Laden Sie den vollständigen Bericht im PDF-Format herunter

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Kryptoassets waren in der vergangenen Woche erneut die beste Anlageklasse und übertrafen aufgrund des schwachen US-Dollars globale Aktien, Anleihen und Rohstoffe um ein Vielfaches

- Unser hauseigener Crypto Sentiment Index ist deutlich gestiegen und hat den höchsten Stand seit Anfang 2021 erreicht und befindet sich nun klar im positiven Bereich

- Generell scheint es ein erneutes Kaufinteresse von institutionellen Anlegern zu geben, das wir in verschiedenen Marktsegmenten beobachten können, u.a. bei den Fondsströmen, den Aktivitäten auf der Handelskette und den Derivatemärkten

Chart der Woche

Leistung

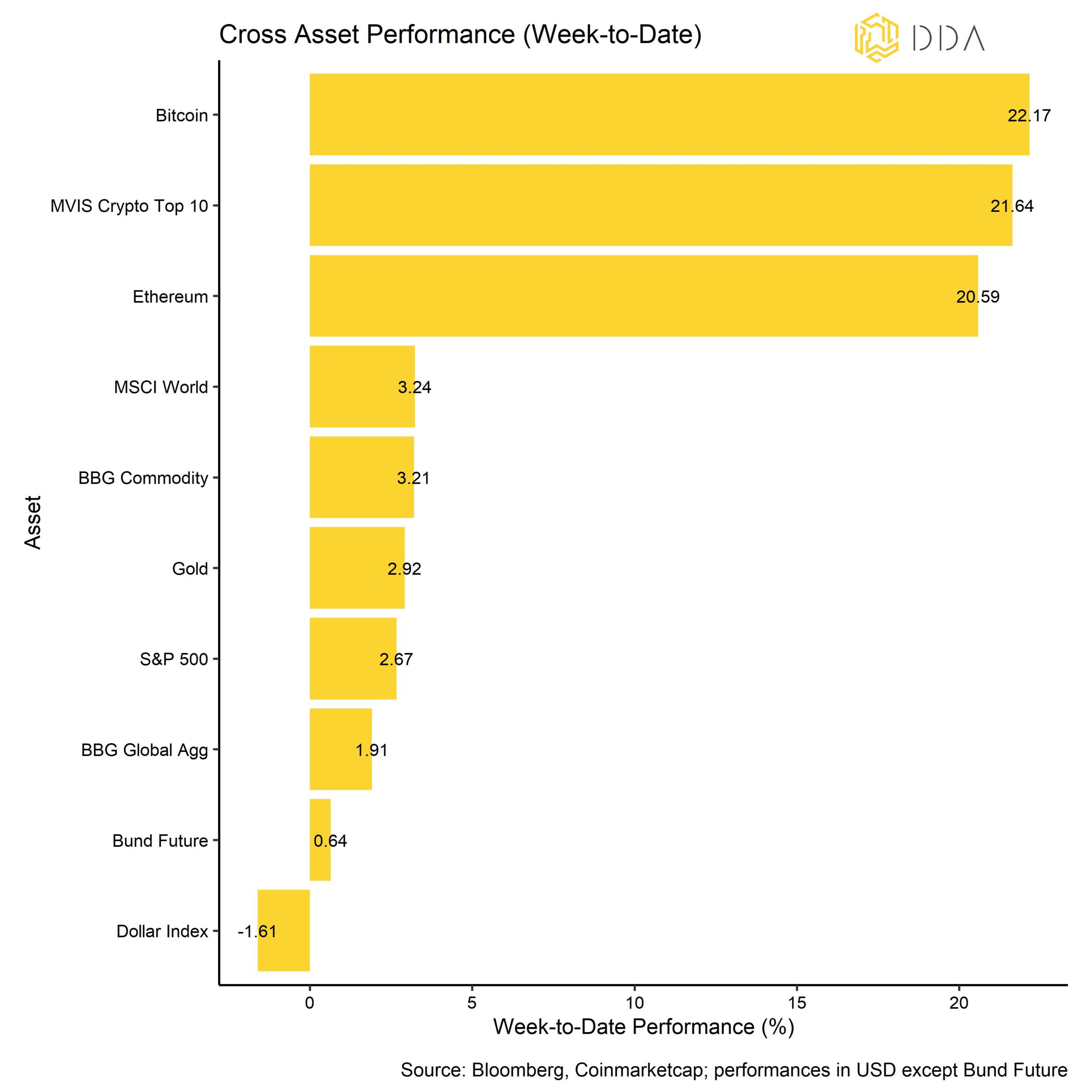

In der vergangenen Woche konnten die Preise für Kryptowährungen erneut überdurchschnittlich zulegen, da es im Laufe der Woche Anzeichen für ein zunehmendes Kaufinteresse institutioneller Anleger gab. Die allgemeine Marktstimmung wurde durch einen weiteren erwarteten Rückgang der US-Inflationszahlen, die am Donnerstag letzter Woche veröffentlicht wurden, aufgehellt. Obwohl die Inflationszahlen größtenteils mit den Konsenserwartungen übereinstimmten, ging die Gesamtinflationsrate des Verbraucherpreisindex gegenüber November 2022 um weitere 60 Basispunkte zurück, was ein weiteres Indiz dafür ist, dass der Höhepunkt der Inflation bereits hinter uns liegt. Die breite Abwertung des Dollars im Laufe der Woche trug ebenfalls dazu bei.

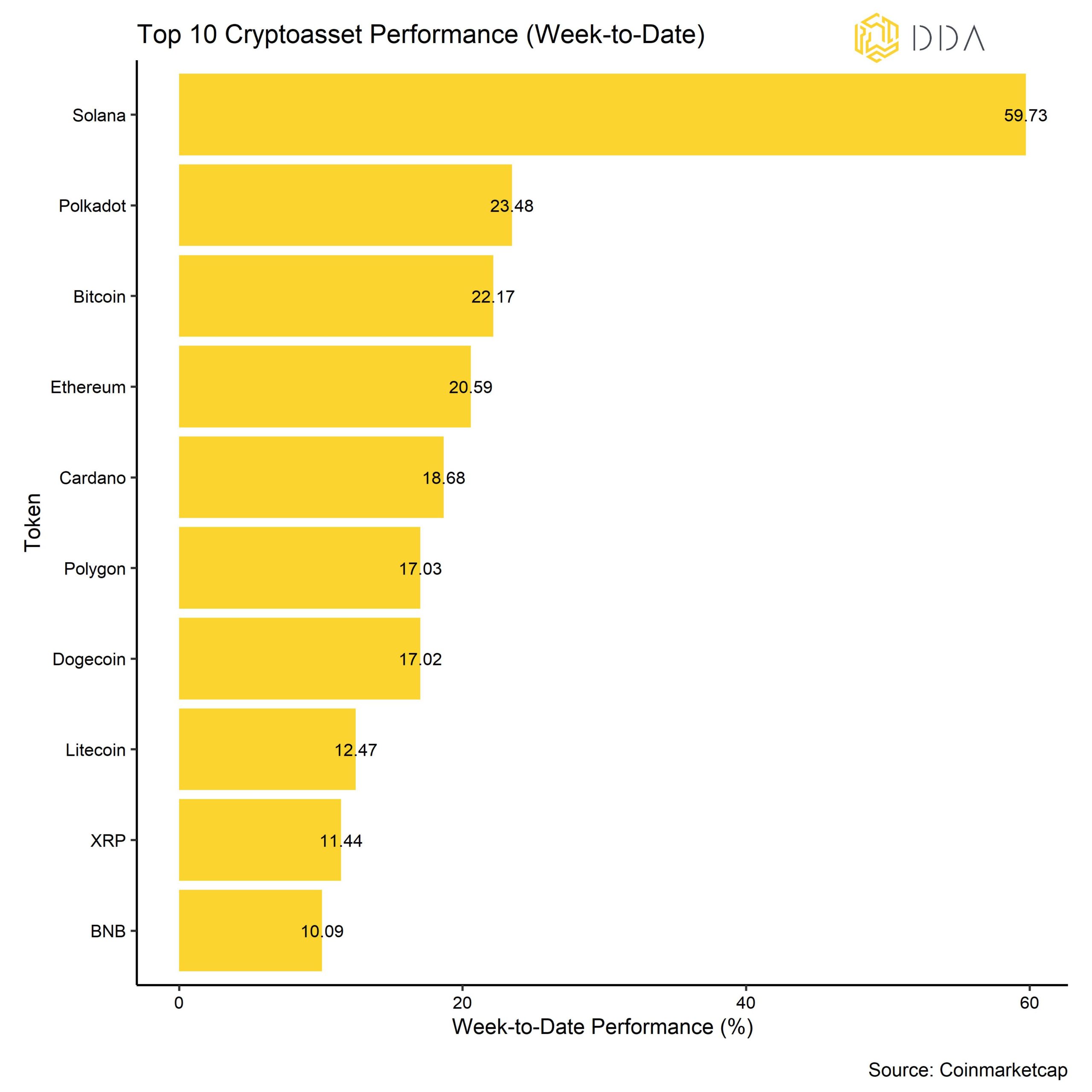

Unter den wichtigsten Kryptoassets waren Solana, Polkadot und Bitcoin die relativen Outperformer. Solana setzte seine starke technische Umkehrung fort, nachdem er im letzten Jahr zu den schlechtesten Kryptoassets gehörte. Kryptoassets waren auch in der zweiten Woche des Jahres die beste Anlageklasse und übertrafen globale Aktien, Anleihen und Rohstoffe um ein Vielfaches. Anleihen waren in der vergangenen Woche die schlechteste Anlageklasse, während der Dollar deutlich an Wert verlor.

Stimmung

Unser hauseigener Krypto-Sentiment-Index ist im Vergleich zur letzten Woche weiter gestiegen und befindet sich nun deutlich im positiven Bereich. 11 von 15 Indikatoren (73%) liegen über ihrem kurzfristigen Trend.

Die wichtigsten Faktoren waren der Anstieg des Crypto Fear & Greed Index und der 25-Delta Bitcoin Option Skew, die einen deutlichen Rückgang der Risikoaversion der Anleger signalisieren.

Die Streuung zwischen den Kryptoassets war weiterhin hoch, was bedeutet, dass der Kryptomarkt eher von münzspezifischen Faktoren als von systematischen Faktoren beeinflusst wurde. Gleichzeitig entwickelten sich Altcoins auf 1-Monats-Basis meist schlechter als Bitcoin und haben erst vor kurzem wieder begonnen, besser abzuschneiden. Auf 1-Monats-Basis haben 25% der erfassten Altcoins besser abgeschnitten als Bitcoin. Die Outperformance von Altcoins ist in der Regel ein Zeichen für eine erhöhte Risikobereitschaft.

Der Crypto Fear & Greed Index ist deutlich gestiegen, befindet sich aber immer noch im Bereich "Fear". Im Gegensatz dazu ist der BTC Twitter Sentiment Index in der letzten Woche deutlich gestiegen und impliziert nun wieder eine bullische Bitcoin-Stimmung.

Strömungen

In der vergangenen Woche stieg das Interesse institutioneller Anleger an Kryptoassets.

Die Fondsströme erholten sich in der letzten Woche und wir verzeichneten in dieser Woche Nettozuflüsse in globale Krypto-ETPs in Höhe von +6,8 Mio. USD. Während BTC- und ETH-basierte Produkte Nettozuflüsse verzeichneten (+13,3 Mio. USD und +8,5 Mio. USD), gab es bei Basket- und thematischen Krypto-ETPs und solchen, die Altcoins ohne ETH abbilden, Nettoabflüsse in Höhe von -13,1 Mio. USD bzw. -1,9 Mio. USD.

Nach dem insgesamt starken Stimmungsanstieg zu urteilen, scheinen die Mittelzuflüsse aus Kryptofonds dieser allgemeinen Entwicklung noch hinterherzuhinken, was ein erhebliches Aufwärtspotenzial für die Mittelzuflüsse bedeutet.

In diesem Zusammenhang verringerte sich der Abschlag auf den Nettoinventarwert des größten Bitcoin-Fonds der Welt - Grayscale Bitcoin Trust (GBTC) - weiter, was ebenfalls auf erneute institutionelle Käufe hindeutet.

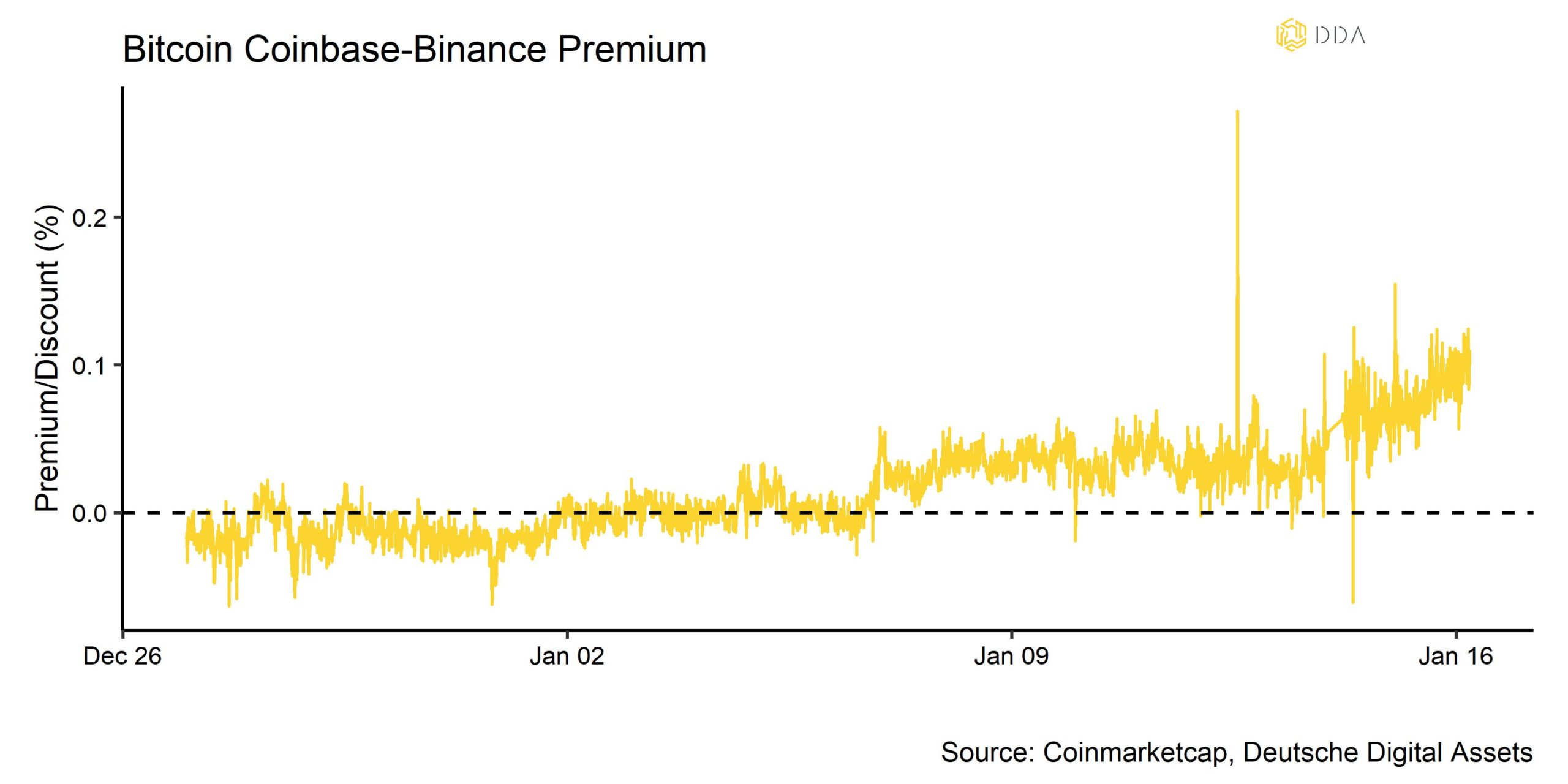

Das Beta der globalen Hedge-Fonds gegenüber Bitcoin ist in den letzten 20 Handelstagen weiter leicht gesunken, was bedeutet, dass Hedge-Fonds ihr Engagement in Krypto-Assets in den letzten 20 Tagen weiter verringert haben könnten. Nichtsdestotrotz war die Preisprämie zwischen den auf Coinbase gehandelten Bitcoins und den auf Binance gehandelten (Coinbase-Binance-Prämie) während der gesamten Woche weiterhin positiv, was auf ein erhöhtes Kaufinteresse von institutionellen Anlegern gegenüber Kleinanlegern hindeutet. Dies wird auch oben in unserem Chart-of-the-Week.

On-Chain

Auch die Entwicklungen in der Handelskette bestätigten die Ansicht, dass die Institute in der vergangenen Woche wieder auf den Markt zurückkehrten.

Zum einen sind die Bitcoin-Bestände an Over-the-Counter (OTC)-Schaltern stark gestiegen und haben den höchsten Stand seit Juli 2022 erreicht (siehe Anhang). Höhere OTC-Desk-Bestände deuten darauf hin, dass die Nachfrage institutioneller Anleger nach Bitcoin gestiegen ist, da diese OTC-Handelsschalter in der Regel von Anlegern genutzt werden, die umfangreiche Transaktionen durchführen, die eine hohe Liquidität auf bilateraler Basis benötigen. Zu den typischen Nutzern von OTC-Handelsschaltern gehören private Vermögensverwalter, vermögende Privatpersonen oder Hedgefonds, die große Bargeldbeträge nahtlos in Kryptowährungen umwandeln möchten.

Eine weitere Beobachtung, die das gestiegene Kaufinteresse von Institutionen an Kryptoassets bestätigt, ist die Tatsache, dass die Abflüsse an den Börsen in der letzten Woche von sehr großen Wallet-Größen (> 1 Mio. USD) dominiert wurden (siehe Anhang). Im Allgemeinen deuten die Abflüsse an den Börsen auf ein Kaufinteresse hin, da die Anleger die Münzen von den Börsen abziehen, um sie in einem Kühlhaus zu lagern.

Außerdem scheinen sich die kurzfristigen Anleger in der Gewinnzone zu befinden (STH-SOPR > 1,0), und die kurzfristigen Anleger sind insgesamt nicht mehr "unter Wasser", d.h. sie haben insgesamt nicht realisierte Gewinne aus ihren Anlagen (STH-NUPL > 0). Im Allgemeinen zeigt die Spent-Output-Profit Ratio (SOPR) einfach das Verhältnis zwischen dem gezahlten Preis und dem verkauften Preis an, und Werte über 1,0 bedeuten insgesamt profitable Transaktionen. Die Kennzahl Unrealisierte Nettogewinne/-verluste (NUPL) gibt den Betrag der nicht realisierten Gewinne oder Verluste an, der sich noch in den Geldbörsen der Anleger befindet.

Ein Umfeld, in dem kurzfristige Händler insgesamt profitabel sind, wirkt sich stabilisierend auf den Gesamtmarkt aus, da diese Händler weniger wahrscheinlich ihre Bestände verkaufen. Dieses Phänomen ist in der Regel in der Nähe des Tiefpunkts eines Zyklus oder ganz am Anfang eines neuen Haussezyklus zu beobachten.

Generell ist die Anzahl der aktiven Adressen auf der Bitcoin-Blockchain auf den höchsten Stand seit Mai 2022 gestiegen, was auf einen allgemeinen Anstieg der On-Chain-Aktivität hindeutet.

Derivate

Die jüngsten Veränderungen in der Futures-Positionierung sprechen ebenfalls dafür, dass die Nachfrage der Anleger nach Kryptoassets in letzter Zeit gestiegen ist. Dies geschieht vor dem Hintergrund eines weiteren Anstiegs der Futures-Basisrate, die derzeit wieder positiv ist. Dies deutet darauf hin, dass die Futures-Händler eine optimistische Preiserwartung haben. Der Preisanstieg der vergangenen Woche wurde auch durch eine Zunahme der Auflösungen von Futures-Leerverkäufen und eine gewisse Zunahme der Leerverkaufsaktivitäten unterstützt. Leerverkäufer müssen ihre Short-Positionen eindecken, wenn ihre Gewinnspannen aufgrund einer falschen Positionierung unter Druck geraten, was bedeutet, dass sie den Basiswert zurückkaufen, um ihre Position zu neutralisieren. Dadurch entsteht Aufwärtsdruck auf den Preis.

Tatsächlich beliefen sich die Short-Liquidationen bei Futures allein am Samstag auf etwas mehr als 120 Mio. USD - der höchste Betrag an Short-Liquidationen seit Juli 2021.

Darüber hinaus hat sich der 25-Delta-Skew bei Bitcoin-Optionen deutlich verringert, was bedeutet, dass der Abwärtsschutz für Bitcoin abgenommen hat. Delta-äquivalente Call-Optionen auf Bitcoin für eine 1-monatige Laufzeit sind jetzt teurer als Put-Optionen. Gleichzeitig ist die implizite Optionsvolatilität etwas angestiegen, nachdem sie in der Vorwoche ein Allzeittief erreicht hatte.

Unterm Strich

Kryptoassets waren in der vergangenen Woche erneut die beste Anlageklasse und übertrafen aufgrund eines schwachen US-Dollars globale Aktien, Anleihen und Rohstoffe bei weitem.

Unser hauseigener Krypto-Sentiment-Index ist deutlich auf den höchsten Stand seit Anfang 2021 gestiegen und befindet sich nun klar im positiven Bereich.

Generell scheint es ein erneutes Kaufinteresse institutioneller Anleger zu geben, das wir in verschiedenen Marktsegmenten beobachten können, u. a. bei den Fondsströmen, den Aktivitäten innerhalb der Handelskette und den Derivatemärkten.

Laden Sie den vollständigen Bericht mit Anhang hier herunter.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets GmbH, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.