[vc_row][vc_column][vc_column_text]

Die große amerikanische Bergbauwanderung

Unter Dominik PoigerLeiter des Produktmanagements, Ikonische Holding

Die große amerikanische Bergbauwanderung ist nun abgeschlossen.

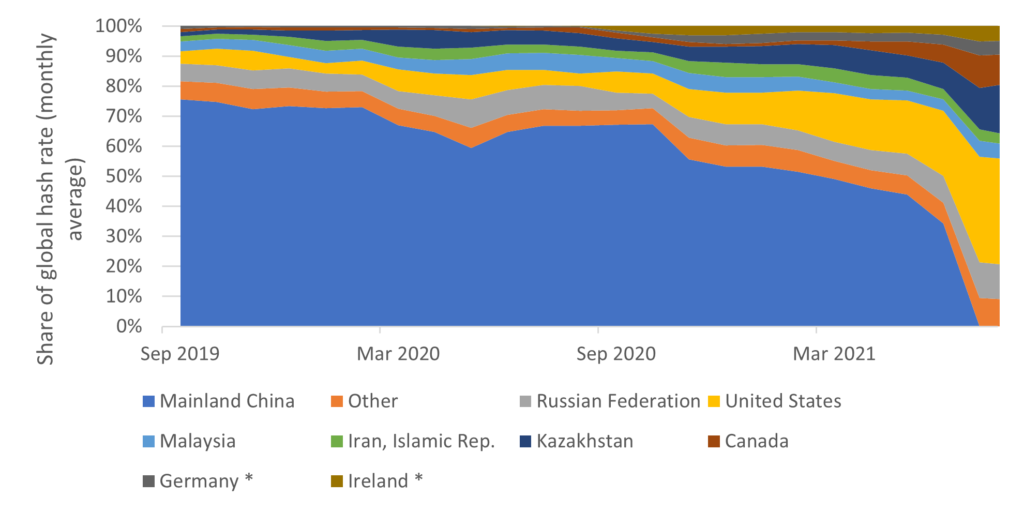

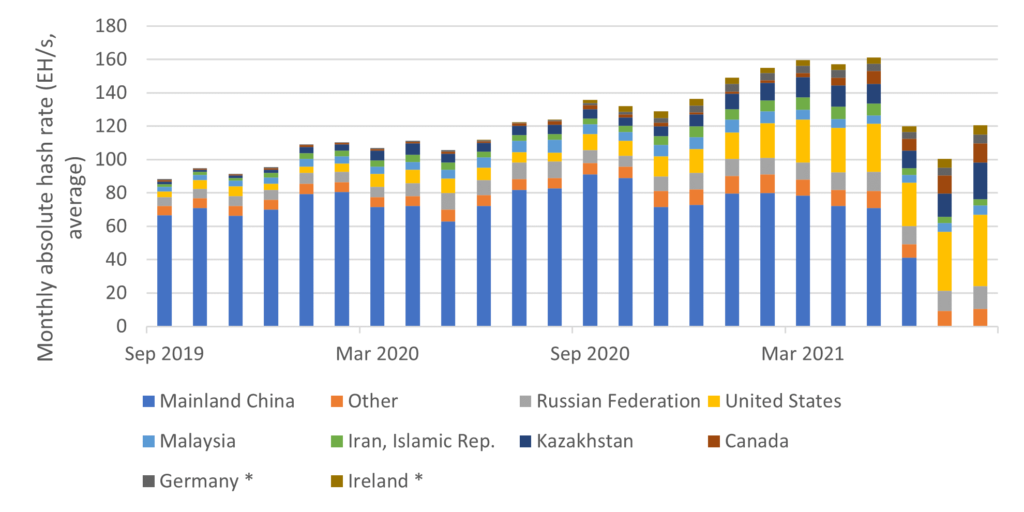

Wie wir bereits erwähnt haben, mussten chinesische Bergleute das chinesische Festland verlassen und sich anderswo niederlassen. Die Daten der vergangenen Monate hatten bereits angedeutet, dass die meisten dieser Minenbetreiber entweder ihre Minenanlagen verkaufen, ihr Geschäft schließen oder sich in Kasachstan oder den Vereinigten Staaten niederlassen würden. Dieser Prozess scheint nun abgeschlossen zu sein, da der Anteil der Minenbetreiber aus China nach Angaben des Cambridge Centre for Alternative Finance ("Cambridge Centre for Alternative Finance") auf 0% gefallen ist.https://cbeci.org/). Gleichzeitig ist der Anteil der USA am Netzwerk von 4% im September 2019 auf 35% und seit Beginn der Miner-Migration von 17% gestiegen.

Quelle: Iconic Funds, Cambridge Centre for Alternative Finance

* Nach Kenntnis des CBECI gibt es kaum Hinweise auf große Bergbauaktivitäten in Deutschland oder Irland, die diese Zahlen rechtfertigen würden. Ihr Anteil ist wahrscheinlich aufgrund umgeleiteter IP-Adressen durch die Nutzung von VPN- oder Proxy-Diensten deutlich überhöht.

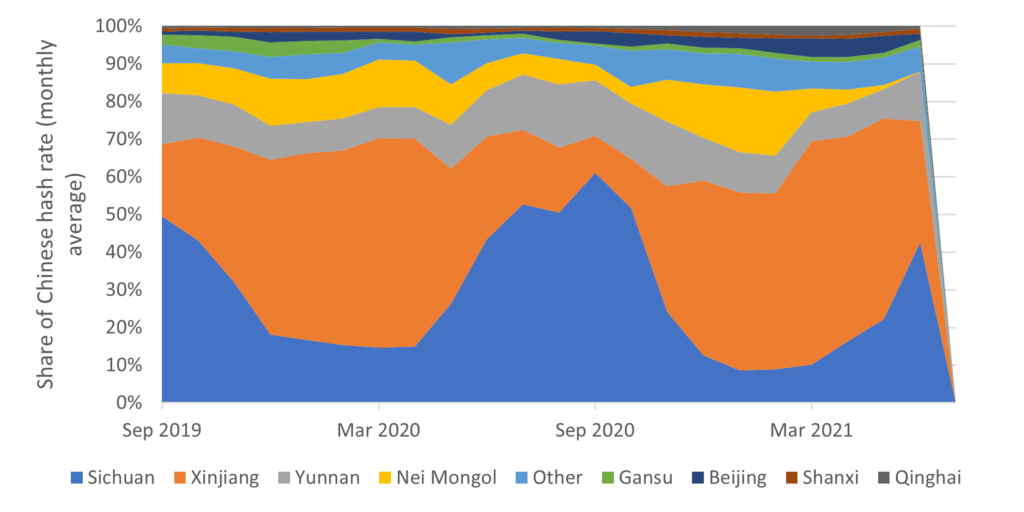

Natürlich ist der Anteil der chinesischen Provinzen an der Hash-Rate auf Null gesunken.

Quelle: Iconic Funds, Cambridge Centre for Alternative Finance

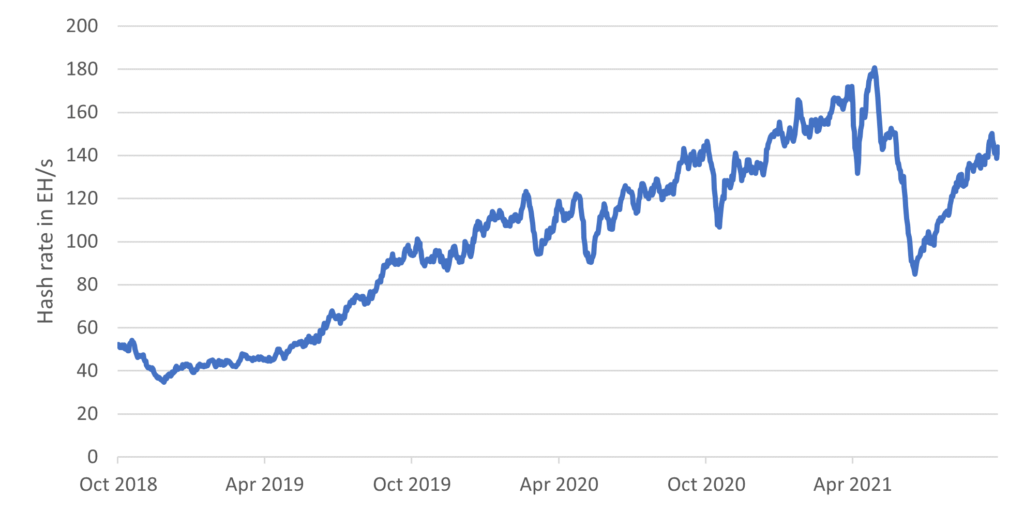

In der Zwischenzeit hat sich die Hash-Rate, die ein Indikator für die Stärke und Sicherheit des Bitcoin-Netzwerks ist, von ihrem Tiefstand im Juli 2021 deutlich erholt, liegt aber immer noch etwa 20% unter dem Allzeithoch von Anfang des Jahres.

Quelle: Iconic Funds, Blockchain.info

Wir wiesen darauf hin, dass das chinesische Bergbauverbot möglicherweise ein gutes Zeichen ist, insbesondere vor dem Hintergrund der zunehmenden ESG-Diskussion. Bergbauunternehmen, die in energieeffizientere Länder wie die USA und 1

Kanada erhöht die Gesamteffizienz des Bitcoin-Netzwerks und verringert aktiv den wahrgenommenen Kohlenstoff-Fußabdruck der Mining-Community.

Im Juli 2021 gab der Bitcoin Mining Council (BMC), ein freiwilliges globales Forum von Bitcoin-Mining-Unternehmen und anderen Unternehmen der Bitcoin-Industrie, die Ergebnisse seiner ersten vierteljährlichen Umfrage bekannt, die sich auf zwei wichtige Kennzahlen konzentrierte: Stromverbrauch und nachhaltiger Strommix. Obwohl diese Umfrage bei weitem nicht alle Miner abdeckt, wurden etwa 32% der weltweiten Hash-Rate erfasst. Die Umfrage ergab, dass die Mitglieder des BMC und die Teilnehmer an der Umfrage Strom mit einem nachhaltigen Strommix von 67% verbrauchten. Der BMC schätzt, dass ist der nachhaltige Strommix der Bergbauindustrie weltweit auf etwa 56% angewachsen.

Dieser Artikel knüpft an unsere beiden früheren Artikel an, die im Juni und August 2021 unter dem Titel "Verbessert sich der Kohlenstoff-Fußabdruck von Bitcoin??" und "Ein Update zur Hash-Rate von Bitcoin".

- Verbessert sich der Kohlenstoff-Fußabdruck von Bitcoin?

- Analyse der wichtigsten Werttreiber der führenden Kryptowährungen

- Der Einfluss von Kryptowährungen auf die Sharpe Ratio traditioneller Anlagemodelle

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes

_ _ _

Haftungsausschluss

In keinem Fall können Sie die ICONIC HOLDING GMBH, ihre Tochtergesellschaften oder eine mit ihr verbundene Partei für direkte oder indirekte Anlageverluste haftbar machen, die durch Informationen in diesem Artikel verursacht wurden. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die ICONIC HOLDING GMBH ist in keiner Rechtsordnung als Anlageberater registriert. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Investitionsentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Investitionsmöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Prognosen und Meinungen, die sich als wesentlich ungenau erweisen können und von Natur aus erheblichen Risiken und Unsicherheiten unterliegen, die außerhalb der Kontrolle der ICONIC HOLDING GMBH liegen. Unsere Artikel und Berichte drücken unsere Meinungen aus, die wir auf der Grundlage allgemein verfügbarer Informationen, Feldforschung, Schlussfolgerungen und Ableitungen durch unsere Due Diligence und unseren analytischen Prozess gewonnen haben.

Die ICONIC HOLDING GMBH geht davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen, die wir für korrekt und zuverlässig halten. Diese Informationen werden jedoch "wie besehen", ohne jegliche Garantie, präsentiert.

[/vc_column_text][/vc_column][/vc_row]