Bleiben Sie auf dem Laufenden mit unserer monatlichen Kryptoübersicht:

- Der November war eine Achterbahnfahrt für Krypto-Investoren

- Bitcoin, Ethereum und Solana haben neue Allzeithochs erreicht, worauf zwei Wochen später eine steile Preiskorrektur folgte

- Die Top-Performer des letzten Monats waren Binance Coin und Avalanche

- El Salvadors "Bitcoin-Woche" war mit der Ankündigung der Entwicklung einer steuerfreien Bitcoin-Stadt und der ersten Bitcoin-Anleihe der Welt ein Erfolg

Krypto-Markt Überblick

Vollständigen Kommentar herunterladen

Der vergangene Monat war eine Art Achterbahnfahrt für Krypto-Investoren. Bitcoin (BTC) und Ethereum (ETH) erreichten am 11. November neue Allzeithochs von $68.622 bzw. $4.843, worauf eine steile Preiskorrektur zwei Wochen später folgte, als die Angst vor der neuesten COVID-19-Variante, Omicron, die globalen Märkte erschütterte.

Trotz der Höhen und Tiefen des Novembers für Bitcoin war die "Bitcoin-Woche" in El Salvador ein Erfolg, mit der Ankündigung der Entwicklung einer steuerfreien Bitcoin-Stadt und der Die erste Bitcoin-Anleihe der Welt als die wichtigsten Highlights.

El Salvadors pro-Bitcoin-Präsident Nayib Bukele plant, im Jahr 2022 eine 10-jährige Staatsanleihe in Höhe von $1 Mrd. auszugeben, die mit Bitcoin über das Liquid Network von Blockstream besichert ist, um die Entwicklung seiner Bitcoin City zu finanzieren und mehr BTC für die Staatskasse zu kaufen.

Ethereum profitiert weiterhin von seiner Dominanz auf dem NFT- und DeFi-Markt, obwohl es mit hohen Gasgebühren und langsamen Bestätigungszeiten zu kämpfen hat. Erfreulicherweise werden neue Lösungen für die Skalierung auf zwei Ebenen zunehmend angenommen, was dazu beiträgt, die Gebührenbelastung für Ethereum-Nutzer zu verringern.

So wurde zum Beispiel das Off-Chain-Skalierungsprotokoll Arbitrum implementiert von Binance Exchange und mehrere führende DeFi-Protokolle, um die Transaktionsgebühren für Ethereum-Nutzer zu senken.

Krypto Asset Performance Übersicht

Im November verzeichneten die Kryptomärkte zahlreiche neue Allzeithochs. Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Avalanche (AVAX) und Crypto.com (CRO) erreichten alle neue Höchststände.

Bitcoin wurde durch die jüngsten Inflationszahlen aus den USA beflügelt, wo Anleger nun eine Rendite von über 6% erzielen müssen, nur um die Inflation zu schlagen. Da die meisten festverzinslichen Wertpapiere dies nicht schaffen, diversifizieren immer mehr Anleger in Bitcoin als Absicherung gegen die Inflation und um potenziell Alpha zu ihren Renditen hinzuzufügen.

Angestachelt durch das neue Allzeithoch von Bitcoin Anfang November folgten zahlreiche Krypto-Assets, allen voran Ethereum-Konkurrenten, die schnelle Transaktionen zu geringeren Kosten anbieten können.

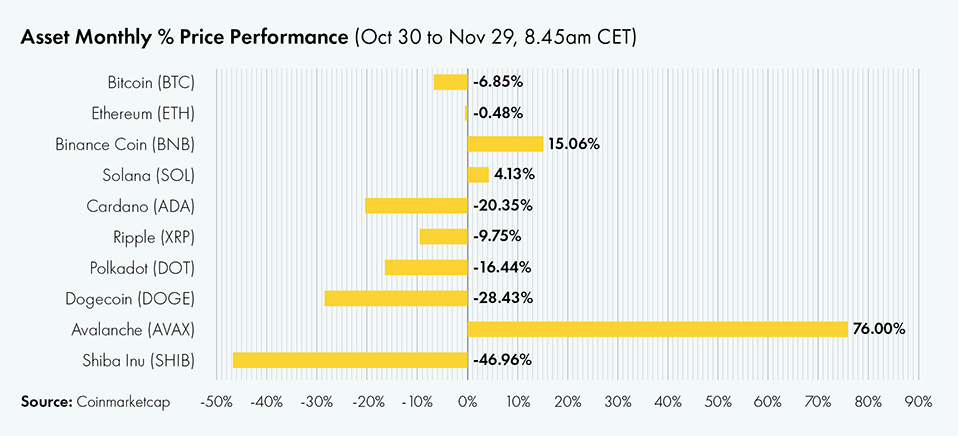

Die Top-Outperformer der letzten 30 Tage unter den größten Krypto-Assets nach Marktkapitalisierung waren Binance Coin (BNB) und Avalanche (AVAX), die beide davon profitieren, dass Entwickler und Nutzer Ethereum-Alternativen erkunden, die einen höheren Durchsatz und erschwingliche Gebühren bieten.

Umgekehrt hatten die Meme-Coins einen schrecklichen Monat: Dogecoin (DOGE) fiel um fast 29% und Shiba Inu (SHIB) verlor fast die Hälfte seines Wertes und schloss den Monat mit einem Minus von 46%.

Hier sind die Performances der Top-Krypto-Assets dieses Monats (vom 30. Oktober bis 29. November 2021)

Die Omicron-Variante hat nicht nur die Kryptomärkte erschüttert. Die globalen Aktienmärkte mussten gegen Monatsende einen Rückschlag hinnehmen. Obwohl der S&P 500 zu Beginn des Monats ein neues Allzeithoch erreichte, schloss er den November mit einem Minus von 0,23%, nachdem er nach der Nachricht über die neue COVID-19-Variante stark gefallen war.

Der Wert von Gold (XAU) stieg im November um 0,57%, während der S&P US Government Bond Index um 0,5% zulegte, da verschreckte Aktienanleger zum Monatsende Geld in Staatsanleihen umschichteten.

Institutionelles Interesse an Kryptowährungen

Der Wall-Street-Riese Morgan Stanley hat in den letzten SEC-Anmeldungen dass mehrere ihrer Fonds im dritten Quartal 2021 ihr Bitcoin-Engagement durch den Kauf von Anteilen am Grayscale Bitcoin Trust (GBTC) erhöht haben. Darüber hinaus erklärte der CEO der Bank, James Gorman, letzten Monat, dass er Kryptowährungen nicht für eine Modeerscheinung hält, was darauf hindeutet, dass die Bank ihre Offenheit gegenüber digitalen Vermögenswerten fortsetzen könnte.

Die Citigroup hat Berichten zufolge hat ihren Head of Blockchain and Digital Assets, Puneet Singhvi, zum Leiter der Institutional Client Group (ICG) der Bank befördert, wo er "eine klare Strategie skizzieren wird, wo und wie ICG digitale Anlagemöglichkeiten verfolgen sollte." Die Bank plant außerdem, weitere 100 Mitarbeiter einzustellen, um ihre Bemühungen um digitale Vermögenswerte auszubauen.

Bitcoin in den Bilanzen

Die "Bitcoin-Nation" El Salvador, die Bitcoin im September als gesetzliches Zahlungsmittel eingeführt hat, hat einen weiteren Bitcoin-Kauf getätigt und seine Staatskasse um 100 BTC aufgestockt, wie ein Tweet von Präsident Nayib Bukele. Das zentralamerikanische Land besitzt nun insgesamt 1.220 BTC.

Hauptverein der Australischen Baseball-Liga, Perth Heat, angekündigt dass er jetzt Bitcoin in seinen Bilanzen führt und den Spielern die Möglichkeit bietet, in Bitcoin bezahlt zu werden, dank einer neuen Partnerschaft mit dem Bitcoin-Zahlungsunternehmen OpenNode. Der Sportverein wird laut Patrick O'Sullivan, dem neuen Chief Bitcoin Officer der Heat, auch Bitcoin-Zahlungen für Fanartikel, Sponsoring und Konzessionen am Spieltag akzeptieren.

Über DDA Ikonische Fonds

Iconic Funds ist die Brücke zum passiven und aktiv verwalteten Engagement in Kryptowährungen. Iconic Funds bietet über seine Tochtergesellschaften Krypto-Asset-ETPs, diversifizierte Indexfonds und Alpha-Strategien für Anleger an.

Iconic Funds hat es sich zur Aufgabe gemacht, die Akzeptanz von Krypto-Assets zu fördern. Als Brücke für Anleger, die in Krypto-Assets investieren wollen, bieten die lizenzierten und regulierten Vehikel von Iconic den Anlegern eine Auswahl an Anlagemöglichkeiten, die von passiven Indexanlagen bis hin zu aktiv verwalteten Strategien reichen. Iconic Funds beseitigt die technischen Risiken von Krypto-Investitionen, indem es Anlegern vertrauenswürdige und vertraute Mittel zur Investition in Krypto zu branchenführend niedrigen Kosten bietet.

Durch die Verbindung von modernster Technologie, innovativen Anlageprodukten und kompromissloser Professionalität steht Iconic an der Spitze der Krypto-Vermögensverwaltung.

Neueste Nachrichten

- Das Argument für Bitcoin in einem diversifizierten Portfolio

- Wie sähe die Welt mit Bitcoin als Reservewährung aus?

- Die Institutionalisierung von Bitcoin: Was bedeutet das für Krypto-Investoren?

- Die große amerikanische Bergbauwanderung ist nun abgeschlossen.

- Iconic Funds erhält die Genehmigung, Europas ersten Krypto-Anlagenfonds an einem regulierten Markt zu notieren.

Iconic in der Presse

- BTC Echo, Bitcoin: "Keine signifikante Korrelation zu einer anderen Anlageklasse“

- ETF-Magazin, Die wichtigsten Werttreiber von Bitcoin und Ethereumvon Michael Geister, Leiter der Krypto-ETPs

- Fundview, Bitcoin, Ethereum & Co: Welche Faktoren beeinflussen den Wert von Kryptowährungen?

- Der Fonds, Krypto-RundtischMaximilian Lautenschläger, Mitbegründer und Abgeordneter der Iconic Holding

Aktuelle Forschungsberichte

- Wie haben sich die Portfolios während der Pandemie entwickelt? ➡ Hier herunterladen

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen ➡ Hier herunterladen

- Wie effektiv sind gängige Anlagestrategien mit Bitcoin? ➡ Hier herunterladen

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes ➡ Hier herunterladen

Weitere Informationen finden Sie unter deutschedastg

Haftungsausschluss

In keinem Fall können Sie die ICONIC HOLDING GMBH, ihre Tochtergesellschaften oder eine mit ihr verbundene Partei für direkte oder indirekte Anlageverluste haftbar machen, die durch Informationen in diesem Artikel verursacht wurden. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die ICONIC HOLDING GMBH ist in keiner Rechtsordnung als Anlageberater registriert. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Investitionsentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Investitionsmöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Prognosen und Meinungen, die sich als wesentlich ungenau erweisen können und von Natur aus erheblichen Risiken und Unsicherheiten unterliegen, die außerhalb der Kontrolle der ICONIC HOLDING GMBH liegen. Unsere Artikel und Berichte drücken unsere Meinungen aus, die wir auf der Grundlage allgemein verfügbarer Informationen, Feldforschung, Schlussfolgerungen und Ableitungen durch unsere Due Diligence und unseren analytischen Prozess gewonnen haben.

Die ICONIC HOLDING GMBH geht davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen, die wir für korrekt und zuverlässig halten. Diese Informationen werden jedoch "wie besehen", ohne jegliche Garantie, präsentiert.