hash-Rate, die dem Bitcoin-Netzwerk zur Verfügung gestellt wird, können langfristige Investoren das China-Mining-FUD ignorieren.

- Erstens wird sich das Bitcoin-Protokoll ständig selbst ausgleichen. Die Neuausgabe von Bitcoin bleibt davon unberührt.

- Zweitens werden die Bergleute in andere Länder abwandern, in denen die politische Zuverlässigkeit möglicherweise größer ist.

- Drittens: Die weltweite Akzeptanz von Bitcoin als Wertaufbewahrungsmittel, Tauschmittel und Rechnungseinheit ist unübersehbar. Als jüngstes Beispiel hat das dollarisierte lateinamerikanische Land El Salvador bitcoin als gesetzliches Zahlungsmittel eingeführt. Damit ist es das erste Land, das bitcoin als offizielles Zahlungsmittel akzeptiert und andere Länder wie Paraguay dazu inspiriert, diesem Beispiel zu folgen.

Verbessert sich der Kohlenstoff-Fußabdruck von Bitcoin?

Das chinesische Bitcoin-Mining steht im Zusammenhang mit der Abhängigkeit Chinas von fossilen Brennstoffen. Nach Angaben der U.S. Energy Information Administration (EIA) trugen kohlebasierte Energiequellen im Jahr 2019 mit 58% zu Chinas Kohlenstoff-Fußabdruck bei.[2]

Ein Nebeneffekt der Verlagerung der Hash-Power in andere Länder könnte sein, dass sich die Wahrnehmung des Kohlenstoff-Fußabdrucks von Bitcoin sowie der tatsächliche Kohlenstoff-Fußabdruck von Bitcoin verbessern könnte.

Andere Länder, die bereits chinesische Miner umworben haben, verfügen möglicherweise über einen weniger kohlenstoffintensiven Energiemix, wodurch sich die Kohlenstoffbilanz des Bitcoin-Minings insgesamt verbessert.

Verwandte Artikel

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen

- Der Einfluss von Kryptowährungen auf die Sharpe Ratio traditioneller Anlagemodelle

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes

Haftungsausschluss

In keinem Fall können Sie die ICONIC HOLDING GMBH, ihre Tochtergesellschaften oder eine mit ihr verbundene Partei für direkte oder indirekte Anlageverluste haftbar machen, die durch Informationen in diesem Artikel verursacht wurden. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die ICONIC HOLDING GMBH ist in keiner Rechtsordnung als Anlageberater registriert. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Investitionsentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Investitionsmöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Prognosen und Meinungen, die sich als wesentlich ungenau erweisen können und von Natur aus erheblichen Risiken und Unsicherheiten unterliegen, die außerhalb der Kontrolle der ICONIC HOLDING GMBH liegen. Unsere Artikel und Berichte drücken unsere Meinungen aus, die wir auf der Grundlage allgemein verfügbarer Informationen, Feldforschung, Schlussfolgerungen und Ableitungen durch unsere Due Diligence und unseren analytischen Prozess gewonnen haben.

Die ICONIC HOLDING GMBH geht davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen, die wir für korrekt und zuverlässig halten. Diese Informationen werden jedoch "wie besehen", ohne jegliche Garantie, präsentiert.