Die Zahl der Vermögensverwalter, die Bitcoin in ihre Portfolios aufnehmen, nimmt zu. Das wachsende institutionelle Handelsökosystem macht es einfacher denn je, digitale Währungen in institutionelle Portfolios aufzunehmen. Dennoch gibt es immer noch viele Fondsmanager, die Kryptowährungen als Anlageobjekt skeptisch gegenüberstehen.

Lesen Sie weiter, um mehr über die Rolle von Bitcoin in einem diversifizierten Portfolio zu erfahren.

Quelle: unsplash.com

Warum ist Bitcoin wertvoll?

Bevor wir uns die Zahlen ansehen, sollten wir erörtern, warum Bitcoin einen Wert hat.

In erster Linie hat Bitcoin einen begrenzten maximalen Münzvorrat von 21 Millionen BTC. Im Gegensatz zu Fiat-Währung, von der mehr gedruckt werden kann, oder Gold, von dem mehr abgebaut werden kann, kann es immer nur 21 Millionen Einheiten von Bitcoin geben.

Außerdem sind von den rund 18 Millionen Bitcoin, die bereits geschürft wurden, ein schätzungsweise 3 bis 4 Millionen BTC sind "verlorene Münzen", d. h. unzugängliche Münzen, die nicht wieder in den Münzkreislauf gelangen, wodurch sich der Bestand an umlaufenden Münzen verringert.

Zusätzlich zu einem festen Gesamtangebot an Münzen wird die Die Geldpolitik des Bitcoin-Netzwerks verlangsamt die Geschwindigkeit, mit der neue Münzen in den Umlauf gebracht werden durch eine zunehmende Schwierigkeit beim Abbau und eine Verringerung der Blockbelohnung für Schürfer alle vier Jahre (bekannt als Bitcoin Halbierung).

Die wachsende Nachfrage nach Bitcoin als eine Absicherung gegen die Inflationals eine Diversifizierungsanlageals eine digitale Zahlungsmethodeund als eine Überweisungsschiene trifft auf das begrenzte Angebot der digitalen Währung, was den Preis in die Höhe treibt.

Es ist unwahrscheinlich, dass die Nachfrage nach Kryptowährungen nachlassen wird Die Akzeptanz des digitalen Vermögenswertes bei institutionellen und privaten Käufern lässt vermuten, dass das "digitale Gold" noch einen langen Weg vor sich hat, bevor es seinen Höhepunkt erreicht.

Auch eine Handvoll Finanzverwaltungen von Unternehmen teilen diese Ansicht. MicroStrategy, unter der Führung von Michael Saylor, war seit Mitte letzten Jahres sehr konsequent mit seinen Bitcoin-Käufen, was auf andere börsennotierte Unternehmen, einschließlich Tesla, abgefärbt hat. Nachdem Saylor Elon Musk in einem Tweet geraten hatte, seinen Aktionären "einen $100-Milliarden-Gefallen" zu tun und Teslas Bilanz in BTC umzuwandeln, kündigte das Elektroautounternehmen etwa zwei Monate später einen $1,5-Milliarden-Kauf an.

Jack Dorsey's Square hat ebenfalls Bitcoin in seine Bilanz aufgenommen, was die Nachfrage nach Bitcoin in einer Zeit unterstreicht, in der die Inflation es für Unternehmen schwierig macht, eine positive Rendite auf Betriebskapital und Barreserven zu erzielen.

Hinzu kommt das begrenzte Angebot von Bitcoin, disinflationäre und programmatische Geldpolitikund der zunehmenden Wahrnehmung als Absicherung gegen die Inflation wird die digitale Währung - nach über einem Jahrzehnt - allmählich auch als eine echte Währung. Um als "Geld" zu gelten, muss eine Währung drei Eigenschaften erfüllen: Wertaufbewahrungsmittel, Rechnungseinheit und Zahlungsmittel.

In El Salvador wurde Bitcoin im September 2021 zum gesetzlichen Zahlungsmittel erklärt, was es den El Salvadorianern ermöglicht, bei einer Vielzahl von Händlern und Einzelhändlern mit Bitcoin zu bezahlen sowie kostengünstige Überweisungen über das Bitcoin Lightning Network zu senden und zu empfangen. Während Bitcoin zuvor als Wertaufbewahrungsmittel angesehen wurde, wurde er durch das Gesetz von El Salvador plötzlich zu einer Rechnungseinheit und einem Zahlungsmittel im Land.

Während die zentralamerikanische Nation vorerst ein Einzelfall bleibt, haben zahlreiche andere Nationalstaaten ihr Interesse an der Einführung von Bitcoin als legale Währung geäußert, was zu einer verstärkten Nutzung von Bitcoin als Tauschmittel führen könnte, was den Preis der digitalen Währung weiter in die Höhe treibt.

Endlich, Bitcoin hat viele Eigenschaften mit Gold gemeinsamBitcoin hat viele Vorteile, wie z. B. Knappheit, Teilbarkeit, Übertragbarkeit, Haltbarkeit und Nützlichkeit, kann aber innerhalb von Minuten zu minimalen Kosten transportiert werden. Infolgedessen beginnt das "digitale Gold" Bitcoin das Edelmetall in den Schatten zu stellen, insbesondere bei jüngeren Anlegern.

Sollte es Bitcoin gelingen, Gold als sicheren Hafen und Inflationsschutz abzulösen und den gleichen Marktwert wie das gelbe Metall zu erreichen, würde der Wert der Kryptowährung wahrscheinlich mit einem Vielfachen des aktuellen Marktpreises gehandelt.

Die Rolle von Bitcoin in einem diversifizierten Portfolio

Nachdem wir nun das Wertangebot von Bitcoin erörtert haben, lassen Sie uns in einige Zahlen eintauchen, um das Engagement für Bitcoin als ein "Must-have"-Asset in einem diversifizierten Portfolio zu festigen.

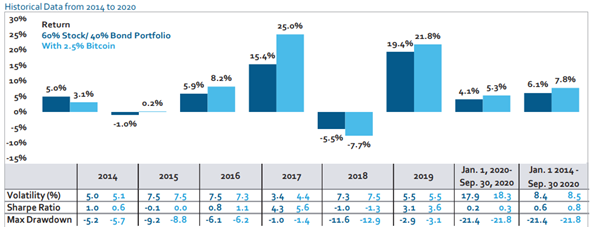

Laut einer Forschungsarbeit von Morgan Stanley mit dem Titel "The Case for Cryptocurrency"," Bitcoin kann einen positiven Einfluss auf ein diversifiziertes Portfolio haben, wenn es in kleinen Mengen hinzugefügt wird.

Die Forscher fanden heraus, dass 2,5% eines 60% Aktien- und 40% Anleihenportfolios über einen Zeitraum von fünf Jahren (2014-2018) mit monatlichem Rebalancing in Bitcoin investiert wurden, Die annualisierten Renditen verbesserten sich, "ohne die Volatilität der maximalen Rückschläge signifikant zu erhöhen".

Eine regelmäßige (vierteljährliche oder monatliche) Umschichtung von Bitcoin zurück auf die ursprüngliche Gewichtung in einem Portfolio kann die Volatilität minimieren und die Rendite steigern.

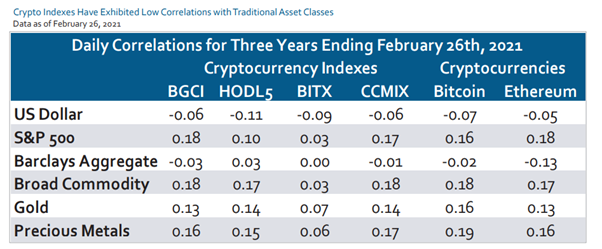

Kryptowährungen weisen - langfristig gesehen - eine geringe Korrelation mit traditionellen Anlageklassen auf. Zum Beispiel ist Bitcoin im Wesentlichen unkorreliert mit dem Anleihemarkt und zeigt nur eine geringe positive Korrelation mit risikoreichen Vermögenswerten wie Aktien und Rohstoffen.

Im Folgenden wird das Verhältnis zwischen zwei Kryptowährungen und traditionellen Anlageklassen dargestellt, wie aus dem Forschungspapier von Morgan Stanley hervorgeht:

Wie Sie Bitcoin in Ihr Portfolio aufnehmen

Institutionelle Anleger, deren Mandat es ihnen erlaubt, Kryptowährungen direkt zu kaufen und sie bei einer qualifizierten Depotbank zu halten, können sie "physisch" kaufen. Die meisten Anleger werden jedoch wahrscheinlich den Kauf von börsengehandelten Krypto-Investmentprodukten wie Bitcoin-Futures-ETFs, Bitcoin-ETPs oder Bitcoin-Futures vorziehen (oder sind aufgrund ihres Mandats dazu verpflichtet).

Europäische Anleger, die sich indirekt am Preis der Kryptowährung beteiligen möchten, können die Iconic Funds kaufen Physisches Bitcoin-ETP. Das börsengehandelte Produkt (ETP) bildet den Bitcoin-Kurs ab, der durch den NYSE Bitcoin Index repräsentiert wird, und ermöglicht Anlegern ein Engagement in der Kursentwicklung der digitalen Währung, ohne die Kryptowährung selbst verwahren zu müssen. Das ETP ist zu 100 Prozent physisch unterlegt und wird bei einer BaFin-regulierten Verwahrstelle sicher gelagert. Zusätzliche Sicherheit wird durch eine Drittversicherung gewährleistet.

Iconic's Physical Bitcoin ETP (XBTI) ist notiert und wird gehandelt an Deutsche Börse Xetra, SIX Swiss Exchange (in USD und CHF), Euronext Paris und Amsterdam. Für das Anlageprodukt fällt lediglich eine jährliche Verwaltungsgebühr von 0,95 Prozent an.

Um mehr über Iconic's Physical Bitcoin ETP zu erfahren, klicken Sie hier.

Über DDA Ikonische Fonds

Iconic Funds ist die Brücke zum passiven und aktiv verwalteten Engagement in Kryptowährungen. Iconic Funds bietet über seine Tochtergesellschaften Krypto-Asset-ETPs, diversifizierte Indexfonds und Alpha-Strategien für Anleger an.

Iconic Funds hat es sich zur Aufgabe gemacht, die Akzeptanz von Krypto-Assets zu fördern. Als Brücke für Anleger, die in Krypto-Assets investieren wollen, bieten die lizenzierten und regulierten Vehikel von Iconic den Anlegern eine Auswahl an Anlagemöglichkeiten, die von passiven Indexanlagen bis hin zu aktiv verwalteten Strategien reichen. Iconic Funds beseitigt die technischen Risiken von Krypto-Investitionen, indem es Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten bietet.

Durch die Verbindung von modernster Technologie, innovativen Anlageprodukten und kompromissloser Professionalität steht Iconic an der Spitze der Krypto-Vermögensverwaltung.

- Kryptowährungen und die Sharpe-Ratio traditioneller Anlagemodelle ➡ Hier herunterladen

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

- Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

Dieser Artikel stellt lediglich eine unverbindliche Vorabinformation dar, die ausschließlich Werbezwecken dient und kein Prospekt im Sinne des Europäischen Wertpapierprospektgesetzes, des Investmentgesetzes oder des Kapitalanlagegesetzbuches oder eines entsprechenden ausländischen Rechts ist. Der Verkaufsprospekt für das physisch besicherte Bitcoin-ETP ist verfügbar unter https://deutschedigitalassets.com/xbti-iconic-funds-physical-bitcoin-etp/. Bitte lesen Sie den Verkaufsprospekt, bevor Sie eine endgültige Anlageentscheidung treffen.

In keinem Fall können Sie die ICONIC HOLDING GMBH, ihre Tochtergesellschaften oder eine mit ihr verbundene Partei für direkte oder indirekte Anlageverluste haftbar machen, die durch Informationen in diesem Artikel verursacht wurden. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die ICONIC HOLDING GMBH ist in keiner Rechtsordnung als Anlageberater registriert. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Investitionsentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Investitionsmöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Prognosen und Meinungen, die sich als wesentlich ungenau erweisen können und von Natur aus erheblichen Risiken und Unsicherheiten unterliegen, die außerhalb der Kontrolle der ICONIC HOLDING GMBH liegen. Unsere Artikel und Berichte drücken unsere Meinungen aus, die wir auf der Grundlage allgemein verfügbarer Informationen, Feldforschung, Schlussfolgerungen und Ableitungen durch unsere Due Diligence und unseren analytischen Prozess gewonnen haben.

Die ICONIC HOLDING GMBH geht davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen, die wir für korrekt und zuverlässig halten. Diese Informationen werden jedoch "wie besehen", ohne jegliche Garantie, präsentiert.