Während "Kaufen und Halten" (bekannt geworden durch das "HODL"-Mem) der wohl bekannteste Ansatz für Investitionen in digitale Vermögenswerte ist, können aktiv verwaltete Anlagestrategien für digitale Vermögenswerte eine risikooptimierte Alternative für Anleger darstellen, die vom Wachstum und der Volatilität des Kryptomarktes profitieren möchten.

Lesen Sie weiter, um mehr über die Vorteile aktiv verwalteter Anlagestrategien auf den Kryptomärkten zu erfahren und wie Iconic Quant Solutions Ihnen dabei helfen kann.

Was sind aktiv gemanagte Fondsstrategien und warum sind sie auf den Märkten für digitale Vermögenswerte sinnvoll?

Bei aktiv verwalteten Anlagestrategien wird - wie der Name schon sagt - ein Portfolio aktiv verwaltet, um die Erträge zu maximieren und gleichzeitig das Risiko zu minimieren.

Die Volatilität der Kryptomärkte und die extremen Renditen, die dort zu beobachten sind, machen es sehr schwierig, ein Portfolio rational zu verwalten, insbesondere wegen der FOMO (Fear Of Missing Out), die noch verstärkt wird, oder wegen frühzeitiger Gewinnmitnahmen, die massive verpasste Chancen bei wichtigen Aufwärtstrends erzeugen.

Der Kryptomarkt ist für jeden aktiven Manager der Tempel des Bedauerns schlechthin, zumal die Mehrheit der Teilnehmer unerfahren ist. Aus diesem Grund haben passive Strategien (auch bekannt als "HODLing") aufgrund ihrer Einfachheit und ihrer langfristigen Effektivität an Popularität gewonnen.

Der Kryptomarkt ist jedoch durch zahlreiche statistische Anomalien gekennzeichnet, die sich gerade aus den extremen Emotionen der Teilnehmer ergeben. Diese Anomalien können von mathematischen Modellen erfasst und ausgenutzt werden, um unter allen Marktbedingungen eine nachhaltige Outperformance zu erzielen.

Durch eine Kombination aus algorithmischen Handelsstrategien - die in der Regel automatisch über APIs an den Börsen ausgeführt werden - sind aktiv verwaltete Kryptofonds in der Lage, selbst während einer Marktkorrektur oder eines Krypto-Winters Renditen zu erzielen.

Neben der Möglichkeit, in fallenden Märkten Renditen zu erwirtschaften, kommen aktiv verwaltete Anlagestrategien auch Anlegern zugute, die die Volatilität der Kryptomärkte nur schwer verkraften können.

Absolute-Return-Strategien, die sowohl Long- als auch Short-Positionen, Relative-Value-Positionen und/oder Arbitragestrategien nutzen, sind so konzipiert, dass sie unter allen Marktbedingungen eine Performance erzielen, indem sie eine physische oder statistische Anomalie erfassen. Darüber hinaus ist das im Laufe der Zeit eingegangene Risiko ein Parameter, der angepasst oder überwacht werden kann, so dass die Fondsmanager vordefinierte Drawdown-Grenzen einhalten können.

Das Ergebnis ist, können die Anleger eine stetige Performance ohne aggressive Drawdowns erwarten. Für Anleger, die neu auf den oft volatilen Märkten für digitale Vermögenswerte sind, kann diese Eigenschaft aktiv verwalteter Fonds besonders attraktiv sein.

Arten von aktiven Anlagestrategien

Es gibt eine breite Palette von Handelsstrategien, die von aktiv verwalteten Investmentfonds angewandt werden. Werfen wir einen Blick auf einige der gängigsten Ansätze.

Trendfolgend

Der Trend ist Ihr Freund, insbesondere wenn Sie Trendfolgestrategien einsetzen.

Die Idee, die hinter der Trendfolgebewegung als Investitionsansatz steht, ist die Überzeugung, dass sich die Märkte in Trends bewegen und so die Möglichkeit bieten, Geld zu verdienen, indem man zum richtigen Zeitpunkt auf einen Trend aufspringt oder ihn verlässt.

Bei trendfolgenden Anlagestrategien werden Preistrends mit Hilfe statistischer Indikatoren ermittelt, um die Stärke der Trends zu messen und sie bis zum Ende zu verfolgen, um von langen Aufwärts- und Abwärtsbewegungen des Marktes zu profitieren.

Durch eine Kombination von Trendfolgeindikatoren wie gleitenden Durchschnitten (SMA), linearen Regressionen und Beschleunigungsmaßen können algorithmische Handelsmodelle Preistrends erkennen, die Trendstärke messen und automatisch Geschäfte auf der Grundlage von Kauf- und Verkaufssignalen ausführen, um Handelseinnahmen zu erzielen.

Im Allgemeinen haben Trendfolgestrategien eine recht niedrige Trefferquote (unter 50%), aber einen positiven durchschnittlichen Gewinn pro Handel. Die Hauptschwierigkeit bei Trendfolgestrategien liegt in der Fähigkeit, zu Beginn des Trends schnell einzusteigen und vor allem am Ende des Trends schnell wieder auszusteigen, indem man während der Dauer des Trends so wenig wie möglich aussteigt, was widersprüchlich ist.

Starke Aufwärtstrends sind eines der Markenzeichen des Kryptomarktes, weshalb sich Trendfolgestrategien besonders gut für diese Anlageklasse eignen.

Mittelwert umkehrend

Mean Reversion ist eine Finanztheorie, die besagt, dass die Renditen und die Volatilität eines Vermögenswerts oder Wertpapiers im Laufe der Zeit zu ihren langfristigen Durchschnittswerten zurückkehren. Auf einem kürzeren Zeithorizont wird eine Mean-Reversion-Strategie im Falle eines statistisch anormalen Verhaltens oder einer übertriebenen Bewegung eine Gegenposition einnehmen.

Bei einer Mean-Reverting-Anlagestrategie können Anleger (in der Regel unter Verwendung von Algorithmen) direktionale Geschäfte mit Vermögenswerten tätigen, die erheblich von ihrem Mittelwert abgewichen sind, in der Erwartung, dass sie wieder zu diesem Niveau zurückkehren werden.

Wenn ein Algorithmus beispielsweise eine starke Korrektur beobachtet, die durch eine Liquidationskaskade verursacht wird, kann er feststellen, dass der Preis aus statistischer Sicht zu schnell fällt, und wenn er das Risiko-Ertrags-Verhältnis als interessant analysiert, kann er ein Kaufsignal erzeugen, das er für einen kurzen Zeitraum beibehalten sollte.

Im Gegensatz zu Trendfolgestrategien lassen die Signale bei Mean-Reverting-Strategien erst nach, wenn der Kurs wieder steigt, so dass das Hinzufügen einer Stop-Loss-Strategie besonders wichtig ist. Mean-Reverting-Strategien haben in der Regel eine gute Trefferquote, aber der durchschnittliche Gewinn pro Handel ist geringer. Die Hauptschwierigkeit bei diesen Strategien liegt in der Risikokalibrierung und der Überwachung des Stop-Loss.

Relativer Wert

Relative-Value-Strategien nutzen Fehlbewertungen zwischen zwei ähnlichen oder eng verwandten Vermögenswerten oder Wertpapieren aus, um durch den Verkauf des einen Wertes gegenüber dem anderen einen Gewinn zu erzielen und dabei marktneutral zu bleiben.

Dieser auch als statistische Arbitrage bezeichnete Ansatz ist bei Anlegern beliebt, die es vorziehen, keine direktionale Wette einzugehen (um die Marktvolatilität zu verringern), sondern darauf zu setzen, dass ein Vermögenswert besser abschneidet als ein anderer.

Sie könnten zum Beispiel einen Long/Short-Handel mit EOS (EOS) gegen Ethereum (ETH)wobei Sie EOS kaufen und gleichzeitig ETH verkaufen. Steigt der Preis von EOS stärker (oder sinkt weniger) als der Preis von ETH, ist der marktneutrale Handel im Geld.

Ein quantitativer Fondsmanager kann:

- Stellen Sie fest, dass ein Vermögenswert einen anderen übertreffen sollte, indem Sie z. B. Preise, Volumina oder alternative Daten wie die Stimmung in sozialen Netzwerken, die Dynamik der Follower oder On-Chain-Daten heranziehen, und versuchen Sie, eine Trendfolgestrategie auf das Verhältnis anzuwenden.

- Erkennen Sie eine statistisch abnormale Bewegung des Verhältnisses und platzieren Sie einen Handel, der den Mittelwert umkehrt.

- Arbitragepreise oder Basisgeschäfte (Spiel mit den Refinanzierungssätzen durch den Handel von Futures gegen Spot-Basiswerte).

Unter Quantitative Lösungen mit SymbolcharakterDas Vermögensverwaltungsteam strebt absolute Renditen an, indem es eine Kombination verschiedener Long-Short-Strategien einsetzt, darunter Trendfolgestrategien, Mean-Reversion-Strategien und Relative-Value-Strategien, mit einer Zielvolatilität von 30%, um den Anlegern eine stetige Performance zu bieten.

Die Vorteile eines konstanten Risikobudgets

Beim Einsatz quantitativer Handelsstrategien können Fondsmanager systematisch steuern, wie viel Risiko ihr algorithmisches Handelsmodell eingehen soll, um dieses Risiko im Laufe der Zeit konstant zu halten.

In einem Markt mit hoher Volatilität werden die Positionen automatisch erheblich reduziert, verglichen mit Zeiten geringer Marktvolatilität. Außerdem begrenzen die meisten Quant-Manager die maximale Hebelwirkung, die der Algorithmus nutzen kann, was der Festlegung eines Mindestvolatilitätsniveaus des Marktes gleichkommt.

Während die Handelsmodelle weiterhin ihre spezifischen Strategien ausführen, ist das Abwärtsrisiko im Laufe der Zeit konstant, da die Algorithmen entscheiden, wie viel Kapital bei jedem Handel angesichts der Volatilität des Basiswerts riskiert werden sollte.

Daraus folgt, dass der Drawdown im Laufe der Zeit die gleiche Bedeutung hat und verglichen werden kann. Er ist nicht das Ergebnis eines zufälligen Marktereignisses. Dies ermöglicht es, Strategien zu erkennen, die für die aktuellen Marktbedingungen weniger geeignet sind, und die Gründe dafür zu analysieren, um zu entscheiden, ob sie neu angepasst, abgetrennt oder zumindest ihre Allokation reduziert werden soll.

Um zu bestimmen, wie viel Risiko angesichts der vorherrschenden Bedingungen auf dem Kryptomarkt angemessen ist, würden quantitative Kryptofonds idealerweise eine implizite Volatilität verwenden, die vom Optionsmarkt abgeleitet wird. Da der Markt für Kryptooptionen jedoch noch nicht ausgereift genug ist, ist die Berechnung der Volatilität anhand historischer Daten relevanter.

Die Vorteile der Minimierung von Drawdowns

Trader lieben Volatilität. Investoren nicht.

Die Anleger wünschen sich eine stetige Wertsteigerung ihres Portfolios im Laufe der Zeit, ohne dass es zu starken Rückschlägen kommt.

Aber jeder, der schon einmal ein Produkt gekauft hat Bitcoin (BTC) oder andere digitale Vermögenswerte kennt, weiß, dass starke Preiskorrekturen auf den Kryptomärkten regelmäßig vorkommen.

Ein starker Drawdown erfordert eine beträchtliche Leistung, bevor ein neuer Höchststand erreicht werden kann. Bitcoin bei $20.000 nach $70.000 muss mit 3,5 multipliziert werden, um ein neues Hoch zu erreichen. Es ist wichtig, Drawdowns zu begrenzen, um schnell neue Höchststände erreichen zu können.

Aktiv verwaltete algorithmische Krypto-Fonds können die Drawdowns reduzieren, indem sie das Risiko, das in ihre Handelsmodelle einfließt, verringern.

In schwierigen Marktsituationen können bei einer Strategie und einem statistisch signifikanten Drawdown die Risikoparameter automatisch gestrafft werden, um weitere Drawdowns zu vermeiden und so das Potenzial für starke Wertverluste des Portfolios für die Anleger zu verringern.

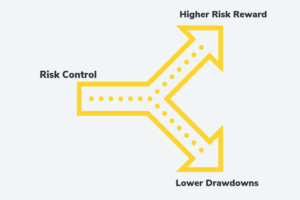

Die Vorteile einer Kombination von dekorrelierten Strategien zur Optimierung Ihres Risiko-/Renditeprofils

Durch die Kombination unkorrelierter Strategien - wie Trendfolgestrategien und Mean-Reverting - können quantitative Fondsmanager die Diversifizierung erhöhen und die globale Volatilität verringern.

Da die Stärke der Preistrends und die Wahrscheinlichkeit einer Mittelwertumkehr beispielsweise nicht miteinander korreliert sind, können Multi-Strategie-Quant-Fonds unkorrelierte Renditen erzielen.

Während die Korrelationen zwischen verschiedenen Anlageklassen abnehmen können, bleibt die Unkorreliertheit aktiv verwalteter Strategien im Laufe der Zeit in der Regel konstant, was es quantitativen Fondsmanagern ermöglicht, die Risikoprofile ihrer Portfolios weiter zu optimieren.

Die verschiedenen Strategien haben nicht die gleichen Positionsdauerhorizonte. Wenn sie zu einem bestimmten Zeitpunkt zufällig in dieselbe Richtung gehen, kann dies keine Gleichgewichtssituation sein und wird nicht von Dauer sein, da sie eine entgegengesetzte Dynamik aufweisen. In der überwiegenden Mehrheit der Fälle neutralisieren sich mehrere Signale zumindest teilweise, und die realisierte Volatilität wird reduziert.

Ebenso haben die Drawdowns der verschiedenen Strategien keinen Grund, gleichzeitig zu sein, so dass der endgültige Drawdown der Mischung deutlich niedriger sein wird als der gewichtete Durchschnitt der Drawdowns der einzelnen Strategien. Dieser Effekt wird als Diversifizierung.

Schließlich ermöglichen einige Algorithmen die Optimierung der Zusammensetzung von Strategien mit dem Ziel, die Drawdowns zu minimieren, die Volatilität zu minimieren oder die Volatilitäts-Performance-Ratio zu maximieren.

Die Tür zu maßgeschneiderten Investitionslösungen öffnen

Algorithmisch gesteuerte, aktiv verwaltete Anlagestrategien ermöglichen es Vermögensverwaltern, ihren Kunden maßgeschneiderte Portfolios anzubieten.

Iconic Alpha AG ist der neu gegründete, aktiv verwaltete Krypto-Investmentarm von Iconic, der sich auf quantitative und algorithmische Handelslösungen spezialisiert hat.

Durch eine Kombination aus Long-Short- und Smart-Beta-Strategien, die von eigens entwickelten Handelsalgorithmen angetrieben werden, bietet Iconic Alpha separat verwaltete Konten (Separate Managed Accounts, SMAs) für vermögende Privatpersonen und professionelle Anleger an, die ein Engagement an den Kryptomärkten ohne die hohe Volatilität suchen.

Um mehr über Iconic Quant Solutions zu erfahren und wie Sie in einen aktiv verwalteten Kryptofonds investieren können, klicken Sie auf hier.

Über DDA Ikonische Fonds

Iconic Funds ist die Brücke zu Krypto-Investitionen durch vertrauenswürdige Anlageinstrumente. Wir bieten Anlegern sowohl passive als auch Alpha-Strategien für Kryptowährungen sowie Risikokapitalmöglichkeiten.

Wir liefern hervorragende Leistungen durch vertraute, regulierte Vehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter erwarten, während wir unsere Mission verfolgen, die Verbreitung von Kryptoanlagen voranzutreiben.

Neueste Nachrichten

- Bitcoin vs. Gold: Warum Sie wahrscheinlich besser dran sind, wenn Sie "digitales Gold" kaufen

- Warum die Volatilität von Bitcoin Sie nicht erschrecken sollte

- Wie Green Mining zur Norm für das Bitcoin-Netzwerk wird

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

- Wie Layer-2-Lösungen Ethereum bei der Skalierung helfen

Iconic in der Presse

- ETF-Stream: Zahl der White-Label-Emittenten in Europa innerhalb einer Woche verdreifacht

- ETF-Strategie: Iconic Funds lanciert das weltweit erste Krypto-ETP auf ApeCoin

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds erweitert seine Produktpalette mit einem physischen Ethereum-ETP

Aktuelle Forschungsberichte

Wie haben sich die Portfolios während der Pandemie entwickelt? ➡ Hier herunterladen

Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Iconic Holding GmbH, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Iconic Holding GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.