Besteht die Gefahr, dass die Kryptowährung von genau den Institutionen vereinnahmt wird, die sie eigentlich ablösen sollte?

CryptoScout von Eleanor Haas, Partnerin der Iconic Holding, Chief Concept Navigator bei der Calyx Group, Beraterin von Astia Angels und Direktorin des Keiretsu Forum Mid-Atlantic

Bitcoin, die erste Kryptowährung, wurde 2009 als Rebell mit einem Ziel ins Leben gerufen: die Umgehung staatlicher Währungskontrollen und die Ausschaltung von Bankvermittlern bei Online-Transaktionen. Zehn Jahre später denken genau die Institutionen, die mit der Kryptowährung umgangen oder eliminiert werden sollten, darüber nach, ausgewählte Bitcoin-Funktionen zu ihrem eigenen Vorteil zu emulieren. Ist der Disruptor dabei, disruptiert zu werden?

Digitale Währungen am Horizont

Bitcoin wurde gegründet, um die Hyperinflation und die Verzögerungen und Kosten, die durch dritte Vermittler bei Finanztransaktionen entstehen, zu beseitigen, indem Fiat-Währungen, also von der Regierung ausgegebene Währungen, durch privat ausgegebene digitale Währungen ersetzt werden. Aber es gibt einen Haken. Jeder kann eine digitale Währung schaffen. Jeder - sogar eine Zentral- oder Geschäftsbank - und sie scheinen genau das zu planen. Von den Institutionen kontrollierte digitale Währungen?

Nationale Regierungen testen ihre eigenen digitalen Währungen

Die digitale Währung ist ein programmierbarer Code ohne physische Form. Wie physisches Geld kann sie zum Kauf und Verkauf von Waren und Dienstleistungen verwendet werden. Sie schafft einen Mehrwert, indem sie Zeit und Geld spart; sie macht Transaktionen sofort möglich - und glättet sogar die grenzüberschreitenden Herausforderungen der Devisenkontrolle und der Einhaltung von Vorschriften von einem Land zum anderen - und beseitigt die Kosten für dritte Vermittler.

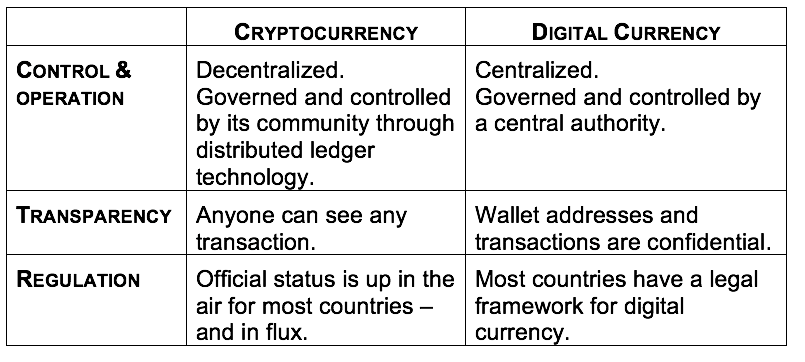

Kryptowährung ist eine Form der digitalen Währung. (Eine andere Form ist die virtuelle Währung, z. B. Vielfliegermeilen, Gutscheine oder Prämienpunkte). Aber sie sind unterschiedlich:

Traditionelles Geld kann digital sein, und die Staaten und ihre Zentralbanken befassen sich intensiv mit den Möglichkeiten der digitalen Zentralbankwährung (CBDC). Dafür gibt es zwei Gründe: Der erste ist, dass größere Effizienz und Kostenwirksamkeit das Wirtschaftswachstum ankurbeln können. Der zweite Grund ist die Befürchtung, dass private Kontrolle an die Stelle staatlicher Kontrolle treten könnte - eine Bedrohung, die durch den letztjährigen Libra-Vorschlag trotz der fast universellen Gegenreaktion gegen Libra nur allzu greifbar wurde. Es wurden zwei Arten von Bedenken geäußert: (1) dass eine private Währung die nationale Souveränität und wirtschaftliche Stabilität untergraben würde und (2) dass Facebook angesichts seiner skandalumwitterten Erfolgsbilanz kaum eine vertrauenswürdige Führungspersönlichkeit für eine solche Verantwortung sei.

Die Ergebnisse einer Studie, die IBM Ende Oktober zu diesem Thema in Auftrag gegeben hat, bestätigen die Realität der kommenden CBDCs: "Politische Entscheidungsträger in einer Reihe von Zentralbanken auf der ganzen Welt erwägen ernsthaft die Entwicklung und Ausgabe einer digitalen Zentralbankwährung (CBDC), wobei eine verbraucherfertige CBDC wahrscheinlich in den nächsten fünf Jahren auf den Markt kommen wird."

Die USA befinden sich in einer regulatorischen Zwickmühle. Der stellvertretende US-Finanzminister Justin Mnuchin argumentierte auf einer jährlichen Bankenkonferenz im November, dass:

"Digitale Währungen in großem Maßstab werfen nicht nur konkrete Fragen zu Geldwäsche, Geldpolitik und anderen Themen auf, sondern auch sehr abstrakte Fragen zur Selbstverwaltung. Diejenigen, die sich auf den Märkten für digitale Währungen engagieren, sollten daher erwarten, dass die politischen Entscheidungsträger bei der Verfolgung des öffentlichen Interesses einen sehr genauen Blick auf diese Fragen werfen werden."

Dann kamen das Coronavirus und die Notwendigkeit noch nie dagewesener staatlicher Maßnahmen zur Bewältigung der wirtschaftlichen Situation. Ein digitaler Dollar wurde von den Demokraten im Kongress während der Verhandlungen über das dritte Notstandsgesetz erwähnt, aber in der endgültigen Fassung gestrichen. Wird er im nächsten Konjunkturpaket wieder auftauchen? Darüber kann man nur spekulieren. Bislang würde ein digitaler Dollar jedoch wahrscheinlich die herkömmliche Banktechnologie verwenden und nicht das dezentrale verteilte Hauptbuch der Blockchain.

China hingegen hat mit dem ersten realen Pilotprojekt eines digitalen Yuan, der den Papier-Yuan ergänzen und den US-Dollar herausfordern soll, die Führung übernommen. Vier Großbanken und wichtige Wirtschaftsteilnehmer wie China Telecom sollten bis Ende 2019 unter der Schirmherrschaft der chinesischen Zentralbank (People's Bank of China, PBoC) einen zweijährigen Test von Zahlungen in digitaler Währung starten.

Einige aktuelle Cointelegraph-Schlagzeilen geben Aufschluss über die Entwicklung:

- Russlands Zentralbank testet jetzt an Realwerte gebundene Stablecoins

- Schwedens Zentralbank kooperiert mit Accenture bei der Einführung der E-Krone.

- Frankreich testet seine digitale Zentralbankwährung in Q1 2020: Offiziell

- Ghana erforscht digitalisierte Landeswährung, sagt der Leiter der Zentralbank

Auch die Geschäftsbanken testen ihre eigenen Währungen

JPMorgan Chase, die größte US-Bank, hat im vergangenen Februar einen Kanarienvogel in den Krypto-Kosmos entlassen, den JPM Coin - ein Kanarienvogel, der die Lebensfähigkeit testen soll. Es handelt sich um eine digitale Münze, genauer gesagt um eine stabile Münze, die durch bereits auf Konten von JPMorgan Chase gehaltene US-Dollar gedeckt ist. Ziel ist es, die Kosten, Kapitalreserven und Risiken für institutionelle Kunden, die Zahlungen an andere Kunden leisten, zu verringern.

Wenn ein Kunde einem anderen über die Blockchain Geld schickt, entfällt die Abwicklungszeit, da die JPM-Coins sofort transferiert und gegen den Gegenwert in US-Dollar eingetauscht werden.

JPM Coin wurde als Prototyp veröffentlicht und hat überlebt, um im Juni in die nächste Phase einzutreten und die Technologie mit Kunden zu testen. Das ist ein langsamer Prozess. "Die Technologie ist sehr gut, aber es braucht Zeit für die Lizenzierung und Genehmigung. Sie muss erklärt werden", sagte Umar Farooq, Leiter der Abteilung für digitale Finanzdienstleistungen und Blockchain bei der Investmentbank.

Eine andere US-Bank, Signature Bank - weniger als 2% so groß wie JPMorgan Chase - hat bereits ein Blockchain-basiertes Zahlungssystem, das von etwa 100 Geschäftskunden genutzt wird. Es wurde von den Aufsichtsbehörden des Bundesstaates New York genehmigt und Ende 2018 eingeführt. Berichten zufolge nutzen Kunden das System, um sich gegenseitig Kryptowährungszahlungen in Höhe von mehreren Millionen Dollar pro Tag zu senden. Signature bietet auch Bankdienstleistungen für einige Kryptowährungs-Start-ups und andere FinTech-Unternehmen auf den Bermudas an.

Der Schlüssel zu diesen beiden Systemen ist die Verwendung von Stablecoins, einer neuen Klasse von Kryptowährungen, deren Variationen und Verwendung im Jahr 2019 drastisch zugenommen haben. Ihr Wert ist an eine Fiat-Währung oder andere Vermögenswerte gekoppelt, um die Volatilität zu vermeiden, die anderen Kryptowährungen innewohnt, deren Preis vollständig vom Markt bestimmt wird.

Sind etablierte Währungen eine Bedrohung für Kryptowährungen?

Wird der Disruptor vom Establishment gestört werden? Auf keinen Fall! Etablierte Währungen sind lediglich Tauschmittel; Kryptowährungen sind vielseitig einsetzbar. Sie wurden nicht nur als Tauschmittel geboren, sondern auch, um Innovationen voranzutreiben - als Treibstoff, auf den sich Blockchains stützen, um Anreize für die Validierung von Transaktionen zu schaffen. Sie sind natürlich auch zu bedeutenden, wenn auch unbeständigen Wertaufbewahrungsmitteln geworden.

Innovation bedeutet, mit allem zu konkurrieren, was bereits existiert. Und die Kryptowährung konkurriert seit zehn Jahren erfolgreich. Die Preise mögen volatil sein, aber der Rebell kämpft weiter und vermehrt sich. Der Preis von Bitcoin liegt derzeit bei $9.732 (www.coinmarketcap.com). Von einer einzigen Kryptowährung im Jahr 2009 haben wir heute, 10 Jahre später, 5.140 Kryptowährungen. Die Kryptowährung muss irgendetwas richtig machen!

Die Erkundung digitaler Währungen durch Zentral- und Geschäftsbanken scheint ein Schritt vorwärts und kein Schritt zurück zu sein - ein erster Schritt zur Übernahme des "Cryptochain"-Ökosystems durch etablierte Institutionen - ein erster Schritt zur Übernahme der neuen Technologie und, was noch wichtiger ist, der neuen Denkweise. Es ist eine Denkweise, die bereit ist, sich auf das Konzept dessen einzulassen, was George Gilder als ein neues Weltsystem beschreibt, "die Reihe von Ideen, die die Technologie, die Institutionen und die Kultur einer Gesellschaft vereinen, und die Investoren und Unternehmer immer haben müssen ... von der Welt, in der sie operieren."

Gilder nennt dieses neue Weltsystem den Kryptokosmos, d. h. eine Wirtschaft, die auf einem Netzwerk von Organisationen, Systemen, Unternehmen und Einzelpersonen aufbaut, das durch Blockchain-Technologien angetrieben wird und in dem Sicherheit und Dezentralisierung die wichtigsten Merkmale sind. Die etablierten Währungen versprechen, der Weg in diese schöne neue Welt zu sein!

# # #

Dieser Artikel dient ausschließlich zu Bildungszwecken und darf nicht als Finanzberatung verstanden werden.

CryptoScout von Eleanor Haas, Partnerin der Iconic Holding, Chief Concept Navigator bei der Calyx Group, Beraterin von Astia Angels und Direktorin des Keiretsu Forum Mid-Atlantic