Eines der Grundprinzipien der Portfoliotheorie ist die Diversifizierung. Die Diversifizierung zielt darauf ab, das Risiko - gemessen an der Standardabweichung - zu minimieren, ohne die erwartete Rendite zu verringern. Lesen Sie weiter, um mehr über die Rolle von Korrelationen in der Portfoliotheorie und bei Investitionen in Kryptowährungen zu erfahren.

Unter Patrick LowryCEO der Deutschen Digital Assets

Die Rolle von Korrelationen bei der Portfoliodiversifizierung

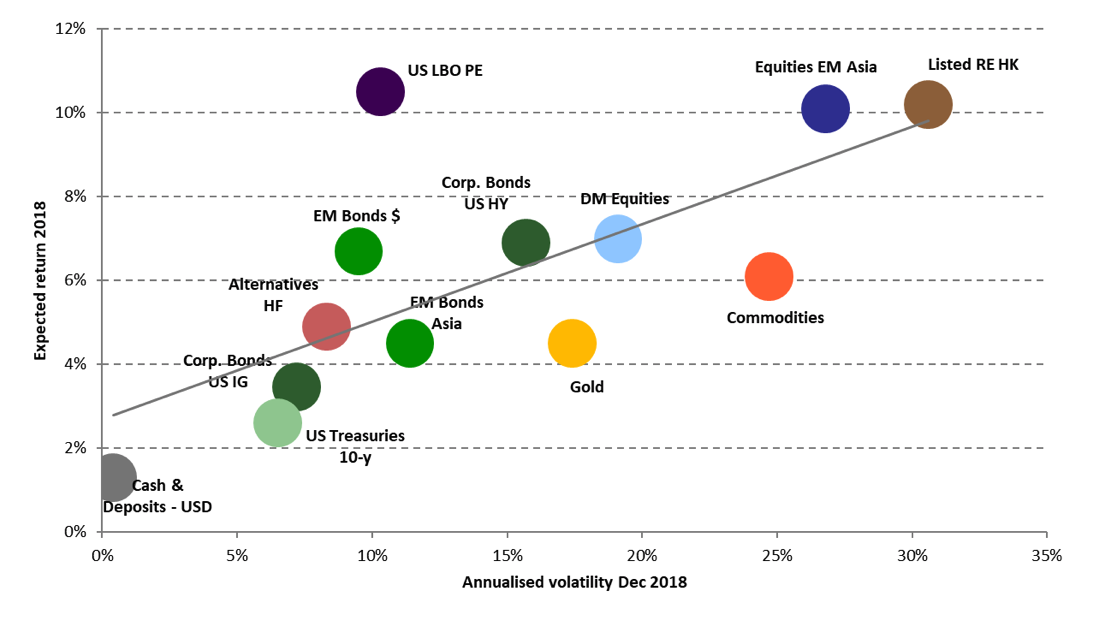

Jede einzelne Anlageklasse hat ihr eigenes Risiko-Ertrags-Profil. In der nachstehenden Grafik sehen Sie die Risiko-Ertrags-Profile für eine Reihe von beliebten Anlageklassen.

Die optimale Investition wäre in der oberen linken Ecke zu finden, d. h. eine hohe erwartete Rendite mit einer geringen Standardabweichung. Normalerweise, eine risikoreichere Investition auch eine höhere Rendite erwarten lässt.

Korrelationen werden mit dem sogenannten Korrelationskoeffizienten gemessen, der zwischen +1 (perfekt positiv) und -1 (perfekt negativ) liegen kann.

Im Hinblick auf die Risikodiversifizierung sind beide Werte nicht wünschenswert. Entweder steigt oder fällt das gesamte Portfolio mit einem Ereignis, oder die Hälfte des Portfolios steigt, während die andere Hälfte fällt.

Diversifizierung wird vor allem dadurch erreicht, dass man einen Vermögenswert hinzufügt, der idealerweise keine Korrelation mit anderen Anlageklassen aufweist. Je geringer die Korrelation zwischen den Vermögenswerten in einem Portfolio ist, desto mehr Risiko kann eliminiert werden.

Eine unkorrelierte Anlage ist der heilige Gral der Portfoliokonstruktion.

Im Rahmen dieses Artikels wird von einer strategischen Vermögensallokation ausgegangen, nicht von einer taktischen Vermögensallokation. Infolgedessen stellen wir die Frage nach der langfristigen Allokation in verschiedene Anlageklassen und berücksichtigen keine kurzfristigen Chancen in bestimmten Branchen oder die Auswahl von Vermögensverwaltern mit überdurchschnittlicher Performance.

Korrelationen zwischen traditionellen und alternativen Anlageklassen

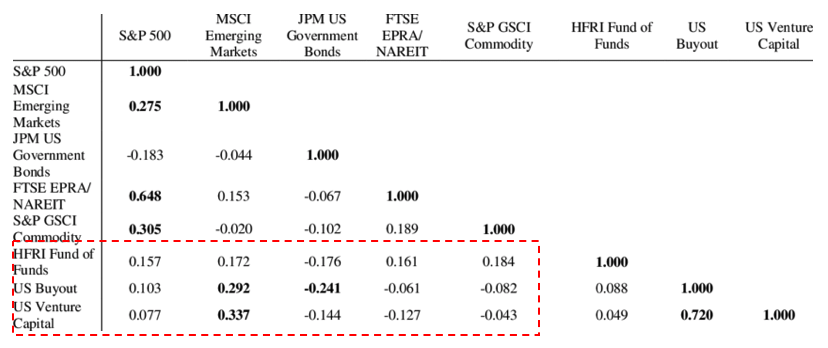

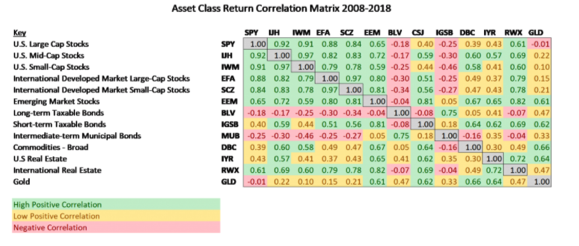

Werfen wir zunächst einen Blick auf traditionelle Anlageklassen wie Aktien, Anleihen, Rohstoffe und Immobilien.

Wie aus dem oberen linken Quadranten ersichtlich ist, korrelieren Aktien weltweit sehr positiv miteinander, so dass sie sich nur bedingt zur Risikodiversifikation eignen.

Wie aus dem oberen linken Quadranten ersichtlich ist, korrelieren Aktien weltweit sehr positiv miteinander, so dass sie sich nur bedingt zur Risikodiversifikation eignen.

Gold eignet sich sehr gut für die Aufnahme in ein Aktienportfolio. Allerdings korreliert es relativ stark mit anderen Rohstoffen und Immobilien. Insbesondere die Beimischung von Anleihen mit einer langen Laufzeit neben Aktien, Rohstoffen und Immobilien eignet sich hervorragend zur Diversifizierung.

Doch wie sieht es mit anderen alternativen Anlageklassen aus?

Es zeigt sich, dass Hedge-Fonds, Private Equity und Risikokapital im Vergleich zu den traditionellen Anlageklassen hervorragend diversifiziert sind, wobei die Werte zwischen 0,05 und 0,35 liegen.

Aus den bisherigen Ergebnissen lässt sich schließen, dass Aktien, Rohstoffe, Immobilien und Anleihen ebenso in ein diversifiziertes Portfolio gehören wie Hedgefonds und Private Equity oder Venture Capital.

Aus den bisherigen Ergebnissen lässt sich schließen, dass Aktien, Rohstoffe, Immobilien und Anleihen ebenso in ein diversifiziertes Portfolio gehören wie Hedgefonds und Private Equity oder Venture Capital.

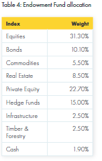

Es ist daher nicht verwunderlich, dass das erfolgreichste Anlagekonzept der letzten Jahrzehnte das sogenannte Stiftungsmodell ist.

Leider hat nicht jeder Anleger Zugang zu bestimmten Anlageklassen. Investitionen in Private-Equity-Fonds beispielsweise sind nur für professionelle (EU) oder zugelassene (USA) Anleger möglich, und der Mindestanlagebetrag liegt oft bei über 1 Million USD.

In meinem früheren Artikel, Ich habe bereits die Auswirkungen der Allokation von Krypto-Vermögenswerten auf verschiedene Arten von Portfolios erörtert.

Krypto und andere Anlageklassen

Wie passen Kryptoanlagen in ein Portfolio?

Ich habe bereits in meinem letzten Artikel gezeigt (dieser Forschungsbericht ), dass sie nicht nur ein ordentliches Alpha generieren, sondern sich auch positiv auf die Sharpe Ratio (Risiko-Rendite-Profil) auswirken.

Aber was ist mit Korrelationen? Legitimieren sie Kryptowährungen als Ergänzung zu einem diversifizierten Portfolio?

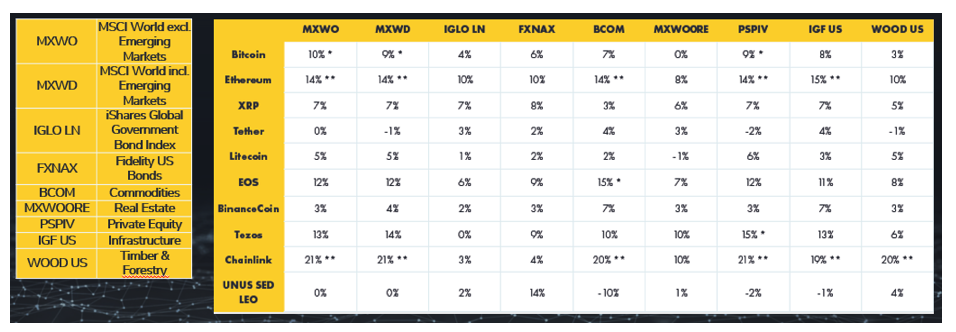

Betrachtet man die gesamte Geschichte der Kryptoassets, so weisen sie praktisch keine Korrelationen zu Aktien, Anleihen und Immobilien sowie zu Rohstoffen, Hedgefonds und Private Equity auf.

Im Falle von Bitcoin nur 0,03 (Timber) bis 0,10 (Aktien).

Das ist also der heilige Gral: eine Anlageklasse, die einen sehr niedrigen Korrelationskoeffizienten zu allen anderen traditionellen und alternativen Anlageklassen aufweist.

Berücksichtigung der Liquidität

Aber wir machen es uns nicht so einfach. Die meisten Krypto-Kiddies, die um die Welt reisen und über Nullkorrelationen twittern, lassen leider eines aus: Ein Vermögenswert kann nur dann korrelieren, wenn er eine gewisse Liquidität (Handelsvolumen) aufweist.

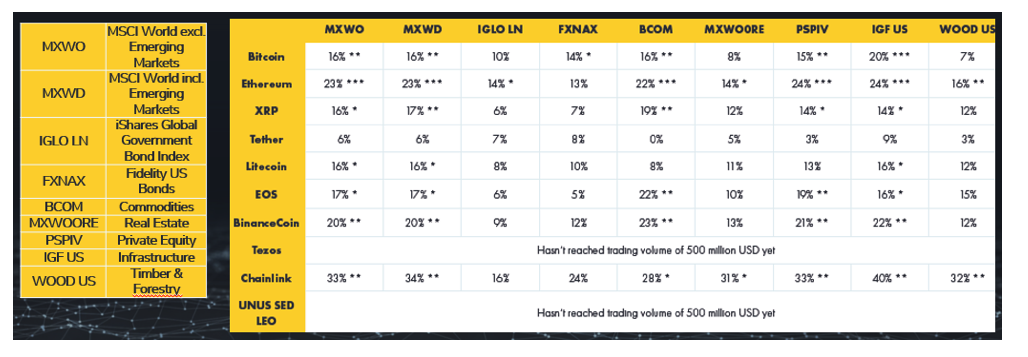

Also wiederholen wir die Übung, aber dieses Mal erst ab einem täglichen Handelsvolumen von mehr als 500 Millionen USD.

Die Korrelationen sind nun zwar immer noch sehr gering, aber zumindest spürbar. Ethereum zum Beispiel erreicht jetzt eine (immer noch relativ niedrige) Korrelation von 0,24 mit Private-Equity- und Infrastrukturfonds.

Weitere Einzelheiten finden Sie in der Originalbericht hier.

Selbst wenn man Kryptowährungen kritisch betrachtet, sind sie derzeit die einzige Anlageklasse, die eine niedrige Korrelation zu allen traditionellen und alternativen Vermögenswerten aufweist, was sie zu einem hervorragenden Portfoliodiversifizierer macht.

Pensionsfonds und Stiftungen investieren schon seit langem in Krypto-Assets, börsennotierte Unternehmen nutzen es nun auch zur Absicherung ihres eigenen Treasury-Managements.

Die Nachfrage wächst, und das Interesse scheint jetzt ein viel stärkeres Fundament zu haben als während der Hype-Phase im Jahr 2017. Nicht nur, weil weltweit mehr Geld gedruckt wird als je zuvor, sondern auch, weil "sichere" Anlagen in diesem Niedrigzinsumfeld praktisch nicht vorhanden sind.

Korrelationen innerhalb von Krypto-Assets

Kryptoassets sind ein hervorragender "Diversifikator" und haben ihre Daseinsberechtigung in der modernen Portfoliokonstruktion. Sie sollten genauso Bestandteil eines jeden Portfolios sein wie Hedgefonds und Private Equity oder Venture Capital. Aber reicht es aus, nur Bitcoin zu allokieren oder lohnt es sich, einen Krypto-Index ins Portfolio aufzunehmen?

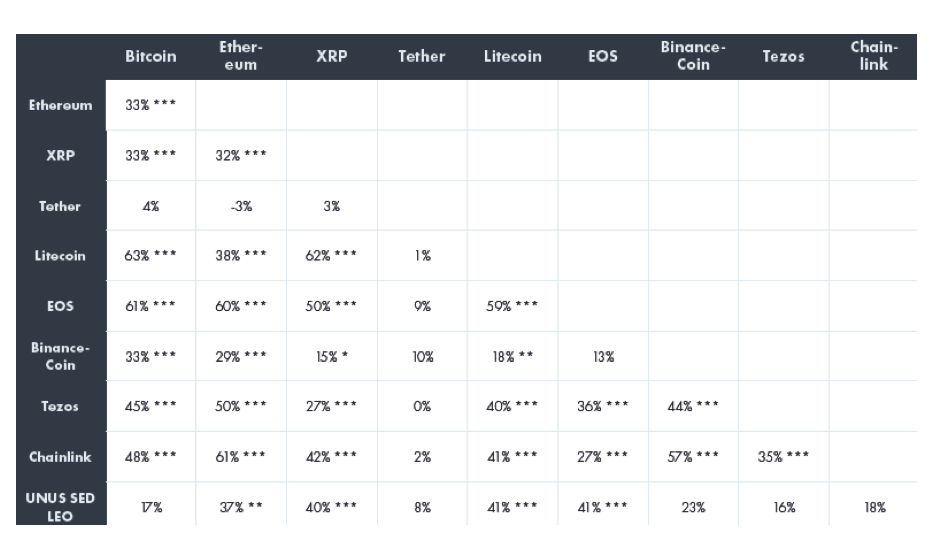

Im Vergleich zu anderen Anlageklassen sind die Korrelationen von Bitcoin zu anderen Kryptoassets mit 0,17 bis 0,63 relativ hoch, aber größtenteils immer noch niedrig bis moderat. Besonders interessant ist, dass diese Korrelationen in den letzten Jahren deutlich zurückgegangen sind.

Bitcoin, Ethereum und Binance Coin haben völlig unterschiedliche Werttreiber. Dies lässt sich an der Entwicklung ihrer unabhängigen Werte ablesen, wenn die Massenanwendung zunimmt. Wenn sich diese unterschiedlichen Werttreiber weiterhin bewahrheiten, dürften sich die einzelnen Kryptoassets in Zukunft noch weiter entkoppeln.

Sie können finden Weitere Informationen über unseren Fonds finden Sie hier.

Wichtigste Erkenntnisse

Was können wir also aus dieser Analyse mitnehmen?

- Ein traditionelles Portfolio sollte nicht nur Aktien, sondern auch Immobilien, Gold und Anleihen enthalten.

- Idealerweise sollten auch Hedge-Fonds und Private-Equity-Anlagen im Portfolio enthalten sein, um eine größtmögliche Diversifizierung zu erreichen.

- Unter Berücksichtigung der Handelsvolumina weisen Kryptowährungen zumindest eine spürbare Korrelation zu einigen anderen Anlageklassen auf. Allerdings bleibt Krypto die einzige Anlageklasse mit einer sehr geringen Korrelation zu allen anderen Portfoliobestandteilen.

- Nicht nur Pensionsfonds und Stiftungen, sondern auch börsennotierte Unternehmen sind inzwischen in Kryptoanlagen investiert.

- Kryptoanlagen haben unterschiedliche Werttreiber und scheinen sich langfristig voneinander zu entkoppeln, was eine Diversifizierung innerhalb der Kryptowährungen unerlässlich macht.

Verwandte Artikel

- Kryptoanlagen im Kontext der Portfoliotheorie

- Der Einfluss von Kryptowährungen auf die Sharpe Ratio traditioneller Anlagemodelle

- Untersuchung des Mythos der Nullkorrelation zwischen Kryptowährungen und Marktindizes

- Wie man den Wert von Bitcoin bestimmt

Haftungsausschluss

In keinem Fall können Sie die Deutsche Digital Assets GMBH, ihre Tochtergesellschaften oder eine mit ihr verbundene Partei für direkte oder indirekte Anlageverluste haftbar machen, die durch Informationen in diesem Artikel verursacht wurden. Dieser Artikel ist weder eine Anlageberatung noch eine Empfehlung oder Aufforderung zum Kauf von Wertpapieren.

Die Deutsche Digital Assets GMBH ist in keiner Rechtsordnung als Anlageberater registriert. Sie erklären sich damit einverstanden, Ihre eigenen Nachforschungen anzustellen und Ihre Sorgfaltspflicht zu erfüllen, bevor Sie eine Anlageentscheidung in Bezug auf die hier besprochenen Wertpapiere oder Anlagemöglichkeiten treffen.

Unsere Artikel und Berichte enthalten zukunftsgerichtete Aussagen, Schätzungen, Prognosen und Meinungen, die sich als wesentlich ungenau erweisen können und von Natur aus erheblichen Risiken und Unsicherheiten unterliegen, die außerhalb der Kontrolle der Deutsche Digital Assets GMBH liegen. Unsere Artikel und Berichte drücken unsere Meinungen aus, die wir auf der Grundlage allgemein verfügbarer Informationen, Feldforschung, Schlussfolgerungen und Ableitungen durch unsere Due-Diligence-Prüfung und unseren analytischen Prozess gewonnen haben.

Die Deutsche Digital Assets GMBH geht davon aus, dass alle hierin enthaltenen Informationen korrekt und zuverlässig sind und aus öffentlichen Quellen stammen, die wir für korrekt und zuverlässig halten. Diese Informationen werden jedoch "wie besehen", ohne jegliche Garantie, präsentiert.