Krypto Market Intelligence August 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

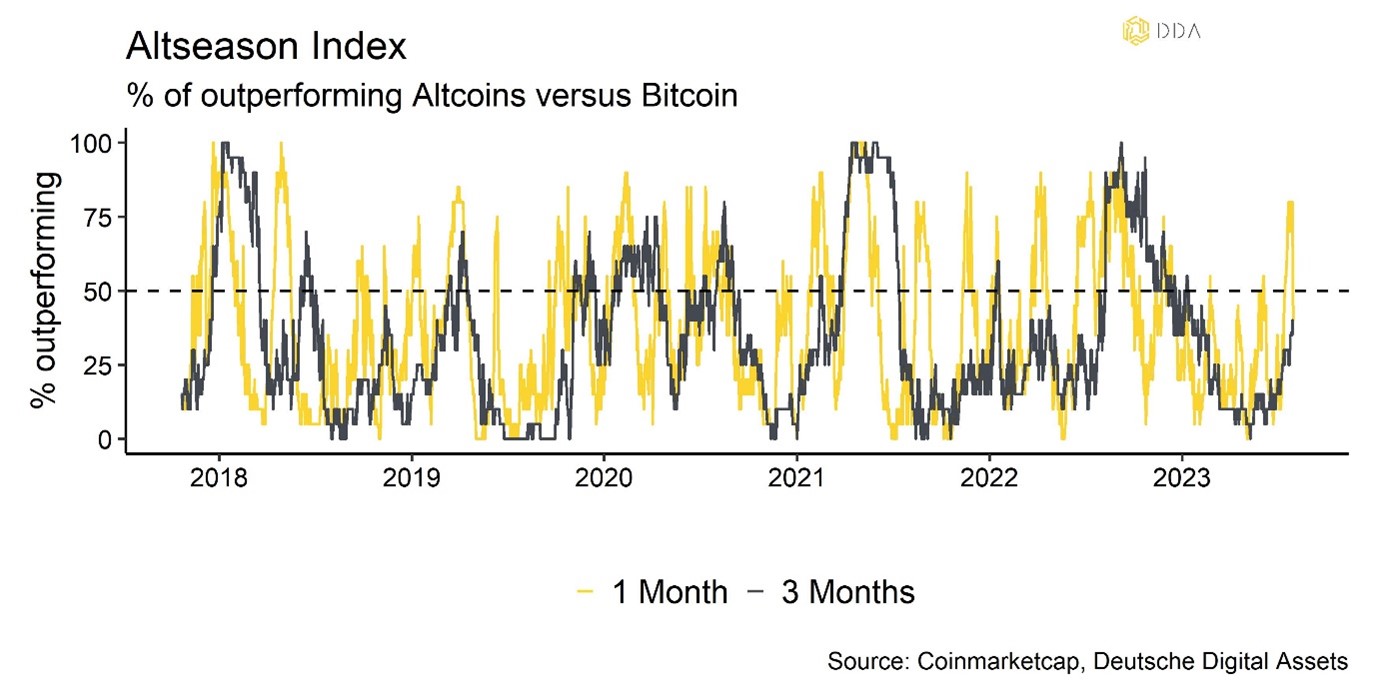

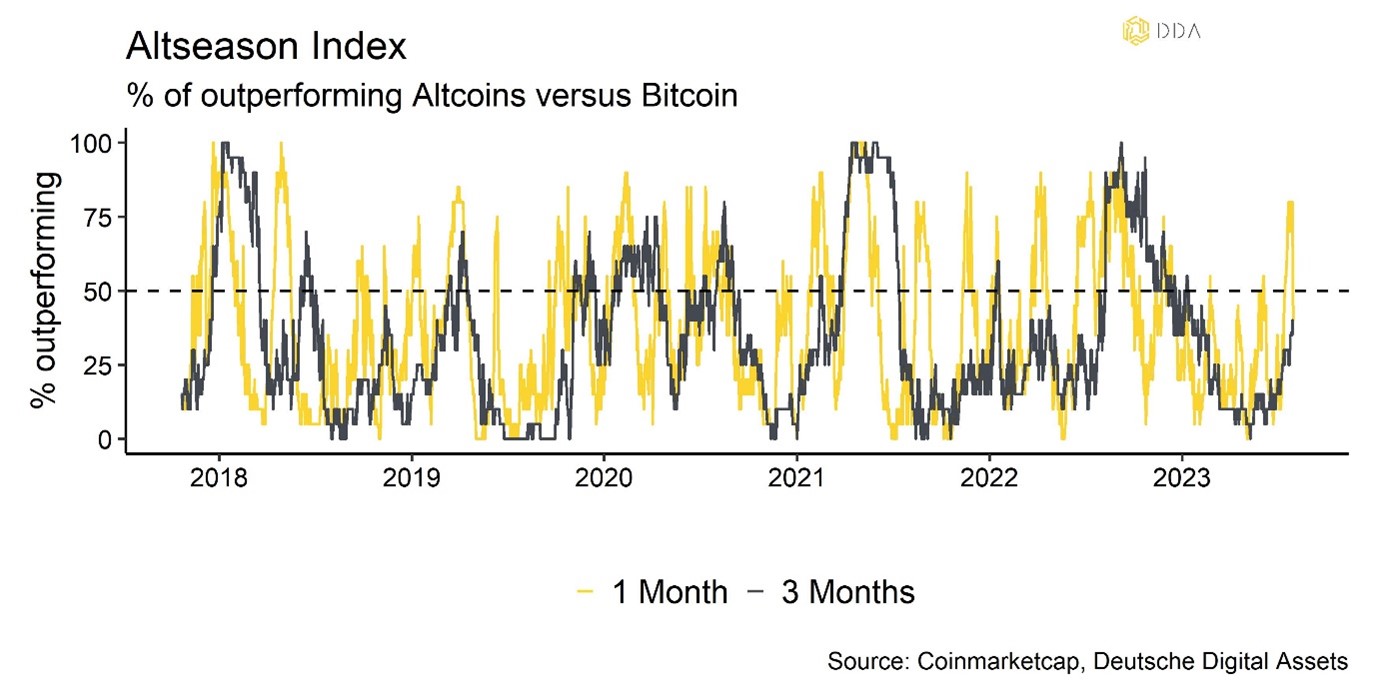

- Kryptoassets wie Bitcoin und Ethereum legten im Juli nach dem Blackrock-ETF-Hype im Juni eine Pause ein, während die XRP-Entscheidung den Altcoins erheblichen Auftrieb verlieh, was zu einer Outperformance von 80% führte, aber die Kryptomärkte beruhigten sich im Sommer mit geringeren Volumina und Volatilität.

- Die sinkende Inflation hilft Bitcoin und Kryptoassets, aber verbesserte Arbeitsmarktdaten und die angespannte Stimmung an den traditionellen Finanzmärkten könnten kurzfristige Gewinne begrenzen.

- Begrenztes kurzfristiges Aufwärtspotenzial für BTC aufgrund erhöhter Stimmung, Positionierung und schwacher On-Chain-Aktivität, während sich Altcoins besser entwickelt haben als BTC, aber die Marktbreite hat sich im Vergleich zum Jahresanfang abgeschwächt.

Grafik des Monats

Kryptoasset Leistung

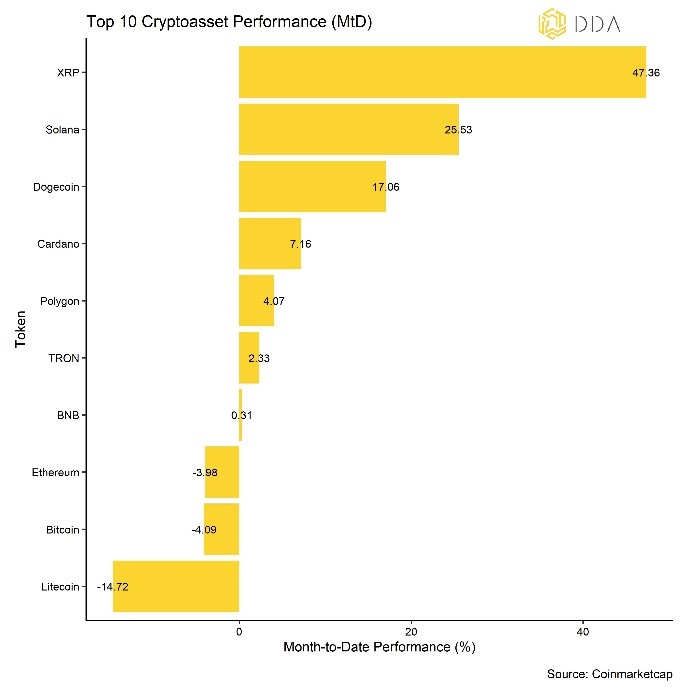

Kryptoassets verzeichneten im Juli insgesamt eine positive Performance, allerdings mit großen Performance-Divergenzen innerhalb des Marktes. Einerseits scheint es, als ob Bitcoin und Ethereum nach der von Blackrock-ETF ausgelösten Euphorie im Juni, die zu einer überschwänglichen Stimmung und Positionierung innerhalb der Kryptomärkte führte, eine Verschnaufpause einlegten.

Auf der anderen Seite war ein wichtiger positiver Katalysator für andere Altcoins die Entscheidung eines US-Richters, dass die Muttergesellschaft von XRP, Ripple Labs Inc, mit dem Verkauf von XRP-Token an öffentlichen Börsen nicht gegen das Bundeswertpapiergesetz verstoßen hat. Dieses Urteil wurde als bahnbrechender juristischer Sieg für die Kryptowährungsbranche angesehen, der den Wert von XRP und anderen Altcoins in die Höhe schnellen ließ.

Infolgedessen blieb die Streuung der Wertentwicklung von Krypto-Assets im Juli auf einem hohen Niveau. Eine Zunahme der Streuung bedeutet, dass die Wertentwicklung von Kryptoassets zunehmend von münzspezifischen Faktoren im Gegensatz zu systematischen Faktoren bestimmt wird.

Der Juli war jedoch auch durch ein eher ruhiges Marktumfeld gekennzeichnet, da die impliziten Volatilitäten für Bitcoin-Optionen einen historischen Tiefstand erreichten. Es scheint, als ob die Kryptomärkte mit geringeren Transfervolumina und geringerer Volatilität in die Sommerferienzeit gegangen sind. In der Tat sind vor allem August und September historisch gesehen die Monate mit der niedrigsten monatlichen Performance für Bitcoin, wie wir bereits festgestellt haben hier.

Der Juli war auch durch eine Zunahme der Outperformance von Altcoins gegenüber Bitcoin gekennzeichnet. Im Juli schafften es 40% der von uns beobachteten Altcoins, Bitcoin zu übertreffen. Irgendwann jedoch erreichte dieser Prozentsatz aufgrund der XRP-Entscheidung 80% auf Monatsbasis. So gesehen scheint dieses Urteil auch ein Katalysator für eine breitere "Altsaison" gewesen zu sein, d. h. eine strukturelle Outperformance von Altcoins gegenüber BTC (siehe auch unsere Chart des Monats).

Im Allgemeinen waren XRP, Solana und Dogecoin unter den Top 10 der wichtigsten Kryptoassets die größten Outperformer.

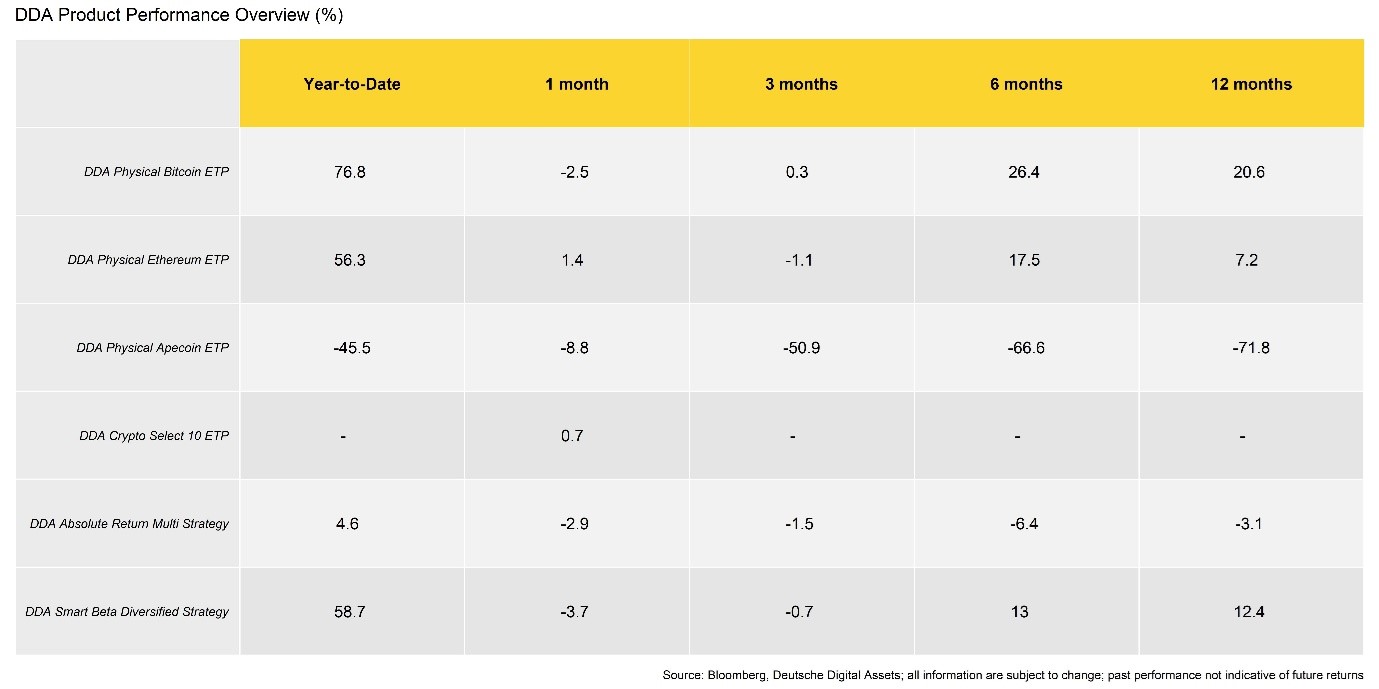

Ebenso ist unsere eigene passive DDA-Produkte haben sich im Juli entsprechend entwickelt:

Der Juli war durch eine insgesamt sehr niedrige Volatilität gekennzeichnet, was kein günstiges Umfeld für Absolute-Return-Strategien ist, die ein wenig gelitten haben. Das Beta-Programm schnitt besser ab und übertraf seine Benchmark leicht, dank des Gerichtsurteils zu XRP und der anschließenden Performance bestimmter Altcoins.

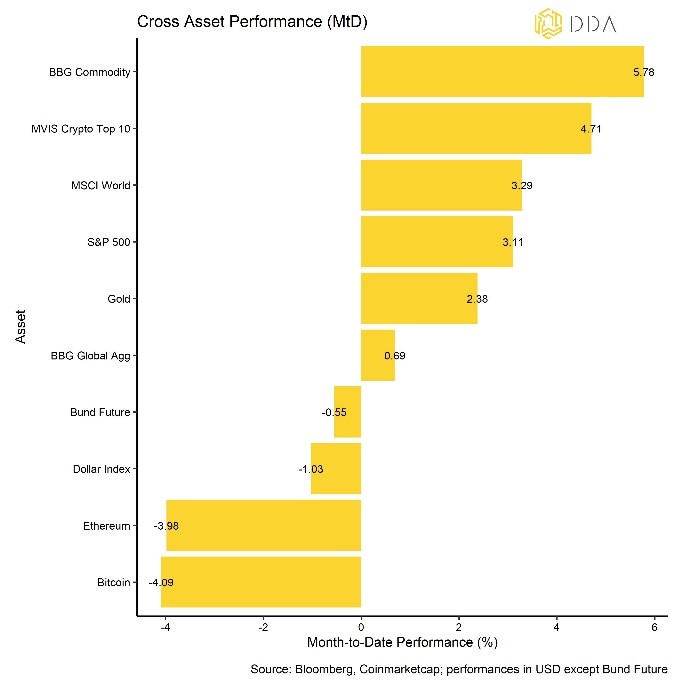

Traditionelle Finanzanlagen entwickelten sich im Juli ebenfalls positiv, da die globalen Aktien trotz der anhaltenden Straffung der Geldpolitik und der Zinserhöhungen durch die Fed und die EZB aufgrund des schwachen Dollars weiter anzogen.

Unterm Strich: Wichtige Kryptoassets wie Bitcoin und Ethereum legten im Juli nach der Blackrock-ETF-Euphorie im Juni eine Verschnaufpause ein. Im Gegensatz dazu ließ das XRP-Urteil die Werte von XRP und anderen Altcoins in die Höhe schnellen, was insgesamt zu einer großen Leistungsstreuung im Juli beitrug. Die Outperformance von Altcoins nahm ebenfalls zu und erreichte im Juli sogar 80%. Es scheint jedoch so, als ob die Kryptomärkte mit geringeren Transfervolumina und einer geringeren Volatilität in die Sommerferienzeit gegangen sind.

Kommentar zu Makro & Märkte

Die Märkte haben seit Oktober, als die US-Inflationszahlen ihren Höhepunkt erreichten, eine Wende in der Geldpolitik der Fed eingepreist. Tatsächlich hat die Fed den sprichwörtlichen "Schwenk" nicht vollzogen, aber die Märkte haben angesichts des zyklischen Rückgangs der Inflation trotzdem "geschwenkt".

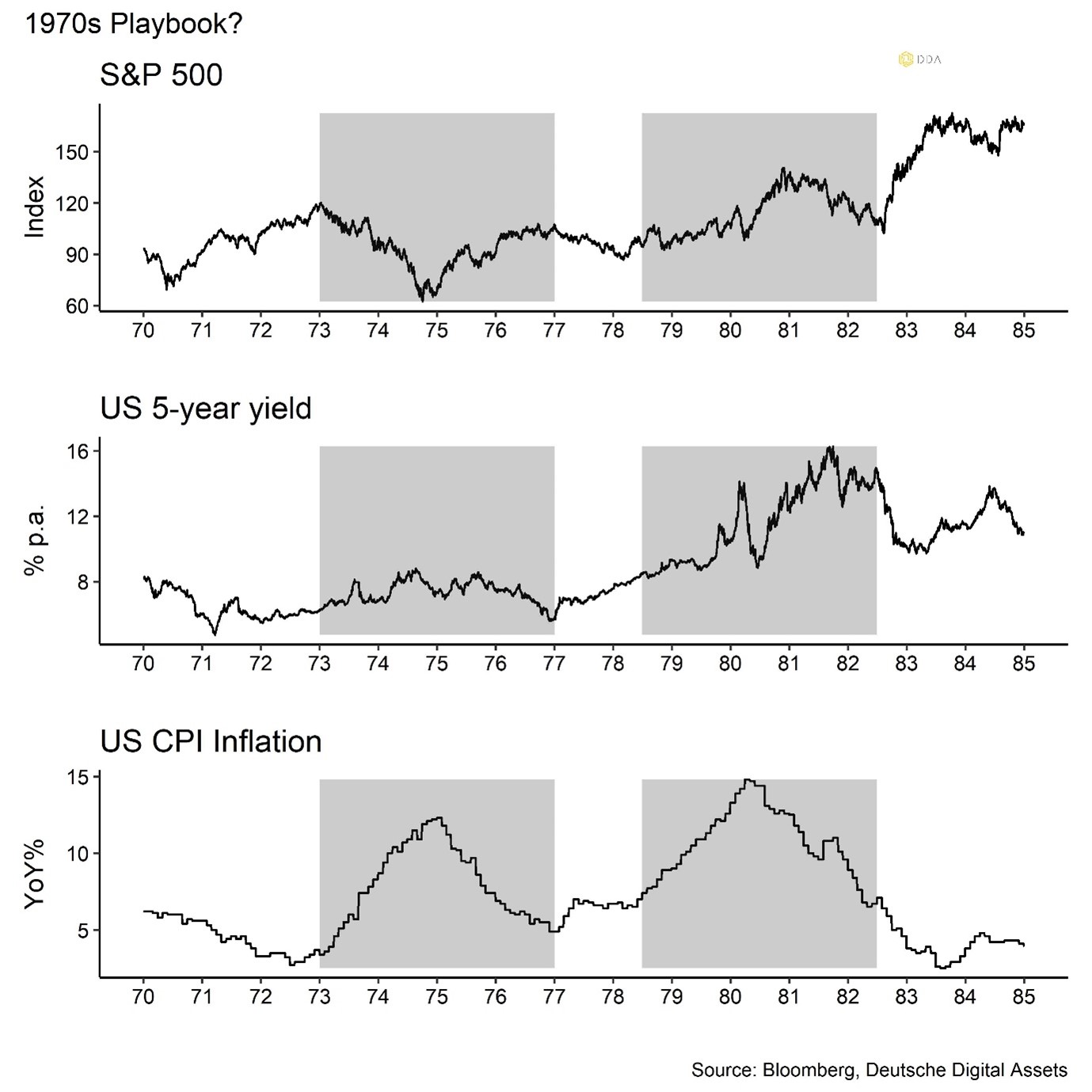

Die traditionellen Finanzmärkte scheinen sich an den Spielregeln der 1970er Jahre zu orientieren, als US-Aktien (trotz rückläufiger Erträge) weiter stiegen, während die Inflationszahlen zurückgingen, was einen weiteren Anstieg der Renditen begrenzte.

Es sei darauf hingewiesen, dass diese umgekehrte Beziehung zwischen dem Aktienmarkt einerseits und den Renditen sowie der Inflation andererseits zwischen 1973 und 1982 fast zu einem "verlorenen Jahrzehnt" bei den US-Aktien führte, als der S&P 500 keine neuen Höchststände (nachhaltig) erreichte. Die inflationsbereinigte Performance war in diesem Zeitraum deutlich negativ.

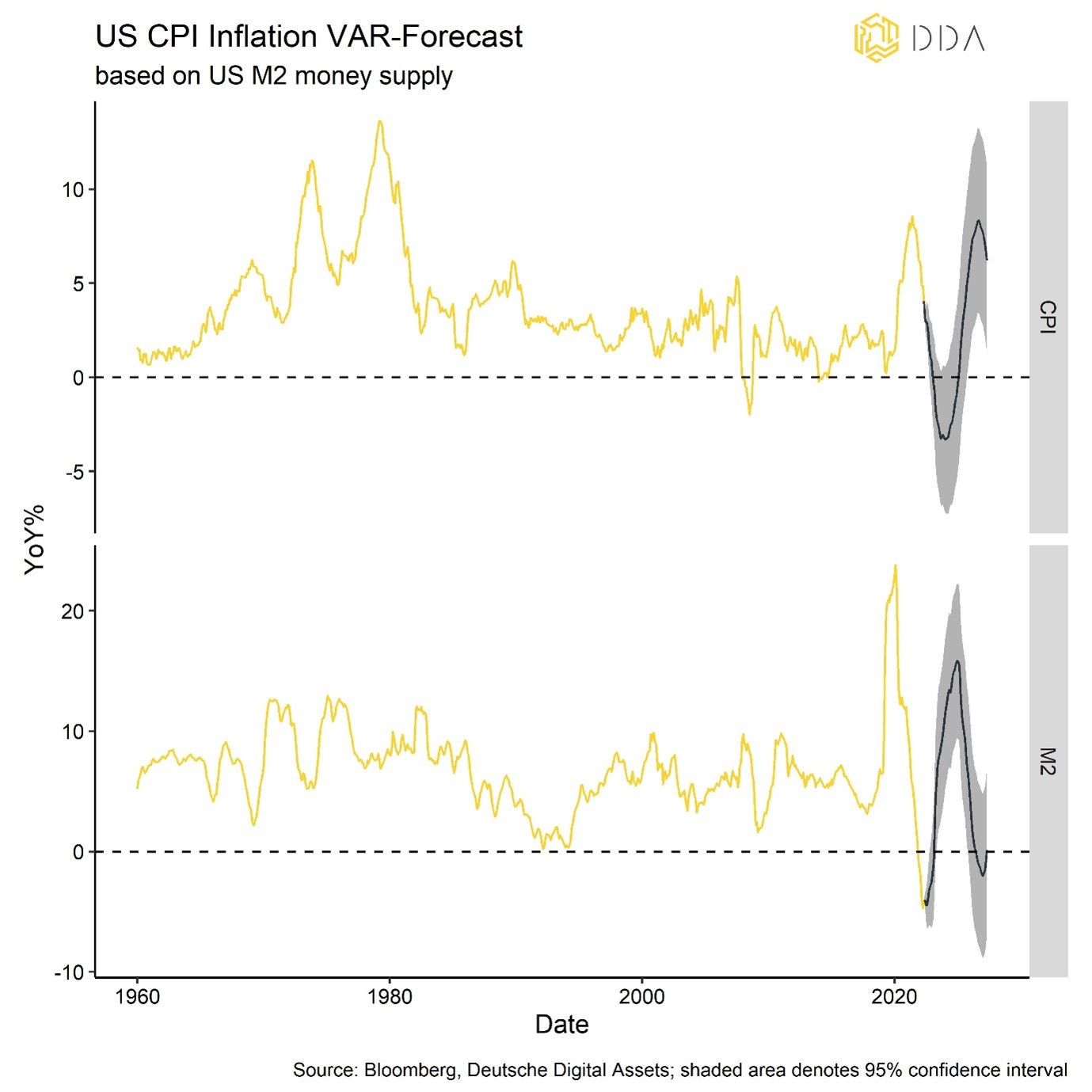

Im gegenwärtigen Umfeld ist es jedoch sehr wahrscheinlich, dass die Inflationszahlen in den USA aufgrund des sinkenden Geldmengenwachstums, das der Inflation in der Regel um mehr als ein Jahr vorausgeht, weiter zurückgehen werden. Nach unserer eigenen Prognose ist die Wahrscheinlichkeit einer Deflation (d. h. negativer Inflationsraten) in den USA in den kommenden Monaten hoch.

Im Gegenzug könnten die Finanzmärkte durch sinkende Inflationswerte und weiter sinkende Renditen unterstützt werden.

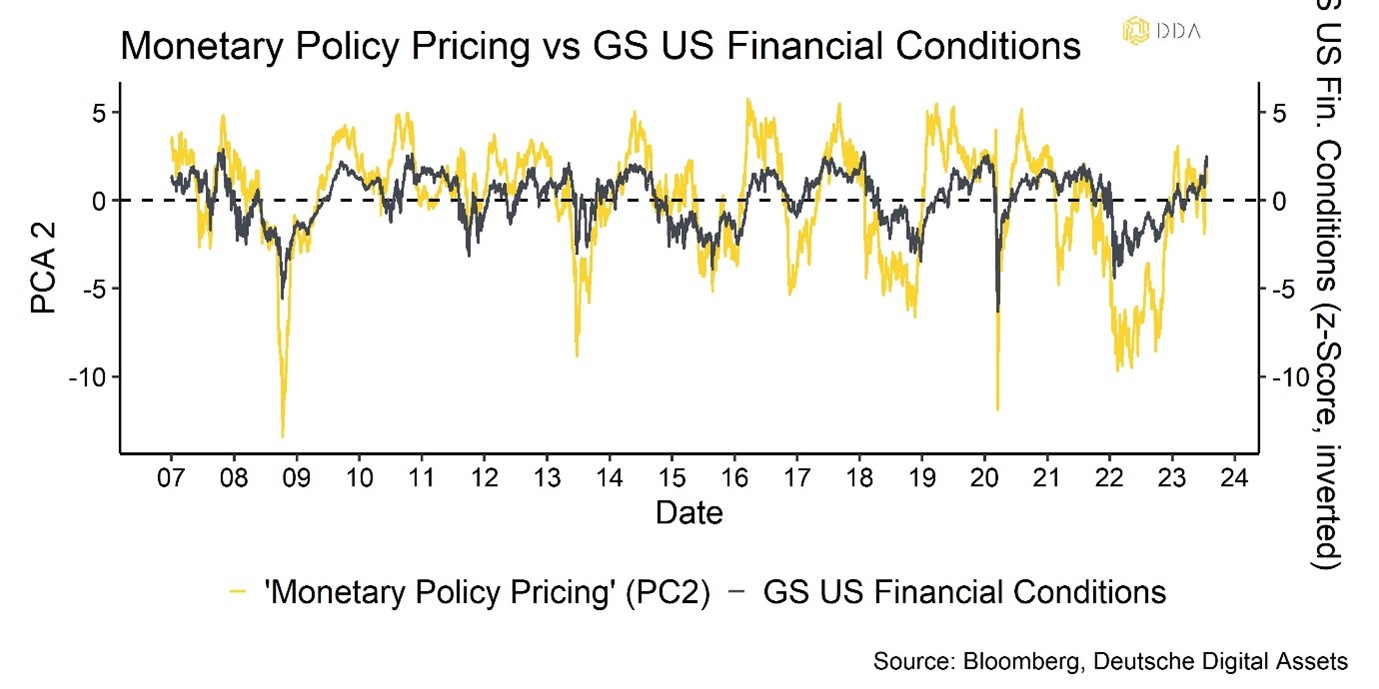

Bislang hat der Inflationsrückgang zu einer deutlichen Verbesserung der finanziellen Bedingungen (gemessen am GS US Financial Conditions Index) sowie der Geldpolitik (wie sie von den Finanzmärkten bewertet wird) geführt, was sowohl den traditionellen Finanzmärkten als auch den Kryptoanlagen eindeutig Rückenwind verliehen hat.

Das Risiko besteht natürlich darin, dass die Geldpolitik weiterhin straff bleibt, was zu einer erneuten Verschärfung der allgemeinen Finanzbedingungen führt. Die jüngsten Maßnahmen der Zentralbanken sowohl der Fed als auch der EZB, die die Zinssätze um weitere 25 Basispunkte angehoben haben, deuten in diese Richtung.

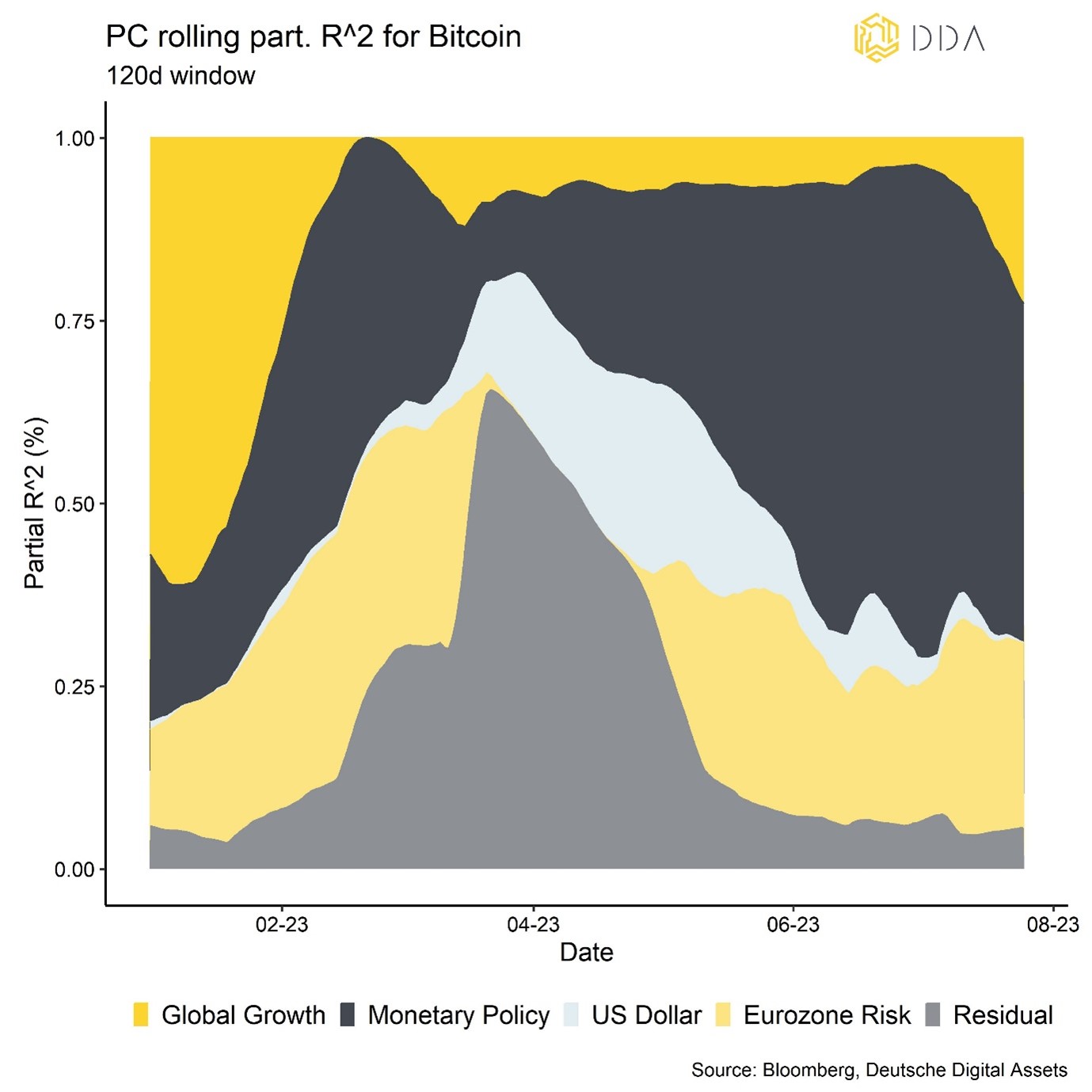

Was Bitcoin und Kryptoassets betrifft, so scheint die Geldpolitik immer noch der wichtigste Makrofaktor zu sein. Dies zeigt das folgende Diagramm, das die %-Änderung des Bitcoin-Preises durch verschiedene Makrofaktoren erklärt:

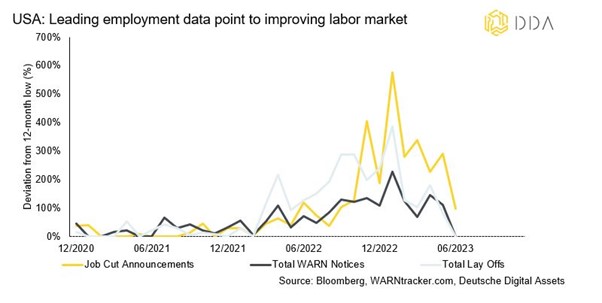

Hinzu kommt, dass sich die führenden Arbeitsmarktindikatoren in den letzten Monaten seit Januar 2023, als die von Challenger, Gray & Christmas zusammengestellten Ankündigungen von Stellenstreichungen in den USA ihren Höhepunkt erreicht zu haben scheinen, deutlich verbessert haben. Dies deutet darauf hin, dass die Renditen trotz des anhaltenden Rückgangs der Inflationsraten "noch länger" höher bleiben könnten.

Seit Januar dieses Jahres sind die alternativen Arbeitsmarktdaten wie Ankündigungen von Stellenstreichungen, Entlassungen sowie die so genannten WARN-Mitteilungen zurückgegangen. Dies scheint von den Finanzmärkten bereits vorausgesehen worden zu sein.

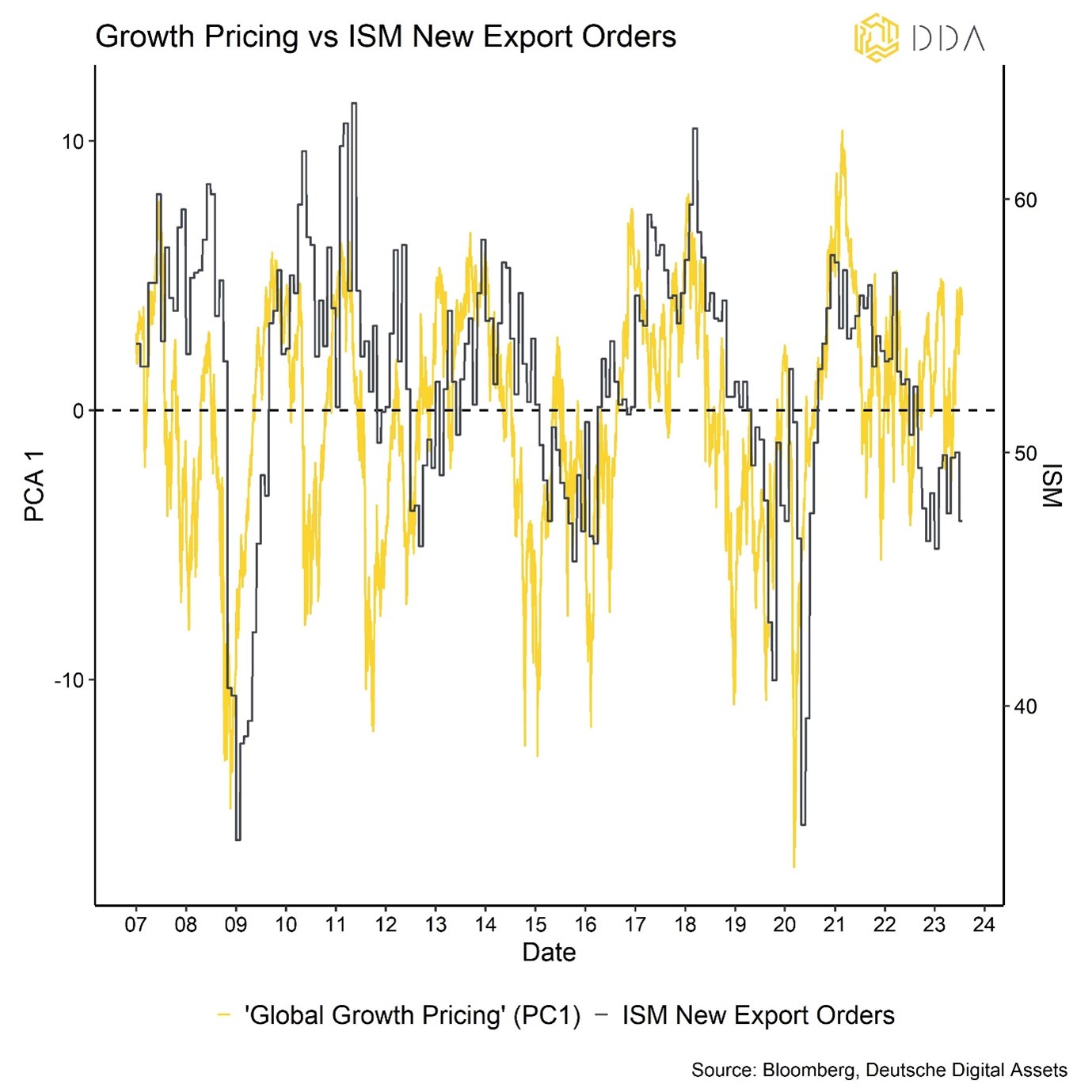

In der Tat scheinen die traditionellen Finanzmärkte bereits sehr zuversichtliche makroökonomische Wachstumsaussichten einzupreisen, wenn man unsere eigene Messung der in den Finanzmärkten eingepreisten globalen Wachstumserwartungen betrachtet:

Darüber hinaus sind die traditionellen Finanzmärkte im Hinblick auf die Positionierung und die Stimmung der Privatanleger bereits überfordert. So impliziert der NAAIM Exposure Index, der das von den Mitgliedern gemeldete durchschnittliche Engagement in den US-Aktienmärkten darstellt, bereits eine Allokation von 99,05% der Mitglieder - der höchste Stand seit November 2021. Gleichzeitig hat die optimistische Stimmung der Kleinanleger laut den von AAII zusammengestellten Daten den höchsten Stand seit April 2021 erreicht.

Die angespannte Positionierung und Stimmung bei traditionellen Finanzanlagen ist wahrscheinlich auch für Kryptoassets kurzfristig ein limitierender Faktor.

Einer der Hauptgründe für die positive Entwicklung der traditionellen Anlagen ist die Tatsache, dass die Wirtschaftsdaten in den letzten Monaten deutlich positiv überrascht haben. So hat beispielsweise der Citi Economic Surprise Index für die USA den höchsten Stand seit März 2021 erreicht.

Lassen Sie uns ein wenig rekapitulieren:

- Der Rückgang der Inflation hat zu einer Lockerung der finanziellen Bedingungen geführt (wie von den Finanzmärkten eingepreist), obwohl die Fed ihre Geldpolitik weiter strafft

- Risiko: Erneute Verschärfung der finanziellen Bedingungen

- Die Inflation wird aufgrund des Geldmengenwachstums weiter sinken, wobei die Wahrscheinlichkeit einer Deflation steigt.

- Führende Beschäftigungsdaten deuten auf eine Verbesserung des Arbeitsmarktes hin, und die Wirtschaftsdaten haben im Allgemeinen positiv überrascht - "höher für länger" ist wahrscheinlicher

- Die traditionellen Finanzmärkte preisen bereits einen zuversichtlichen makroökonomischen Wachstumsausblick ein, und die Aktien scheinen in Bezug auf Positionierung und Stimmung überzogen zu sein

Unterm Strich: Sinkende Inflationsraten werden wahrscheinlich weiterhin Rückenwind für Bitcoin und Kryptoassets bieten, da sie eine weniger aggressive Geldpolitik implizieren. Die Verbesserung der Arbeitsmarktdaten deutet jedoch darauf hin, dass die Inflationsrate länger steigen wird, was die finanziellen Bedingungen wieder verschlechtern könnte. Eine Verschlechterung der finanziellen Bedingungen wäre auch für Bitcoin negativ. Darüber hinaus preisen die traditionellen Finanzmärkte bereits einen zuversichtlichen makroökonomischen Wachstumsausblick ein und scheinen in Bezug auf die Stimmung und Positionierung überfordert zu sein. Dies könnte den weiteren Aufwärtstrend auf kurze Sicht begrenzen.

On-Chain-Analytik

Es hat den Anschein, als ob Kryptoassets vorerst in einem "Trott" feststecken. Die Blackrock-ETF-induzierte Rallye ist verblasst und der XRP-induzierte Rückgang der regulatorischen Unsicherheit war bisher nur von kurzer Dauer. Außerdem weisen die Sommermonate Juli, August und September normalerweise unterdurchschnittliche Renditen für Bitcoin auf, wie wir gezeigt haben hier.

Der Markt wartet eindeutig auf neue Katalysatoren, während die Stimmung und die Positionierung in den Kryptomärkten immer noch erhöht zu sein scheinen, wie wir in unserem jüngsten Bericht "Crypto Market Pulse" (hier).

Abgesehen davon war die On-Chain-Aktivität in den letzten Wochen generell recht gering. So befindet sich das Volumen der Überweisungen auf der Bitcoin-Blockchain derzeit in der Nähe eines Mehrjahrestiefs. Darüber hinaus sind sowohl die Zu- als auch die Abflüsse an den Börsen im letzten Monat stark zurückgegangen. Die Coins haben die Börsen auf Nettobasis verlassen und die Guthaben sind auf den niedrigsten Stand seit Februar 2018 gefallen. Es besteht jedoch kaum ein Zweifel daran, dass sich die Änderungsrate dieser Nettoabflüsse erheblich verlangsamt hat.

Da kurzfristige Bitcoin-Investoren dazu neigen, mehr Coins in Form von Verlusten an Börsen zu übermitteln als in Form von Gewinnen, scheint derzeit ein gewisser Abwärtsdruck zu herrschen. Mehr als 1% der Guthaben kurzfristiger Investoren werden derzeit an einem einzigen Tag an die Börsen gesendet, was eine beträchtliche Menge ist.

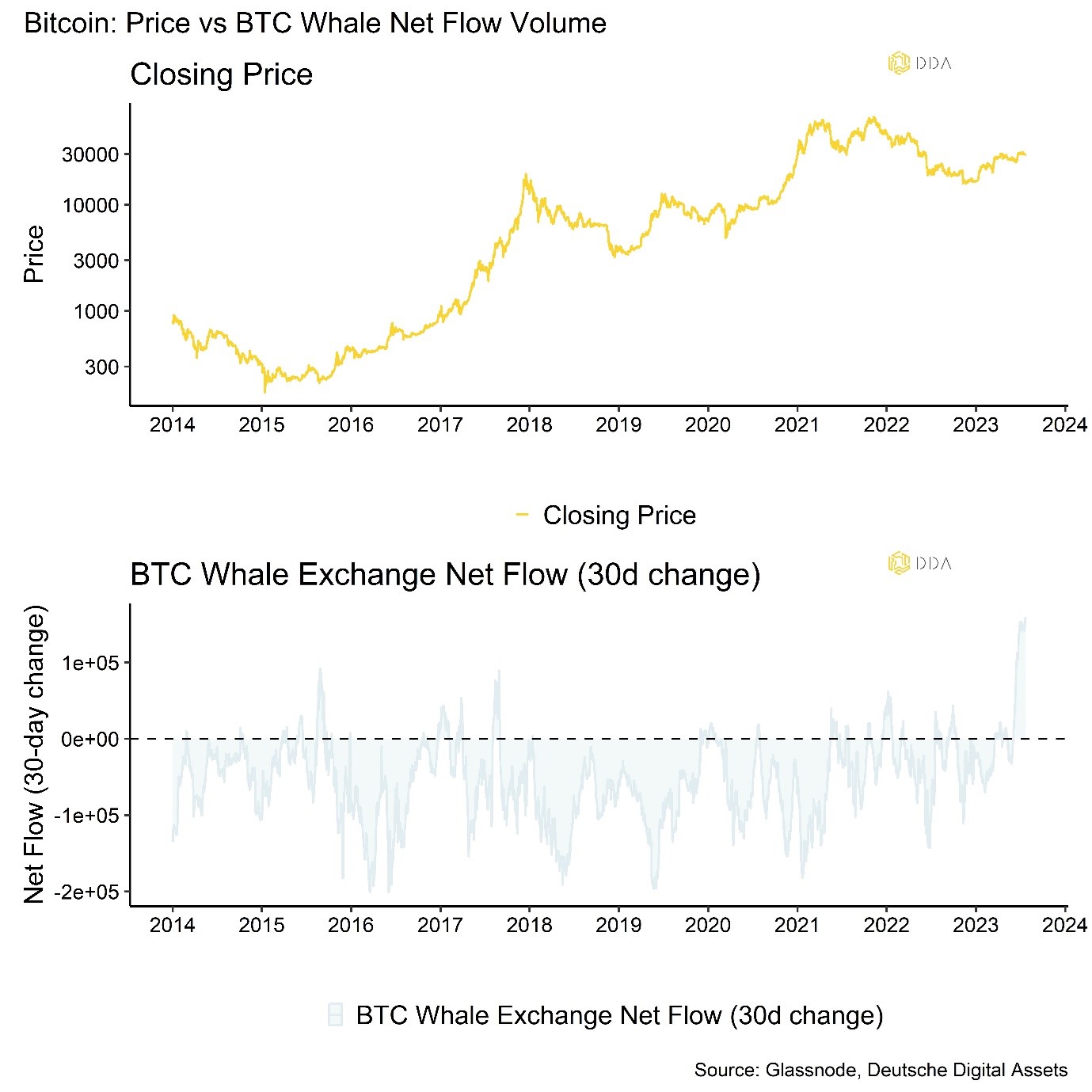

Solche Liquidationen können durch eine Reihe von Variablen verursacht werden, wie z. B. allgemeine makroökonomische Schwierigkeiten oder sogar saisonale Liquiditätsanforderungen aufgrund der Sommerferien. Bei vielen dieser kurzfristigen Inhaber handelt es sich in der Regel um große Geldbörsen mit mehr als 1000 BTC (d. h. "Wale").

Die jüngste Entwicklung der Netto-Waldevisenströme gibt den Märkten Anlass zur Sorge. Die 1-Monats-Änderung der Wal-Netto-Börseneinlagen hat kürzlich ein Allzeithoch erreicht. Obwohl einige On-Chain-Analysten dies auf eine kurzfristige "Umschichtung der Geldbörsen" zurückführen, stellt die Menge an Münzen, die an die Börsen geflossen ist, immer noch einen potenziellen Verkaufsdruck und damit ein Abwärtsrisiko dar.

Positiv zu vermerken ist, dass langfristige Bitcoin-Investoren anscheinend nicht mehr von ihren Beständen verkaufen. Genauer gesagt, werden nur 0,0002% der Bestände von Langzeitinvestoren an Börsen geschickt. Die Mehrheit der Münzen, die überhaupt verschickt werden, sind diejenigen, die profitabel waren.

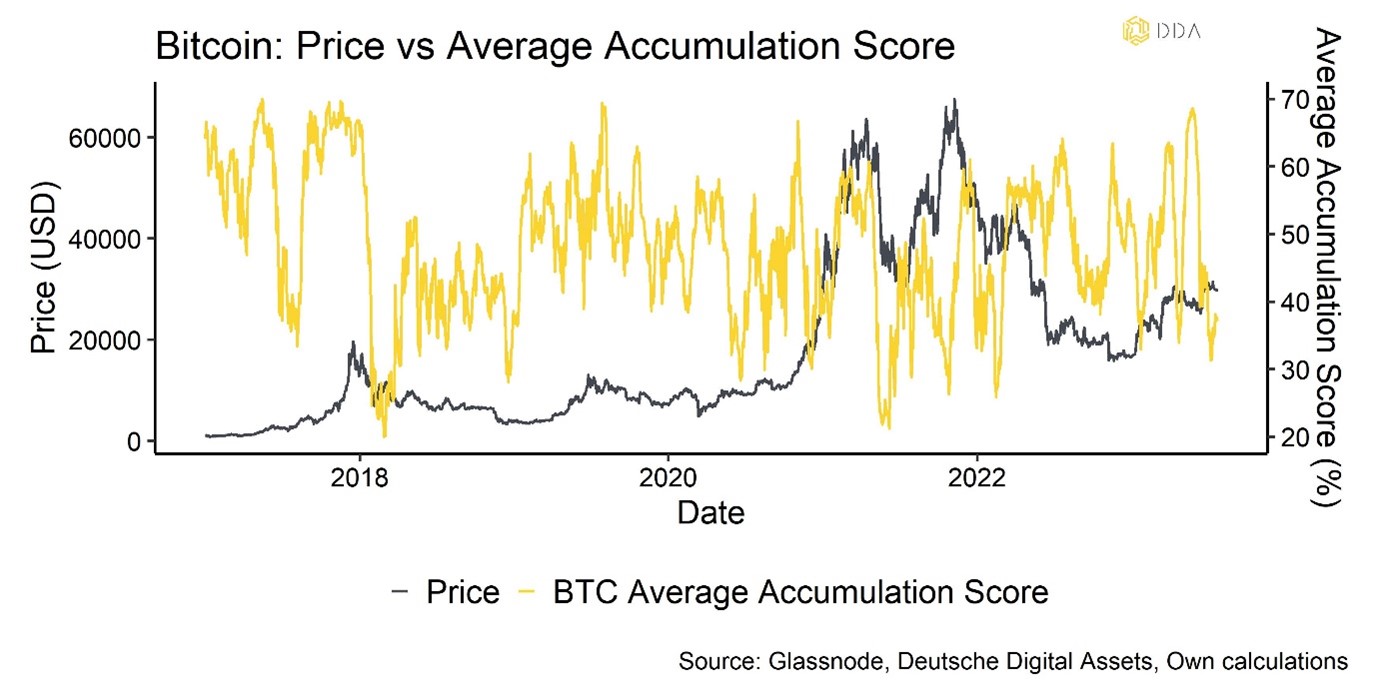

Betrachtet man jedoch die Überweisungsvolumina nach verschiedenen Geldbörsenkohorten, so zeigt sich, dass der durchschnittliche Akkumulationswert über alle Geldbörsenkohorten hinweg ebenfalls deutlich gesunken ist und sich seit Jahresbeginn auf dem niedrigsten Stand befindet.

Diese Beobachtungen deuten darauf hin, dass der weitere Aufwärtstrend von BTC aufgrund der hohen Stimmung, der Positionierung und der schwachen On-Chain-Aktivität kurzfristig begrenzt sein dürfte.

In der Zwischenzeit scheint die XRP-Entscheidung als Katalysator für eine breit angelegte Outperformance der Altcoins gegenüber Bitcoin gedient zu haben. Auf Monatsbasis konnten 40% der von uns beobachteten Altcoins eine Outperformance gegenüber BTC erzielen. Zu einem bestimmten Zeitpunkt im letzten Monat erreichte die Outperformance der Altcoins gegenüber BTC sogar 80%.

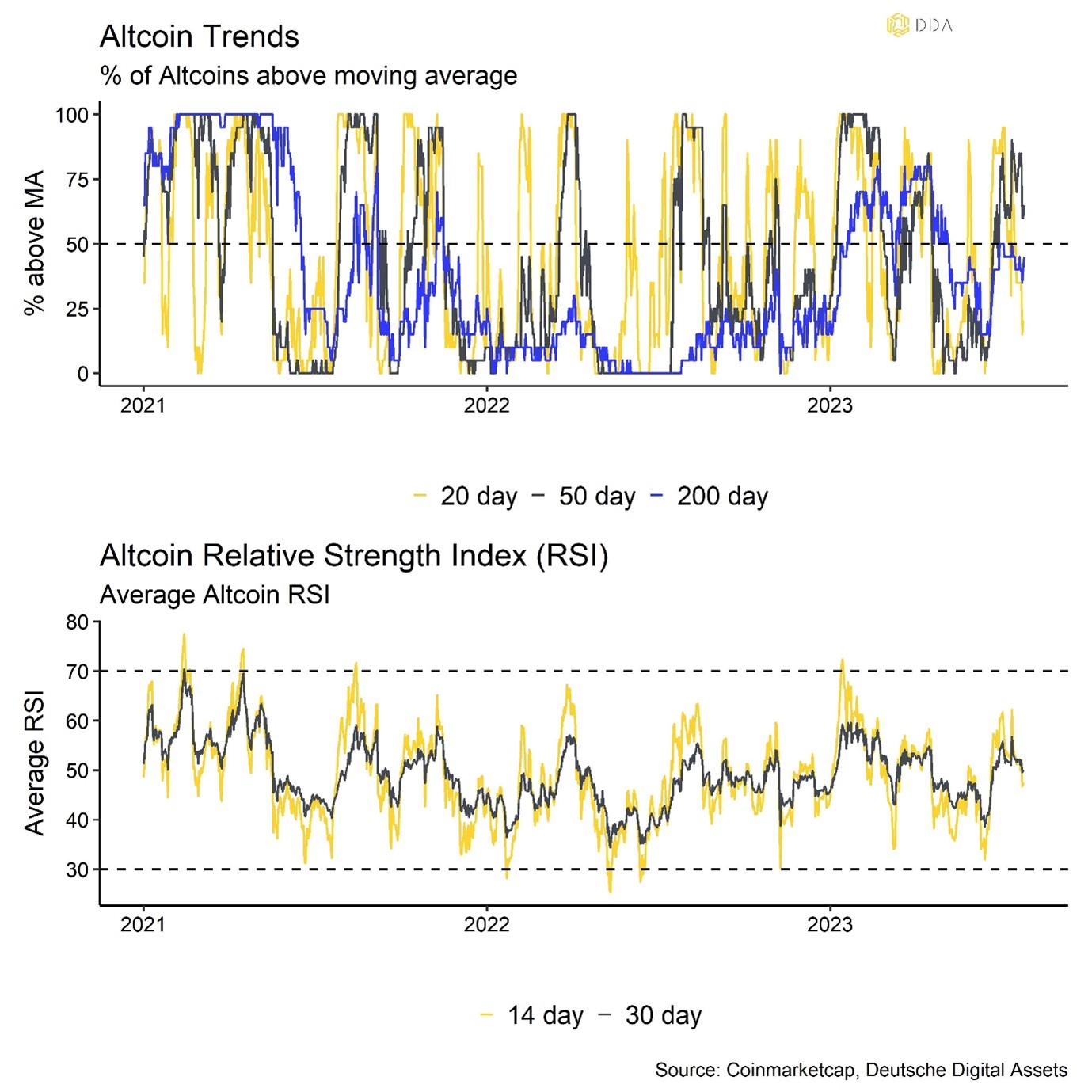

Generell scheint sich die Marktbreite für Altcoins gegenüber dem hohen Niveau zu verschlechtern, das wir zu Beginn des Jahres gesehen haben.

Die Mehrheit der von uns beobachteten Altcoins liegt unter ihrem jeweiligen gleitenden 200-Tage-Durchschnitt, d.h. sie befindet sich derzeit in einem allgemeinen Abwärtstrend. Darüber hinaus liegt nur 1/5 der erfassten Altcoins derzeit über ihrem kurzfristigen 20-Tage-Gleitenden-Durchschnitt.

Im Allgemeinen geht die Outperformance von Altcoins mit einer zunehmenden Streuung der Kryptowährungen einher, d. h. Bitcoin und Altcoins werden während der "Altsaison" in der Regel höher gehandelt, wobei Altcoins besser abschneiden als Bitcoin. Eine breitere Outperformance von Altcoins ist in der Regel ein Zeichen für zunehmende Risikobereitschaft und eine breitere Underperformance von Altcoins ein Zeichen für zunehmende Risikoaversion.

Die oben genannten Kennzahlen könnten also ein Zeichen dafür sein, dass die Risikobereitschaft der Märkte für Kryptowährungen insgesamt immer noch eher zurückhaltend ist.

Unterm Strich: Diese Beobachtungen deuten darauf hin, dass der weitere Aufwärtstrend von BTC aufgrund der erhöhten Stimmung, der Positionierung und der schwachen On-Chain-Aktivität kurzfristig etwas begrenzt zu sein scheint. Altcoins konnten sich in letzter Zeit besser entwickeln als Bitcoin, aber die Marktbreite hat sich im Vergleich zum Jahresanfang deutlich abgeschwächt.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.