Kryptowährungen befinden sich wieder in einem Bärenmarkt, und Bitcoin-Kritiker haben ihren großen Tag, um Zweifel in den Köpfen der Investoren zu säen. Deshalb fragen Sie sich vielleicht: "Ist Bitcoin im Jahr 2022 noch eine gute Investition?"

Lesen Sie weiter, um unsere Antwort auf diese dringende Frage zu erfahren.

Bitcoins holpriger Start ins Jahr 2022

Nach einem aufregenden Jahr 2021 hat Bitcoin einen holprigen Start in das Jahr 2022 erlebt, der die Hoffnungen, dass der Preis bald die lang erwartete Marke von $100.000 erreichen wird, zunichte macht. Der aktuelle makroökonomische Gegenwind sorgt für viel Unsicherheit, weshalb es schwierig ist zu sagen, was in der zweiten Hälfte des Jahres 2022 passieren wird.

Laut Coinmarketcap DatenBitcoin begann das Jahr 2022 bei $46.311,74, fiel aber Ende Januar unter $40.000. Im Februar stieg der Preis wieder auf über $40.000, um dann am Ende des Monats wieder unter diese Marke zu fallen. Im März schwankte der Bitcoin-Kurs zwischen $48.000 und $36.000, während der April eine etwas bessere Performance aufwies.

Der Mai war jedoch ein schwieriger Monat für Bitcoin aufgrund der Zinserhöhungen in den USA als Folge der Bekämpfung der nicht transitorischen Inflation. Wie es aussieht, erwarten Experten, dass die Federal Reserve die Zinsen bis ins Jahr 2023 weiter anheben wird. Das könnte bedeuten, dass eine nennenswerte Erholung des Kryptomarktes in weiter Ferne liegt.

Auch, Probleme bei Luna haben die Kryptomärkte insgesamt beeinflusstund drückte den Bitcoin-Preis unter $30.000. Der Russland-Ukraine-Krieg ist ein weiterer Faktor, der die globalen Märkte und damit auch den Kryptomarkt gestört und die Volatilität erhöht hat. Terras "Luna Foundation Guard" (LFG) war dafür verantwortlich, dass allein rund 80.000 BTC in einen schwachen Markt fielen.

Darüber hinaus hat die Risikobereitschaft der Anleger im Jahr 2022 abgenommen, da die US-Notenbank die Zinssätze erhöht hat. Infolgedessen werden sowohl die Aktien- als auch die Kryptomärkte negativ beeinflusst, und zum ersten Mal wird der die Korrelation zwischen den beiden hat zugenommen deutlich.

Mit zunehmender Korrelation ist Bitcoin in den letzten sechs Monaten immer weniger eine Absicherung gegen die Aktienmärkte.

Warum Bitcoin (wahrscheinlich) immer noch in Ihrem Portfolio sein sollte

Wir sind der Meinung, dass Sie Bitcoin in Ihrem Portfolio behalten sollten, auch wenn er seit Jahresbeginn einen Verlust von ~37% erlitten hat.

Denken Sie daran, dass dies nicht das erste Mal ist, dass Bitcoin einen Absturz erlebt. Bitcoin hat erlebt mehrere Preisstürze bevor er sich erholte und wieder über die Allzeithochs hinausging.

Erst letztes Jahr fiel der Wert von Bitcoin von April bis Juli um 53% von über $63.500 auf knapp $30.000. Ein paar Monate später, im November, stieg der Bitcoin-Preis über seinen vorherigen Höchststand hinaus und erreichte sein aktuelles Allzeithoch von über $68.700.

Eine ähnliche Situation trat vor zwei Jahren zu Beginn der Pandemie auf. Innerhalb von zwei Tagen fiel der Bitcoin-Kurs im März 2020 um 50% auf einen jüngsten Tiefstand von $4.000, bevor er sich erholte und zum Jahresende auf $29.000 stieg.

Wenn Sie sich jedoch fragen, ob Bitcoin immer noch eine gute Investition ist, finden Sie hier einige Gründe, um Ihre Zweifel in Schach zu halten.

Die weltweite Akzeptanz steigt

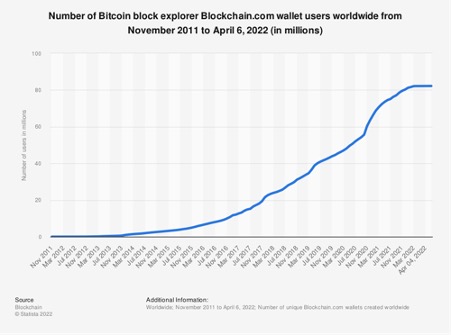

Die Zahl der Bitcoin-Nutzer (gemessen an den Nutzern von Blockchain.com-Wallets) ist seit 2013 gestiegen. Laut Daten Statista zufolge ist die Zahl der Wallets von weniger als einer Million im November 2013 auf über 81 Millionen im April 2022 gestiegen.

Die zunehmende Berichterstattung in den Mainstream-Medien und die Unterstützung von Technologieführern wie Elon Musk und Jack Dorsey haben die Verbreitung von Bitcoin vorangetrieben. Darüber hinaus hat El Salvador Bitcoin im Jahr 2021 zum gesetzlichen Zahlungsmittel gemacht, und die Zentralafrikanische Republik wird 2022 folgen, was die Akzeptanz von Bitcoin als Zahlungsmittel und Wertaufbewahrungsmittel (zwei entscheidende Funktionen, um ein "Geld" zu werden) weiter fördert.

Online-Zahlungsplattformen wie PayPal und Cash App haben BTC für US-Kunden verfügbar gemacht, ein Schritt, der die Akzeptanz ebenfalls fördert. Eine breite Akzeptanz bedeutet, dass Bitcoin seine Rolle als Geld erreichen kann, weil mehr Menschen ihm als Tauschmittel vertrauen werden.

Mehr Bitcoin-gebundene ETFs sind im Kommen

In Bitcoin zu investieren bedeutet nicht nur, Coins zu kaufen und in einer persönlichen Wallet zu halten. Es gibt auch eine Möglichkeit, sich indirekt am Preis des Bitcoins zu beteiligen.

Heute können traditionelle Anleger auf Finanzprodukte zugreifen, die sie verstehen, und in Bitcoin investieren. Diese Produkte werden auf der ganzen Welt immer leichter zugänglich. So legte ProShares im Oktober 2021 den ersten börsengehandelten US-Bitcoin-Futures-Fonds (ETF) auf. Der ETF wird an der New Yorker Börse gehandelt und war der schnellste ETF, der die Marke von 1 Mrd. USD an AuM überschritten hat.

Auch Australien hat seinen ersten BTC-ETF im Mai 2022. Das ETF-Produkt wird an der Cboe Australia gehandelt. Brasilien, Kanada, Deutschland, Schweden, die Schweiz, Liechtenstein und Jersey haben ebenfalls börsengehandelte Produkte auf Bitcoin zugelassen.

Institutionelle Investoren und öffentliche Unternehmen setzen auf Bitcoin

Viele der größten Akteure an der Wall Street setzen ihre Kunden auf Bitcoin an und zeigen damit ihre positive Einstellung zu diesem digitalen Vermögenswert. Fidelity Investments beispielsweise ermöglicht es US-Bürgern, einen Teil ihrer 401(K)-Ersparnisse in BTC anzulegen. Auch die Bank of America, Goldman Sachs und Morgan Stanley setzen sich auf verschiedene Weise für Bitcoin ein.

Darüber hinaus haben börsennotierte Unternehmen wie Tesla, Microstrategy, Square und Galaxy Digital Holdings BTC als Reserveaktivum in ihre Bilanzen aufgenommen. Sie nutzen Bitcoin als Absicherung gegen die Inflation und als alternative Renditequelle, da die Renditen an den Anleihemärkten sinken.

Bitcoin ist die beste Wertentwicklung aller Zeiten

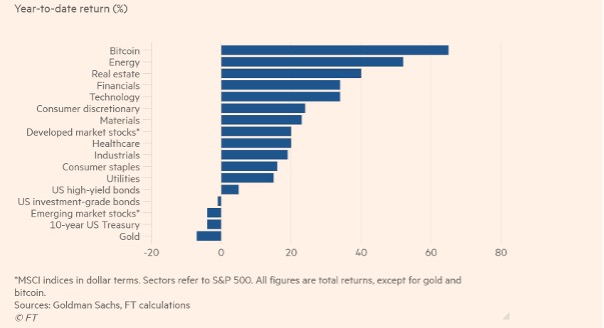

Bitcoin war die Anlage mit der besten Wertentwicklung im Jahr 2021, gemäß an die Financial Times. Die Kryptowährung übertraf alle wichtigen Vermögenswerte, einschließlich Gold, Energie und Technologie.

Aber Bitcoin hatte nicht nur ein gutes Jahr.

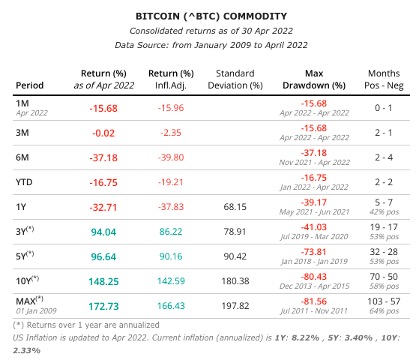

Seit seiner Einführung im Jahr 2009 ist der Preis von Bitcoin von weniger als einem Cent auf über $68.000 Ende 2021 gestiegen.

In den letzten fünf Jahren erwirtschaftete Bitcoin eine durchschnittliche jährliche Rendite von über 96%, während Bitcoin-Investoren im Laufe des letzten Jahrzehnts eine durchschnittliche jährliche Rendite von über 148% erzielten.

Die jährlichen Renditen von Bitcoin übertrumpfen alle wichtigen Anlageklassen von Rohstoffen bis hin zu Aktien, was ein starkes Argument für die Aufnahme von Bitcoin in das Portfolio ist.

Aber es sind nicht die jährlichen Renditezahlen, die Bitcoin zu einer so wertvollen Portfolioergänzung machen.

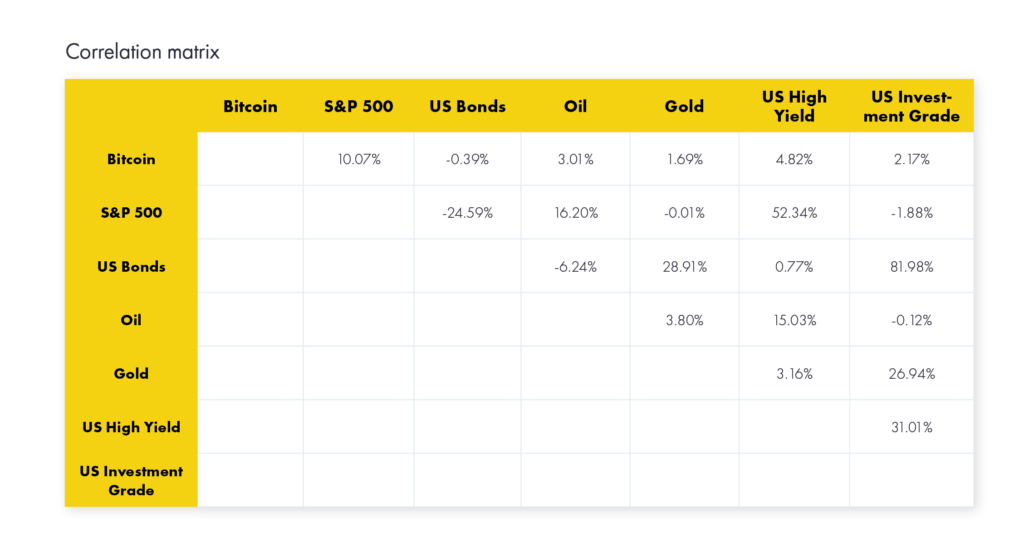

Im Vergleich zu traditionellen Anlageklassen sind die langfristigen Korrelationen von Bitcoin gering bis negativ, was Bitcoin zum idealen Diversifizierungsobjekt macht - mit positiven Auswirkungen auf die Sharpe Ratio des Portfolios und die Standardabweichung des Portfolios trotz der geringen Volatilität von Bitcoin.

Bitcoin kann in Zeiten wirtschaftlicher Ungewissheit als Absicherung dienen

In Zeiten großer wirtschaftlicher Unsicherheit können sich die Menschen an Bitcoin wenden, der als Absicherung gegen den Zusammenbruch des Bankensystems, schwächelnde Währungen und hohe Inflationsraten dienen kann.

Bitcoin ist eine dezentralisierte digitale Währung, die es Privatpersonen und Unternehmen ermöglicht, Zahlungen zu senden und zu empfangen, selbst wenn das Bankensystem oder die traditionellen Zahlungswege gestört sind. Außerdem konnte Bitcoin in Ländern mit kollabierenden Währungen oder hoher Inflation als Wertaufbewahrungsmittel dienen.

Bitcoin-Preis-Prognosen sind optimistisch

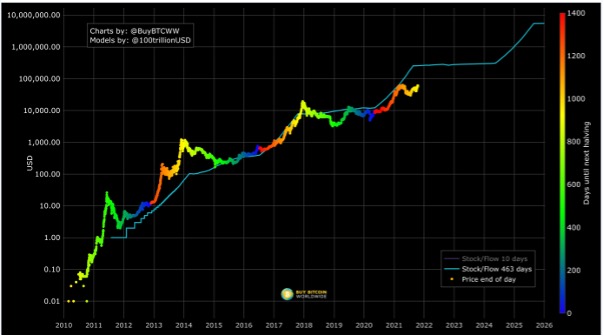

Die beliebte Bitcoin-Preisvorhersagemodell Stock-to-Flow (S2F) geht davon aus, dass Bitcoin im Jahr 2022 die Marke von $100.000 überschreiten wird. Der Preis sollte bis zur nächsten Halbierung im Juni 2024 über dieser Marke bleiben. Danach könnte der Preis in den Jahren 2025 und 2026 über $1.000.000 klettern.

In der Vergangenheit lag das S2F-Modell ziemlich nah am realen Preis, wie die Grafik unten zeigt. Nur in jüngster Zeit ist der Bitcoin-Preis am weitesten vom S2F-Modellpreis abgewichen.

Wenn sich diese Vorhersage bewahrheitet, könnte Bitcoin vor der nächsten Halbierung $100.000 erreichen. Daher könnte der derzeitige Rückgang um 2022 eine Gelegenheit für Investoren sein, in Erwartung eines zukünftigen Preisanstiegs niedrig zu kaufen.

Vorstellung des Iconic Funds Physical Bitcoin ETP

Wenn Sie in Bitcoin investieren möchten, es aber vorziehen, ein reguliertes Finanzprodukt zu kaufen, das ein Engagement in den Bitcoin-Kurs bietet, könnten Sie Anteile am Iconic Funds Physical Bitcoin ETP (XBTI) kaufen.

Der Bitcoin-ETP verfolgt den Preis von Bitcoin und ist mit physischen BTC besichert. Iconic verwahrt den Bitcoin bei einer BaFin-regulierten Krypto-Depotstelle - Coinbase Germany GmbH. Mit dem Kauf dieses ETPs erhalten Sie den Anspruch auf eine vordefinierte Menge an Bitcoin.

Das Iconic Funds Physical Bitcoin ETP wird unter dem Ticker XBTI an der Deutschen Börse Xetra, SIX Swiss Exchange und Euronext Paris und Amsterdam gehandelt.

Über DDA Ikonische Fonds

Iconic Funds ist die Brücke zum passiven und aktiv verwalteten Engagement in Kryptowährungen. Iconic Funds bietet über seine Tochtergesellschaften Krypto-Asset-ETPs, diversifizierte Indexfonds und Alphastrategien für Anleger.

Unsere Aufgabe ist es, die Akzeptanz von Krypto-Assets zu fördern. Als Brücke für Anleger, die in Krypto-Assets investieren wollen, bieten die lizenzierten und regulierten Vehikel von Iconic den Anlegern eine Auswahl an Investitionsmöglichkeiten, die von passiven Indexinvestitionen bis hin zu aktiv verwalteten Strategien reichen. Iconic Funds beseitigt die technischen Risiken von Krypto-Investitionen, indem es Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten bietet.

Durch die Verbindung von modernster Technologie, innovativen Anlageprodukten und kompromissloser Professionalität steht Iconic an der Spitze der Krypto-Vermögensverwaltung.

Neueste Nachrichten

- Warum die Volatilität von Bitcoin Sie nicht erschrecken sollte

- Wie Green Mining zur Norm für das Bitcoin-Netzwerk wird

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

- Wie Layer-2-Lösungen Ethereum bei der Skalierung helfen

- Bitcoin-Bildung ebnet den Weg für die Hyperbitcoinisierung

Iconic in der Presse

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds erweitert seine Produktpalette mit einem physischen Ethereum-ETP

Aktuelle Forschungsberichte

- Wie haben sich die Portfolios während der Pandemie entwickelt? ➡ Hier herunterladen

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

- Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

In keinem Fall können Sie die ICONIC HOLDING GMBH, ihre Tochtergesellschaften oder eine mit ihr verbundene Partei für direkte oder indirekte Anlageverluste haftbar machen, die durch Informationen in diesem Artikel verursacht wurden. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die ICONIC HOLDING GMBH ist in keiner Rechtsordnung als Anlageberater registriert. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Investitionsentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Investitionsmöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Prognosen und Meinungen, die sich als wesentlich ungenau erweisen können und von Natur aus erheblichen Risiken und Unsicherheiten unterliegen, die außerhalb der Kontrolle der ICONIC HOLDING GMBH liegen. Unsere Artikel und Berichte drücken unsere Meinungen aus, die wir auf der Grundlage allgemein verfügbarer Informationen, Feldforschung, Schlussfolgerungen und Ableitungen durch unsere Due Diligence und unseren analytischen Prozess gewonnen haben.

Die ICONIC HOLDING GMBH geht davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen, die wir für korrekt und zuverlässig halten. Diese Informationen werden jedoch "wie besehen", ohne jegliche Garantie, präsentiert.