Macro Turmoil – A Bitcoin Macro Update

Von Dominik Poiger, Leiter des Produktmanagements, DDA

Let’s make it quick as we all know what happened: The Trump administration slapped a blanket of tariffs on imports from various countries. And naturally, other countries (i.e. China) reacted with countermeasures on US good imported to their countries.

This sent markets sharply south with global fears of a global trade war breaking out.

While crypto assets surprisingly held up steadily on Thursday, 3 April 2025 and Friday, 4 April 2025, contagion started when Asian equities sold off sharply on Sunday night/Monday morning (7 April 2025). Until that point, the price of Bitcoin was mainly influenced by the third macroeconomic factor linked to the dollar.

Which macro factors explain the price returns of bitcoin?

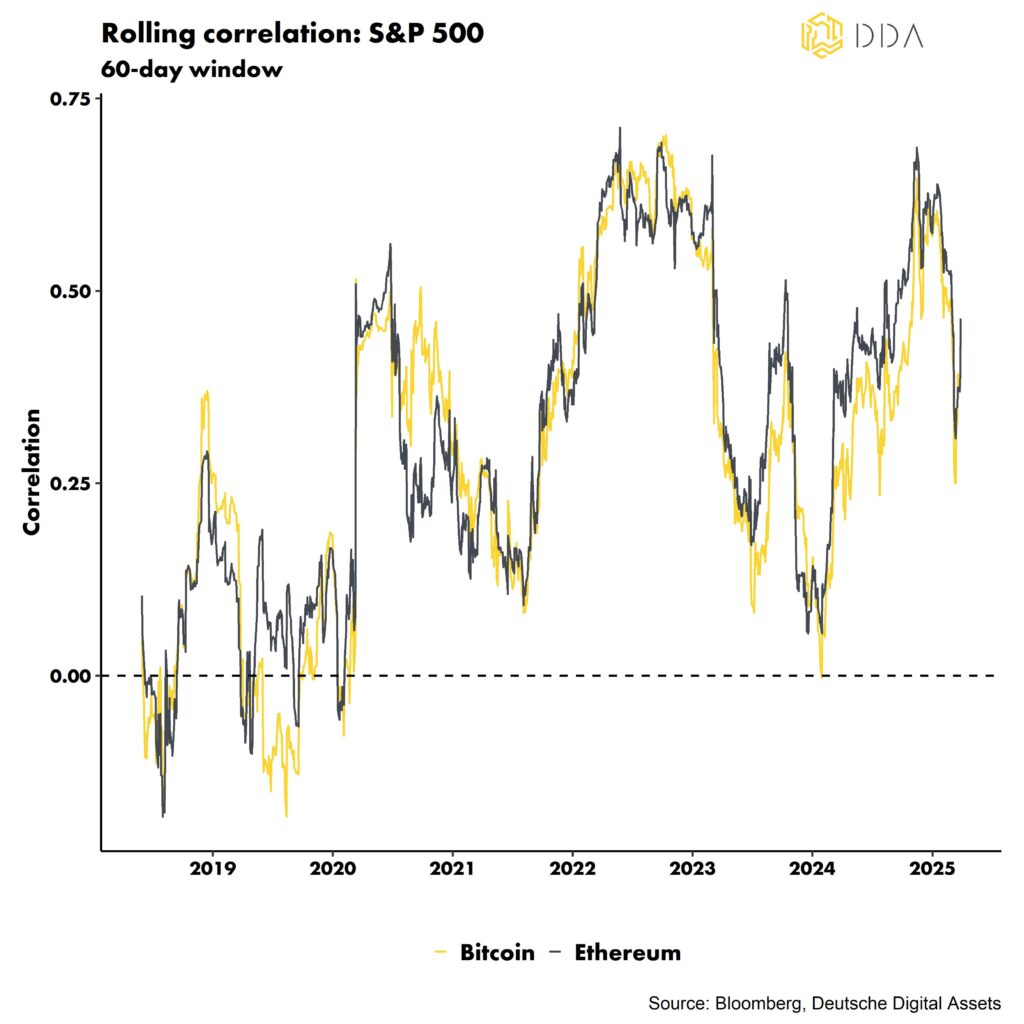

Which macro variables have recently been influencing the price of Bitcoin is a topic of continuing discussion in the cryptoasset community. Some contend that Bitcoin is just another “risk-on” trade like any other and that its value has a strong correlation with equity prices. There is some truth to that, as Bitcoin is currently still one of the most volatile financial instruments.

In fact, similar to the S&P 500, Bitcoin sold off during the Covid-shock in February/March 2020, recovered similarly, and has been trading downwards in a similar fashion since the beginning of 2025.

Source: DDA, Bloomberg, as of 31 March 2025, past performance is no guarantee of future returns

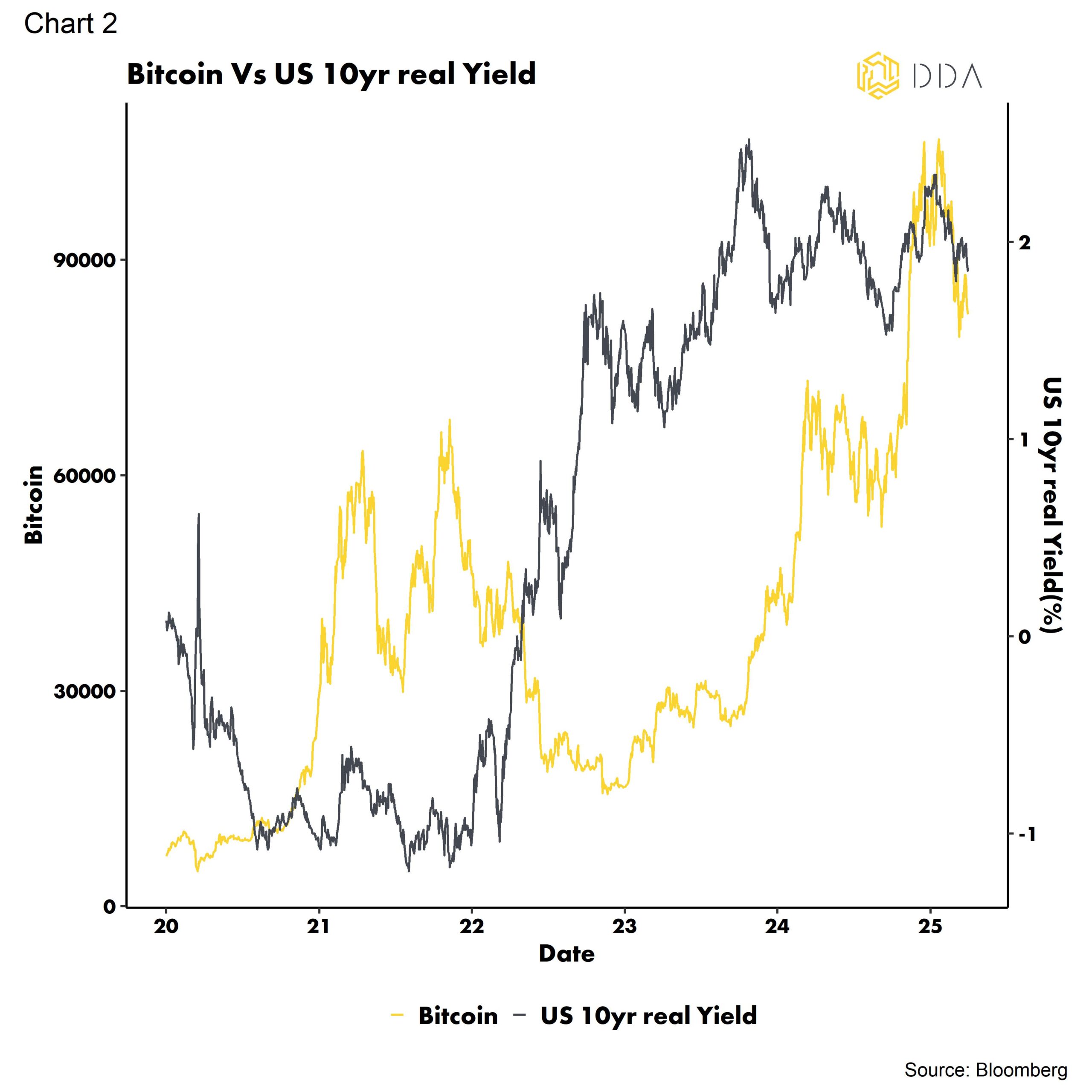

The “money printer” argument is also used by many experts to claim that monetary policy has been the only game in town for Bitcoin. In fact, it seems that in 2022, both Bitcoin and the real interest yield on US Treasuries have been strongly correlated.

Source: DDA, Bloomberg, as of 31 March 2025, past performance is no guarantee of future returns

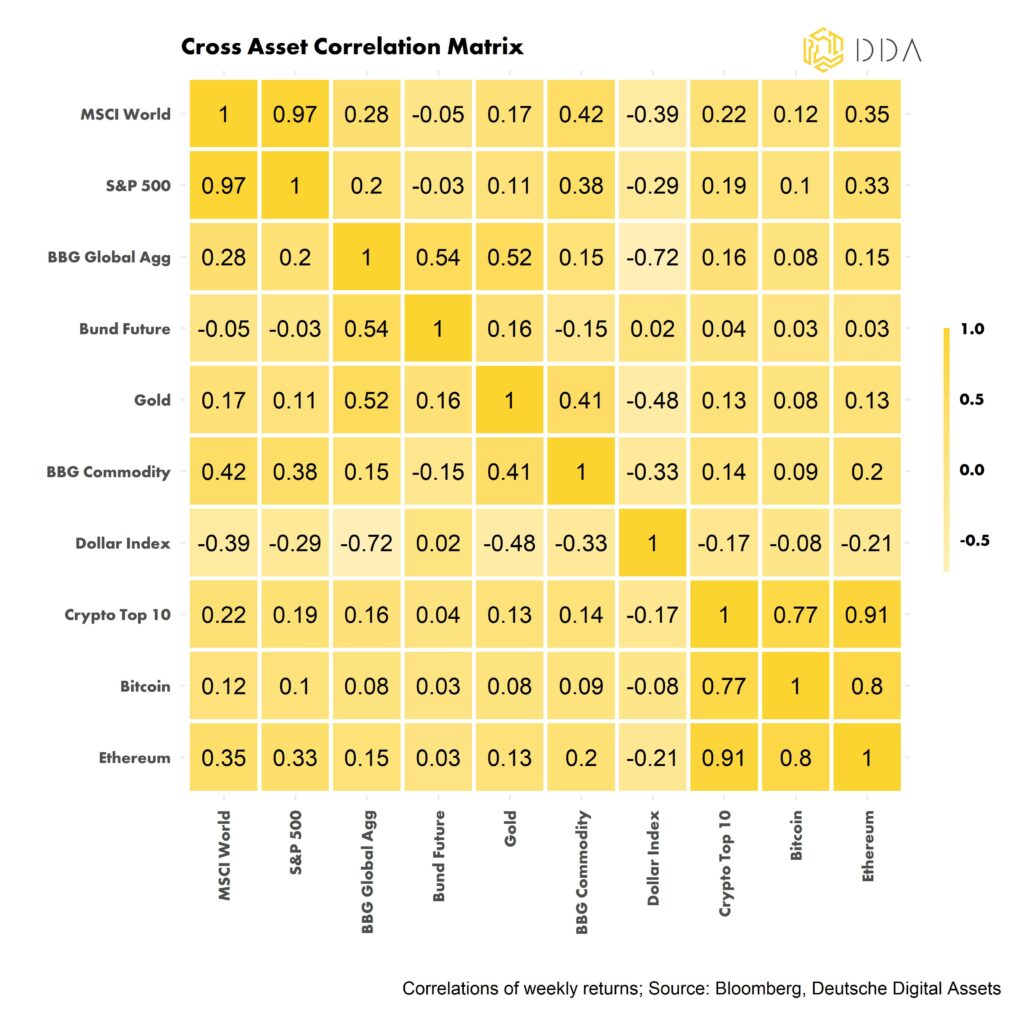

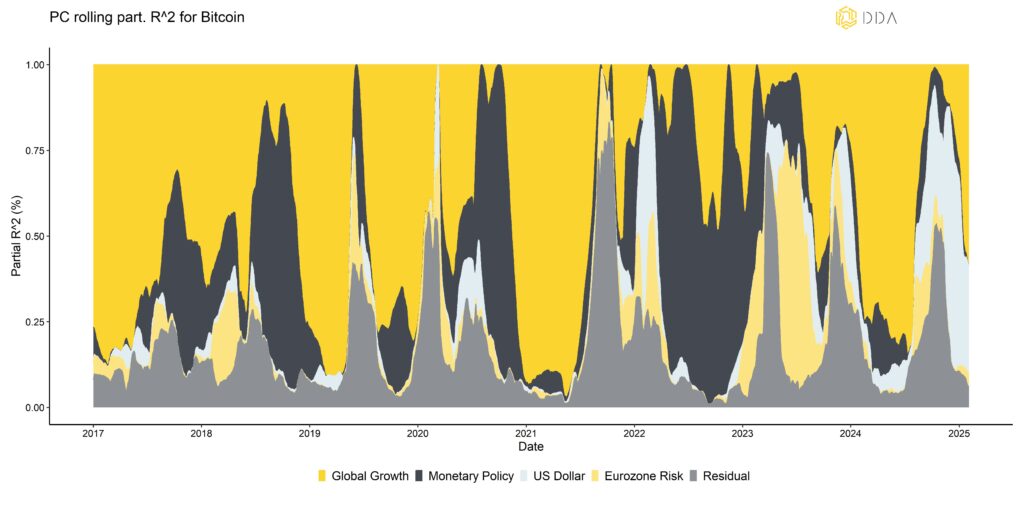

To find factors that influence the price of bitcoin the most, we employ a so-called principal component analysis (or “PCA”). This PCA breaks down the complexity of financial markets to only a handful of common factors that can account for the bulk of price movements.

While analyzing a large set of financial data and performing a PCA on them, it can be shown that the bitcoin price is primarily moved by four factors plus residuals:

- Global Growth (PC1)

- Monetary Policy (PC2)

- US Dollar (PC3)

- Eurozone risk (PC4)

- Residuals

It is crucial to understand that correlations are dynamic, i.e., they vary over time, rather than static. To capitalize on this idea of time-varying correlations among variables, researchers frequently use the word “regimes.”

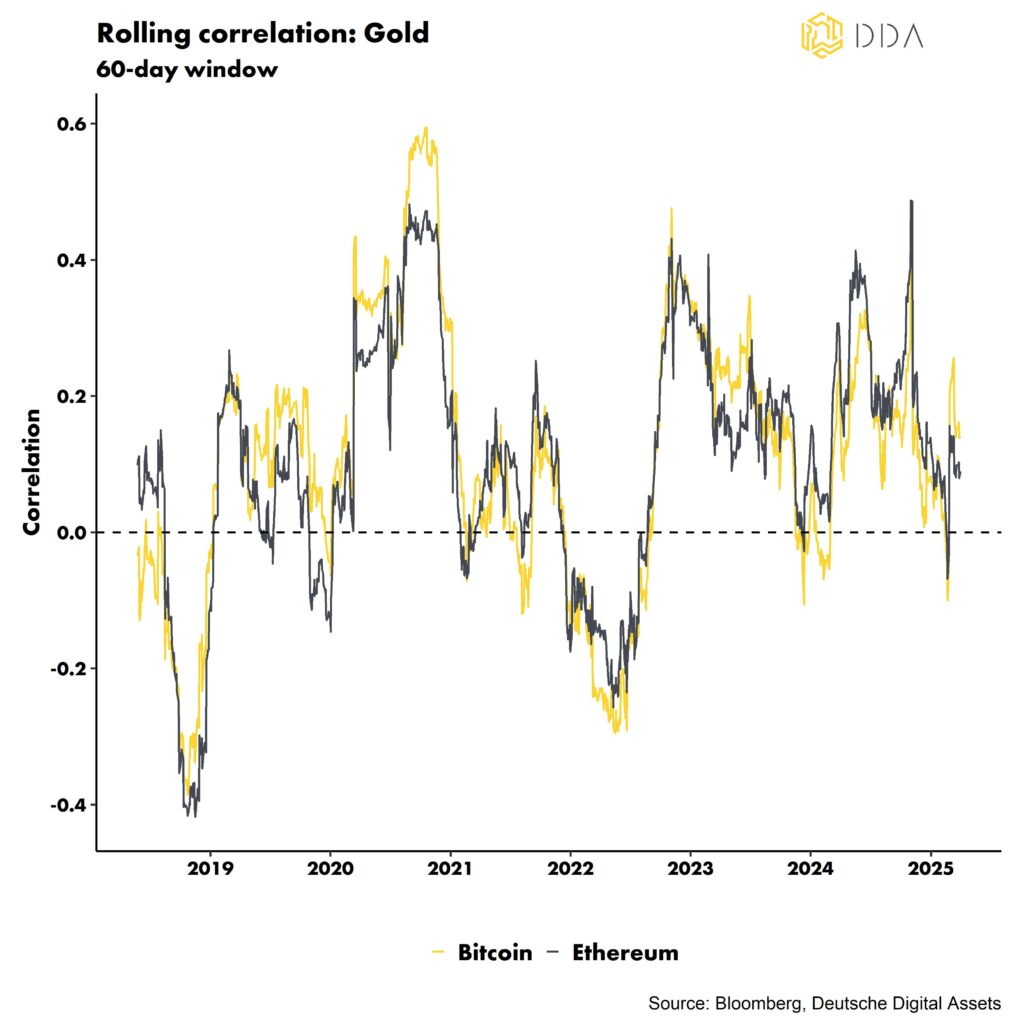

Correlations over different time periods change and bitcoin is no different: Bitcoin occasionally “behaves” more like a Tech stock (rallying with increasing risk appetite) and occasionally more like a safe-haven asset like Gold (rallies with falling risk appetite).

Source: DDA, Bloomberg, as of 31 March 2025, past performance is no guarantee of future returns

US Dollar Dominated Explanatory Power; Global Growth Concerns Returned

Source: DDA, Bloomberg, as of 31 March 2025, past performance is no guarantee of future returns

In the beginning of 2024, residuals, meaning bitcoin-specific factors, were high as bitcoin price was not driven by macro factors but by the SEC’s approval of Bitcoin ETFs in the US. Then factor 1 linked to global growth took the lead until summer where a transition from factor 1 (global growth) to factor 3 (dollar and stores of value) occurred, signifying that bitcoin was perceived as a store of value with a behavior showing similarities to those of assets such as gold. Historically, Bitcoin and gold on the one hand and the dollar on the other have been anti-correlated, and Bitcoin and gold are seen as a way to trade the de-dollarisation of the world. However, the plan to create a Strategic Bitcoin Reserve under Trump presidency could break this relationship somewhat.

It is worth noting that while gold has performed well in recent months, the US dollar has also risen sharply (but has since come back down, i.e. has weakened) following Trump’s election and the first implementation of his policies, which are very protectionist. This could be a tailwind in the months ahead, although it should weigh on the current US recovery and ultimately lead to rate cuts (benefitting factor 2).

While factor 3 used to be the most dominant factor, quickly, factor 1 became dominant as fears around a global trade war started and global growth expectations were repriced sharply.

Introducing: The DDA Bitcoin Macro ETP (BMAC)

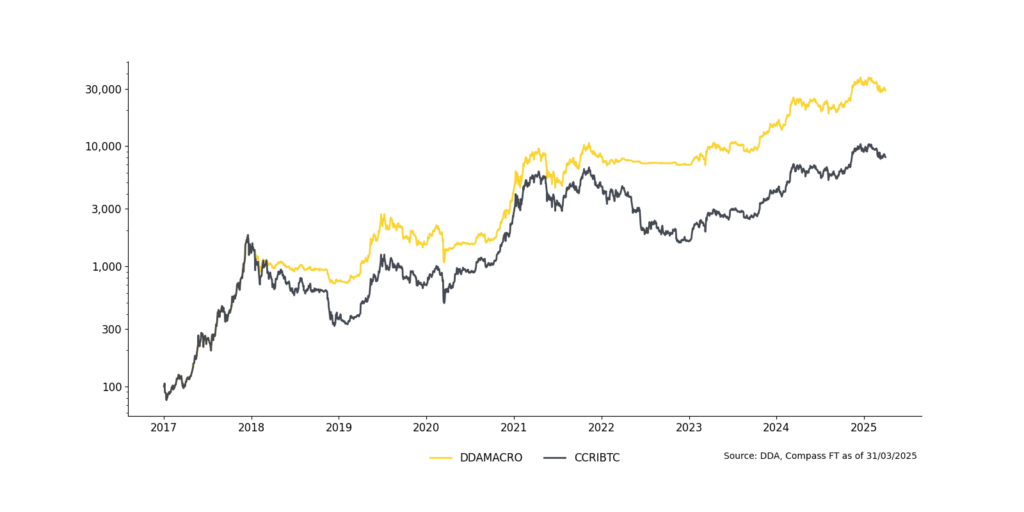

On the back of the results of this analysis, DDA has launched the DDA Bitcoin Macro ETP (ISIN: DE000A3G9SE0; WKN: A3G9SE, Ticker: BMAC) in June 2024 and listed the product on Deutsche Börse Xetra and Euronext Paris in EUR.

DDA Bitcoin Macro ETP is 100% physically backed by a basket of cryptocurrencies composing the components (BTC and/or USDC) of the Compass FT DDA Bitcoin Macro Allocation Index (“DDAMACRO”) and is held in “cold storage” at a regulated custodian. The DDA Bitcoin Macro ETP provides a dynamic, systematic exposure to BTC and USDC, utilizing key macroeconomic factors to optimize its Bitcoin exposure and enhance long-term risk management. The product aims to capture the upside of Bitcoin while protecting against adverse macro-economic conditions.

Source: DDA, Bloomberg, as of 31 March 2025, past performance is no guarantee of future returns

First Rebalancing Since Launch

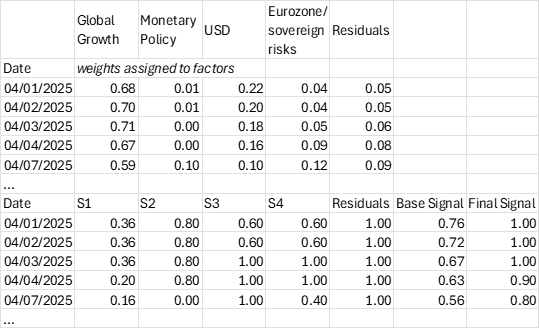

On the back of the events happening in the first week of April, the product went through its first rebalancing and reduction of bitcoin exposure. Since launch in June 2024, the product was 100% exposed to the price of bitcoin as no macro factor delivered sufficient reason to divest (and invest into USDC). Recently, global growth expectations plummeted and signaled a rebalancing for the index/product. Globally, the model only rebalances when the final signal drops below 0.67 (as it is forced to 1, i.e. full bitcoin exposure) when above.

As of this week (7-11 April 2025), the model suggests divesting approximately 40% of bitcoin exposure into USDC. This divesture cannot happen in one instance though as it rebalances over 10% increments.

Source: DDA, Compass FT, as of 7 April 2025, past performance is no guarantee of future results

The model reacted quite quickly to the sharp repricing of global growth expectations and also priced in some likelihood of a reply through monetary policy as central banks can either lower interest rates or start the money printer to dampen a potential recession.

The outlook becomes clearer: amid sovereign dysfunction and increasingly unpredictable policy, scarce, decentralized assets like Bitcoin are of more relevant than ever to investors.

Produktdetails

| Produktname | DDA Bitcoin Macro ETP |

| Ticker Xetra / Bloomberg | BMAC / BMAC GY / BMAC FP |

| ISIN / WKN | DE000A3G9SE0 / A3G9SE |

| TER | 2.00%, currently waived to 0% |

| Basiswährung | USD |

| Basiswert | DDA Bitcoin Macro Allocation Index ("DDAMACRO") |

| Produktstruktur | Physisch replizierend |

| Rebalancing | Täglich (bis zu) |

| Ertragsverwendung | Akkumulierend |

| Indexanbieter | Compass FT |

| Domizil | Liechtenstein |

| Emittent | DDA ETP AG |

| Treuhänder | Griffin Trust AG |

| Verwahrstelle(n) | Coinbase Custody International Ltd. |

| Auflagedatum | 18. Juni 2024 |

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.

Wichtige Hinweise

Dieser Artikel stellt lediglich eine unverbindliche Vorabinformation dar, die ausschließlich Werbezwecken dient. Es handelt sich nicht um einen Prospekt im Sinne der Verordnung (EU) 2017/1129 (Prospektverordnung) und des Wertpapierprospektgesetzes (WpPG).

Risikoerwägungen

Preis einer Anlage in ein DDA-ETP kann steigen oder fallen und der Anleger erhält den investierten Betrag möglicherweise nicht zurück.

Die Kursentwicklung von Kryptowährungen ist sehr volatil und unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher keine Garantie für die zukünftige Wertentwicklung.

Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen.

Die Billigung des Prospekts ist nicht als Billigung der angebotenen oder zum Handel an einem geregelten Markt zugelassenen Wertpapiere zu verstehen. Dies sind keine umfassenden Risikoerwägungen. Potenzielle Anleger sollten den Prospekt lesen, bevor sie eine Anlageentscheidung treffen, um sich ein umfassendes Bild von den möglichen Risiken und Vorteilen einer Anlage in die Wertpapiere zu machen.

Die Prospekte der einzelnen ETP-Produkte sind unter https://deutschedigitalassets.com/products/etp/ abrufbar.