Geringe Transfervolumina während der "Urlaubssaison" beeinflussen die Performance von Kryptoassets, während Altcoins Bitcoin übertreffen

DDA Krypto-Markt-Puls, 24. Juli 2023

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Kryptoassets blieben hinter traditionellen Vermögenswerten zurück, da der Markt mit niedrigen Transfervolumina in die "Ferienzeit" zu gehen scheint

- Unser hauseigener Krypto-Sentiment-Index bleibt erhöht, was den weiteren Aufwärtstrend auf kurze Sicht etwas begrenzt

- Unter der Oberfläche hat sich mehr getan, da die Altcoins im letzten Monat begonnen haben, Bitcoin deutlich zu übertreffen

Chart der Woche

Kryptoasset Leistung

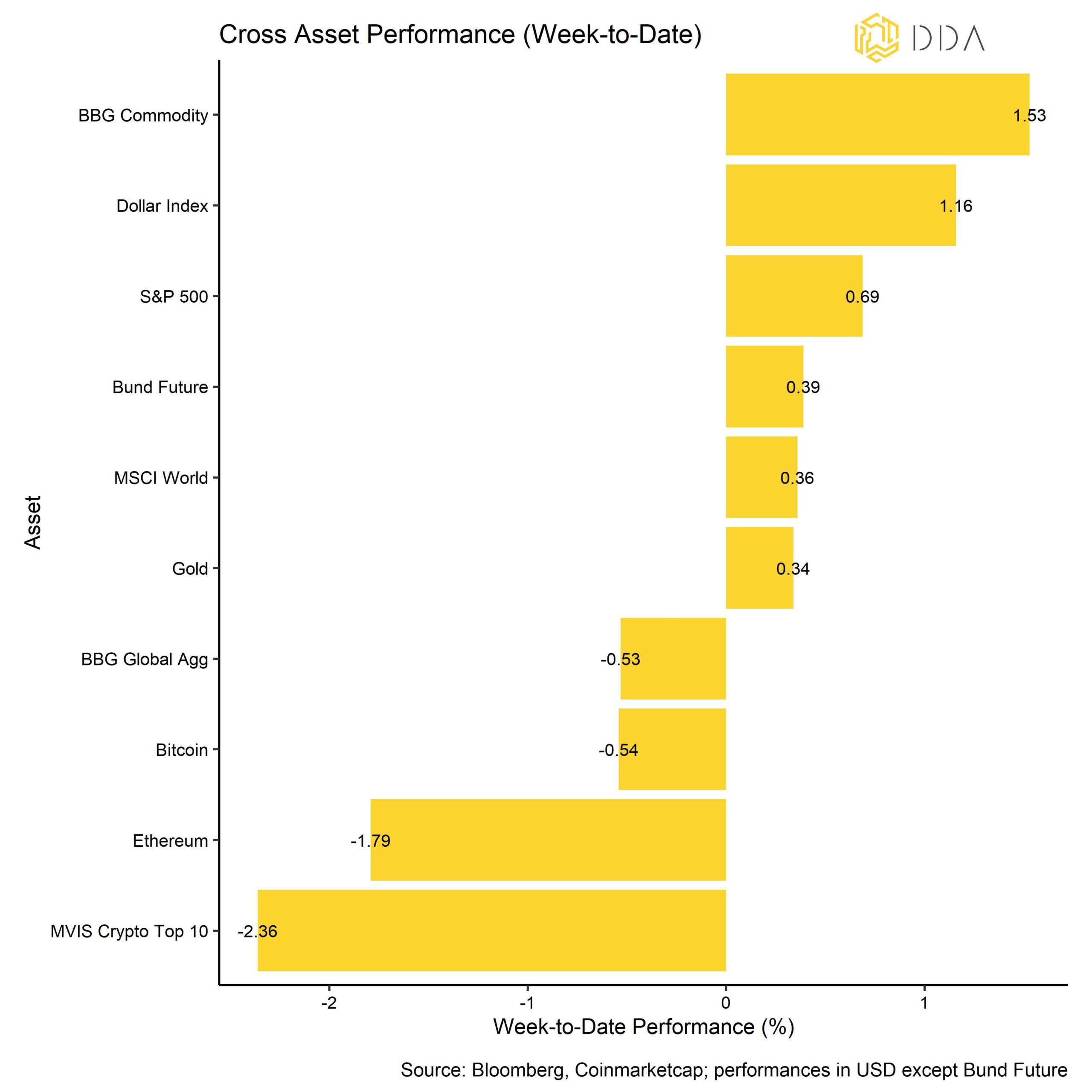

In der vergangenen Woche entwickelten sich Kryptoassets schlechter als traditionelle Vermögenswerte, da der Markt nach der XRP-induzierten Rallye in der Vorwoche nach neuen Katalysatoren suchte. Der Kryptomarkt scheint sich bereits in der "Urlaubssaison" zu befinden, da sich die Transfervolumina in der Nähe von Mehrjahrestiefs bewegen. In der Tat sind insbesondere Juli, August und September traditionell die Monate mit der schwächsten Performance-Saisonalität für Bitcoin, wie wir bereits beschrieben haben hier.

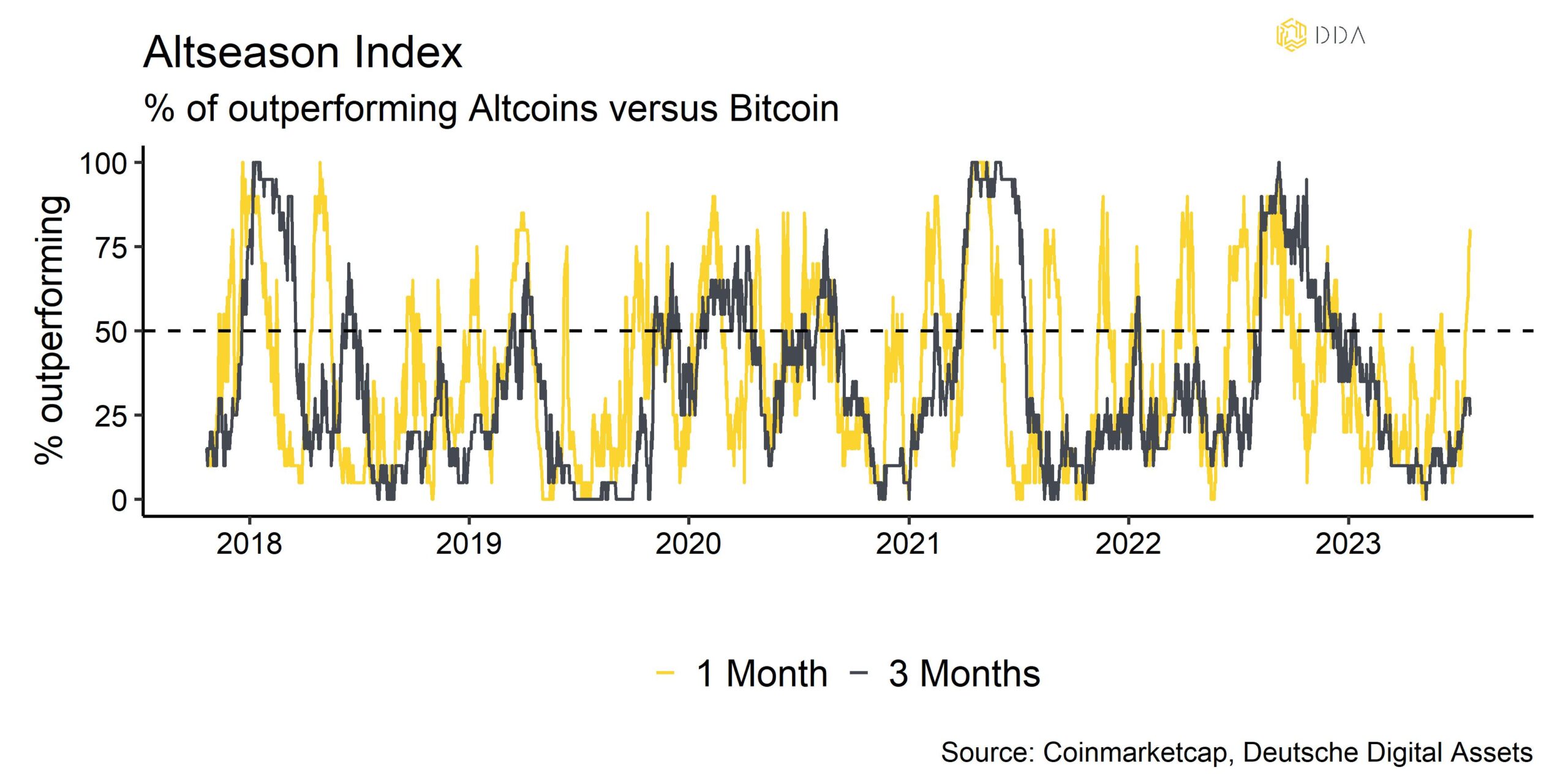

Die meisten Kursbewegungen scheinen sich jedoch unter der Oberfläche abzuspielen: Altcoins konnten sich im letzten Monat besser entwickeln als Bitcoin im Allgemeinen (Chart-der-Woche).

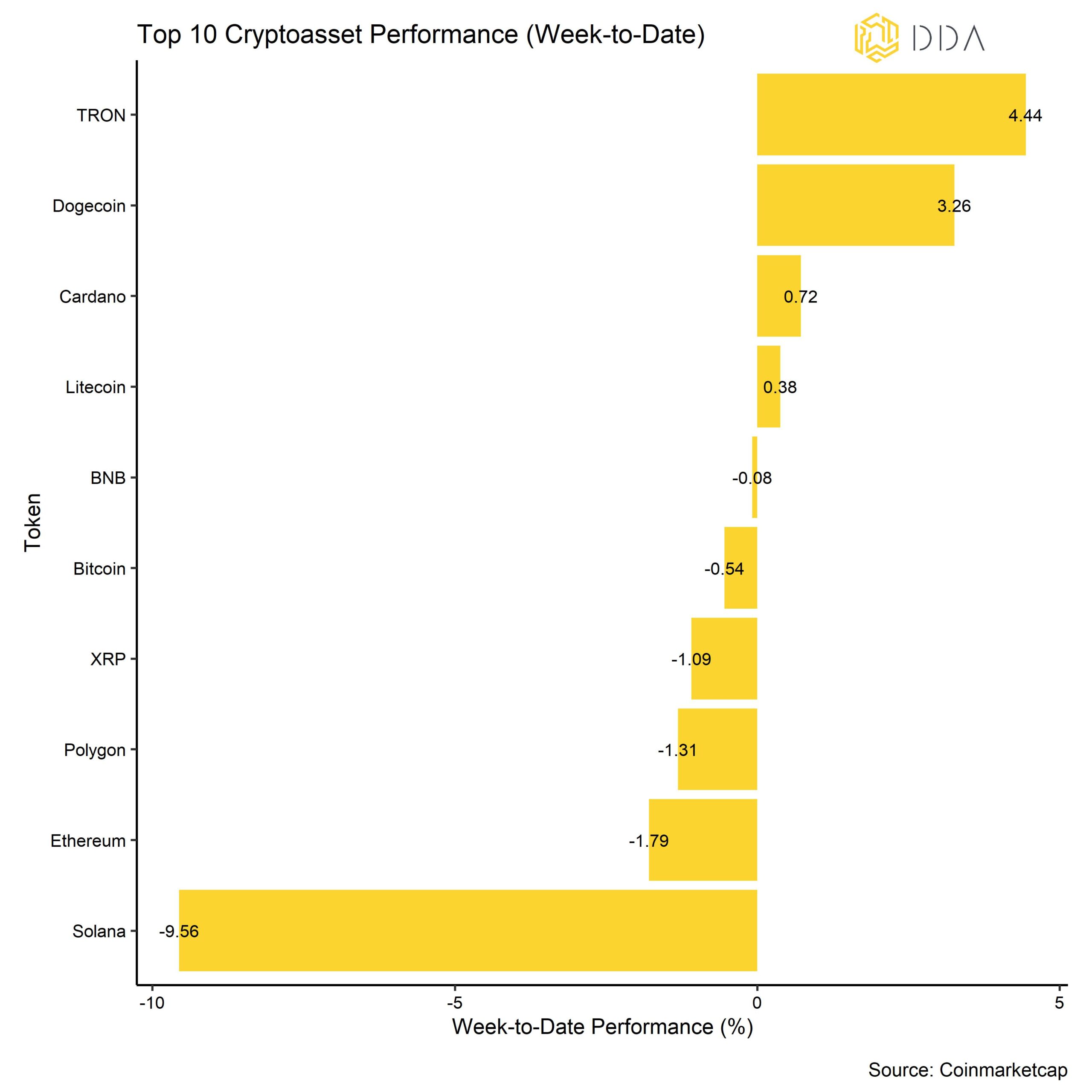

Unter den Top 10 Kryptoassets waren TRON, Dogecoin und Cardano die relativen Outperformer.

Wie bereits erwähnt, hat die Outperformance von Altcoins gegenüber Bitcoin erneut zugenommen. Auf Basis der von uns beobachteten Altcoins konnten 55% und 80% Altcoins auf wöchentlicher bzw. monatlicher Basis eine bessere Performance als Bitcoin erzielen.

Krypto-Marktstimmung

Unser hauseigener Krypto-Sentiment-Index ist nach wie vor hoch, was den weiteren Aufwärtstrend kurzfristig etwas einschränkt. 11 von 15 Indikatoren liegen immer noch über ihrem kurzfristigen Trend.

Im Vergleich zur letzten Woche gab es beim Altseason-Index und bei der impliziten Volatilität von BTC erhebliche Umschwünge nach oben.

Der Crypto Fear & Greed Index bleibt heute Morgen im Bereich "Greed".

Die Leistungsstreuung zwischen den Kryptoassets ist nach wie vor hoch.

Im Allgemeinen bedeutet eine hohe Leistungsstreuung zwischen den Kryptoassets, dass die Korrelationen zwischen den Kryptoassets abgenommen haben, was bedeutet, dass Kryptoassets stärker von münzspezifischen Faktoren abhängig sind.

Gleichzeitig hat sich, wie oben erwähnt, die Outperformance der Altcoins in der letzten Woche erhöht und liegt nun bei 55% Altcoins, die Bitcoin auf wöchentlicher Basis übertreffen.

Im Allgemeinen geht die Outperformance von Altcoins mit einer zunehmenden Streuung der Kryptowährungen einher, d. h. Bitcoin und Altcoins werden während der "Altsaison" in der Regel höher gehandelt, wobei Altcoins besser abschneiden als Bitcoin. Eine breitere Outperformance von Altcoins ist in der Regel ein Zeichen für zunehmende Risikobereitschaft und eine breitere Underperformance von Altcoins ein Zeichen für zunehmende Risikoaversion.

Krypto Asset Flows

Auch in der vergangenen Woche gab es wieder geringe Nettozuflüsse in globale Krypto-ETPs.

Insgesamt verzeichneten wir Nettomittelzuflüsse in Höhe von +4,8 Mio. USD (Woche bis Freitag).

Allerdings verzeichneten Bitcoin-Fonds zum ersten Mal Nettoabflüsse, nachdem sie vier Wochen in Folge erhebliche Nettozuflüsse verzeichnet hatten (-5,6 Mio. USD auf Nettobasis).

Im Gegensatz dazu verzeichneten andere Kryptoasset-Fonds Nettozuflüsse.

Ethereum-Fonds verzeichneten Nettozuflüsse von +2,7 Mio. USD, während andere Altcoin-basierte Fonds ebenfalls +4,2 Mio. USD an Nettozuflüssen erhielten.

Thematische und Korb-Kryptofonds verzeichneten letzte Woche Nettoabflüsse in Höhe von +3,8 Mio. USD.

Außerdem hat sich der NAV-Abschlag des größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - in der vergangenen Woche überwiegend seitwärts bewegt, was darauf hindeutet, dass weder signifikante Nettozu- noch -abflüsse über dieses Fondsvehikel zu verzeichnen waren.

Im Gegensatz dazu war das Beta der globalen Hedge-Fonds gegenüber Bitcoin in den letzten 20 Handelstagen leicht positiv, was bedeutet, dass die globalen Hedge-Fonds ein positives Nettoengagement gegenüber Krypto-Assets haben. Allerdings ist das Beta noch zu gering, um es als statistisch signifikant zu betrachten. Globale Hedgefonds scheinen in Bezug auf Kryptoassets derzeit noch neutral positioniert und daher eher unterdurchschnittlich engagiert zu sein.

On-Chain Tätigkeit

Insgesamt war die On-Chain-Aktivität in der letzten Woche eher verhalten. Zum Beispiel bewegen sich die Transfervolumina auf der Bitcoin-Blockchain in der Nähe von Mehrjahrestiefs. Außerdem haben sowohl die Zu- als auch die Abflüsse an den Börsen in der letzten Woche deutlich abgenommen. Auf Nettobasis sind weiterhin Münzen aus den Börsen abgeflossen, da die Bitcoin-Börsensalden den niedrigsten Stand seit Februar 2018 erreicht haben. Die Änderungsrate dieser Nettoabflüsse hat sich jedoch deutlich verlangsamt.

Im Moment scheint es einen gewissen Abwärtsdruck zu geben, da kurzfristige Bitcoin-Inhaber eher dazu neigen, Münzen mit Verlusten an Börsen zu schicken als Münzen mit Gewinnen. Kurzfristige Inhaber senden derzeit an einem einzigen Tag mehr als 1% ihrer Guthaben an Börsen, was relativ signifikant ist. Liquidationen dieser Art könnten mit einer Vielzahl von Faktoren zusammenhängen, einschließlich der allgemeinen makroökonomischen Bedingungen oder einfach dem saisonalen Liquiditätsbedarf aufgrund der Ferienzeit.

Im Gegensatz dazu scheinen Langzeitbesitzer von Bitcoin keine größeren Mengen ihrer Bestände zu liquidieren. Genauer gesagt, schicken die Langzeitbesitzer derzeit nur 0,0002% ihrer Bestände an Börsen. Der Großteil der Münzen, die überhaupt verschickt werden, sind Münzen im Gewinn.

Krypto-Asset-Derivate

In der vergangenen Woche deuteten auch die Derivatemetriken auf eine eher gedämpfte Preisentwicklung hin.

So sank beispielsweise die implizite Volatilität von BTC weiter auf ein Mehrjahrestief.

Auch das BTC-Put-Call-Verhältnis ist weiter gesunken. Die Schieflage der 1-Monats-25-Delta-Optionen für BTC war weiterhin zugunsten von Kaufoptionen verschoben, was bedeutet, dass die Händler von BTC-Optionen positive Erwartungen hinsichtlich der künftigen Marktentwicklung haben.

Der 3-Monats-Basissatz für BTC ist leicht gesunken, liegt aber immer noch über 5% p.a., was auf positive Preisaussichten hindeutet, die von Bitcoin-Futures-Händlern in der Futures-Kurve eingepreist werden.

Das offene Interesse war während der gesamten Woche sowohl bei den Futures (Kalender und Perpetual) als auch bei den Optionen relativ stabil.

Unterm Strich

Kryptoassets schnitten schlechter ab als traditionelle Vermögenswerte, da der Markt mit geringen Transfervolumina in die "Ferienzeit" zu gehen scheint.

Unser hauseigener Krypto-Sentiment-Index ist nach wie vor hoch, was den weiteren Aufwärtstrend kurzfristig etwas einschränkt.

Unter der Oberfläche hat sich mehr getan, da die Altcoins im letzten Monat begonnen haben, Bitcoin deutlich zu übertreffen.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.