Erfahren Sie mehr über die Volatilität von Bitcoin und warum die starken Kursschwankungen der digitalen Währung langfristige Investoren nicht abschrecken sollten.

Die Volatilität von Bitcoin ist ein Thema, über das die Medien gerne und regelmäßig berichten. Ob rasante Kurssprünge oder atemberaubende Kurseinbrüche, die Medien dokumentieren scheinbar jede Bewegung von Bitcoin. Folglich werden potenzielle Investoren ständig mit der Volatilität von Bitcoin konfrontiert, was sie zögern lässt, überhaupt zu investieren.

Bevor Sie Bitcoin jedoch wegen seiner Volatilität abtun, sollten Sie diesen Artikel lesen, um herauszufinden, warum er langfristige Investoren nicht kümmern sollte.

Warum ist der Preis von Bitcoin so volatil?

Zum Zeitpunkt der Erstellung dieses Artikels (2. März 2022) ist Bitcoin um 35,85% gefallen, seit es am 10. November 2021 ein Allzeithoch von $68.789,63 erreichte. Beim Herauszoomen zeigt der Bitcoin-Chart auch, dass Bitcoin seit Juli 2013 um 65.000% gestiegen ist.

Bitcoin ist bekannt für seine hohe Volatilität, die Kursschwankungen von mehreren Tausend Dollar in beide Richtungen mit sich bringt. Aus der Sicht eines Anlegers gleicht diese Volatilität einer Achterbahnfahrt, die sowohl adrenalingeladene Höhen als auch deprimierende Tiefen aufweist.

Das Wissen um die Ursachen dieser Preisschwankungen kann den Anlegern jedoch helfen, bei Kursschwankungen ruhig zu bleiben. Mehr noch: Wenn sie wissen, woher die Preisvolatilität kommt, können sie mögliche Preiskorrekturen vorhersagen und sich entsprechend vorbereiten.

Es geht um Angebot und Nachfrage, Dummkopf!

Einfach ausgedrückt, ist die Volatilität von Bitcoin eine Funktion von Angebot und Nachfrage. Mit einer Angebotsobergrenze von 21 Millionen Münzen ist die Kryptowährung von vornherein eine knappe Ressource. Wenn also das Angebot sinkt, wird der Preis wahrscheinlich langfristig steigen, da die Nachfrage hoch bleibt.

Dies ist eine einfache ökonomische Erkenntnis, die besagt, dass eine hohe Nachfrage in Verbindung mit einem begrenzten Angebot zu höheren Preisen führt. Zum Beispiel war Bitcoin im ersten Quartal 2021 bei institutionellen Anlegern sehr gefragt, was zu Preisen über $50.000 führte.

Die dezentrale Natur von Bitcoin und die Tatsache, dass Anleger ihn als Wertaufbewahrungsmittel nutzen können, sind einige der Gründe, die die Nachfrage ankurbeln. Als Nutzer können Sie selbst die Kontrolle über Ihr Geld übernehmen, da Bitcoin nicht von einer zentralen Behörde kontrolliert wird. Aufgrund dieser Eigenschaft kann Bitcoin auch als eine Möglichkeit angesehen werden, das eigene Vermögen in Zeiten schwieriger wirtschaftlicher Umstände zu schützen.

Von großer Bedeutung: Anleger- und Nutzerstimmung

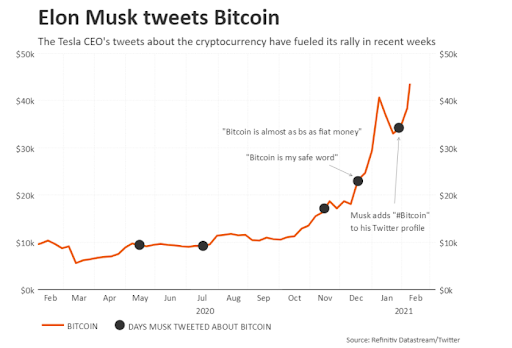

Erinnern Sie sich an die berüchtigten Tweets von Elon Musk, die den Bitcoin-Kurs in beide Richtungen beeinflusst haben?

Nun, hier geht es um die Stimmung der Anleger oder Nutzer. Zum Beispiel, wenn Musk erwähnt das Wort Bitcoin in seiner Twitter-Bio, erlebte die Kryptowährung einen 14% Kursanstieg. Andererseits ist der Preis von Bitcoin fiel 5% im Juni desselben Jahres, als er den folgenden Tweet veröffentlichte:

Das folgende Diagramm zeigt außerdem, wie Musk den Bitcoin-Kurs durch seine Tweets beeinflusst hat:

Musk ist nicht die einzige populäre Figur, die die Bitcoin-Kursbewegungen beeinflussen kann.

Die Ankündigung von Bitcoin-Investitionen durch institutionelle Investoren wie Morgan Stanley, Bank of America oder JP Morgan kann ebenfalls positiven Rückenwind für den Bitcoin-Markt bedeuten und zu einem Preisanstieg führen. Oder börsennotierte Unternehmen, die in Bitcoin investieren, wie MicroStrategy, Tesla oder Galaxy Digital, verbessern ebenfalls die allgemeine Marktstimmung gegenüber Bitcoin, was den Preis in die Höhe treibt.

Blick auf die Aktionen der Investoren

Wichtiger Hinweis: Große Bitcoin-Besitzer, die auch als Wale bezeichnet werden, können den Bitcoin-Kurs abstürzen lassen, wenn sie plötzlich beschließen, ihre Bestände zu liquidieren. Aufgrund von Beschränkungen der Krypto-Börsen werden Wale jedoch daran gehindert, große Mengen an einem Tag zu verkaufen.

Dennoch kommt es immer wieder vor, dass mittlere und kleinere Investoren als Reaktion auf Wal-Aktionen Panikverkäufe tätigen, was den Abwärtsdruck auf den Bitcoin-Preis weiter verringert.

Beachten Sie den Medienhype

Ein offensichtlicher Faktor für die Volatilität von Bitcoin sind die Medien selbst. Sie schreiben es nicht nur im Nachhinein, sondern können es auch genauso gut beeinflussen. Zum Beispiel, Nachrichten über die Einführung des Proshares Bitcoin Strategy ETF trieb den Bitcoin-Kurs in die Höhe. Kurz nach seinem Debüt an der New Yorker Börse stieg der Bitcoin-Kurs um 3% an.

Behalten Sie die Verordnung im Auge

Die Regulierung ist etwas, das Anleger im Auge behalten sollten. Wenn Regulierungsbehörden neue Regeln einführen, die sich negativ auf die Bitcoin-Branche auswirken, werden die Preise wahrscheinlich fallen. Ein Beispiel dafür ist das chinesische Bitcoin-Mining-Verbot im Jahr 2021, das dem Bitcoin-Preis geschadet hat. Am wichtigsten ist jedoch, dass diese Auswirkungen der Regulierung auf den Bitcoin-Preis in der Regel nur von kurzer Dauer sind.

Bitcoin steckt noch in den Kinderschuhen

Was viele beim Umgang mit Bitcoin vergessen, ist die Tatsache, dass seine Volatilität auch darauf zurückzuführen ist, dass der digitale Vermögenswert noch in den Kinderschuhen steckt. Im Vergleich zu Vermögenswerten wie Gold, die es schon seit Jahrhunderten gibt, ist Bitcoin ein Kleinkind. Daher befindet sich die Kryptowährung derzeit in der Preisfindungsphase, die ganz offensichtlich die volatilste Phase im Lebenszyklus eines Vermögenswerts ist.

Die Auswirkungen globaler Ereignisse

Wie sich in letzter Zeit gezeigt hat, können globale Ereignisse auch den Bitcoin-Preis beeinflussen. Zur Veranschaulichung: Als die Coronavirus-Pandemie im März 2020 die globalen Märkte zusammenbrechen ließ, erlitt auch der Bitcoin-Kurs einen erheblichen Einbruch. Das Gleiche gilt für die Ukraine-Krise, die Unsicherheit für Bitcoin und die Märkte im Allgemeinen schafft. Allerdings stieg der Bitcoin-Kurs nach beiden Krisen wieder an, was darauf hindeutet, dass einige Anleger Bitcoin eher als sicheren Hafen denn als Risikoanlage betrachten.

Bitcoin ist volatil, aber nicht mehr so stark wie früher

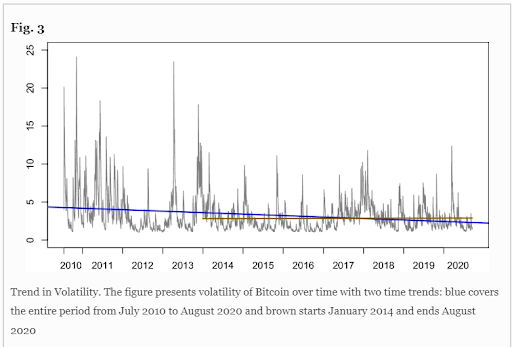

Die Frage ist: Wird diese Volatilität von Bitcoin jemals nachlassen? Laut einer Artikel von Springer war die Volatilität von Bitcoin im Jahr 2010 höher als im Jahr 2020. Sie können dies an der blauen Linie im Diagramm unten erkennen, die einen leichten Abwärtstrend zeigt.

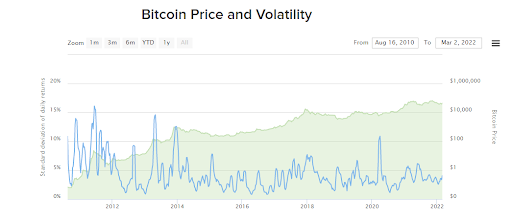

Auch diese Grafik auf Buy Bitcoin Worldwide zeigt dass die 30-Tage-Volatilität von BTC/USD, dargestellt in Blau, mit der Zeit abgenommen hat.

Diese leicht rückläufige Trendlinie bei der Bitcoin-Volatilität könnte auf die allgemeine Akzeptanz des Bitcoins zurückzuführen sein. Öffentliche Unternehmen und institutionelle Anleger machen sich Bitcoin zu eigen und verringern damit das Reputationsrisiko für andere Anleger.

Dies hat zur Folge, dass Bitcoin in den Augen der traditionellen Marktinvestoren an Legitimität gewinnt, was zu mehr Stabilität führt. Sollte sich dieser Trend in den kommenden Jahren fortsetzen, würde die Volatilität von Bitcoin weiter abnehmen.

Warum die Bitcoin-Volatilität für (langfristige) Investoren keine Rolle spielen sollte

Während die aktuelle Volatilität von Bitcoin unbestreitbar auf den Anlegern lastet, positionieren die einzigartigen Eigenschaften der Kryptowährung die digitale Währung als einen Vermögenswert, der im Laufe der Zeit wahrscheinlich weiter an Wert gewinnen wird.

Darüber hinaus bedeutet die Verwendung von Bitcoin als Wertaufbewahrungsmittel sowohl durch institutionelle als auch durch private Anleger, dass es höchstwahrscheinlich immer eine Nachfrage geben wird. Darüber hinaus bleibt Bitcoin für diejenigen attraktiv, die seinen dezentralen Charakter schätzen.

Langfristige Anleger sollten sich von den täglichen Kursschwankungen nicht beunruhigen lassen. Warum? Weil sie Bitcoin hauptsächlich wegen seines Peer-to-Peer-Charakters und seiner langfristigen Wertaufbewahrungsfunktion halten.

Darüber hinaus bietet Bitcoin mehrere Vorteile für ein diversifiziertes Portfolio. Wie in einer Morgan Stanley Studie berichtet PapierBitcoin ist weitgehend unkorreliert mit Anleihen. Außerdem hat er eine eher geringe positive Korrelation zum Aktienmarkt. Das bedeutet, dass, wenn der Preis der Aktien und Anleihen in Ihrem Portfolio fällt, Ihr Bitcoin davon unberührt bleibt oder sich sogar in die andere Richtung bewegt. Dies führt zu einem besseren Chance-Risiko-Verhältnis für Ihr Portfolio. Auch eine monatliche oder vierteljährliche Umschichtung Ihrer Bitcoin-Position zurück auf ihr ursprüngliches Gewicht in Ihrem Portfolio kann die Volatilität minimieren und die Rendite steigern.

Langfristig gesehen sind sich die Bitcoin-Experten einig, dass die digitale Währung in nicht allzu ferner Zukunft wieder ein neues Allzeithoch erreichen wird. Daher können langfristige Investoren einfach die nächsten 5 bis 10 Jahre abwarten, anstatt sich über die Volatilität in der Zwischenzeit Gedanken zu machen.

Abschließende Überlegungen

Experten glauben, dass die zunehmende Akzeptanz von Bitcoin seinen Preis stabilisieren und ihm helfen wird, sein Potenzial als Währung auszuschöpfen. Folglich würde die einfache Nutzung von Bitcoin als Währung die Akzeptanz noch weiter steigern und Bitcoin möglicherweise zu einer globalen Währung machen.

Daher können wir davon ausgehen, dass die Bitcoin-Volatilität, wie wir sie heute erleben, eines Tages abnehmen wird. Bevor sich Bitcoin jedoch stabilisiert, sollten Anleger in naher Zukunft mit ständigen Kursschwankungen in beide Richtungen rechnen. Schließlich bietet diese Volatilität aktiven Anlegern die Möglichkeit, mit kurzfristigen Handelsstrategien Geld zu verdienen.

Über DDA Ikonische Fonds

Iconic Funds ist die Brücke zu Krypto-Investitionen durch vertrauenswürdige Anlageinstrumente. Wir bieten Anlegern sowohl passive als auch Alpha-Strategien für Kryptowährungen sowie Risikokapitalmöglichkeiten.

Wir liefern hervorragende Leistungen durch vertraute, regulierte Vehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter erwarten, während wir unsere Mission verfolgen, die Verbreitung von Kryptoanlagen voranzutreiben.

Neueste Nachrichten

- Wie Green Mining zur Norm für das Bitcoin-Netzwerk wird

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

- Bitcoin-Bildung ebnet den Weg für die Hyperbitcoinisierung

Iconic in der Presse

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds erweitert seine Produktpalette mit einem physischen Ethereum-ETP

Aktuelle Forschungsberichte

Wie haben sich die Portfolios während der Pandemie entwickelt? ➡ Hier herunterladen

Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen nur zu Informationszwecken.

Die Iconic Holding GmbH, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung.

Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen naturgemäß erheblichen Risiken und Unsicherheiten, die außerhalb der Kontrolle der Iconic Holding GmbH liegen.

Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" ohne jegliche Garantie präsentiert.