Krypto-Vermögenswerte legen inmitten starker Fundamentaldaten deutlich zu und übertreffen traditionelle Vermögenswerte

DDA Krypto-Marktimpuls, 18. September 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Letzte Woche erholten sich Kryptoanlagen von überverkauften Niveaus und übertrafen traditionelle Anlagen

- Unser hauseigener Krypto-Sentiment-Index hat sich ebenfalls von einem sehr bärischen Niveau aus stark gedreht

- Insgesamt hat sich die BTC-Aktivität auf der Kette in verschiedenen Bereichen während des jüngsten Ausverkaufs deutlich erhöht, was recht ermutigend ist

Chart der Woche

Kryptoasset Leistung

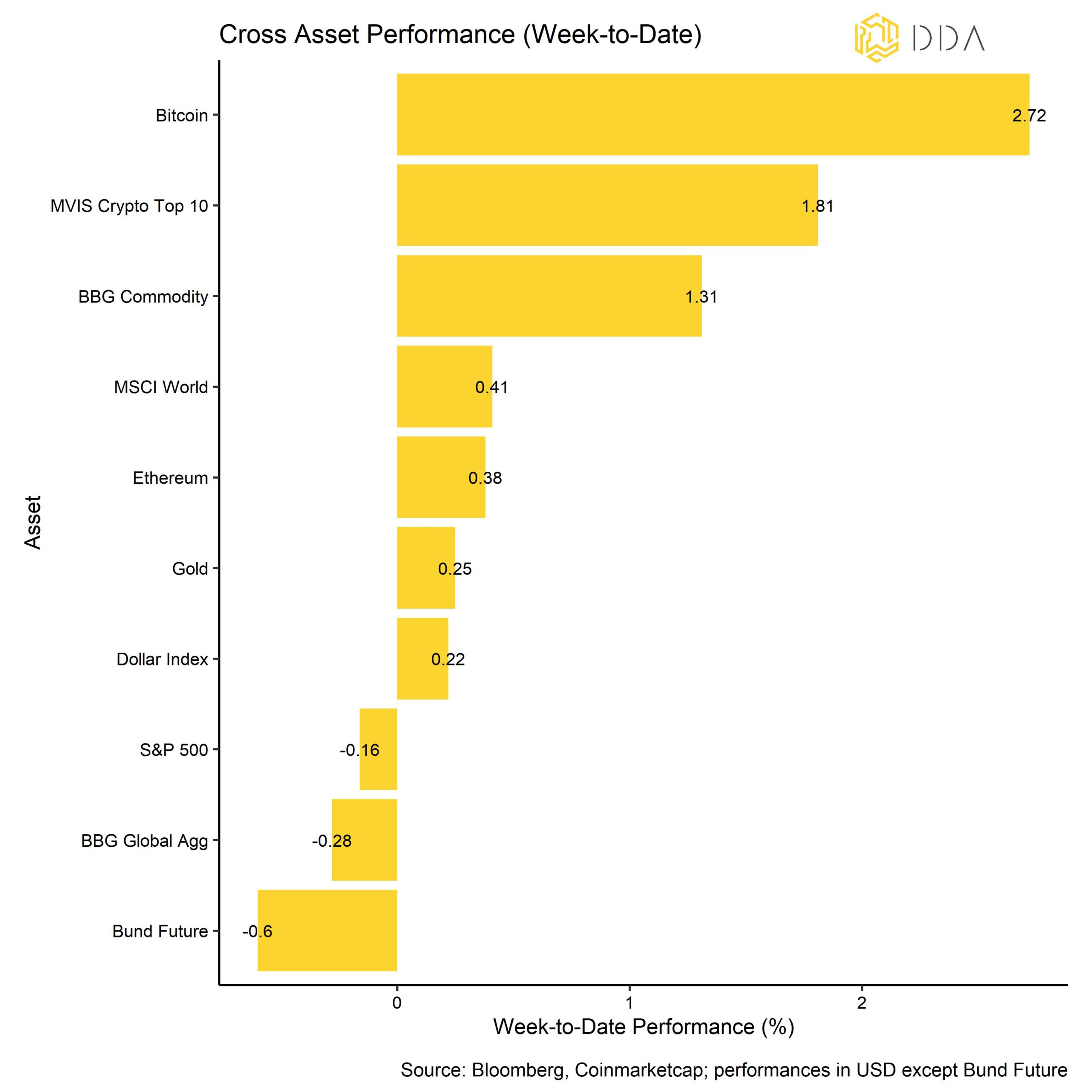

In der vergangenen Woche erholten sich Kryptoanlagen von überverkauften Niveaus und übertrafen dabei traditionelle Anlagen. Die 10 wichtigsten Krypto-Vermögenswerte schnitten auch besser ab als Rohstoffe, während globale Anleihen und US-Aktien in der vergangenen Woche zurückgingen. Die überdurchschnittliche Performance wurde in einer Woche erzielt, in der die Märkte für Kryptowährungen überwiegend von negativen Nachrichten geprägt waren, wie z. B. mehrere Hacks von Sekundärbörsen und Wallet-Exploits. Nichtsdestotrotz hat sich die Gesamtaktivität von BTC auf der Kette über verschiedene Messgrößen hinweg während des jüngsten Ausverkaufs deutlich verbessert, was recht ermutigend ist (Chart-der-Woche).

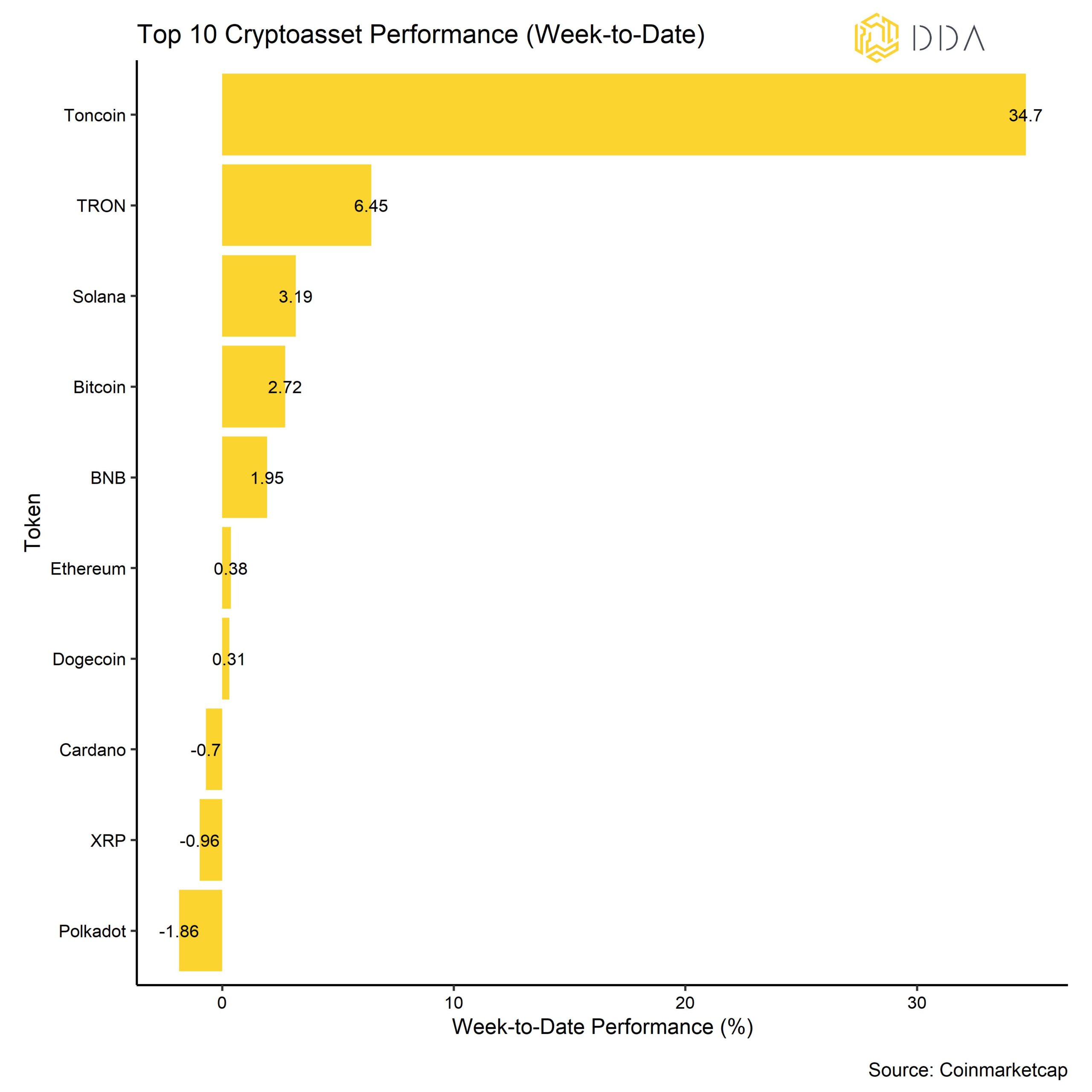

Unter den Top 10 der Kryptoanlagen waren Toncoin, TRON und Solana die relativen Outperformer.

Im Allgemeinen war die Outperformance von Altcoins gegenüber Bitcoin immer noch gering: Nur 10% der von uns beobachteten Altcoins übertrafen Bitcoin auf wöchentlicher Basis.

Krypto-Marktstimmung

Unser hauseigener Crypto Sentiment Index hat sich ebenfalls von einem sehr bärischen Niveau aus stark gedreht. Allerdings liegen nur 5 von 15 Indikatoren über ihrem kurzfristigen Trend, so dass die Mehrheit der Indikatoren immer noch rückläufig ist.

Im Vergleich zur letzten Woche gab es beim BTC-Put-Call-Volumen-Verhältnis und beim Crypto Dispersion Index große Umschwünge nach oben.

Der Crypto Fear & Greed Index bleibt heute Morgen im Bereich "Fear".

Die Streuung der Wertentwicklung von Kryptoassets hat im Vergleich zur Vorwoche deutlich zugenommen.

Im Allgemeinen bedeutet eine höhere Leistungsstreuung zwischen Kryptoassets, dass die Korrelationen zwischen Kryptoassets abgenommen haben, was bedeutet, dass Kryptoassets stärker von münzspezifischen Faktoren abhängig sind.

Gleichzeitig ist, wie oben erwähnt, die Outperformance von Altcoins immer noch gering, da nur 10% der Altcoins auf wöchentlicher Basis eine bessere Performance als Bitcoin aufweisen.

Im Allgemeinen geht die Outperformance von Altcoins mit einer zunehmenden Streuung der Kryptowährungen einher, d. h. Bitcoin und Altcoins werden während der "Altsaison" in der Regel höher gehandelt, wobei Altcoins besser abschneiden als Bitcoin. Eine breitere Outperformance von Altcoins ist in der Regel ein Zeichen für zunehmende Risikobereitschaft und eine breitere Underperformance von Altcoins ein Zeichen für zunehmende Risikoaversion.

Krypto Asset Flows

In der vergangenen Woche kam es erneut zu erheblichen Nettoabflüssen aus globalen Krypto-ETPs.

Insgesamt verzeichneten wir Netto-Fondsabflüsse in Höhe von -59,7 Mio. USD (Woche bis Freitag).

Alle Fondskategorien wiesen erhebliche Nettoabflüsse auf, mit Ausnahme der Altcoin-basierten Fonds, die geringfügige Nettozuflüsse verzeichneten (+1,2 Mio. USD).

Der Großteil der Nettoabflüsse erfolgte bei Bitcoin- und Ethereum-Fonds (-45,0 Mio. USD bzw. -15,0 Mio. USD).

Thematische und Basket-Kryptofonds verzeichneten in der vergangenen Woche ebenfalls leichte Nettoabflüsse von -0,8 Mio. USD.

Nichtsdestotrotz lag der Abschlag auf den Nettoinventarwert des größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - in der vergangenen Woche weiterhin über -20%. Mit anderen Worten: Die Anleger schätzen die Wahrscheinlichkeit, dass der Trust in einen Bitcoin-Spot-ETF umgewandelt wird, auf etwa 80% ein.

Darüber hinaus hat sich das Beta der globalen Krypto-Hedgefonds gegenüber Bitcoin in den letzten 20 Jahren seitwärts bewegt, was bedeutet, dass die globalen Krypto-Hedgefonds ihr Marktengagement gegenüber Krypto-Assets nicht wesentlich verändert haben.

On-Chain Tätigkeit

Die Gesamtaktivität in der Kette hat sich in der letzten Woche weiter verbessert.

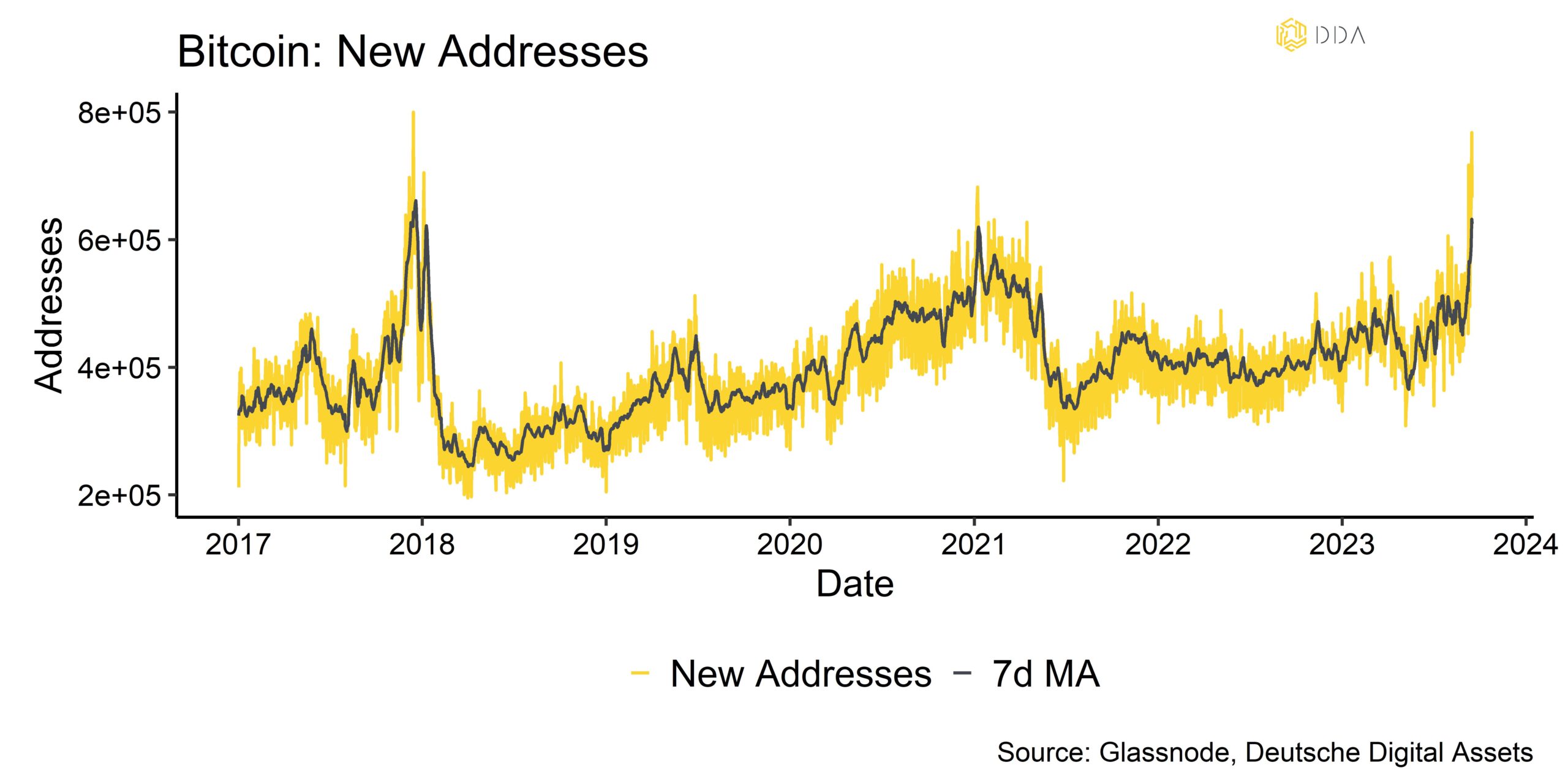

So sind beispielsweise die aktiven Adressen in der Bitcoin-Blockchain auf neue Jahreshöchststände gestiegen. Darüber hinaus sind auch die neuen Adressen auf der Bitcoin-Blockchain weiter stark angestiegen und haben neue Mehrjahreshöchststände erreicht (Chart-der-Woche).

Außerdem ist die Bitcoin-Hash-Rate auf ein neues Allzeithoch gestiegen. Die Anzahl der Adressen mit Nicht-Null-Salden hat sich ebenfalls weiter nach oben bewegt.

Unser hauseigener Bitcoin Network Activity Index ist ebenfalls auf ein neues Allzeithoch gestiegen (jetzt angezeigt). Der Index setzt sich aus einer Vielzahl von Metriken wie Transaktionsvolumen, Blockgröße oder aktiven Adressen zusammen.

Interessanterweise hat die Akkumulationsaktivität über alle Wallet-Kohorten hinweg im Zuge der jüngsten Marktkorrektur wieder zugenommen, was ein ermutigendes Signal ist. Insbesondere bei den kleineren Wallet-Kohorten (1 BTC oder weniger) war eine deutliche Zunahme der Akkumulationsaktivität zu beobachten.

In der Zwischenzeit sanken die Börsensalden sowohl für Bitcoin als auch für Ethereum weiter.

In diesem Jahr haben wir im Allgemeinen ein konträres Kaufverhalten von Bitcoin-Investoren gesehen, was den Preisen sicherlich einen Boden verschafft hat.

Krypto-Asset-Derivate

In der vergangenen Woche zeigten die Derivatemetriken einen gewissen Risikoabbau, da einige Abwärtsabsicherungen offenbar neutralisiert wurden.

So sank beispielsweise das offene Interesse an BTC-Verkaufsoptionen, da das relative Handelsvolumen von Verkaufsoptionen im Vergleich zu Kaufoptionen zusammenbrach. Dies zeigte sich auch in der Schiefe der 1-Monats-25-Delta-Optionen auf BTC, die in der letzten Woche stark zurückging. Auch die implizite 1-Monats-Volatilität von BTC ging etwas zurück.

Im Gegensatz dazu gab es in der vergangenen Woche bei den BTC-Futures und den unbefristeten Verträgen nicht viel Bewegung. Die BTC-Futures und das offene Interesse an unbefristeten Kontrakten bewegten sich überwiegend seitwärts. Trotz der zinsbullischen Preisentwicklung driftete die annualisierte 3-Monats-Basis der Futures weiter nach unten, da sich die ewigen Finanzierungssätze von den negativen Niveaus der letzten Woche erholten.

Der jüngste Preisanstieg scheint auch nicht durch eine signifikante Zunahme der Auflösung von Futures-Leerverkäufen ausgelöst worden zu sein.

Unterm Strich

In der vergangenen Woche erholten sich Kryptoanlagen von überverkauften Niveaus und übertrafen traditionelle Anlagen.

Auch unser hauseigener Crypto Sentiment Index hat sich von einem sehr bärischen Niveau aus stark gedreht.

Insgesamt hat die Aktivität auf der BTC-Kette in verschiedenen Bereichen nach dem jüngsten Ausverkauf deutlich zugenommen, was recht ermutigend ist.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.