Ethereum Shapella Upgrade. Was kommt als Nächstes?

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Das Upgrade von Shanghai-Capella (Shapella) wurde letzte Nacht abgeschlossen, so dass die Nutzer ihr eingesetztes ETH-Kapital und ihre Belohnungen abheben können

- Zum Zeitpunkt der Erstellung dieses Artikels wurden Abhebungen in Höhe von 106.158 ETH (~$206 Millionen) verarbeitet, aber die Börsenzuflüsse für Ethereum scheinen immer noch moderat zu sein

- Obwohl die Modernisierung erfolgreich war, bleiben kurzfristig einige Hauptrisiken bestehen

Einführung

Der Shanghai-Capella Hard Fork von Ethereum, auch bekannt als "Shapella", wurde abgeschlossen und ermöglicht es Nutzern, die ihre Ether (ETH) zum Schutz und zur Bestätigung von Transaktionen auf der Blockchain eingesetzt haben, ihr Geld abzuheben.

Gestern um 22:27 UTC begann die Aktualisierung in Shanghai, die um etwa 22:42 UTC abgeschlossen war.

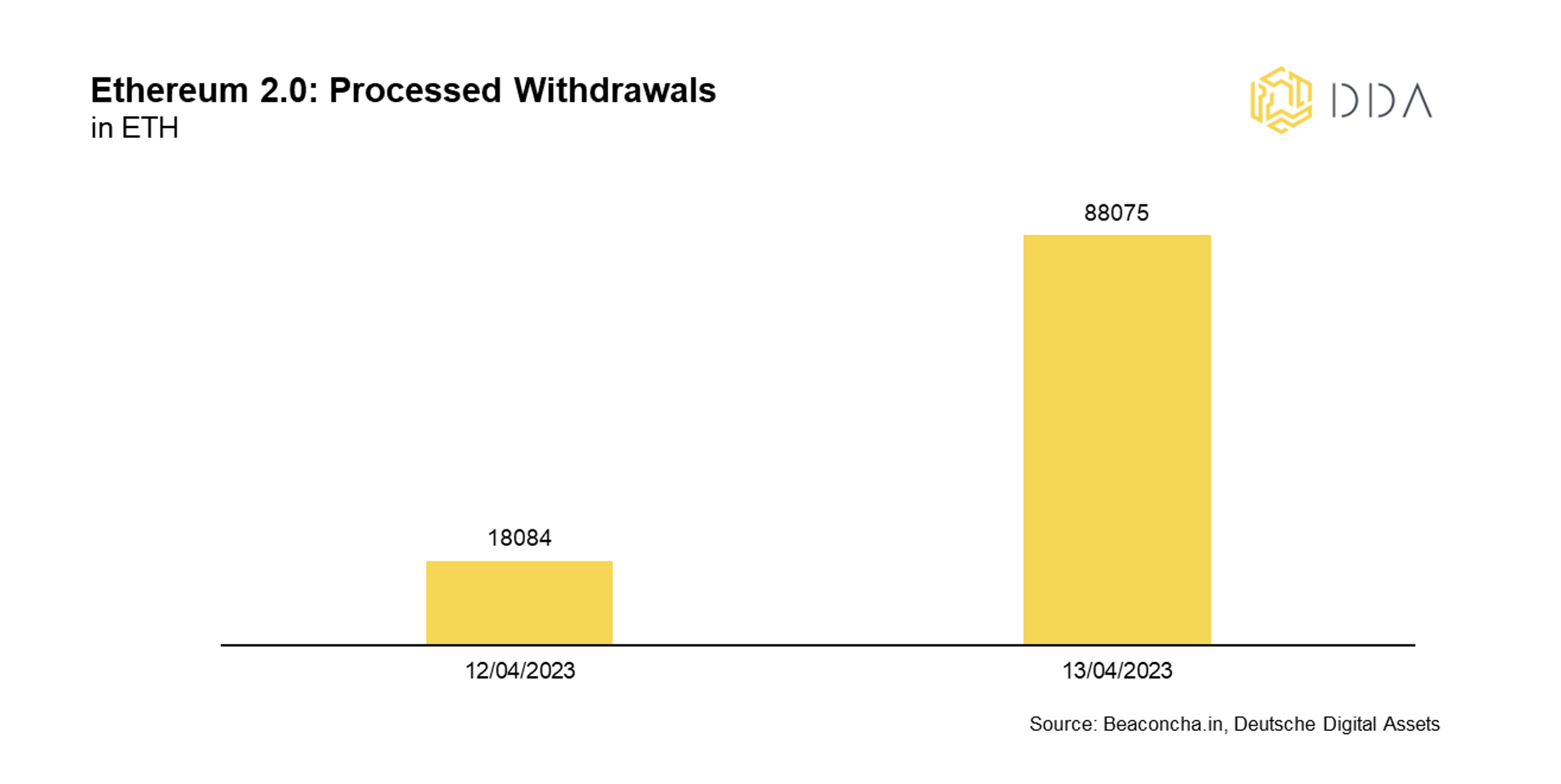

Laut beaconcha.in wurden seit der Aktivierung des Shapella-Upgrades bereits Abhebungen von insgesamt 106.158 ETH (~$206 Millionen) verarbeitet (siehe Grafik oben).

Validatoren können nun sowohl ihr eingesetztes ETH-Kapital (sog. "full withdrawal") als auch die Höhe der eingesetzten ETH-Belohnungen (sog. "partial withdrawal") abheben, beides wurde mit dem neuesten Upgrade aktiviert.

Mehr als 18 Millionen ETH, oder etwa 15% des verfügbaren ETH-Angebots, wurden eingesetzt, seit die Beacon Chain im Dezember 2020 live ging. Mit der Inbetriebnahme von Shapella stehen nun 1,1 Millionen ETH aus Zuteilungen für eine schnelle Auszahlung zur Verfügung.

Das Shapella-Upgrade ist ein wichtiger Meilenstein für den Übergang von Ethereum von der Proof-of-Work- zur Proof-of-Stake-Validierung von Transaktionen.

Die Nutzer "setzen" Geld in einem Proof-of-Stake-Mechanismus ein, um neue Transaktionsblöcke zu sichern und zu bestätigen. Seitdem der alte Proof-of-Work-Konsensprozess der Blockchain im vergangenen Jahr aufgegeben wurde, konnten die Nutzer die eingesetzten Ether nicht mehr abheben oder sich die angesammelten Stake-Belohnungen auszahlen lassen, was eine Schlüsselkomponente des neuen Paradigmas ist.

Als die Shanghai Hard Fork gestern Abend initiiert wurde, war der ETH-Preis weitgehend unverändert und es gab keine nennenswerte Preisreaktion auf das Upgrade. Darüber hinaus gab es keinen großen Exodus von Validierern, der vor dem Upgrade aufgrund eines Anstiegs der sogenannten "freiwilligen Ausstiege" am vergangenen Sonntag erwartet worden war (siehe hier).

Freiwillige Austritte stellen die Gesamtzahl der Validierer dar, die freiwillig aus dem Validierer-Pool ausgetreten sind und nicht mehr an der Proof-of-Stake-Validierung teilnehmen. In der vergangenen Woche ist die Zahl der aktiven Validierer zum ersten Mal in Folge gesunken.

Neben der Freischaltung von ETH-Einsätzen wurden mit dem Shapella-Upgrade die folgenden Verbesserungen am Ethereum-Protokoll vorgenommen, von denen die meisten auf eine Senkung der Transaktionsgebühren (Gaspreise) abzielen:

- EIP-3651 hat niedrigere Gaskosten und greift auf die "COINBASE"-Adresse zu, eine Software, die von Validierern verwendet wird (ohne Bezug zu der bekannten Börse). Diese Änderung des Blockchain-Codes kann die MEV-Zahlungen (Maximum Extractable Value) der Kunden verbessern;

- EIP-3855, die "Push0", einen Code, der die Gaskosten der Entwickler reduzieren wird;

- EIP-3860, die die Gaspreise für Entwickler, die "Initcode" (einen Code für intelligente Verträge) verwenden, einschränkt;

- EIP-6049 informiert die Entwickler über die Abschreibung eines Codes namens "SELFDESTRUCT", der auch die Gaspreise senkt.

Was kommt als Nächstes?

Ethereum-Gründer Vitalik Buterin hat gleich nach dem Upgrade betont, dass der Fokus nun auf der weiteren Senkung der Transaktionsgebühren und der Erhöhung der Skalierbarkeit der Ethereum-Basisschicht liegen wird, was mit dem neuesten Upgrade auch teilweise in Angriff genommen wurde. Zum Zeitpunkt der Erstellung dieses Artikels liegt die durchschnittliche Transaktionsgebühr auf der Ethereum-Basisschicht bei etwa 5 USD pro Transaktion, was einer der Gründe dafür ist, dass viele Entwickler nach alternativen Brückenprotokollen wie Polygon (MATIC) oder Arbitrum (ARB) gesucht haben, um die Ethereum-Basisschicht zu skalieren und ihre Transaktionskosten zu senken.

Daher scheint die Senkung der Transaktionsgebühren die oberste Priorität auf der Entwicklungsliste von Ethereum zu sein.

Die gute Nachricht für Investoren ist, dass Ethereum nun eine flexible Lösung bietet, um Zinsen/Belohnungen über Staking zu verdienen, d.h. bei der Validierung von Transaktionen. Der geschätzte ROI pro Validierer liegt derzeit bei etwa 4,26% pro Jahr. Staking-Belohnungen sind eine Funktion, die Proof-of-Work-Kryptoassets wie Bitcoin nicht besitzen.

Allerdings bestehen auch nach der Aktualisierung noch wesentliche Risiken.

Große Inhaber von ETH-Einsätzen wie das insolvente Celsius Network, die noch rund 158.000 ETH halten, könnten die Freischaltung nutzen, um ihre Bestände zu liquidieren und Gelder für ihre Gläubiger zurückzuholen.

Um die Vorwürfe der SEC auszuräumen, hat die US-amerikanische Krypto-Börse Kraken gerade beschlossen, ihr Staking-Geschäft einzustellen. Infolgedessen wird sie wahrscheinlich alle ihre 1,2 Millionen ETH entwerten müssen. Das bedeutet zwar nicht unbedingt, dass diese eingesetzten ETH am Ende liquidiert werden, aber ein Risiko besteht dennoch.

Zumindest ein Teil der Abhebungen von Einsätzen könnte schließlich bei Börsen landen, um die eingesetzte ETH einzulösen. Dies könnte kurzfristig einen gewissen Abwärtsdruck auf den Preis ausüben. Allerdings scheinen die Börsenzuflüsse für Ethereum bisher relativ gering zu sein, was keinen nennenswerten Verkaufsdruck bedeutet.

In Anbetracht der implementierten Abhebungsschlange - das Protokoll lässt nur bis zu 115200 Abhebungen pro Tag zu - wird der Gesamtbetrag des Verkaufsdrucks durch diesen harten Faktor etwas begrenzt sein.

Und schließlich besteht das wahrscheinlich größte Risiko darin, dass die SEC nach der Freigabe von Abhebungen die Blockchain wieder stärker unter die Lupe nehmen könnte, da die Verteilung der eingesetzten ETH eine Gewinnausschüttung in einem gemeinsamen Unternehmen implizieren könnte - ein Schlüsselkriterium des berüchtigten "Howey-Tests", mit dem festgestellt wird, ob ein Unternehmen in den USA ein Wertpapier darstellt.

Dies könnte zu einer weiteren Preisvolatilität auf den Kryptoasset-Märkten führen, da es die regulatorische Unsicherheit in den USA wieder erhöhen könnte.

Zumindest kurzfristig könnte die Aufhebung des Abwärtsschutzes durch ETH-Optionen und -Futures nach der erfolgreichen Einführung von Shapella zu einem gewissen Aufwärtsdruck auf den Preis führen, was eine gute Nachricht ist.

Vor dem Upgrade gab es einige signifikante Hedging-Aktivitäten, die sich in der erhöhten Prämie für ETH-Optionen, die nach dem Upgrade ausliefen, und in der negativen Schieflage zugunsten von Verkaufsoptionen zeigten, die dem Inhaber das Recht geben, eine bestimmte Menge ETH zu einem vorher festgelegten Preis zu verkaufen.

Wir werden diese Kennzahlen auch in Zukunft weiter beobachten und auf neue Entwicklungen hinweisen.

Wie immer hoffen wir, dass diese Erkenntnisse für Sie nützlich sind.

Bleiben Sie bescheiden und stapeln Sie Sats,

André

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.