Bitcoin vs. Gold hat sich zu einer der größten Debatten im Bereich der Finanzanlagen entwickelt und wütet schon seit Jahren. Dieser Artikel versucht, diese Debatte zu schlichten, indem er aufzeigt, warum es wahrscheinlich besser ist, "digitales Gold" zu kaufen.

Warum nennt man Bitcoin "digitales Gold"?

Viele führende Experten betrachten Bitcoin als Wertaufbewahrungsmittel, da es Ähnlichkeiten mit Gold aufweist, das sich im Laufe der Zeit zu einem der beliebtesten Wertaufbewahrungsmittel entwickelt hat.

Ein guter Wertaufbewahrungsgegenstand zeichnet sich dadurch aus, dass sein Wert, wenn er heute gekauft wird, morgen nicht sinkt. Er wird auch in Zukunft den gleichen oder einen höheren Wert haben.

Anleger haben Gold seit Jahrhunderten als Wertaufbewahrungsmittel genutzt, um ihr Vermögen in Zeiten des wirtschaftlichen Abschwungs zu schützen. Bitcoin hat sich ebenfalls zu einem Wertaufbewahrungsmittel entwickelt, da die Anleger es als Absicherung gegen schwache Währungen und wirtschaftliche Unsicherheit nutzen. Dies hat der Kryptowährung den Titel "digitales Gold" eingebracht.

So stieg der Bitcoin-Preis Ende 2020 und bis ins Jahr 2021 aufgrund der übermäßigen Geldmengenausweitung durch die großen Zentralbanken an. Das bedeutet, dass sich mehr Menschen dem Bitcoin zuwandten, um ihr Vermögen zu schützen. Der Anstieg der Nachfrage führte zu einem Preisanstieg.

Bitcoin vs. Gold: Gemeinsamkeiten und Unterschiede

Bitcoin und Gold teilen andere Ähnlichkeiten die beide als Wertaufbewahrungsmittel dienen. Dazu gehören:

Begrenztes Angebot

Gold ist eines der seltensten Metalle der Welt. Es ist nur in begrenztem Umfang vorhanden und nicht leicht zu fördern. Laut einer Bericht Laut BBC haben die Bergleute erst rund 20 Prozent des Goldes aus den Goldreserven gefördert. Außerdem sagen Experten, dass neue große Goldvorkommen immer seltener zu finden sind.

In ähnlicher Weise hat Satoshi Nakamoto bei der Entwicklung von Bitcoin auf Knappheit geachtet und das Angebot auf 21 Millionen begrenzt. Bislang haben Bitcoin-Schürfer 19 Millionen Bitcoin (90%) geschürft, und der letzte Bitcoin könnte im Jahr 2140 geschürft werden. Das begrenzte Angebot beider Vermögenswerte führt dazu, dass Anleger sie wegen ihrer Knappheit nachfragen.

Dauerhaftigkeit

Massives Gold ist oxidations- und korrosionsbeständig, was es zu einem langlebigen Metall macht. Aus diesem Grund können Schatzsucher in alten Schiffswracks noch immer rostfreies Gold finden. Und deshalb ist z. B. Weizen kein gutes Tauschmittel, da er sich mit der Zeit zersetzt.

Im Gegensatz dazu kann niemand Bitcoin aufgrund seiner dezentralen Natur zerstören. Er wird immer existieren, solange es das Netzwerk gibt. Das macht Bitcoin auch zu einem dauerhaften Vermögenswert. Langlebigkeit ist eine der Eigenschaften, die Experten verwenden, um zu definieren, welche Vermögenswerte Wertaufbewahrungsmittel oder im weiteren Sinne "Geld" sind.

Spekulative Investitionen

Sowohl Gold als auch Bitcoin sind spekulative Anlagen, da die Gewinne von den Preisschwankungen an den Märkten abhängen. Weder Bitcoin noch Gold haben einen inneren Wert, der durch Diskontierung der Cashflows berechnet werden kann. Die hohe Volatilität von Bitcoin macht ihn zu einer spekulativen Anlage. Gold hingegen ist nicht so volatil wie Bitcoin. Dennoch kaufen und halten Anleger es in der Hoffnung, dass es während der Haltedauer seinen Wert behält.

Bitcoin und Gold haben mehrere Unterschiede auch. Werfen wir einen Blick auf sie.

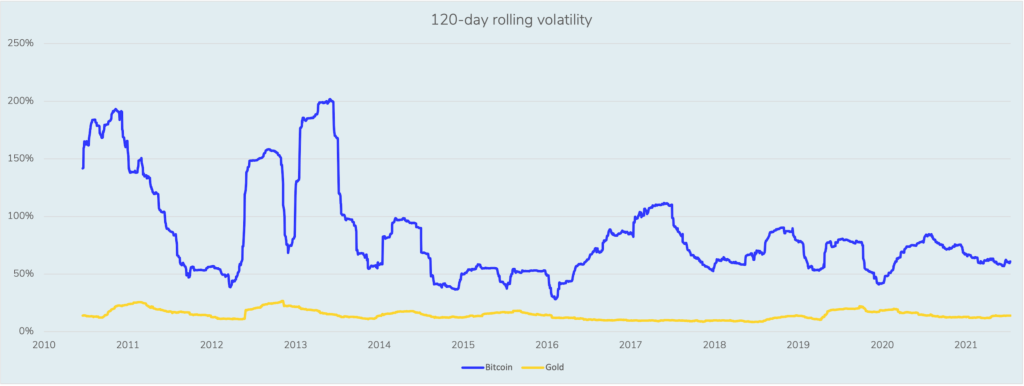

Volatilität

Bitcoin weist eine höhere Volatilität auf als Gold. Ein Blick auf die rollierende 120-Tage-Volatilität von Bitcoin und Gold zeigt, dass die Preisvolatilität von Bitcoin in den letzten Jahren zwar abgenommen hat, aber immer noch wesentlich volatiler ist als Gold.

In jüngster Zeit verzeichnete Gold einen (niedrigeren) Höchststand von $1.954,40 im Jahr 2021 im Vergleich zu $2.058,40 im Jahr 2020. Im Gegensatz dazu erreichte Bitcoin im Jahr 2021 einen Höchststand von $68.789,63 im Vergleich zu $29.244,88 im Jahr 2020, was die erheblichen Volatilitätsunterschiede zwischen den beiden unterstreicht.

Verordnung

Bitcoin ist zensurresistent, weil es unmöglich ist, sein Protokoll ohne Zustimmung fast des gesamten Netzwerks zu ändern. Daher können Regierungen nur Unternehmen regulieren, die den Handel und die Verwendung von Bitcoin erleichtern, aber sie können nicht regulieren, wie Bitcoin funktioniert. Außerdem können sie niemanden daran hindern, BTC zu besitzen und zu halten.

Im Gegensatz dazu haben die Regierungen mehr Möglichkeiten, wenn es um Gold geht. Sie können die Unternehmen der Goldindustrie, den Goldbesitz, die Lagerung und den Transfer von Gold regulieren. Oder sie können versuchen, eine Wiederholung der Executive Order 6102 aus dem Jahr 1933 durchzusetzen, die "das Horten von Goldmünzen, Goldbarren und Goldzertifikaten auf dem US-amerikanischen Festland verbietet".

Dienstprogramm

Die Menschen verwenden Gold als Finanzanlage, zur Herstellung von Schmuck und Medaillen sowie in der Elektronik-, Medizin- und Raumfahrtindustrie.

Im Gegensatz dazu hat Bitcoin weniger Verwendungszwecke in der physischen Welt. Bitcoin-Benutzer verwenden ihn als Finanzanlage und Geld. Als Tauschmittel ist Bitcoin jedoch nicht weit verbreitet, da seine Akzeptanz noch gering ist. Dies könnte sich jedoch mit der breiten Einführung des Bitcoin Lightning Network ändern, das sofortige, kostengünstige Transaktionen ermöglicht.

Außerdem ist Bitcoin programmierbares Geld, was bedeutet, dass es potenziell vielseitiger eingesetzt werden kann, um eine Reihe von Zahlungen abzuwickeln. Gold kann nicht auf diese Art und Weise verwendet werden.

Geschichte

Bitcoin gibt es erst seit 2009, während Gold schon seit Tausenden von Jahren existiert. Gold hat also eine wesentlich längere Geschichte als Bitcoin.

Authentizität

Die Authentizität von Bitcoin liegt in seinem Code, der für jedermann einsehbar ist. Außerdem sorgt die zugrunde liegende Blockchain-Technologie dafür, dass niemand in Frage stellen kann, ob ein Bitcoin-Bit authentischer ist als ein anderes. Das liegt daran, dass die Blockchain fälschungssicher ist und Doppelausgaben verhindert. Andererseits können Händler den Reinheitsgrad von Gold verdünnen oder andere Metalle fälschen und sie als Gold ausgeben. Dadurch ist Bitcoin unendlich viel leichter zu verifizieren.

Tragbarkeit

Physisches Gold ist nicht leicht zu transportieren, da es schwer ist. Es muss ordnungsgemäß gelagert und während des Transports versichert werden. Daher ist es teuer, es von Ort zu Ort zu transportieren. Im Gegensatz dazu können Sie Bitcoin in Sekundenschnelle direkt von Ihrem Telefon aus von einer Brieftasche in eine andere übertragen. Da Bitcoin digital ist, ist er sehr mobil.

Teilbarkeit

Sie können sowohl Gold als auch Bitcoin in kleinere Beträge aufteilen. Allerdings ist es nicht so einfach, Gold aufzuteilen. Auch die genaue Teilung ist ein Problem. Im Gegensatz dazu ist Bitcoin bis auf acht Dezimalstellen teilbar - ein Bitcoin entspricht 100.000.000 Satoshis.

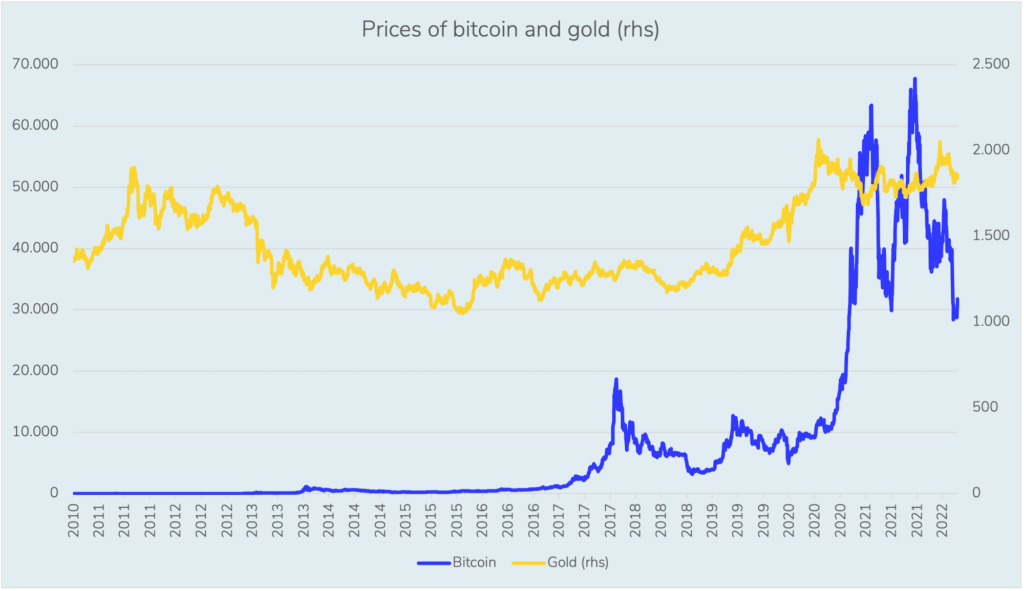

Bitcoin vs. Gold: Historische Preisentwicklung

Im Vergleich zu Gold hat Bitcoin im Laufe der Jahre eine höhere jährliche Preisveränderung verzeichnet. Infolgedessen hat er als spekulativer Vermögenswert besser abgeschnitten.

Die nachstehenden Tabellen zeigen die jährlichen Preisänderungen der beiden Vermögenswerte von 2013 bis heute.

Im Gegensatz zu Gold hat Bitcoin seit 2013 mehr Wachstum erfahren. Er ist innerhalb von neun Jahren von $13 auf über $40.000 gestiegen, während Gold auf Basis der Jahresanfangspreise innerhalb von $1.000 pro Unze geblieben ist.

Dieselbe Schlussfolgerung lässt sich auch aus der Tatsache ziehen, dass Gold in den vergangenen Jahren mehr negative Renditen verzeichnet hat als Bitcoin.

Gold oder Bitcoin: Was ist die bessere Investition?

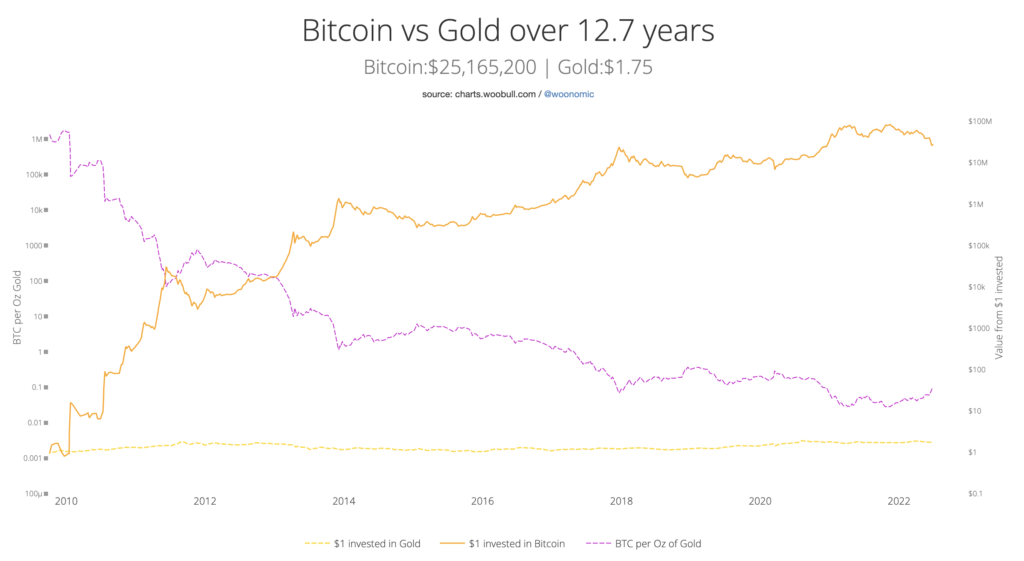

Historischen Daten zufolge ist Bitcoin eine bessere Investition als Gold.

BTC hat in den letzten Jahren im Vergleich zu Gold ein enormes Wachstum erfahren, so dass Bitcoin-Anleger in den Genuss höherer Renditen als Goldanleger kamen. Diese deutlich höheren Renditen gingen allerdings mit einer deutlich höheren Volatilität einher.

Der Bitcoin gegen Gold Karte Die folgende Tabelle vergleicht $1-Dollar-Investitionen in Gold und Bitcoin über 12,5 Jahre. Die Bitcoin-Investition erzielte einen deutlich höheren Wert.

Obwohl beide Vermögenswerte einige Gemeinsamkeiten aufweisen, kann Bitcoin aufgrund seiner Eigenschaften, die ihn zu einem besseren Wertaufbewahrungsmittel machen, als besser als Gold angesehen werden. Bitcoin schneidet in den Bereichen Haltbarkeit, Teilbarkeit, Übertragbarkeit, Knappheit, Authentizität und Zensurresistenz besser ab als Gold.

Über DDA Ikonische Fonds

Iconic Funds ist die Brücke zu Krypto-Investitionen durch vertrauenswürdige Anlageinstrumente. Wir bieten Anlegern sowohl passive als auch Alpha-Strategien für Kryptowährungen sowie Risikokapitalmöglichkeiten.

Wir liefern hervorragende Leistungen durch vertraute, regulierte Vehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter erwarten, während wir unsere Mission verfolgen, die Verbreitung von Kryptoanlagen voranzutreiben.

Neueste Nachrichten

- Wie Green Mining zur Norm für das Bitcoin-Netzwerk wird

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

- Bitcoin-Bildung ebnet den Weg für die Hyperbitcoinisierung

Iconic in der Presse

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds erweitert seine Produktpalette mit einem physischen Ethereum-ETP

Aktuelle Forschungsberichte

Wie haben sich die Portfolios während der Pandemie entwickelt? ➡ Hier herunterladen

Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

"Dieser Artikel stellt lediglich eine unverbindliche Vorabinformation dar, die ausschließlich Werbezwecken dient. Er ist kein Prospekt im Sinne der Verordnung (EU) 2017/1129 (Prospektverordnung) und des deutschen Wertpapierprospektgesetzes (WpPG). Sie stellt kein Angebot zum Verkauf von Wertpapieren in den Vereinigten Staaten dar und die in dieser Mitteilung genannten Wertpapiere dürfen in den Vereinigten Staaten nicht angeboten oder verkauft werden, sofern sie nicht registriert oder von der Registrierungspflicht befreit sind.

Risikoerwägungen:

Der Preis einer Anlage in ein Iconic-ETP kann steigen oder fallen und der Anleger erhält den investierten Betrag möglicherweise nicht zurück. Die Kursentwicklung von Kryptowährungen ist äußerst volatil und unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher keine Garantie für die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Die Billigung des Prospekts ist nicht als Billigung der angebotenen oder zum Handel an einem geregelten Markt zugelassenen Wertpapiere zu verstehen. Dies sind keine umfassenden Risikoerwägungen. Potenzielle Anleger sollten den Prospekt lesen, bevor sie eine Anlageentscheidung treffen, um sich ein umfassendes Bild von den potenziellen Risiken und Vorteilen einer Anlage in die Wertpapiere zu machen. Der Verkaufsprospekt ist unter https://deutschedigitalassets.com/xbti-iconic-funds-physical-bitcoin-etp/ erhältlich.