Eine Woche mit hervorragender Performance und steigender optimistischer Stimmung: Was steckt hinter dem Boom?

DDA Krypto-Markt-Puls, 23. Oktober 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

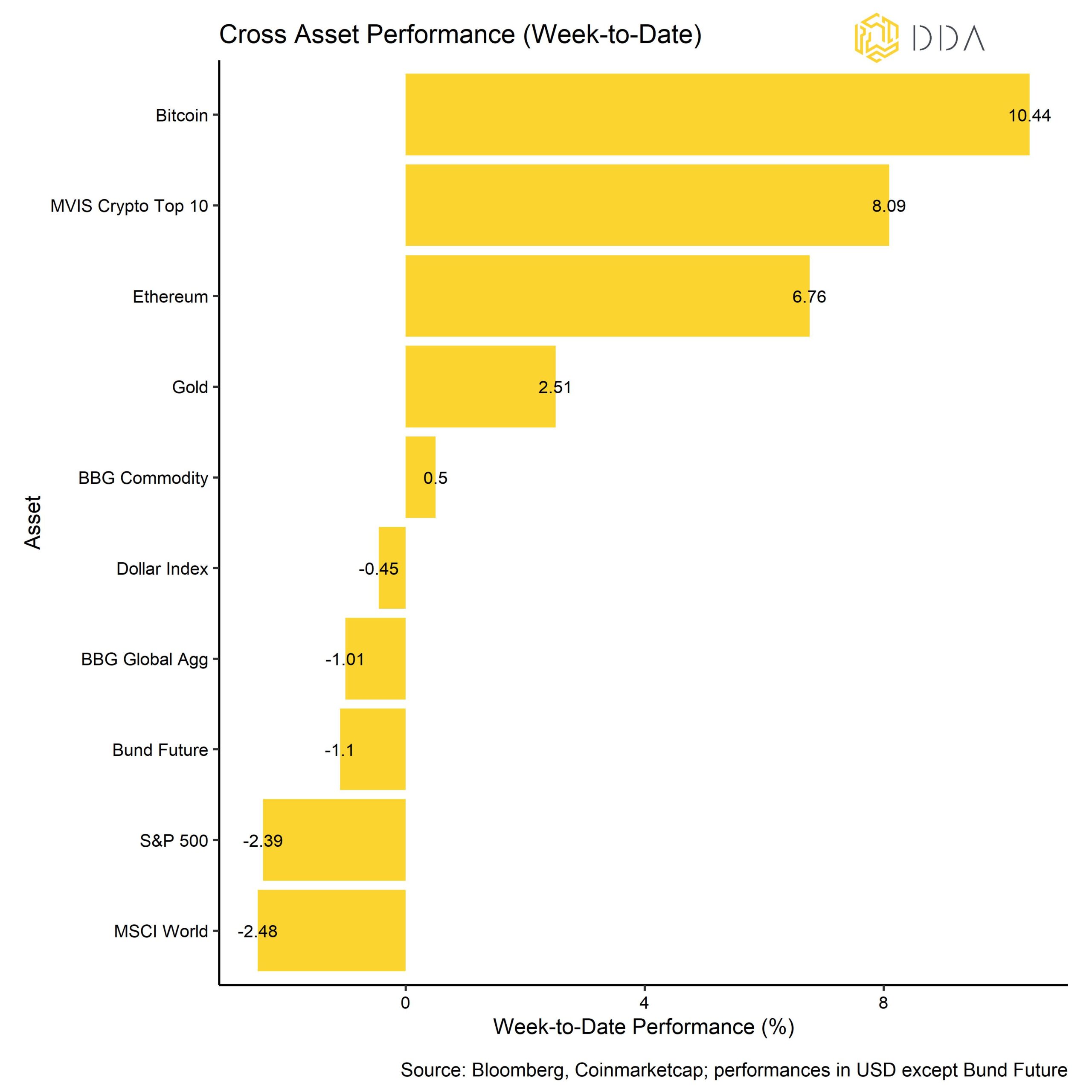

- Letzte Woche übertrafen Kryptoanlagen traditionelle Anlagen um mehr als 10%-Punkte

- Unser hauseigener Krypto-Sentiment-Index ist deutlich gestiegen und befindet sich nun im bullischen Bereich

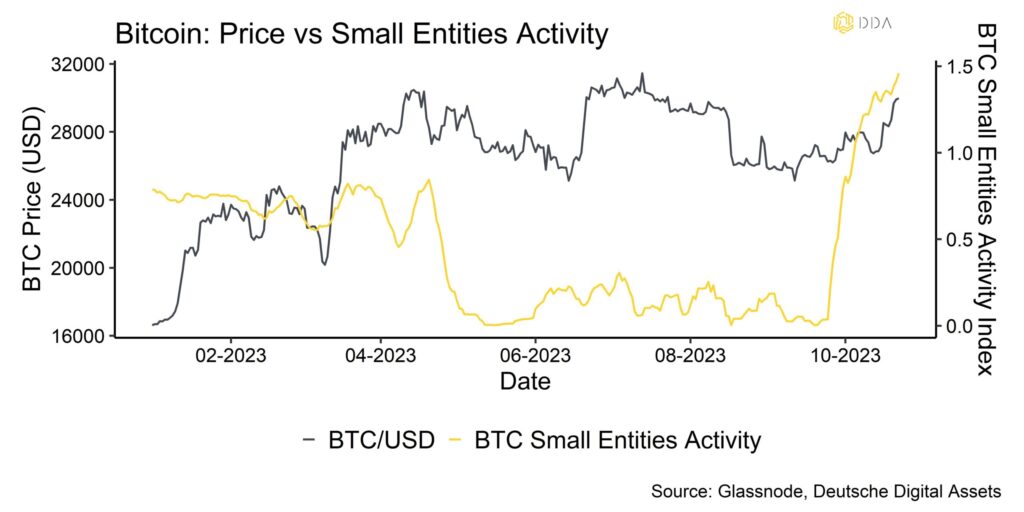

- Diese Verbesserung zeigt sich auch in der zunehmenden Aktivität von Kleinanlegern in den letzten Wochen, die sich an den BTC-Transfervolumina ablesen lässt, die seit Jahresbeginn einen Höchststand erreicht haben

Chart der Woche

Kryptoasset Leistung

In der vergangenen Woche übertrafen Kryptoanlagen die traditionellen Anlagen um mehr als 10%-Punkte. Während traditionelle Vermögenswerte wie Aktien durch steigende Renditen und die Unsicherheit auf dem US-Schatzmarkt gebremst wurden, wurden Krypto-Vermögenswerte durch die erneute Hoffnung auf die Zulassung eines US-Bitcoin-ETFs nach oben getrieben.

Es gab sogar die Nachricht, dass ein börsengehandelter Bitcoin-Spot bereits von der SEC genehmigt worden war, was den Bitcoin innerhalb weniger Minuten um etwa +2.000 USD nach oben katapultierte, nachdem erhebliche Leerverkäufe aufgelöst worden waren.

Obwohl sich diese Nachricht als Fake herausstellte, trug sie wesentlich zu einer allgemeinen Verbesserung der Marktstimmung bei. Diese Verbesserung zeigt sich auch in der verstärkten Aktivität von Kleinanlegern in den letzten Wochen, die sich an den BTC-Transfervolumina ablesen lässt, die seit Jahresbeginn Höchststände erreicht haben (Chart-der-Woche). Die Beteiligung von Kleinanlegern ist in der Regel eine Voraussetzung für einen anhaltenden Bullenmarkt bei Kryptoanlagen.

In jedem Fall ist die Zulassung eines Bitcoin-Spot-ETF in den USA noch wahrscheinlicher geworden, wie die kontinuierliche Verringerung des Abschlags auf den Nettoinventarwert des weltweit größten Bitcoin-Fonds (Grayscale Bitcoin Trust) zeigt.

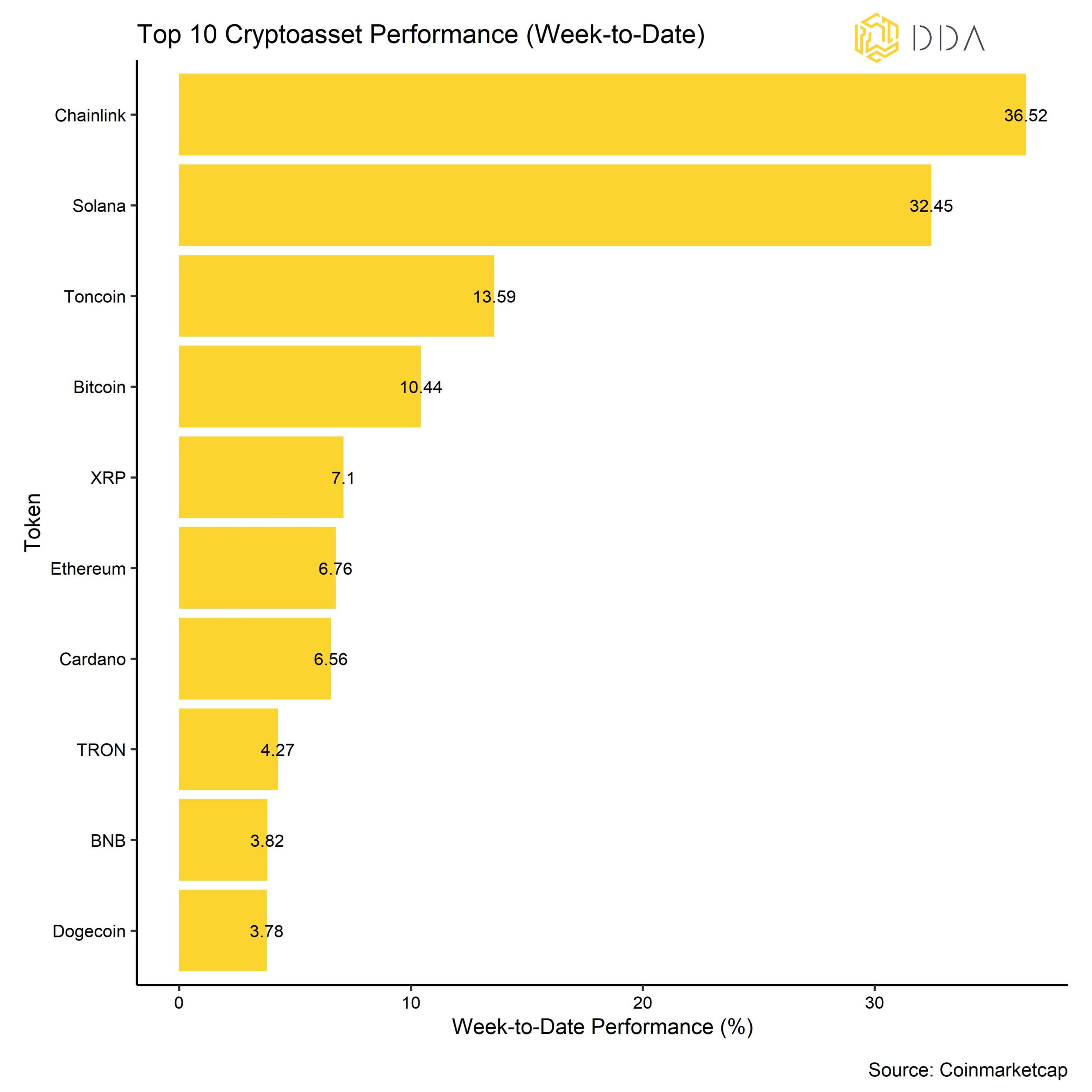

Unter den Top 10 der Kryptoanlagen waren Chainlink, Solana und Toncoin die relativen Outperformer.

Insgesamt war die Outperformance von Altcoins gegenüber Bitcoin jedoch weiterhin sehr schwach, was auf eine geringe Risikobereitschaft hindeutet. Nur 15% der von uns beobachteten Altcoins konnten Bitcoin auf wöchentlicher Basis übertreffen.

Krypto-Marktstimmung

Unser hauseigener Krypto-Sentiment-Index ist deutlich gestiegen und befindet sich nun fest im bullischen Bereich. Momentan liegen nur 9 von 15 Indikatoren über ihrem kurzfristigen Trend.

Im Vergleich zur letzten Woche kam es bei der BTC 25-Delta-Option Skew und der BTC STH-SOPR zu größeren Umkehrungen nach oben.

Der Crypto Fear & Greed Index bleibt heute Morgen ebenfalls im "neutralen" Bereich.

Die Leistungsstreuung zwischen den Kryptoassets ist weiterhin relativ hoch.

Im Allgemeinen bedeutet eine hohe Leistungsstreuung zwischen den Kryptoassets, dass die Korrelationen zwischen den Kryptoassets abgenommen haben, was bedeutet, dass Kryptoassets stärker von münzspezifischen Faktoren abhängig sind.

Gleichzeitig war die Outperformance der Altcoins, wie bereits erwähnt, weiterhin gering: Nur 15% der Altcoins übertrafen Bitcoin auf wöchentlicher Basis.

Im Allgemeinen ist die geringe Outperformance von Altcoins ein Zeichen für eine geringe Risikobereitschaft auf den Kryptomärkten.

Krypto Asset Flows

In der vergangenen Woche gab es beträchtliche Nettomittelzuflüsse in globale Krypto-ETPs, allerdings mit großen Unterschieden zwischen den einzelnen Kryptoanlagen.

Insgesamt verzeichneten wir Nettomittelzuflüsse in Höhe von +80,9 Mio. USD (Woche bis Freitag).

Die meisten dieser Zuflüsse konzentrierten sich auf Bitcoin-Fonds (+78,3 Mio. USD) und Altcoin ex ETH-Fonds (+16,2 Mio. USD), während andere Arten von Krypto-Assets Netto-Fondsabflüsse verzeichneten.

So verzeichneten Ethereum-Fonds in der vergangenen Woche Netto-Fondsabflüsse in Höhe von -7,3 Mio. USD.

Thematische und Basket-Kryptofonds verzeichneten in der vergangenen Woche ebenfalls Nettoabflüsse (-6,4 Mio. USD).

Der Abschlag auf den Nettoinventarwert des größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - hat sich in der vergangenen Woche deutlich verringert und liegt nun bei -11%. Mit anderen Worten: Die Anleger messen dem Trust eine höhere Wahrscheinlichkeit von etwa 89% bei, dass er in einen Bitcoin-Spot-ETF umgewandelt wird.

Darüber hinaus ist das Beta der globalen Krypto-Hedge-Fonds gegenüber Bitcoin in den letzten 20 Handelsjahren weiter gesunken, was bedeutet, dass die globalen Krypto-Hedge-Fonds ihr Marktengagement gegenüber Krypto-Assets reduziert haben.

On-Chain Tätigkeit

Insgesamt ist die Aktivität in der Kette noch immer relativ verhalten, aber es zeichnen sich erste Anzeichen ab.

So befinden sich die aktiven Adressen und neuen Adressen auf der Bitcoin-Blockchain weiterhin in der Nähe der bisherigen Jahrestiefststände. Außerdem bewegte sich die Anzahl der Adressen mit Guthaben ungleich Null in der letzten Woche weiter seitwärts. Derweil bewegt sich der Bitcoin-Hash immer noch in der Nähe von Allzeithochs.

Nichtsdestotrotz sahen wir eine zunehmende Aktivität sowohl bei kleinen als auch bei großen BTC-Wallet-Unternehmen, was darauf hindeutet, dass vor allem kleinere Investoren zunehmend in den Markt strömen. Dies lässt sich an dem signifikanten Anstieg des Medianwerts der Transfervolumina auf der Bitcoin-Blockchain ablesen, der auf eine Beteiligung von Kleinanlegern hindeutet. Beachten Sie, dass die (neue) Beteiligung von Kleinanlegern eine notwendige Voraussetzung für einen anhaltenden Bullenmarkt bei Kryptoanlagen ist.

Vor dem jüngsten Anstieg auf über 30.000 USD gab es auch erhebliche Abflüsse, insbesondere von größeren Anlegern mit Geldbörsen von über $10M. Tatsächlich sind die BTC-Börsenguthaben erneut gesunken und haben neue Mehrjahrestiefs erreicht. Insgesamt verbleiben etwas weniger als 11% des aktuellen BTC-Angebots an den Börsen.

Auch die Akkumulationstätigkeit hat in den verschiedenen Portemonnaie-Kohorten deutlich zugenommen, was ebenfalls ein positives Zeichen ist.

Krypto-Asset-Derivate

Einerseits stieg das offene Interesse an den BTC-Futures nur leicht an, während sich das offene Interesse an BTC-Futures in der vergangenen Woche überwiegend seitwärts bewegte.

Andererseits ist das offene Interesse an BTC-Optionen im Laufe der Woche erheblich gestiegen. Der größte Teil dieses Anstiegs war auf einen relativ starken Anstieg der Call-Optionen zurückzuführen, so dass Optionshändler ihr Aufwärtsrisiko deutlich erhöht haben. In diesem Zusammenhang ist das Verhältnis zwischen offenen BTC-Put- und Call-Optionen nach wie vor auf dem niedrigsten Stand seit Jahresbeginn. Die Nachfrage nach einem Abwärtsschutz ist also derzeit relativ gering.

In diesem Zusammenhang hat sich auch der 25-Delta-Skew der 1-Monats- und 3-Monats-BTC-Optionen beträchtlich verringert und die niedrigsten Werte des laufenden Jahres erreicht. Dies bedeutet, dass delta-äquivalente Kaufoptionen teurer sind als vergleichbare Verkaufsoptionen.

Auch die implizite Volatilität von BTC ist in der vergangenen Woche deutlich gestiegen und erreichte den höchsten Stand seit August dieses Jahres.

Alles in allem zeigt der BTC-Optionenmarkt bereits ein gewisses Maß an Überschwang in der Stimmung, was kurzfristig auf einige Abwärtsrisiken hindeutet.

Unterm Strich

In der vergangenen Woche übertrafen Kryptoanlagen die traditionellen Anlagen bei weitem.

Unser hauseigener Krypto-Sentiment-Index ist deutlich gestiegen und befindet sich nun fest im bullischen Bereich.

Diese Verbesserung zeigt sich auch in der zunehmenden Aktivität von Kleinanlegern in den letzten Wochen, die sich an den BTC-Transfervolumina ablesen lässt, die seit Jahresbeginn Höchststände erreicht haben.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.