Laden Sie den vollständigen Bericht im PDF-Format herunter

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

- Das Jahr 2022 war für Kryptoassets eher schwierig, da sich der Markt in einem Bärenmarkt befunden hat. Andere wichtige Anlageklassen wie Aktien oder Anleihen entwickelten sich aufgrund der strafferen Geldpolitik ebenfalls nicht gut.

- Es gibt jedoch eine zunehmende Divergenz zwischen den Markterwartungen und der Fed-Politik, was die Risiken kurzfristig erhöhen könnte, da sich die US-Wirtschaft immer noch als recht widerstandsfähig erweist

- Da die US-Wirtschaft jedoch wahrscheinlich in diesem Jahr in eine Rezession fallen wird, erwarten wir eine allmähliche Lockerung der Geldpolitik, die Kryptoassets im Jahr 2023 unterstützen sollte. Eine allmähliche Wiederöffnung Chinas sollte ebenfalls helfen

- Es gab eine klassische Umverteilung von Münzen von kurzfristigen zu langfristigen Anlegern, einen deutlichen Anstieg der realisierten und nicht realisierten Verluste sowie eine weitgehende Rücksetzung der Bewertungen. All diese Entwicklungen sind typisch für Bärenmärkte und haben ein Niveau erreicht, das zunehmend auf einen Tiefpunkt des Zyklus hindeutet

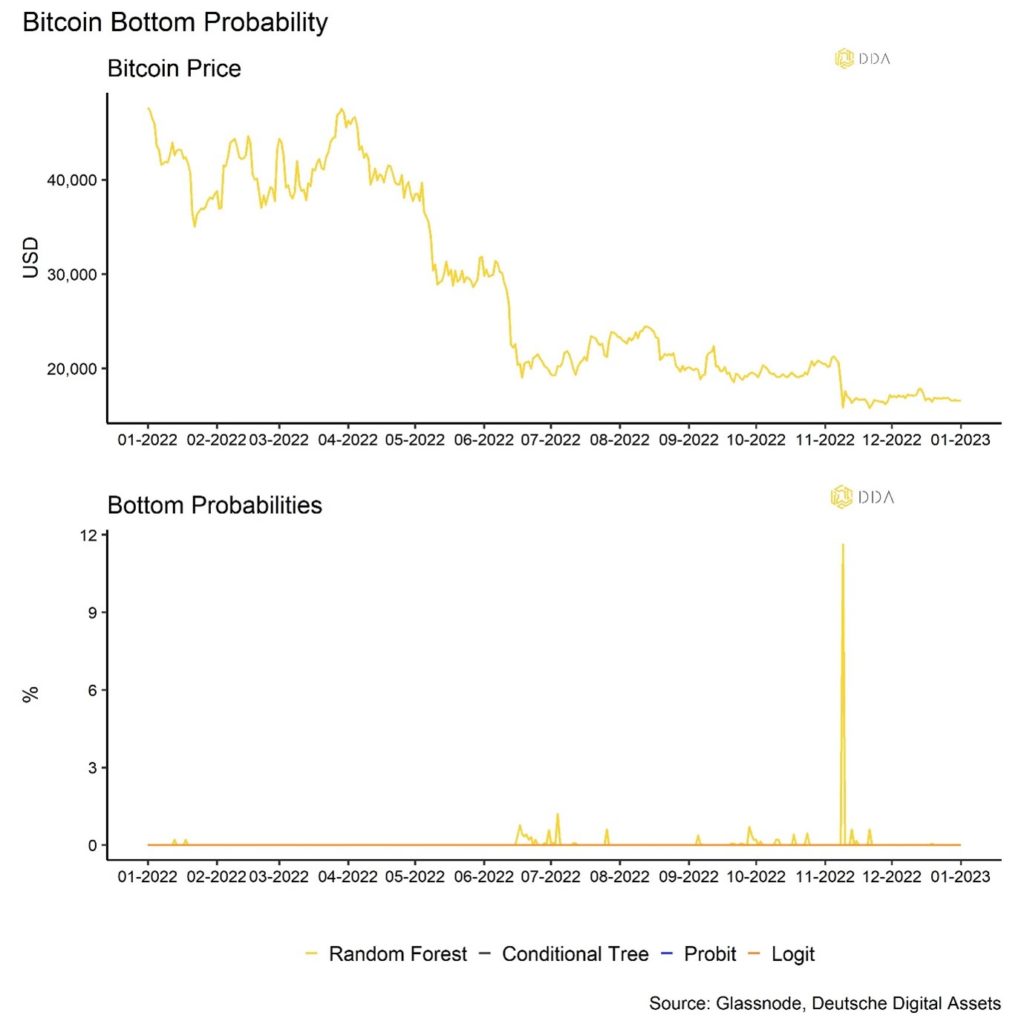

Chart des Jahres

Leistungsüberprüfung

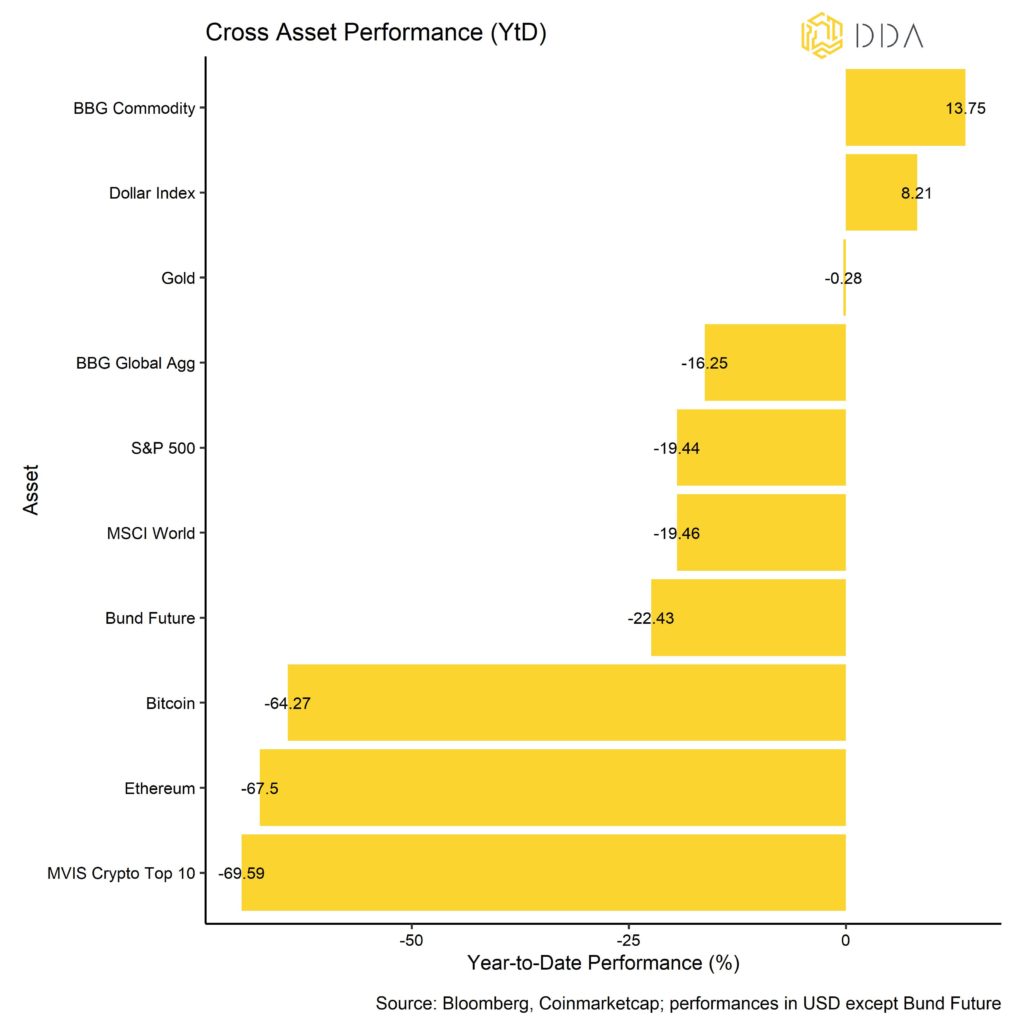

Zugegeben, 2022 war ein sehr hartes Jahr für Kryptoasset-Investoren, aber auch andere Anlageklassen waren von der Straffung der Geldpolitik der großen Zentralbanken negativ betroffen.

Im Jahr 2022 befanden sich Kryptoassets, wie auch andere wichtige Anlageklassen, größtenteils in einem Bärenmarkt.

Da die "steigende Flut alle Boote hebt", ließ die sinkende Liquidität den Anlegern nicht viele Wahlmöglichkeiten. Vor allem Anleiheinvestoren hatten es sehr schwer, denn das vergangene Jahr war eines der schlechtesten für Anleihen seit Jahrhunderten. Im Jahr 2022 schnitten Anleihen meist schlechter ab als Aktien.

Der Anstieg der Zinssätze aufgrund der Straffung der Geldpolitik wirkte sich auch sehr negativ auf Aktien mit einer hohen Duration der Cashflows aus. Zu den am stärksten betroffenen Aktien gehörten wachstumsstarke Unternehmen wie Tesla, Shopify oder PayPal, die ähnliche Rückgänge wie Kryptoassets verzeichneten.

In diesem Umfeld knapper werdender Liquidität ist "Cash is King", und Anleger, die einen großen Teil ihres Portfolios in Dollar hielten, schnitten im Allgemeinen gut ab.

Die am besten abschneidende Anlageklasse waren im vergangenen Jahr jedoch Rohstoffe, was auf die anhaltenden Angebotsengpässe zurückzuführen ist, die durch den Krieg in der Ukraine und den Inflationsanstieg noch verstärkt wurden.

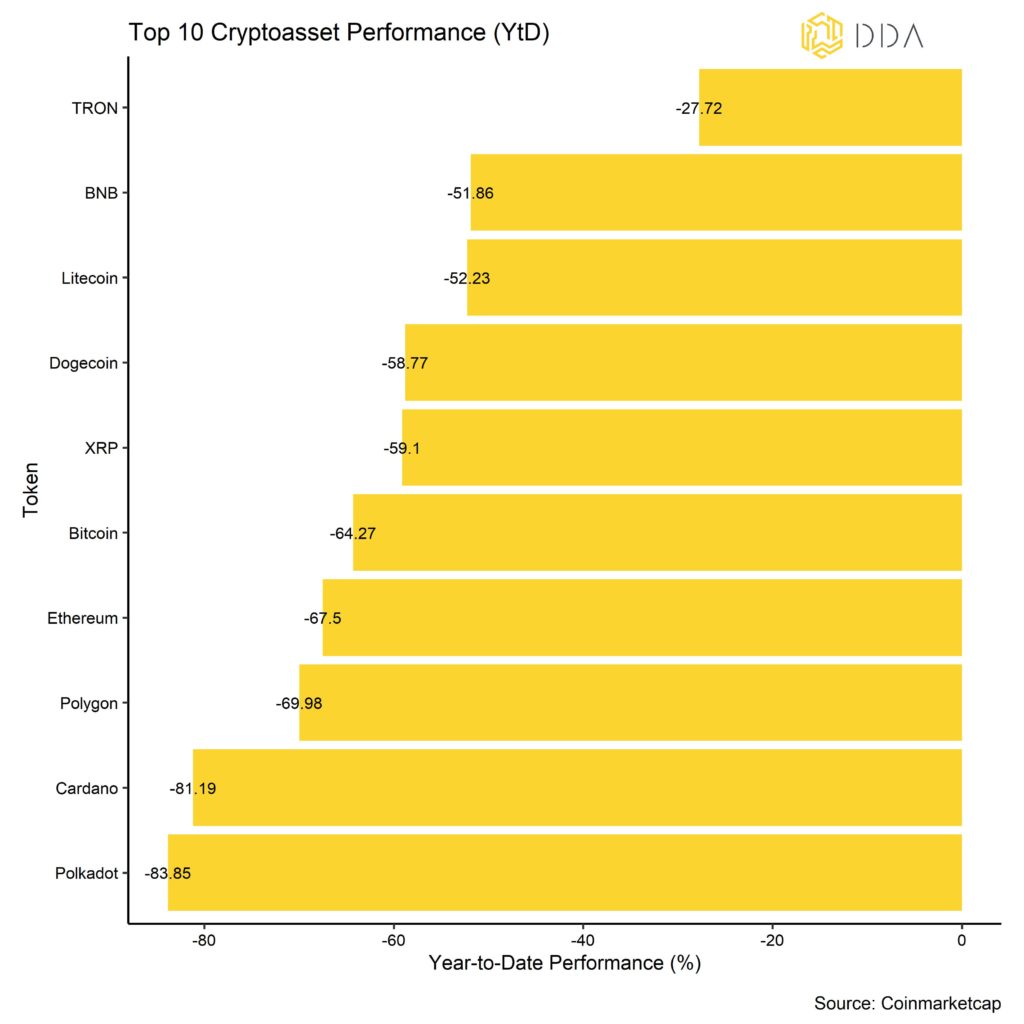

Unter den Top 10 der wichtigsten Kryptoassets waren TRON, BNB und Litecoin die größten Outperformer. Litecoin hat sich aufgrund der erwarteten Halbierung im August 2023 gut gehalten, während der BNB-Börsen-Token durch das Ende seines Hauptkonkurrenten FTX massiv gestützt wurde. Die Preise von TRON hielten sich gut, da die TRON DAO Reserve, die den algorithmischen Stablecoin USDD stützt, weiterhin TRON-Token kauft. Bitcoin und Ethereum schlossen das Jahr mit -64% bzw. -67%.

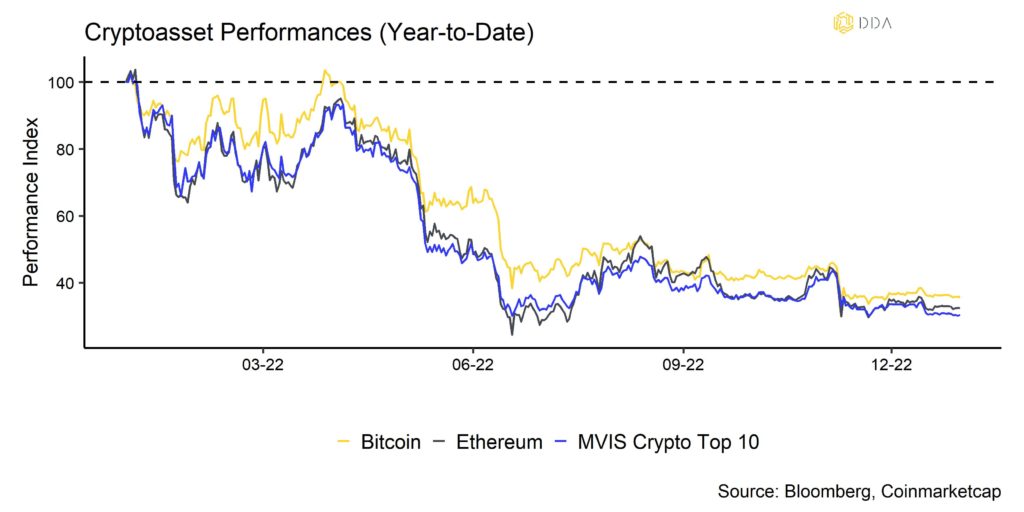

Es ist wichtig anzumerken, dass der Großteil der Underperformance im Jahr 2022 im zweiten Quartal 2022 mit dem Zusammenbruch des Terra (LUNA)-Ökosystems im Mai und der anschließenden Insolvenz des Krypto-Hedgefonds 3-Arrows Capital im Juni erzielt wurde. Seitdem haben sich die Kryptoassets überwiegend seitwärts bewegt.

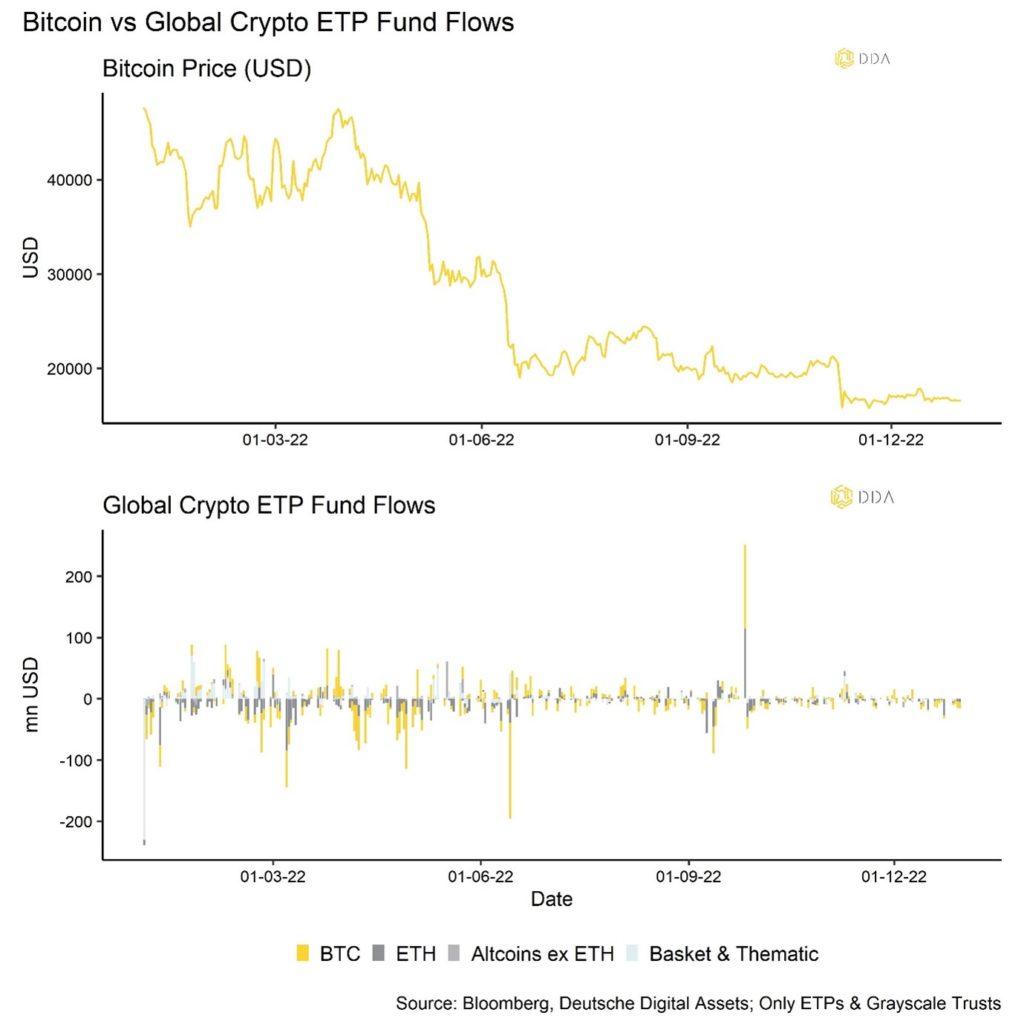

Auf institutioneller Seite verzeichneten wir im Laufe des Jahres ebenfalls erhebliche Nettomittelabflüsse, wobei sich die Nettomittelzuflüsse aus Krypto-ETPs im Jahr 2022 auf insgesamt -1,15 Mrd. USD beliefen. Die meisten dieser Abflüsse erfolgten ebenfalls in der ersten Jahreshälfte und haben in der zweiten Jahreshälfte 2022 im Wesentlichen nachgelassen.

Die allgemeine Risikobereitschaft für Altcoins war relativ gering, wenn man unseren internen 1-Monats-Altseason-Index (siehe Anhang) betrachtet. Nur 25% der wichtigsten im Index erfassten Altcoins schafften es, Bitcoin im Dezember 2022 zu übertreffen.

Unser hauseigener Crypto Dispersion Index deutet darauf hin, dass die Wertentwicklung von Kryptoassets in den letzten 30 Tagen hauptsächlich von münzspezifischen Faktoren beeinflusst wurde. Ein hoher Wert des Crypto Dispersion Index bedeutet, dass die durchschnittlichen paarweisen Korrelationen zwischen Altcoins und Bitcoin niedrig sind, was bedeutet, dass Bitcoin und Altcoin nicht in dieselbe Richtung handeln und von unterschiedlichen Faktoren beeinflusst werden.

Unterm Strich: Das Jahr 2022 war für Kryptoassets eher schwierig, da sich der Markt in einem Bärenmarkt befunden hat. Andere wichtige Anlageklassen wie Aktien oder Anleihen entwickelten sich aufgrund der Straffung der Geldpolitik ebenfalls nicht gut. Wachstumsstarke Aktien wie Tesla, Shopify oder PayPal erlebten ähnliche Rückgänge wie Kryptoassets. Nur Rohstoffe und der Dollar entwickelten sich im vergangenen Jahr gut

Kommentar zu Makro & Märkte

Die Hauptthemen des vergangenen Jahres setzen sich auch im neuen Jahr fort: Anhaltende geopolitische Spannungen, steigende Rezessionsrisiken und eine restriktive Geldpolitik stehen auch in diesem Jahr auf dem Speiseplan der Anleger.

Was die Geldpolitik betrifft, so war eines der wichtigsten Ereignisse im Dezember wahrscheinlich die FOMC-Sitzung am 14.12.2022. Die Fed schlug einen eher hawkishen Ton an, obwohl die Veröffentlichung der VPI-Inflation nur einen Tag vor der Sitzung hinter den Erwartungen zurückblieb.

Genauer gesagt lag die VPI-Inflation in den USA für November 2022 bei 7,1%, während der Konsens 7,3% erwartete, nach 7,7% im Oktober 2022. Damit ist die US-Inflation im Vergleich zum Vormonat erneut gesunken und sogar noch stärker als vom Konsens erwartet. Die erste Marktreaktion war sowohl für Kryptoassets als auch für traditionelle Finanzanlagen sehr positiv, und Bitcoin stieg an diesem Tag um mehr als 4%. Nichtsdestotrotz erhöhte die Fed ihren Leitzins um 50 Basispunkte und versprach, die Zinsen länger als erwartet hoch zu halten, um die Inflation einzudämmen.

Auf der Grundlage seiner eigenen Projektionen sieht das FOMC die Endrate (die höchste potenzielle Fed Funds Rate im Zyklus) jetzt bei über 5%. Die Markterwartungen liegen jedoch deutlich unter diesem Wert (~4,9% im Juni '23). Eine zunehmende Divergenz könnte den Markt auf Kollisionskurs mit der Fed bringen, wenn die Fed die Zinsen trotz weiterer negativer Überraschungen bei Inflation und Beschäftigung weiter anheben würde.

Auch die EZB gab sich relativ kämpferisch und erhöhte die Leitzinsen um 50 Basispunkte. Die EZB erklärte, dass sie die Zinsen "erheblich" weiter anheben müsse, um die Inflation zu zügeln.

Dies führte im Dezember zu einer insgesamt rückläufigen Risikostimmung bei risikoreichen Anlagen wie US-Aktien. Die von den meisten Anlegern erwartete "Weihnachtsrallye" wurde von der Fed zunichte gemacht.

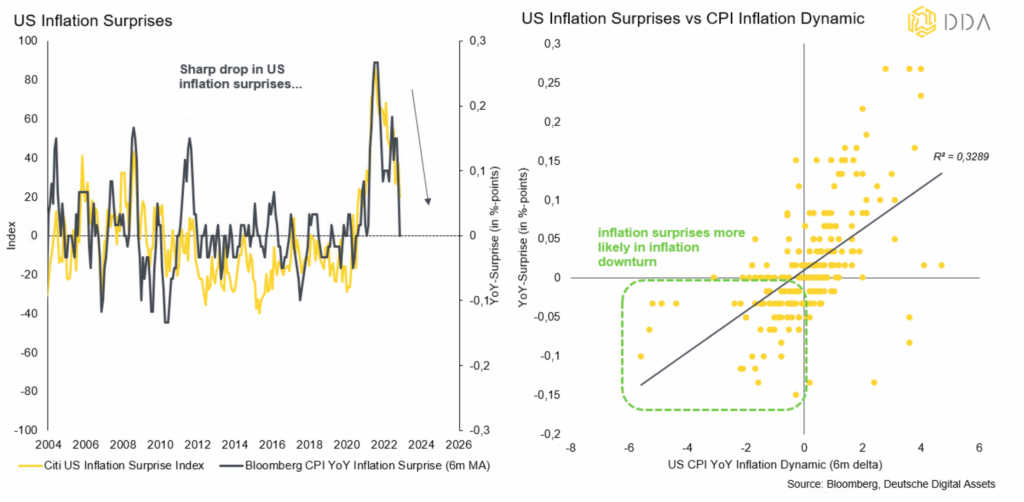

Nichtsdestotrotz sind wir der Meinung, dass der Abschwung im Inflationszyklus auch in Zukunft Rückenwind für Kryptoassets sein sollte. Der Grund dafür ist, dass Inflationsabschwünge in der Regel mit negativen Inflationsüberraschungen einhergehen, d.h. Inflationszahlen, die die Konsenserwartungen unterbieten (rechte Grafik).

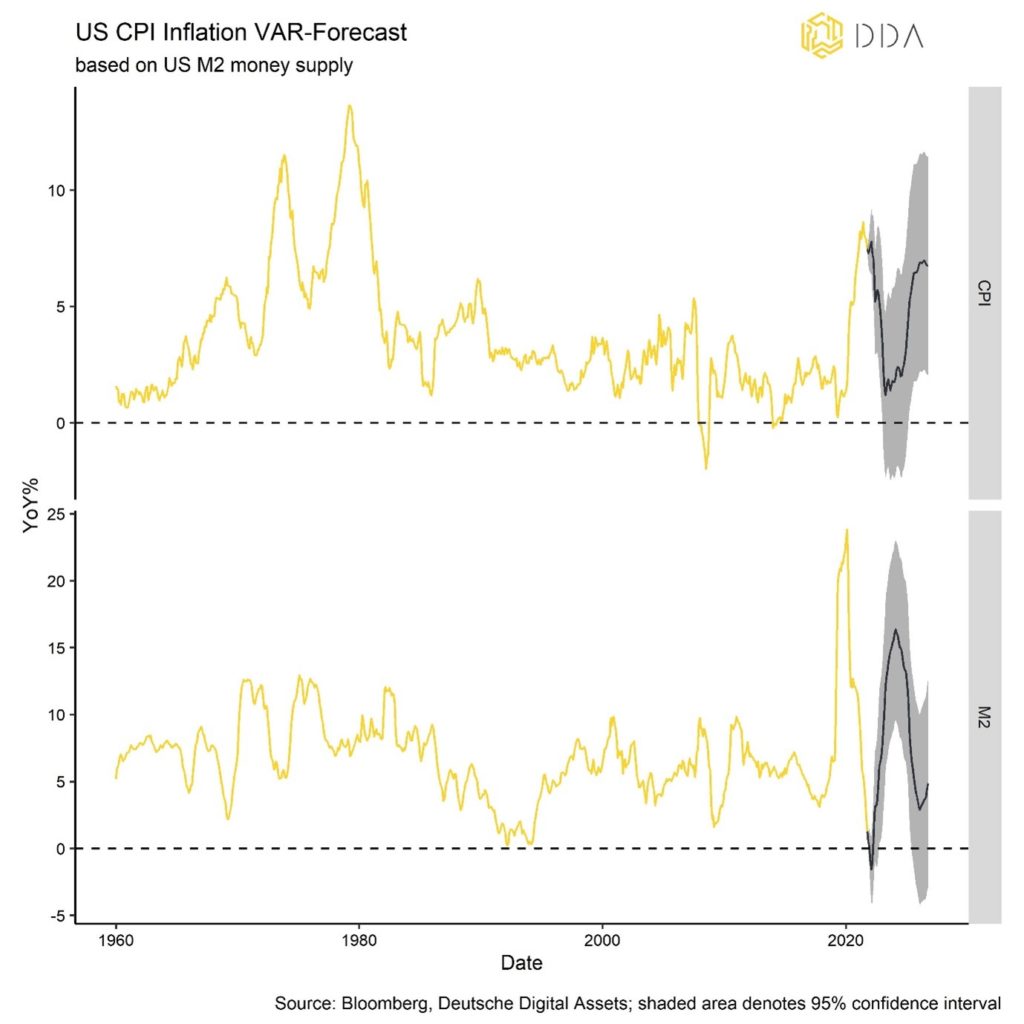

Die Inflationsüberraschungen sind deutlich zurückgegangen, aber wir glauben, dass sich dies im nächsten Jahr fortsetzen wird. Auf der Grundlage unseres hauseigenen Geldmengeninflationsmodells prognostizieren wir sogar einen weiteren Rückgang der US-Inflationsraten bis Mai 2024, wenn die Inflation höchstwahrscheinlich 1,2% YoY erreichen wird, bevor ein neuer Inflationszyklus beginnt.

Dennoch sind wir generell der Meinung, dass die marktbasierten US-Inflationserwartungen mittelfristig immer noch zu niedrig sind, da wir eine durchschnittliche US-Inflationsrate von 4,5% erwarten, während der Markt derzeit von durchschnittlich 2,5% in den nächsten 5 Jahren ausgeht (CPI Swaps).

In dieser Hinsicht sollten Vermögenswerte, die empfindlich auf steigende Inflationserwartungen reagieren, wie Bitcoin, zentrale Portfoliobestände sein, wie wir kürzlich in unserem letzten Deep Dive argumentiert haben. Sie können den vollständigen Bericht finden hier.

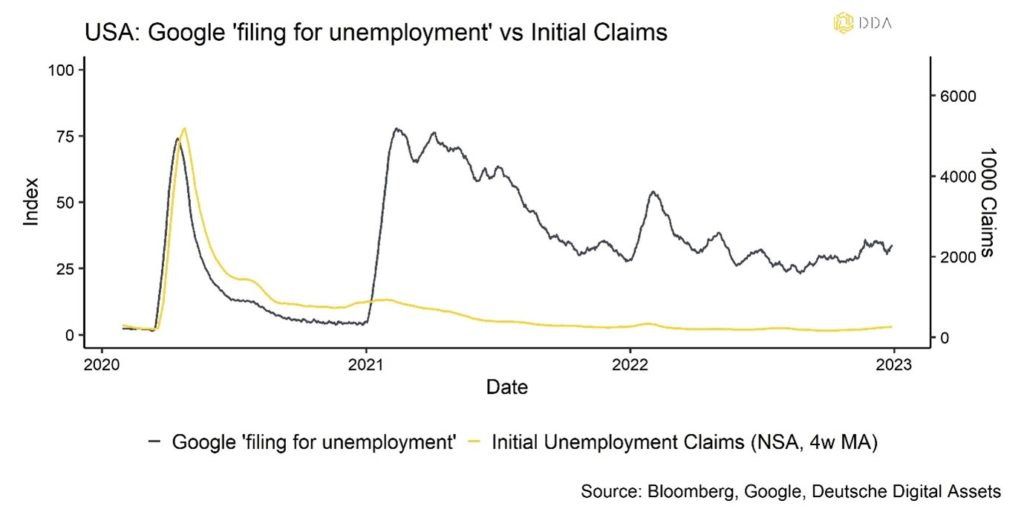

Was die US-Beschäftigung angeht, so haben wir im November 2022 bisher einen deutlichen Anstieg der Entlassungsankündigungen erlebt (+416% YoY Challenger, Grey & Christmas Survey), der sich erst noch in den offiziellen Beschäftigungsstatistiken zeigen muss. Bei anderen vorlaufenden Beschäftigungsindikatoren, die von den Anlegern genau beobachtet werden, wie z. B. den Erstanträgen auf Arbeitslosenunterstützung, war bisher jedoch kein signifikanter Anstieg zu verzeichnen. Wir sind nach wie vor davon überzeugt, dass eine signifikante Schwäche der US-Beschäftigung von den Finanzmärkten und Kryptoassets als bullish interpretiert werden wird, da dies eine moderatere Haltung der Geldpolitik in der Zukunft implizieren würde.

Die Zahl der Google-Suchanfragen zum Thema "Arbeitslosmeldung" hat in letzter Zeit zugenommen, ohne dass es bisher zu einem nennenswerten Anstieg gekommen wäre. Trotz einiger schwerwiegender Einbrüche auf dem US-Immobilienmarkt haben die US-Wirtschaft und insbesondere die Beschäftigung die Auswirkungen der Konjunkturabschwächung noch nicht zu spüren bekommen und scheinen erstaunlich widerstandsfähig zu sein.

Wir werden die weitere Entwicklung aufmerksam verfolgen und unsere Leser informieren, sobald wir eine wesentliche Änderung feststellen.

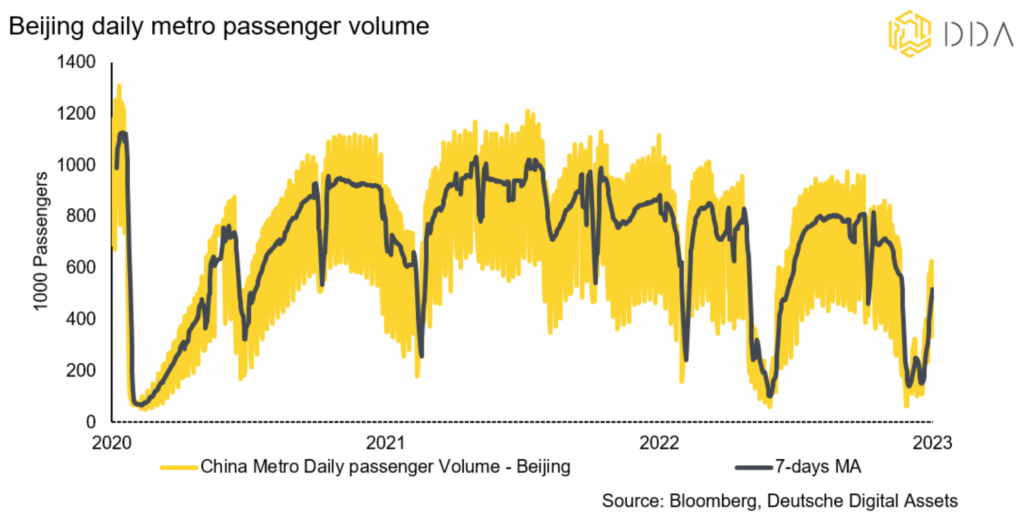

Ein weiteres großes Thema unter den Anlegern ist die Nachricht, dass China anscheinend endlich seine Wirtschaft wieder öffnet und seine strengen Covid-Beschränkungen teilweise aufhebt. Dies kommt nach einer Reihe von sehr enttäuschenden Makrodaten aus China, insbesondere aus dem Industrie- und Bausektor.

Insgesamt ist die chinesische Wirtschafts- und Reisetätigkeit nach wie vor gedämpft, hat sich aber erholt, wie die niedrigen täglichen Fahrgastzahlen in der Hauptstadt Peking zeigen:

Gleichzeitig haben wichtige Frühindikatoren wie der chinesische Kreditimpuls in den letzten 6 Monaten bereits zugenommen. Alles in allem ist es sehr wahrscheinlich, dass die Wirtschaft in den kommenden Monaten an Schwung gewinnen wird.

Der Grund, warum dies für Krypto-Investoren relevant ist, ist, dass sowohl die globalen Wachstumserwartungen aufgrund der Wiedereröffnung Chinas als auch der geldpolitische Gegenwind durch die restriktive Politik der US-Zentralbank allmählich zu schwinden scheinen. Dies sollte ein Rückenwind für Kryptoassets und insbesondere Bitcoin im Jahr 2023 sein.

Es ist jedoch zu beachten, dass die Bitcoin-Schwankungen derzeit offenbar in gleichem Maße auf Veränderungen der globalen Wachstumserwartungen und der geldpolitischen Erwartungen zurückzuführen sind. Während die globalen Wachstumserwartungen in letzter Zeit im Einklang mit den sinkenden Anleiherenditen zurückgegangen sind, haben sich die geldpolitischen Erwartungen verbessert (siehe Anhang). Wir haben es also mit divergierenden Marktkräften zu tun, die den Bitcoin derzeit unterstützen, aber gleichzeitig auch bremsen.

Unterm Strich: Während sich die geldpolitischen Erwartungen aufgrund eines moderateren Kurses der US-Geldpolitik verbessert haben, sind die globalen Wachstumserwartungen im letzten Monat zurückgegangen. Wir haben also immer noch gemischte Signale von der Makro-Seite für Bitcoin und Kryptoassets.

Eine allmähliche Wiederbelebung der chinesischen Wirtschaft dürfte die globalen Wachstumserwartungen in den kommenden Monaten unterstützen. Rückläufige US-Inflationsüberraschungen dürften ebenfalls für Rückenwind sorgen. Es gibt jedoch eine zunehmende Divergenz zwischen den Markterwartungen und der Fed-Politik, was die Risiken kurzfristig erhöhen könnte, da sich die US-Wirtschaft immer noch als recht widerstandsfähig erweist. Da die US-Wirtschaft jedoch wahrscheinlich in diesem Jahr in eine Rezession fallen wird, erwarten wir eine allmähliche Lockerung der Geldpolitik, die Kryptoassets im Jahr 2023 unterstützen sollte.

On-Chain-Analytik

Insgesamt waren die Entwicklungen in der Kette im Jahr 2022 durch drei wesentliche Punkte gekennzeichnet:

- Umverteilung von Münzen von kurzfristigen zu langfristigen Anlegern

- Erhebliche realisierte und nicht realisierte Verluste

- Zurücksetzen von Bewertungen

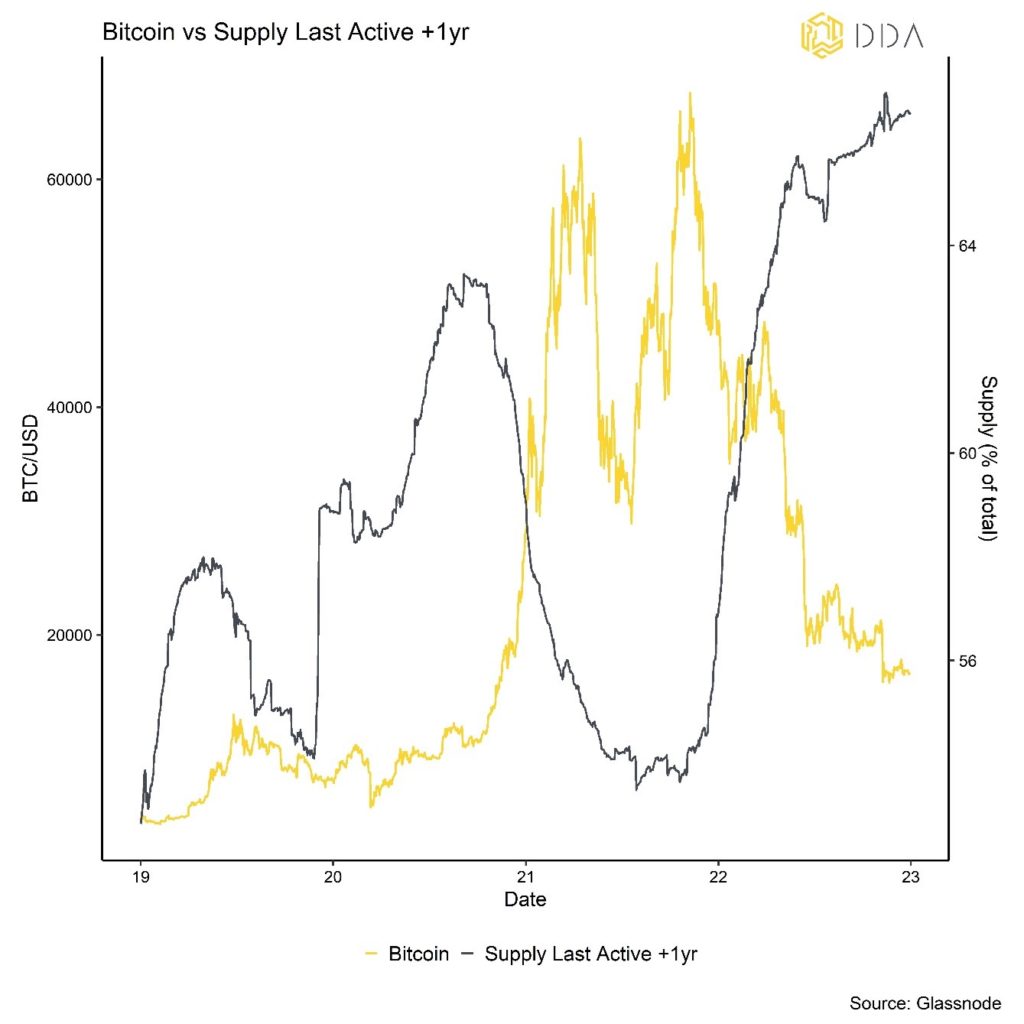

Bärenmärkte führen in der Regel zu einer Umverteilung des Münzangebots von kurzfristigen Pessimisten zu langfristigen Optimisten. Dieser Bärenmarkt ist nicht anders.

Bislang haben wir einen deutlichen Anstieg des Angebots an Münzen gesehen, die zuletzt über ein Jahr aktiv waren, sowie % der realisierten Kappe mit einer Haltedauer von mehr als 5 Monaten, was in der Regel eine Schwelle für langfristige Investoren ist.

Bärenmärkte sind in der Regel durch einen Rückgang der kurzfristigen Anleger und einen Mangel an "neuem" Geld gekennzeichnet. Im Jahr 2022 haben sich die kurzfristigen Anleger größtenteils aus dem Markt zurückgezogen, weshalb der Markt die meiste Zeit in einem Bärenmarkt steckte.

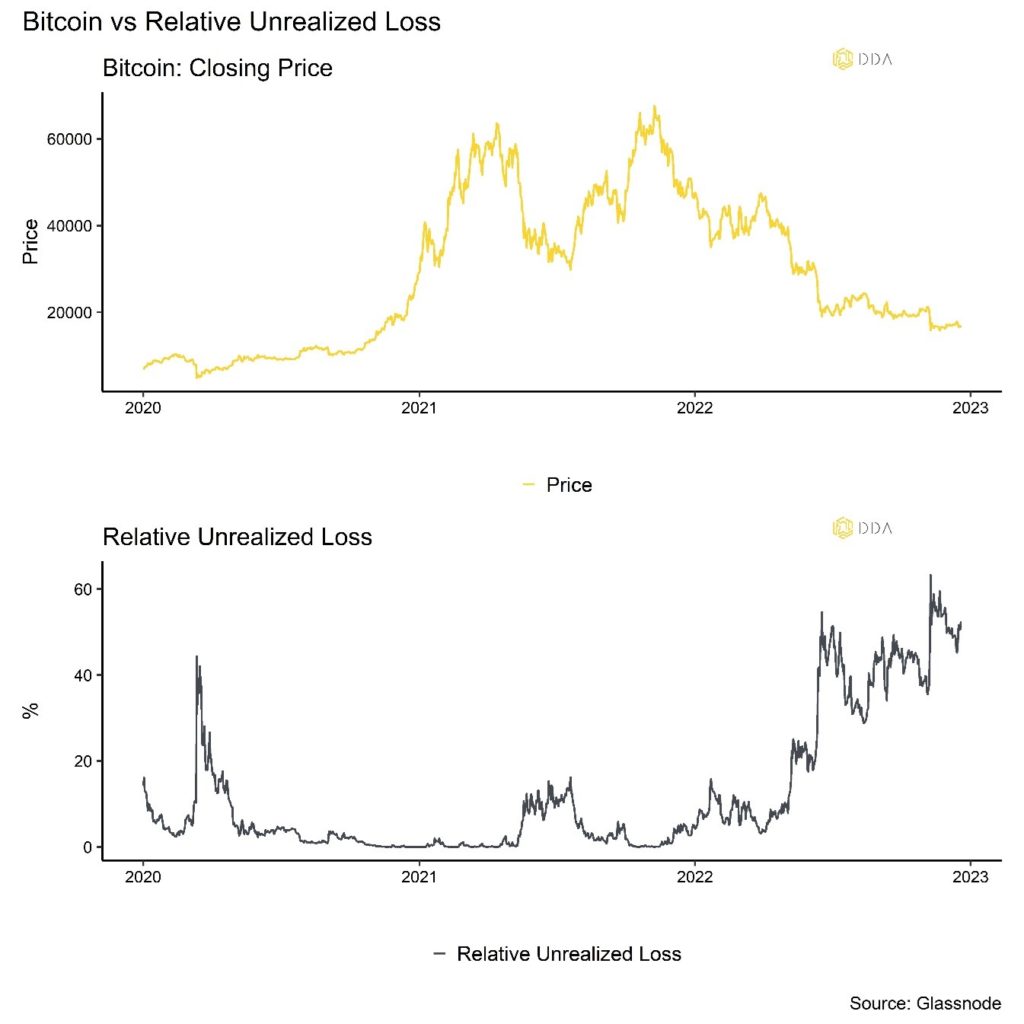

Im Laufe des Jahres haben die Anleger auch einen erheblichen Betrag an realisierten und nicht realisierten Verlusten auf der Kette angehäuft.

Die gute Nachricht ist, dass alle oben genannten Faktoren in der Regel auf einen Tiefpunkt im Zyklus hinweisen:

Theoretisch kommt es zu Markttiefs, wenn das Angebot an Coins von kurzfristigen zu langfristigen Inhabern umverteilt wurde, der Verkaufsdruck erschöpft ist und die günstigen Bewertungen eine neue Gruppe von Anlegern anzuziehen beginnen. Dieser Prozess scheint bereits begonnen zu haben, wenn man unsere internen "Accumulation Scores" für kleinere Wallet-Kohorten von 0,01 BTC bis 10 BTC betrachtet. Diese Kohorte hat seit November 2022 ein sehr starkes Akkumulationsverhalten gezeigt (siehe Anhang). Eine große Anzahl von Verlusten ist ebenfalls ein Indiz für einen Tiefpunkt des Zyklus.

In der Tat haben wir in diesen Punkten so große Fortschritte erzielt, dass unsere internen Bitcoin-Boden-Wahrscheinlichkeit begann im November 2022 zu steigen. Dies zeigt sich auch in unserem Chart des Jahres. Weitere Informationen zu diesem Indikator finden Sie in diesem Artikel oder im Anhang zu diesem Bericht. Obwohl die Gesamtwahrscheinlichkeit noch nicht hoch ist, deutet sie doch darauf hin, dass wir uns der Talsohle in diesem Zyklus nähern.

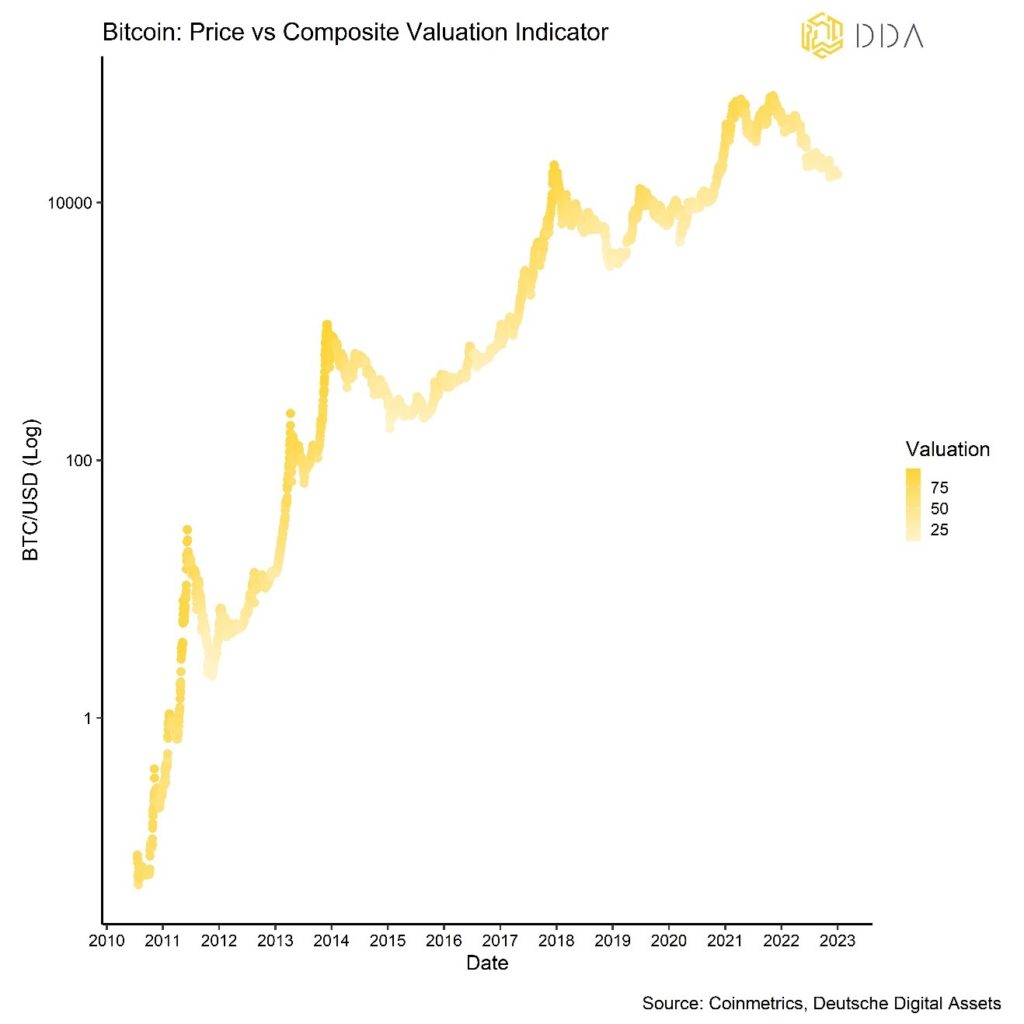

Gleichzeitig haben sich die Bewertungen wieder auf ein attraktives Niveau eingependelt. Tatsächlich ist unser zusammengesetzter Bewertungsindikator, der aus 7 verschiedenen Bewertungsmetriken für Bitcoin besteht, auf Niveaus, die zuletzt an früheren Tiefpunkten des Zyklus gesehen wurden (hellgelbe Punkte):

Dies erhöht die Wahrscheinlichkeit, dass eine neue Gruppe von Anlegern in den Markt eintritt und das derzeitige Preisniveau nach unten drückt.

Eine weitere interessante Entwicklung auf der Bitcoin-Kette im Dezember war die Tatsache, dass die Bitcoin-Hash-Rate aufgrund des Schneesturms in den USA, der die meisten US-amerikanischen Miner dazu veranlasste, ihre Mining-Rigs vorübergehend abzuschalten, deutlich zurückging. Der starke Rückgang der Hash-Rate führte zu einer Vergrößerung der Modelllücke zwischen dem aktuellen Preis und dem vom Stock-to-Flow-Modell vorhergesagten "fairen Wert" (siehe Anhang).

An einem Punkt während des Rückgangs schätzte das Modell die 12-Monats-Performance kurzzeitig auf ~895%. Die Hash-Rate bestimmt den Fluss der neu produzierten Münzen, und da die Schwierigkeitsanpassung nur alle 2016 Blöcke erfolgt, ändert sich der Fluss täglich.

Daher führt ein Rückgang der Hash-Rate zu einem Anstieg des Stock-to-Flow-Verhältnisses, wenn alles andere gleich bleibt. Bitte beachten Sie, dass es, wenn überhaupt, nur eine langfristige Beziehung zwischen dem Preis und dem Stock-to-Flow-Verhältnis gibt. Dennoch scheint es eine enge Beziehung zwischen den Abweichungen/Residuen des Stock-to-Flow-Modells und den nachfolgenden 12-Monats-Renditen zu geben, wie in der Grafik dargestellt.

Die Stimmung auf dem Kryptomarkt wurde im Dezember jedoch weiterhin von negativen Nachrichten dominiert. Der Börsenriese Binance geriet unter Druck, als der Markt begann, den Wahrheitsgehalt der von Mazars durchgeführten "Proof-of-Reserves"-Prüfung in Frage zu stellen. Der Grund dafür ist, dass Mazars sich kürzlich aus der Zusammenarbeit mit Binance zurückgezogen hat. Die Prüfung des Nachweises der Reserven umfasst die Bestätigung, dass eine Finanzorganisation die Gelder ihrer Kunden decken kann.

Infolgedessen sah sich Binance im Dezember mit erheblichen Rückzügen konfrontiert, da Gerüchte über ein "Flywheel-Schema", vergleichbar mit FTX, aufkamen. Ein Flywheel-Schema beinhaltet einen Token, der durch ausgeklügelte Marketingstrategien und Insiderkäufe künstlich aufgebläht wird, um den Gesamtmarktwert zu erhöhen, der dann dazu verwendet werden kann, weitere Vermögenswerte über besicherte Kredite auf der Grundlage dieser aufgeblähten Token-Preise zu erwerben.

Aufgrund der steigenden Risikoaversion kam es auch zu erheblichen Umschichtungen von BUSD (dem USD-Stablecoin von Binance) in Tether USD (USDT) und USD Coin (USDC). Diese Abflüsse und Umtauschvorgänge scheinen sich jedoch abgeflacht zu haben.

Ein weiteres wichtiges Gesprächsthema unter Kryptoasset-Investoren war die Nachricht, dass der Verwalter des größten Bitcoin-Fonds der Welt - Grayscale - beabsichtigt, bis zu 20% der Anteile seines Grayscale Bitcoin Trust (GBTC) zurückzunehmen, falls die SEC die Umwandlung des Trusts in einen ETF ablehnt.

In diesem Fall würde Grayscale höchstwahrscheinlich den zugrundeliegenden Bitcoin liquidieren, um die Rücknahme der Anteile zu bezahlen.

Der Grayscale Bitcoin Trust hält derzeit rund 632k BTC und 20% davon würden eine potenzielle Liquidation von rund 126k BTC bedeuten.

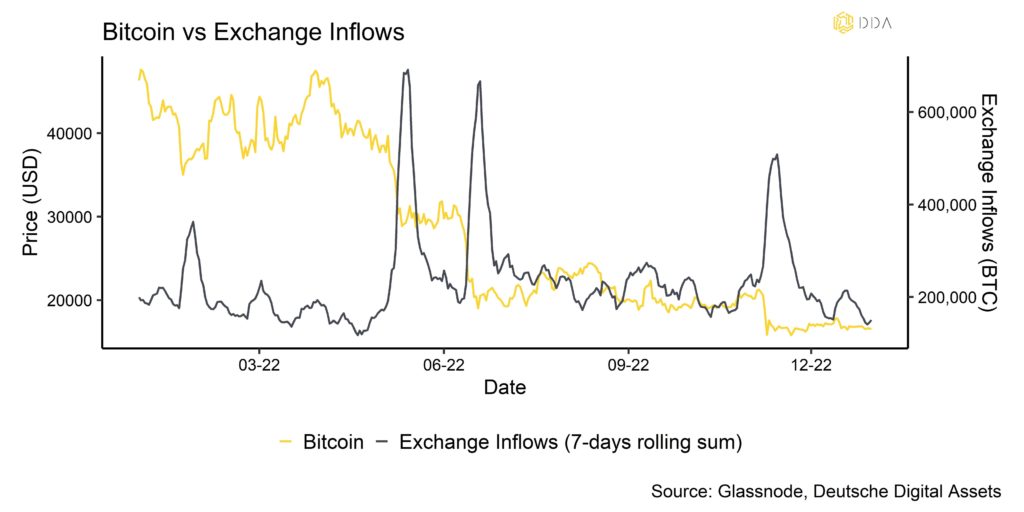

Um die potenziellen Auswirkungen auf die Preise zu beurteilen, sollten die folgenden Liquidationsereignisse im Jahr 2022 berücksichtigt werden:

- Mai 2022: LUNA Foundation Wächter liquidiert rund 80k BTC / 685k BTC an Devisenzuflüssen in 7 Tagen.

Auswirkungen auf den BTC-Preis: 36566 USD → 28900 USD (-21%)

- Juni 2022: Insolvenz des Hedgefonds 3-Arrows Capital (3AC) / 659k BTC an Devisenzuflüssen in 7 Tagen

Auswirkungen auf den BTC-Preis: 28359 USD → 19021 USD (-32%) - November 2022: Insolvenz von FTX exchange und Alameda Research / 499k BTC an Devisenzuflüssen in 7 Tagen

Auswirkungen auf den BTC-Preis: 21276 USD → 16798 USD (-21%)

Bitte beachten Sie, dass Börsenzuflüsse in der Regel auf Verkaufsabsichten der Anleger hindeuten und hier als Ersatz für das Verkaufsvolumen herangezogen werden. Allerdings sind Börsenzuflüsse nicht mit dem Verkaufsvolumen identisch.

Die oben genannten Beispiele für Liquidationen zeigen, dass sich die Auswirkungen auf den Preis in Grenzen halten dürften, wenn die Liquidationen von Grayscale (ca. 126.000 BTC) nicht von zusätzlichen Börsenzuflüssen aufgrund der erhöhten Risikoaversion der Anleger begleitet werden. Die letztendlichen Auswirkungen auf den Markt werden jedoch auch von anderen Faktoren abhängen, wie z. B. den allgemeinen Liquiditätsbedingungen an den Börsen oder den Zuflüssen institutioneller Fonds außerhalb der Kette.

Als grobe Faustregel kann man sagen, dass jede 100k BTC innerhalb von 7 Tagen mit einem BTC-Preisrückgang von etwa -12% im Jahr 2022 verbunden war. Wir würden also erwarten, dass die potenzielle Liquidation von Grayscale eine Preisauswirkung zwischen -10% und -15% in Bitcoin haben wird.

Unterm Strich: Bärenmärkte führen in der Regel zu einer Umverteilung des Münzangebots von kurzfristigen Pessimisten zu langfristigen Optimisten. Dieser Bärenmarkt ist nicht anders. Es gibt eine klassische Umverteilung von Münzen von kurzfristigen zu langfristigen Anlegern, einen erheblichen Anstieg der realisierten und nicht realisierten Verluste sowie eine breite Rücksetzung der Bewertungen. All diese Entwicklungen sind typisch für Bärenmärkte und haben ein Niveau erreicht, das zunehmend auf einen Tiefpunkt des Zyklus hindeutet. Ein potenzieller Verkauf von Grayscale Bitcoin Trust-Beständen könnte jedoch kurzfristig weiteren Abwärtsdruck auf den Markt ausüben.

Laden Sie den vollständigen Bericht mit Anhang hier herunter.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.