Laden Sie den vollständigen Bericht im PDF-Format herunter

von André DragoschLeiter der Forschung

Wichtigste Erkenntnisse

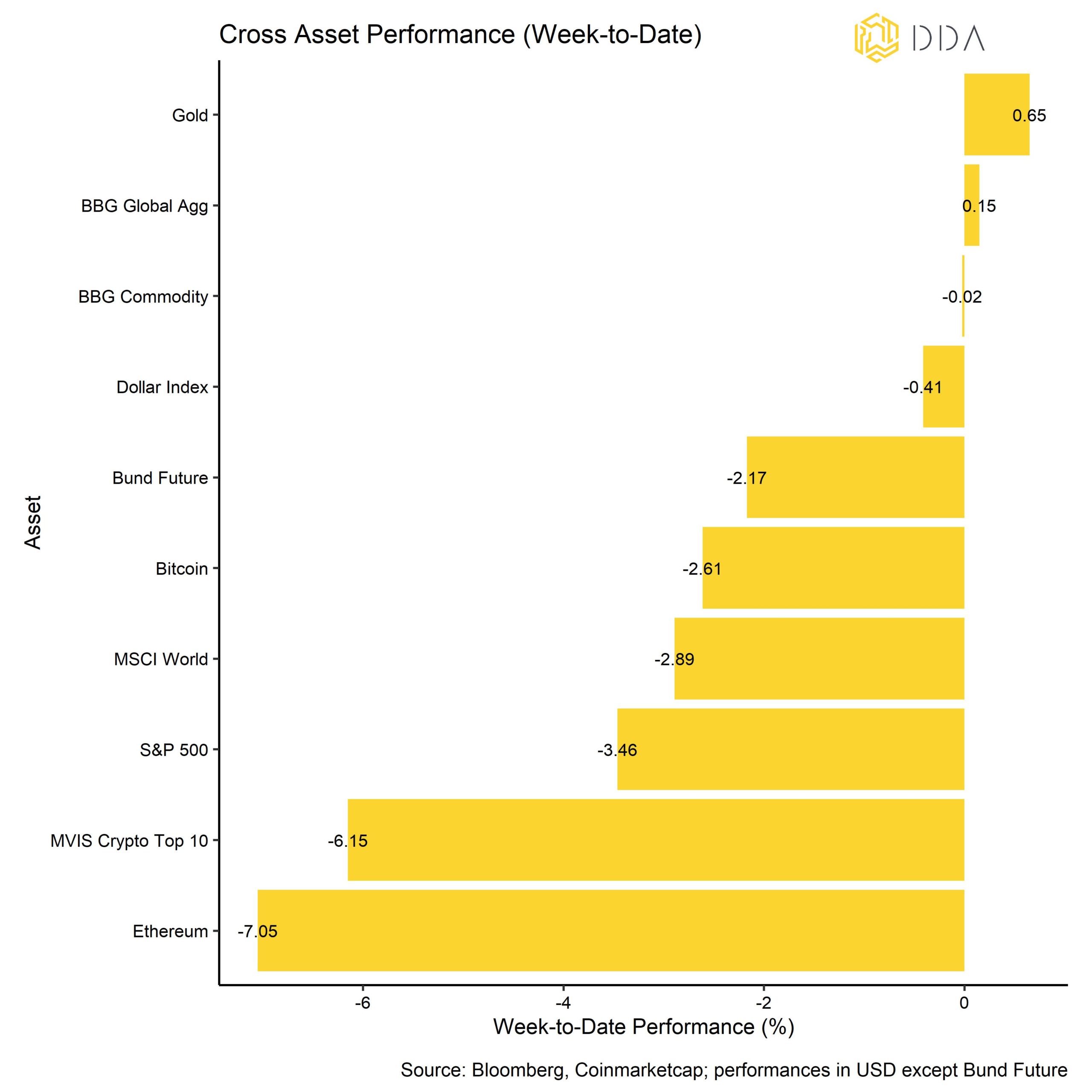

- Kryptoassets waren letzte Woche die schlechteste Anlageklasse und schnitten schlechter ab als globale Aktien, Anleihen und Rohstoffe

- Aufgrund der negativen Nachrichtenlage ist unser hauseigener Crypto Sentiment Index erneut gesunken

- Im Allgemeinen setzten sich die Abflüsse in der letzten Woche aufgrund der Gerüchte um Binance

Chart der Woche

Leistung

Auch die vergangene Woche war wieder von rückläufigen Nachrichten geprägt.

Der Börsenriese Binance sah sich im Laufe der Woche mit erheblichen Rückzügen konfrontiert, da Gerüchte über ein "Flywheel-Schema", vergleichbar mit FTX, aufkamen. Ein Flywheel-Schema beinhaltet einen Token, der durch ausgeklügelte Marketingstrategien und Insiderkäufe künstlich aufgebläht wird, um den Gesamtmarktwert zu erhöhen, der dann dazu verwendet werden kann, weitere Vermögenswerte über besicherte Kredite auf der Grundlage dieser aufgeblähten Token-Preise zu erwerben.

Infolgedessen kam es zu erheblichen Bitcoin- und Ethereum-Börsenabzügen bei Binance.

Aufgrund der steigenden Risikoaversion kam es auch zu erheblichen Umschichtungen von BUSD (dem USD-Stablecoin von Binance) in Tether USD (USDT) und USD Coin (USDC). Diese Abflüsse und Umtauschvorgänge scheinen jedoch auch heute Morgen noch anzuhalten.

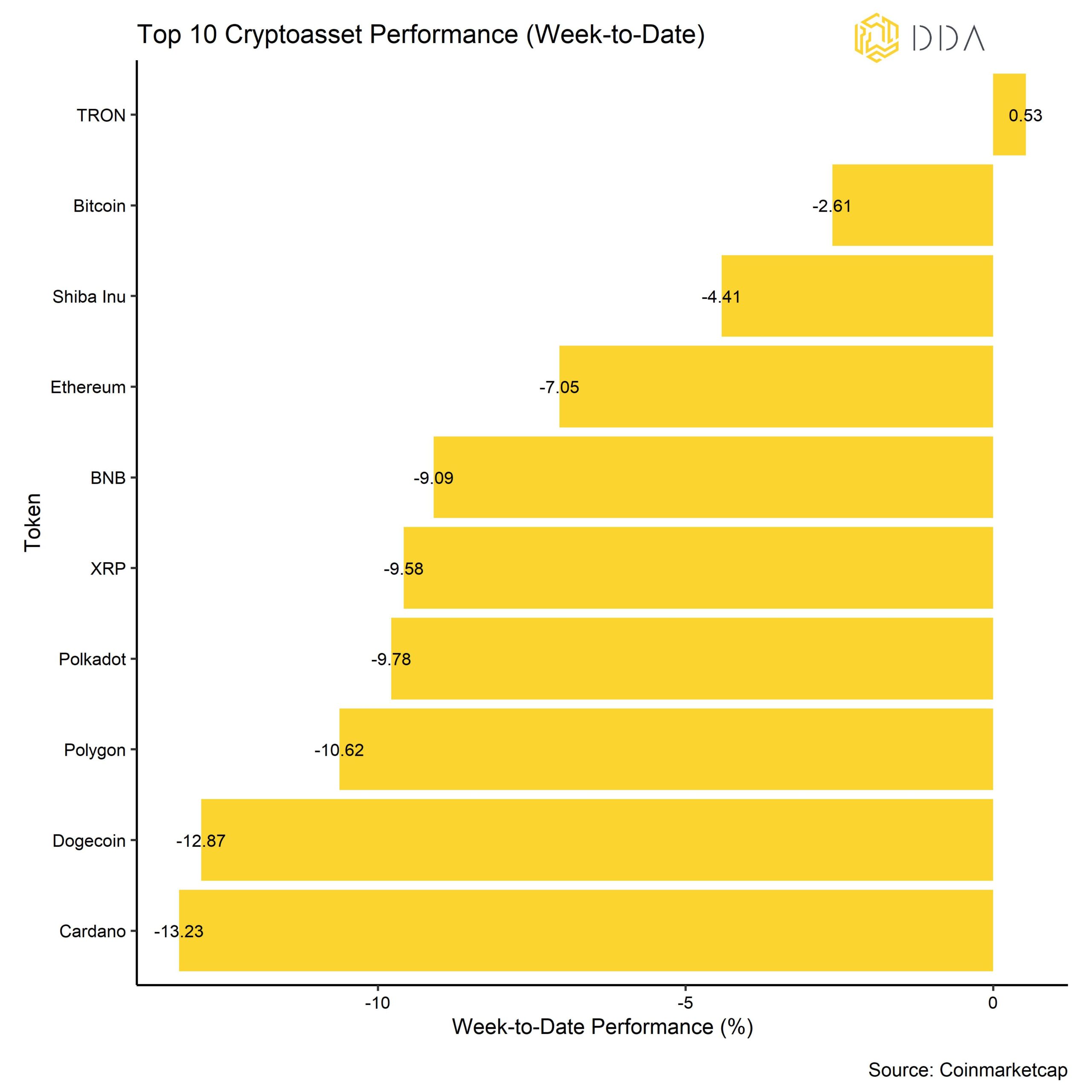

Dementsprechend haben sich die Preise von Kryptowährungen und anderen risikoreichen Vermögenswerten unterdurchschnittlich entwickelt. Unter den wichtigsten Kryptoassets waren TRON, Bitcoin und Shiba Inu die relativen Outperformer.

Dementsprechend haben sich die Preise von Kryptowährungen und anderen risikoreichen Vermögenswerten unterdurchschnittlich entwickelt. Unter den wichtigsten Kryptoassets waren TRON, Bitcoin und Shiba Inu die relativen Outperformer.

Das makroökonomische Ereignis der Woche war, dass die Verbraucherpreisinflation in den USA am Dienstag nach unten überraschte, was positiv interpretiert wurde, da der Markt eine moderatere Haltung der US-Geldpolitik in der Zukunft erwartete.

Dennoch schlug der Fed-Vorsitzende Powell nach der letzten FOMC-Sitzung am vergangenen Mittwoch, auf der das Gremium eine weitere Zinserhöhung um 50 Basispunkte beschloss, hawkishe Töne an.

Auf der Grundlage seiner eigenen Projektionen sieht das FOMC die Endrate (die höchste potenzielle Fed Funds Rate im Zyklus) jetzt bei über 5%. Die Markterwartungen liegen jedoch weit unter diesem Wert (~4,8% im Mai '23). Eine zunehmende Divergenz könnte den Markt auf Kollisionskurs mit der Fed bringen, wenn die Fed die Zinsen trotz weiterer negativer Überraschungen bei Inflation und Beschäftigung weiter anheben würde.

Auch die EZB gab sich relativ kämpferisch und erhöhte die Leitzinsen um 50 Basispunkte. Die EZB erklärte, dass sie die Zinsen "erheblich" weiter anheben müsse, um die Inflation zu zügeln.

Dies führte zu einer insgesamt rückläufigen Risikostimmung auch bei risikoreichen Anlagen wie US-Aktien.

Kryptoassets waren in der vergangenen Woche die schlechteste Anlageklasse und schnitten schlechter ab als globale Aktien, Rohstoffe und Anleihen. Der Dollar schwächte sich letzte Woche wieder leicht ab.

Stimmung

Der Nachrichtenfluss war überwiegend bärisch, weshalb unser hauseigener Krypto-Sentiment-Index im Vergleich zur letzten Woche erneut gesunken ist und sich derzeit im negativen Bereich befindet. Das bedeutet, dass die meisten unserer Indikatoren leicht unter ihrem kurzfristigen Trend liegen. Positiv zu vermerken ist, dass der Crypto Fear & Greed Index, der 3-Monats-Altseason-Index sowie die Short-Term Holder Net Unrealized Profit/Loss-Metrik (STH-NUPL) gestiegen sind, was insgesamt einen Anstieg der unrealisierten Gewinne bedeutet.

Der Crypto Fear & Greed Index hat sich ebenfalls leicht verbessert, befindet sich aber immer noch im Bereich "Angst".

Strömungen

Die Fondsflüsse waren in der letzten Woche sehr schwach, und wir sahen in dieser Woche Nettoabflüsse aus globalen Krypto-ETPs in Höhe von -54,4 Mio. USD. Alle Arten von Krypto-ETP-Produkten verzeichneten Nettoabflüsse, wobei ETH-basierte Produkte am stärksten betroffen waren (-22,6 Mio. USD netto).

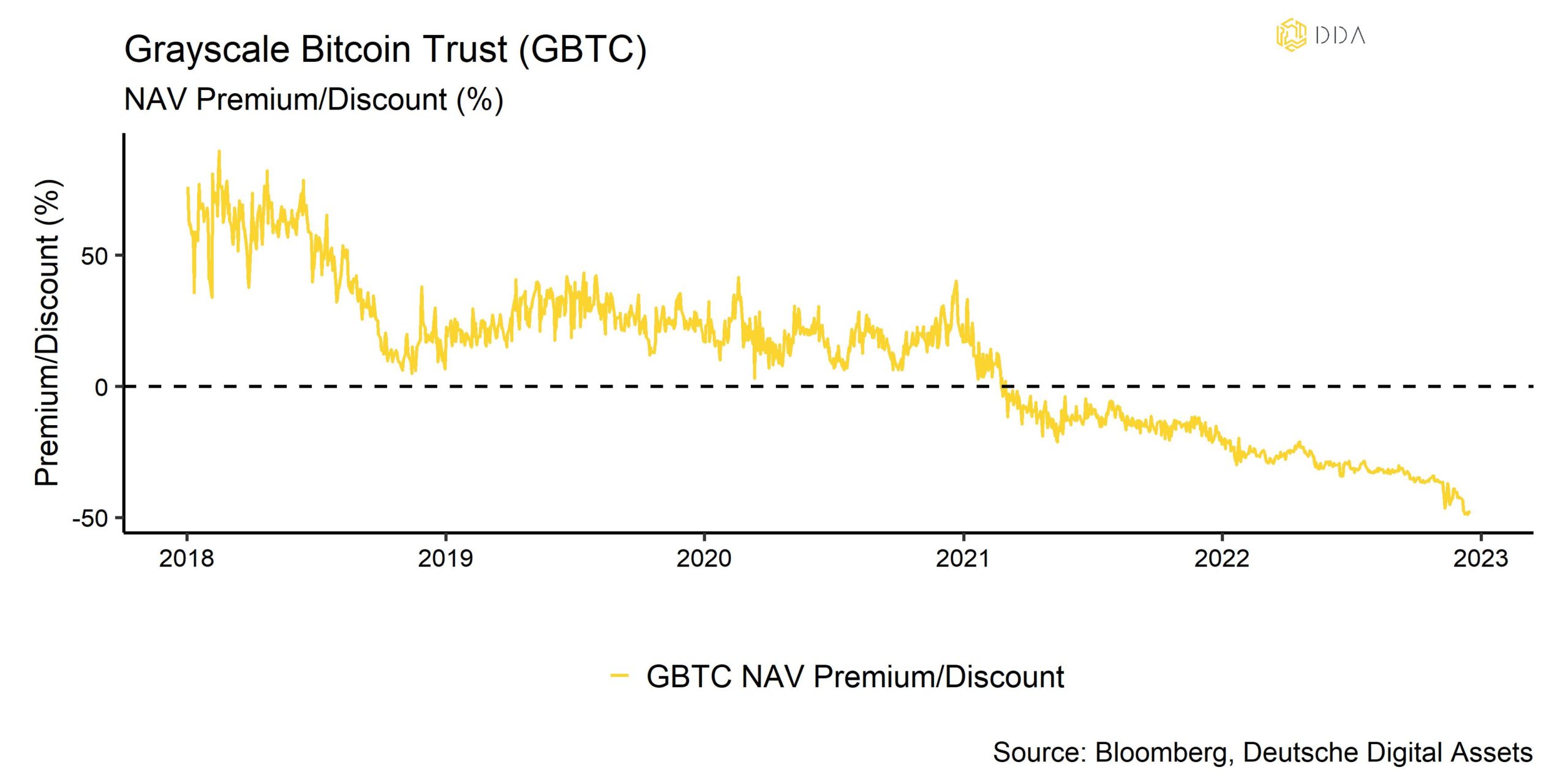

In diesem Zusammenhang haben wir auch ein neues Allzeittief beim Abschlag des weltweit größten Bitcoin-Fonds - dem Grayscale Bitcoin Trust (GBTC) - gesehen, der auch in unserem Chart der Woche.

Im Gegensatz zu ETPs können GBTC-Anteile nicht gegen die zugrundeliegenden Bitcoins zurückgegeben werden, weshalb sie an den OTC-Märkten mit einem Auf- oder Abschlag auf den Nettoinventarwert (NAV) gehandelt werden. Anleger in GBTC haben in der Regel eine 6-monatige Sperrfrist. Positiv zu vermerken ist, dass der Aufschlag auf den Nettoinventarwert des 3iQ Coinshares Bitcoin ETP (einer der größten Bitcoin-ETFs weltweit) deutlich gestiegen ist, was auf eine erhöhte Nachfrage nach diesem Produkt schließen lässt.

Das Beta der globalen Hedgefonds gegenüber Bitcoin ist in den letzten 20 Handelstagen von einem hohen Niveau aus weiter gesunken, was darauf hindeutet, dass Hedgefonds ihr Engagement in Kryptoassets im Laufe des Monats verringert haben könnten.

Ein weiteres Highlight ist, dass die Coinbase-Binance-Prämie während des größten Teils der Woche weiterhin positiv war, was auf ein relatives Kaufinteresse von institutionellen Anlegern gegenüber Kleinanlegern hindeutet.

On-Chain

Im Allgemeinen sind die Börsenguthaben in dieser Woche weiter gesunken. Tatsächlich erreichten sowohl die Bitcoin- als auch die Ethereum-Börsensalden jeweils ein Vierjahrestief. Dies ist wahrscheinlich auf die gestiegene Risikoaversion in Bezug auf Börsenbestände im Allgemeinen und Binance-Börsenbestände im Besonderen zurückzuführen.

Die meiste Handelsaktivität konzentrierte sich jedoch in der vergangenen Woche auf Stablecoins. Wir sahen ein neues Allzeithoch bei der Anzahl der Tether-USD (USDT)-Sendeadressen und ein 13-Monats-Hoch bei der Anzahl der neuen Adressen, die auf der USDT-Blockchain erstellt wurden. Wie bereits erwähnt, gab es aufgrund der steigenden Risikoaversion erhebliche Umschichtungen von BUSD (dem USD-Stablecoin von Binance) in Tether USD (USDT) und USD Coin (USDC). Diese Umtauschvorgänge scheinen sich heute Morgen fortzusetzen.

Derivate

Im Allgemeinen haben wir einen Anstieg der Risikoaversion an den Bitcoin-Derivatemärkten festgestellt. Dies zeigt sich in der Umkehrung der impliziten Volatilitäten für Bitcoin-Optionen. Ein Anstieg der impliziten Volatilitäten ist in der Regel ein Anzeichen für steigende Unsicherheit. Es gab auch einen erneuten Rückgang der Optionsneigung zugunsten von Verkaufsoptionen, was darauf hindeutet, dass die Nachfrage nach Abwärtsabsicherungen wieder etwas zugenommen hat.

Der 3-Monats-Basissatz hat sich ebenfalls umgekehrt und ist derzeit wieder negativ. Die Bitcoin-Futures-Kurve befindet sich weiterhin in Backwardation, was darauf hindeutet, dass die Händler derzeit eher pessimistische Preisaussichten haben.

Unterm Strich

Kryptoassets waren letzte Woche die schlechteste Anlageklasse und schnitten schlechter ab als globale Aktien, Anleihen und Rohstoffe.

Negative Nachrichten sowohl von der Makro- als auch von der Krypto-Front dominierten die Marktstimmung in der vergangenen Woche.

Infolgedessen ist unser hauseigener Krypto-Sentiment-Index gesunken und liegt derzeit wieder im negativen Bereich.

Die Zuflüsse aus Krypto-ETP-Fonds waren bei allen Arten von ETP-Produkten negativ, während der NIW des Grayscale Bitcoin Trust ein neues Allzeittief erreichte. On-Chain-Indikatoren deuten angesichts der jüngsten Gerüchte um Binance auf weitere Abflüsse von Börsen hin.

Außerdem haben wir einen Anstieg der Risikoaversion an den Bitcoin-Derivatemärkten festgestellt.

Laden Sie den vollständigen Bericht mit Anhang hier herunter.

Über DDA Deutsche Digital Assets

Deutsche Digital Assets (DDA) ist ein deutscher Digital Asset Manager, der als vertrauenswürdige Anlaufstelle für Investoren dient, die ein Exposure zu Krypto Assets suchen. Über verschiedene Tochtergesellschaften bietet DDA eine Reihe von kryptobezogenen Anlageprodukten an, die von passiven bis hin zu aktiv verwalteten Investmentlösungen reichen. Darüber hinaus bietet das Unternehmen professionelle Anlageberatung für Family Offices, High Net Worth Individuals (HNWI) und institutionelle Anleger an.

Wir bieten hervorragende Leistungen durch vertraute, vertrauenswürdige Anlagevehikel, die den Anlegern die Qualitätsgarantien bieten, die sie von einem erstklassigen Vermögensverwalter verdienen, während wir uns für unsere Mission einsetzen, die Akzeptanz von Kryptoanlagen zu fördern. DDA beseitigt die technischen Risiken von Krypto-Investitionen, indem wir Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten anbieten.

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen ausschließlich zu Informationszwecken. Die Deutsche Digital Assets, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren. Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen. Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen erheblichen Risiken und Unwägbarkeiten, die außerhalb der Kontrolle der Deutsche Digital Assets GmbH liegen. Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" und ohne jegliche Garantie präsentiert.