Unsere monatliche Kryptoübersicht für März:

- Die Kryptomärkte legten im März deutlich zu und verzeichneten zweistellige prozentuale Gewinne.

- Bitcoin und Ether sind um 21,31% bzw. 21,24% gestiegen.

- Der beste Outperformer unter den führenden Kryptowährungen war Cardano (ADA).

Krypto-Markt Übersicht März

Nach einem volatilen Februar, der durch den Krieg in der Ukraine und hohe gemeldete Inflationszahlen geprägt war, zeigten sich die Kryptomärkte im März widerstandsfähig und verzeichneten zweistellige prozentuale Zuwächse bei allen führenden Kryptoanlagen.

Die beiden größten Kryptowährungen nach Marktkapitalisierung, Bitcoin (BTC) und Ether (ETH), legten um 21,31% bzw. 21,24% zu.

Angesichts der hohen Inflation in den wichtigsten Volkswirtschaften der Welt erkennen immer mehr Anleger die Stärke von Bitcoin als Wertaufbewahrungsmittel und Absicherung gegen hohe Inflation. Darüber hinaus wurde die Durchführungsverordnung von US-Präsident Biden zur Regulierung digitaler Vermögenswerte von den Kryptomärkten weitgehend positiv aufgenommen.

Der Bitcoin-Preis wurde auch durch den Kauf von BTC durch die Luna Foundation Guard (LFG) in die Höhe getrieben, die als Reservewährung für Terras dezentralen Stablecoin TerraUSD (UST) dient.

Nach Angaben von Do Kwon, dem Geschäftsführer von LFG, der das Terra-Projekt leitet, hat die Stiftung hat gekauft über $1 Milliarde in Bitcoin seit Januar. Die Bitcoin-Reserven werden verwendet, um den Preis der UST zu stabilisieren, die ein Token-Minting- und Burning-Verfahren verwendet, um ihre Dollar-Bindung aufrechtzuerhalten.

"Der Grund, warum wir besonders an Bitcoin interessiert sind, ist, dass wir glauben, dass es sich um das stärkste digitale Reserve-Asset handelt. Die UST wird die erste native Internetwährung sein, die den Bitcoin-Standard als Teil ihrer Geldpolitik implementiert", sagte Kwon gegenüber Bloomberg.

Gleichzeitig hat der Preis von Ether (ETH) von einem Rückgang der Gasgebühren profitiert, da Layer-2-Skalierungslösungen erfahren eine zunehmende Akzeptanz und das Protokoll nähert sich immer mehr Ethereum 2.0 an.

Krypto Performance Übersicht März

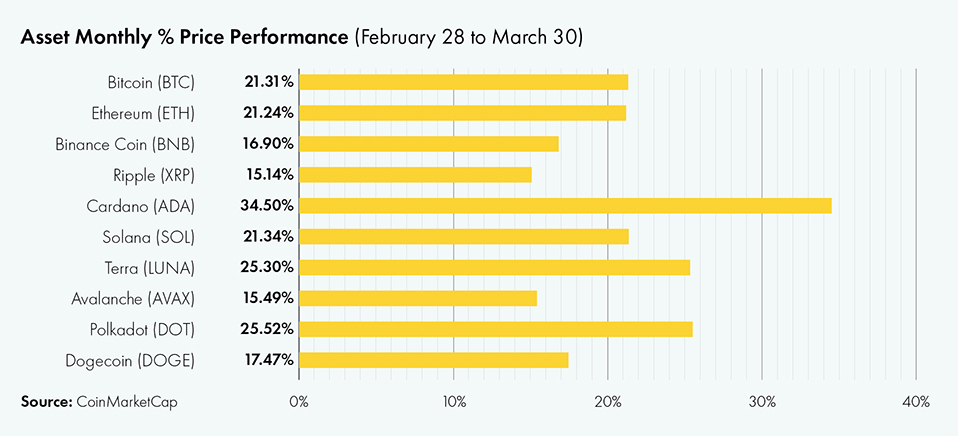

Der März war ein hervorragender Monat für Krypto-Investoren, die mit ihren Anlagen zweistellige prozentuale Zuwächse erzielten.

Bitcoin und Ether waren die Spitzenreiter und verbuchten im Monatsvergleich über 21% an Erträgen. Layer-1-Ketten der nächsten Generation, wie Solana (SOL), Terra (LUNA) und Avalanche (AVAX), folgten und schlossen den Monat um 21,34%, 25,30% bzw. 15,49% höher ab.

Die beiden marktführenden Börsentoken - Binance Coin (BNB) und FTX Token (FTT) - verzeichneten ebenfalls kräftige Zuwächse und legten um 16,90% bzw. 21,10% zu.

Der Top-Outperformer unter den größten Krypto-Assets nach Marktkapitalisierung war Cardano (ADA), das um 34,50% zulegte, nachdem das Unternehmen bekannt gab, dass es durch die Milkomeda EVM Sidechain EVM-kompatibel geworden ist, wodurch Ethereum DApps im Cardano-Ökosystem eingesetzt werden können.

Die Aktien erholten sich, da die Aussicht auf eine Lösung des Ukraine-Krieges immer wahrscheinlicher wird, und der S&P 500 Index legte um 5,90% zu. Im Gegensatz dazu schlossen US-Staatsanleihen, gemessen am S&P U.S. Government Bond Index, den Monat mit einem Minus von 3,65%.

Wie Bitcoin konnte auch Gold (XAU) seiner Rolle als sicherer Hafen gerecht werden und verzeichnete im Februar und in der ersten Märzhälfte beträchtliche Zuwächse, als die Unsicherheit im Zusammenhang mit dem Ukraine-Krieg die Märkte erschütterte. Nach einem Höchststand von $2.050 fiel das Edelmetall jedoch wieder auf $1.920 zurück und verzeichnete im Monatsvergleich nur ein kleines Plus von 0,36%.

Institutionelles Interesse an Kryptowährungen

Die CME-Gruppe hat angekündigt Die CME Group hat die Einführung neuer Kryptowährungsderivate bekannt gegeben und erweitert ihr Angebot an Kryptoprodukten um Optionen auf Bitcoin- und Ether-Mikrofutures. "Die Einführung dieser Mikro-Optionen baut auf dem signifikanten Wachstum und der Liquidität auf, die wir bei unseren Micro-Bitcoin- und Micro-Ether-Futures gesehen haben", sagte Tim McCourt, CME Group Global Head of Equity and FX Products.

Goldman Sachs angekündigt plant, Anlegern über einen von Galaxy Digital Holdings aufgelegten Fonds Zugang zur Kryptowährung Ether (ETH) von Ethereum zu bieten. Die Mindestanlagesumme wird $250.000 betragen, da die Bank mit diesem neuen Service auf Großkunden abzielt.

Bitcoin in den Bilanzen

Das an der NASDAQ notierte Unternehmen MicroStrategy, angeführt von Bitcoin-Befürworter Michael Saylor, hat mehr Bitcoin hinzugefügt in seine Bilanz aufgenommen, nachdem es sich einen Bitcoin-gesicherten Kredit von der Silvergate Bank (SI) gesichert hatte, um mehr BTC zu kaufen. MicroStrategy ist einer der größten Bitcoin-Besitzer der Welt.

Das kanadische Fintech-Unternehmen Mogo (MOGO) hat einen VC-Arm, Mogo Ventures, gegründet, um seine hauptsächlich auf Kryptowährungen fokussierten Investitionen zu verwalten. Neben Kapitalbeteiligungen an Coinsquare und mehreren web3-Plattformen hat das Unternehmen auch Berichten zufolge hält C$1,7 Millionen ($1,36 Millionen) an Bitcoin (BTC) und Ether (ETH) in seiner Bilanz.

Über DDA Ikonische Fonds

Iconic Funds ist die Brücke zum passiven und aktiv verwalteten Engagement in Kryptowährungen. Iconic Funds bietet über seine Tochtergesellschaften Krypto-Asset-ETPs, diversifizierte Indexfonds und Alpha-Strategien für Anleger an.

Unsere Aufgabe ist es, die Akzeptanz von Krypto-Assets zu fördern. Als Brücke für Anleger, die in Krypto-Assets investieren wollen, bieten die lizenzierten und regulierten Vehikel von Iconic den Anlegern eine Auswahl an Investitionsmöglichkeiten, die von passiven Indexinvestitionen bis hin zu aktiv verwalteten Strategien reichen. Iconic Funds beseitigt die technischen Risiken von Krypto-Investitionen, indem es Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten bietet.

Durch die Verbindung von modernster Technologie, innovativen Anlageprodukten und kompromissloser Professionalität steht Iconic an der Spitze der Krypto-Vermögensverwaltung.

Neueste Nachrichten

- Warum die Volatilität von Bitcoin Sie nicht erschrecken sollte

- Wie Green Mining zur Norm für das Bitcoin-Netzwerk wird

- Wie genau ist das Bitcoin Stock-to-Flow-Modell?

- Wie Layer-2-Lösungen Ethereum bei der Skalierung helfen

- Bitcoin-Bildung ebnet den Weg für die Hyperbitcoinisierung

Iconic in der Presse

- Das Investment: Kryptowährungen kommen 2022 im Mainstream an

- Private Banking Magazin, Bitcoin - das perfekte Beispiel für ein ESG-Investment?

- Institutionelles Geld, Krypto-Manager steigt bei Family Office ein

- Morningstar, Iconic Funds erweitert seine Produktpalette mit einem physischen Ethereum-ETP

Aktuelle Forschungsberichte

- Wie haben sich die Portfolios während der Pandemie entwickelt? ➡ Hier herunterladen

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

- Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

Die in diesem Artikel enthaltenen Materialien und Informationen dienen nur zu Informationszwecken.

Die Iconic Holding GmbH, ihre verbundenen Unternehmen und Tochtergesellschaften fordern nicht zu Handlungen auf der Grundlage dieses Materials auf. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die Wertentwicklung ist unvorhersehbar. Die Wertentwicklung in der Vergangenheit ist daher kein Hinweis auf die zukünftige Wertentwicklung.

Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Projektionen und Meinungen. Diese können sich als wesentlich ungenau erweisen und unterliegen naturgemäß erheblichen Risiken und Unsicherheiten, die außerhalb der Kontrolle der Iconic Holding GmbH liegen.

Wir gehen davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen. Diese Informationen werden jedoch "wie besehen" ohne jegliche Garantie präsentiert.